Markets

Bitcoin’s Role as Collateral in Real Estate Development Financing

Published

3 months agoon

By

admin

Enhancing Creditworthiness with Bitcoin in a Debt-Intensive Economy

Since US President Richard Nixon announced in 1971 that the US dollar would no longer be convertible into gold at a fixed rate, central banks around the world have started operating a fiat-based monetary system with floating exchange rates and no currency standard. As a result, the money supply worldwide has increased exponentially and most industries now rely on credit to finance their operations and growth.

With the anticipated further devaluation of fiat currencies, driven by nation states needing to produce additional currency to cope with high borrowing costs, the creditworthiness of companies across all sectors is becoming increasingly important. This is particularly true for the real estate sector, which is extremely debt-intensive. In this context, bitcoin can play a crucial role as a disinflationary money, meaning its inflation rate decreases over time, providing an appreciating capital base that can help mitigate the risks associated with fiat currency devaluation and enhance a real estate company’s creditworthiness. In the following I will explain why bitcoin should be integrated into real estate development financing, illustrating how to integrate bitcoin into real estate investment from the start.

Why Bitcoin Should Be Integrated into Real Estate Development Financing

Real estate has been widely used as an inflation hedge since the inflationary policies following the Nixon shock in 1971, closely tracking the growth of the US money supply M2. Consequently, real estate has accrued a substantial monetary premium, indicative of the collective confidence in its ability to serve as a reliable store of value, a function traditionally associated with money, that is no longer possible due to decades of monetary inflation that has decimated fiat money’s purchasing power. However, with the rise of bitcoin, a near-perfect digital alternative, there’s potential for a shift. This gradual transition could diminish the monetary premium that real estate has historically enjoyed, redirecting it toward bitcoin over time. Bitcoin offers an alternative that is easier to access and cheaper to store and maintain.

Real estate investors can benefit greatly from integrating the purchase of bitcoin at the start of a development project by including it in project financing. This approach hedges against the scenario where real estate loses its monetary premium to bitcoin, due to bitcoin’s superior qualities as a store of value.

Similarly, bitcoin competes with real estate by serving as a digitally accessible, globally usable, and pristine collateral for lending. The popularity of real estate investments stems not only from its use as a store of value but also from its common use as collateral in the traditional banking system.

We can therefore assume that bitcoin’s increasing use as collateral, due to its accessibility and user-friendly nature for both borrowers and lenders, will negatively impact the use of real estate in this capacity. As more people recognize bitcoin’s advantages as collateral, real estate may see a decline in use for this purpose, while bitcoin’s importance as a type of collateral grows.

It is therefore important to integrate bitcoin into real estate development from the start, ensuring that investors are well-positioned to capitalize on bitcoin’s growing role in the financial landscape and its impact on real estate’s valuation.

My proposition is to integrate the purchase of bitcoin into real estate development financing. Allocating a portion of a loan, let’s say 10%, to purchase bitcoin enables real estate developers to hedge against the risk of real estate losing its status as humanity’s primary store of value. This strategy prepares real estate developers for a potential shift towards a Bitcoin standard, a hypothetical reality in which bitcoin becomes the world’s main store of value and unit of account, and real estate may no longer dominate.

The Benefits of Integrating Bitcoin into Real Estate Development Financing

By incorporating the purchase of bitcoin into real estate development financing and holding the bitcoin within the same legal entity that holds the property titles, developers can capture the monetary premium that flows from real estate into bitcoin, hedge against monetary inflation, and build resilience and creditworthiness over time. This ensures the ongoing viability of their business operations while leveraging the benefits of both asset classes: bitcoin’s price appreciation and real estate’s cash flow.

Integrating bitcoin into real estate financing can also help facilitate a smoother and more productive transition onto a Bitcoin standard where the value of real estate is expected to be based on its utility, as people can save in bitcoin by default rather than having to invest in real estate to protect their purchasing power. Additionally, this approach can help developers gain more independence from the inflationary fiat system, which is making it increasingly difficult to beat inflation and remain profitable.

Inflation severely devalues fiat currencies and erodes purchasing power. Initially, this scenario benefits the real estate sector as people invest in properties to outperform inflation, thus increasing its nominal value. Besides, inflation decreases the real cost of debt incurred to develop or purchase real estate over time, temporarily benefiting property owners. However, in the long term, inflation negatively affects the real estate industry due to soaring construction and maintenance costs, and the diminishing value of income generated from properties.

This dual impact underscores the need for an alternative strategy, such as incorporating bitcoin into credit products to hedge against the negative consequences of inflation. An ideal scenario for integrating bitcoin into real estate development would involve a financial service provider offering traditional financing supplemented with a portion of bitcoin in the loan. By incorporating the purchase of bitcoin into credit lines, businesses can not only survive but also thrive in an inflationary environment.

This approach benefits the borrower by providing a hedge against inflation but also offers the lender additional security through the inclusion of a disinflationary digital asset, bitcoin, as collateral.

I will now provide an example of such a loan.

Example Real Estate Development Loan Enhanced with Bitcoin

Let’s imagine a bank financing a $10 million real estate development project. The bank could extend the loan to $11 million and require the developer to purchase bitcoin for an additional $1 million, bringing the total loan amount to $11 million (with 91% intended for real estate development and 9% for bitcoin acquisition). This strategy serves as a hedge against several key risks for the borrower:

- It protects against the erosion of the monetary premium traditionally associated with real estate by the growing importance of bitcoin, a near-perfect digital store of value.

- It provides a safeguard against the perils of monetary inflation.

- It allows a company to build a novel capital base through the increase in value of bitcoin, which can be used to finance maintenance, further construction or other development projects.

- By owning bitcoin, particularly in the debt-intensive real estate sector, the credit rating of a company improves over time.

- Bitcoin, as an absolutely scarce and decentralized asset, exists outside the inflationary fiat system, offering stability during times of economic instability. In chaotic conditions, its limited supply and independence from central banks make its value proposition more apparent, acting as a hedge against financial collapse and strengthening the market from within.

- The borrower should ideally retain possession of the bitcoin for the long term and continuously, even after the loan is repaid. This serves as a hedge against property confiscation.

- Repeat the process with a new construction project while lending against the held bitcoin and potentially acquire more bitcoin through a new project financing, to continuously ensure the financial stability and growth of your business.

Including the purchase of bitcoin in a credit line also holds significant advantages for the lender. In the event of a project’s failure and subsequent property liquidation, both the lender and, depending on the agreement, ideally also the borrower, are left with an asset: bitcoin.

This principle is not limited to the real estate sector but is applicable to all industries. I can therefore imagine bitcoin becoming an integral part of credit products, specifically to hedge against loan defaults.

If bitcoin is properly secured, its purchasing power will continue to increase even in the event of a loan default. Bitcoin safeguards lenders and potentially borrowers in the event of a borrower’s failure to repay, provided that the borrower also holds custody of the bitcoin.

Including bitcoin in a loan not only acts as an effective hedge against default but also offers the advantage of swift and cost-effective liquidation in the event of non-payment. Bitcoin’s high liquidity considerably accelerates and reduces the expense of this process compared to a property. Once financial institutions understand that they can use bitcoin in this manner, it will undoubtedly become a fundamental component of lending solutions

Managing bitcoin custody properly is crucial. Consider multisignature setups or multi-custodial solutions to ensure security and control. For lending purposes, non-custodial solutions are emerging as a secure method for handling funds. Multisignature wallets, which require multiple signers to move funds, offer a significant advantage by allowing both lenders and borrowers to share custody. This collaborative approach enhances security and trust, as it provides oversight and control to all parties involved. It ensures that funds can only be accessed with the agreement of a majority of all authorized signers, reducing the risk of loss, theft, misuse, or mismanagement.

Conclusion

Including the purchase of bitcoin as part of a credit line generally increases the security of a loan structure, benefiting both borrowers and lenders. Bitcoin can be integrated relatively easily into the structure of real estate development financing. It presents a compelling narrative that challenges traditional views on real estate but offers an innovative solution to growing concerns about inflation and the rising costs of construction and maintenance.

The integration of bitcoin into financing is in its nascent stages, with no known products specifically tailored for real estate development. Nevertheless, the possibilities are vast and promising. This type of product will likely emerge from an innovative company that recognizes the potential of incorporating bitcoin into lending products. Traditional financial institutions are likely to be the last to recognize and seize this opportunity because of their reliance on established systems and regulatory constraints.

The dynamics described are prevalent in most industries, including real estate, banking and finance, energy, manufacturing, retail, healthcare, technology, aviation, mobility, food and beverages, and many others. Consequently, the integration of bitcoin into credit products would be beneficial to most industries, making it conceivable that bitcoin will become an integral part of credit markets, especially to secure loans against default. This could bolster the resilience of market actors in the face of rising economic and geopolitical uncertainties.

By embracing bitcoin-backed credit products, we can usher in a new era of economic empowerment and stability, with the potential to lead to greater resilience and productivity in the global economy.

This is a guest post by Leon Wankum. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

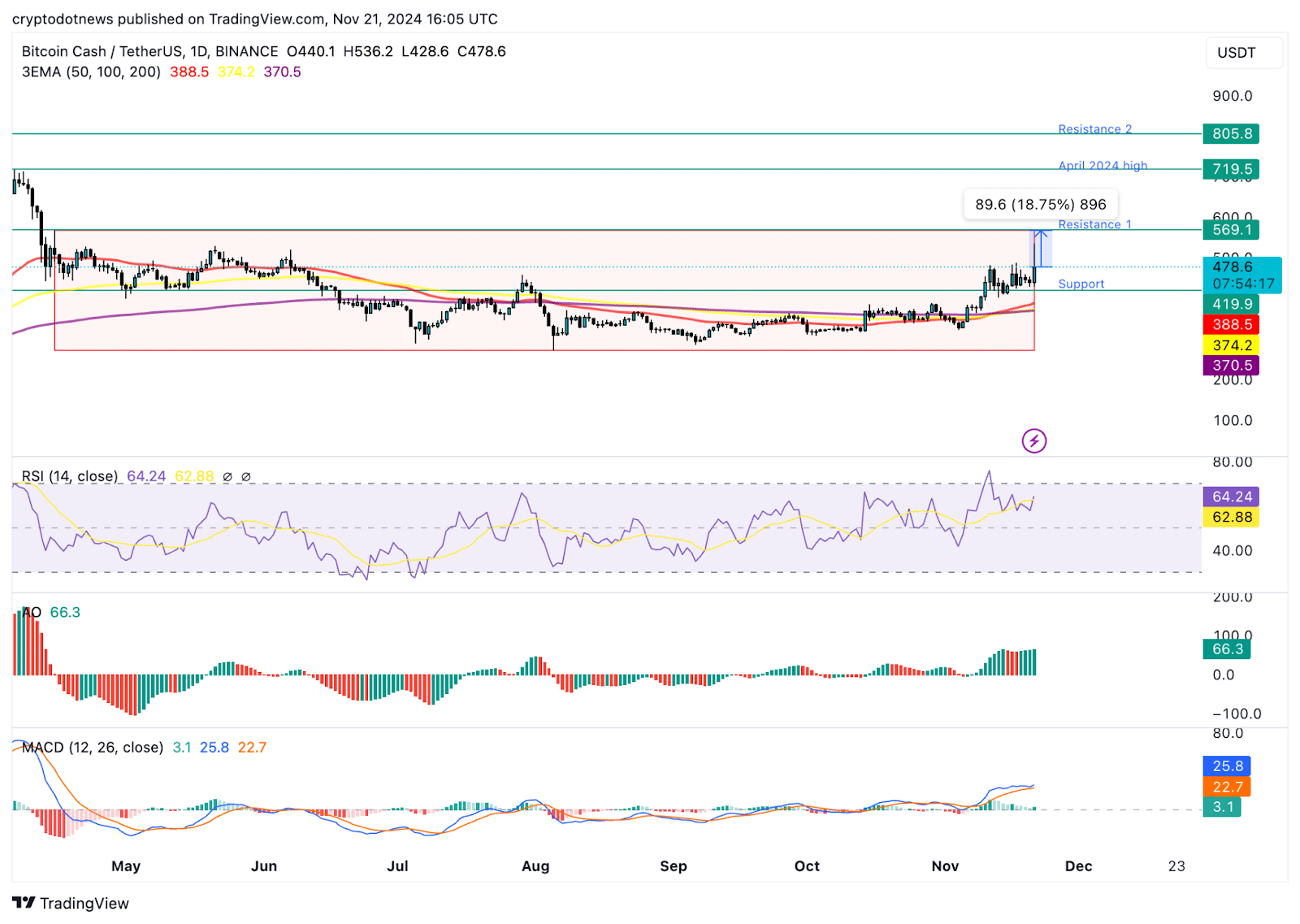

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Cash (BCH) added nearly 35% to its value in the past month and rallied 12% on Nov. 21. Bitcoin’s (BTC) observed a rally to $98,384 early on Nov. 21, with BCH and other top cryptocurrencies tagging along for the ride.

An analysis of on-chain and technical indicators and data from the derivatives market shows that BCH could extend gains and retest its mid-April 2024 peak of $569.10.

Bitcoin hits all-time high, fork from 2017 ignites hope for traders

Bitcoin hit a record high of $98,384 on Nov. 21, a key milestone as the cryptocurrency eyes a run to the $100,000 target. BTC was forked in 2017, creating a spin-off or alternative, Bitcoin Cash.

BCH hit a peak of $1,650 in May 2021. Since April 2024, BCH has been consolidating with no clear trend formation.

BCH price rallied nearly 30% since Nov. 15, on-chain indicators show that further rally is likely in the Bitcoin spin-off token.

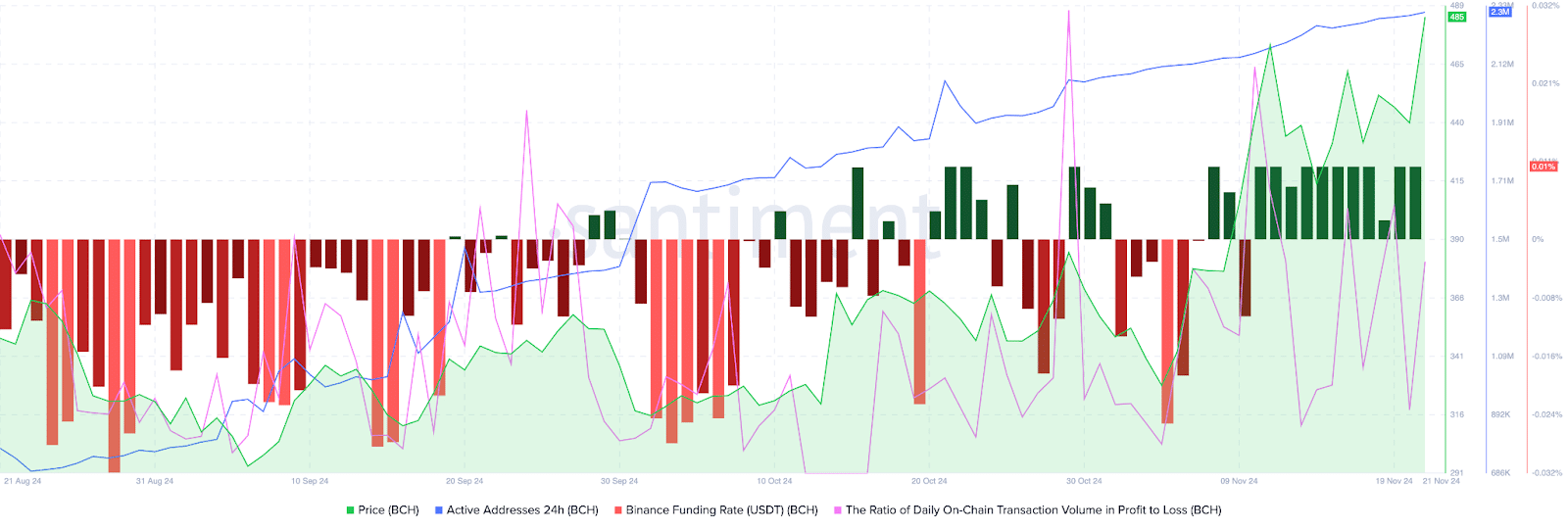

Bitcoin Cash’s active addresses have climbed consistently since August 2024. Santiment data shows an uptrend in active addresses, meaning BCH traders have sustained demand for the token, supporting a bullish thesis for the cryptocurrency.

The ratio of daily on-chain transaction volume in profit to loss exceeds 2, is 2.141 on Thursday. BCH traded on-chain noted twice as many profitable transactions on the day, as the ones where losses were incurred. This is another key metric that paints a bullish picture for the token forked from Bitcoin.

Binance funding rate is positive since Nov. 10. In the past eleven days, traders have been optimistic about gains in BCH price, according to Santiment data.

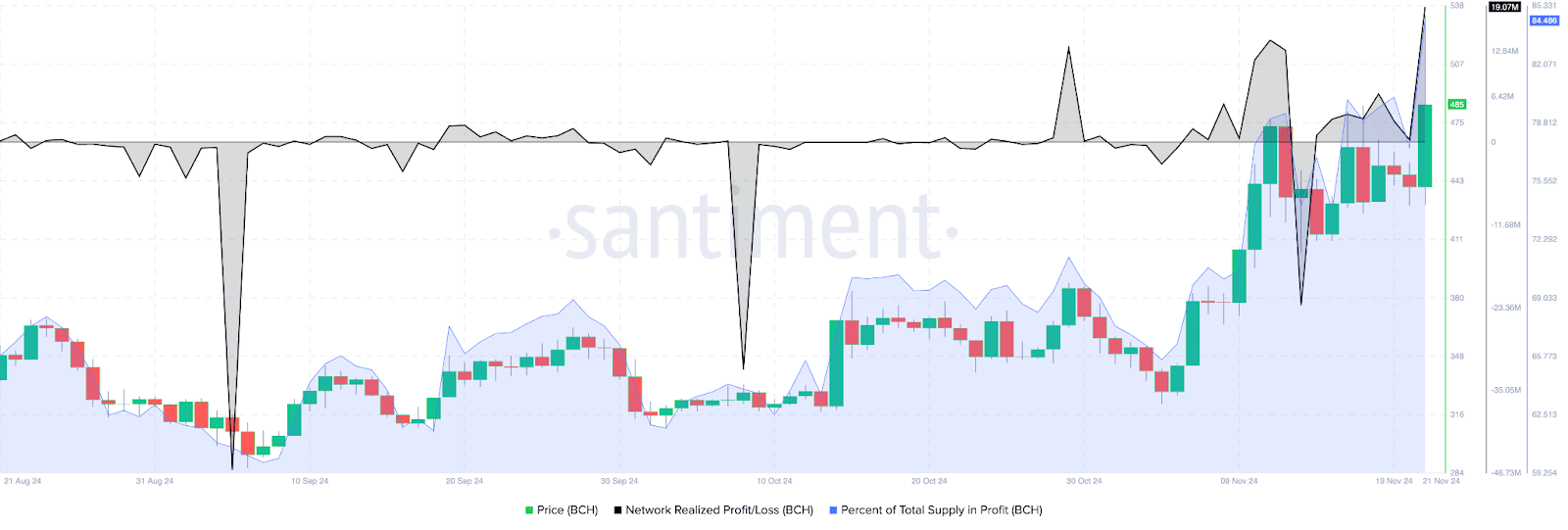

The network realized profit/loss metric identifies the net gain or loss of all traders who traded the token within a 24 hour period. NPL metric for Bitcoin Cash shows traders have been taking profits on their holdings, small positive spikes on the daily price chart represent NPL.

Investors need to keep their eyes peeled for significant movements in NPL, large positive spikes imply heavy profit-taking activities that could increase selling pressure across exchange platforms.

84.48% of Bitcoin Cash’s supply is currently profitable, as of Nov. 21. This metric helps traders consider the likelihood of high profit-taking or exits from existing BCH holders, to time an entry/ exit in spot market trades.

Derivatives traders are bullish on BCH

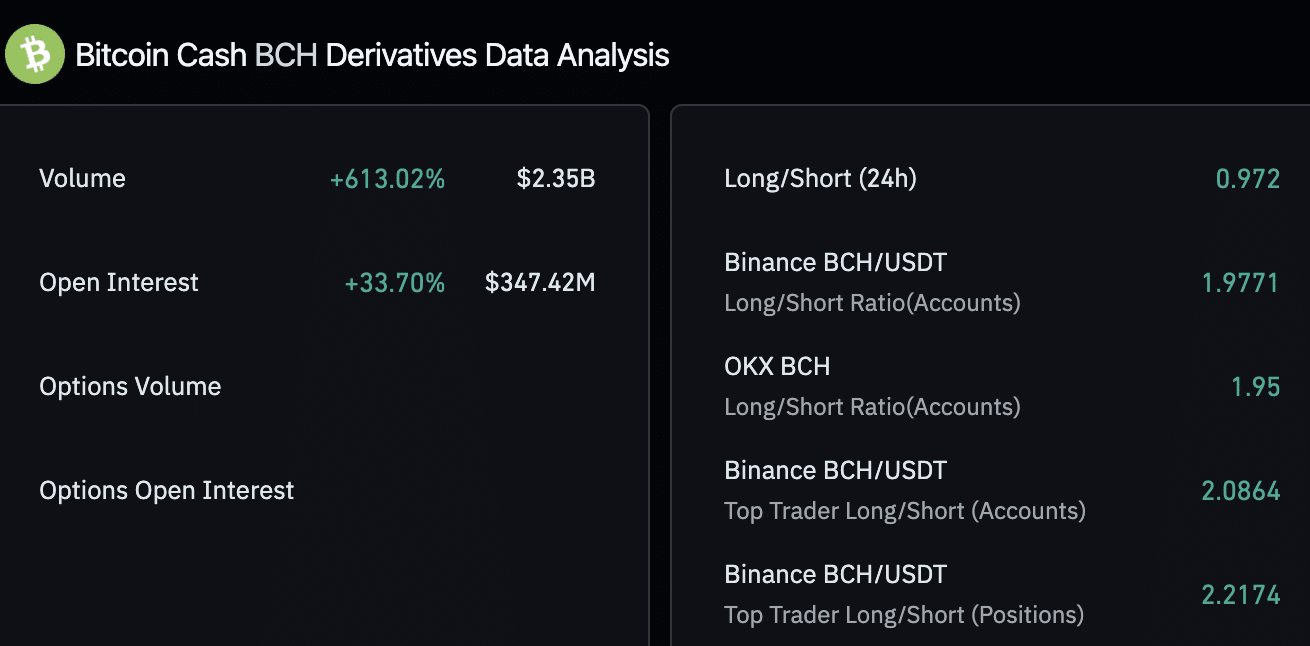

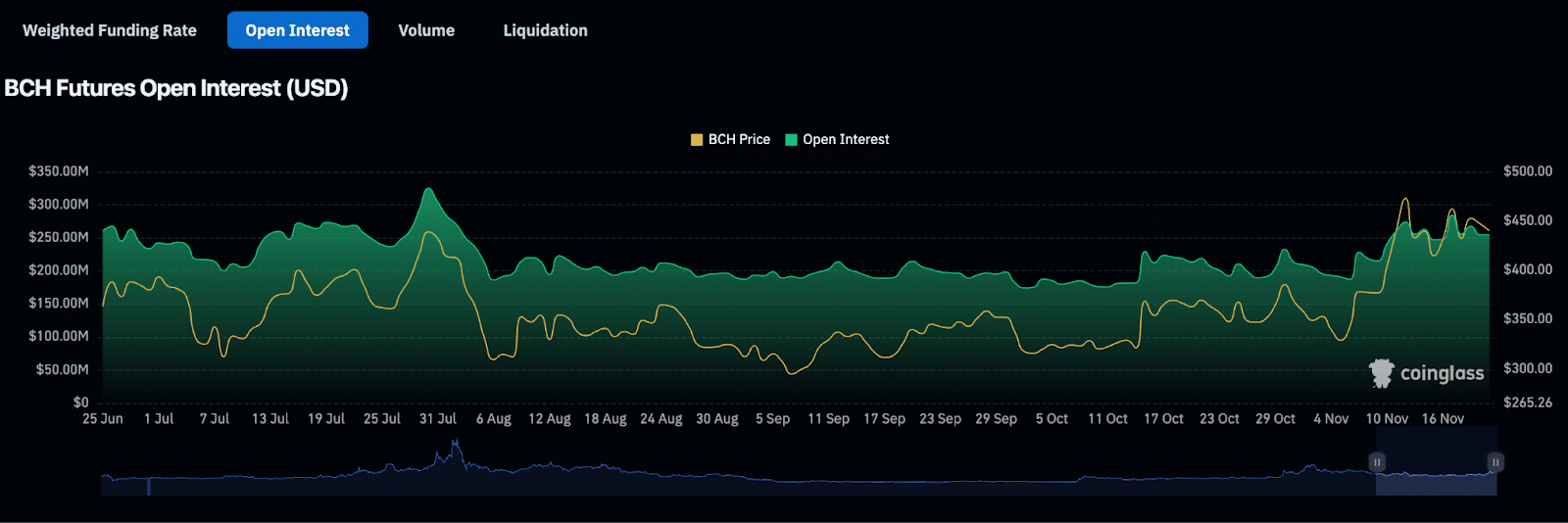

Derivatives market data from Coinglass shows a 33% increase in open interest in Bitcoin Cash. Open interest represents the total number of active contracts that haven’t been settled, representing demand for the BCH token among derivatives traders.

Derivatives trade volume climbed 613% in the same timeframe, to $2.35 billion. Across exchanges, Binance and OKX, the long/short ratio is above 1, closer to 2, meaning traders remain bullish on BCH and expect prices to rally.

BCH futures open interest chart shows a steady increase in the metric, alongside BCH price gain since November 5, 2024. Open interest climbed from $190.74 million to $254.87 million between November 5 and 21.

Technical indicators show BCH could gain 18%

The BCH/USDT daily price chart on Tradingview.com shows that the token remains within the consolidation. The token is stuck within a range from $272.70 to $568.20. BCH could attempt to break past the upper boundary of the range, a daily candlestick close above $568.20 could confirm the bullish breakout.

The April 2024 high of $719.50 is the next major resistance for BCH and the second key level is at $805.80, a key level from May 2021.

The relative strength index reads 64, well below the “overvalued” zone above 70. RSI supports a bullish thesis for BCH. Another key momentum indicator, moving average convergence divergence flashes green histogram bars above the neutral line. This means BCH price trend has an underlying positive momentum.

The awesome oscillator is in agreement with the findings of RSI and MACD, all three technical indicators point at likelihood of gains.

A failure to close above the upper boundary of the range could invalidate the bullish thesis. BCH could find support at the midpoint of the range at $419.90 and the 50-day exponential moving average at $388.50.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Bitcoin Magazine Pro

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Published

7 hours agoon

November 22, 2024By

admin

The Bitcoin Pi Cycle Top Indicator has gained legendary status in the Bitcoin community for its uncanny accuracy in identifying market cycle peaks. Historically, it has timed every single Bitcoin cycle high with remarkable precision—often within just three days. Could it work its magic again this cycle? Let’s dive deeper into how it works and its significance in navigating Bitcoin’s market cycles.

What is the Pi Cycle Top Indicator?

The Pi Cycle Top Indicator is a tool designed to identify Bitcoin’s market cycle tops. Created by Philip Swift, Managing Director of Bitcoin Magazine Pro in April 2019, this indicator uses a combination of two moving averages to forecast cycle highs:

- 111-Day Moving Average (111DMA): Represents the shorter-term price trend.

- 350-Day Moving Average x 2 (350DMA x 2): A multiple of the 350DMA, which captures longer-term trends.

When the 111DMA rises sharply and crosses above the 350DMA x 2, it historically coincides with Bitcoin’s market cycle peak.

The Mathematics Behind the Name

Interestingly, the ratio of 350 to 111 equals approximately 3.153—remarkably close to Pi (3.142). This mathematical quirk gives the indicator its name and highlights the cyclical nature of Bitcoin’s price action over time.

Why Has It Been So Accurate?

The Pi Cycle Top Indicator has been effective in predicting the peaks of Bitcoin’s three most recent market cycles. Its ability to pinpoint the absolute tops reflects Bitcoin’s historically predictable cycles during its adoption growth phase. The indicator essentially captures the point where the market becomes overheated, as reflected by the steep rise of the 111DMA surpassing the 350DMA x 2.

How Can Investors Use This Indicator?

For investors, the Pi Cycle Top Indicator serves as a warning sign that the market may be approaching unsustainable levels. Historically, when the indicator flashes, it has been advantageous to sell Bitcoin near the top of the market cycle. This makes it a valuable tool for those seeking to maximize gains and minimize losses.

However, as Bitcoin matures and integrates further into the global financial system—bolstered by developments like Bitcoin ETFs and institutional adoption—the effectiveness of this indicator may diminish. It remains most relevant during Bitcoin’s early adoption phase.

A Glimpse Into the Future

The big question now is: will the Pi Cycle Top Indicator remain accurate in this cycle? With Bitcoin entering a new era of adoption and market dynamics, its cyclical patterns may evolve. Yet, this tool has proven its worth repeatedly over Bitcoin’s first 15 years, offering investors a reliable gauge of market tops.

Final Thoughts

The Pi Cycle Top Indicator is a testament to Bitcoin’s cyclical nature and the power of mathematical models in understanding its price behavior. While its past accuracy has been unparalleled, only time will tell if it can once again predict Bitcoin’s next market cycle peak. For now, it remains an indispensable tool for those navigating the thrilling highs and lows of Bitcoin.

Explore the full chart and stay informed.

Source link

$100

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Published

15 hours agoon

November 22, 2024By

admin

What an enormous day it has been today.

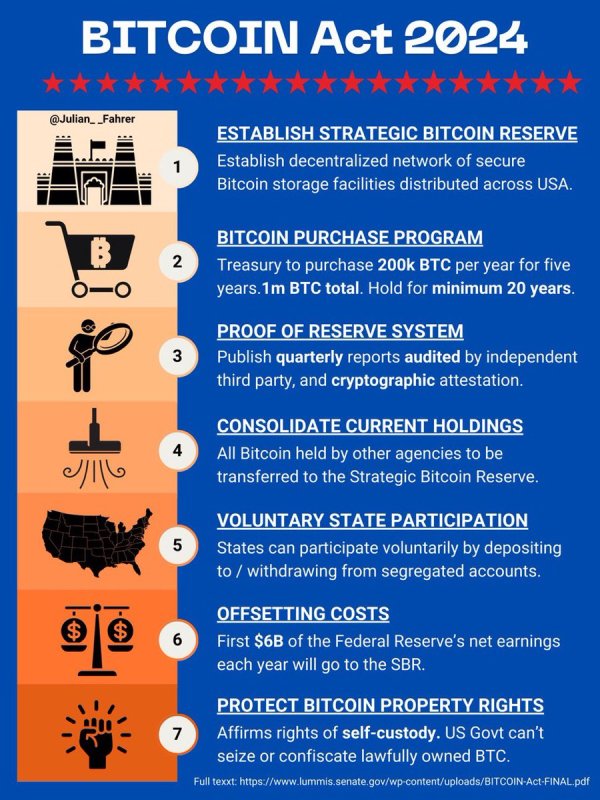

Gary Gensler officially announced that he is stepping down from his position as Chairman of the Securities and Exchange Commission (SEC), and minutes later, Reuters reported that Donald Trump’s “crypto council” is expected to “establish Trump’s promised bitcoin reserve.” A bitcoin reserve, that would see the United States purchase 200,000 bitcoin per year, for five years until it has bought 1,000,000 bitcoin.

Right after both of those, Bitcoin continued its upward momentum and broke $99,000, with $100,000 feeling like it can happen at any second now.

It is hard to contain my bullishness thinking about the United States purchasing 200,000 BTC per year. They essentially have to compete with everyone else in the world who is also accumulating bitcoin and attempting to front run them. There are only 21 million bitcoin and that is a LOT of demand.

To put this into context, so far this year the US spot bitcoin ETFs have accumulated a combined total of over 1 million BTC. At the time of launch the price was ~$44,000 and now bitcoin is practically at $100,000. And that’s all ETFs combined. Imagine what will happen when just one entity wants to buy a total of 1 million coins, having to compete with everyone else accumulating large amounts as well?

I mean MicroStrategy literally just completed another $3 BILLION raise to buy more bitcoin, and will continue raising until it purchases $42 billion more in bitcoin. The United States are most likely going to be purchasing their coins (if this legislation is officially signed into law) at very high prices. The demand is insane and only rising in the foreseeable future.

With two months left to go until Trump officially takes office, it remains to be seen if this bill becomes law, but at the moment things are looking really good. As Senator Cynthia Lummis stated, “This is our Louisiana Purchase moment!” and would be an absolutely historic moment for Bitcoin, Bitcoiners, and the future financial dominance of the United States of America.

This is the solution.

This is the answer.

This is our Louisiana Purchase moment!#Bitcoin2024 pic.twitter.com/RNEiLaB16U

— Senator Cynthia Lummis (@SenLummis) July 27, 2024

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential