funding

Story Protocol, Sorella, BSX Exchange

Published

3 months agoon

By

admin

The crypto VC community turned out for several startups this week, including Story Protocol’s $80 million series B funding round.

The week, between Aug. 18 and Aug. 24, has been buzzing with activity in the crypto venture capital space. According to crypto funding tracker Crypto Fundraising, 32 blockchain startups raked in more than $202 million from various investors in that period.

Below we look at a few of the standouts.

Story Protocol, $80 million

Story Protocol raised $80 million in its series B round. Serial crypto VC firm Andreessen Horowitz led the round, which also saw participation from Polychain Capital, Hashed, Samsung Next, and SparkLabs Global among others.

The series B round pushes the San Francisco-based startup’s total funding to $140 million and values the company at an impressive $2.25 billion.

The company aims to tackle what it considers an escalating problem of intellectual property theft, particularly in the era of generative artificial intelligence.

Story’s blockchain network allows IP owners to store their creations on the platform, embedding licensing terms directly into smart contracts.

In that way, it ensures that IP owners are compensated whenever their content is used, countering the growing concerns of technology giants using AI models to ingest copyrighted material without proper authorization.

Sorella Labs, $7.5 million

Next on the list is Sorella Labs, also a San Francisco-based startup. The company secured $7.5 million in funding to further its work to develop tools designed to identify and process maximum extractable value activities on the Ethereum (ETH) blockchain.

Research-driven tech investment company Paradigm led this particular funding round. Other participants included Nascent, Uniswap Ventures, Robot Ventures, and Bankless Ventures.

Sorella Labs plans to use the proceeds to expand its operations and speed up the development of its key products, Brontes and Angstrom.

Corn, $6.7 million

Corn is another winner in this week’s crypto VC fundraising column. The Ethereum layer-2 network, which uses hybrid tokenized Bitcoin (BTC) as gas, collected $6.7 million in a seed round led by Polychain Capital.

Binance Labs, Framework Ventures, as well as Polygon (MATIC) co-founder Sandeep Nailwal also lent a hand in the round.

Corn is reportedly looking to create a “crop circle” ecosystem that matches users, applications, and token holders, to address challenges faced by other decentralized networks, including insufficient liquidity and limited token utility.

BSX Exchange, $6.2 million

Meanwhile, BSX Exchange, a decentralized derivatives protocol built on the Ethereum L2 network Base, raised $6.2 million through pre-seed and seed funding rounds.

🚨 Exciting news! 🚨

1/ The team at @bsx_labs is excited to announce a total fundraise of $6.2M, led by @blockchaincap and 50+ additional supporters

The funding was completed to further expand BSX product development — the liquidity layer for onchain derivatives and capital… pic.twitter.com/QxYtwg1pZZ

— BSX (@bsx_labs) August 21, 2024

The seed round, worth $4 million, was led by Blockchain Capital. Other notable investors include Bankless Ventures and Maelstrom, the family office of BitMEX co-founder Arthur Hayes.

With this fresh capital, BSX plans to expand beyond derivatives trading, launching a spot aggregator in September as well as several earn-and-stake products shortly after.

Orderly Network, $5 million

Orderly Network, a project developing a web3 liquidity layer, was also on the right end of a $5 million round of funding. OKX Ventures, Manifold Trading, and Origin Protocol are among its backers.

The team behind the project plan to use the funds to bolster its capabilities in creating a permissionless liquidity layer for web3 trading across multiple blockchains.

Currently, Orderly supports six chains, including the Ethereum mainnet and Polygon. It intends to provide deep liquidity for any asset across those networks.

Other funding rounds

Wrapping up the notable VC funding rounds of the week are three projects, Soulbound, Stork Network, and Thalex. Between them, they managed to raise more than $12 million, with the web3 social gaming space getting $4 million from Animoca Brands to further its mission of empowering its new creator economy.

Soulbound is building a platform that combines GameFi and SocialFi to offer a new digital experience. The platform’s builders say they will use the money to establish gaming partnerships, grow social interactions, and expand streamer bounties as well as social questing.

On its part, Stork Network earned $4.705 million in seed funding to expand its product suite, including developing its open data market. Lightspeed Faction and Lattice co-led the round, which also saw participation from CMS and Wintermute Ventures.

Finally, Thalex, a crypto derivative exchange, raised 3 million euros ($3.3 million) in a series A extension. According to Axios, which exclusively reported on the fundraising, backers in the extended round included Bitfinex, Bitstamp and Flow Traders. IMC and Wintermute also invested in the project.

Source link

You may like

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Binance Labs

Binance Labs invests in DeSci platform BIO Protocol

Published

2 weeks agoon

November 9, 2024By

admin

Binance Labs, the venture capital arm of Binance, has announced its investment in BIO Protocol, a platform designed to help early-stage scientific research startups access decentralized funding opportunities.

The investment sees Binance, powered by the native token BNB (BNB), make its first foray into decentralized science, the platform said in an announcement on Nov. 8.

According to Binance Labs, BIO Protocol is the equivalent of the “Y Combinator of on-chain science”, a reference to the U.S.-based VC firm and startup accelerator.

BIO Protocol advances the DeSci sector by providing a platform for scientists and investors to access collective funding and co-ownership opportunities.

The platform currently operates through a network of seven biotech decentralized autonomous organizations, (also known as BioDAOs) covering areas such as women’s health, mental health, and cryopreservation.

“BIO Protocol represents a significant step forward in DeSci by merging biotechnology and DeFi,” Andy Chang, investment director at Binance Labs, said. “At Binance Labs, we are dedicated to unlocking groundbreaking advancements that drive long-term, real-world impact by supporting projects building meaningful technology – an approach that closely aligns with our investment in BIO”.

The BIO Protocol team plans to use the funding to expand its BioDAOs further, with seed funding available for new entities. BIO will also offer community and tokenomics support as it seeks to broaden its presence and impact in scientific funding.

Binance Labs has recently increased its footprint in the VC ecosystem, backing multiple projects in various industry fields. This includes the investment platform’s backing of Lombard, a Bitcoin (BTC) liquid staking platform.

The crypto and blockchain-focused venture capital provider has also invested in Solana (SOL) staking protocol Solayer and Telegram mini-app Blum.

Source link

funding

Kraken bags $42.5m from Optimism, Glow Labs raises $30m

Published

3 weeks agoon

November 2, 2024By

admin

This week, crypto exchange Kraken stole the show with its $42.5 million grant raise from Optimism.

Kraken has disclosed its latest decision to launch Ink, a layer-2 on the Optimism (OP) blockchain. As a part of the deal, Optimism has announced that they will offer $42.5 million, or 25 million OP tokens.

This has brought the exchange’s funds raised to date to $164.8 million. Crypto.news dug deeper into the firms that raised the most capital from Oct. 27 to Nov 2.

Here are the firms that bagged million-dollar amounts during this period, according to data from Crypto Fundraising.

Glow Labs, $30 million

- Glow Labs is a community-powered platform that aims at ramping up global solar energy adoption.

- The firm raised $30 million from Framework and Union Square Ventures.

Nillion, $25 million

- Nillion has raised $25 million from investors like Hack VC.

- So far, the decentralized network for secure storage has raised $50 million.

Ellipsis Labs, $21 million

- The platform that builds sustainable and efficient DeFi protocols has raised $21 million from HAUN.

- Ellipsis Labs has raised a total of $23.3 million to date.

Chainway Labs, $14 million

- The blockchain infrastructure company focused on Bitcoin, Ethereum, and Zero Knowledge technology has raised $14 million in a Series A round from Founders Fund and other investors.

- Chainway Labs has raised $16.7 million so far.

Today, we announce our $14M Series A led by @foundersfund, joined by @maven11capital, @mirana, @erikvoorhees, @balajis, @bitfish1, @0xMert_ & more.

This will help us expand Bitcoin from digital gold to an active, programmable asset, with @CitreaOrigins driving this expansion 🧵 pic.twitter.com/DxkgoeLERH

— Citrea (@citrea_xyz) October 31, 2024

Gelato Network, $11 million

- Gelato Network has raised $11 million in a Series A round led by HACK VC.

- The decentralized backend for web3 has raised $23.2 million to date.

Sapien AI, $10.5 million

- Sapien is a gamified Web3 platform where users play and train AI by completing various challenges.

- The firm has raised $10.5 million in a seed round led by Variant.

PumpBTC, $10 million

- The liquid staking platform has raised $10 million in a seed round.

- Lead investors include SevenX Ventures, Mirana Ventures, etc.

BitSmiley, $10 million

- BitSmiley encompasses a stablecoin, a lending platform, and a derivatives protocol.

- The firm raised $10 million from various investors like Nxgen, IBC Group, etc.

Notable crypto VC funding rounds under $10 million

- Spire Labs raised $7 million in a seed round.

- Alliance Games raised $5 million in a Series A round.

- 81Ravens raised $4.5 million in a seed round.

- Phylax Systems raised $4.5 million in a pre-seed round.

- Nitro Labs raised $4 million in a seed round.

- MagmaDAO raised $3.9 million in a seed round.

- Native raised $2.6 million in a seed round.

- Axal raised $2.5 million in a pre-seed round.

- Streamflow raised $1.9 million.

- Cap Labs raised $1.9 million in a pre-seed round.

- KRNL Labs raised $1.7 million in a pre-seed round.

Have a peek at last week’s column here.

Source link

Bridge, a stablecoin startup founded not even three years ago, announced a deal this week that would cause most crypto entrepreneurs to salivate.

Stripe, the San Francisco-based payment processing company, agreed to buy Bridge for $1.1 billion.

The transaction likely has crypto entrepreneurs wondering when their own ventures will be ripe enough to attract a big-name buyer. Until then, early-stage companies will have to continue courting venture capitalists to extend their runways.

Here are the latest startups doing just that, according to data from Crypto Fundraising collected between Oct. 20 and Oct. 26:

Bluesky, $15 million

- Bluesky completed a Series A funding round.

- The decentralized social media platform raised $15 million from lead investors like Blockchain Capital.

Bluesky raises $15M Series A investment

Decentralized social media project Bluesky has raised $15 million in Series A investment led by Blockchain Capital. According to Decrypt, SevenX, True Ventures, and Alumni Ventures also participated in this round. Bluesky also announced…

— CoinNess Global (@CoinnessGL) October 24, 2024

Variational, $10.3 million

- Variational is a peer-to-peer trading protocol that is created for perpetual and generalized derivatives.

- The firm has raised $10.3 million in a seed round led by investors like Bain Capital Crypto and Peak XV Partners.

Validation Cloud, $10 million

- Validation Cloud is a web3 infrastructure platform that focuses on scalable and compliant infrastructure for enterprises.

- The firm raised $10 million from True Global Ventures.

- Validation Cloud has raised a total of $15.8 million so far.

Crypto VC funding rounds < $10 million

- Web3 mobile gaming platform Party Icons raised $9 million.

- Digital investment marketplace STOKR raised $7.98 million from Fulgur Ventures.

- Karpatkey, which provides DAO Treasury services, raised $7 million.

- Full-stack decentralized platform Azura raised $6.9 million in a seed round.

- Non-custodial crypto trading platform Shuttle Labs raised $6 million from CMCC Global.

- Crypto exchange Hata raised $4.2 million in a seed round led by Castle Island Ventures and Nic Carter.

- Hana Network raised $4 million from investors like Binance Labs, Sushi, Orange DAO, etc.

- Decentralized borrowing platform Fluid Protocol raises $3.9 million in a seed round.

- Moonwalk Fitness has raised $3.4 million from lead investors like Hack VC.

- Borderless has raised $3.3 million in a pre-seed round led by Amity Ventures.

- Opti Games Studio raised $2 million with L1 Digital as the lead investor.

- NFT marketplace Ordzaar raised $2 million from lead investors like LongHash Ventures.

- Decentralized infrastructure platform Craftt raised $2 million in a seed round.

- Decentralized exchange BulbaSwap raised $1.3 million from lead investors like Foresight Ventures.

- Skyfire raised $1 million from Coinbase Ventures and a16z crypto.

Check out our last week’s column from here.

Source link

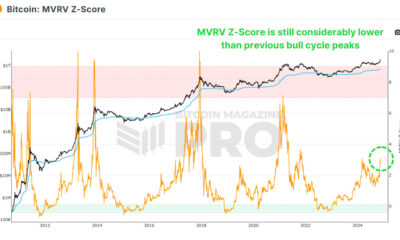

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential