24/7 Cryptocurrency News

Binance CEO Richard Teng Refutes $26B Revenue Claim In Nigeria Lawsuit

Published

4 months agoon

By

admin

Binance CEO Richard Teng has issued a powerful response to the Nigerian government’s allegations regarding the company’s operations in the country. The ongoing legal battle has seen Binance and two of its executives, Nadeem Arjarwalla and Tigran Gambaryan, face charges of money laundering and tax evasion. The case, initially scheduled for October 11, has now been brought forward to September 2 following requests from the defense.

Binance CEO Richard Teng Calls Out Nigerian Govt’s Misreporting

The Nigerian government claims that Binance earned $26 billion in revenue from its activities within the country in 2023. Teng, however, firmly denied this accusation ahead of the September 2 hearing in Binance vs. Nigeria lawsuit. He clarifying that the figure cited by the Nigerian authorities is misleading. “The Government has said that we made $26B in revenue from Nigeria in 2023. That is not the case,” Teng stated in an official statement.

He explained that the exchange’s transaction volume in Nigeria for 2023 was $21.6 billion, which is much less than the claimed revenue generated in the region. Hence, the actual revenue generated has to be much lesser. The Binance CEO further elaborated, “Our actual revenue is based on charging a small percentage of transaction fees, and we are proud to offer our users some of the lowest fees of any exchange globally.”

Teng Dismisses Claims Tied To Naira Devaluation

The case against the crypto exchange also includes allegations that the company’s activities contributed to the depreciation of the Nigerian Naira. Teng refuted these claims, attributing the naira’s decline to broader macroeconomic factors rather than Binance’s operations. “Another claim made by the Nigerian government was that Binance was responsible for its currency’s decline, which is not backed up by facts,” the Binance CEO asserted.

Teng provided a detailed account of the Naira’s exchange rate movements, noting that between 2021 and 2022, the naira traded within a relatively narrow range. He pointed out that the most significant drop occurred after the Nigerian government ended the Naira’s currency peg in June 2023, leading to a dramatic depreciation.

“The Naira traded at a recent low of USD1:1,660 on July 31, 2024, representing a 50% decline from the start of 2024,” Teng said. He emphasized that this downward trend continued even after the exchange ceased offering its peer-to-peer (P2P) services in the country in February 2024.

Tigran Gambaryan’s Health Worsens

A significant aspect of the controversy involves the detention of Tigran Gambaryan. He is Binance’s Head of Financial Crime Compliance, who has been held in Nigeria since February. Binance CEO Teng expressed deep concern over Gambaryan’s deteriorating health and the Nigerian government’s refusal to provide adequate medical care or allow him access to legal counsel.

“Tigran’s physical and mental conditions have deteriorated rapidly, and his situation is now more dire than ever. He is in severe pain and unable to walk due to a herniated disc,” Teng revealed. The CEO also condemned the Nigerian government’s alleged failure to comply with court orders demanding the release of Gambaryan’s medical records and the denial of access to his U.S. consulate representative.

Teng characterized these actions as “inexplicable” and appealed for Gambaryan’s release on humanitarian grounds. “I appeal once again for the Nigerian government to allow him to go home to his family on humanitarian grounds so that he can seek the appropriate medical treatment in the US,” Teng urged.

In his statement, the Binance CEO called on the U.S. government to intervene and designate Gambaryan as one of its “unlawfully detained” citizens overseas. He also appealed to the international community to voice their concerns about the Nigerian government’s actions.

“People globally should add their voices and concerns, convincing the Nigerian government such unilateral action without a strong basis will be detrimental to the long-term economic development and well-being of the country,” he said.

Kritika Mehta

Kritika boasts over 2 years of experience in the financial news sector. Currently working as a crypto journalist at Coingape, she has consistently shown a knack for blockchain technology and cryptocurrencies. Kritika combines insightful analysis with a deep understanding of market trends. With a keen interest in technical analysis, she brings a nuanced perspective to her reporting, exploring the intersection of finance, technology, and emerging trends in the crypto space.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Analyst Reveals Timeline When Bitcoin Price Could Jump To $140,000

How Lightchain AI Is combining AI and blockchain like never before

Here’s What To Do As ADA Bottoms

CME Gap Threatens Bitcoin With Potential Drop To $77,000

Analysts predict this under $1 token will surpass WIF and FLOKI in 2025; here’s why

Will Dogecoin Price Hit $20 On Its Next Leg Up?

24/7 Cryptocurrency News

Analyst Reveals Timeline When Bitcoin Price Could Jump To $140,000

Published

18 minutes agoon

December 29, 2024By

admin

Crypto analyst Jelle has provided a bullish outlook for the Bitcoin price for the remainder of this market cycle. The analyst predicted that the flagship crypto will reach $140,000 and revealed when this price surge could likely happen.

When The Bitcoin Price Will Jump To $140,000

In an X post, Crypto Jelle predicted that the Bitcoin price could rally to $140,000 in the next three months. This came as the analyst highlighted a cup and handle pattern, which put BTC’s price target at this level.

Crypto analyst Titan of Crypto also suggested that Bitcoin could rally to $140,000 in the next three months. In an X post, the analyst shared an accompanying chart, which he tagged as the ‘Bitcoin 2025 Roadmap.’

The accompanying chart showed that the Bitcoin price could reach $140,000 at the start of the new year. However, this price is unlikely to mark the top for Bitcoin, as it could still surge to $150,000.

Other market experts have even provided a more bullish outlook for the flagship crypto. Engineer Ted Boydston predicted that BTC could hit $225,000, the biggest bull run for the flagship crypto.

Meanwhile, renowned finance author Robert Kiyosaki predicted that the flagship crypto will hit $350,000 in 2025. While it remains to be seen if the flagship crypto could reach such heights, fundamentals such as Donald Trump’s inauguration support a bullish continuation.

A Price Rebound Is Imminent

In an X post, crypto analyst Ali Martinez stated that the Bitcoin price could be preparing for a rebound. The analyst mentioned that Bitcoin is showing a bullish divergence on the hourly chart against the Relative Strength Index (RSI).

The analyst added that the percentage of Binance traders going long on BTC has increased from 53.12% to 64%. These traders are said to have a solid record of being right.

Martinez further stated that the Bitcoin price needs to break above $94,800 to confirm this rebound. A break above this level could send BTC to $95,300 or even $96,000.

On the flip side, the analyst warned that if Bitcoin drops below $93,600, the bull case is off the table as the flagship crypto could drop to $84,000 or even $70,000.

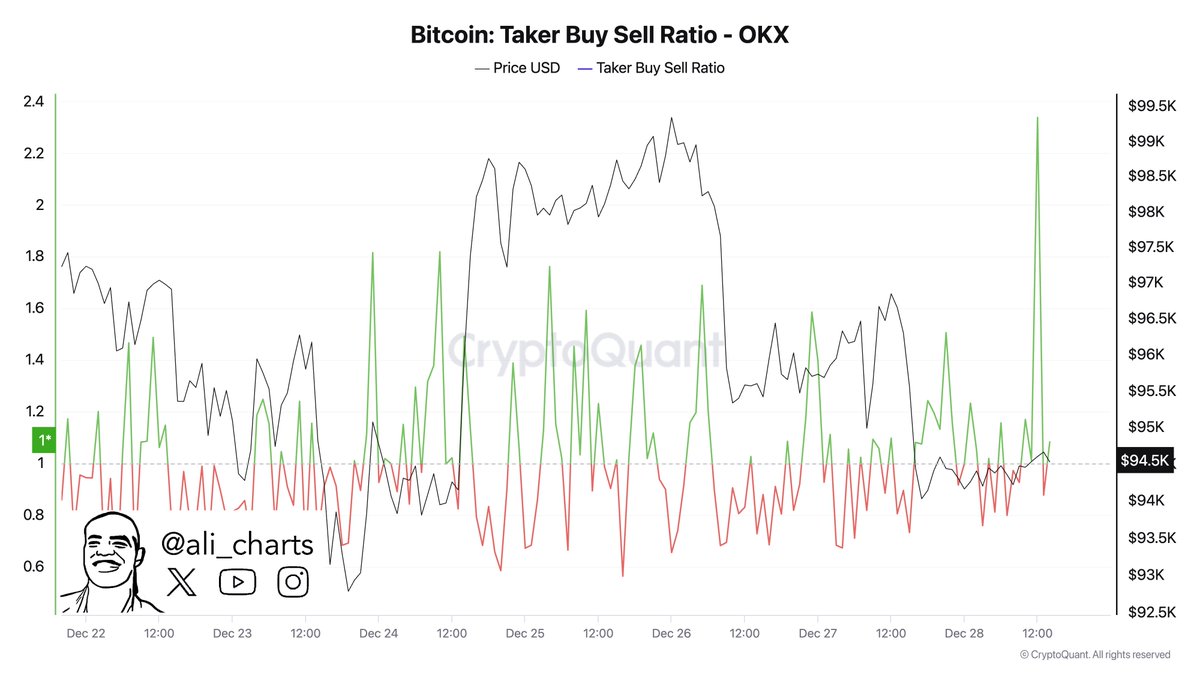

However, the bullish case is looking more likely. In another X post, the analyst revealed that there was a spike in Bitcoin’s Taker Buy/Sell ratio on the top crypto exchange OKX. This indicates a surge in aggressive buying, which is a sign of upward momentum ahead.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across DeFi, NFTs, smart contracts, and blockchain interoperability, among others. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Will Dogecoin Price Hit $20 On Its Next Leg Up?

Published

6 hours agoon

December 29, 2024By

admin

Analyst Javon Marks forecasts that Dogecoin (DOGE) price is poised for a major rally, potentially reaching $20 during the ongoing bull cycle. Marks’ analysis is based on historical performance trends, which have shown progressively larger price gains in Dogecoin’s previous cycles. Current market activities, including a rebound in DOGE price and increased whale transactions, suggest a promising outlook for the meme coin.

Will Dogecoin Price Surge to $20? Analyst Predicts Monumental Bull Cycle Ahead

In a recent analysis shared on X (formerly Twitter), Javon Marks expressed confidence in Dogecoin’s potential to achieve unprecedented growth during the ongoing bull cycle. His observations highlighted a pattern of progressively larger price gains in Dogecoin’s previous cycles, with the current trajectory suggesting another monumental run.

According to Javon’s analysis, DOGE price cycles exhibit exponential growth during bull runs, with significant surges noted in 2017 (90x) and 2021 (306x). Based on these historical patterns, projections for 2024 suggest a potential surge exceeding 306 times, targeting prices above $20.

The chart highlights consistent upward trends leading to explosive rallies, driven by market momentum and investor sentiment. If DOGE replicates past performance, the next cycle could see unparalleled highs.

Additionally, Dogecoin price recently rebounded to $0.3226 after touching a weekly low of $0.3097. This movement indicates that the $0.3097 mark could be a potential floor price signaling further upward momentum.

These analyses are in line with recent bullish predictions by Galaxy Research, which projects Dogecoin to reach $1 by 2025. The firm highlights key fundamentals like whale accumulation and Elon Musk’s D.O.G.E. initiatives as catalysts for this growth. While Dogecoin faces competition from other memecoins, its historical growth patterns suggest this target is achievable.

Whale Activity Boosts Dogecoin Ecosystem

The Dogecoin ecosystem has experienced a surge in whale activity, signaling increased interest among large-scale investors. Data from IntoTheBlock revealed that large transactions within the Dogecoin network have risen by 41% in the past 24 hours, with a cumulative transaction value exceeding $23 billion.

This uptick in whale transactions is a positive indicator for the meme coin rally, reflecting heightened market participation and liquidity. The sustained activity in this price range could provide the foundation for a stronger rebound in the midterm.

According to a recent Coingape report, Dogecoin price is signaling a bullish reversal as DOGE whales have accumulated an impressive 90 million DOGE in just two days. This surge in whale activity reflects growing interest among investors and suggests a meme coin rally. Positive on-chain indicators and increased market activity further support this sentiment.

At press time, DOGE price is trading at $0.3224, reflecting a 2.57% increase in the past 24 hours. The meme coin rally market capitalization stands at $47.52 billion, with a 24-hour trading volume of $1.43 billion.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Engineer Predicts Biggest Bull Run Coming Soon for Bitcoin; Here’s All

Published

9 hours agoon

December 29, 2024By

admin

With an almost negligible recovery in the last 24 hours, Bitcoin has been stranding around $94k despite hitting the ATH of $108.2k a few days ago. The Bitcoin price performance is also impacting the crypto market, but most experienced investors argue that this is a momentary phase. Interestingly, an engineer believes that the biggest Bitcoin bull run is coming soon, considering the M2 marker.

Understanding the Biggest Bitcoin Bull Run Phase

In a recent tweet, a popular crypto analyst & engineer, Ted Boydston, presented an interesting BTC price analysis, predicting the upcoming Bitcoin bull run phase. According to Ted’s analysis, the price oscillator on the M2 has recently formed, which provides buy and sell signals. As the M2 money stock analyses the liquid cash circulation, including physical cash (M1), checking deposits, and other near money instruments like saving, money markets, etc, it is a key economic indicator that influences all the financial markets, including the crypto market.

The engineer’s prediction also focuses on the same, as he talks about the Bitcoin price movements and the global liquidity trends. More importantly, the oscillator derived from the PPO of M2 sits at the lower panel. As a result, it flashed the buy signal and entered the green zone. More importantly, historical reports confirm that such signals often head to major money printing and Bitcoin’s manic phase. Eventually, this leads to the famous Bitcoin bull run.

During this time, investors often witness increased price volatility and rapid price appreciation. Although this signal works pretty well, there was one exception in 2016. It failed to flash a signal back then, as the Bitcoin halving event primarily drove the BTC price rally.

Interestingly, the investor’s expectations are still consistent to witness Bitcoin regaining support and surging past the current ATH of $108.2k.

Expert Bitcoin Price Predictions & Forecasts

Until recently, the biggest target for BTC price was $100k, but that has been achieved, so now the eyes are on what’s more coming. Many crypto analysts have claimed to see Bitcoin price at $150k or even $1M, but the most understandable one is that Bitcoin might reach $225k per Boydston’s analysis.

Boydston talks about the manic phase bull market, wherein each BTC cycle, a top is formed at around 0.382 Fibonacci retracement level. If the same data is put in the current cycle, the BTC price target is $225K with the Bitcoin bull run. Another crypto analyst has come with a similar outlook and predicted that Bitcoin price could reach $225k in June 2025. More importantly, he also predicted a major altcoin season beginning after that.

Such similar outlooks increased the probability of that happening for real. One other outlook focuses on Tether’s dominance, which is in a tough spot with its decreasing circulating supply with Europe’s Tether Ban.

Final Thoughts

Ted Boydston’s analysts’ Bitcoin price prediction has presented a new image of the possible bull market for this cryptocurrency. As the M2 has flashed a buy signal, this has hinted that Bitcoin’s manic phase will begin soon. Interestingly, another crypto analyst has added the timelines to that as the Bitcoin bull run could result in the BTC price hitting $225k in June 2025 before handing over the bulls to the altcoins. This might make hundreds of investors’ dreams come true. However, careful investment and strategic planning are a must, as many factors could hinder this path. More importantly, running the technical analysis and making smart decisions are the keys to returns, not the internet analysts’ prediction, as they vary from time to time and from person to person.

Pooja Khardia

With a deep-seated passion for reading and five years of experience in content writing, Pooja is now focused on crafting trending content about cryptocurrency market.

As a dedicated crypto journalist, Pooja is constantly seeking out trending topics and informative statistics to create compelling pieces for crypto enthusiasts. Staying abreast of the latest trends and advancements in the field is an integral part of her daily routine, fueling a commitment to delivering timely and insightful coverage

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Analyst Reveals Timeline When Bitcoin Price Could Jump To $140,000

How Lightchain AI Is combining AI and blockchain like never before

Here’s What To Do As ADA Bottoms

CME Gap Threatens Bitcoin With Potential Drop To $77,000

Analysts predict this under $1 token will surpass WIF and FLOKI in 2025; here’s why

Will Dogecoin Price Hit $20 On Its Next Leg Up?

Dogecoin Primed for a Price Rebound As Crypto Whales Accumulate DOGE, According to Analyst

XYZVerse tops the list with promising returns

Engineer Predicts Biggest Bull Run Coming Soon for Bitcoin; Here’s All

HSBC analysts reveal which one will reach $10 by January 1, 2025

Crypto and AI Hardware That Turned Heads in 2024

Bitcoin Clean Energy Usage Soar, Tesla To Accept BTC Payments?

Lightchain AI among the most talked-about token of the next bull run

DeFi Education Fund Sues US IRS Over Controversial Tax Rules

Bitcoin (BTC) Institutional Adoption Accelerates as ETF Filings Show Investor Appetite

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis5 months ago

Price analysis5 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Altcoins5 months ago

Altcoins5 months agoEthereum Crash A Buying Opportunity? This Whale Thinks So

✓ Share: