AVAX Price

Will Price Survive $200M Token Unlock FUD?

Published

3 months agoon

By

admin

AVAX price has been dropping since the March mini-bull run and is currently in a critical position. Meanwhile, the looming token unlock may contribute significantly to more downside pressure. Nevertheless, there is a silver lining in this situation, as the price of Avalanche may rebound aggressively after the unlock FUD dies down.

$200M Supply Dilution Impact on AVAX Price

On August 20, the Avalanche team is set to release $200.53 million worth of AVAX tokens into the open market. This significant influx could dilute the existing supply, potentially leading to a sharp decline in the token’s price.

Currently, the Avalanche price is trading at $20.89, down 1.4% in the last 24 hours, according to CoinGecko. Trading volume has also taken a hit, with Messari Research reporting an all-time low on August 19, just before the scheduled token release.

Further insights from Coinalyze reveal that AVAX open interest has dropped 4.07% over the past 24 hours, while the price has declined by 2.1% during the same period. This suggests that many traders are closing their Long positions, likely at a loss, in anticipation of a further price drop.

The AVAX Liquidation Map also shows a higher number of Shorts compared to Longs, reinforcing the trend of traders exiting Long positions to avoid potential liquidations.

Additionally, a deeper analysis shows there is a significant concentration of buy orders around the $20.30 level, indicating that many traders believe this price point could act as a strong support. However, if the price breaks below this level, it could trigger liquidations for those holding these positions.

Avalanche Price Eyes $15 For A Rebound

Avalanche price prediction shows the asset is in a clear downtrend, moving within a descending channel that has been tested multiple times since early April 2024. The price is currently trading near the lower boundary of this channel, suggesting a potential further downside.

AVAX is currently struggling to break above the midline of the falling channel and may find support near the lower boundary, which lies between $19.50 and $20.00. Should this support level fail, the next major support could be at $16.00, marking the channel’s lower extension.

On the flip side, if AVAX manages to break above the midline of the descending channel around $21.50, the upper boundary of the channel, between $24.00 and $25.00, will likely present a stronger resistance level.

The Stochastic RSI, which measures the relative strength index (RSI) in relation to its own high/low range over 24 hours, is currently at 82.54 (RSI Line) and 79.30 (Signal Line).

This overbought condition suggests that buying pressure may be peaking, indicating a potential short-term pullback or continuation of the downtrend, especially given the prevailing bearish market structure.

If AVAX price breaks above the descending channel at $27.00 with strong volume, it would signal a shift in market sentiment from bearish to bullish, invalidating the current bearish thesis. The next target would be around the $35.00 level, which aligns with the price action from early May 2024.

Should You Buy AVAX?

AVAX remains in a strong downtrend, with bearish signals suggesting potential further downside. The next move is critical, with the price near the lower boundary of the descending channel. Broader market sentiment, especially the Bitcoin performance, could heavily influence the ability of AVAX price to reach these higher targets.

Frequently Asked Questions (FAQs)

AVAX has been on a downward trend since the March mini-bull run. As of the latest data, it’s trading at $20.89, down 1.4% in the last 24 hours. The price is currently in a critical position, facing potential further downside pressure due to an upcoming $200M token unlock.

AVAX may drop 21% ahead of the $200M token unlock, but a strong rebound is possible once the FUD subsides. This is the last major token release, potentially reducing future selling pressure and aiding in price recovery.

AVAX may face further downside pressure due to the current downtrend, but its price is near a critical support level. Broader market sentiment, especially Bitcoin’s performance, could influence its movement. If you believe in Avalanche’s long-term potential and are comfortable with the risks, consider buying after the token unlock FUD subsides.

Related Articles

Evans Karanja

Evans Karanja is a content writer and scriptwriter with a focus on crypto, blockchain, and video gaming. He has worked with various startups in the past, helping them create engaging and high-quality content that captures the essence of their brand. Evans is also an avid crypto trader and investor, and he believes that blockchain will revolutionize many industries in the years to come. When he is not writing, you can find him playing video games or chasing waterfalls.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

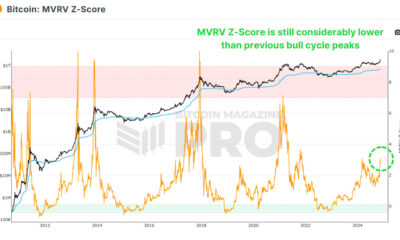

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

24/7 Cryptocurrency News

AVAX Price Shoots 10% As Avalanche Foundation Announces Token Repurchase from Luna

Published

1 month agoon

October 12, 2024By

admin

The AVAX price has surged by a staggering 10% in the last few hours after the recent announcement by the Avalanche Foundation of a repurchase agreement with the Luna Foundation Guard (LFG) – the entity associated with Terra blockchain – to buy back all tokens sold back in 2022. This has pushed AVAX closer to $30 taking its market cap above $11.5 billion.

Avalanche Agreement With Luna Foundation

As per the latest announcement, the Avalanche Foundation has reached an agreement to repurchase all AVAX tokens sold to the Luna Foundation Guard (LFG) in April 2022. However, the deal is currently pending approval from the Bankruptcy court. The announcement has led to huge bullish momentum for the AVAX price as bulls rush to fill their bags beforehand.

Ahead of its bankruptcy back in the summer of 2022, LFG held a total of 1.97 million AVAX tokens worth a staggering $60 million. The Luna Foundation purchased AVAX as part of its reserves to boost the strength of its UST stablecoin.

This strategic decision from the Avalanche Foundation will prevent LFG from breaching the original agreement and restricting AVAX token usage. Besides, this move from Avalanche will protect the assets from the complexities of bankruptcy trustee liquidation. Earlier this year, LFG started moving its token following the Terraform Labs settlement with the US SEC.

Upon completion, the Avalanche Foundation will reclaim 1.97 million AVAX tokens, bolstering its capacity to foster growth and development within the Avalanche ecosystem.

The Avalanche Foundation has negotiated an agreement to repurchase all AVAX tokens previously sold to the Luna Foundation Guard (LFG) in April 2022, which is now awaiting approval from the Bankruptcy Court.

This action ensures that LFG would not violate the original…

— Avalanche Foundation 🔺 (@AvalancheFDN) October 11, 2024

AVAX Price Rally to Continue?

The repurchase of AVAX tokens has provided a major catalyst to the AVAX price bolstering confidence among investors. This massive purchase of 1.97 million tokens by Avalanche Foundation will significantly reduce the AVAX circulating supply thereby putting upward price pressure on the altcoin.

At press time, the Avalanche price is up 9.33% trading at $28.49. On the technical chart, the AVAX price is also forming a flawless breakout from the falling wedge pattern formation over the past few months.

Also, the Relative Strength Index (RSI) for AVAX stands at around 49.8 while the Moving Average Convergence Divergence (MACD) is positive at 0.19, signaling bullish momentum. Crypto analyst ‘Crypto Winkle’ hinted at further AVAX price surge if the bulls manage to break the crucial resistance past $30. Market analysts are already predicting the Avalanche price rally to $50.

#AVAX Breaking Out! Avalanche showing incredible strength as wedge pattern executes flawlessly

The falling wedge we’ve been tracking for months has finally paid off! Strong money flow confirmed this textbook breakout, launching $AVAX into a beautiful ascending channel.

Current… pic.twitter.com/QRDU65ZbPD

— Crypto Winkle (@CryptoWinkle) October 10, 2024

Additionally, the Avalanche blockchain is turning out to be a preferred choice for traditional financial players to launch their products in the market. Earlier this week, Colombian neobank Littio shifted its base from the Ethereum to the Avalanche blockchain.

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: