Adoption

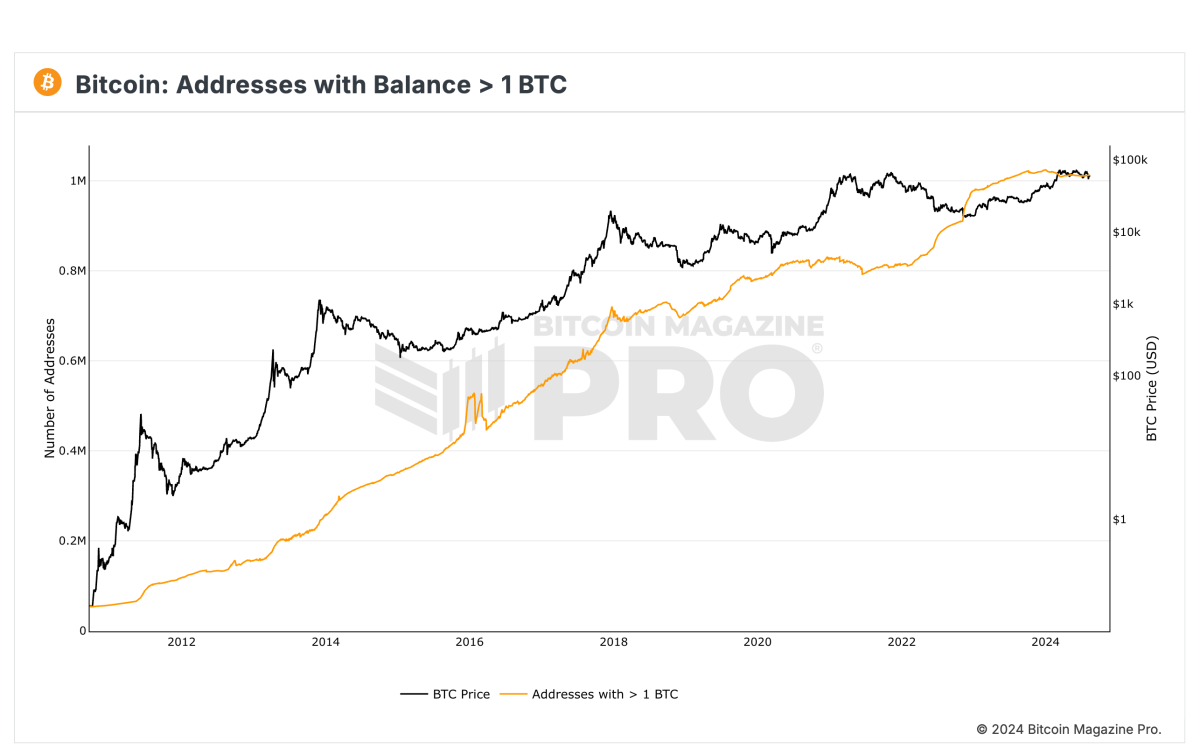

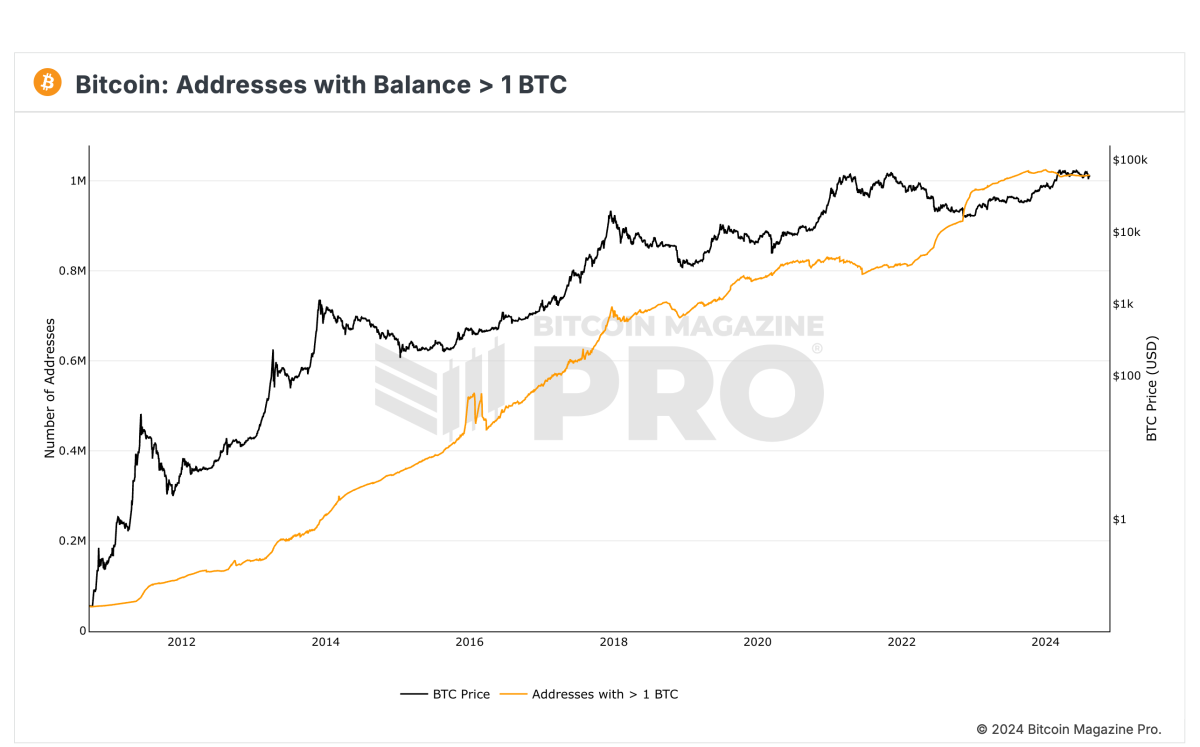

Over 1 Million Bitcoin Addresses Hold 1 BTC or More, Reflecting Strong Adoption

Published

3 months agoon

By

admin

According to data from Bitcoin Magazine Pro, there are 1,012,650 Bitcoin addresses that contain 1 BTC or more.

This represents more than 1 million BTC potentially taken off the market and held by strong hands, a significant portion of the 21 million BTC that will ever exist. Demand continues to rise as U.S. spot Bitcoin ETFs collectively hold over 901,000 BTC, while MicroStrategy, a major corporate Bitcoin holder, owns 226,500 BTC. Additionally, MicroStrategy plans to raise $2 billion to buy more Bitcoin, further emphasizing the trend of institutions buying and holding substantial amounts of BTC, tightening the available supply as demand increases.

The number of Bitcoin addresses holding 1 BTC or more has historically lagged behind BTC’s price. However, in the past two years, this trend has reversed, with the number of these addresses increasing more rapidly than Bitcoin’s price. This shift signals growing adoption and reflects rising long-term confidence in Bitcoin, as more users accumulate and hold significant amounts of Bitcoin.

The rise in addresses with 1 BTC or more signifies that both retail and institutional investors are actively accumulating Bitcoin. With only 21 million BTC ever to be mined, and approximately 19 million already in circulation, the demand for Bitcoin appears to be increasing as users aim to secure their share of the limited supply.

For more detailed information, insights, and to sign up to access Bitcoin Magazine Pro’s data and analytics, visit the official website here.

Source link

You may like

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Adoption

AI startup Genius Group picks Bitcoin as main treasury asset

Published

1 week agoon

November 12, 2024By

admin

Bitcoin as an institutional reserve asset gained more traction as a Singapore-based AI company took a page from MicroStrategy’s book.

Per a press statement, publicly-traded artificial intelligence firm Genius Group will onboard Bitcoin (BTC) as its main treasury holding and immediately purchase $120 million worth of the world’s leading cryptocurrency.

Genius Group also said it would hold 90% of its current and future treasury value in Bitcoin, adding to its initial 1,380 token buy plan disclosed on Nov. 12. The startup’s GNS shares surged 50% during pre-market trading, according to Yahoo Finance. GNS prices shook off gains by publishing time, but the shares still traded higher than their previous close.

At least three institutional players have now adopted the BTC accumulation strategy pioneered by Michael Saylor’s software behemoth MicroStrategy. Firms like Tokyo’s Metaplanet, medical tech provider Semler Scientific, and now Genius announced BTC purchasing plans inspired by Saylor’s company.

All three companies hold over 1,000 BTC. The trio were leagues away from MicroStrategy’s 279,420 Bitcoin trove valued at over $24 billion due to recent highs.

We believe that with our Bitcoin-first strategy, we will be among the first NYSE American listed companies to fully embrace Microstrategy’s Bitcoin strategy for the benefit of our shareholders.

Thomas Power, Genius Group director

Stocking most of its treasury with BTC was also revealed shortly after Genius reshuffled its top decision-makers. Genius added multiple crypto-savvy board members as the firm paid more attention to web3 and blockchain technology.

Source link

Adoption

Crypto wins the vote in the 2024 US elections

Published

3 weeks agoon

November 3, 2024By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

The 2024 US election campaigns have been a masterclass in how to compel a large group of people to elect their country’s leaders. In a short time, we’ve seen sentiments shift after each candidate began their campaign trails and made promises to voters surrounding issues such as immigration, cost of living, and reproductive rights.

From spreading memes about migrants eating cats and dogs and the humorous “coconut tree” remark to the decisive role of lobbying regulators, the similarities between pushing political messaging and crypto narratives are difficult to ignore.

Crypto is no stranger to compelling messages. One of the most memorable phrases in crypto history, “The Times 03/Jan/2009 Chancellor on the brink of second bailout for banks,” contained in Bitcoin’s (BTC) genesis block, is a reminder of the powerful messaging that has helped propel the industry forward. For crypto to win the “people’s vote” again, the industry can learn from several foundational communication principles we observed in this year’s elections.

Tapping into the psyche of the masses with memes

The use of memes in political messaging this election cycle has helped candidates engage the voter base and shift their perceptions.

In July, singer Charli XCX took to her almost 3.7 million followers on X to endorse Kamala Harris with a three-word X-post, “kamala IS brat.” Brat was an album launched by Charli XCX, with notable colors of neon lime green and black. The Harris campaign quickly adopted the theme into their campaign color scheme, resulting in the “Kamala is brat” meme exploding across the web and TikTok, introducing a new cultural reference that positively shaped discourse. This is particularly significant for young and new voters who are increasingly getting their news through social media, according to Pew Research.

Originating from evolutionary biology, memetics, the study of memes explores how ideas, behaviors, and cultural phenomena spread. The light-heartedness of the medium allows people to digest complex or unsettling political realities in a more approachable way, impacting voter attitudes at an emotional level.

Crypto has seen its successful application through memecoins like Dogecoin (DOGE), Shiba Inu (SHIB), and Dogwifhat (WIF), which leverage meme culture to build communities and hype. Similar to political memes spreading ideology, memecoins spread economic narratives through humor and social media engagement.

The overall industry needs to see a return to memes that captivate users broadly. Popular memes like ‘diamond hands,’ ‘WAGMI’ (we’re all gonna make it), and HODL (hold on for dear life) have in the past spread beliefs about crypto like wildfire. The industry needs to craft new memes and leverage new moments to maintain its relevance and resonate with broad audiences again.

The use of emotional and purpose-driven messaging

Political campaigns also provide examples of how emotionally resonant, purpose-driven language connects with supporters.

Donald J. Trump’s campaign used many bold statements of purpose that studies show resonate with themes of strength and patriotism. Among the most popular is the campaign’s “Make America Great Again” (MAGA) message. His appeal is connected to the psychological readiness in the US culture for an antihero figure, who represents someone bold and unconstrained by typical political decorum and the willingness to challenge the status quo. This was symbolized in Trump’s call to “fight, fight, fight!” that spread following the assassination attempt in July.

The web3 parallel is the need to evoke purpose when speaking to end-users by bypassing complex jargon in favor of emotionally engaging language. Mert Mumtaz, CEO of Helius Labs, a key crypto opinion leader, uses direct and emotionally engaging messaging to resonate with crypto enthusiasts. His commentary, which centers around key trends and recent events, enhances his credibility as a key spokesperson for Solana (SOL) and blockchain tech broadly.

Similarly to how political campaigns use soundbites that reflect the core values of the voter, web3 projects and founders need to rely more on using memorable statements that create an emotional connection, creating greater buy-in from a wider audience.

Lobbying to engage policymakers more seriously

Lobbying played a notable role in this year’s elections. The health of US citizens became an issue that rose in prominence when health lobbyist Calley Means reconnected Republican and independent presidential candidates Donald Trump and Robert F. Kennedy Jr. This played a part in RFK dropping out of the race to support Trump’s campaign, catalyzing the MAHA (Make America Healthy Again) movement and may make a difference in the final election outcome.

The US crypto industry itself has experienced regulatory hostility towards companies after the FTX collapse. Since then, there has been a growing realization that the use of money in politics is simply the way the system operates. Lobbying is needed for the industry’s priorities to be heard in the halls of Congress.

The last two years saw a major uptick in advocacy efforts for better US crypto policy. As of mid-October, crypto-focused super PACs (political action committees) had spent over $134 million to persuade voters to elect Congress members who support crypto. Just this week, the CEO of Coinbase, Brian Armstrong, announced the company was committing an additional $25 million to support the Fairshake PAC leading up to the 2026 midterms to elect pro-crypto candidates.

A continuation of this strategy by US companies could lead to significant shifts in US policy and could see better reception of crypto by users locally, with a ripple effect globally.

The 2024 US elections were littered with examples of masterful communication tactics that can be adopted by crypto projects. As the focus of the industry begins shifting from infrastructure development to the growth of consumer applications across various verticals, these strategies will be increasingly important in persuading users about why they should choose the products offered instead of the many other alternatives available to them.

Debra Nita

Debra Nita is the associate director and head of growth at YAP Global, a crypto-native PR firm. With over a decade of strategic communications and product marketing experience, Debra helps leading crypto and web3 projects gain publicity and build their reputation through top-tier media coverage, leadership, and narrative development. Her expertise includes layer-1 blockchains, rollups, decentralized finance, zero knowledge and cryptography, and stablecoins. Debra has also been a speaker and hackathon judge at leading crypto conferences, including ETHDenver, Mainnet in NYC, ETHToronto, and ETH Kuala Lumpur.

Source link

Adoption

Algoz taps Wincent to streamline its fiat-to-crypto onboarding process

Published

3 weeks agoon

October 30, 2024By

admin

Digital asset investment firm Algoz has announced a strategic collaboration with regulated market maker and top over-the-counter desk Wincent.

Algoz shared details of the new partnership via a press release sent to crypto.news on Oct. 30. This announcement follows Algoz’s recent collaboration with Standard Chartered-backed Zodia Custody.

According to the announcement, Algoz will leverage its partnership with Wincent to facilitate the onboarding of new investors. Through this collaboration, investors such as family offices seeking to enter the crypto market via Algoz will not need to convert fiat currencies to crypto beforehand, as is typical across many providers in the industry.

Wincent offers the solution to this hurdle. Algoz users can now invest using Tether (USDT) Bitcoin (BTC) and Ethereum (ETH) and other cryptocurrencies using U.S. dollars, euros, or other fiat currencies. The partnership allows Algoz clients to directly swap fiat for crypto, reducing risks associated with exposure to unregulated providers.

Algoz noted that its collaboration with Wincent supports asset conversion based on already approved know-your-customer and anti-money laundering checks. These regulatory requirements are critical components of global crypto regulation, with various industry players viewing them as essential to the growth of the crypto market.

With regulatory clarity pivotal to the industry, many players are implementing measures to ensure safe on- and off-ramping of customers. Regulated platforms like Wincent and institutional-backed providers like Zodia Custody contribute to this approach.

The platform’s off-exchange settlement solution, Quant Pro, plays a central role in the partnership.

For Algoz, the solution, Zodia’s custody wallet, and Wincent’s know-your-customer and anti-money laundering integration add a layer of protection for users.

“The creation of Quant Pro, our off-exchange settlement system, using Zodia was the first breakthrough for investors as we were able to significantly mitigate exchange and management counterparty risk.”

Stephen Wundke, director of strategy and revenue at Algoz.

Wincent’s regulated market records between $3 and $5 billion in daily volume, with over 300,000 daily transactions.

Source link

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential