Chainalysis

Approval phishing scams ‘a much bigger problem’ than first thought

Published

4 months agoon

By

admin

Since May 2021, a staggering $2.7 billion has been lost to approval phishing attacks — and a multinational operation led to one victim being identified in the middle of a scam.

A widespread operation has been launched to thwart cybercriminals engaged in “approval phishing.”

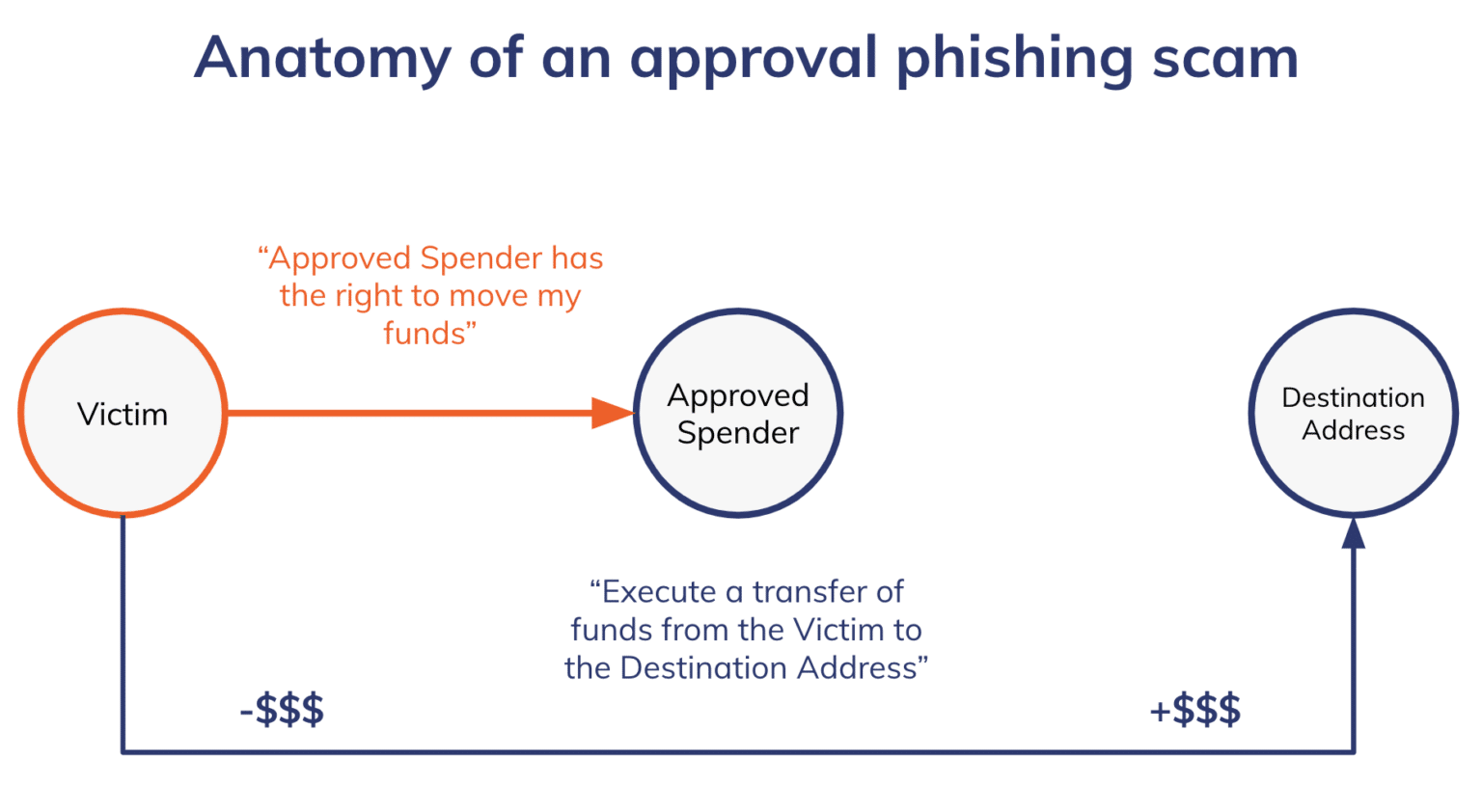

According to Chainalysis, such attacks involve deceiving an unsuspecting victim into signing a malicious blockchain transaction — often through a fake crypto app.

Once complete, it means scammers can spend certain tokens within their wallet at will — potentially draining someone’s life savings in certain circumstances.

A particularly notorious incident back in September 2023 led to one person losing $24.23 million of staked ETH that was sitting in their wallet.

Since May 2021, a staggering $2.7 billion has been lost to approval phishing attacks, with the blockchain analytics firm warning it’s “a much bigger problem than previously known.”

As a result, Chainalysis says that it’s now launched “Operation Spincaster,” which aims to identify compromised wallets before any lasting damage can be done.

Sprints across six countries led to more than 7,000 leads being identified — with losses among these cases amounting to approximately $162 million.

And in a particularly breathtaking development, one victim was contacted and alerted that they were in the middle of an ongoing scam, meaning the approval that was given to their attacker could be revoked before crypto worth hundreds of thousands of dollars was stolen.

Operation Spincaster shows how law enforcement agencies are increasingly making use of the intelligence delivered through blockchain analytics, which leverages the transparency of this technology to monitor how illicit funds flow through the ecosystem.

The National Crime Agency says 230 British victims were identified as a result and has vowed to bring offenders to justice no matter where they are. The NCA’s acting head of illicit finance, Celestino Calabrese, said:

This work has protected victims here in the U.K. and provided opportunities for us to pursue organized crime groups causing significant harm. Many of these groups are based overseas, and utilize sophisticated methods to gain the trust of unsuspecting investors.

While some police forces are beginning to hire their own crypto investigators, such departments are often experimental and sometimes understaffed. Operations like this — when coupled with collaboration from the crypto exchanges that are being used to move stolen funds — help to give law enforcement agencies the extra manpower they need to deliver results. As Ruben van Well of the Dutch National Police said:

By the end of the sprint, we were able to set up detection methods and freeze several wallets to prevent further loss of funds for victims. The relationships and collaborative efforts established through Operation Spincaster marks a pivotal step in our efforts to disrupt and prevent scams within the ecosystem.

Binance was involved in Operation Spincaster, and says that the initiative is now going to be expanded to a greater number of countries. As well as tracing the flow of funds, the exchange’s staff were also tasked with identifying victims, breaking news of the scam to them, and offering education to help them stay safe in the future.

According to Chainalysis, educating crypto users is a crucial first step in clamping down on scams — and unfortunately, even experienced investors can often fall susceptible to a phishing attack. The company went on to add:

Cryptocurrency exchanges wield significant influence in detecting and preventing approval phishing scams. Implementing proactive — rather than reactive — transaction monitoring capabilities and a robust risk management strategy is essential to effectively combat and prevent such threats.

And in terms of top tips for the public as approval phishing remains a persistent threat, the company says crypto owners should be exceedingly wary if they are urgently asked to send money or provide personal information — even if the source of the request looks official.

Oftentimes, taking a beat and performing some independent research through search engines and social media can help verify whether such a request is genuine. It’s also about trusting your instincts — as the old saying goes, if something seems too good to be true, it probably is.

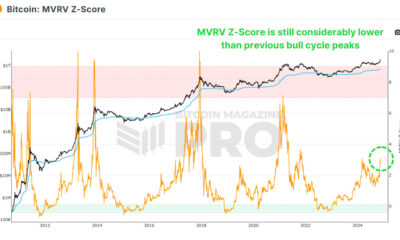

Approval phishing is the latest sign that cybercriminals are continually changing their tactics as awareness grows of their methods — and becoming even more emboldened during the bull market. With hacks happening at an alarming frequency, investing in crypto is full of risk… and that might be a substantial stumbling block in the quest for wider global adoption.

Source link

You may like

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Blockchain

UAE exempts cryptocurrency transfers from value-added tax

Published

2 months agoon

October 7, 2024By

admin

The UAE, particularly through its Dubai and Abu Dhabi financial hubs, continues to introduce initiatives and regulatory frameworks to attract crypto companies and investors.

Consider the latest update: The UAE announced value-added tax (VAT) exemptions for crypto transfers and conversions.

The UAE’s published changes will take effect on Nov. 15.

The Federal Tax Authority (FTA) on Oct. 2, published Cabinet Decision No. (100) of 2024 to update the executive regulation related to VAT.

The updated executive regulation includes more than 30 amendments affecting various industries.

The nation’s Federal Tax Authority, as per the details shared by business consultancy firm PwC, will apply these exemptions to managing investment funds and other crypto-related activities.

Additionally, PwC reports that the exemptions for the transfer and conversion of virtual assets are treated as effective from Jan. 1, 2018.

Furthermore, the amendments address input tax recovery for crypto companies. PwC explains that in the UAE, crypto is defined as a “representation of value that can be digitally traded or converted and can be used for investment purposes.”

UAE wants to be crypto-friendly

While several countries, including China and India, have been taking a step back when it comes to crypto adoption, the UAE is embracing it.

The country has been actively working to create a favorable environment for blockchain and crypto businesses. Dubai’s Virtual Assets Regulatory Authority is also playing a crucial role in regulating virtual assets in the UAE.

The VAT exemptions for crypto transfers and conversions could attract more crypto businesses to the UAE.

The country’s positive outlook on crypto is also visible from its growth in the market. A recent report from Chainalysis highlighted that the UAE received over $30 billion in crypto between July 2023 and June 2024.

This number has brought the country to the top as MENA’s third-largest crypto economy. Chainalysis also mentioned the rise in the number of venture capital funds and blockchain businesses in the UAE as a factor contributing to the country’s growth.

Source link

Africa

Stablecoins represent 40% of crypto economy in Sub-Saharan Africa

Published

2 months agoon

October 3, 2024By

admin

As businesses turn to dollar-pegged options, stablecoins now represent over 40% of Sub-Saharan Africa’s crypto economy.

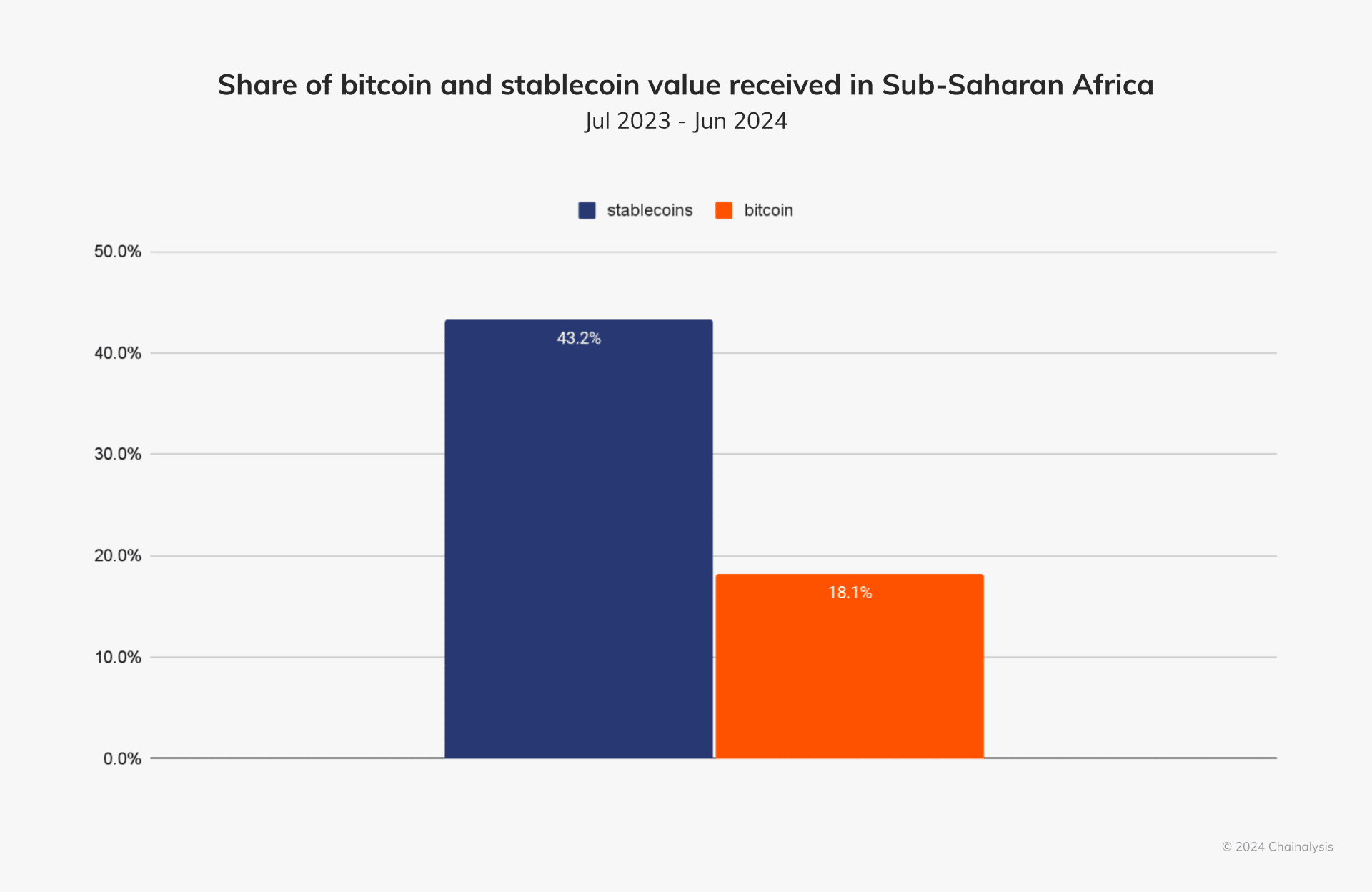

Stablecoins have emerged as a vital component of Sub-Saharan Africa‘s crypto economy, accounting for approximately 43% of the region’s total transaction volume, according to a recent report from Chainalysis.

In nations grappling with volatile local currencies and limited access to U.S. dollars, dollar-pegged stablecoins such as Tether (USDT) and Circle (USDC) have gained prominence, enabling businesses and individuals to store value, facilitate international payments, and bolster cross-border trade.

In a commentary to Chainalysis, Yellow Card chief executive Chris Maurice said that “about 70% of African countries are facing an FX shortage, and businesses are struggling to get access to the dollars they need to operate.”

Stablecoins to become primary use case for crypto in South Africa

As a result of this struggle, Ethiopia, Africa’s second-most populous nation, has seen retail-sized stablecoin transfers grow by 180% year-over-year, fueled by a recent 30% devaluation of its local currency, the birr.

While traditional financial institutions struggle to meet the demand for U.S. dollars, stablecoins are increasingly viewed as a “proxy for the dollar,” Maurice said, adding that “if you can get into USDT or USDC, you can easily swap that into hard dollars elsewhere.”

Looking ahead, Rob Downes, head of digital assets at ABSA Bank, a major African bank operating in 12 African countries, foresees stablecoins playing a pivotal role in Africa’s economic landscape, stating that dollar-pegged tokens are going to be the “primary use case for crypto in South Africa over the next three to five years.”

Source link

Adoption

MENA received $338b value in crypto as the 7th-largest market

Published

2 months agoon

September 25, 2024By

admin

The Middle East and North Africa region has become the seventh-largest cryptocurrency market as both retail and institutional adoption grows.

According to a Chainalysis report, MENA received $338.7 billion in cryptocurrencies between July 2023 and June 2024, securing the seventh spot. This accounted for 7.5% of the global on-chain value.

1/ MENA is the 7th largest crypto market we studied in 2024, receiving ~$338.7B in on-chain value. Türkiye (#11) and Morocco (#27) rank high in our adoption index, capturing $137B and $12.7B, respectively. pic.twitter.com/uKfFJMsLrF

— Chainalysis (@chainalysis) September 25, 2024

Türkiye leads the region with $137 billion in on-chain value received, followed by Morocco’s $12.7 billion. These two are the only countries in Chainalysis’ global crypto adoption index.

The report found that 93% of the transactions in the region were worth over $10,000, driven by professional and institutional movements.

Per Chainalysis, the United Arab Emirates witnessed impressive growth in retail and institutional on-chain value due to its favorable regulatory landscape.

Last month, Tether, the issuer of the largest stablecoin USDT, announced to create a dirham-pegged stablecoin in the UAE which will be backed by the country’s liquid reserves.

The stablecoin issuer joined forces with Fuze, a crypto infrastructure company, to educate both individuals and large institutions in Türkiye and the Middle East about cryptocurrencies and raise their awareness.

According to data from Chainalysis, Saudi Arabia’s crypto market saw a 154% year-over-year growth in the mentioned timeframe, emerging as the fastest-growing digital asset economy in the region.

Most of the on-chain activity in MENA happened on decentralized exchanges. 32.4% and 30.9% of the on-chain movements in the UAE and Saudi Arabia occurred on DEXs, per the report.

It’s important to note that Saudi Arabia and Qatar still don’t have an operational regulatory framework for crypto companies which could be the main reason behind their DEX use.

The Saudi Arabian Ministry of Investment invested $250 million in the Hedera blockchain in February to boost web3 development in the country.

Source link

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential