Binance

Bitcoin ETFs See $19,000,000,000 in Net Flows As BlackRock Becomes Third-Largest BTC Holder: Bloomberg Analyst

Published

3 months agoon

By

admin

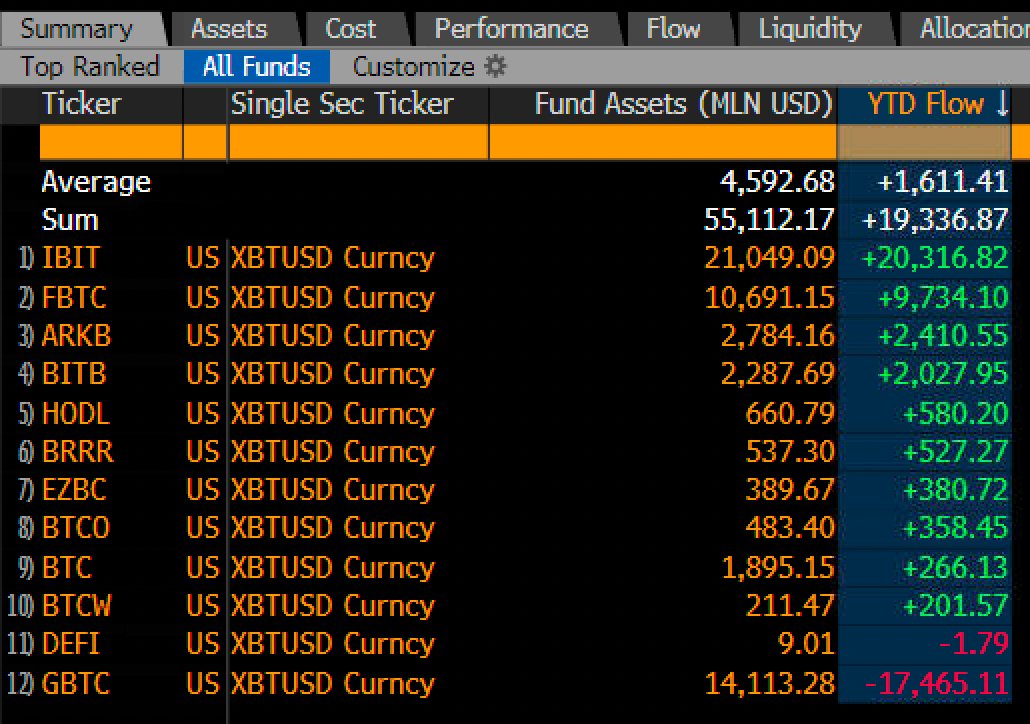

Spot Bitcoin (BTC) exchange-traded funds have witnessed more than $19.3 billion of net inflows this year, according to Eric Balchunas, a Bloomberg ETF analyst.

Balchunas tells his 319,100 followers on the social media platform X that the number is “surprisingly strong” and argues that it is the most important bellwether of success given Grayscale’s GBTC unlock and net price movement.

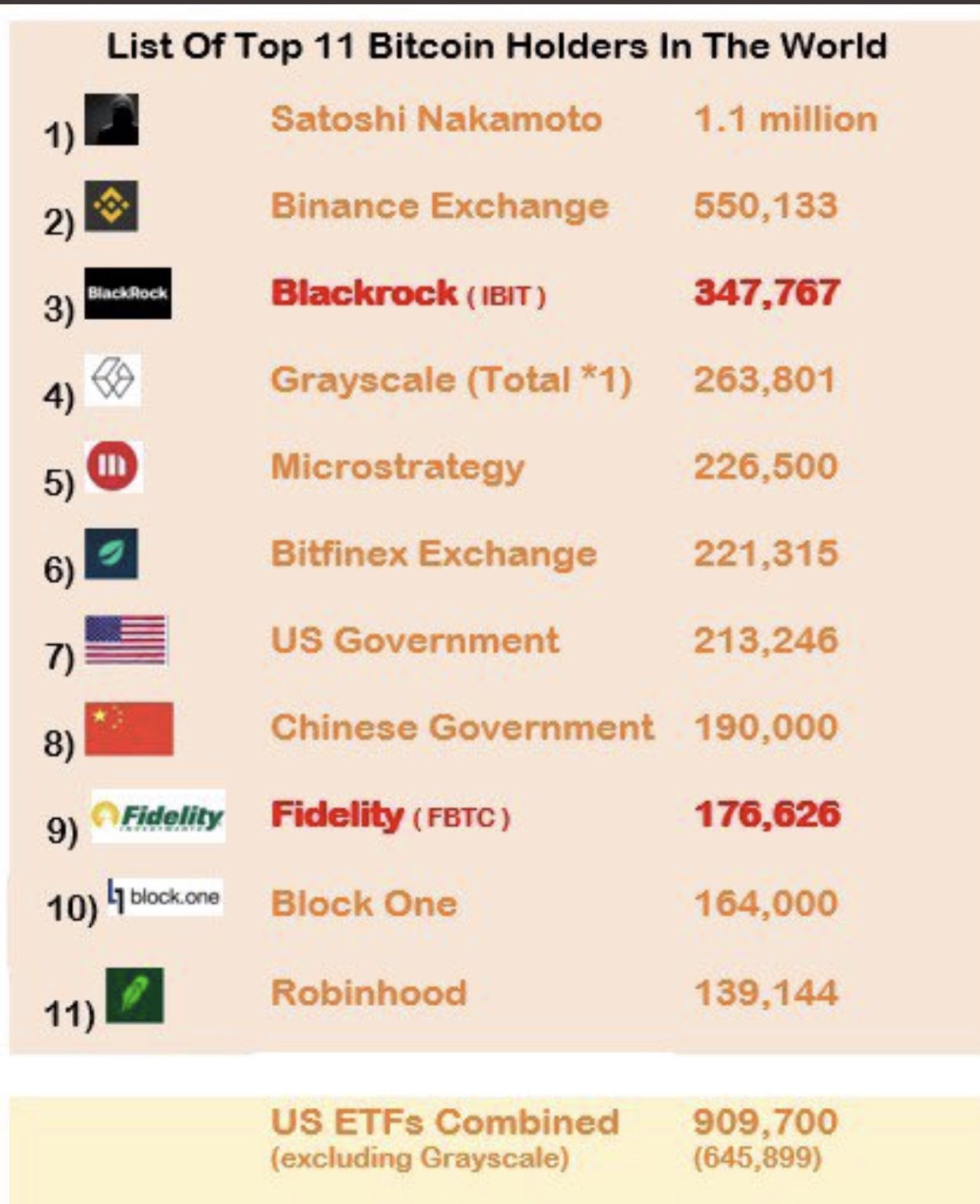

Balchunas also notes US ETFs are on pace to pace Satoshi Nakamoto, Bitcoin’s pseudonymous creator, as the top holders of BTC.

“BlackRock alone is already #3 and on pace to be #1 late next year, and will likely stay there for a very long time.”

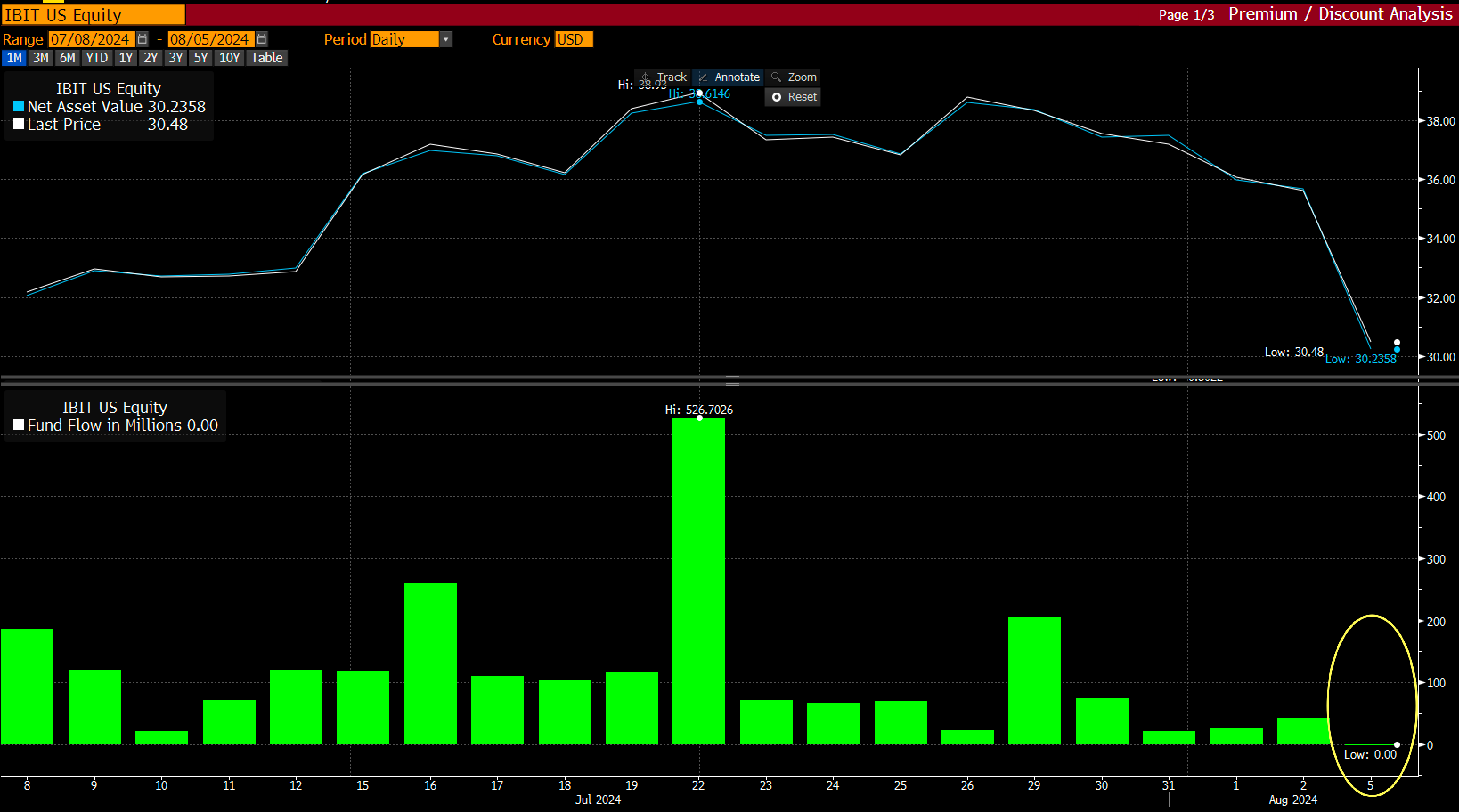

The Bloomberg analyst also argues that ETF holders offer the top crypto asset some stability in the face of volatility.

“So IBIT investors woke up on Monday to a -14% move over the weekend after stomaching an 8% decline the week prior and what did they do? ABSOLUTELY NOTHING. $0 flows. Compared to some of these degens these boomers are like the Rock of Gibraltar. You guys are so lucky to have them.”

IBIT is BlackRock’s iShares Bitcoin Trust.

BTC is trading at $60,719 at time of writing. The top-ranked crypto asset by market cap is up more than 1.5% in the past 24 hours and more than 8% in the past week.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

You may like

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

Binance

Binance will launch USUAL stablecoin on Nov. 19

Published

1 week agoon

November 14, 2024By

admin

Binance will be the first platform to launch the stablecoin USUAL on Nov. 19. The crypto exchange will provide trading support for USDT and USUAL trading pairs.

In a notice published on Nov. 14, Binance announced the 61st project that will be launched on Binance Launchpool, the stablecoin Usual. The webpage for Usual is expected to be available 12 hours before the pre-market launch on Nov. 19 at 10:00 UTC.

Usual Labs is a decentralized fiat stablecoin issuer backed by Kraken, Mantle, Starkware and GSR, as well as more than 150 investors. The token will be launched on the Ethereum network.

According to the announcement, users will be able to receive airdrops for the USUAL tokens in the form of BNB (BNB) and FDUSD (FDUSD) within four days. Farming for USUAL will start on Nov. 15 at 00:00 UTC.

https://twitter.com/usualmoney/status/1856966210790781158

According to Usual’s X post, the stablecoin uses a revenue-based model that prioritizes its community members.

According to data from CoinMarketCap, the Usual stablecoin went up by 0.08% and is current trading hands at $0.9991. The stablecoin has a market cap of $345.71 million and a total supply of 346 million USUAL tokens.

Binance provides a total token supply of 4 billion USUAL tokens, with 7.5% of the supply being allocated to rewarding users. The initial circulating supply for the stablecoin’s listing will be 12.37% of the total token supply, amounting to 494,600,000 USUAL.

Usual will be available for pre-market trading in USUAL/USDT trading pairs. At the moment, it is only available for pre-market trading with the exchange stating that the pre-market closing time and spot listing time will be announced at a later date.

Last week, the stablecoin issuer completed a round of community funding which raised a total of $1.5 million. The Echonomist, Breed Syndicate, and Comfy Capital were among the investors participating in the community round.

Usual introduced the stablecoin USD0 in February 2024, describing it as a permissionless stablecoin backed by real-world assets. It also serves as a governance token that allows users to vote on the network’s future.

Source link

24/7 Cryptocurrency News

Binance And Changpeng Zhao Faces FTX Lawsuit To Return $1.8B Fund

Published

2 weeks agoon

November 11, 2024By

admin

FTX has recently filed a lawsuit against Binance and its former CEO Changpeng Zhao, demanding a return of $1.8 billion. According to FTX, the fund was fraudulently transferred by its co-founder, Sam Bankman-Fried, to Binance. This legal development has sparked speculations in the broader crypto market, especially as it comes as FTX works to recover funds following its collapse two years ago.

FTX Seeks $1.8B Clawback From Binance And Changpeng Zhao

According to a recent Bloomberg report, FTX alleges that Binance and Changpeng Zhao (CZ) received the $1.8 billion as part of a share repurchase agreement in July 2021. In this transaction, Sam Bankman-Fried or SBF reportedly used a combination of FTX’s own token (FTT) and Binance-branded tokens (BNB and BUSD) to repurchase approximately 20% of the international unit of FTX and 18.4% of the US-based entity.

The report notes that at the time, the total value of these assets was around $1.76 billion. In its filing, FTX contends that it and its sister firm, Alameda Research, may have been financially unstable from the beginning and were likely already insolvent by early 2021.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Binance

Binance bets on Thailand as region signals supportive crypto approach

Published

2 weeks agoon

November 5, 2024By

admin

Binance is prioritizing Thailand as a key market in its mission to reach one billion users, with crypto-friendly regulations seen as a driving factor.

Cryptocurrency exchange Binance is betting big on Thailand as it aims to bring crypto mainstream worldwide, spotlighting the country’s regulatory openness, The Bangkok Post reports, citing Binance chief marketing officer Rachel Conlan.

Per Conlan, Thailand ranks among Binance’s top 20 markets worldwide, with local crypto penetration estimated at 12%, double the global average of 6%. She also praised Thailand for taking a “pioneering approach to crypto” and working to establish regulations and a framework “in the right way.”

“I think that is what ultimately is going to help this industry thrive and drive forward.”

Rachel Conlan

Binance, which gained 60 million users in the past six months, attributes its growth to increased institutional adoption and positive developments like ETF approvals, Conlan said, noting the exchange sees a 20% global adoption rate as mainstream, a milestone it aims to reach within three years. Binance currently claims 240 million users globally.

The crypto exchange is doubling down on Thailand as the country itself appears to be betting on crypto as well. Recently, Siam Commercial Bank launched Thailand’s first stablecoin-powered cross-border payment system to facilitate faster, more efficient international transactions.

In August, Thai financial regulators also launched a Digital Asset Regulatory Sandbox to encourage crypto adoption in the country. The initiative, backed by a public hearing in May, allowed participants to test crypto services under flexible regulations to help develop Thailand’s digital asset market.

Source link

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: