Culture

Not Your Keys, Not Your Name: Here’s Why Naming is the Next Killer App for Bitcoin

Published

3 months agoon

By

admin

In the Name of Freedom

Neutral money like bitcoin preserves economic liberty. It respects individual freedom. It silently advocates for property rights. Whether you’re an individual or a business, it gives you complete empowerment over your decisions about production, investment, and consumption without the threat of censorship, confiscation, or debasement. Without the involvement of governments, this encourages self-reliance and contributes to social harmony. Bitcoin, in other words, is essential for maintaining a free, prosperous, and just society. The same is true for naming. If anything is as important to society as money, it’s naming. Names are needed for almost everything and individuals & businesses should be able to own their name without it being in the control of a centralized, third party.

Names and money both have historically relied on trust for their efficacy, but just like bitcoin as money ushered in an era of trustlessness, the same must be accomplished for names.

Centralized Naming Providers are Dinosaurs

People have to realize, if they haven’t yet, that they do not own their usernames on social media and are always one click away from having their property, or what should be their property, confiscated.

The security risk of relying on centralized naming systems is especially true for individuals & businesses building in Bitcoin. If you are relying on centralized naming services, it is only a matter of time until you’re compromised, just like we saw with the Squarespace DNS hijacking last month.

Governments often silence political opponents by confiscating their names. Take for instance, PuntCAT, a Catalan private non-profit foundation whose mission is to promote all kinds of activities related to the creation, management, and control of the top-level domain name .cat and, in general, to promote the Catalan language and culture. They were raided by the Spanish police during a tumultuous political time and forced to block several websites critical of the Spanish government due to legal pressure from Madrid. The head of IT was arrested for sedition.

What’s more, The Internet Corporation for Assigned Names and Numbers (ICANN), which is responsible for managing the global domain name system, has faced numerous controversies over the years related to centralized control, transparency, and accountability. ICANN’s practices and policies are opaque, they have been called out by the likes of Ralph Nader for violating consumer rights, and as the Electronic Frontier Foundation put it, there is evident susceptibility to capture in the excessive deference given to the interests of major trademark and copyright holders.

The point is, if we don’t succeed in decentralizing naming, the risk of censorship, property confiscation, and other rights will always be under attack.

As Bitcoin continues to evolve along with adjacent technology protocols like NOSTR, names will become increasingly important for this reason alone. Names can serve as identifiers for various components within these systems, facilitating communication between different parties and improving the usability, interoperability of protocols, and freedom of speech.

Don’t call it a comeback

Past attempts to decentralize naming have included initiatives like the DNS root server separation in 1997 and new top-level domains (TLDs) like .bit and .name. In the cryptocurrency space, projects such as Namecoin, BitDNS, and blockchain-based name services from companies like Namecoin, Blockstack, and Stacks have also sought to decentralize naming systems. Despite these efforts, many of these initiatives have fallen short due to limited adoption, scalability issues, distribution issues, and other technical complexities, leaving centralized naming systems dominant in both the traditional internet and crypto landscape.

Earlier this year, Matt Corallo proposed a BIP for the coordination of making Bitcoin payments using DNS. Matt is correct to not rely on another blockchain (e.g. ENS on Ethereum), but he acknowledges it is a risk to rely on traditional centralized DNS, and this is only the “best option.” There are organizations in between you and your name, and every website that uses HTTPS to encrypt traffic is relying on a third party to secure it – you are literally not holding your own keys. Not your keys, not your name.

What is needed is a truly decentralized, permissionless naming system built on Bitcoin, free from third party certificate authorities, that empowers users with control and privacy over their online identities. And in contrast to attempts that came before, naming needs to be done in a cypherpunk-centric way without a new blockchain, or modifications to Bitcoin itself, without a new token, foundation, or premine. Users must be entirely in control of how they register, manage, and transfer names.

The Future of Naming is Cypherpunk

The internet, once envisioned as a democratizing force for free expression and global communication, now faces mounting threats from government censorship, corporate influence, and technical vulnerabilities. Decentralized naming, built on the robust and secure foundation of Bitcoin, offers a future where individuals and businesses have greater control over their identities, ideas, and information. By leveraging the immutability, transparency, and censorship-resistant nature of Bitcoin, decentralized naming systems can provide a more resilient and democratic alternative for managing their identities. With Bitcoin as the backbone, we can ensure that decentralized naming is not only inevitable but also truly successful in creating a global, open, and free internet – one where everyone has an equal voice in shaping the global conversation without fear of censorship or control. An internet that is cypherpunk.

This is a guest post by Mike Carson. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

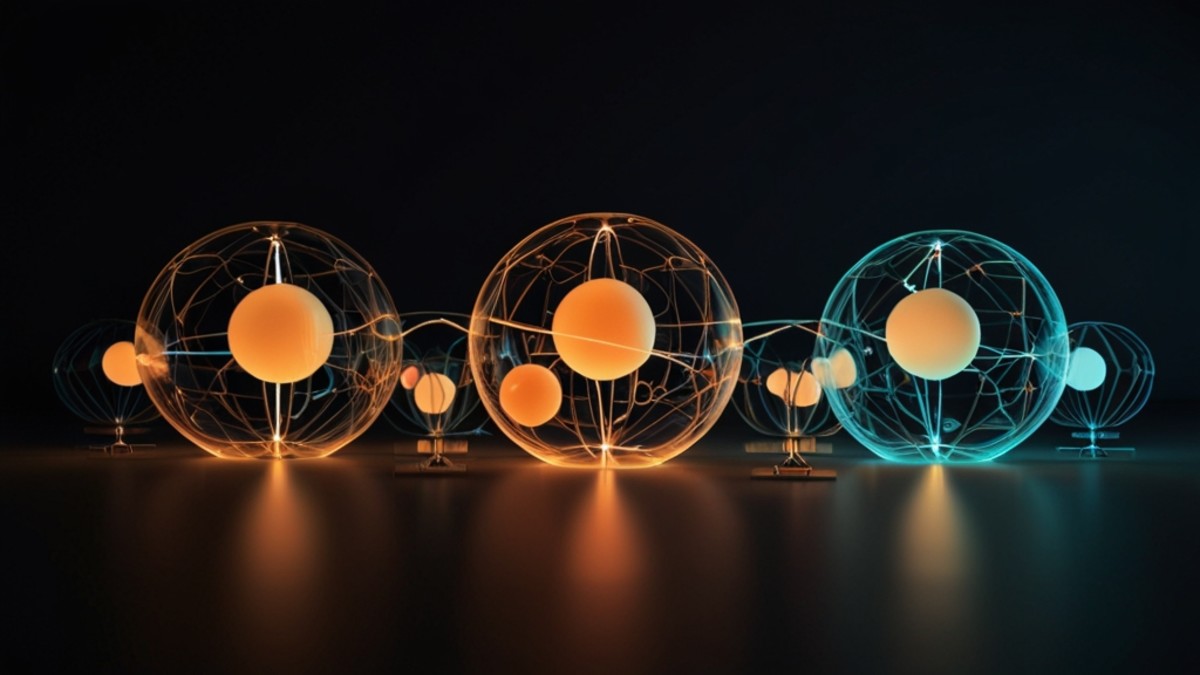

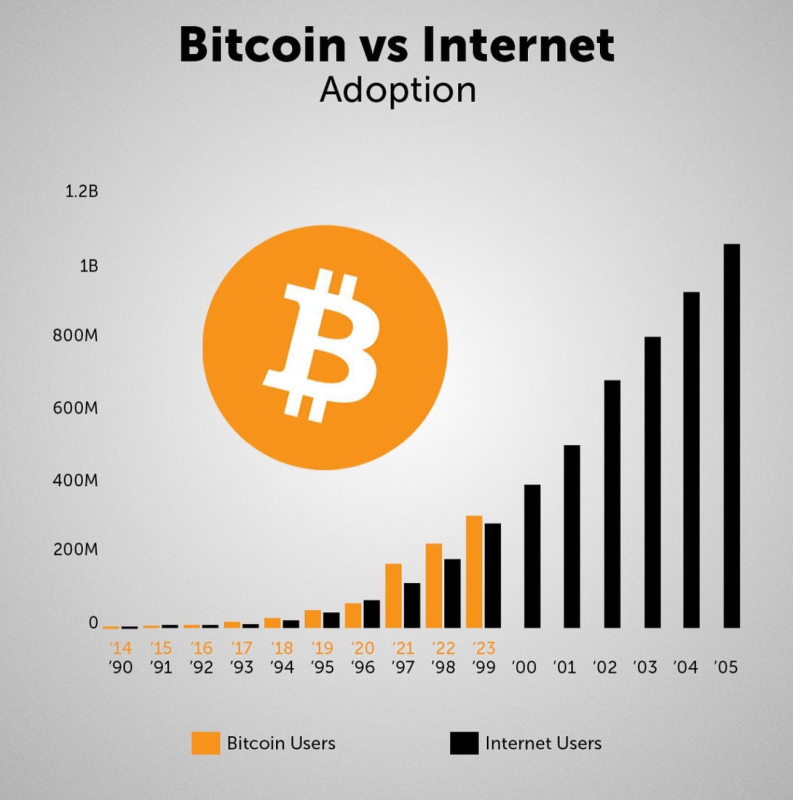

Today’s modern Bitcoin exchanges have drastically improved access to Bitcoin ownership in 2024. Gone are the days of janky peer-to-peer (P2P) trade forums and questionably secure early exchanges like Mt Gox. Instead, a legion of Bitcoin on-ramps focused on superior security and user experience (UX) has made purchasing your first Bitcoin a breeze. Many of these services have even embarked on education-focused initiatives to encourage greater adoption during Bitcoin’s most recent bear market. In November 2023 Swan launched Welcome to Bitcoin, their free introductory 1 hour course about Bitcoin. In December 2023, Cash App released BREAD, a free, limited-edition magazine that uses design to tell stories and educate readers about Bitcoin in a relatable and accessible way.

What these initiatives show is that Bitcoin adoption is approaching a turning point. These two major Bitcoin exchanges, along with the industry as a whole, are discovering that easy access to a smash buy button does not guarantee purchase. Numerous barriers to entry still exist for nocoiners, which provide significant constraints to understanding Bitcoin, and thus throttle Bitcoin’s growth and adoption. As we approach a steeper incline in Bitcoin’s bell curve, throwing novices into exchange apps without sufficient education and cultivation is no longer a strategy for success.

What once was a far simpler task of energizing early adopters and cypherpunks around Bitcoin’s clear value proposition, is evolving into a more complex and convoluted process of orange-pilling the early majority of future Bitcoin holders. This, we hope, will then lead to widespread Bitcoin mass adoption as society en masse chooses to store its time and energy in the best money ever created. For this hyperbitcoinization to occur, more people need to understand the intricacies of Bitcoin. This is easier said than done because Bitcoin still has an education problem:

- An Economist Intelligence Unit study reported that 51% of people said a lack of knowledge is the main barrier to Bitcoin ownership.

- A YouGov survey found that 98% of novices don’t understand basic Bitcoin concepts.

- A nationwide survey from the Yale Center discovered that 69% of young people find learning boring.

This research outlines the struggle of onboarding and educating the next generation of Bitcoiners, most notably younger generations who have been shown to possess a limited attention span of 8 seconds. For inspiration to help solve this problem, we can look at one of the most popular mobile games of all time… Pokémon GO.

Pokémon GO was and remains to be, a global phenomenon. This beloved app caught the attention of Gen-Z, millennials, and Gen-X alike, boasting record-breaking engagement stats:

- In 2016, the game peaked at 232 million active players.

- Pokémon GO has grossed over $6 billion in revenue.

- In 2024, 24% of 18–34-year-olds in the US are playing Pokémon GO, while 49% of 35–54 year-olds are playing.

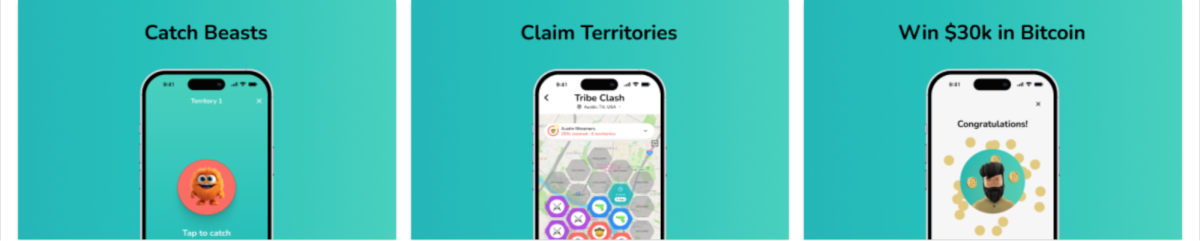

We at Jippi believe that the success of this award-winning game can illuminate the path forward for Bitcoin adoption. So we have set upon the electrifying task of building Tribe Clash–the world’s first Pokémon GO-inspired Bitcoin education game. The rules are simple, create or join a Tribe and battle for dominance over a city with your friends by catching a Bitcoin-themed Beast in every Territory.

Each week Jippi will release a new Territory to be claimed. A Tribe member will explore that Territory with their phone, where they will discover a Bitcoin Beast to catch. If they successfully answer all Bitcoin quiz questions correctly the fastest, they will then catch that beast. The Tribe with the most Territories and Bitcoin Beasts at the end of the game will win $30k worth of Bitcoin to be dispersed equally to each Tribe member.

Our vision is for Jippi to become the largest, most popular platform for beginners to gather, educate, and accumulate Bitcoin. We see Jippi as the most accessible on-ramp into the industry, where we can educate a whole new generation of Bitcoiners from novices to experts by lowering the barrier to entry.

You can support the development of Tribe Clash by contributing to our crowdfunding campaign on Timestamp. Timestamp enables investors of all backgrounds to support Bitcoin-only companies and make an impact. Our campaign is open to both the general public and accredited investors, so we would love for you to join us on this journey.

This is a guest post by Oliver Porter. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Art

How To Paint a Sandwich: A Solo Presentation On Memes And Digital Culture By Nardo At Bitcoin MENA

Published

4 days agoon

November 18, 2024By

admin

In anticipation of a solo exhibition by artist Nardo at Bitcoin Mena, in collaboration with AOTM Gallery, I sat down with him to explore the intersections of memes, mythologies, and digital culture. Nardo’s work navigates the intriguing space between the tangible form of traditional painting and the fleeting nature of meme culture—two seemingly contrasting mediums that are evolving in tandem with Bitcoin.

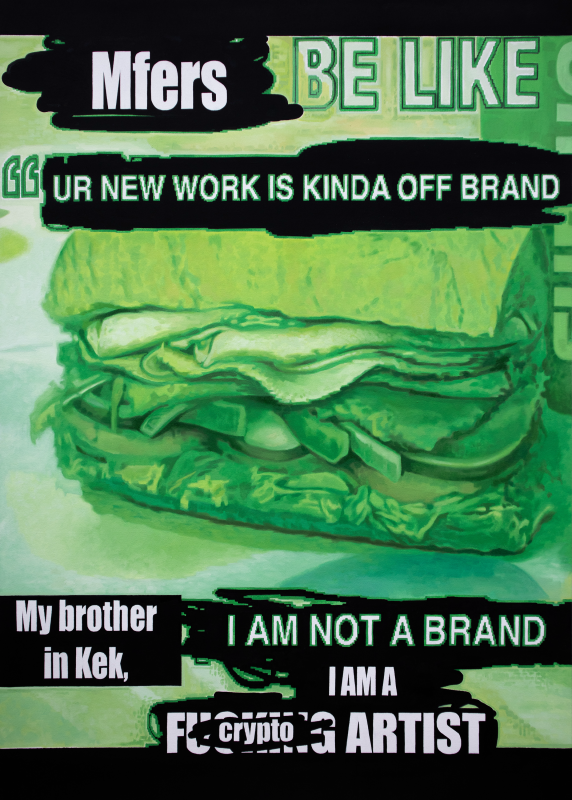

The title of your exhibition, Fresh Impact, and the centerpiece painting, Sandwich Artist, both reference Subway-related memes. Notably, Subway became the first fast-food chain to accept bitcoin in 2013—a moment documented by Andrew Torba, who famously used bitcoin to buy a $5 sub in Allentown, Pennsylvania (an ironic detail, given that Torba is now CEO of the social network Gab). This early mix of Bitcoin and meme culture sparked humorous reflections on “spending generational wealth” on footlongs and highlighted themes of currency value over time, as the dollar’s purchasing power wanes while bitcoin’s grows. How does this Subway meme resonate with you, and how does it shape your approach to painting in an increasingly digital age?

I think there is something to be said about quick consumption in contemporary culture—whether it’s fast food footlong subs or internet memes. The attention span of human senses has diminished to bursts of repeated dopamine, where selecting your type of bread, meats, and toppings becomes the most exciting part of your afternoon. Then comes the tireless effort of finishing 12 inches of processed food matter. You repeat this over and over because it’s convenient, and maybe next time, you’ll excite yourself by swapping cheddar for provolone.

However, Subway has developed a systematic experience that feels eternal. Memes and internet behavior function in a similar way. The ephemeral consumption of entertaining or humorous memes acts as the dopamine hit—we share them with friends, they spread at rapid speeds, and then they often die off, leading us to move on to the next. Yet, the success of memes also lies in their systems: cultural iconography, bold fonts superimposed onto captivating imagery, hyper-sharpened visuals, deep-fried aesthetics, or low effort applications. Memes rely on visual and cultural layers—bread, meat, and toppings.

I think, as it relates to Bitcoin, we should really confront its experiential nature in the exact moment of exchange. To have purchased a footlong for $5 worth of Bitcoin in 2013, only to view it today in 2024 as ~$4,300, is both absurd and somewhat painful—but the experience is eternal. The very act of using digital internet money in exchange for physical, consumable goods feels almost alchemical.

Evolutionary biologist Richard Dawkins coined the term “memes” to describe units of cultural transmission, likening their spread to gene replication. Memes also resemble viruses in how they propagate through social networks, blurring the lines between genes and viruses as both can integrate into DNA and influence evolution. You and I have joked that memes—and memecoins—are akin to the fast food of digital culture, serving as cybernetic junk food or street drugs. Do you consider memes to be a low art form? Is the buildup of studio trash made famous by painter Francis Bacon or the outlandish waste and detritus of Dash Snow’s 2007 “hamster nest” installation somehow related? What are your thoughts on contemporary artists like Christine Wang, who replicates notable memes in her recent painting exhibition, “Cryptofire Degen,” at The Hole in New York? What happens when a digital meme becomes a physical painting?

This all ties back to what I discussed earlier—I am interested in slowing down the process of consumption. To meticulously hand-paint a meme in oil and present it as such can be a little jarring. Similarly, considering trash as form or content, rather than something to be discarded, fascinates me.

After the user has consumed their lunch and doom-scrolled through countless memes on Twitter, what remains as the detritus of all that? The whole experience can feel like nullifying brain rot—a diminishing of structure and existence within passive chaos. Perhaps, though, that is the liminal mindset necessary to birth the most viral ideas.

My introduction to cybernetics came from Japanese animation series like Ghost in the Shell (1995-2014), which explore cyberpunk themes such as internet-connected minds, hackers, and cyber viruses, echoing Dawkins’ ideas about memes and cultural transmission. The series highlights concepts like “ghost-hacking” and “thought viruses,” which replicate across networks and influence societal behavior, aligning with Dawkins’ notion of self-replicating cultural units. Given your recent exploration of the “skibidi toilet” meme phenomenon, what insights have you gained about how this meme has propagated across social networks and shaped the collective consciousness of younger audiences?

The Ghost in the Shell connection isn’t far removed from the world as we know it now. Much like the premise of that “fiction,” our fleshy brains are nestled within a cybernetic façade of digital personas and communications. We practically live vicariously through a digitized shadow-self—a projection of what we think we could become. This aligns with why I often say, “You become what you meme.”

I am deeply intrigued by the phenomenon of American youth becoming obsessed with new memes that older generations are unable to compute, such as Skibidi Toilet. I think it is in this fracturing of sensibility that new languages are born, while old mythologies are repackaged in contemporary ways. Skibidi Toilet is the Iliad of the Internet.

Beyond Ghost in the Shell’s exploration of cybernetics, the seminal anime series Neon Genesis Evangelion intersects with the Age of Aquarius concept through its themes of interconnectedness and collective consciousness. The series delves into the merging of individual identities, echoing how “hive mind” behaviors in contemporary internet culture reflect the rapid influence of shared information and memes. In your artwork Sandwich Artist, you highlight the tension between individual artistry and the pressures of representing a faceless brand. How have you observed this shift over time, and how can artists engage with collective ideas while preserving their individuality in today’s digital culture?

The Sandwich Artist piece utilizes a well-known meme template, yet through various digital alterations—specifically the literal scribbling out of pre-existing text—it takes on the feel of graffiti and eventually becomes my own. I like this piece for how it represents an individual manifesto of my work and reflects how I think about my artistry as a whole. Sure, consistent branding and aesthetics are great for sales if done right, but I’m more interested in how my work exists within a long enough historical timeline. The hive mind desires a brand to rally behind, yet history yearns for individual artistry.

We’ve discussed the term “subway” in relation to submarine sandwiches, but it also evokes the idea of underground transportation. Japan famously studied mycelial growth patterns to optimize its subway and train systems. Similar to fungi, memes propagate and connect individuals in a vast, decentralized network, evolving as they move from one “host” to another. This fungal comparision highlights how memes adapt and spread dynamically, mirroring natural systems of growth and communication. How do you think artists can consciously navigate this memetic landscape of propagation, host vessels, and network dynamics?

The lifespan of most internet memes moves so rapidly that it’s difficult to grasp them before they vanish into a shallow grave. Among the few that manage to take hold of the collective consciousness, I find it fascinating to analyze how they connect to humanity’s past on a metaphysical level. Trends and symbols have remained consistent throughout human history; they simply resurface in different forms as time passes.

Efficient memes rely on efficient systems for delivering information. As artists, we should remain conscious of history and metaphysical symbolism, as this awareness can help us uncover our own primordial self through the mirror of memes.

Source link

A lot of consensus-change proposals for bitcoin are on the table at the moment. All of them have good motivations, whether it’s scaling UTXO ownership or making self-custody more tractable. I won’t rehash them here, you’re probably already familiar. Some have been actively developed for years.

The past two such changes that have been made to bitcoin successfully, Segwit and Taproot, were massive engine-lift-style deployments fraught with drama. There have been smaller changes in bitcoin’s past, like the introduction of locktimes, but for some reason the last two have been kitchen sink affairs.

The reality not often talked about by many bitcoin engineers is that up until Taproot, bitcoin’s consensus development was more or less operating under a benevolent dictatorship model. Project leadership went from Satoshi to Gavin to… well, I’ll stop naming names.

Core developers will likely quibble with this characterization, but we all know deep down that to a first order approximation that it’s basically true. The “final say” and big ideas were implicitly signed off on by one guy, or maybe a small oligarchy of wizened autists.

In many ways there’s really nothing wrong with this – most (all?) major open source projects operate similarly with pretty clear leadership structures. Oftentimes they have benevolent dictators who just “make the call” in times of high-dimensional ambiguity. Everyone knows Guido and Linus and the based Christian sqlite guy.

Bitcoin is aesthetically loath to this but the reality, whether we like it or not, is that this is how it worked up until about 2021.

Given that, there are three factors that create the CONSENSUS CONUNDRUM facing bitcoin right now:

(1) The old benevolent dictators (or high-caste oligarchy) have abdicated their power, leaving a vacuum that shifts the project from “conventional mode of operation” to “novel, never-before-tried” mode: an attempt at some kind of supposedly meritocratic leaderlessness.

This change is coupled with the fact that

(2) the possible design space for improvements and things to care about in bitcoin is wide open at this point. Do you want vaults? Or more L2s? What about rollups? Or how about a generic computational tool like CAT? Or should we bundle the generic things with applications (CTV + VAULT) to make sure they really work?

The problem is that all of these are valid opinions. They all have merit, both in terms of what to focus on and how to get to the end goal. There really isn’t a clear “correct” design pattern.

(3) A final factor that makes this situation poisonous is that faithfully pursuing, fleshing out, building, “doing the work” of presenting a proposal IS REALLY REALLY TIME CONSUMPTIVE AND MIND MELTING.

Getting the demos, specs, implementation, and “marketing” material together is a long grind that takes years of experience with Core to even approach.

I was well paid to do this fulltime for years, and the process left me disgusted with the dysfunction and having very little desire to continue contributing. I think this is a common feeling.

A related myth is that businesses will do something analogous to aid the process. The idea that businesses will build on prospective forks is pretty laughable. Most bitcoin companies have a ton on their backlog, are fighting for survival, and have basically no one dedicated to R&D. The have a hard enough time integrating features that actually make it in.

Many of the ones who do have the budget for R&D are shitcoin factories that don’t care about bitcoin-specific upgrades.

I’ve worked for some of the rare companies that care about bitcoin and do have the money for this kind of R&D, and even then the resources are not sufficient to build a serious product demo on top of 1 of N speculative softforks that may never happen.

—

This kind of situation is why human systems evolve leadership hierarchies. In general, to progress in a situation like this someone needs to be in a position to say “alright, after due consideration we’re doing X.”

Of course what makes this seem intractable is that the Bitcoin mythology dictates (rightly) that clear leadership hierarchies are how you wind up, in the limit, with the Fed.

Sure, bitcoin can just never change again in any meaningful way (“ossify”). But at this point that almost certainly resigns it to yet another financial product that can only be accessed with the benefit of a large institution.

If you grant that bitcoin should probably keep tightening its rules for more and better functionality, but that we should go “slow and steady,” I think there are issues with that too.

Because another factor that isn’t talked about is that as bitcoin rises in price, and as nation-states start buying in size, the rules will be harder to change. So inaction — not deciding — is actually a very consequential decision.

I do not know how this resolves.

—

There’s another uncomfortable subject I want to touch on: where the power actually lies.

The current mechanism for changing bitcoin hinges on what Core developers will merge. This of course isn’t official policy, but it’s the unintended reality.

Other less technically savvy actors (like miners and exchanges) have to pick some indicator to pay attention to that tells them what changes are safe and when they are coming. They have little ability or interest to size these things up for themselves, or do the development necessary to figure them out.

My Core colleagues will bristle at this characterization. They’ll say “we’re just janitors! we just merge what has consensus!” And they’re not being disingenuous in saying that. But they’re also not acknowledging that historically, that is how consensus changes have operated.

This is something that everyone knows semi-consciously but doesn’t really want to own.

Core devs saying “yes” and clicking merge has been a necessary precursor every time. And right now none of the Core devs are paying attention to the soft fork conversations – sort of understandable, there’s a bunch to do in bitcoin.

But let’s be honest here, a lot of the work happening in Core has been sort of secondary to bitcoin’s realization.

Mempool work is interesting, but the whole model is more or less upside down anyway because it’s based on altruism. For-profit darkpools and accelerators seem inevitable to me, although that could be argued. Much of the mempool work is rooted in support for Lightning, which is pretty obviously not going to solve the scaling problem.

Sure, encrypted P2P connections are great, but what’s even the point if we can’t get on-chain ownership to a level beyond essentially requiring the use of an exchange, ecash mint, sidechain, or some other trusted third party?

My main complaint is that Core has developed an ivory tower mindset that more or less sneers at people piatching long-run consensus stuff instead of trying to actually engage with the hard problems.

And that could have bitcoin fall short of its potential.

—

I don’t know what the solution to any of this is. I do know that self-custody is totally nervewracking and basically out of the question for casual users, and I do know that bitcoin in its current form will not scale to twice-monthly volume for even 10% of the US, let alone most of the world.

The people who don’t acknowledge this, and who want to spend critical time and energy wallowing in the mire of proposing the perfect remix of CTV, are making a fateful choice.

Most of the longstanding, fully specified fork proposals active today are totally fine, and conceptually they’d be great additions to bitcoin.

Hell, probably a higher block size is safe given features like compactblocks and assumeutxo and eventually utreexo. But that’s another post for another day.

—

I’ve gone back and forth about writing a post like this, because I don’t have any concrete prescriptions or recommendations. I guess I can only hope that bringing up these uncomfortable observations is some distant precursor to making progress on scaling self-custody.

All of these opinions have probably been expressed by @JeremyRubin years ago in his blog. I’m just tired of biting my tongue.

Thanks to @rot13maxi and @MsHodl for feedback on drafts of this.

This is a guest post by James O’Beirne. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential