Ethereum NFTs

NFT buyer activity surges over 173%, sales plummet

Published

3 months agoon

By

admin

This past week, the overall non-fungible token market was a mixed bag.

NFT sales volume dropped by 11.92%, totaling $81.8 million, while the number of NFT buyers increased by 173.25% to 327,594.

Let’s take a look at some of the key metrics that characterized the NFT market over the last seven days based on data from CryptoSlam.

Key blockchain performances

Ethereum (ETH) continued its dominance in terms of NFT sales volume. Despite a more than 10% drop from the previous week, the network still managed to rake in over $28 million — a figure accompanied by a notable rise in buyer activity, which went up 42.5%.

Solana (SOL) came in second after it generated more than $16 million in NFT sales. However, the figure represented a 15% decline, even though the network witnessed a staggering 245.93% increase in buyers. It also saw a nearly 6% drop in wash trading activities.

Bitcoin (BTC) maintained the third spot for a third week running, even though the $13.8 million it brought in reflected a 6.1% drop from the previous week’s numbers.

Wash trading on the network went up by more than 4%, although the $410,863 realized from that activity pales in comparison to other blockchains. For instance, fourth-placed Polygon (MATIC) had the highest amount of funds from wash trading at $9.1 million. The amount was markedly higher than the $6.6 million that came into Polygon from owner to owner NFT sales.

Rounding out the top five is Mythos Chain, which experienced the steepest decline in NFT sales volume, plummeting almost 30% to just north of $5 million.

Notable collections and sales

Coming to NFT collections, Mythos Chain surprisingly produced the best-selling NFT collection of the week, with its DMarket collection raking in $4.99 million in sales across seven days.

However, the amount was still a nearly 30% plunge from last week’s levels, with the number of transactions recorded for the collection also dropping 33%.

Meanwhile, second-placed Sorare, hosted on Ethereum, showed resilience, with sales going up 8.3% to $3.65 million. The number of transactions for the collection also went up by almost 8%, while buyer activity increased by more than 10%.

The uptick in activity coincides with the start of popular European soccer leagues including the Premier League and La Liga, which may have caused renewed interest in the fantasy sports platform.

However, the standout performer of the week was Bitcoin’s Uncategorized Ordinals, which saw a staggering 864.66% increase in sales to $3.1 million.

Top NFT sales of the week

In terms of sales of individual NFT pieces, one of the most notable transactions was that of an Uncategorized Ordinal on Bitcoin which sold for a whopping $2.4 million.

In contrast, Ethereum’s Bored Ape Yacht Club #2579 sold for $342,542, a pretty huge amount but dwarfed by the Ordinal sale. Other notable transactions in the week included Solana’s Froganas #4559, which fetched $82,689, and a BNB Paraluni Perpetual Bond, which sold for $134,751.

Source link

You may like

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

CryptoPunks

Are NFTs Making a Comeback or Just Riding the Hype?

Published

1 month agoon

October 10, 2024By

admin

After a dull stretch, NFT sales have taken a turn for the better. What’s behind this momentum, and is it a sign of a lasting revival?

NFTs are finally making a comeback

Non-fungible tokens are starting to show signs of life again after a rather dull performance in the last few weeks.

According to data from CryptoSlam, sales between Sep. 30 and Oct. 6 soared past $84.9 million, marking the highest sales volume since the week ending Aug. 25, which recorded over $93 million.

What’s even more interesting is that the NFT market has been gaining momentum throughout September. During the week of Sep. 16-22, NFT sales reached $69 million, and the following week, Sep. 23-29, saw a modest uptick to $75 million.

The current week, as of Oct. 7, has already clocked over $5.5 million in sales, suggesting that the market could continue this upward trend.

In addition to the rise in sales volume, there’s been an increase in activity, with over 2 million transactions recorded in the last seven days as of Oct. 7, a 29.73% jump from the previous period.

However, it’s not all sunshine. The average sale price of NFTs has dropped by 32.91%, now sitting at around $43 per sale, indicating that while more people are engaging with NFTs, the high-priced collectibles may still be lagging behind.

With the numbers showing positive momentum, what’s driving this rebound? Let’s dive deeper into which blockchains are leading the NFT race, why NFTs are making a comeback, and what we can expect in the days to come.

Which blockchains are leading the race?

As of Oct. 9, Ethereum (ETH) still holds the crown as the dominant blockchain in the NFT space, but the landscape is shifting, and other platforms are quietly gaining ground.

Ethereum (ETH)

Ethereum remains the leader in terms of NFT sales, bringing in over $26.5 million in the past week. Ethereum’s sales accounted for nearly 31% of the entire NFT market, but it’s also plagued by a relatively high percentage of wash trading — roughly 11.69%.

Wash trading involves artificially inflating the volume by buying and selling within the same wallet to create the illusion of higher demand.

Despite this, Ethereum’s vast user base and dominance in the NFT ecosystem cannot be ignored, as it recorded over 136,000 buyers during this period.

However, the volume of transactions (over 654,000) suggests a growing reliance on smaller trades, with the average sale price taking a sharp dip.

Mythos (MYTH)

Mythos (MYTH), a relatively newer player, is perhaps the most surprising competitor. Sales skyrocketed by over 6200% in the last week alone, reaching $15.3 million, giving it the second spot.

This explosion is driven by its gaming-centric focus, tapping into a relatively untapped and highly passionate user base. In-game assets such as NFTs have been a concept that gamers are increasingly embracing, and Mythos is positioning itself as the leader in this niche.

What’s even more interesting is that this surge isn’t heavily tied to wash trading, as only 0.28% of its transactions are wash trades, showing the platform is experiencing genuine user-driven growth.

Mythos has attracted over 632,000 transactions this week alone, which is nearly five times that of Ethereum, signaling that it might be a blockchain to watch closely as it builds on this rapid adoption.

However, gaming NFTs are highly dependent on the success of the underlying games. Hence, if those games fail to attract or retain users, the NFT market on Mythos might see a sharp decline.

Bitcoin (BTC)

Bitcoin (BTC) entering the NFT race was not something many anticipated a few years ago. Traditionally viewed as a store of value, Bitcoin’s blockchain wasn’t designed with NFTs in mind.

However, the introduction of Ordinals has breathed new life into Bitcoin’s potential in this space. While its weekly sales volume of $14.1 million might seem modest compared to Ethereum, the fact that Bitcoin’s NFT market is growing organically, with only 5.15% wash trading, is worth noting.

Interestingly, despite having fewer transactions and users compared to Ethereum, Bitcoin boasts a higher average sale price, hinting that its NFT market might be more geared toward high-end, premium assets.

Solana (SOL)

Solana (SOL) continues to be a serious competitor, posting over $10.8 million in sales this week, ranking fourth.

However, Solana’s wash trade percentage — at a whopping 22.7% — is one of the highest among the top blockchains, indicating that while Solana is seeing growth, much of its activity may be artificially inflated.

Yet, with nearly 223,000 unique weekly buyers and over 421,000 weekly transactions, it’s clear that Solana remains a key player, especially among collectors who prefer faster and cheaper transaction fees than Ethereum offers.

Polygon (POL)

Polygon (POL), known for its efficiency and low transaction costs, clocked over $10.7 million in sales last week, with wash trades making up only 0.25% of its transactions — far lower than Ethereum or Solana.

Polygon also recorded an impressive 84,532 sellers, indicating that the blockchain is attracting a healthy level of marketplace activity.

Why are NFTs surging again?

The recent surge in NFT sales can be traced to a few key developments, the most notable being a high-profile, yet dubious, CryptoPunk sale and the introduction of innovative NFT features by Telegram.

A flash loan-fueled transaction involving CryptoPunk #1563 recently made headlines when it appeared to sell for an eye-popping $56.3 million on the Ethereum blockchain.

On the surface, this seemed like a monumental sale in a space that has been struggling with lower sales volumes and declining prices.

But a closer look revealed that the sale was anything but legitimate. The buyer of the CryptoPunk used a flash loan — an uncollateralized loan that’s paid back in the same transaction — creating the illusion of a massive purchase.

3/ The progression:

Contract A holds Punk #1563, Contract B holds nothing.

Contract A lists for 24,000 ETH.

Contract B borrows 24,000 ETH from Balancer.

Contract B buys #1563. Contract B now has #1563, contract A has 24,000 ETH.

Contract A returns ETH to Balancer. pic.twitter.com/Clw1JGWASn

— Quit (@0xQuit) October 3, 2024

In reality, the Punk, which had been purchased for just $69,000 in September, was simply transferred between wallets without any real funds changing hands. Despite this, the sale grabbed attention and sparked conversations, renewing interest in the NFT space.

These carefully orchestrated events often attract investors’ attention, especially those who had stepped away from the market amid the broader decline in NFT activity.

The psychological impact of these “sales” can reignite fear of missing out, pulling speculators back into the space as they anticipate that increased attention could lead to real opportunities.

Simultaneously, Telegram’s move into the NFT arena has introduced a more accessible avenue for users to engage with digital collectibles.

On Oct. 5, Telegram launched its new “Gifts” feature — animated images that can be sent to contacts on the platform. But what’s most exciting is that these Gifts are set to be converted into NFTs later this year, with Telegram allowing users to mint these limited-edition assets on the TON blockchain.

This feature builds on Telegram’s previous introduction of its in-app currency, Stars, which users can spend on digital services within the platform. By linking NFTs to social interactions, Telegram is making NFTs more accessible to everyday users.

Telegram’s integration of NFTs is a key development because of its massive user base and the seamless experience it offers. Users will soon be able to convert these digital gifts into NFTs, trade them, and even auction them off, all while staying within the Telegram ecosystem.

While the broader market saw its lowest sales volume since January 2021 in September, these recent events have breathed new life into the sector. Whether this resurgence will hold remains to be seen, but for now, NFTs are back in the spotlight.

What to expect next?

Looking ahead, the NFT space faces some uncertainties, especially with the recent Wells notice issued by the U.S. Securities and Exchange Commission to OpenSea, the largest NFT marketplace.

On Aug. 28, the SEC signaled its intent to take enforcement action against OpenSea, claiming that some NFTs on the platform may qualify as securities. This could have major implications for the entire NFT ecosystem.

A Wells notice is a formal warning that the SEC might pursue legal action, and while OpenSea has the opportunity to respond, the looming threat creates an atmosphere of uncertainty.

If the SEC classifies certain NFTs as securities, it could trigger a wave of regulatory scrutiny, not just for OpenSea, but for other platforms and NFT projects.

The potential for stricter regulations could make some investors hesitant and slow down market growth, especially for projects that don’t have clear legal frameworks in place.

At the same time, the current uptick in NFT sales seems largely fueled by hype. It remains to be seen whether this buzz will translate into long-term growth or if it’s just another short-lived trend.

Source link

Ethereum NFTs

NFT bubble burst: Monthly sales, transactions crash

Published

3 months agoon

September 2, 2024By

admin

The non-fungible token industry remained under pressure in August as sales continued falling.

Total NFT sales dropped by 41% in August to $376 million as the number of buyers and sellers fell by double digits.

Data by CryptoSlam shows that the number of buyers dropped by 29% to 127,913 while the number of sellers fell by 17% to 93,600.

Additionally, total NFT transactions declined by 50% to 7.4 million, signaling that demand for these assets has waned.

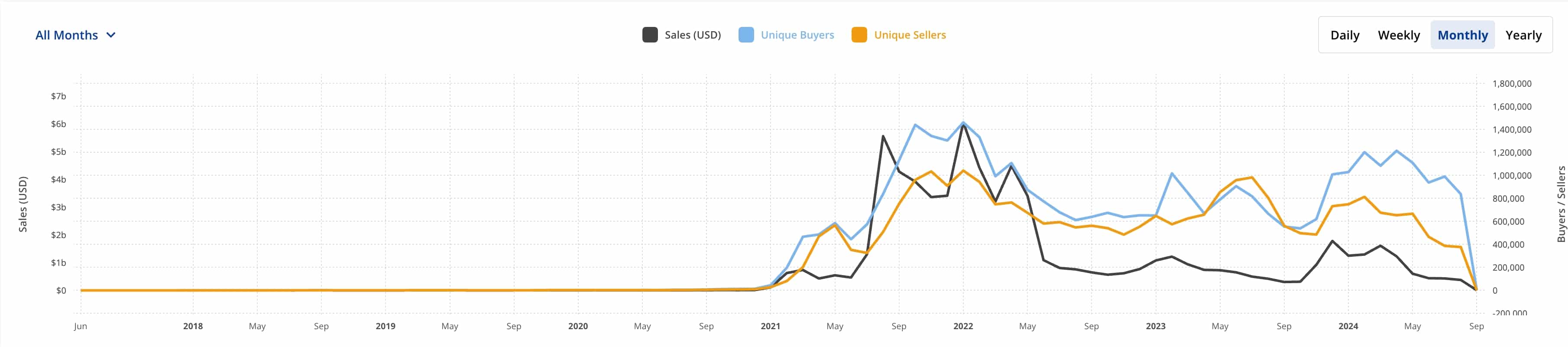

At the peak in January 2022, total monthly sales were over $6.5 billion while the number of unique buyers and sellers stood at over 1.5 million and over 1 million.

Ethereum (ETH) maintained its lead as the most popular chain for NFT traders, handling over $129 million in August, down by 38% from the previous month.

It was followed by Solana (SOL), which handled $78.9 million. Bitcoin’s NFT sales dropped by 50% to $57 million while Polygon (MATIC) fell by 52% to $36 million.

Mythos Chain saw an improvement in August. It handled $20 million in sales. That’s up by 14% from the previous month. Mythos was led by DMarket, whose sales rose by 17% during the month.

Some of the most popular NFTs have seen their valuation and sales drop in the past few years. For example, Bored Ape Yacht Club has moved from having monthly sales worth over $50 million in 2022 to just $11 million in August.

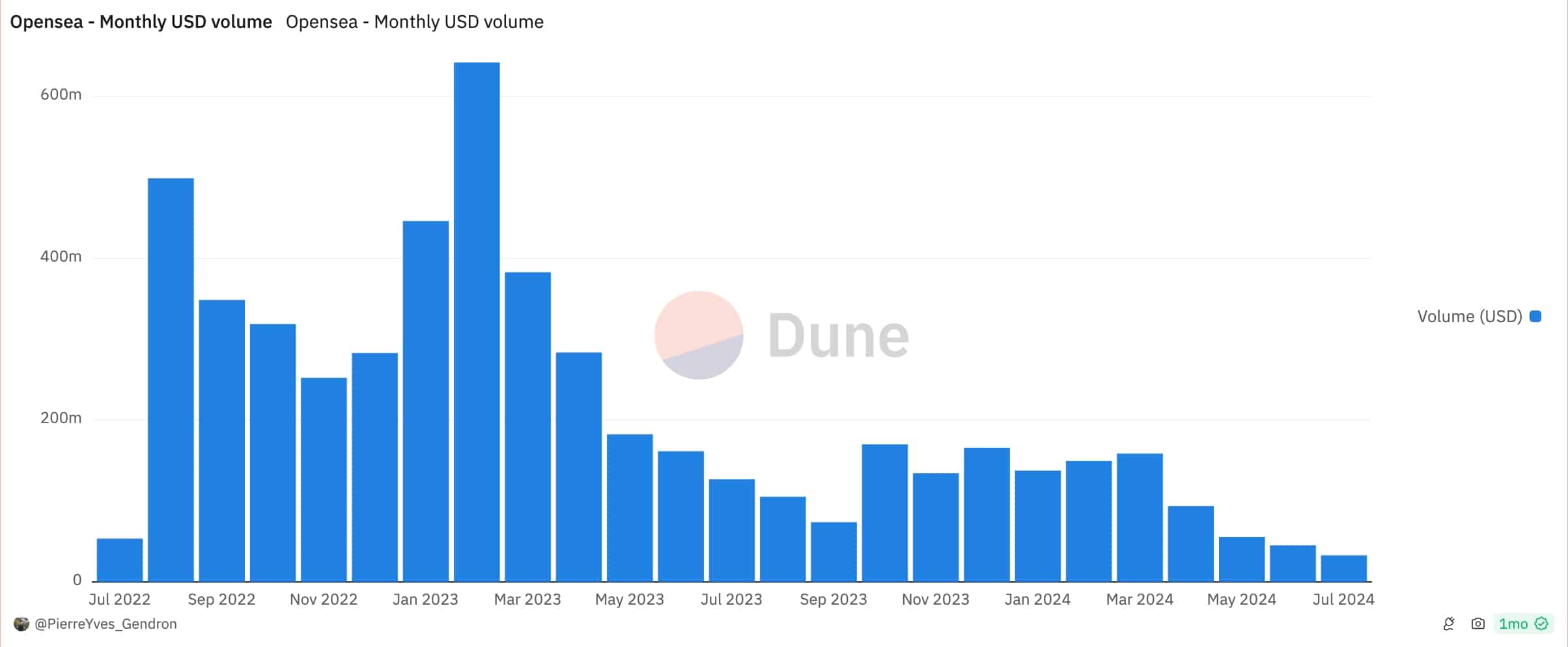

This sharp decline in NFT monthly volume has hurt both investors and marketplaces like OpenSea and Rarible. Data by Dune Analytics shows that OpenSea’s monthly volume in July was just $32 million, down from $641 million in January last year.

Other NFT marketplaces like Blur, Magic Eden, and SuperRare have also had weak volume and users in the past few months.

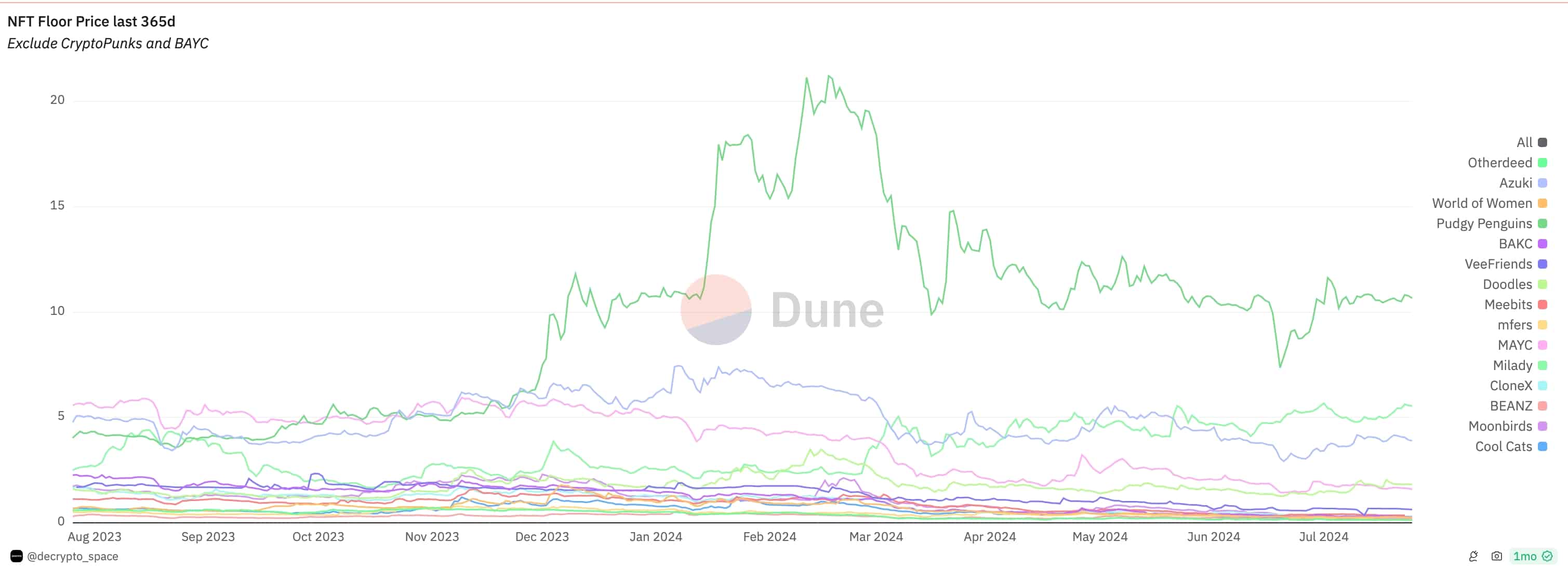

NFT sales have dropped because of the falling prices. CryptoPunks, the biggest NFT collection, has a floor price of $88,839, a 52% drop from the same period in 2023. Bored Ape Yacht Club’s floor price has dropped by 70% in the past 12 months to $29,593 while Azuki has fallen by 20%.

The top gainers in the same period were Pudgy Penguins and Milady whose floor prices jumped by 166% and 121%, respectively.

Source link

Bored Ape Yacht Club

Pudgy Penguins floor price rises as key metrics improve

Published

3 months agoon

September 1, 2024By

admin

Pudgy Penguins, the viral Ethereum Non-Fungible Token collection, has defied the gloom in the industry in August.

Data by CryptoSlam and Dune Analytics shows that its key metrics performed well even as the sector came under intense pressure.

Total sales jumped by 29% in August to over $8.6 million as the number of transactions jumped by 73% to 348.

Additionally, the number of buyers and sellers rose by 73% and 39% to 176 and 205, respectively. The average number of days held also rose slightly by 5% to 85.5.

While Pudgy Penguins sales rose in August, they remain sharply lower than their all-time high of $99.2 million in August 2021. They were also lower than the March high of $26.5 million

Pudgy Penguins Get Pricey

The prices of Pudgy Penguin NFTs are also rising.

According to Dune, the floor price rose by 30% in August to 10.66 ETH and 166% from the same period in 2023. Floor price refers to the lowest price that an NFT is being sold in marketplaces.

Pudgy Penguins is one of the three blue-chip NFT collections that has seen its floor price rise in the past 12 months. Milady’s floor price has jumped by 121% while Doodles has risen by 12%.

The floor price of other popular blue-chip NFT collections like CryptoPunks, Bored Ape Yacht Club, Azuki, and Mutant Ape Yacht Club has dropped by over 50% in the last 12 months as their demand has waned.

According to NFT Evening, 96% of all NFTs have “died,” with four out of 10 holders being in loss. Additionally, the average lifespan of an NFT has dropped to 1.14 years, much lower than other crypto assets.

Pudgy Penguins, founded by entrepreneur Luca Schnetzler (aka Luca Netz), has done well even as the total sales, transactions, and NFT users have continued to fall.

Total NFT sales in August dropped by 41% to $376 million, down from an all-time high of over $6 billion.

Pudgy Penguin’s sales rose a month after the developers secured $11 million funding from a group of investors to build a layer-2 network. The funding came from Founders Fund, Peter Thiel’s venture company.

The developers have also launched branded toys that are being sold in popular retailers like Walmart and Target.

Source link

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential