Chainlink Price

Chainlink Price Bearish Pattern Holds Despite Market Recovery—What’s Next?

Published

3 months agoon

By

admin

Chainlink price showed some strength in the past 24 hours as the entire market started to rise. However, technical analysis suggests the asset is still stuck in a broader bearish pattern. The price of Chainlink increased by 3.6% in the last 24 hours, and the price was traded at $10.50. The question remains whether the current general bullish market sentiment will be enough to turn the tide for Chainlink.

Can Traders Sustain Chainlink Price Up?

The disparity between Chainlink price and on-chain metrics is concerning. While a deep analysis of LINK open interest (OI) and price relationship reveals bullish sentiment among traders, on-chain metrics speak a different story—one that is bearish.

The Coinglass Crypto Derivatives Visualizer shows that LINK OI increased by 0.91% over the last 24 hours, and its price spiked by 3.88% in the same duration. When price and OI both rise, it signals that traders are opening Long positions, which is bullish for the asset’s price.

However, a look at Chainlink’s real volume on Messari Research reveals the network is struggling. LINK on-chain volume hit a monthly low of $46.1 million, with an occasional anomaly spike on August 5, when the entire crypto market crashed.

This suggests that while both futures and spot traders are sustaining the price up, little is happening on-chain in terms of transactional operations. While this can be explained as Chainlink cornering institutional clients, the steady decline of on-chain volume is still worrying.

LINK Price Analysis: Is a 47% Crash Avoidable?

Chainlink price prediction shows the asset is in a bearish continuation pattern, known as a Bear Pennant. This indicates that LINK may continue its downtrend after a period of consolidation.

If the price follows through with the Bear Pennant pattern, LINK will likely find support around the $10.49 level, but a break below this could push the price toward the next support near $9.00. Below that, a long-term support target could be set around $5.50, based on the flagpole’s projected downward height. This represents a 47% drop from the current price.

All the exponential moving averages (EMAs) are sloping and expanding downward, confirming the bearish sentiment. Chainlink price is also trading below all of them, reinforcing the downtrend.

The Stochastic RSI is currently in the overbought region, indicating that the asset might be due for a short-term pullback or continuation of the downtrend. The %K (RSI line) and %D (Signal line) are converging, suggesting a potential bearish crossover.

If the LINK price breaks above $10.85, this could invalidate the Bear Pennant and bearish thesis. LINK would test the next major resistance at $12.04 and finally at $14.50

Frequently Asked Questions (FAQs)

The technical analysis suggests that Chainlink is stuck in a bearish continuation pattern, specifically a Bear Pennant, indicating a potential further decline.

On-chain volume for Chainlink has hit a monthly low of $46.1 million, with little transactional activity, which is concerning despite the price surge.

The exponential moving averages (EMAs) are sloping downward, and the Stochastic RSI is in the overbought region, suggesting the possibility of a continued downtrend.

Related Articles

Evans Karanja

Evans Karanja is a content writer and scriptwriter with a focus on crypto, blockchain, and video gaming. He has worked with various startups in the past, helping them create engaging and high-quality content that captures the essence of their brand. Evans is also an avid crypto trader and investor, and he believes that blockchain will revolutionize many industries in the years to come. When he is not writing, you can find him playing video games or chasing waterfalls.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Trump Nominates Pro-Crypto Hedge Fund Manager Scott Bessent as Treasury Secretary

Dogecoin surges 10% as this new altcoin shakes the market, and preps for stage 2 presale

Ripple CEO Shares Bullish News With XRP Army As Trump Names Treasury Secretary

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Chainlink Price

3 Reasons Chainlink Price May Be Bigger than BTC and ETH in 2025

Published

2 months agoon

October 1, 2024By

admin

Chainlink price has been on an upward trajectory throughout the month of September, rising by as much as 39% and making higher highs. Investors are closely watching this gem as they believe it could one day be bigger than even Bitcoin (BTC) and Ethereum (ETH). But how exactly will this happen?

Reasons Chainlink Price Could Surpass BTC and ETH

Bitcoin and Ethereum are the world’s largest cryptocurrencies in terms of market cap and popularity. The BTC price has a market cap of $1.26 trillion, while the ETH price follows it with $318 billion. On the other hand, the LINK price is sitting at a $7.6 billion market cap in the 18th rank, according to CoinGecko data.

However, this decentralized finance (DeFi) project is not to be underestimated, as it possesses the power to rise to the top, potentially displacing BTC and ETH. Here are a few reasons this feat could be possible in 3 years.

1. Increasing Partnerships and Adoptions

Chainlink has been forming significant partnerships with major companies and projects, including government agencies like the Depository Trust and Clearing Corporation (DTCC). Moreover, the collaboration with DTCC has allowed Chainlink to work with top U.S. financial institutions such as $1.5 trillion AuM Franklin Templeton and $1.7 trillion AuM Invesco, among others.

Additionally, its collaboration with SWIFT aims to integrate traditional finance with blockchain technology, which could drive substantial adoption, usage, and, eventually, Chainlink price.

2. Dominance in Oracle Technology

Chainlink is the leading decentralized oracle network, crucial for bridging smart contracts with real-world data. Banks that move over quadrillions of dollars need to be able to pick the most secured and widely adopted standard. They are testing with Chainlink now, and once they’re ready, trillions of dollars will be piling into this new age of the internet, flowing through CCIP and other services provided by Chainlink.

In its latest adoption, Chainlink has secured a partnership with ANZ, a leading bank in Australia with over $1 trillion AuM. In the partnership, Chainlink’s Cross-Chain Interoperability Protocol (CCIP) will help enable the secure cross-chain exchange of tokenized real-world assets (RWA).

.@ChainlinkLabs is officially partnering with ANZ—a leading Australian bank with over A$1 trillion in AUM—in the Monetary Authority of Singapore’s Project Guardian.#Chainlink CCIP will help enable the secure cross-chain exchange of tokenized RWAs. https://t.co/nlXJPJKjDv

— Chainlink (@chainlink) September 30, 2024

Major banks and corporations choose Chainlink CCIP for its security, reliability, and flexibility to connect private blockchains with other private chains OR even public chains. This dominance creates demand for the LINK token, which will reflect in Chainlink price increments in the future. This partnership is part of the Project Guardian program, facilitated by the Monetary Authority of Singapore.

3. Chainlink Staking

While it seems obvious, staking has proven to be one of the most efficient price movers in the crypto space. For instance, Solana has a circulating supply of 468.4 million coins, and 99% of the supply is staked, making the coin scarce as meme coins on the chain increase its demand. This partly contributed to SOL price surging 680% in the last year from sub-$20 prices to over $150 today.

A total of 626.8 million LINK is in circulation, with investors staking 6.87% of this.

As more LINK is staked and demand from institutions and retail skyrockets, Chainlink price is expected to surge and potentially surpass BTC and ETH in the coming years.

Conclusion

Chainlink price looks set to make significant strides in the blockchain and decentralized finance sectors, with its dominance in Oracle technology, increasing adoption by major institutions, and the potential of staking to drive demand for LINK. As partnerships with organizations like SWIFT and ANZ deepen and the need for secure, reliable data integration grows, Chainlink could see substantial value growth. While surpassing Bitcoin and Ethereum may seem ambitious, the unique value Chainlink brings to the crypto ecosystem suggests it could be a top contender in the coming years.

Frequently Asked Questions (FAQs)

Chainlink specializes in decentralized oracle technology, which bridges blockchain smart contracts with real-world data. Unlike Bitcoin (BTC) and Ethereum (ETH), Chainlink is a leader in providing the infrastructure needed for smart contracts to interact with off-chain data, a key component in decentralized finance (DeFi) and other blockchain applications.

Chainlink has secured significant partnerships with major organizations such as SWIFT, the Depository Trust and Clearing Corporation (DTCC), and leading banks like ANZ. These partnerships position Chainlink at the forefront of integrating blockchain technology with traditional finance, which could drive substantial adoption and increase the value of its native token, LINK.

While Bitcoin and Ethereum have much larger market caps, Chainlink’s potential to surpass them stems from its unique role in DeFi, its growing number of high-profile partnerships, and the adoption of its oracle technology across traditional finance. If these factors continue to expand, Chainlink’s price could see dramatic growth over the next three years.

Related Articles

Evans Karanja

Evans Karanja is a crypto analyst and journalist with a deep focus on blockchain technology, cryptocurrency, and the video gaming industry. His extensive experience includes collaborating with various startups to deliver insightful and high-quality analyses that resonate with their target audiences. As an avid crypto trader and investor, Evans is passionate about the transformative potential of blockchain across diverse sectors. Outside of his professional pursuits, he enjoys playing video games and exploring scenic waterfalls.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

chainlink

Is $15 Next For Chainlink Price After Proof of Reserves Integration?

Published

2 months agoon

September 24, 2024By

admin

Chainlink price is gaining traction and is slowly headed toward a potential breakout level. Besides the overall crypto market recovery, Chainlink has been working hard to secure integrations. The latest is one with 21.co which will go a long way to help the company ensure its assets. For Chainlink, each integration is paid for with LINK, creating demand for the token. But can the price reach $15 amid this rapid adoption?

What Next for Chainlink Price after 21.co Integration

On September 23, 21.co, the company behind 21Shares, integrated Chainlink’s Proof of Reserves (PoR) for its Wrapped Bitcoin (21BTC) on the Solana and Ethereum blockchains. For context, 21Shares has $2 billion asset under management (AuM), which means it is not a small company. The integration aims to provide a real-time verification of Bitcoin reserves backing 21BTC.

.@21co__ has integrated Chainlink Proof of Reserve (PoR) on @ethereum & @solana to enhance reserves transparency for 21BTC, its wrapped Bitcoin.

How PoR provides the Ethereum & Solana ecosystems with assurances that 21BTC is fully backed 1:1 by BTC👇https://t.co/kUqFTlofcJ pic.twitter.com/SD6UdG4ABV

— Chainlink (@chainlink) September 23, 2024

The Chainlink PoR brings reserve data on-chain, enabling protocols to build automated logic around the data backing the asset. This improves security by preventing malicious infinite mint attacks.

Link price has increased by 0.7% in the last 24 hours and is trading at $11.51.

LINK Price Analysis: Volume Confirms 22% Breakout Imminent

Chainlink price has recently broken above a trend line but shows signs of instability, with fluctuations around this line. The relevance of the trend line is being questioned due to these movements.

The inverse double-bottom formation on the chart is bullish, with a clearly defined neckline at around $12.35

Key Support and Resistance Levels

- $11: immediate support lies around $11 (neckline of the inverse head-and-shoulders pattern).

- $10: The next strong lower support zone is around.

- $15: Major resistance is at $15, where the price might face heavy selling pressure, aligning with the top of the projected breakout target.

If the Chainlink price breaks above $12.35, it could surge to $15, indicating a strong bullish trend that could potentially reach $19.50. However, it requires a sustained movement above $12.35.

Volume has been increasing slightly as the price approaches the neckline, which is an early indication that a breakout could be imminent if the buying pressure continues to rise.

Chainlink price prediction shows that if the asset movement fails to break above $12.35, it could lead to further declines to $9 and even $8. Additionally, Chainlink continues to top the chart among projects with the highest development activity. The integration of of 21.co is just another addition to the over 1,000 integration the Oracle service provider has offered on its platform. The LINK price could surge not just to $15, but 10–15X, and it would still remain undervalued, given the immense capability of the technology.

Frequently Asked Questions (FAQs)

The recent surge in Chainlink’s price is primarily driven by its integration with 21.co’s Proof of Reserve (PoR) system, which is expected to create more demand for the LINK token as it continues to secure integrations.

Chainlink’s Proof of Reserve (PoR) is a mechanism that provides real-time verification of reserves, such as Bitcoin, backing certain assets. It ensures transparency and security, preventing malicious attacks and ensuring that assets are properly backed.

Chainlink price could reach $15 and possibly beyond, depending on sustained market momentum and continued adoption of its technology. Some analysts suggest that due to its capabilities, LINK could even achieve a 10–15X increase in value over time.

Related Articles

Evans Karanja

Evans Karanja is a crypto analyst and journalist with a deep focus on blockchain technology, cryptocurrency, and the video gaming industry. His extensive experience includes collaborating with various startups to deliver insightful and high-quality analyses that resonate with their target audiences. As an avid crypto trader and investor, Evans is passionate about the transformative potential of blockchain across diverse sectors. Outside of his professional pursuits, he enjoys playing video games and exploring scenic waterfalls.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Chainlink Price

Can a Push for $16 Overcome Bearish Pressure?

Published

4 months agoon

August 1, 2024By

admin

Chainlink price has been declining since its peak in March despite several market-moving events. During the Bitcoin Conference week, the LINK price initially rose by 7%, only to lose all its gains in the subsequent three days.

The price of LINK has dropped by 3.9% in the last 24 hours and is trading at $12.82. This is likely due to the data from yesterday’s FOMC meeting. The Fed’s decision to leave interest rates untouched may have resulted in a market-wide dip. Chainlink needs to cool down before it can run for $16.

Chainlink Price Ready to Rally

LINK price is currently trending downward within a falling wedge pattern. The price action is also below the 50-day (green line) and 200-day (black line) exponential moving averages (EMA), indicating bearish momentum. However, the falling wedge is a bullish reversal pattern, which signals a potential breakout to the upside.

The main support levels for LINK price are $11.4 and $10. The former aligns with the lower boundary of the falling wedge, while the latter represents significant historical support below the market structure. On the flip side, Chainlink sports major resistance levels at $13.92 (50-day EMA), $14.78 (200-day EMA), and $16.00, which coincides with the upper boundary of the falling wedge.

On June 28, the Chainlink price chart flashed a death cross on the daily timeframe chart, signalling the beginning of a potential bearish trend. Recent candlestick formation indicates a consolidation phase near the $11.4 support level, suggesting LINK price may drop 11% before engaging a bullish reversal within the wedge.

The Relative Strength Index (RSI) is at 48.45, indicating a neutral stance but leaning towards bearish territory. However, it is near the oversold region, suggesting potential for upward movement. The Chaikin Money Flow (CMF) is at 0.07, indicating positive money flow and modest buying pressure.

The Chainlink price forecast shows that if it slips below $10 and fails to recover above it, it would signal market weakness. The LINK price would establish a lower low, signalling a market shift and invalidating the bullish thesis supported by the falling wedge pattern. The price of Chainlink may find further support below around $8.11.

Chainlink Whale Activity Supports Inbound Rally

Data from IntoTheBlock shows Chainlink whales have been steadily accumulating tokens for the past two months. The spikes show days when whales deposited large amounts of LINK, while the dips show when whales transferred Chainlink tokens out. A comparison of the spikes and dips shows Whale inflow was relatively larger than outflow, indicating they may be accumulating for a potential price breakout.

Data from Coingecko shows the trading volume is slightly up by 4% and relatively stable, with occasional spikes during both upward and downward movements. A significant increase in volume would be needed to confirm a breakout from the falling wedge pattern. If the volume fails to increase, the Chainlink price bullish thesis may be invalidated, resulting in a break lower.

Frequently Asked Questions (FAQs)

LINK is trending downward within a falling wedge pattern. This pattern typically signals a potential bullish reversal, but the price is currently below both the 50-day and 200-day exponential moving averages, indicating bearish momentum.

The Federal Reserve’s decision to keep interest rates unchanged contributed to a market-wide dip, including a 3.9% drop in Chainlink’s price over the past 24 hours.

Data shows that Chainlink whales have been accumulating tokens for the past two months, with larger inflows compared to outflows. This accumulation might indicate preparation for a potential price breakout.

Related Articles

Evans Karanja

Evans Karanja is a content writer and scriptwriter with a focus on crypto, blockchain, and video gaming. He has worked with various startups in the past, helping them create engaging and high-quality content that captures the essence of their brand. Evans is also an avid crypto trader and investor, and he believes that blockchain will revolutionize many industries in the years to come. When he is not writing, you can find him playing video games or chasing waterfalls.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Trump Nominates Pro-Crypto Hedge Fund Manager Scott Bessent as Treasury Secretary

Dogecoin surges 10% as this new altcoin shakes the market, and preps for stage 2 presale

Ripple CEO Shares Bullish News With XRP Army As Trump Names Treasury Secretary

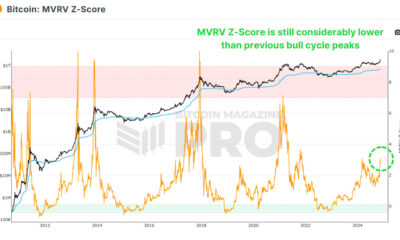

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: