crypto assets

Top cryptocurrencies to watch this week

Published

3 months agoon

By

admin

The cryptocurrency market witnessed a rollercoaster ride last week, with the global market cap collapsing to a two-month low of $1.76 trillion, as Bitcoin dropped below $50,000.

The global crypto market cap, however, recovered to the $2.15 trillion mark amid a rebound from Bitcoin (BTC) and other major altcoins.

Here are our top cryptocurrencies to watch this week following their notable performances last week:

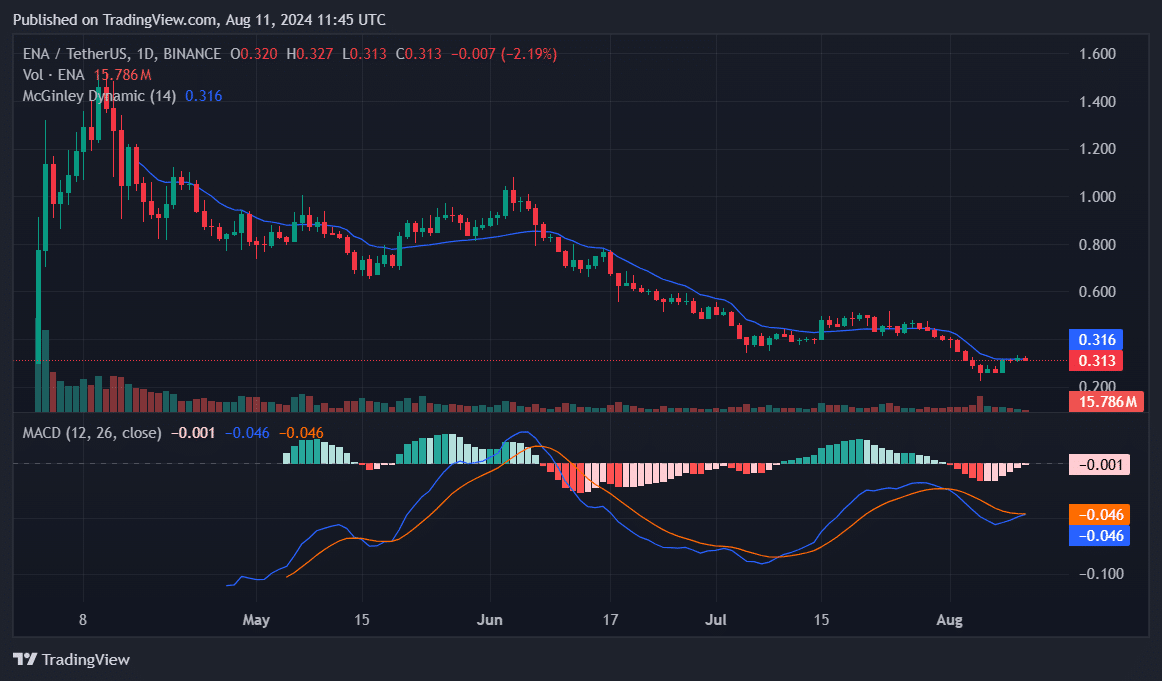

ENA survives onslaught

Ethena (ENA) slumped with the rest of the market on Aug. 5. It eventually recovered to close the week at $0.32, slightly above the McGinley Dynamic line at $0.316.

This marks a modest 2% weekly increase for ENA.

The MACD currently shows a bearish momentum. This suggests that selling pressure has been dominant, although the gap between the two lines is narrowing, indicating a potential shift in momentum.

The McGinley Dynamic is acting as a resistance level. The ENA price has struggled to break above it amid weak bullish sentiment. If Ethena fails to sustain above this level, it may retest the $0.30 support, with a potential downside towards $0.28.

However, if buying pressure increases and the price breaks above the McGinley Dynamic, a move toward $0.35 could be expected. The MACD crossover, if it occurs, could confirm this bullish reversal.

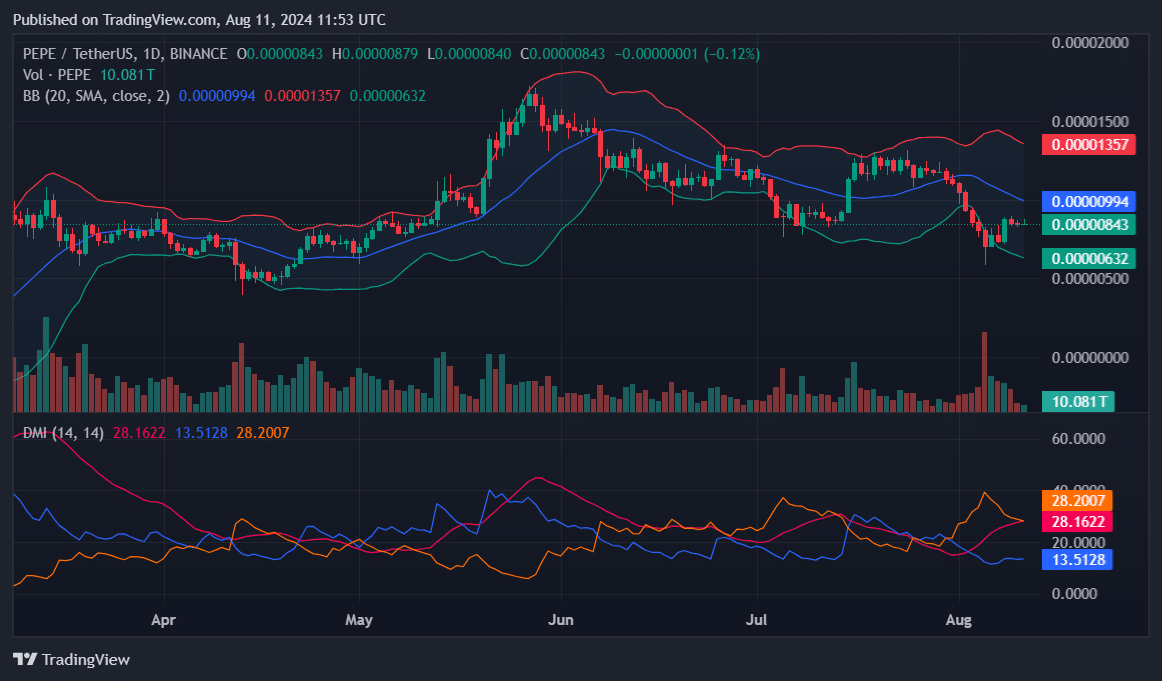

Pepe hovers around lower Bollinger Band

Pepe (PEPE) experienced notable volatility over the past week, dropping to a low of $0.00000585 on Aug. 5 before rebounding.

The meme coin’s price fluctuated significantly, ultimately closing the week at $0.00000844 — a 2% decline.

The Bollinger Bands show that PEPE traded close to the lower band, which suggests it was in an oversold region. The price dipped below the middle band, around $0.00000994, mid-week, signaling bearish momentum.

The Directional Movement Index shows mixed signals. The ADX, which measures trend strength, is at 28.2, indicating a moderately strong trend.

If Pepe fails to reclaim the middle Bollinger Band, it could continue trading near the lower band, potentially testing the $0.00000632 support. Conversely, if bullish momentum returns, breaking above $0.00000994 could pave the way for a recovery towards $0.00001357.

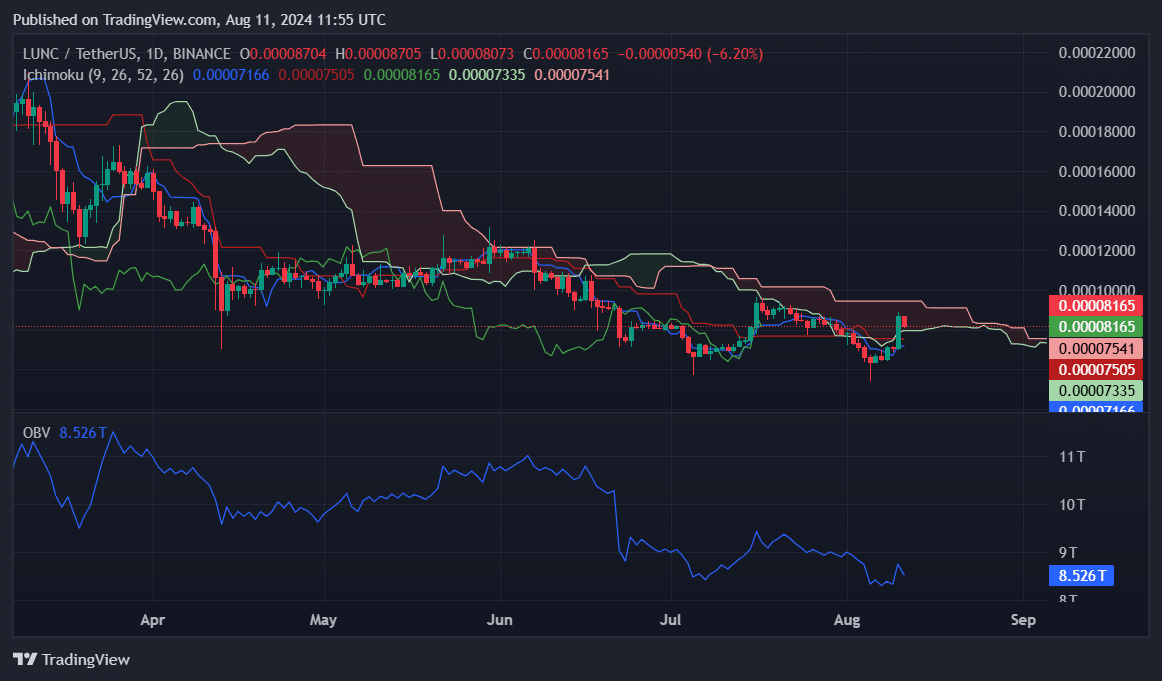

LUNC spikes 22%

Terra Classic (LUNC) experienced a strong bullish reversal last week, closing at $0.00008705 after a 22% spike.

The majority of this surge occurred on the last day of the week, with LUNC witnessing a remarkable 23% intraday gain.

The Ichimoku Cloud indicator suggests a potential trend reversal. LUNC closed above the Tenkan-sen, $0.00007505, and the Kijun-sen, $0.00007335, showing bullish momentum.

However, the price remains below the Kumo cloud, which spans $0.00007466 to $0.00008705, indicating resistance ahead.

To confirm a bullish trend, Terra Classic would need to break and close above the cloud, particularly surpassing the upper boundary.

Meanwhile, the On-Balance Volume is at 8.526 trillion, showing an increase in buying pressure. If LUNC manages to break above the Ichimoku Cloud, it could target higher resistance levels around $0.00010000. However, failure to sustain momentum might result in a retracement towards the Kijun-sen or even lower.

Source link

You may like

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Blockchain

Blockchain Association urges Trump to prioritize crypto during first 100 days

Published

8 hours agoon

November 22, 2024By

admin

The Blockchain Association has called on president-elect Donald Trump and Congress to prioritize five key actions during the administration’s first 100 days to establish the U.S. as a global leader in cryptocurrency innovation.

In an open letter, the industry group outlined specific measures to address regulatory challenges and support the domestic digital asset economy.

The Blockchain Association is a U.S.-based crypto lobbying group advocating for a regulatory framework for cryptocurrencies. They emphasized lifting the bank account ban on crypto companies and appointing new leadership for the SEC, Treasury Department, and IRS.

They also proposed creating a cryptocurrency advisory committee to work with Congress and federal regulators.

Five priorities for Trump’s first 100 days

The letter highlighted five steps aimed at fostering a supportive environment for crypto businesses and users:

- Creating a Crypto Regulatory Framework

The Blockchain Association urged Congress to draft comprehensive legislation for cryptocurrency markets and stablecoins. This framework, it argued, would balance consumer protection with innovation. Stablecoins are digital currencies tied to traditional assets, such as the U.S. dollar, offering price stability for users. - Ending the Debanking of Crypto Companies

The group expressed concern over crypto businesses losing access to banking services. These companies rely on traditional banks to handle payroll, taxes, and vendor payments. Without banking access, their operations can be severely disrupted. - Reforming the SEC and Repealing SAB 121

The association called for a new SEC chair to replace what it described as a hostile regulatory approach under the current leadership. It also recommended reversing SAB 121, an accounting rule that imposes strict requirements on crypto-related businesses. - Appointing New Treasury and IRS Leadership

Tax policies for cryptocurrencies, such as the proposed Broker Rule, have been criticized for potentially stifling innovation and driving companies offshore. The letter urged the administration to appoint leaders who would support privacy and foster a fair tax environment for digital assets. - Establishing a Crypto Advisory Council

The letter proposed a council to facilitate collaboration between the industry, Congress, and federal regulators. Public-private partnerships, it said, could create rules that protect consumers while encouraging innovation.

Crypto collaboration

In their letter, the Blockchain Association emphasized its readiness to work with the administration and 100 member organizations to ensure the U.S. regains its position as a financial and technological innovation leader.

“We stand ready to work with you to ensure the United States can regain its position as the crypto capital of the world,” the Blockchain Association wrote in the letter.

This letter comes as Trump adopts a strong pro-crypto stance. Earlier in November, reports emerged that Trump plans to create a White House position solely focused on cryptocurrency and related policies.

This letter also comes a day after crypto-foe and SEC chair Gary Gensler announced his upcoming resignation.

Source link

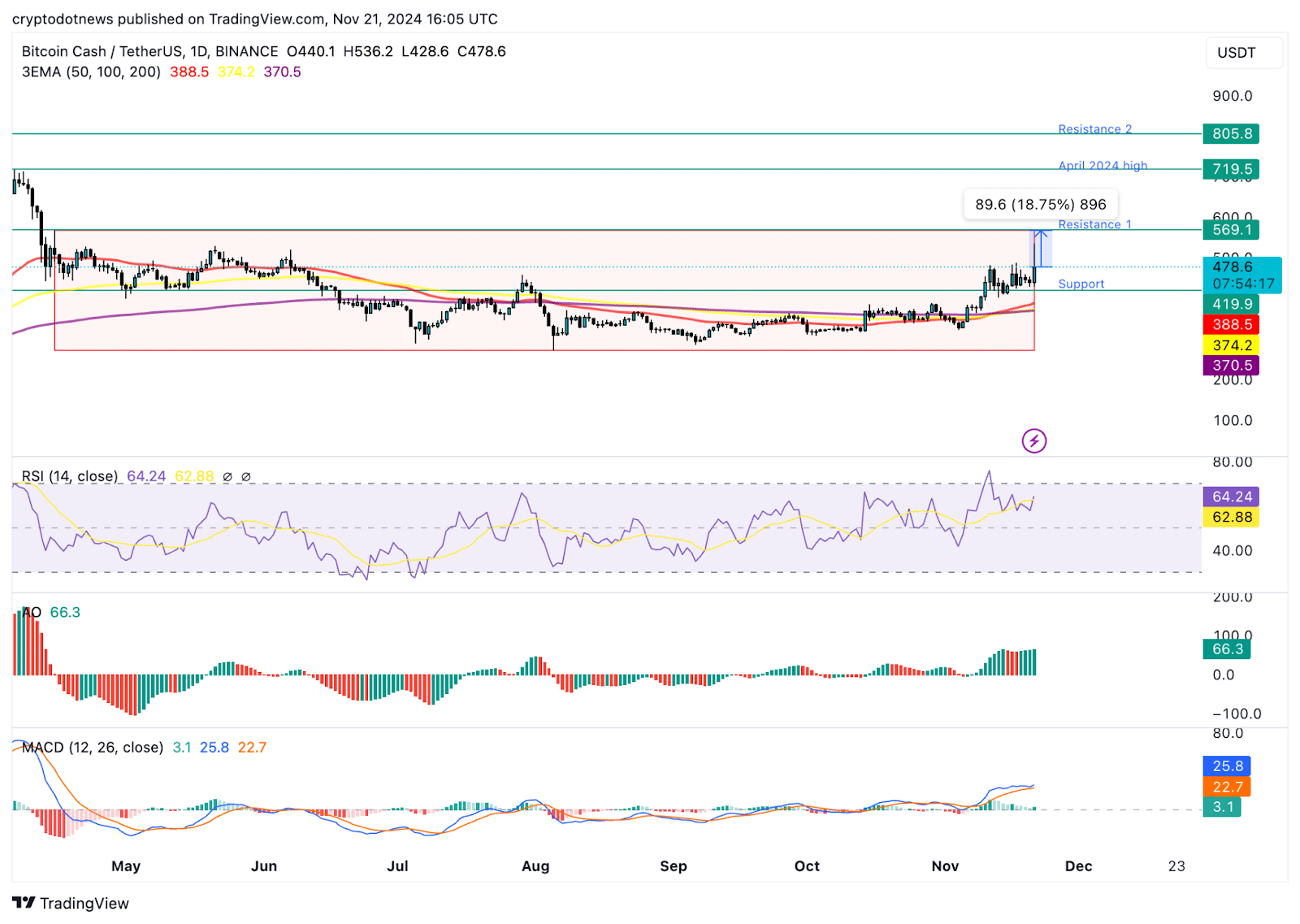

Bitcoin Cash (BCH) added nearly 35% to its value in the past month and rallied 12% on Nov. 21. Bitcoin’s (BTC) observed a rally to $98,384 early on Nov. 21, with BCH and other top cryptocurrencies tagging along for the ride.

An analysis of on-chain and technical indicators and data from the derivatives market shows that BCH could extend gains and retest its mid-April 2024 peak of $569.10.

Bitcoin hits all-time high, fork from 2017 ignites hope for traders

Bitcoin hit a record high of $98,384 on Nov. 21, a key milestone as the cryptocurrency eyes a run to the $100,000 target. BTC was forked in 2017, creating a spin-off or alternative, Bitcoin Cash.

BCH hit a peak of $1,650 in May 2021. Since April 2024, BCH has been consolidating with no clear trend formation.

BCH price rallied nearly 30% since Nov. 15, on-chain indicators show that further rally is likely in the Bitcoin spin-off token.

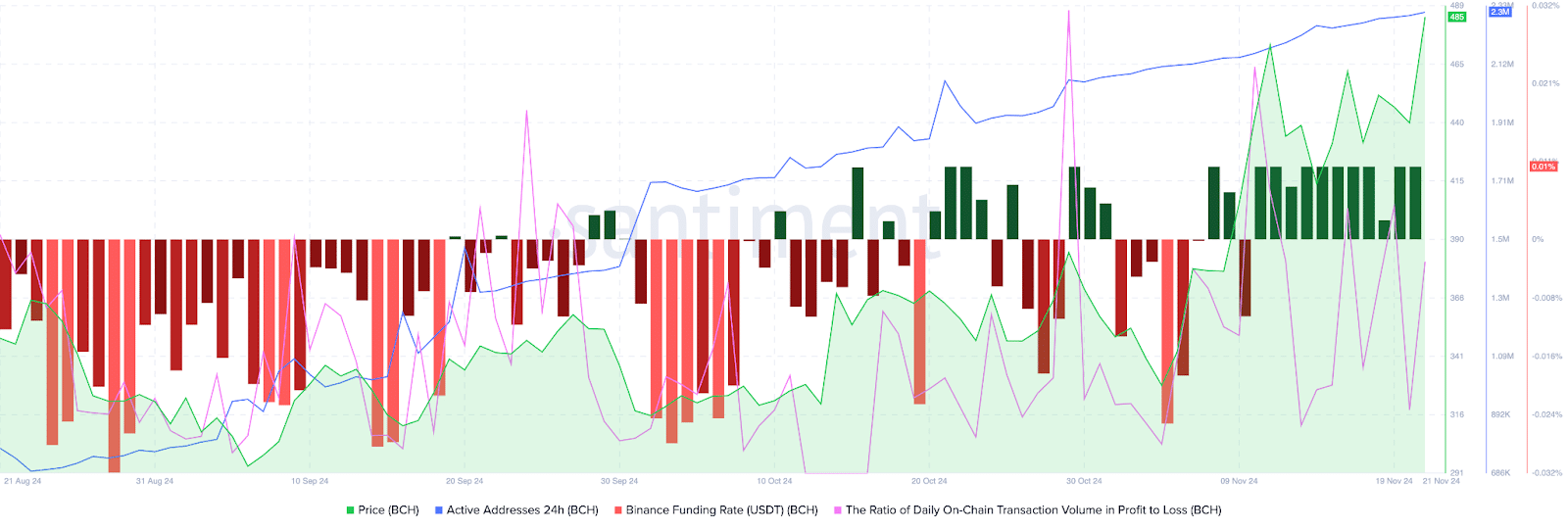

Bitcoin Cash’s active addresses have climbed consistently since August 2024. Santiment data shows an uptrend in active addresses, meaning BCH traders have sustained demand for the token, supporting a bullish thesis for the cryptocurrency.

The ratio of daily on-chain transaction volume in profit to loss exceeds 2, is 2.141 on Thursday. BCH traded on-chain noted twice as many profitable transactions on the day, as the ones where losses were incurred. This is another key metric that paints a bullish picture for the token forked from Bitcoin.

Binance funding rate is positive since Nov. 10. In the past eleven days, traders have been optimistic about gains in BCH price, according to Santiment data.

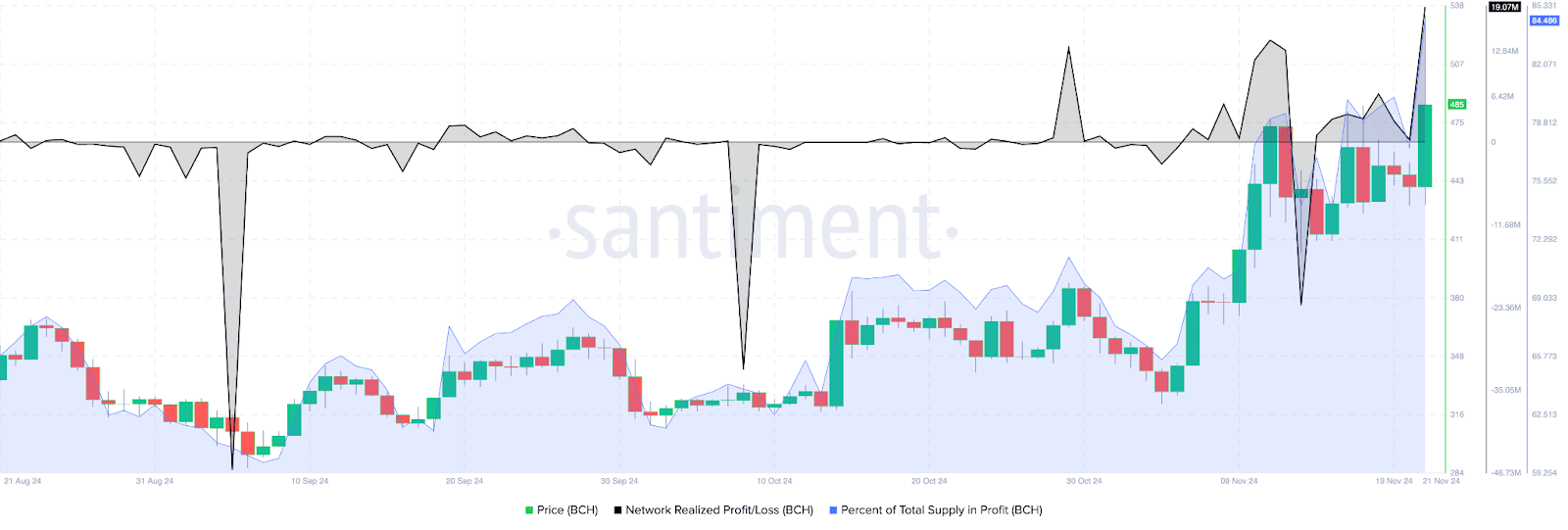

The network realized profit/loss metric identifies the net gain or loss of all traders who traded the token within a 24 hour period. NPL metric for Bitcoin Cash shows traders have been taking profits on their holdings, small positive spikes on the daily price chart represent NPL.

Investors need to keep their eyes peeled for significant movements in NPL, large positive spikes imply heavy profit-taking activities that could increase selling pressure across exchange platforms.

84.48% of Bitcoin Cash’s supply is currently profitable, as of Nov. 21. This metric helps traders consider the likelihood of high profit-taking or exits from existing BCH holders, to time an entry/ exit in spot market trades.

Derivatives traders are bullish on BCH

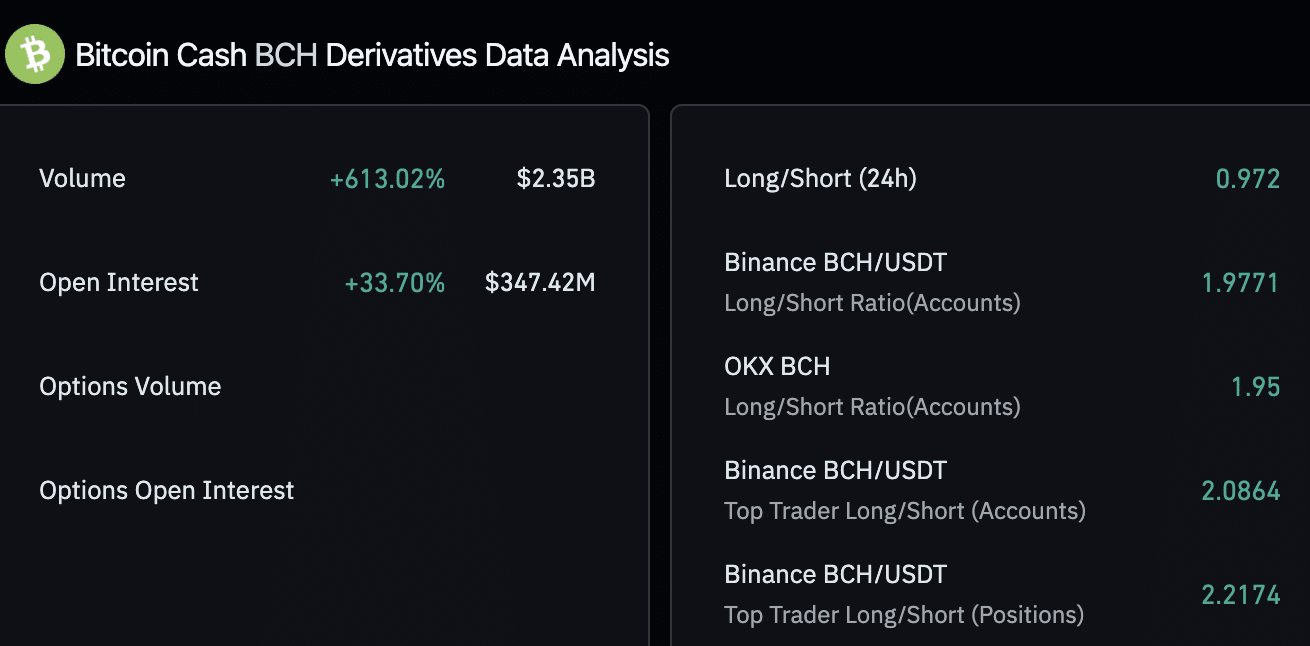

Derivatives market data from Coinglass shows a 33% increase in open interest in Bitcoin Cash. Open interest represents the total number of active contracts that haven’t been settled, representing demand for the BCH token among derivatives traders.

Derivatives trade volume climbed 613% in the same timeframe, to $2.35 billion. Across exchanges, Binance and OKX, the long/short ratio is above 1, closer to 2, meaning traders remain bullish on BCH and expect prices to rally.

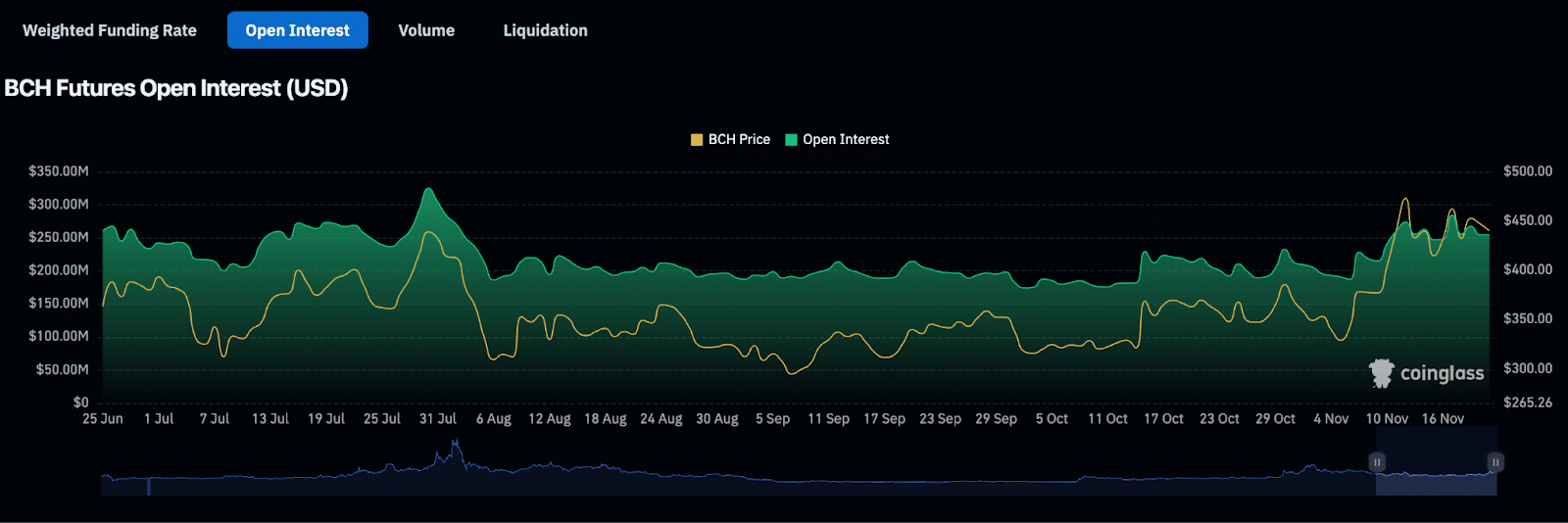

BCH futures open interest chart shows a steady increase in the metric, alongside BCH price gain since November 5, 2024. Open interest climbed from $190.74 million to $254.87 million between November 5 and 21.

Technical indicators show BCH could gain 18%

The BCH/USDT daily price chart on Tradingview.com shows that the token remains within the consolidation. The token is stuck within a range from $272.70 to $568.20. BCH could attempt to break past the upper boundary of the range, a daily candlestick close above $568.20 could confirm the bullish breakout.

The April 2024 high of $719.50 is the next major resistance for BCH and the second key level is at $805.80, a key level from May 2021.

The relative strength index reads 64, well below the “overvalued” zone above 70. RSI supports a bullish thesis for BCH. Another key momentum indicator, moving average convergence divergence flashes green histogram bars above the neutral line. This means BCH price trend has an underlying positive momentum.

The awesome oscillator is in agreement with the findings of RSI and MACD, all three technical indicators point at likelihood of gains.

A failure to close above the upper boundary of the range could invalidate the bullish thesis. BCH could find support at the midpoint of the range at $419.90 and the 50-day exponential moving average at $388.50.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

crypto assets

How many cryptocurrencies are there? Total number and types

Published

2 weeks agoon

November 7, 2024By

admin

The first cryptocurrency appeared in 2009, and today, its name is known by almost everyone — Bitcoin. What made it so intriguing was the promise of a new kind of money: no government interference, full privacy, and everyone having the same rights within the system.

At first, Bitcoin (BTC) was not taken seriously. It wasn’t until 2013, when its price passed a few hundred dollars, that the rise of cryptos really took off, and they began spreading and multiplying globally. So, how many cryptocurrencies are there today?

How many cryptocurrencies are in the world?

Statista reports that by September 2024, the number of cryptocurrencies is getting close to 10,000. However, it’s worth noting that many of these cryptocurrencies may not be particularly relevant or active.

Statista also notes that other sources estimate there are around 20,000 cryptocurrencies in existence, though most of these are either inactive or have been discontinued.

As of early November CoinMarketCap, a leading cryptocurrency data aggregator that tracks prices, market cap, and trading volume, lists 9,916 cryptocurrencies, while CoinGecko, another popular crypto data platform known for its comprehensive market statistics, shows 15,142.

Figuring out exactly how many cryptos there are is tricky, since the number keeps changing, but we can say this for sure: there are way more now than there were in 2009.

Why are there so many cryptocurrencies?

Thanks to easier access to blockchain technology, even those with basic coding knowledge can launch their own cryptocurrency. Platforms like Ethereum allow developers to create tokens without needing to build their own blockchain from scratch.

This low barrier to entry has led to an explosion of new projects, each claiming to offer something unique, whether it’s faster transactions, privacy features, or use in specific industries. Some even target niche markets like gaming, art, or supply chains.

While many of these coins won’t survive long-term, the ease of creation fuels constant experimentation and innovation, driving the evolution of the entire crypto ecosystem.

How many types of cryptocurrencies are there?

How many crypto are there?

With so many different types of cryptocurrencies, each designed for a specific goal, here’s a breakdown of the main categories.

Bitcoin and Bitcoin forks

Bitcoin is the first and most famous cryptocurrency, designed as a decentralized, peer-to-peer digital currency. Bitcoin forks like Bitcoin Cash (BCH) and Bitcoin SV (BSV) are versions of Bitcoin with minor adjustments to improve speed or transaction costs.

Altcoins

Altcoins are basically any cryptocurrencies that aren’t Bitcoin, each offering something unique, whether it’s new features, different uses, or fresh technology to shake up the digital currency scene. For example, Ethereum (ETH) brings smart contracts to the table, while Solana (SOL) stands out for its fast and low-cost transactions.

Stablecoins

Designed to reduce volatility, stablecoins are pegged to real-world assets like the US dollar. Tether (USDT) is the most widely used, offering stability for traders.

Meme coins

Meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) were created as fun projects but turned into something much bigger thanks to viral social media moments. Pepe Coin, inspired by the Pepe the Frog meme, has also become popular in the meme-crypto space.

Utility tokens

These tokens are used to power specific applications. Chainlink connects smart contracts to real-world data, while Uniswap is used for governance in the Uniswap decentralized exchange. Binance Coin started as a way to pay lower fees on the Binance exchange but now has broader uses across the Binance ecosystem.

How many cryptos are actually significant?

There are thousands of cryptocurrencies out there, but only a small percentage are truly significant, in terms of widespread use, market value, and technological impact. Bitcoin remains the dominant force, widely recognized as the first and most valuable cryptocurrency.

Ethereum is another heavyweight, known for its smart contract capabilities and dApps, driving much of the DeFi and NFT boom. Other notable cryptos include Binance Coin, which powers the Binance ecosystem, and Solana, praised for its high-speed transactions.

Meme coins, like Dogecoin and Shiba Inu, have certainly gotten attention, but whether they’ll have lasting value is still a big question. The crypto world is moving fast, but not many assets have truly changed the industry. The ones that have are still the ones leading in terms of innovation and market impact.

Source link

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential