Bitcoin

Trump and the Future of Bitcoin

Published

4 months agoon

By

admin

If you weren’t there in person, it would be hard to accurately describe how long and winding the line was to see Donald Trump speak at the Bitcoin conference. The wait to even pass through security and find a seat in the auditorium was hours long and thousands of folks were scrambling to find seats at the Nakamoto Stage early in the day. As the line snaked through the expo hall, it was easy to find an even distribution of Bitcoiners and Trump supporters (some were both) all eager to hear Trump speak. There was an excitement in the atmosphere, and while I didn’t share in the excitement, it did permeate the air in Nashville. Uber drivers were quick to point out that Trump was speaking at the conference. Around the city were large images of Trump’s face next to Bitcoin symbols advertising the conference. Trump-mania surely had taken over the conference, but it also seemed to take over the city of Nashville, too.

I can’t deny that getting Donald Trump to speak at the Bitcoin Conference during an election year is a huge “get.” It is an important moment for Bitcoin and we should all appreciate this development, in some sense, as a milestone that we can all be proud of as Bitcoiners. Trump’s speech promised to lunge Bitcoin into the mainstream political conversation and thereby normalize an up and coming digital currency that most people still dismiss as “fake internet money”. It was a moment we were all supposed to remember for the rest of our lives; this was Bitcoin’s chance to be included in serious conversations held by serious people.

If Trump had shown up for his speech on time, we would have known an hour earlier that this wasn’t going to happen. Instead, we waited. Once Trump did start his speech, it didn’t take long to realize that the folks waiting for hours all day were sold a bill of goods. Trump’s speech was a rambling, at times incoherent, stump speech with a few little nods toward crypto, and… I guess… Bitcoin thrown in for good measure. The first mention of Bitcoin came about six and a half minutes into his remarks. I don’t blame Trump for speaking about crypto more than Bitcoin; most politicians do. But while he was speaking at the Bitcoin conference, I was expecting him to spend more time discussing Bitcoin than his genius uncle who used to work at MIT. Alas, sometimes you just can’t set the bar low enough.

The most concrete take away from hearing Trump speak about Bitcoin was the not-so-shocking realization that Robert Kennedy Jr. thinks more deeply about Bitcoin while he has his first cup of coffee each morning than Donald Trump has thought about Bitcoin during his entire life. All of Trump’s best moments during his speech (and there were some) were lifted, whole cloth, from RFK Jr’s keynote address the day prior. The parts of the speech he didn’t copy from RFK Jr were dismissive, arrogant, pandering and ill informed. The value in watching the speech at all is that the single issue Bitcoin voters I keep hearing about now have an easy decision to make.

No doubt, there are plenty of Bitcoiners who love Trump and loved his speech. But there are also a surprising number of folks that see all this for what it is: a politician pandering for money and votes and an insecure Bitcoin community pandering for some borrowed legitimacy. Having a leading presidential candidate discuss Bitcoin has some positive effects, but the most serious people I know in the space also recognize there are some risks and dangers involved, too. Chief among these dangers is that by cozying up to Trump, the Bitcoin community risks alienating itself from pre-coiner audiences for the foreseeable future. This seems to be a point, I think, that is hard to comprehend if you already like Bitcoin or already like Trump. Try to remember, most people don’t fit into either category.

I’ve publicly been in the Bitcoin space long enough to appreciate the massive cognitive dissonance that exists among many Bitcoiners. Some of these people are Libertarians who are fully committed to individual freedom, but are unwilling to respect a person’s gender identity. Some of these people are Conservatives who want to see the government get smaller while that same government polices what books get banned and what healthcare people are allowed to receive. Some of these people are Bitcoiners who want to see the government disintermediated from the financial system while they cheer uproariously for a politician promising to buy Bitcoin on behalf of the United States Government. If I can see the cognitive dissonance, why is it so hard for a community that prides itself on being heterodox, skeptical and don’t-trust-verify?

I consider it a personal responsibility to orange pill as many people as I can, and I have been serious about doing that. This means, I want to expose the 57% of Americans that don’t like Trump to Bitcoin as a force for good in this world; my job is hard and since Nashville, it just got harder. Let’s be real: Bitcoin is the perfect combination of “internet” and “money” that should make anyone skeptical. There is no shortage of FUD dismissing Bitcoin as pretend money or a scam or a ponzi scheme or money for criminals. Experienced Bitcoiners may not be worried about any of that, but the pre-coiners I know certainly are hyper aware of the reputation. If my job is to convince them to take a second look, that gets harder when Bitcoiners are falling over themselves to align with a known con artist, philanderer, fraud, and convicted felon.

To be sure, Bitcoin will attract its share of con artists, philanderers, frauds and felons. Bitcoin is for them, too. But we shouldn’t capitulate and rebrand Bitcoin as something Trumpian. This is simply bad marketing. The most compelling argument I’ve heard in support of seeking out Trump’s approval is that it will force other politicians to support Bitcoin and his policies would force other nations to take Bitcoin seriously. This could prove to be true, but it is just as likely that the opposite will happen. Normie pre-coiners, if they are paying attention at all, will so easily be able to hold up the “scam” Bitcoin next to the “scam” Trump and walk away from the whole thing and sleep easily. Meanwhile, Trump will have no genuine affinity toward Bitcoin after the votes are counted.

After so much effort going toward ensuring Bitcoin is non-partisan, bi-partisan and non-political, it was our community (really a handful of influential and connected Bitcoiners) that sought out an alliance with the most polarizing political figure in generations. It would be one thing if Trump found Bitcoin on his own, but that’s not the case. We committed this unforced error ourselves, or more accurately, we allowed the leaders in our leaderless movement to err on our behalf.

I can hear you screaming “Well, what’s your solution? Vote for the other guys?!” Fair question. Here’s my solution: Walk away from politicians and walk towards voters. Meet them where they are and educate them about the ways Bitcoin solves the problems they care about. That’s really it. The rest will take care of itself. Take a low time preference and it will happen from the ground up, without having to sacrifice your principles. This is the best way to promote Bitcoin adoption, protect the marginalized people Bitcoin can help, and attract policy makers who truly and deeply care about Bitcoin and eschew “crypto”. If you do get to interact with politicians, advocate for protections for self custody, de minimis tax treatment so Bitcoin can be easily spent, and consumer protections imposed on exchanges and brokerages.

For those that think Trump is now one of us, he isn’t. He will drop our community the moment it serves him, and we will be worse off for it. Zoom out. One week after Trump appeared in Nashville, he sat for a disastrous interview with the National Association of Black Journalists. This, it turns out, did not make him a Black journalist. Nor did showing up in Nashville make him a Bitcoiner. We would, all of us, be well served to remember that.

This is a guest post by Jason Maier. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

Bitcoin

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Published

1 hour agoon

November 22, 2024By

adminBitcoin has shattered expectations once again, surging past the critical $93,257 level in a display of unstoppable momentum. This breakout has ignited fresh waves of bullish optimism across the crypto market, as traders and investors anticipate greater gains. With market sentiment shifting and key indicators aligning, could this be the spark for Bitcoin’s next major rally?

As optimism steadily increases in the market, the goal is to take a closer look at BTC’s impressive breakout above the $93,257 mark, analyze the positive sentiment driving its climb, and assess the potential for continued upward strength in the market.

Bullish Indicators: What’s Fueling BTC’s Uptrend?

Currently, on the 4-hour chart, BTC is sustaining its position after successfully surpassing the $93,257 mark while trading above the 100-day Simple Moving Average (SMA). By maintaining its position above this level and the 100-day SMA, BTC demonstrates resilience and capability for more price growth, targeting new highs.

An analysis of the 4-hour Relative Strength Index (RSI) shows a significant surge, climbing to 70% from its previous low of 56%, indicating strong bullish pressure for BTC. While this increase signals growing positive market sentiment, it raises concerns about the rally’s sustainability since a price correction could occur if profit-taking ensues.

Bitcoin is showing strong positive movement after breaking past the $93,257 level, supported by a rise above the 100-day SMA, reflecting sustained bullish strength and potential for continued upward movement. The fact that BTC is consistently above the 100-day SMA suggests a solid trend and that the bulls are eager to push prices higher, possibly leading to an extended growth if pressure continues to build.

Finally, the RSI on the daily chart is currently at 81%, well above the key 50% threshold, signaling a strong uptrend for Bitcoin. With the RSI at this level, it suggests that the upside pressure is likely to continue, which means that Bitcoin’s price could keep rising in the near term, as there are no signs of a reversal or decline.

What The $93,257 Breakout Signals For Bitcoin

The $93,257 breakout opens the door to a more optimistic future outlook for Bitcoin. This key resistance level has been decisively breached, suggesting that BTC may continue its upbeat momentum, potentially targeting higher price levels such as the $100,000 mark and beyond.

However, careful monitoring is essential for any signs of resistance or market corrections that could hinder its ascent. Should such a scenario occur, Bitcoin’s price could begin to drop toward the $93,257 mark. A break below this level might trigger further declines, possibly testing additional support levels in the process.

Source link

Bitcoin

Bitcoin Approaches $100K; Retail Investors Stay Steady

Published

2 hours agoon

November 22, 2024By

admin

Bitcoin trades at $99,340.23, approaching the $100K mark as retail investors retain market dominance.

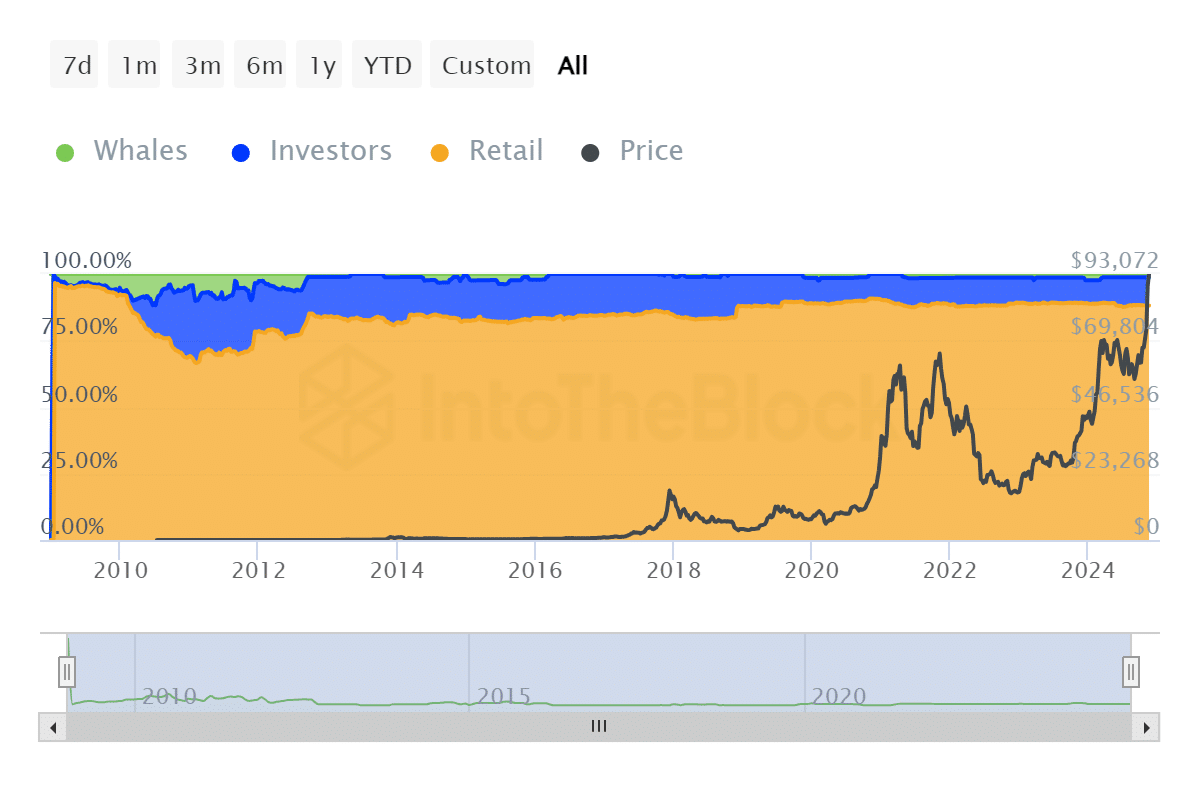

What is more interesting about this rally is the dominance of retail investors, who currently account for 88.07% of all Bitcoin (BTC) in circulation, according to The Block. Contrary to the recent claims that institutional investors are leaving retail investors behind in ownership of BTCs, the asset is still in the hands of retail investors, which underlines their stronghold in the market. This grassroots stronghold contrasts the much smaller shares held by whales at 1.26% and institutional investors at 10.68%.

Adding momentum to BTC, the historic debut of BlackRock’s BTC ETF options witnessed $1.9 billion in notional value traded on the first day. It is a landmark news because it signifies growing institutional interest in BTC, yet lowers entry barriers for everyday investors. But there’s still some way to go, says Jeff Park, Head of Alpha Strategies at Bitwise Invest, in his observations on X about the ETF’s potential to reshape access to BTC.

1/ Just as we expected, the market launched with a beautiful “volatility smile” quickly established by 945AM and for the rest of the day. In fact, the smile got even wider throughout the day, finishing with higher wings by EoD. pic.twitter.com/BHI09pORS4

— Jeff Park (@dgt10011) November 20, 2024

Bitcoin Breakdown:

How BTC ownership is distributed supports the overall trend of asset availability in the market. Companies such as Coinbase have substantial quantities of BTC, holding more than 2.25 million BTC. However, most of this is kept for their clients. Satoshi Nakamoto‘s wallet, which contains 96,8452 BTC, remains untouched as it played a role in creating the Genesis block.

Overall, funds and ETFs account for 1.09 million BTC, or about 5.2%, while governments such as the U.S. and China collectively hold around 2.5%.

Despite BTC witnessing price surges, the market is far from stable and often shows extreme volatility. For instance, on Nov. 21, the price of BTC dipped to $95,756.24, with trading volume reaching $98.40 billion. This volatility then reflects the vital role that retail investors play during price hikes, even as institutional investors become more active in the market.

Some argue that BTC is becoming more centralized, but the data does not back this claim. Financial products like ETFs are attractive to institutions, but they also make BTC more accessible to retail investors. BTC continues to align with Satoshi Nakamoto’s vision of a decentralized and democratized financial system. As BTC nears the $100,000 threshold, its open-and-shut conversation that BTC’s ownership remains essential.

Source link

$100

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Published

9 hours agoon

November 22, 2024By

admin

What an enormous day it has been today.

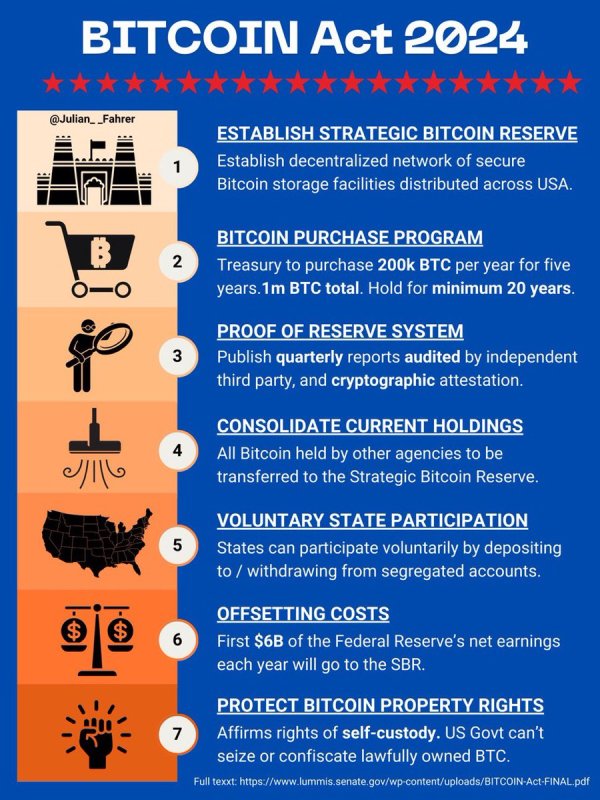

Gary Gensler officially announced that he is stepping down from his position as Chairman of the Securities and Exchange Commission (SEC), and minutes later, Reuters reported that Donald Trump’s “crypto council” is expected to “establish Trump’s promised bitcoin reserve.” A bitcoin reserve, that would see the United States purchase 200,000 bitcoin per year, for five years until it has bought 1,000,000 bitcoin.

Right after both of those, Bitcoin continued its upward momentum and broke $99,000, with $100,000 feeling like it can happen at any second now.

It is hard to contain my bullishness thinking about the United States purchasing 200,000 BTC per year. They essentially have to compete with everyone else in the world who is also accumulating bitcoin and attempting to front run them. There are only 21 million bitcoin and that is a LOT of demand.

To put this into context, so far this year the US spot bitcoin ETFs have accumulated a combined total of over 1 million BTC. At the time of launch the price was ~$44,000 and now bitcoin is practically at $100,000. And that’s all ETFs combined. Imagine what will happen when just one entity wants to buy a total of 1 million coins, having to compete with everyone else accumulating large amounts as well?

I mean MicroStrategy literally just completed another $3 BILLION raise to buy more bitcoin, and will continue raising until it purchases $42 billion more in bitcoin. The United States are most likely going to be purchasing their coins (if this legislation is officially signed into law) at very high prices. The demand is insane and only rising in the foreseeable future.

With two months left to go until Trump officially takes office, it remains to be seen if this bill becomes law, but at the moment things are looking really good. As Senator Cynthia Lummis stated, “This is our Louisiana Purchase moment!” and would be an absolutely historic moment for Bitcoin, Bitcoiners, and the future financial dominance of the United States of America.

This is the solution.

This is the answer.

This is our Louisiana Purchase moment!#Bitcoin2024 pic.twitter.com/RNEiLaB16U

— Senator Cynthia Lummis (@SenLummis) July 27, 2024

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

Polkadot investor predicts a 30,000% rally for this $0.04 token by 2025

Donald Trump Proposed Crypto Advisory Council To Set Up Strategic Bitcoin Reserve

Want Greater Bitcoin Adoption? Engage With Your Government.

Why the Media Loves the Worst of Crypto

HashCats prepares for Token Generation Event after completing mining season

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential