ETH ETF

Can Ethereum Price Overcome ETH ETF Drawdown

Published

3 months agoon

By

admin

Ethereum (ETH) price quickly reversed its 24-hour gains following the US Consumer Price Index (CPI) report, which affirmed easing inflation. The largest altcoin dropped 2.5% alongside Bitcoin price correction below $60,000 after peaking above $61,000 on Wednesday.

Ethereum Price Uptrend Falters After CPI Data Release

Ethereum price has continued with lock-step movement since Monday last week, reflecting the uncertainty that still shrouds the cryptocurrency market. For a moment, investors believed that the pre-CPI release dash above $2,700 would inch closer to $3,000, but a surprise correction has seen ETH price drop to exchange at $2,645.

Based on the CPI report, monthly inflation for July increased 0.2% bringing the annual inflation below 3% to settle at 2.9% for the first time since March 2021. The actual CPI came in lighter than what economists had expected at 0.2% and 3%, respectively. Not considering the prices of food and energy, the core CPI remained steady at 3.2% annually, meeting expectations.

Although the Federal Reserve has hinted at slashing interest rates, the sudden correction in Ethereum and Bitcoin prices, shows a lack of conviction among traders who remain cautiously optimistic. With the Core CPI steady, the Fed is unlikely to consider a larger cut of 50 basis points, driving expectations down to 25 basis points.

ETH ETF Drawdown Raises Concerns

Ethereum price marginally rallied to $3,561 after ETH ETFs started trading in July. However, due to a dismal uptake compared to Bitcoin ETFs in Q1, headwinds continue to weigh on Ether.

According to SoSoValue, Ethereum ETFs have posted only seven days of net inflows since launch compared to nine days of net outflows. The last two days have been bullish for the stock exchange-traded products, with $4.93 million and $24.34 million in net inflows.

Despite the resurgence, Ether ETFs still lag, considering the net total of $376.67 million outflows. Investors anticipated a Bitcoin-like rally but the dismal performance narrows the chances of Ethereum price reaching ATH in 2024.

Meanwhile, the impressive upswing from $2,111 slowed down at $2,774 on Wednesday, followed by an immediate correction to exchange at $2,645. According to this ETH price prediction, the falling Relative Strength Index below 50 reinforces the short-term bearish grip.

The confluence resistance formed at $2,665 by the 20-day and 50-day Exponential Moving Averages (EMAs) paints a grim short-term picture. A retest of $2,600 support is expected within the American session. If traders feel the pinch and close more long positions, a further decline to $2,100 will follow.

In his latest technical outlook on the assets, Peter Bradt, a renowned trader, pointed at ETH falling to $1,651. Bradt highlighted a five-month rectangle pattern and a rising wedge, both of which reinforce the bearish thesis. Traders can expect a 3:1 profit-to-loss ratio; however, patterns tend to be unreliable, calling for more analysis using key technical indicators.

Ether $ETH

I am posting this not as a slam on ETH, even though I’m not a fan, but to describe how I trade – so ETHernuts, dont take offense. I am as quick to go long on a good pattern as short on a good pattern

1. 5-mo rectangle (my fav pattern) completed Aug 4

2. Retest of BO… pic.twitter.com/h89EAzP7cb— Peter Brandt (@PeterLBrandt) August 14, 2024

Based on IntoTheBlock’s IOMAP model, robust support between $2,263 and $2,345 is expected to come in handy and stop the sell-off. Approximately 2.24 million addresses purchased 50.36 million ETH—enough to trigger a larger breakout toward $3,000.

The IOMAP model reveals shrinking resistance toward $3,000. This means that with a minor push above the $2,800 hurdle, Ether will be on the way to launch above $3,000.

Frequently Asked Questions (FAQs)

Initially, positive sentiment triggered a rally above $3,500 but continued net outflows have suppressed significant price movement on the upside.

The crypto market tends to be volatile making it difficult to predict. However, massive ETF withdrawals limit the chances of reaching ATH in 2024.

Ethereum enjoys several technical support areas at $2,600 and $2,500, as well as fundamental support at $2,300. If these levels are not broken, the path of least resistance will remain upward.

John Isige

John is a seasoned crypto expert, renowned for his in-depth analysis and accurate price predictions in the digital asset market. As the Price Prediction Editor for Market Content at CoinGape Media, he is dedicated to delivering valuable insights on price trends and market forecasts. With his extensive experience in the crypto sphere, John has honed his skills in understanding on-chain data analytics, Non-Fungible Tokens (NFTs), Decentralized Finance (DeFi), Centralized Finance (CeFi), and the dynamic metaverse landscape. Through his steadfast reporting, John keeps his audience informed and equipped to navigate the ever-changing crypto market.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

5 tokens to consider buying today

Terra Luna Classic Community Discord On Proposal Amid LUNC Price Rally

Trump Nominates Pro-Crypto Hedge Fund Manager Scott Bessent as Treasury Secretary

Dogecoin surges 10% as this new altcoin shakes the market, and preps for stage 2 presale

Ripple CEO Shares Bullish News With XRP Army As Trump Names Treasury Secretary

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Bitcoin

Ethereum Price To Outperform Bitcoin As SEC Approves ETH ETF Trading

Published

4 months agoon

July 23, 2024By

admin

Ethereum price is gearing up for a historic rally as a large bullish market structure nears completion. This coincides with the arrival of the much-awaited start date of Ethereum ETF trading. The price of ETH remains stable, only dropping 2.9% to $3,438 in the last 24 hours as the SEC approves 9 spot ETH ETF applications to begin trading. Meanwhile, Bitcoin’s price remains securely above $66,700, just 10% away from the previous all-time high.

Ethereum Price Set to Explode 160% as Spot ETH ETF Receives Launch Approval

The ETH price displays a neutral to upward trend. The chart shows the price moving within a symmetrical triangle pattern from points A, B, C, and D. The price is currently heading to test the upper boundary of the triangle, indicating a potential breakout.

The symmetrical triangle is also part of a bullish pennant, a continuation pattern. A breakout from this market structure could catapult Ethereum 161% to $9,600.

The ETH price action trends above the 50-day and 200-day exponential moving averages (EMA), which act as support levels around $3,370 and $3120, respectively. The eight spot Ethereum ETFs have been approved by the SEC to start trading later today, and the Ethereum price looks poised to rally above its previous all-time high. There is more robust support lower, around $2,800.

On the flip side, on its way up, the ETH price forecast shows the asset may encounter resistance around $3,750, which coincides with the upper boundary of the symmetrical triangle. A major resistance exists around $4,095 (previous high), which, if broken, may confirm the rally to the last all-time high.

The ETH RSI (14, close) is currently at 55.96, indicating bullish momentum as it rises above the neutral 50 level. The RSI is also above its moving average, which is used to support the trend. The CMF (20) is at 0.15, indicating strong buying pressure with positive money flow.

Ethereum’s 24-hour trading volume is moderate. Despite the approval of the spot ETH ETF, there has been no sudden spike in its trading volume, although it is increasing steadily. This may support the Ethereum price movement if a breakout occurs.

Grayscale Goes in Big As ETH ICO Whale Wakes Up

Big financial institutions and whales are moving funds around in anticipation of the spot Ethereum ETF trading slated to start at 9:30 a.m. NJT (less than 7 hours from press time).

Grayscale transferred over 292,000 ETH (over $1 billion) to Coinbase, as Bloomberg ETF specialist Eric Balchunas confirmed.

Eth ETF race has already begun w/ a transfer from $ETHE to its mini-me = $ETH gonna begin its life w/ $1b and a category-low 15bp fee. That’s a new variable in this race that we didn’t have in btc race. https://t.co/7v6kh8Kw5Q

— Eric Balchunas (@EricBalchunas) July 22, 2024

Meanwhile, a dormant ETH ICO whale just woke up and activated its wallet after 9 years. Whale Alert says the ICO address holds 977 ETH worth about $3.3 million. Speculation is that these whales are planning to exit their positions as the spot for Ethereum ETF trading begins.

Dormant Bitcoin addresses are also being activated, signaling that this bull run may differ from the past ones.

Bottom Line

The SEC’s approval of Ethereum ETF trading marks a significant milestone for the crypto market. This development could position Ethereum price to gain ground relative to Bitcoin in terms of price performance. ETH price eyes 160% if it breaks out of this critical bullish continuation pattern, which may set it just shy of $10,000.

Frequently Asked Questions (FAQs)

Spot Ethereum (ETH) ETFs are scheduled to start trading on July 23, 2024, according to the Chicago Board Options Exchange (Cboe).

Grayscale Ethereum Mini Trust (ETH), Franklin Ethereum ETF (EZET), VanEck Ethereum ETF (ETHV), Bitwise Ethereum ETF (ETHW), 21Shares Core Ethereum ETF (CETH), Fidelity Ethereum Fund (FETH), iShares Ethereum Trust (ETHA), and the Invesco Galaxy Ethereum ETF (QETH) have been approved.

According to Ethereum price analysis, ETH price is well set to rally to a new all time high (ATH) once ETH ETFs start trading.

Related Articles

Evans Karanja is a content writer and scriptwriter with a focus on crypto, blockchain, and video gaming. He has worked with various startups in the past, helping them create engaging and high-quality content that captures the essence of their brand. Evans is also an avid crypto trader and investor, and he believes that blockchain will revolutionize many industries in the years to come. When he is not writing, you can find him playing video games or chasing waterfalls.

The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

5 tokens to consider buying today

Terra Luna Classic Community Discord On Proposal Amid LUNC Price Rally

Trump Nominates Pro-Crypto Hedge Fund Manager Scott Bessent as Treasury Secretary

Dogecoin surges 10% as this new altcoin shakes the market, and preps for stage 2 presale

Ripple CEO Shares Bullish News With XRP Army As Trump Names Treasury Secretary

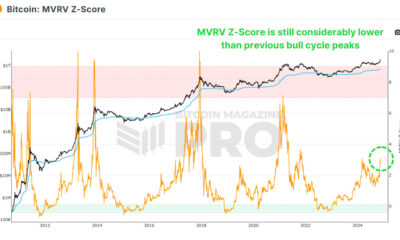

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: