24/7 Cryptocurrency News

Grayscale and Bitwise Files To Launch Options On Ethereum ETF

Published

3 months agoon

By

admin

Grayscale Investments and Bitwise have submitted filings with the US Securities and Exchange Commission (SEC) to list Options products on their spot Ethereum ETF offering. According to a filing lodged by both asset managers, the New York Stock Exchange (NYSE) is contracted as the stock trading platform to list the products, if approved.

Options on Spot Ethereum ETF: The Challenge

This demand for a rule change to list Options on spot Ethereum ETF comes after the markets regulator has approved the base product. However, institutional investors want more than just the original ETF offering. Growing demand has now pushed Ethereum ETF issuers like BlackRock, and now Grayscale to make move for the product.

Options on crypto ETF remains a gray area for the Gary Gensler-led markets regulator. While it took a lot of concessions to permit Bitcoin and ETH ETFs, the risky nature of an Options linked crypto fund sounds far fetched.

However, proponents of this product argue that with traditional investment products linked to Options, then it is the right for crypto versions as well. With the filing lodged, comments on the filings are notably due in 21 days.

As the NYSE argued, the listing and eventual trading of Options on Grayscale Ethereum Trust (ETH) will offer investors more exposure to the coin. Additionally, the same holds true for Bitwise Ethereum ETF and Grayscale Ethereum Trust Mini. With Grayscale and Bitwise among the top issuers of this product, their combined weight and influence for approval might sway the market regulator into reconsidering its stance.

That BlackRock is also joining this bid is also a strengthening factor based on its precedents. Though the options bid on spot Bitcoin ETF has not gained approval yet, this might not impact Ethereum’s chances moving forward.

Right Time for Grayscale ETF Expansion?

The Grayscale move to exchange its ETF product suit is timely. There is a lot of focus on the digital currency ecosystem at the moment with the Donald Trump and Kamala Harris election showdown.

The industry is also currently in celebratory mode today as Judge Analisa Torres issued her verdict on Ripple lawsuit against the US. The Judge ordered the blockchain payments firm to pay a fine of $125 million for selling XRP to institutional investors.

Following the ruling, CEO Brad Garlinghouse says the company will now focus on growth initiatives moving forward.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture. Follow him on Twitter, Linkedin

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Donald Trump Appoints Elon Musk & Ramaswamy To Lead D.O.G.E, Dogecoin Price To $2.4?

Analyst Sets $320,000 Target As Wave 5 Begins

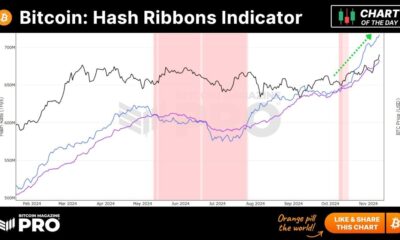

Bitcoin Hash Ribbons Indicator: Miners Show Unwavering Optimism as Hash Rate Hits New Highs

DeFi Technologies creates SolFi to be its ‘MicroStrategy for Solana’

Shibarium Crosses 500 Mln Transaction Milestone, SHIB Reacts

Dogecoin (DOGE) Leads Crypto Market Resurgence With Explosive Move As Traders Eye $1 Price Target

24/7 Cryptocurrency News

Donald Trump Appoints Elon Musk & Ramaswamy To Lead D.O.G.E, Dogecoin Price To $2.4?

Published

17 mins agoon

November 13, 2024By

admin

US President Donald Trump revealed that Elon Musk and Vivek Ramaswamy will lead a newly created Department of Government Efficiency, or “DOGE.” This initiative, aimed at streamlining government operations and reducing bureaucratic waste, aligns with Trump’s “Save America” movement and promises to reshape federal spending and regulatory practices.

Following the announcement, Dogecoin (DOGE) experienced a surge in trading, with analysts predicting further growth in its value, fueled by renewed interest in the cryptocurrency market.

Donald Trump Appoints Elon Musk & Ramaswamy To Lead D.O.G.E

According to Donald Trump’s statement, the Department of Government Efficiency (DOGE) will focus on cutting down unnecessary regulations, reducing wasteful expenditures, and restructuring federal agencies.

Elon Musk and Ramaswamy will lead this effort from outside the federal government, partnering with the White House and the Office of Management and Budget (OMB) to drive large-scale reform. Trump described the project as potentially “The Manhattan Project” of modern government, emphasizing the ambitious nature of the initiative.

The DOGE initiative has been positioned as a patriotic mission to improve government accountability and efficiency, making the federal system more responsive to “We the People.” Trump expressed confidence that this effort would create a “leaner” and “more accountable” government by July 4, 2026, in time for the United States’ 250th anniversary. Musk echoed the sentiment, suggesting that the changes would send “shockwaves through the system.”

This Is A Breaking News, Please Check Back For More

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Shibarium Crosses 500 Mln Transaction Milestone, SHIB Reacts

Published

4 hours agoon

November 12, 2024By

admin

Shibarium, the Ethereum-based Layer-2 scaling solution backed by the Shiba Inu (SHIB) ecosystem has recorded a huge mainnet milestone. According to data from Shibarium scan, the total transactions processed on the platform has crossed the 500 million milestone. As of writing, the total transaction is pegged at 500,623,178.

Shibarium and the Obvious Growth Catalyst

The Shiba Inu-backed layer-2 scaling solution launched in August 2023. For a protocol with a largely rocky start, the new milestone has sparked series of debates on X. Shibarium got a major boost less than a month ago when Shiboshi-linked NFT update triggered enhanced ecosystem adoption.

With the NFT bridge feature on the mainnet, transaction count jumped to millions per day from a few thousands. At the time of writing, the daily transaction count comes in at 4.69 million. Despite this figure, the protocol records at least 2,227 transctions in hours. The new milestone has triggered a comment from Kaal Dhairya, one of the ecosystem’s lead developers.

PAW-some news! 🐾 Shibarium just fetched 500M transactions—proof of pack is unstoppable! 🚀 Here’s to more tail-wagging milestones ahead. #ShibArmy #Shibarium https://t.co/1gBzGyY85E

— Kaal (@kaaldhairya) November 12, 2024

Per the Shibariumscan data, the protocol now have a total block of 7,849,660 with wallet adresses coming in at 1,889,496. With the consistent growth, the protocol hopes to match with some of its peers like Base and Optimism soon.

Shiba Inu Reacts, Will This Boost Market Value?

The memecoin has reacted to the update within the ecosystem as it underscore the relative growth overall. At the time of writing, SHIB price was changing hands for $0.0000264, down by 3.39% in 24 hours. Within this period, the token has traded within a low price of $0.00002457 and a high of $0.0000303.

While the token ought to print a rally, SHIB has recorded an extreme growth trend amid the boom in the price of Bitcoin. In the past week, the token has retained a more than 48% rally overall. With the token’s price largely linked to the broader market trend, it’s recovery might come faster than projected.

Meanwhile, lead developer Shytoshi Kusama has set his sight on his SH.I.B proposal to create the Silicon Valley destination for crypto. He recently pitched this idea to Elon Musk in a bid to get the Donald Trump administration to consider the prospects.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

How A Simple Wallet Error Cost $25 Million To This Crypto User?

Published

11 hours agoon

November 12, 2024By

admin

In an unfortunate situation, a crypto user faced investors’ scariest dreams. He lost $25M worth of crypto while transferring from one wallet to the other. The user wished to transfer to the liquid restacking platform called Renzo. However, with a simple wallet error, the user transferred all the cryptos to the platform’s wrong address, bearing millions worth of losses.

When the rest of the market is busy grabbing all the gains, as Bitcoin surpassed Silver after a new ATH, this one user is bearing a loss.

Crypto User Sent Cryptos To The Wrong Wallet Address

The person lost $25 Million on Sunday while transferring the Renzo Restaked ETH to Renzo’s safe wallet. However, instead of the safe wallet, which is a primary wallet that allows full access to funds, the users pasted the wrong address link, which led to the transfer to a safe module. As a result, all those tokens are now locked in a Smart Contract and cannot be retrieved due to the transaction’s decentralized nature.

Urgent Request for Help!

To all skilled hackers and white hats out there: I’ve lost a significant sum of funds in a contract and urgently need help recovering it. If you can successfully retrieve the funds, I’ll immediately offer a 10% reward, which is approximately $2.5 million…

— 我有一个狗王梦 (@qklpjeth) November 10, 2024

The user has approached people on X, describing his story to the community members. He has pleaded with hackers and white hats to help with this situation in return for a 2.5% reward ($22.5M), which is quite high. Many people have replied to support, and a few even attempted to recover, but the person has sent it to the safe module, making it almost impossible to retain these tokens without changing the Smart Contracts code.

A few readers have advised reaching out to the platform’s team and conveying the needed changes to retrieve the assets. Even the DeFiLlama founder 0xngmi has suggested that the crypto user should connect with the Renzo team to edit the contract code and retrieve his tokens.

Renzo Fails To Help Due to Compliance Issues

Renzo is a staking platform designed to simplify restocking on popular blockchains like Ethereum and Solana. Despite the possibility of updating the code, the team has declined to assist in this matter. The crypto user explained that Renzo could not help due to compliance issues.

A few community members further advised the victim to take legal action to solve this issue. This is because, on many occasions, the court has ordered to resend the cryptos in case of hacks and similar situations. However, the crypto user has declined to do so due to his good relations with the company, saying,

I haven’t considered the legal process. I’m good friends with the Renzo team and don’t want to go through legal procedures.

How To Protect Your Crypto?

This unfortunate event is a big-time reminder that trading in digital assets comes with multiple challenges other than thefts and hacks. Even a minor mistake could lead to losing your crypto forever, as this crypto user did, as he sent all the tokens to a safe module instead of a safe wallet. As a result, the user has lost $25M worth of Renzo Restaked ETH and is approaching crypto hackers to retrieve the tokens. Till now, no solution has come out, and even Renzo’s team failed to help out on this due to compliance issues. With this, it has become an important lesson to double-check the details and understand the platform protocol to protect cryptos. More importantly, every user should have a strategic trading strategy to help with losses and grabbing profits, as this crypto investor turned $1.2M to $9.36M.

Pooja Khardia

With a deep-seated passion for reading and five years of experience in content writing, Pooja is now focused on crafting trending content about cryptocurrency market.

As a dedicated crypto journalist, Pooja is constantly seeking out trending topics and informative statistics to create compelling pieces for crypto enthusiasts. Staying abreast of the latest trends and advancements in the field is an integral part of her daily routine, fueling a commitment to delivering timely and insightful coverage

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Donald Trump Appoints Elon Musk & Ramaswamy To Lead D.O.G.E, Dogecoin Price To $2.4?

Analyst Sets $320,000 Target As Wave 5 Begins

Bitcoin Hash Ribbons Indicator: Miners Show Unwavering Optimism as Hash Rate Hits New Highs

DeFi Technologies creates SolFi to be its ‘MicroStrategy for Solana’

Shibarium Crosses 500 Mln Transaction Milestone, SHIB Reacts

Dogecoin (DOGE) Leads Crypto Market Resurgence With Explosive Move As Traders Eye $1 Price Target

The Digit Addiction Pandemic

AI startup Genius Group picks Bitcoin as main treasury asset

Cryptocurrencies That Soared to All-Time High, Rewarding Investors with Massive Returns

AI Startup Hugging Face is Building Small LMs for ‘Next Stage Robotics’

Kraken launches ATH and APU token listings on Nov. 12

How A Simple Wallet Error Cost $25 Million To This Crypto User?

Shiba Inu price pumps over 45% and these meme coins might explode next

Ether (ETH) ETF Inflows Hit Record, Bitcoin ETF Inflows Soar as BTC Price Eyes $90K

Bitget Re-Launches UK Platform With Over 150 Tokens Ready for Trading

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News2 months ago

News2 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

✓ Share: