24/7 Cryptocurrency News

Celsius Holds $5M On-chain Balance Amid $2.5B Bankruptcy Distribution

Published

3 months agoon

By

admin

Crypto firm Celsius has distributed over $2.5 billion to creditors in its ongoing bankruptcy process. On-chain data shows the firm now holds $5 million amid the recent distributions. The company’s bankruptcy distribution plan which dragged on for months is now underway, per new filing.

Celsius On-chain Balance Drops to $5M

Celsius bankruptcy distribution plan has seen over $2.5 billion sent to eligible creditors. According to crypto analytics firm Arkham Intelligence, the company holds only $5 million in on-chain balances. Most users expressed delight concerning the distribution process to creditors calling on remaining investors to claim their payouts.

In a recent filing, Celsius bankruptcy administrator announced payment of $2.53 billion to 251,000 creditors covering about 93% of total values. However, this figure is only two-thirds of eligible creditors with another 121,000 creditors yet to claim their funds. Per the filing, the reason for the delay in these classes of creditors could be due to the small amounts of their holdings.

“Approximately 64,000 of these remaining creditors have a distribution of less than $100, and approximately 41,000 more have a distribution of between $100 and $1,000…Given the small amounts at issue for many of these creditors, they may not be incentivized to take the steps needed to successfully claim a distribution.”

These payments made by the bankrupt crypto lender were cash and liquid digital assets at Jan 16 prices. This year, the prices of crypto assets saw an uptick following the approval of spot Bitcoin ETFs by the United States Securities and Exchange Commission (SEC).

LATEST: CELSIUS HAS ONLY $5M REMAINING ON-CHAIN

According to a court filing, Celsius Network has now distributed over $2.5B, or 93% of eligible funds to over 250K individual creditors.

Celsius began distributing over $3B of assets to creditors in January of this year – and now… pic.twitter.com/ktZdkLG3gD

— Arkham (@ArkhamIntel) August 27, 2024

Firm’s Bankruptcy Saga

The company’s crisis rocked the crypto ecosystem in 2022 adding the industry’s woes alongside Terra Network and crypto exchange FTX. The crypto lender once had over 1.7 million users with over $25 billion in assets under management (AUM).

The company’s popularity was linked to the wider adoption of decentralized finance (DeFi) before its bankruptcy in July 2022. As a result, the bankruptcy case rolled out with the court approving the final distribution plan this year. Recently, Celsius tapped PayPal’s Hyperwallet services to enable distributions.

David Pokima

David is a finance news contributor with 4 years of experience in Blockchain Technology and Cryptocurrencies. He is interested in learning about emerging technologies and has an eye for breaking news. Staying updated with trends, David reported in several niches including regulation, partnerships, crypto assets, stocks, NFTs, etc. Away from the financial markets, David goes cycling and horse riding.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Crypto cops record $8.2b in financial remedies for investors: SEC

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Survival of the healthiest: Creating a successful crypto

Cardano Hydra Unveils Gamified Test Campaign, ADA Price Reacts

The DeFi duo with potential to multiply a crypto portfolio

24/7 Cryptocurrency News

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Published

2 hours agoon

November 24, 2024By

admin

Stellar price has seen a remarkable surge, climbing over 80% in the last 24 hours, rising to number one in the top gainers. The bullish momentum has pushed XLM from $0.302 to a peak of $0.55, as traders and analysts anticipate the possibility of the asset nearing the $1 mark.

Stellar Price Reaches $0.55 Amid Bullish Momentum

Stellar’s price rise reflects strong buying interest as it touched $0.55, marking a significant upward trend. After a period of consolidation around $0.40, the cryptocurrency broke through resistance levels, delivering impressive returns for investors.

Market participants have noted this upward movement as a sign of renewed confidence in the asset’s potential. However, the price also briefly retraced from its peak as it faced resistance at the $0.55 level, suggesting that $1 remains a potential milestone rather than an immediate outcome. Jed McCaleb, Stellar’s founder, has also added to the growing optimism surrounding the network.

In a recent statement, McCaleb commented on Stellar’s current momentum and its role in global financial systems. “Stellar is the most underrated and least understood crypto project,” McCaleb remarked, emphasizing its ability to facilitate real-world transactions and its high efficiency. He noted,

“The best and most impactful use of crypto is as digital money, and this is what Stellar is built for.”

Grayscale Stellar Lumens Trust Records 10% Asset Growth

Grayscale Investments LLC’s recent 10-K filing highlighted a 10% increase in the net assets of its Stellar Lumens Trust during the fiscal year ending September 2024.

Despite the challenges posed by XLM price fluctuations and management fees, the trust managed to grow its assets due to the addition of 34,875,230 XLM tokens valued at $3,923.

Trading activity around Stellar has surged, with derivatives markets experiencing substantial growth in both volume and open interest. The trading volume for XLM derivatives rose by 284.26%, reaching $8.98 billion, while open interest increased by 125.88% to $393.05 million.

The filing also outlined that the trust faced losses stemming from token depreciation earlier in the year, but these were offset by a robust recovery and asset inflows. The document underscores the growing institutional interest in Stellar as an investment vehicle, aligning with its recent market performance.

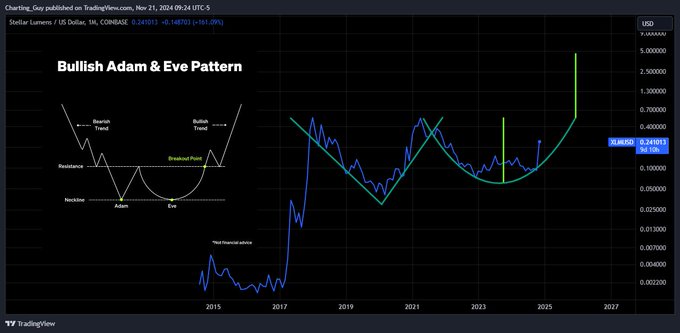

Analyst Predicts Multi-Year Price Pattern May Propel XLM to $3-$5

Cryptocurrency analysts have highlighted a multi-year price structure for Stellar, suggesting that it may be poised for further growth. A prominent market speculator, known as “Charting Guy,” recently shared a prediction that Stellar could achieve price targets between $3 and $5.

According to the analyst, XLM price has been forming a bullish “Adam and Eve” pattern on the monthly chart since 2017. This chart pattern is often associated with long-term upward momentum.

Charting Guy emphasized patience, indicating that the current rally could lead to substantial gains for long-term holders. A potential breakout from this pattern could result in a 930% to 1,617% increase from current levels, further reinforcing optimism in Stellar’s market trajectory.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Cardano Hydra Unveils Gamified Test Campaign, ADA Price Reacts

Published

5 hours agoon

November 24, 2024By

admin

Input Output Hong Kong (IOHK), the parent company of Cardano (ADA) has announced its upcoming Hydra testing campaign. Packaged as a gaming tournament on Doom, a title built on Hydra protocol, the startup said it plans to push the limit of the scaling solution.

Cardano Hydra Expectations

As IOHK revealed, the Hydra Doom deathmatch will kick off next month. The gamified testing is in stages and will feature both bots and humans. While the first round will feature players versus bots, the second round will see real players take on themselves.

Help us push Hydra to the limits on Cardano!

A tournament like no other, the Hydra Doom deathmatch kicks off this December, and 100,000 USDM in various prizes can be won. Featuring a brand new customized game look, multiple thrilling rounds of non-stop fragging, and an in-person… pic.twitter.com/iRLVFYrsld

— Input Output (@InputOutputHK) November 23, 2024

Cardano plans to incentivize participation in the Hydra Doom tournament with a 100,000 USDM prize pool. Cardano developed the protocol as its solution to scaling the mainnet. Doom is one of the dominant DApps that even Charles Hoskinson promotes as a showcase of the Hydra innovation.

This is not the first time the protocol will carry out related testing on Hydra. It relies on the performance and statistics from this testing to firther develop the protocol.

As reported earlier by Coingape, in previous testing, Hydra Doom recorded a total transaction of 3 million in approximately 1 hour. Beyond this, it achieved a 1663 Global TPS. In addition, it recorded more than a constant 1000 transactions with no failed transactions. Lastly, Cardano Hydra Doom attained a 14% 1 hour chain load.

Community and ADA Market Reaction

Cardano remains one of the best performing assets in the market at the month. Despite ADA price crossing the $1 mark, top market analysts believes it is just getting started.

Initial reaction that trailed the Hydra Doom testing has further sparked community intrigue. Many members of the Cardano ecosystem confirmed sign ups to the testing event, boosting ADA price sentiment.

At the time of writing, the coin was changing hands for $1.06, up 8.62% in 24 hours. Within this time span, the coin jumped from a low of $0.9508 to a high of $1.16. Riding on the broader Bitcoin price momentum, Cardano appears poised to reclaim new highs and current ecosystem upgrades might help achieve this goal.

Godfrey Benjamin

Benjamin Godfrey is a blockchain enthusiast and journalists who relish writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desires to educate people about cryptocurrencies inspires his contributions to renowned blockchain based media and sites. Benjamin Godfrey is a lover of sports and agriculture.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

BTC Continues To Soar, Ripple’s XRP Bullish

Published

8 hours agoon

November 24, 2024By

admin

The crypto universe has concluded yet another week, primarily with riveting developments unfolding across the broader sector. Bitcoin (BTC) continues to pump, hitting a new ATH this week. Simultaneously, Ripple’s XRP garnered significant market attention, recording considerable gains. The broader market continues to leverage investor optimism post-U.S. elections that saw Donald Trump reelected as the president.

Here’s a brief collection of some of the top cryptocurrency market headlines that have significantly impacted investor sentiment over the past seven days.

BTC Hits New ATH Amid Bull Crypto Market

BTC price hit a new ATH near the $100K level this week, echoing a buzz across the broader sector. Notably, the flagship coin gained roughly 10% over the past week to hit an ATH of $99,655. Attributable to this bullish movement post-U.S. elections, Rich Dad Poor Dad author Robert Kiyosaki shared a bold prediction for the coin, anticipating its price to hit $13 million.

Simultaneously, the crypto also saw heightened institutional interest amid its bullish movement, underscoring the potential for further gains. Aligning with this heightened market interest, biopharmaceutical firm Hoth Therapeutics forged ahead with BTC buying plans, sparking additional optimism surrounding the crypto.

Meanwhile, Bitcoin miner MARA completed its $1 billion private offering this week, with some of the proceeds set to be used to buy more BTC. Overall, the flagship coin leveraged significant buying pressure this week, paving a bullish path for future movements.

Ripple’s XRP Steals Attention

On the other hand, XRP’s price witnessed gains worth 40% over the past week, cementing investor optimism amid a bullish digital asset sector. Notably, XRP whales accumulated nearly $526M worth of the token this week, indicating that the Ripple-backed coin could pump higher. Veteran trader Peter Brandt predicted amid this bullish movement that a parabolic rally for the crypto also lies ahead.

Further, Ripple CEO Brad Garlinghouse conveyed bullish sentiments on XRP and a possible end to the SEC lawsuit, primarily attributable to the newly appointed U.S. Treasury Secretary Scott Bessent. Simultaneously, the Ripple vs. SEC lawsuit saw the regulator and FINRA trying to bring “digital asset securities” claims. This mover comes against the backdrop of XRP’s rally to $1, with speculations of a looming $2 target on SEC Chair Garu Gensler’s exit.

Overall, these market updates have sparked significant investor enthusiasm over the crypto realm’s future action, with market watchers being optimistic.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Crypto cops record $8.2b in financial remedies for investors: SEC

Stellar Price Skyrockets Over 80%, XLM Rally to $1 Imminent?

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Survival of the healthiest: Creating a successful crypto

Cardano Hydra Unveils Gamified Test Campaign, ADA Price Reacts

The DeFi duo with potential to multiply a crypto portfolio

Bitcoin Rally Benefits From US Buyers

BTC Continues To Soar, Ripple’s XRP Bullish

Ethereum whales accumulate RCO Finance after 2025 predictions hint at a 19,405% rally

US PCE, FOMC Minutes, & Crypto Expiry In Focus, Brace For Market Impact

Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

Senator Lummis wants to replenish Bitcoin reserves with gold

Will Toncoin Price Hit $10 After Recent 20% Rally?

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Gensler to resign as SEC chair: What’s next under Trump?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: