Markets

Bitcoin, Ethereum, and Solana Surge as Traders Face Choppy Market

Published

2 months agoon

By

admin

Crypto markets have surged—along with other risk-on assets like U.S. stocks—on news that the American economy may be stronger than previously thought.

Bitcoin, Ethereum, and Solana have made big gains on Thursday, with smaller-cap digital coins and tokens also jumping significantly.

The price of Bitcoin is currently at $59,401, a 24-hour rise of 8%. Ethereum is up even more over the same period and is now priced at $2,576—a 9% day jump, according to CoinGecko data.

Solana is now trading hands for $157.03, having also risen 9% since yesterday.

Digital assets started the week off bloody, after a jobs report last Friday sparked fears that the U.S. economy could be sliding into a recession, causing a Wall Street sell-off.

A surge in the value of the Japanese yen—a favorite for global traders—against the U.S. dollar on Monday didn’t help, with investors hurrying to sell anything deemed risky—including crypto exposure.

But fears that the U.S. economy may be in serious trouble could be assuaged—at least for now—after data Thursday showed that filings for unemployment benefits decreased from the week prior, soothing investor concerns.

Stocks rose on the news, with the S&P500 and Nasdaq making gains of 2% and nearly 3%, respectively.

David Lawant, head of research at FalconX, told Decrypt that crypto investors were also pleased to hear the news that former customers of collapsed exchange FTX would get their lost investments back.

Today, a judge approved the settlement the collapsed crypto company FTX had with the Commodity Futures Trading Commission (CFTC). The failed crypto brand now has to pay $12.7 billion to resolve the lawsuit.

“On the macro side, the soft initial jobless claims number temporarily reduced hard-landing concerns, lifting risk assets more broadly,” he said.

He added: “On the crypto side, the perception that we are one step closer to FTX creditors receiving their $12.7 billion is positive, as part of it could re-enter the market.”

Other cryptocurrencies making big gains include Dogecoin, which is up nearly 7% in 24 hours, trading hands for $0.1028, and Toncoin—up 15% in a day and priced at $6.19.

XRP is the biggest winner over the past day, though, after a judge yesterday ruled that Ripple, the company whose owners created XRP, would have to pay the Securities and Exchange Commission (SEC) a $125 million fine in a long-running lawsuit.

The ruling has been interpreted as a win as the SEC had asked for a $2 billion settlement in the case. XRP, as a result, is up 26% and trading for $0.63.

Edited by Ryan Ozawa.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Crypto Strategist Sees Bitcoin Potentially Rallying to $68,000 – But There’s a Big Catch

SEC’s Ripple case appeal, Israel-Iran tension, market uncertainties, Satoshi’s identity | Weekly Recap

If This Pattern Holds Dogecoin Price Could Target $0.20; Analysts Predict

Solana Dev Quits Project He Set Himself on Fire to Pump

Top cryptocurrencies to watch this week

Ethereum Price $3K Rally at Risk as ETH Turns Inflationary Post-Dencun

cryptocurrency

Top cryptocurrencies to watch this week

Published

4 hours agoon

October 6, 2024By

admin

The global crypto market cap ended last week with a 7% drop, losing $160 billion as it closed at $2.15 trillion.

While Bitcoin (BTC) influenced the broader market, several altcoins charted their own paths, benefiting from unique developments within their ecosystems.

Here are some of these cryptocurrencies to keep an eye on this week, following their diverse price movements last week:

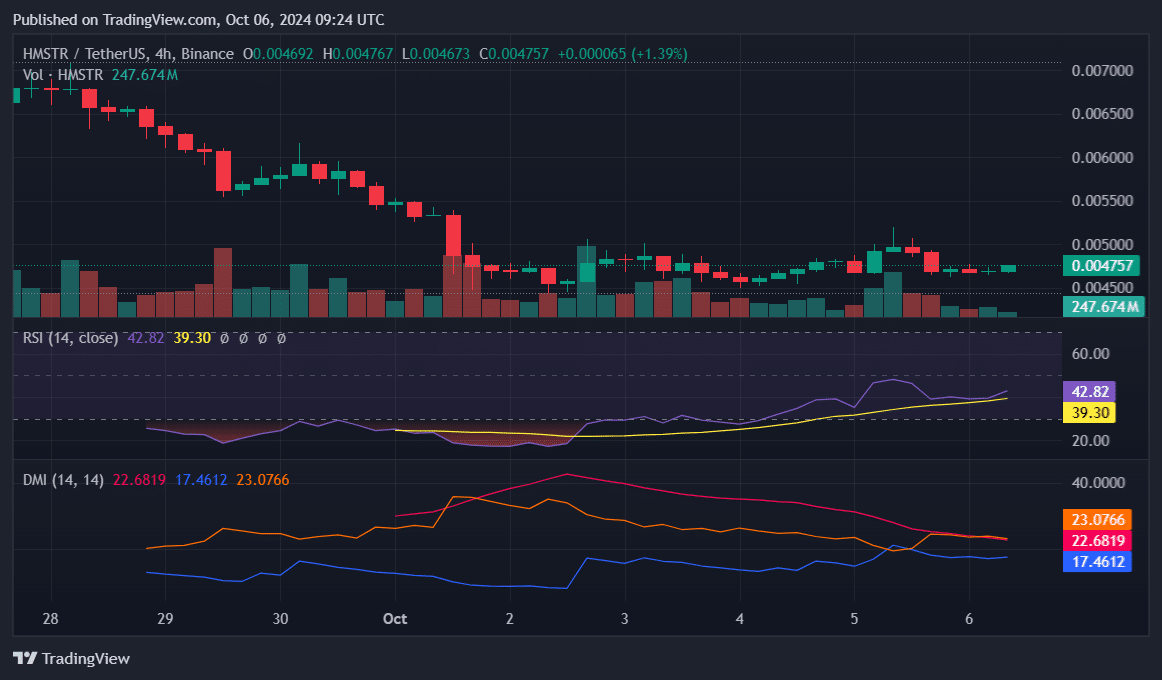

HMSTR collapses 18%

Hamster Kombat (HMSTR) saw a bearish week, dropping 18% to $0.004714. Its worst day came on Oct. 1 when it fell 13.94% amid a broader market decline on the back of geopolitical tensions.

Last week’s bearishness built on a downtrend HMSTR has faced since its airdrop on Sept. 26. However, the four-hour chart shows some signs of recovery, with the RSI sloping upward, now at 42.82.

For the DMI, the +DI is steady at 17.46, signaling slight buyer momentum. However, the -DI at 23.07 slopes downward, indicating weakening selling pressure. The ADX is at 22.68 and trending downward, as the current trend loses strength.

These figures suggest a possible recovery if buying momentum continues, with bulls possibly targeting $0.0051. However, the downtrend may persist if buyers do not pick up pace this week.

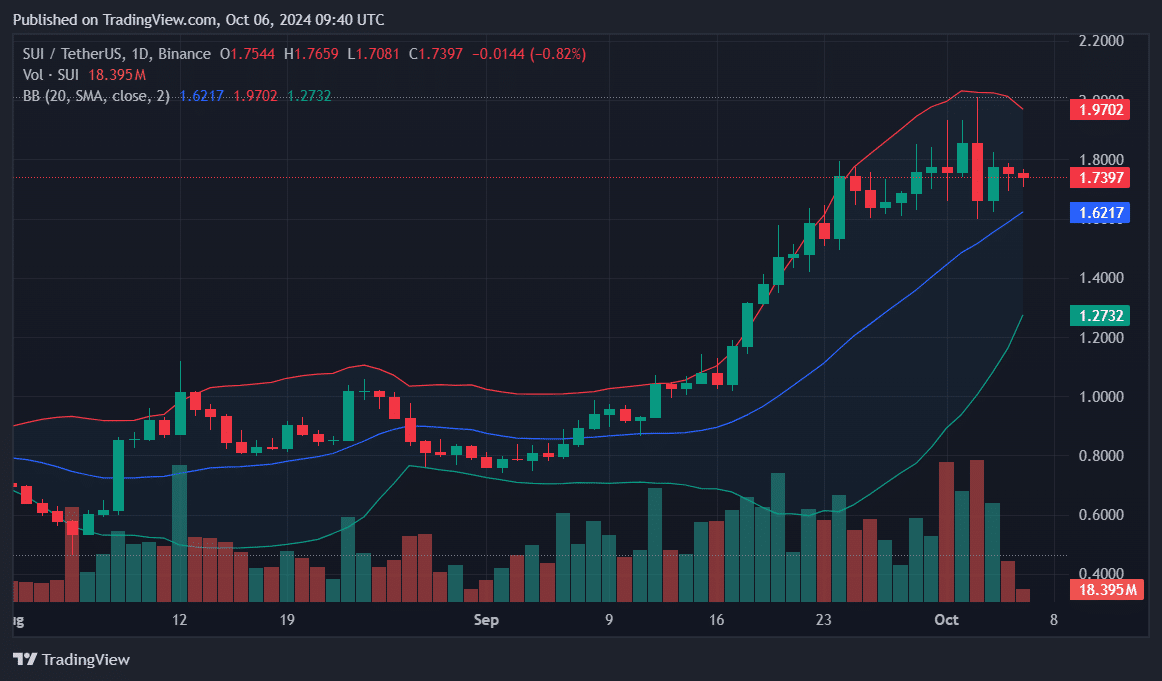

SUI demonstrates resilience

Sui (SUI) showed resilience despite broader market volatility, dropping only 0.3%. On Oct. 1, amid market turmoil, SUI dipped just 0.97%.

However, it saw a sharper 10.38% decline on Oct. 3, its largest intraday crash in three months.

SUI appears to be forming a bull pennant following its uptrend in September. Currently, the Bollinger Bands indicate the upper band at $1.97, which acts as resistance, and the 20-day MA at $1.62 provides immediate support.

With SUI trading below the upper band, the price could stabilize above the $1.62 support.

Investors should monitor for a bounce between $1.62 and $1.97, with a breakout above the resistance likely signaling bullish momentum for the week.

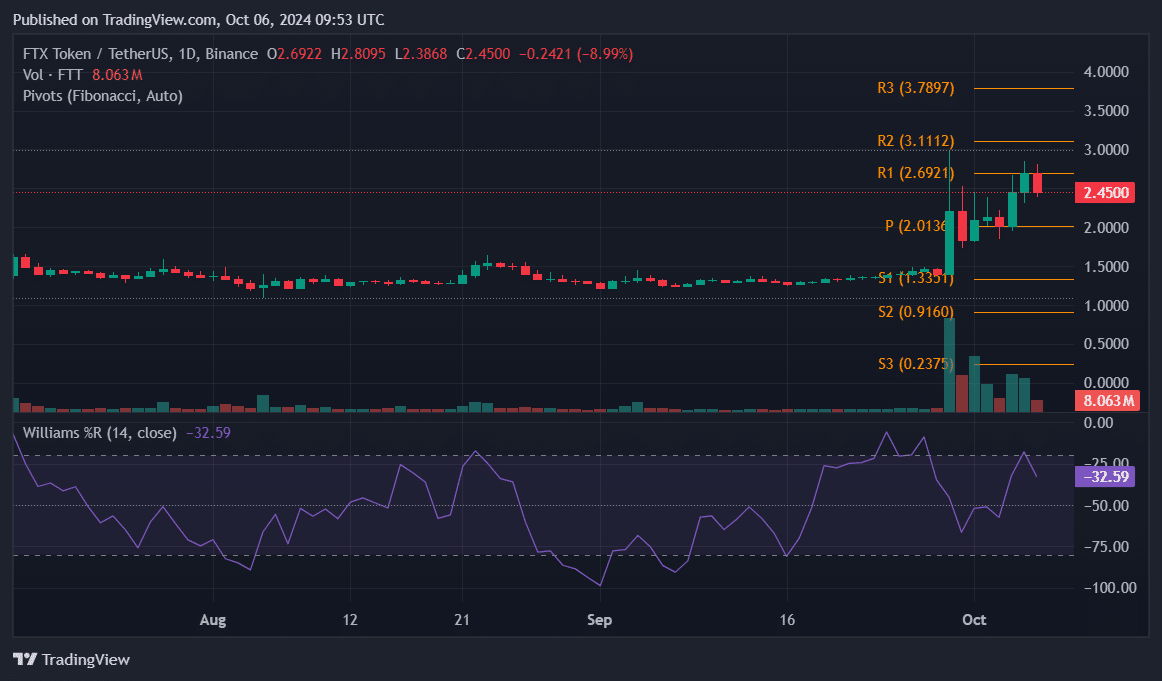

FTT bucks the trend

FTX Token (FTT) defied market trends last week, gaining 22% while most assets declined.

On Oct. 1, FTT rose by 13.89%, followed by a 21.53% surge on Oct. 4 and another 9.86% the next day.

Amid this uptrend, the Williams Percent Range stands at -32.59, signaling that FTT is near overbought territory but still has room for further gains.

As it witnesses a 9% retracement this new week, bulls need to defend the Pivot support at $2.01 to prevent a slip into bearish territories. Below this, the next support rests at $1.33, marking lows last seen in two weeks.

Should FTT recover from the latest correction, market participants should watch for a break above the resistance level at $2.68, which continues the bullish momentum.

Source link

Bitcoin

Whales didn’t sell Bitcoin at $62k, on-chain data shows

Published

7 hours agoon

October 6, 2024By

admin

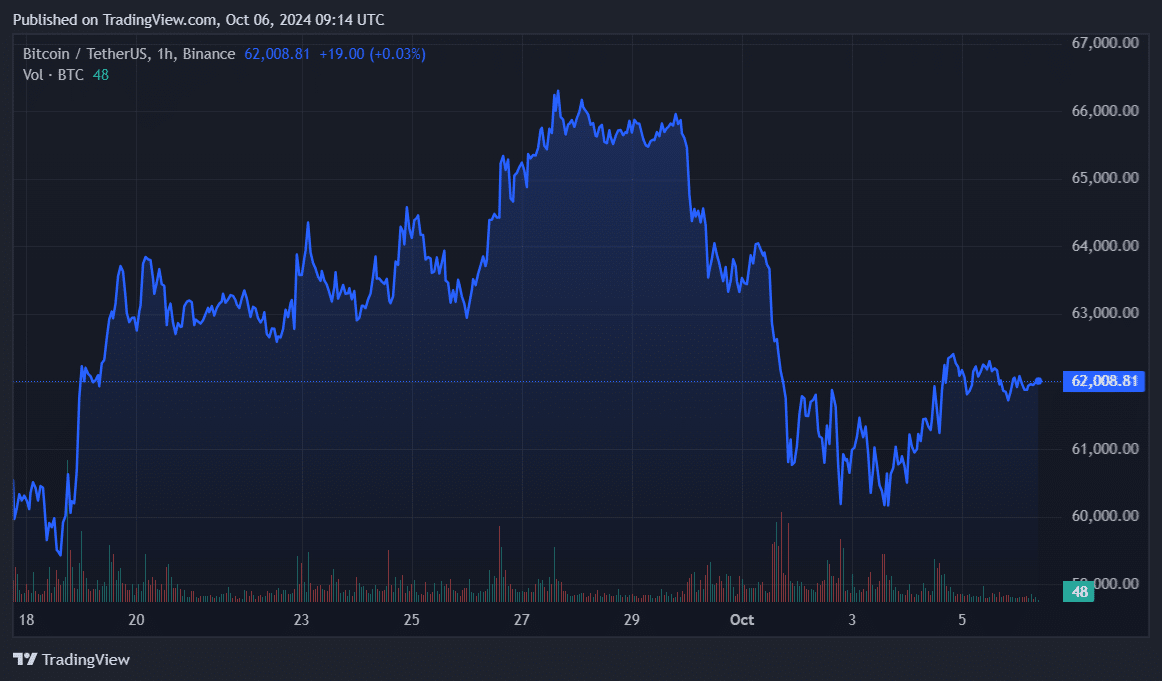

Bitcoin faces yet another correction after surpassing the $62,000 mark on Oct. 2. However, data shows that whales haven’t taken part in the latest selloff.

Bitcoin (BTC) consolidated around the $60,000 zone between Oct. 1 and 4 as the geopolitical tension between Iran and Israel heated up.

Right after the U.S. jobs report, the flagship cryptocurrency reached a local high of $62,370 on Oct. 5 as the broader crypto market witnessed bullish momentum.

Bitcoin declined by 0.2% in the past 24 hours and is trading at $61,950 at the time of writing. Its daily trading volume plunged by 53% and is currently hovering at $12.2 billion.

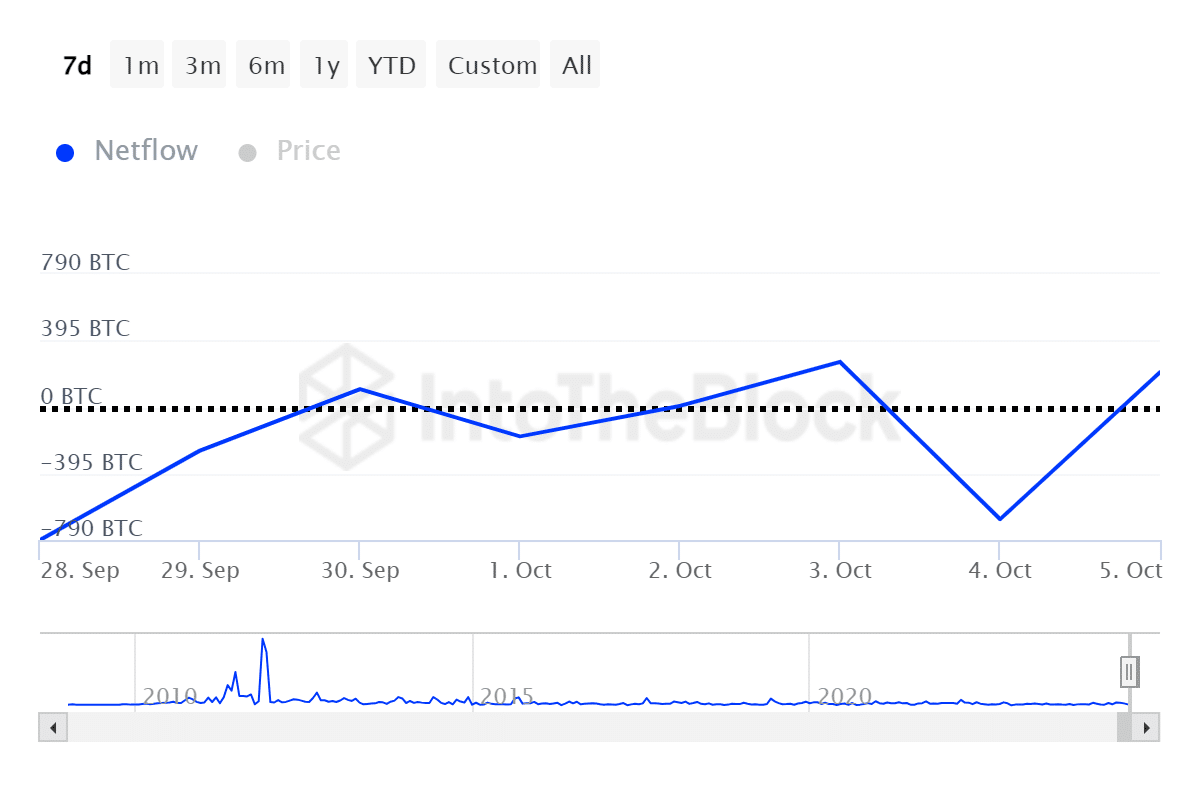

According to data provided by IntoTheBlock, large Bitcoin holders recorded a net inflow of 205 BTC on Oct. 5 as the outflows remained neutral. The on-chain indicator shows that whales didn’t sell Bitcoin as its price surpassed the $62,000 mark.

Meanwhile, Bitcoin’s whale transaction volume decreased by 48% on Oct. 5 — falling from $48 billion to $25 billion worth of BTC. Lower trading and transaction volumes usually hint at price consolidations and lower volatility.

Data from ITB shows that Bitcoin registered a net outflow of $153 million from centralized exchanges over the past week. Increased exchange outflows suggest accumulation as the bullish expectations for October rise.

It’s important to note that macroeconomic events and geopolitical tension can suddenly change the direction of financial markets, including crypto.

Source link

artificial intelligence

AI Tokens Lead Crypto Rebound Amid Strong U.S. Economy

Published

2 days agoon

October 5, 2024By

admin

Bitcoin may have bottomed at $60,000 earlier this week, and the Fed easing into a strong economy points to more upside, Will Clement said.

Source link

Crypto Strategist Sees Bitcoin Potentially Rallying to $68,000 – But There’s a Big Catch

SEC’s Ripple case appeal, Israel-Iran tension, market uncertainties, Satoshi’s identity | Weekly Recap

If This Pattern Holds Dogecoin Price Could Target $0.20; Analysts Predict

Solana Dev Quits Project He Set Himself on Fire to Pump

Top cryptocurrencies to watch this week

Ethereum Price $3K Rally at Risk as ETH Turns Inflationary Post-Dencun

Whales didn’t sell Bitcoin at $62k, on-chain data shows

HBO Is Joining Search for Bitcoin's Satoshi. Past Attempts Haven’t Turned Out Great.

Will Bitcoin Price Benefit from UAE’s New VAT Exemptions for Virtual Assets?

Will XRP or Cybro hit $3 first?

Will Telegram’s New ‘Gift’ Feature Drive Toncoin Price for $8 Breakout?

Bitcoin Price Lags Beneath $63,000 — What Does This Mean?

Museums, AI-generated art, blockchain, and NFTs

Dogwifhat Price 8% Away From Ending Six-Month Bearish Phase

Analyst PlanB Unveils Potential Trigger for Next Bitcoin ‘Pump,’ Says Whales Waiting for Outcome of One Event

182267361726451435

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Why Did Trump Change His Mind on Bitcoin?

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Crypto Market Movers: 5 Altcoins Making Waves This Bull Run

Trending

3 weeks ago

3 weeks ago182267361726451435

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoTop Crypto News Headlines of The Week

News1 month ago

News1 month agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin2 months ago

Bitcoin2 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Opinion3 months ago

Opinion3 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin3 months ago

Bitcoin3 months agoEthereum, Solana touch key levels as Bitcoin spikes

Altcoins2 months ago

Altcoins2 months agoEthereum Crash A Buying Opportunity? This Whale Thinks So

Donald Trump2 months ago

Donald Trump2 months agoWhy Did Trump Change His Mind on Bitcoin?