24/7 Cryptocurrency News

Tron Founder Justin Sun Bursts Rumors of Leverage Trading Liquidations

Published

5 months agoon

By

admin

The 18% drop in the broader crypto market over the past 24 hours has sent major shockwaves leading to huge liquidations in the leveraged positions. With the Ethereum price tanking over 20%, several rumors started floating that Tron founder Justin Sun got rekt with more than $152 million in liquidations of the leveraged positions. However, the Tron founder denied these developments clearing the air on the liquidation process.

Justin Sun Clears Air on Liquidations

The recent sell-off in the crypto market in the Asian trading hours on Monday has led to more than $1 billion in total crypto market liquidations. Most of the traders with leveraged long positions got Rekt with rumors suggesting that Justin Sun was one of them.

Justin Sun potentially getting liquidated could be the reason for that nasty -20% wick on $ETH https://t.co/amPsbnmrbu

— Johnny (@CryptoGodJohn) August 5, 2024

The Tron founder, however, has dismissed the rumors stating that he and his team rarely engage in any leverage trading strategies. As per Justin Sun, leverage trades bring no benefit to the crypto market.

Instead, the Tron founder said that he and his team focus more on activities that support the crypto industry and entrepreneurs. He added that the Tron team remains focused on activities such as working on blockchain projects, staking, running nodes, or assisting project teams in providing liquidity.

The rumors about our positions being liquidated are false. We rarely engage in leveraged trading strategies because we believe such trades do not significantly benefit the industry. Instead, we prefer to engage in activities that provide greater support to the industry and…

— H.E. Justin Sun 孙宇晨 (@justinsuntron) August 5, 2024

Also Read: Crypto Prices Today August 5: BTC Tanks 10%, ETH Crashes 20%, & Altcoins In Bearish State

Liquidations On the Rise

There’s a strong volatility in the crypto market as the Bitcoin price tanked further all the way to $50,000. However, it has recovered at press time to $52,800 levels. The daily trading volumes have shot up by 161% to a staggering $71.8 billion.

Bitcoin critic Peter Schiff believes that the situation can worsen once the US market trading begins on Monday. The US futures are already down heavily as of now. Schiff predicts a strong liquidation coming in the Bitcoin ETF market, expecting a 30% gap down.

As I warned #Bitcoin has taken out the March low. It’s now trading $51K. That’s a 20% decline from where it was trading when the #BitcoinETFs closed on Friday. So this is a #Crypto Black Monday. Look out below! https://t.co/CK1rHutgly

— Peter Schiff (@PeterSchiff) August 5, 2024

Amid fears of a US recession and hard landing, there are talks about the hard landing in the US economy. However, some reports also suggest that the Fed could intervene even before September to announce a 50 bps rate cut.

Also Read: Jump Trading Dumping Ethereum, Which Crypto Is Next?

Bhushan Akolkar

Bhushan is a FinTech enthusiast and holds a good flair in understanding financial markets. His interest in economics and finance draw his attention towards the new emerging Blockchain Technology and Cryptocurrency markets. He is continuously in a learning process and keeps himself motivated by sharing his acquired knowledge. In free time he reads thriller fictions novels and sometimes explore his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Why meme coins are fading amidst Bitcoin institutional adoption and gains this cycle

Why Bitcoin Price Is Falling Today: Is $80K Next?

Here Are The Major Bitcoin Support Levels To Watch As Bulls Push For $100,000 Again

Flockerz presale enters final stage with 28 days remaining

What Happens to Ethereum Price If Bitcoin Crashes to $80,000?

XRP Has Most Bullish-Looking Chart in Entire Crypto Space, According to Analyst – Here’s Why

24/7 Cryptocurrency News

Why Bitcoin Price Is Falling Today: Is $80K Next?

Published

3 hours agoon

December 26, 2024By

admin

The recent dip in Bitcoin price has sparked concerns among investors while triggering massive selling pressure in the broader crypto market. In addition, the recent market developments also hint towards a further dip, with many predicting a potential slip to $80K or even below. Notably, this comes despite the strong institutional interest in the flagship crypto, as evidenced by the buying spree of MicroStrategy (MSTR) and others.

Why Is Bitcoin Price Falling Today?

Bitcoin price has recorded a sharp decline today, sparking concerns in the broader crypto market. A flurry of reasons could have weighed on the investors’ sentiment recently, which has also triggered massive selling pressure in the digital assets space.

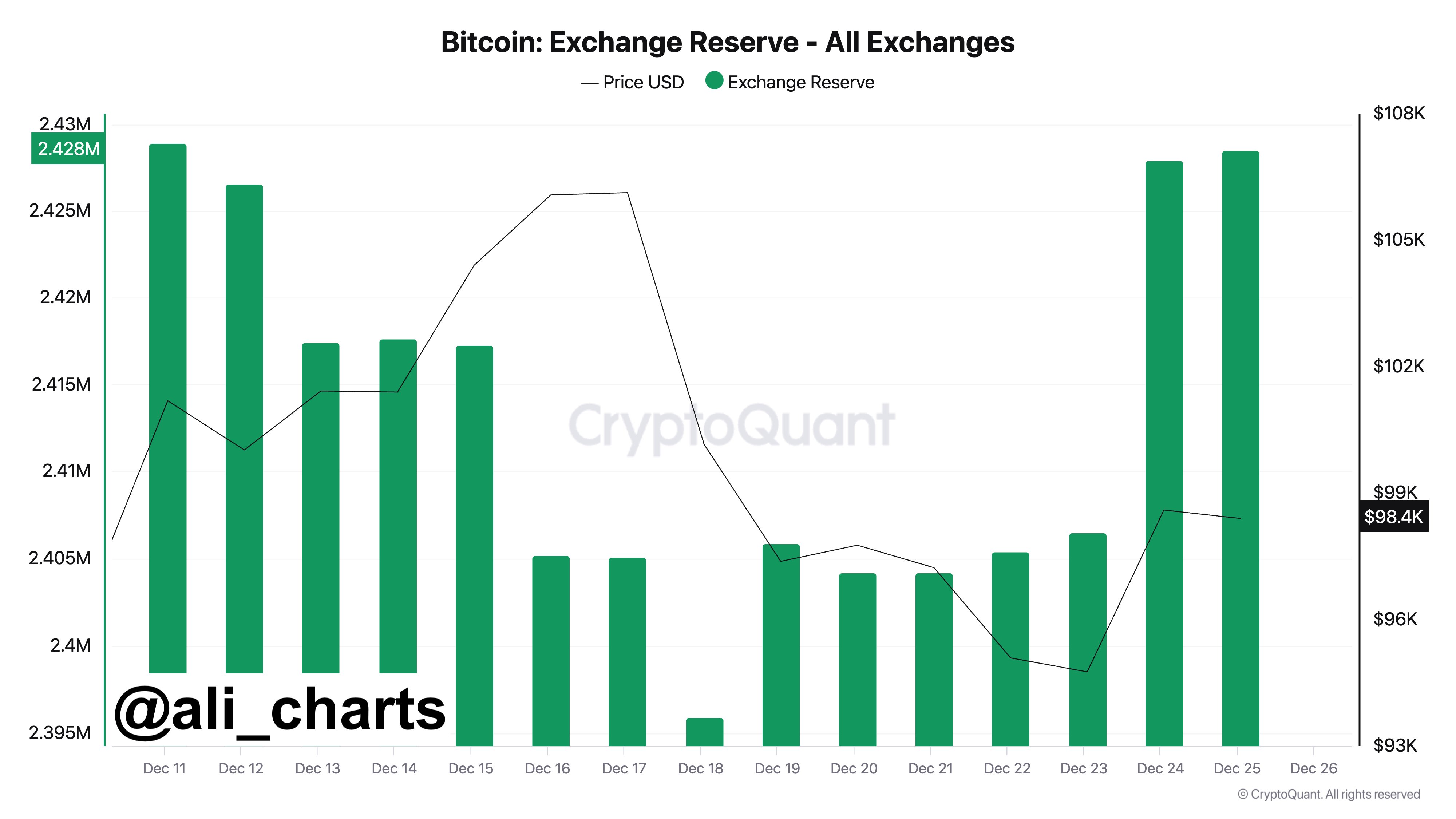

For context, BTC has recorded massive rallies since Donald Trump’s election win in November. Having said that, it also provided a profit-booking opportunity to many investors, with recent on-chain data indicating heavy selling pressure on the crypto. Top crypto market expert Ali Martinez highlighted the trend, saying that 33,000 BTC, worth over $3.23 billion, has moved to exchanges recently.

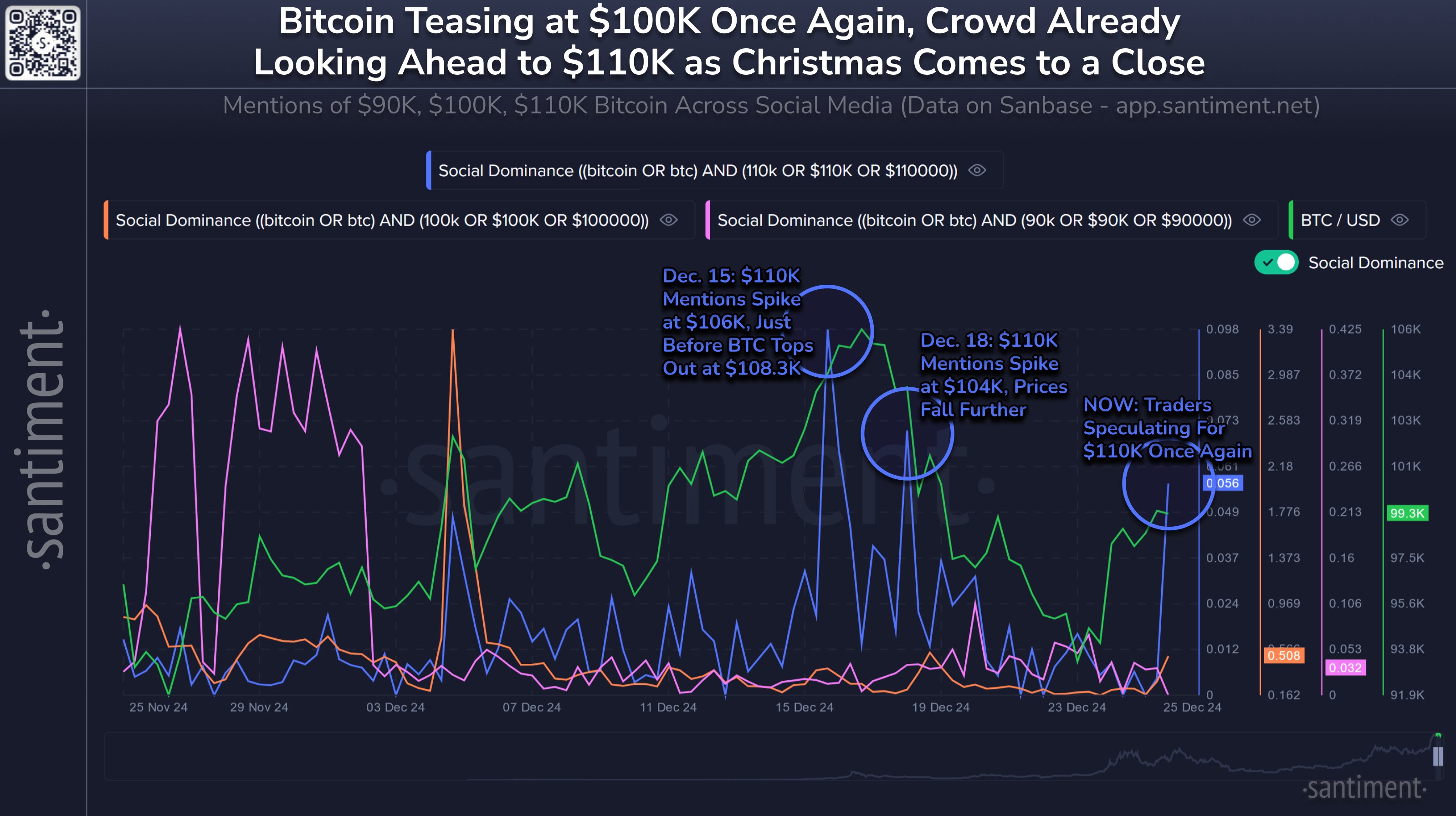

This indicates the profit-booking strategy, which the traders often use when an asset’s price goes higher. On the other hand, Santiment recently highlighted the BTC drop after reaching $99.8K on Christmas, sparked by bullish trader sentiment. The report noted that speculation of the cryptocurrency hitting $110K has also increased due to the recent rally.

However, Santiment suggests that historically, Bitcoin only reaches such highs when crowd expectations are low. This indicates that the current downturn may be a market correction, as traders’ high expectations for $110K may be self-fulfilling prophecies that prevent the price from rising further.

Bitcoin Options Expiry Sparks Concern

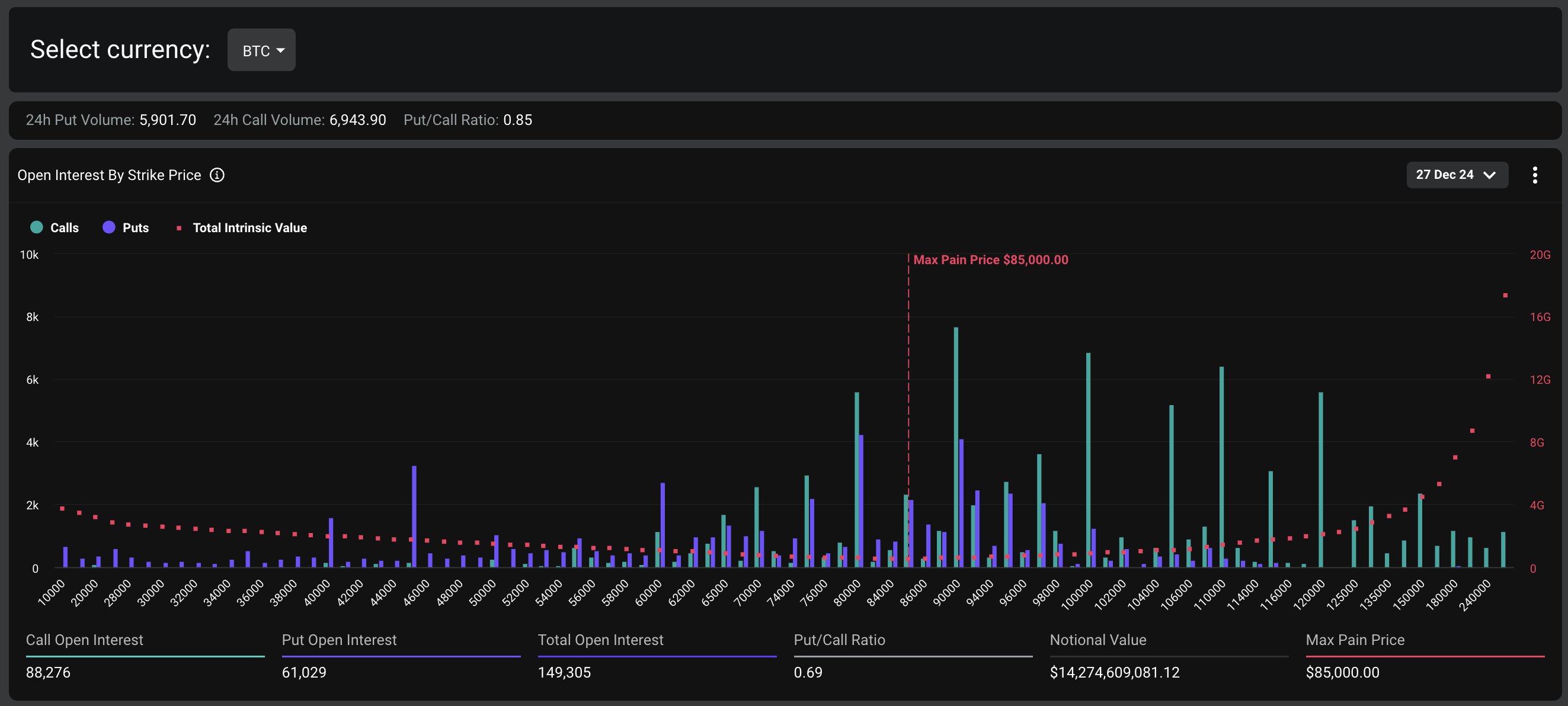

The recent downturn in Bitcoin price comes ahead of the largest crypto options expiry on the Deribit exchange, with over $18 billion in options set to expire tomorrow. The expiry has sparked directional uncertainty, with elevated volatility and “sharp swings in DVOL”, Deribit noted. Besides, market experts also warned that the heavily leveraged market to the upside could trigger a rapid snowball effect with any significant downside move, leading to high volatility.

Notably, the Bitcoin options expiry accounts for the majority of the total notional value, with $14.27 billion set to expire. The put/call ratio stands at 0.69, indicating a slightly bullish sentiment among traders. The max pain point for Bitcoin is $85,000, which could act as a resistance level in the event of a price swing.

On the other hand, Ethereum options expiring tomorrow account for $3.79 billion in notional value. The put/call ratio is 0.41, suggesting a more pronounced bullish bias among Ethereum traders. The max pain point for Ethereum is $3,000, which may influence the asset’s price movement.

BTC Dip To $80K Imminent?

The latest BTC price chart showed that the crypto plunged about 3.5% to $95,175, with its trading volume falling 1.5% to $42.45 billion. Notably, the crypto has touched a 24-hour high of $99,884, while maintaining a monthly gain of 2%. Further, BTC Futures Open Interest also fell about 3.5%, CoinGlass showed, indicating a bearish momentum hovering in the market.

Notably, the market picture indicates that despite soaring institutional interest, the recent developments have weighed on the market sentiment. For context, MicroStrategy (MSTR) stock recorded volatility recently amid its BTC buying strategy, which has fueled market speculations. Besides, many firms like KULR have also shifted their focus towards BTC accumulation.

Meanwhile, in a recent analysis, popular market expert Justin Bennett said that BTC is likely to fall to the $81K-$85K range. This analysis of Bitcoin price has fueled market concerns, with many other experts echoing a similar sentiment.

For context, Ali Martinez noted as Bitcoin dipped below the $97,300 mark, it indicates a bearish momentum for the crypto. However, he noted if BTC rebounds to this crucial support and rally to $100K, it could rally to $168,500 ahead.

Simultaneously, Peter Brandt has also predicted a potential BTC dip to $80K ahead, citing technical trends. On the other hand, popular market expert Tone Vays also said that if BTC trades below the $95,000 mark, it increases the probability of a correction to $75K.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

BTC Hits $99K, BGB Jumps 26%, MOVE Surges 15%

Published

15 hours agoon

December 26, 2024By

admin

Crypto prices today are showcasing a bullish trend as Bitcoin (BTC) touched $99,000, recovering from a low of $92,000. Major altcoins are also exhibiting positive momentum. Bitget Exchange token (BGB) emerged as the top gainer in the last 24 hours, with an 18% surge. Over the past week, BGB has risen by 48%, outperforming other major altcoins, which showed bearish trends during the same period.

Movement (MOVE) became the second top gainer, with a 15% price increase. The global cryptocurrency market cap rose by approximately 1%, reaching $3.43 trillion, while overall trading volume dropped 11%, settling at $117 billion. The decline in volume is attributed to the ongoing Christmas holiday season globally.

Market activity is expected to rise next week as the United States prepares for Donald Trump’s presidential oath ceremony in three weeks. The Fear and Greed Index currently stands at 63, indicating that greed persists in the market. Here’s an overview of the leading cryptocurrencies by market capitalization and price movements.

Crypto Prices Today: BTC Climbs Higher, XRP, ETH, and SOL Show Positive Momentum

Crypto prices today reflect a strong bullish momentum, with Bitcoin (BTC) maintaining its position near $99,000. Ethereum (ETH) and XRP showed steady gains, while Solana (SOL) rebounded after recent losses. These developments highlight renewed investor confidence in major cryptocurrencies.

Bitcoin Price Today

Bitcoin (BTC) price was trading at $99,123, reflecting approximately a 1% increase in the last 24 hours. Its 24-hour low and high were $97,681 and $99,974, respectively. BTC’s market cap stood at $1.96 trillion, with trading volume dropping to just $35 billion due to reduced holiday activity. Bitcoin’s market dominance rose to 57.04%, up from the previous day. Moreover, Russia has been leveraging Bitcoin and other digital currencies for foreign trade to mitigate the impact of Western sanctions.

Ethereum Price Today

Ethereum (ETH) price was trading at $3,462, marking approximately a 0.5% increase in the last 24 hours. Its 24-hour low and high were $3,442 and $3,545, respectively. ETH’s market cap reached $417 billion, with a trading volume of $18 billion. Additionally, The Sonic Chain has expanded its reach by introducing a new bridge to connect with the Ethereum ecosystem, further bolstering its milestones and ties with Fantom (FTM).

XRP Price Today

XRP price was trading at $2.274, with a 24-hour low of $2.265 and a high of $2.329. Its market cap stood at $130 billion, while the trading volume was relatively low at $4 billion. Crypto analysts are predicting that XRP could potentially reach an all-time high of $3.775 in the near term.

Solana Price Today

Solana (SOL) price was trading at $198, with a 24-hour low of $195 and a high of $201. Its market cap stood at $94 billion, with a trading volume of $2.5 billion. Crypto prices today show a strong outlook for SOL, as a top expert recently predicted its price could reach $330, driven by soaring anticipation towards Solana’s potential ETF approval and other positive market developments.

Meme Crypto Prices Today

Meme crypto prices today are showing a bearish momentum, with top meme coins experiencing a decline. Dogecoin (DOGE) was down by 1%, trading at $0.33. Similarly, Shiba Inu (SHIB) saw a 3% drop, trading at $0.00002256. Despite the overall decline, there are signs of hope within the meme coin community.

In the last 24 hours, Shiba Inu’s burn rate surged by nearly 100%, sparking optimism among its supporters. This increase in burn rate is part of recent advancements within the Shiba Inu community, which have fueled speculation of a potential rally in the near future.

Other top meme coins like BONK, PEPE, and WIF also experienced declines, ranging from 4% to 6% in the last 24 hours. These coins are also facing the broader market pressure, but the recent Shiba Inu developments have added some excitement to the meme coin space.

Top Crypto Gainer Prices Today

Bitget Token

BGB price is making history today, with the coin up by 26% in the last 24 hours, currently trading at $6.291. Its 24-hour low and high are $4.87 and $6.30, respectively. Crypto prices today reflect the remarkable surge of BGB, which has seen a market cap of $8.8 billion and a trading volume of $800 million.

This coin has experienced impressive growth, rising by 300% in the last month and 500% in the past quarter. The extraordinary performance of BGB is drawing significant attention, and its rise continues to fuel optimism in the crypto space.

Movement

Movement (MOVE) price was up by 15% in the last 24 hours, trading at $1.156. Its 24-hour low and high were $0.99 and $1.21, respectively. With a market cap of $2.61 billion, MOVE continues to show positive momentum in the crypto market.

GateToken

GT price was up by 10%, trading at $15.32. Its 24-hour low and high were $13.85 and $15.42, respectively. With a market cap of $1.36 billion, GateToken is ranked among the top 100 coins by market cap, reflecting its strong performance in the crypto market.

Top Crypto Loser Prices Today

Hyperliquid

HYPE price was trading at $26.30, showing an 11% drop in the last 24 hours. Its 24-hour low and high were $25.64 and $30.46, respectively. Despite the recent decline, crypto prices today reflect a market cap of $7.17 billion, maintaining its significant presence in the market.

Helium

Helium (HNT) price was down by 9%, trading at $7. Its 24-hour low and high were $6.90 and $7.64, respectively. With a market cap of just $1.23 billion, HNT is facing a challenging period in the market.

Fartcoin

FARTCOIN price was down by 7% in the last 24 hours, with its 24-hour low and high at $1.112 and $1.288, respectively. Despite the recent decline, it was the top gainer yesterday, surging by 70%.

Besides, the crypto market has continued to hold upside momentum in the last few hours with positive signs of further upside in Bitcoin (BTC), Ethereum (ETH), and major altcoins. Traders are expecting a rally after Christmas from the year’s end crypto options expiry.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

AVAX Price Eyes Rally As Avalanche Founder Draws Parallel To Bitcoin

Published

18 hours agoon

December 26, 2024By

admin

The speculations over a potential AVAX price rally soared as Avalanche founder Emin Gun Sirer drew parallels to Bitcoin’s capped 21 million supply. Highlighting AVAX’s maximum supply of 715.74 million and its deflationary mechanism of burning transaction fees, Sirer contrasts it with Ethereum’s uncapped supply. This scarcity-driven approach positions it as a strong contender among digital assets, sparking investor confidence and raising hopes for a potential price surge in the near future.

AVAX Price Gains Attention As Founder Highlights Bitcoin-Like Supply Cap

On December 25, AVA Labs CEO and founder Emin Gun Sirer posted on X, emphasizing a critical aspect of Avalanche – its capped supply, which he likened to Bitcoin’s 21 million fixed limit. Unlike Ethereum, which has no maximum supply and currently has over 120 million coins in circulation, the Avalanche token has a total cap of 715.74 million coins. This scarcity, combined with Avalanche’s mechanism of burning all transaction fees, has sparked discussions about its potential impact on AVAX price growth over time.

Sirer explained that Bitcoin’s capped supply has been a cornerstone of its value, attracting long-term investors and fostering confidence in its deflationary nature. By adopting a similar model, Avalanche aims to position itself as a scarce digital asset with strong value-accrual dynamics. This deflationary mechanism could drive interest in capped-supply tokens.

Also, the comparison with Bitcoin positions Avalanche token as a unique player in the crypto market, offering scarcity alongside a robust ecosystem. These features could make it appealing to investors looking for long-term value, which in turn could boost the Avalanche price ahead. This is especially true in a market dominated by inflationary assets like Ethereum.

What’s Next For Avalanche?

The latest Avalanche price chart showed that the crypto declined 2% to $40.973. Its 24-hour low and high are are $40.08 and $41.84. The token market cap is $16.5 billion with $453 million of trading volume. Despite the recent decline, its market cap and rank suggest resilience and ongoing investor interest.

The expert said that the current price action indicates a bullish momentum ahead for the crypto. Highlighting $34.71 as a key support zone, the expert has shared a strong forecast for the crypto ahead. According to Rose, the AVAX price could target the brief $64.04 or $79.77 mark ahead.

Besides, Avalanche recently launched the Avalanche9000 upgrade. This aims to improve scalability and make launching subnets cheaper. The upgrade could increase network activity, boosting AVAX price in the future.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Why meme coins are fading amidst Bitcoin institutional adoption and gains this cycle

Why Bitcoin Price Is Falling Today: Is $80K Next?

Here Are The Major Bitcoin Support Levels To Watch As Bulls Push For $100,000 Again

Flockerz presale enters final stage with 28 days remaining

What Happens to Ethereum Price If Bitcoin Crashes to $80,000?

XRP Has Most Bullish-Looking Chart in Entire Crypto Space, According to Analyst – Here’s Why

Coinbase CLO shares data on crypto hedge funds debanking, demands for answers

Here’s Why Dogecoin Price May Never Hit $50 or $100 Mark

Buying this token under $0.05 could be like buying Solana at $0.50

7 Massive Games From 2024 Worth Playing Over the Holiday Break

WhiteBIT Adds Pepe, Bonk, Sui & 57 New Crypto to Expand Collateral Options to 80

5 game-changing altcoins for December/January

BTC Hits $99K, BGB Jumps 26%, MOVE Surges 15%

Floki DAO Floats Proposal Ahead of Possible European ETP, Second After Dogecoin

Polygon’s presale token captures XRP and Cardano investors’ attention

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis5 months ago

Price analysis5 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: