Bitcoin

Bitwise Brings The Bitcoin Ethos To Wall Street

Published

3 months agoon

By

admin

Company Name: Bitwise Asset Management

Founders: Hong Kim and Hunter Horsley

Date Founded: December 2016

Location of Headquarters: San Francisco, CA and New York, NY

Amount of Bitcoin Held in Treasury: Undisclosed

Number of Employees: 65

Website: https://bitwiseinvestments.com/

Public or Private? Private

In 2016, Hong Kim and his co-founder at Bitwise Asset Management (Bitwise), Hunter Horsely, were living the startup life — working from a living room in San Francisco and looking for a project that they could develop into a business.

While experimenting with various ideas, none of which were gaining much traction, their friends wouldn’t shut up about Bitcoin. Plus, by early 2016, every venture capital firm in Silicon Valley was focused on Bitcoin, as well.

“We wanted to avoid it for a long time because [there was] too much hype,” Kim told Bitcoin Magazine. “But then, just by osmosis, we spent more and more time thinking about it.”

By the end of the year, after doing their homework on Bitcoin, Kim and Horsely had incorporated Bitwise, a bitcoin-first crypto asset management firm that would provide wrappers for bitcoin so that customers could purchase these assets via traditional brokerages.

Eight years later, Bitwise was one of the 11 US firms to issue a spot bitcoin ETF; it’s currently the 5th largest US spot bitcoin ETF as per the amount of assets under management (AUM). This is in part due to the Bitcoin enthusiasts who’ve purchased it because of how Bitwise has maintained the Bitcoin ethos as it’s interfaced with Wall Street.

Bitwise vs. All Other Spot Bitcoin ETF Issuers

There are a number of factors that differentiate the Bitwise Bitcoin ETF (BITB) from its competitors.

For one, Bitwise is the only company that issues a US spot bitcoin ETF that publishes the addresses of its bitcoin holdings, embracing the idea of transparency, a core Bitcoin tenet.

“Even now, many, many months have passed and still we’re the only Bitcoin ETF that discloses its holding addresses,” said Kim. “You can go to a Bitcoin block explorer and check our on-chain holdings.”

Kim also made the point that Bitwise is the only spot bitcoin ETF issuer that proactively communicates with its customers via social media.

“We are on Twitter talking about a product and answering questions,” explained Kim.

“I’ll explain anything and engage with the community. If there’s anything they’re upset about [regarding] the products, they can yell at us and we respond and take them seriously,” he added.

What is more, Kim pointed out that Bitcoin remains Bitwise’s primary focus, which makes the company much different from other spot bitcoin ETF issuers like BlackRock or Invesco who manage a plethora of other types of assets.

“We’ve been around for seven years or so and this is the only thing that we talk about,” said Kim.

“When prices go down when there’s a bear market, We don’t rotate to emerging markets or fixed income or whatever,” he added.

“There might not be that big of a difference between BlackRock and Invesco or BlackRock or Franklin Templeton, but there’s a big difference between BlackRock and Bitwise.”

Lastly, Bitwise has committed to giving 10% of its ETF fee profits to three nonprofits that support Bitcoin Core developers — OpenSats, Brink and the Human Rights Foundation (HRF) — for 10 years.

Donating To Open-Source Developers

While many in the Bitcoin community have praised Bitwise for donating to Bitcoin Core developers, Kim sees this contribution as more of an obligation and less as a sacrifice.

“As a Bitcoiner, I feel that it’s not really a donation,” said Kim.

“The US taxpayer doesn’t think that they’re donating to the military budget,” he added.

“That’s not a donation. That’s your security budget.”

Kim went on to explain that while Bitwise does manage some other crypto assets, two-thirds of the company’s holdings is bitcoin. For this reason, he views supporting Bitcoin Core developers as contributing the technology that buoys his livelihood.

“If you’re like BlackRock, where you have all sorts of other [assets] and bitcoin is only one of them, then maybe you don’t feel that way,” Kim said in regard to why a company like Bitwise cares about bitcoin more than some of the bigger traditional financial institutions that issued spot bitcoin ETFs.

“If you are like me or are in an economic situation like me and you care enough about Bitcoin, then it’s not an optional matter that the Bitcoin network is as secure as it can be,” he added.

Kim, Bitwise’s CTO, who has a background in cybersecurity, explained why open-source developers are essential to Bitcoin, noting that many who don’t understand how open-source technology works misperceive what Bitcoin developers do. He made the argument that the majority of Bitcoin developers aren’t there to make radical changes to Bitcoin, but to keep it functional as it interfaces with other software.

“You can have an opinion about the latest contentious soft fork proposal or whatever, but 95% of the devs that we’re talking about don’t work on that,” Kim explained.

“The 50 or so core devs that do this day in and day out, that’s not what they’re spending time on. Whenever there’s a new version of Linux or Mac or Windows, guess what — we need to make sure that Bitcoin Core compiles on that version,” he continued.

“Somebody needs to make sure that the software we depend upon continues to be compatible, well-documented, and runnable.”

On A Mission

While Bitwise does a lot to differentiate itself from its competitors, Kim wants Bitwise to do something more profound than just being one of the better US spot bitcoin ETF issuers.

“There are ways of thinking about a business as the product [it offers] or how it’s different from its competitors, but I think there’s another way of looking at a company as like, ‘What are you here to do?’” explained Kim.

He shares that he and Horsely didn’t start by asking themselves this question, though, now, it seems to be at the forefront of his mind.

“I want Bitwise to be the company that helps accelerate and guide this movement, because it’s such an important thing for the world to have public money that everyone can access and that nobody controls,” said Kim.

After sharing this, Kim acknowledged what he felt many might be thinking as they read this: You’re offering exposure to bitcoin’s price within the walled garden of traditional finance.

“TradFi and Bitcoin culture are inevitably colliding and people rightfully have concerns and some kind of dissonance about that,” said Kim. “That was really top of mind for me.”

Kim reiterated that this is why Bitwise chose to donate to open-source Bitcoin developers, make their Bitcoin addresses public and engage with the Bitcoin community. And he also shared some information on what Bitwise is working on next: redeemable bitcoin.

Redeemable Bitcoin

Bitwise is currently speaking with policymakers in Washington, DC in efforts to have Bitwise facilitate in-kind redemptions of bitcoin from the Bitwise Bitcoin ETF. In layperson’s terms, Kim wants Bitwise customers to be able to withdraw the bitcoin in which they’ve invested via the ETF if they so please, whereas, right now, customers can only withdraw the cash value of the bitcoin in which they’ve invested via bitcoin ETF.

“There are gold ETFs where you can redeem, even as an individual retail investor, and get gold coins and bars delivered to your door,” explained Kim.

“You redeem in-kind without incurring a taxable event. There’s no reason that a bitcoin ETF shouldn’t be able to do that,” he added.

“That would be a product that I would be proud of.”

Kim believes that if Bitwise can make redeemable bitcoin a reality for investors, then spot bitcoin ETFs like BITB have the potential to become some of the biggest on-ramps to Bitcoin.

“Bitcoin ETFs are a huge improvement [in Bitcoin onboarding] in that most people have brokerage accounts,” said Kim, who added that it’s much easier to get family and friends to invest in bitcoin when they don’t have to go through the hassle of setting up an account with a Bitcoin or crypto exchange.

“If your uncle at the Thanksgiving table is convinced and wants to put $100 into bitcoin, you no longer have to go, ‘Wait a minute. First buy a ledger for $40…’ [Now, it’s] just two taps and you have a hundred dollars worth of Bitcoin exposure,” he added.

“But then, at any point in their journey, if they are so inclined, they can withdraw that. And in that sense, it can become a really clean and simple on-ramp.”

While Kim acknowledged that many are skeptical this will ever happen — speculating that Wall Street wants as much bitcoin within walled gardens as possible — he also noted that many felt the same way about the spot bitcoin ETFs ever being issued. He requested some patience as Bitwise persists in its efforts to knock down the wall between Bitcoin and traditional finance.

“There’s a way of looking at Bitcoin ETFs as a clean and easy on-ramp and off-ramp and the lowest friction one for the average person,” said Kim.

“That would be my ideal world, and that is a world that Bitwise is currently working on,” he added.

“In that world, the ETFs and the on-chain world aren’t as separate, but rather they can have a close relationship.”

Source link

You may like

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Bitcoin Cash (BCH) added nearly 35% to its value in the past month and rallied 12% on Nov. 21. Bitcoin’s (BTC) observed a rally to $98,384 early on Nov. 21, with BCH and other top cryptocurrencies tagging along for the ride.

An analysis of on-chain and technical indicators and data from the derivatives market shows that BCH could extend gains and retest its mid-April 2024 peak of $569.10.

Bitcoin hits all-time high, fork from 2017 ignites hope for traders

Bitcoin hit a record high of $98,384 on Nov. 21, a key milestone as the cryptocurrency eyes a run to the $100,000 target. BTC was forked in 2017, creating a spin-off or alternative, Bitcoin Cash.

BCH hit a peak of $1,650 in May 2021. Since April 2024, BCH has been consolidating with no clear trend formation.

BCH price rallied nearly 30% since Nov. 15, on-chain indicators show that further rally is likely in the Bitcoin spin-off token.

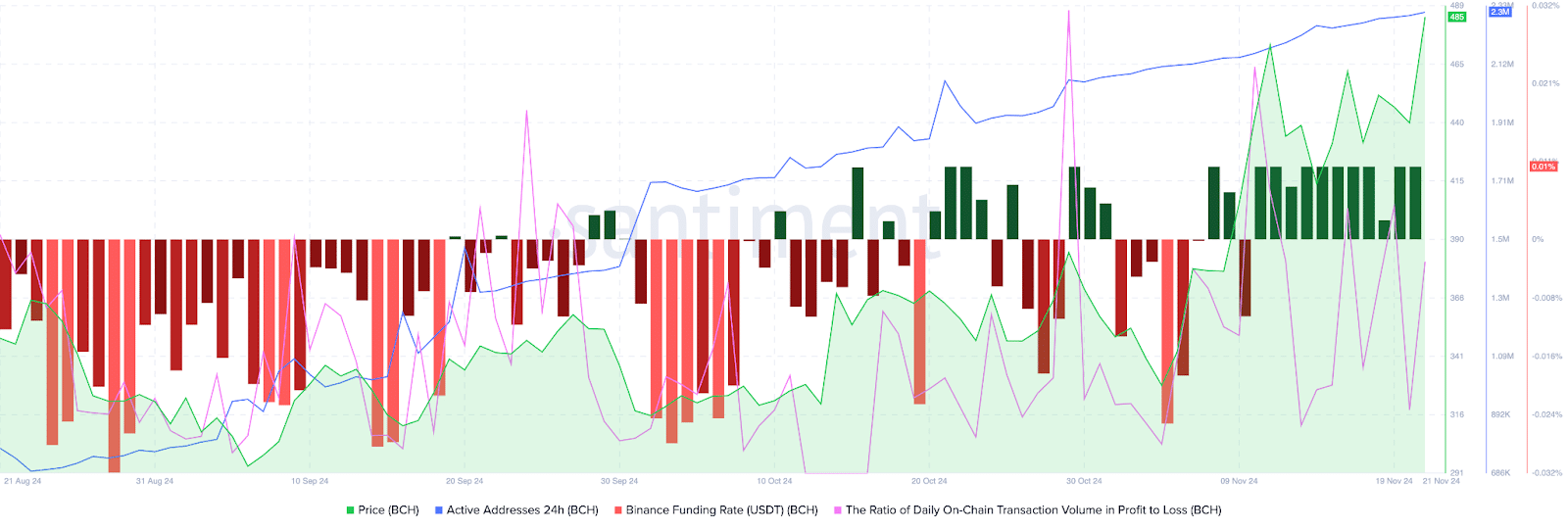

Bitcoin Cash’s active addresses have climbed consistently since August 2024. Santiment data shows an uptrend in active addresses, meaning BCH traders have sustained demand for the token, supporting a bullish thesis for the cryptocurrency.

The ratio of daily on-chain transaction volume in profit to loss exceeds 2, is 2.141 on Thursday. BCH traded on-chain noted twice as many profitable transactions on the day, as the ones where losses were incurred. This is another key metric that paints a bullish picture for the token forked from Bitcoin.

Binance funding rate is positive since Nov. 10. In the past eleven days, traders have been optimistic about gains in BCH price, according to Santiment data.

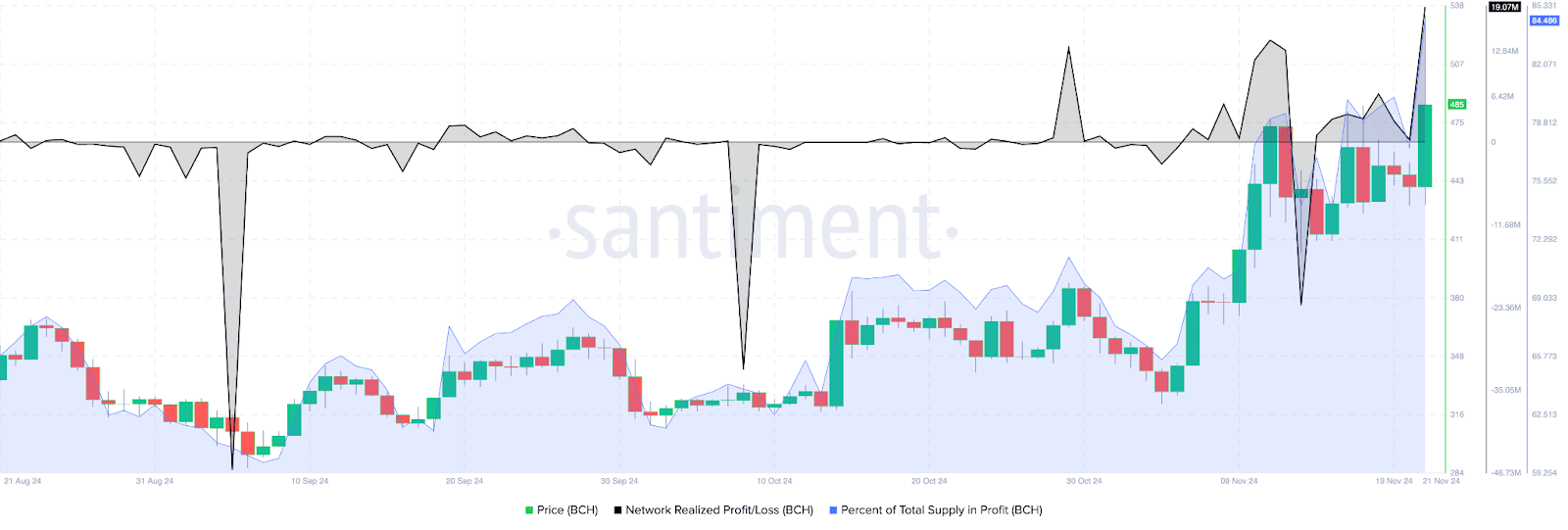

The network realized profit/loss metric identifies the net gain or loss of all traders who traded the token within a 24 hour period. NPL metric for Bitcoin Cash shows traders have been taking profits on their holdings, small positive spikes on the daily price chart represent NPL.

Investors need to keep their eyes peeled for significant movements in NPL, large positive spikes imply heavy profit-taking activities that could increase selling pressure across exchange platforms.

84.48% of Bitcoin Cash’s supply is currently profitable, as of Nov. 21. This metric helps traders consider the likelihood of high profit-taking or exits from existing BCH holders, to time an entry/ exit in spot market trades.

Derivatives traders are bullish on BCH

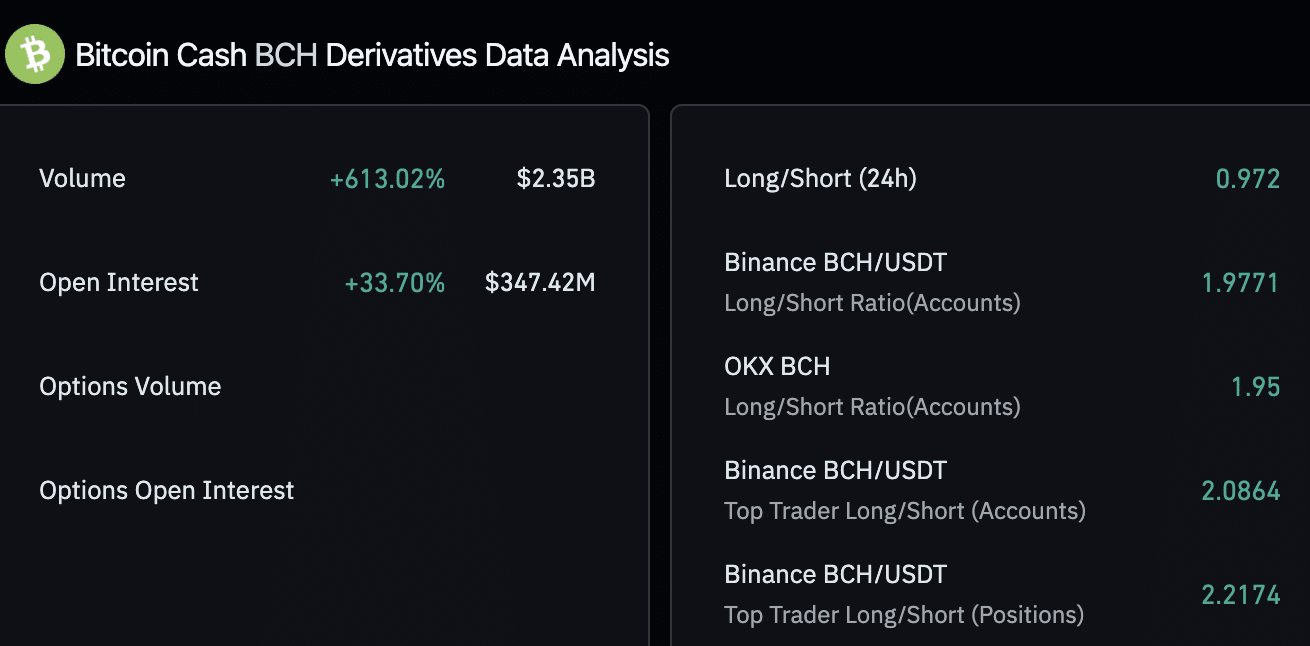

Derivatives market data from Coinglass shows a 33% increase in open interest in Bitcoin Cash. Open interest represents the total number of active contracts that haven’t been settled, representing demand for the BCH token among derivatives traders.

Derivatives trade volume climbed 613% in the same timeframe, to $2.35 billion. Across exchanges, Binance and OKX, the long/short ratio is above 1, closer to 2, meaning traders remain bullish on BCH and expect prices to rally.

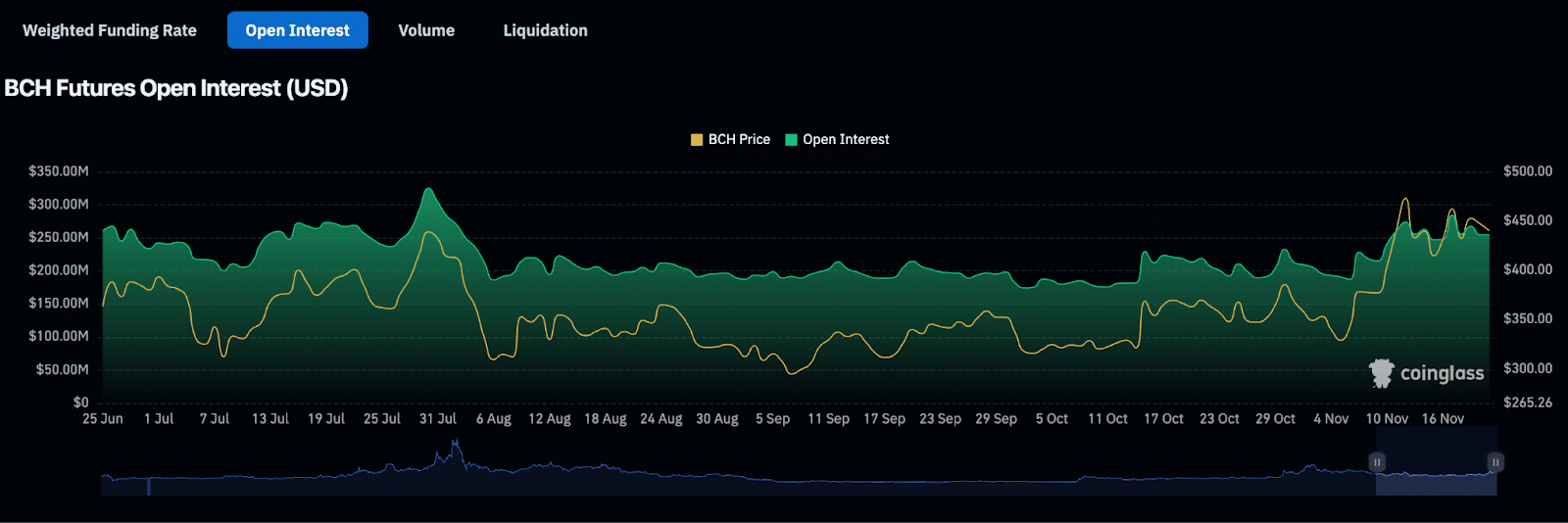

BCH futures open interest chart shows a steady increase in the metric, alongside BCH price gain since November 5, 2024. Open interest climbed from $190.74 million to $254.87 million between November 5 and 21.

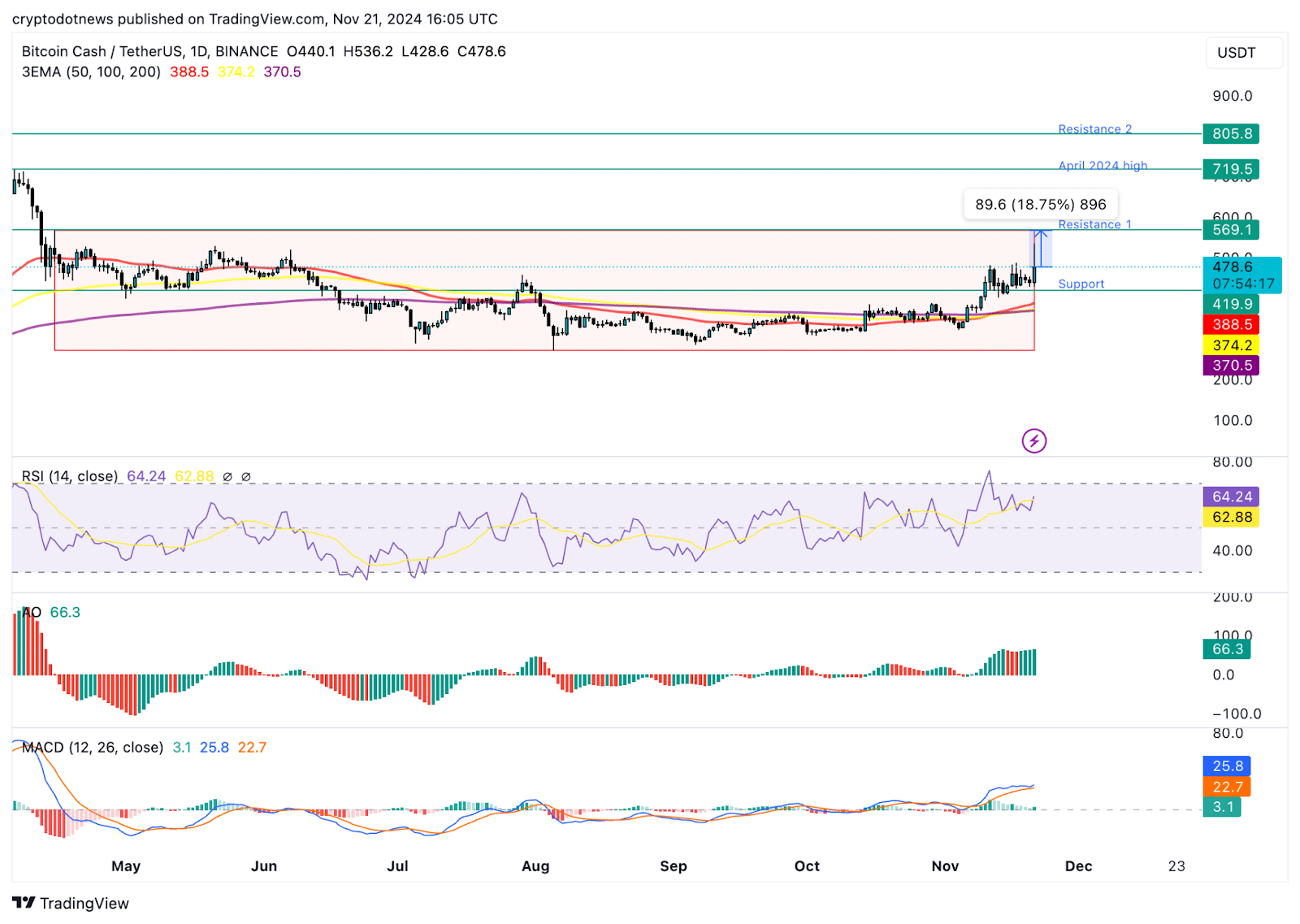

Technical indicators show BCH could gain 18%

The BCH/USDT daily price chart on Tradingview.com shows that the token remains within the consolidation. The token is stuck within a range from $272.70 to $568.20. BCH could attempt to break past the upper boundary of the range, a daily candlestick close above $568.20 could confirm the bullish breakout.

The April 2024 high of $719.50 is the next major resistance for BCH and the second key level is at $805.80, a key level from May 2021.

The relative strength index reads 64, well below the “overvalued” zone above 70. RSI supports a bullish thesis for BCH. Another key momentum indicator, moving average convergence divergence flashes green histogram bars above the neutral line. This means BCH price trend has an underlying positive momentum.

The awesome oscillator is in agreement with the findings of RSI and MACD, all three technical indicators point at likelihood of gains.

A failure to close above the upper boundary of the range could invalidate the bullish thesis. BCH could find support at the midpoint of the range at $419.90 and the 50-day exponential moving average at $388.50.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Bitcoin

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Published

14 hours agoon

November 22, 2024By

adminBitcoin has shattered expectations once again, surging past the critical $93,257 level in a display of unstoppable momentum. This breakout has ignited fresh waves of bullish optimism across the crypto market, as traders and investors anticipate greater gains. With market sentiment shifting and key indicators aligning, could this be the spark for Bitcoin’s next major rally?

As optimism steadily increases in the market, the goal is to take a closer look at BTC’s impressive breakout above the $93,257 mark, analyze the positive sentiment driving its climb, and assess the potential for continued upward strength in the market.

Bullish Indicators: What’s Fueling BTC’s Uptrend?

Currently, on the 4-hour chart, BTC is sustaining its position after successfully surpassing the $93,257 mark while trading above the 100-day Simple Moving Average (SMA). By maintaining its position above this level and the 100-day SMA, BTC demonstrates resilience and capability for more price growth, targeting new highs.

An analysis of the 4-hour Relative Strength Index (RSI) shows a significant surge, climbing to 70% from its previous low of 56%, indicating strong bullish pressure for BTC. While this increase signals growing positive market sentiment, it raises concerns about the rally’s sustainability since a price correction could occur if profit-taking ensues.

Bitcoin is showing strong positive movement after breaking past the $93,257 level, supported by a rise above the 100-day SMA, reflecting sustained bullish strength and potential for continued upward movement. The fact that BTC is consistently above the 100-day SMA suggests a solid trend and that the bulls are eager to push prices higher, possibly leading to an extended growth if pressure continues to build.

Finally, the RSI on the daily chart is currently at 81%, well above the key 50% threshold, signaling a strong uptrend for Bitcoin. With the RSI at this level, it suggests that the upside pressure is likely to continue, which means that Bitcoin’s price could keep rising in the near term, as there are no signs of a reversal or decline.

What The $93,257 Breakout Signals For Bitcoin

The $93,257 breakout opens the door to a more optimistic future outlook for Bitcoin. This key resistance level has been decisively breached, suggesting that BTC may continue its upbeat momentum, potentially targeting higher price levels such as the $100,000 mark and beyond.

However, careful monitoring is essential for any signs of resistance or market corrections that could hinder its ascent. Should such a scenario occur, Bitcoin’s price could begin to drop toward the $93,257 mark. A break below this level might trigger further declines, possibly testing additional support levels in the process.

Source link

Bitcoin

Bitcoin Approaches $100K; Retail Investors Stay Steady

Published

14 hours agoon

November 22, 2024By

admin

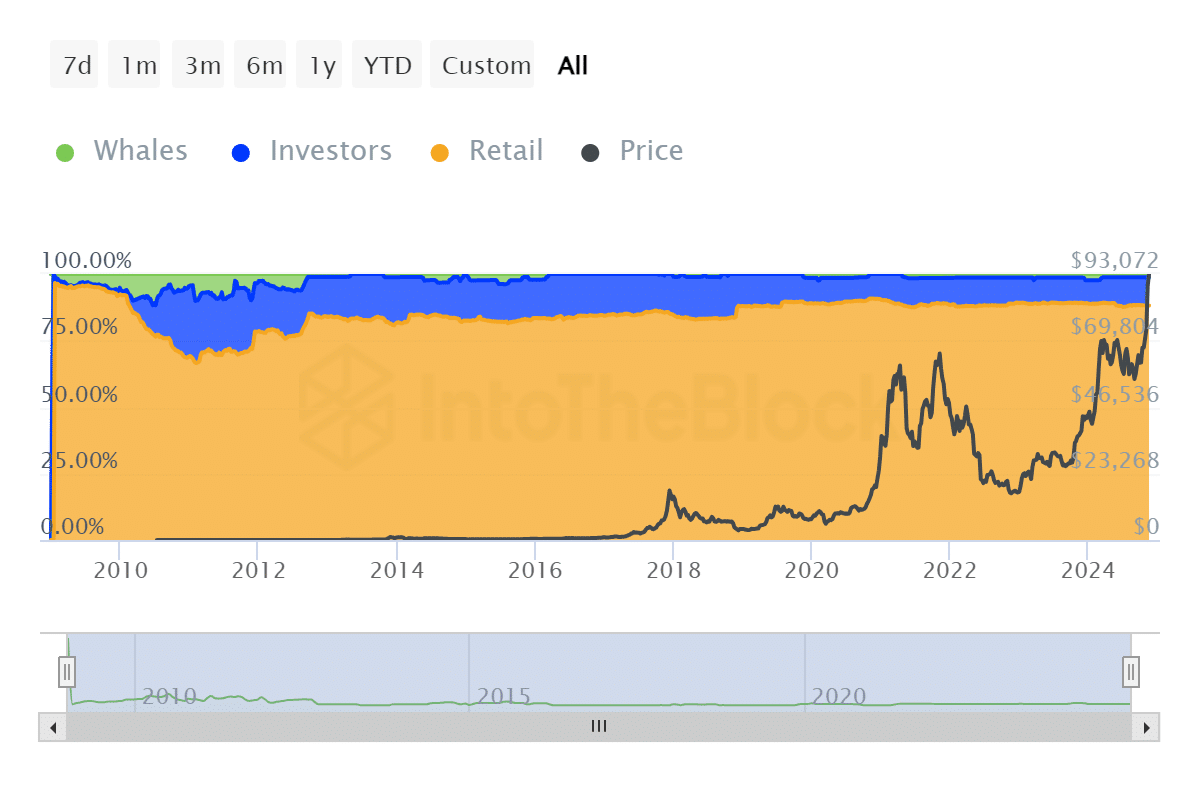

Bitcoin trades at $99,340.23, approaching the $100K mark as retail investors retain market dominance.

What is more interesting about this rally is the dominance of retail investors, who currently account for 88.07% of all Bitcoin (BTC) in circulation, according to The Block. Contrary to the recent claims that institutional investors are leaving retail investors behind in ownership of BTCs, the asset is still in the hands of retail investors, which underlines their stronghold in the market. This grassroots stronghold contrasts the much smaller shares held by whales at 1.26% and institutional investors at 10.68%.

Adding momentum to BTC, the historic debut of BlackRock’s BTC ETF options witnessed $1.9 billion in notional value traded on the first day. It is a landmark news because it signifies growing institutional interest in BTC, yet lowers entry barriers for everyday investors. But there’s still some way to go, says Jeff Park, Head of Alpha Strategies at Bitwise Invest, in his observations on X about the ETF’s potential to reshape access to BTC.

1/ Just as we expected, the market launched with a beautiful “volatility smile” quickly established by 945AM and for the rest of the day. In fact, the smile got even wider throughout the day, finishing with higher wings by EoD. pic.twitter.com/BHI09pORS4

— Jeff Park (@dgt10011) November 20, 2024

Bitcoin Breakdown:

How BTC ownership is distributed supports the overall trend of asset availability in the market. Companies such as Coinbase have substantial quantities of BTC, holding more than 2.25 million BTC. However, most of this is kept for their clients. Satoshi Nakamoto‘s wallet, which contains 96,8452 BTC, remains untouched as it played a role in creating the Genesis block.

Overall, funds and ETFs account for 1.09 million BTC, or about 5.2%, while governments such as the U.S. and China collectively hold around 2.5%.

Despite BTC witnessing price surges, the market is far from stable and often shows extreme volatility. For instance, on Nov. 21, the price of BTC dipped to $95,756.24, with trading volume reaching $98.40 billion. This volatility then reflects the vital role that retail investors play during price hikes, even as institutional investors become more active in the market.

Some argue that BTC is becoming more centralized, but the data does not back this claim. Financial products like ETFs are attractive to institutions, but they also make BTC more accessible to retail investors. BTC continues to align with Satoshi Nakamoto’s vision of a decentralized and democratized financial system. As BTC nears the $100,000 threshold, its open-and-shut conversation that BTC’s ownership remains essential.

Source link

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential