Ethereum

Successful Beta Service launch of SOMESING, ‘My Hand-Carry Studio Karaoke App’

Published

5 months agoon

By

adminAug 3, 2024 14:38 UTC

| Updated:

Aug 3, 2024 at 14:38 UTC

By Clark

After issuing a Shiba Inu (SHIB) price prediction that played out veraciously, a Solana (SOL) millionaire has forwarded a bold claim, asserting that RCO Finance (RCOF), an emerging cryptocurrency within the Ethereum network, is poised to experience a parabolic shift.

Due to fluctuating market conditions, this forecast comes amid growing skepticism amongst crypto investors. Let’s discover why this expert is optimistic about RCO Finance (RCOF).

Solana Millionaire Endorses RCO Finance Due To Its AI Advantage

A Solana millionaire has declared RCO Finance (RCOF) one of the best altcoins to invest in. He believes RCOF is on the verge of an astronomic surge, urging investors to cash in on the anticipated price increase.

Having made a similar projection about Shiba Inu, which was followed by a 244% increase in SHIB’s value, his RCOF price prediction seems plausible.

Moreover, RCO Finance’s fundamentals, utility, and community support backs this claim. As a decentralized trading platform, RCO Finance sets itself apart by integrating sophisticated technologies that position it ahead of the competition. One such technology is an AI-powered robo-advisor.

The robo-advisor is a cutting-edge AI-driven tool developed with a machine-learning algorithm that can function without human intervention. Integrated into RCO Finance, users can invest in a portfolio of digital assets without directly engaging with the market. The robo-advisor can not only execute trades on behalf of an investor but also develop a portfolio suitable for the investor’s financial goals and risk appetite.

It can spot trends, patterns, market structures, and price actions and make predictions based on this information, allowing investors to make informed investing decisions.

With over 120,000 digital assets offered on RCO Finance, the robo advisor is an investor’s best bet for identifying profitable assets to invest in due to its fast-paced response. This feature has increased its adoption rate among institutional investors and retailers, resulting in its constant endorsement.

RCO Finance: An All-inclusive Trading Platform

RCO Finance features over 12,500 asset classes, comprising stocks, shares, cryptocurrencies, derivatives, ETFs, and real-world assets. Each of these financial instruments is tradable and storable on a single interface. This all-encompassing feature enables investors to diversify their portfolios across multiple asset classes.

Investors can trade each of these assets with subsidized fees. Unlike other DeFi platforms, borrowing and lending attract infinitesimal rates.

By designing a user-friendly interface, going through a thorough examination by notable firms, such as SolidProof, and precluding Know Your Customer (KYC), the platform showcases its commitment to accessibility, security, and privacy. Upon launch, its operations will be by the EU MiCA standard protocol, with the European Securities Commission providing full oversight.

RCOF Offers An Avenue To Generate Passive Income

RCO Finance offers users numerous streams of income, one of which includes investing in RCOF. Some benefits of investing in RCOF are access to priority customer support, governance voting rights through staking, and reduced trading fees.

Also, the platform adopted a community-centric strategy that involves access to airdrops, debit cards for spending profits in a real economy, and tier-based rewards for generating passive income.

The Ethereum token, RCOF, is currently available at $0.0127 per token in Stage 1 of its public presale. Experts speculate the token will list between $0.4 and $0.6, potentially attracting a 5,000% profit to investors.

In other words, investors can multiply their funds fifty-fold through RCOF’s presale; i.e., a $1,000 investment could easily become $50,000 when the Ethereum token launches.

Its robust tokenomics and growing adoption amongst institutional investors guarantee sustained growth and stability in the long Run. Although this opportunity is open to everyone, those who act fast and join now will milk it to the core.

For more information about the RCO Finance Presale:

Join The RCO Finance Community

Clark

Head of the technology.

#Press Release

This is a paid press release. Btcwires does not endorse and is not responsible for or liable for any content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any actions related to the company.

Source link

You may like

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Blockchain

Most Layer 2 solutions are still struggling with scalability

Published

7 hours agoon

December 23, 2024By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Since pivoting to a layer 2-centric approach, the Ethereum (ETH) ecosystem has relied heavily on L2 solutions to scale. However, these solutions are struggling to compete effectively, especially under pressure from alternatives like Solana (SOL). During the recent meme coin craze, Solana attracted much of the activity due to its advantages: low fees, high transaction speed, and user-friendliness.

To understand the challenges, it’s essential to examine why L2 solutions have not demonstrated the scalability and cost advantages that were widely anticipated.

Why meme projects favor Solana over Ethereum L2s

Meme projects have significantly contributed to the recent surge in market activity. These projects favor Solana for several reasons beyond user-friendliness:

- Low fees: Solana’s low transaction costs make it ideal for fee-sensitive applications like memecoins.

- High speed: Solana’s multithreaded architecture enables high throughput, ensuring seamless user experiences.

- Better developer experience: Solana’s tools and ecosystem are optimized for ease of use, attracting developers and projects.

Why is scalability important?

Scalability is fundamentally measured by the number of transactions a blockchain can process. A highly scalable blockchain can handle more TXs while offering lower fees, making it crucial for widespread adoption and maintaining a seamless user experience.

This is especially important for grassroots projects like meme coins, many of which are short-lived and highly fee-sensitive. Without scalability, these projects cannot thrive, and users will migrate to platforms that offer better efficiency and cost-effectiveness.

Why Ethereum L2s aren’t up to the challenge

Architectural limitations of Ethereum. Ethereum has long faced scalability issues, and L2 rollups are its primary solution to these problems. L2s operate as independent blockchains that process transactions off-chain while posting transaction results and proofs back to Ethereum’s mainnet. They inherit Ethereum’s security, making them a promising scaling approach.

However, Ethereum’s original design poses inherent challenges. Ethereum’s founder, Vitalik Buterin, has admitted that “Ethereum was never designed for scalability.” One of the key limitations is the lack of multithreading in the Ethereum Virtual Machine. The EVM, which processes transactions, is strictly single-threaded, meaning it can handle only one transaction at a time. In contrast, Solana’s multithreaded architecture allows it to process multiple transactions simultaneously, significantly increasing throughput.

L2s inheriting Ethereum’s limitations. Virtually all L2 solutions inherit Ethereum’s single-threaded EVM design, which results in low efficiency. For instance, Arbitrum: With a targeted gas limit of 7 million per second and each coin transfer costing 21,000 gas, Arbitrum can handle about 333 simple transactions per second. More complex smart contract calls consume even more gas, significantly reducing capacity. Optimism: With a gas limit of 5 million per block and a block time of 2 seconds, Optimism can handle only about 119 simple transfers per second. Gas-intensive operations further reduce this capacity.

Unstable fees. Another major issue with Ethereum and its L2 solutions is unstable fees during periods of high network activity. For applications relying on low and stable fees, this is a critical drawback. Projects like meme coins are especially fee-sensitive, making Ethereum-based L2s less attractive.

Lack of interoperability between L2s. The scalability argument for having multiple L2s only holds if contracts on different L2s can interact freely. However, rollups are essentially independent blockchains, and accessing data from one rollup to another is as challenging as cross-chain communication. This lack of interoperability significantly limits the potential of L2 scalability.

What can L2s do to further scale?

Embed features to enhance interoperability. Ethereum L1 needs to do more to support interoperability among L2s. For example, the recent ERC-7786: Cross-Chain Messaging Gateway is a step in the right direction. While it doesn’t fully resolve the interoperability issue, it simplifies communication between L2s and L1, laying the groundwork for further improvements.

Architectural updates: Diverge from the existing L1 design. To compete with multithreaded blockchains like Solana, L2s must break free from Ethereum’s single-threaded EVM design and adopt parallel execution. This may require a complete overhaul of the EVM, but the potential scalability gains make it a worthwhile endeavor.

Future milestones

Ethereum’s L2 solutions face significant challenges in delivering the scalability and cost-effectiveness that applications like meme coins demand. To stay competitive, the ecosystem must address fundamental architectural limitations, enhance interoperability, and embrace innovations in blockchain design. Only by doing so can Ethereum L2s achieve the scalability needed to support widespread adoption and fend off competition from emerging blockchains like Solana.

Laurent Zhang

Laurent Zhang is the president and founder of Arcology Network, a revolutionizing Ethereum layer-2 solution with the first-ever EVM-equivalent, multithreaded rollup—offering unparalleled performance and efficiency for developers building the next generation of decentralized applications. With an executive leadership and innovation background, Laurent holds a degree from Oxford Brookes University. Laurent’s professional journey includes over a decade of experience in science, research, engineering, and leadership roles. After graduating in 2005, he joined MKS Instruments as an Algorithm Engineer. From 2010 to 2012, he worked as a research engineer at the Alberta Machine Intelligence Institute, followed by a position as a research scientist at Baker Hughes from 2012 to 2014. He then served as vice president of engineering at Quikflo Health between 2016 and 2018. Since 2017, Laurent has been the president of Arcology Network, being a visionary of a future where blockchain technology reaches its full potential, offering unmatched scalability, efficiency, and innovation.

Source link

24/7 Cryptocurrency News

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Published

14 hours agoon

December 23, 2024By

admin

Tron founder Justin Sun has been heavily offloading his ETH holdings with Ethereum price crashing 17% following the rejection at $4,000. Over the past 7 days, Sun has offloaded another 50% of his holdings worth $143 million. Market analysts predict that ETH price could further take a dip below $3,000 once again before resuming upside momentum.

Tron’s Justin Sun on ETH Selling Spree

Justin Sun is on a massive Ethereum selling spree since the coin resumed its upward journey after Donald Trump’s election win. This continued even until last week, when Tron founder offloaded $143 million worth of ETH causing Ethereum price to tank over 15% amid the crypto market crash.

Blockchain analytics firm Spot On Chain reported that Justin Sun redeemed 39,999 ETH (valued at $143 million) from liquid staking platforms Lido Finance and EtherFi. He subsequently deposited the entire amount into HTX.

Since November 10, as Ethereum price has trended upward, Sun has deposited a total of 108,919 ETH (worth $400 million) to HTX at an average price of $3,674. Notably, many of these deposits occurred near local price peaks.

Spot On Chain also revealed that Justin Sun currently has 42,904 ETH (valued at $139 million) in the process of unstaking from Lido Finance. The Tron founder might potentially send this funds to HTX later.

Ethereum Price Drop Below $3,000 Coming?

With Ethereum price losing its crucial support of $3,500, the market sentiment for the world’s largest altcoin has turned bearish. Last week, crypto market analysts turned bearish on Ethereum expecting the ETH price to drop $2,800 on selloff by whales.

Popular market analyst IncomeSharks stated that it was a “low-volume weekend,” for Ethereum following a volatile week for stocks. The analysts added that it won’t be the right time to sell.

The On-Balance Volume (OBV) indicator, a tool used to gauge buying and selling pressure, remains steady, oscillating within a channel. Recent Ethereum buyers are still in profit, providing some support for the market. However, the below chart shows that there’s still scope for Ethereum to take a dip to $3,000.

Prominent crypto analyst “I am Crypto Wolf” also highlighted a bullish outlook with a potential inverse head-and-shoulders (iHS) pattern. According to the analyst, Ethereum price chart is currently forming the “right shoulder” of the iHS continuation pattern.

This setup could provide the momentum needed to surpass the $4,000 resistance and aim for a $10,000 target by May. A breakout is anticipated by the end of January, though a retest of the $3,000 level remains a possibility before the rally takes off, he noted.

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

CryptoQuant

Ethereum Accumulation Address Holdings Surge By 60% In Five Months – Details

Published

1 day agoon

December 22, 2024By

admin

Amid a general crypto market price fall in the past week, Ethereum (ETH) recorded a price correction of over 19.5% finding support at a local bottom of $3,100. Since then, the prominent altcoin has only shown slight resilience rising by over 5% in the past two days. However, recent data on wallet activity provides much cause to be bullish on Ethereum’s long-term future.

Ethereum HODL Addresses Increase Supply Dominance To 16%

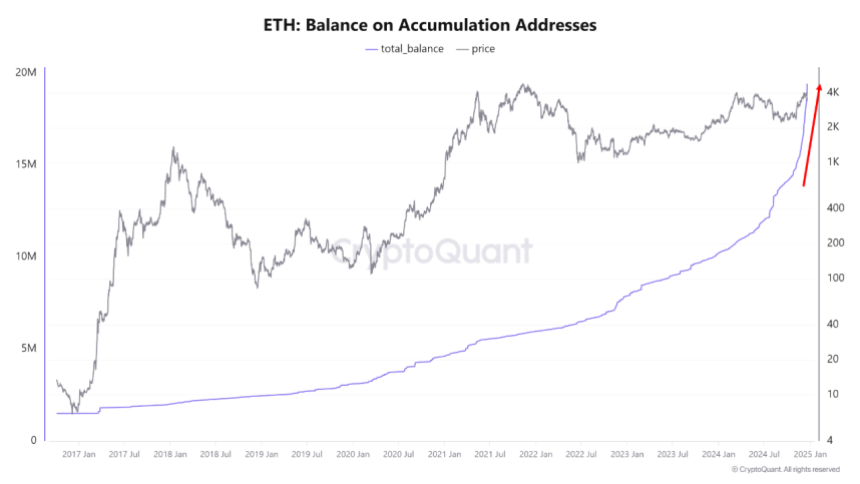

In a recent QuickTake post, CryptoQuant analyst MAC_D shared some positive insights on the Ethereum market.

The crypto market expert reports that the balance of Ethereum Accumulation Addresses has surged by a remarkable 60% from August to December. During this time, these HODL wallets have boosted their portion of ETH supply from 10% to 16% i.e. 19.4 million ETH of 120 million ETH.

To explain, the Accumulation Addresses are wallets that hold Ethereum but rarely move or sell their holdings. They are considered a measure of long-term investment and confidence.

According to MAC_D, the rapid increase in these Ethereum HODL wallets’ holdings is a new development absent from previous bull cycles. The analyst attributed this massive accumulation rate to investors’ bullish expectations of the incoming Donald Trump administration in the US.

These expectations include more favorable regulations on the DeFi industry which represents a major sector of the Ethereum ecosystem. Therefore, regardless of Ethereum’s current price movement, these long-holding wallets are likely to keep increasing their holdings in anticipation of future price growth.

In addition, MAC_D emphasizes the importance of these Accumulation Addresses in that the price of Ethereum has never slipped below their realized price. Therefore, a continuous purchase by these wallets provides a high potential for a long-term price gain.

What’s Next For ETH?

In regards to Ethereum’s immediate movement, MAC_D warns that macroeconomic factors are likely to exert a stronger influence on ETH’s price in the short-term as illustrated by the recent price crash induced by potential reduced interest rate cuts in 2025.

At the time of writing, the altcoin trades at $3,352 following a 3.07% decline in the past 24 hours. In tandem, ETH’s daily trading volume is down by 53.25% and valued at $31.15 billion.

Following recent price falls, Ethereum also presents a negative performance on larger charts with losses of 14.74% and 1.05% in the past seven and thirty days, respectively. On a positive note, the asset’s price remains far above its initial price point ($2,397) at the start of the post-US elections price rally, indicating that long-term sentiment remains positive.

With a market cap of $401 billion, Ethereum continues to rank as the second-largest cryptocurrency and largest altcoin in the digital asset market.

Source link

Solana L2 Sonic includes TikTok users in airdrop

5 Tokens Ready For A 20X After Solana ETF Approval

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: