Blockchain

SBI Holdings embraces blockchain gaming, invests in Oasys

Published

3 months agoon

By

admin

The latest deal in the blockchain space will mesh old-school finance with next-generation gaming.

SBI backs Oasys

SBI Holdings Inc., founded in 1999, is touted as one of the largest financial conglomerates in Japan. It specializes in traditional finance (aka tradfi), including asset management and venture capital.

Over the past few years, the firm started integrating blockchain technology into its services. It even developed its own cryptocurrency exchange called SBI VC Trade.

As of Aug. 29, a new segment is being added to its portfolio via a partnership with the Oasys blockchain network: gaming.

The Tokyo-based firm invested an undisclosed amount in Oasys, promising to enhance “synergies” with the game tokens on the blockchain.

“From its inception, [Oasys] has included several globally renowned major game development companies as initial validators,” SBI CEO Yoshitaka Kitao said in a blog post confirming the deal.

Earlier in the year, SBI and Oasys had partnered on an NFT initiative. But it’s worth noting that NFTs, or non-fungible tokens, are plummeting in value.

In contrast, Oasys shows more promise by making inroads with video game companies. After all, the Oasys network is affiliated with household names like Sega and Ubisoft.

In February, Oasys partnered with Com2uS to integrate several game franchises, including ‘Summoners War: Chronicle’ and ‘The Walking Dead: All Stars,’ onto its network.

Since 2021, Singapore-based Oasys raised about $20 million throughout three funding rounds.

In addition to SBI, Hyperithm — a Tokyo- and Seoul-based digital asset financial service provider backed by Coinbase, Samsung, Kakao and Hashed — also invested an undisclosed amount.

Tradfi’s new territory

This isn’t the first time SBI has expressed interest in digital tokens or blockchain technology.

In 2016, SBI created a new company called SBI Ripple Asia, which expanded the use of Ripple (XRP) products throughout China, Korea, Japan and Taiwan. It was also a part of the consortium that launched the R3 blockchain initiative.

And SBI is just one of several old-school finance firms dipping their toes in the burgeoning sector.

JPMorgan Chase remains committed to expanding its Onyx segment, hoping to further integrate blockchain into mainstream financial services. And BlackRock, along with Fidelity, began offering cryptocurrency exposure to clients, including Bitcoin ETFs and digital asset funds.

These moves reflect a broader trend of institutional adoption, driven by the bet that blockchain can enhance transparency, security, and efficiency in financial services.

SBI’s Oasys investment, however, is unique in that video games play a prominent role in the partnership.

According to Deloitte’s 2024 banking outlook report, blockchain-based and fiat currency-backed stablecoins are “entering the world of consumer payments.”

As tradfi continues to merge with the world of crypto and blockchain, the line between traditional and digital finance is becoming increasingly blurred, paving the way for a more interconnected and innovative financial system.

By investing in Oasys, SBI Holdings is seemingly looking to stay ahead of the curve.

Source link

You may like

Donald Trump Proposed Crypto Advisory Council To Set Up Strategic Bitcoin Reserve

Want Greater Bitcoin Adoption? Engage With Your Government.

Why the Media Loves the Worst of Crypto

HashCats prepares for Token Generation Event after completing mining season

Gary Gensler To Step Down As US SEC Chair In January

The Chart That Shows Bitcoin’s Bull Run Won’t Stop at $100,000

Blockchain

Sui Network blockchain down for more than two hours

Published

10 hours agoon

November 21, 2024By

admin

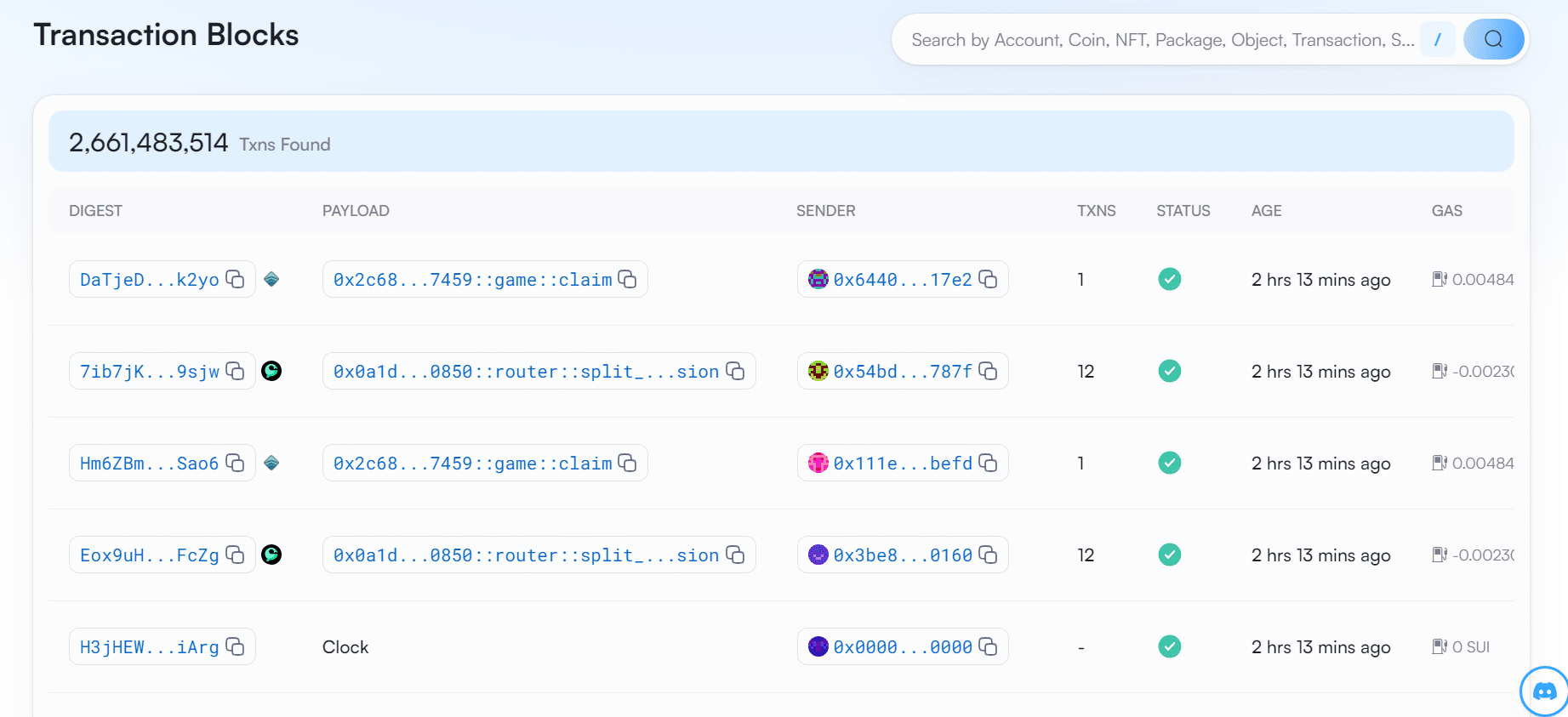

The Sui Network is suspected to be down for more than two hours. The protocol has not produced any new transaction blocks since Nov. 21 UTC 9:15.

Based on the latest data from Sui Network’s explorer site Sui Vision, the decentralized layer-1 blockchain has stopped producing blocks for more than two hours.

At the time of writing, the last transaction block took place on Nov. 21 at 9:15 am UTC. Since then, no new blocks have been produced on the blockchain.

The Sui Network confirmed the outage on its official X account, stating that the blockchain is currently unable to process transactions. However, it claims that the problem has been identified and will be back to normal soon.

“We’ve identified the issue and a fix will be deployed shortly. We appreciate your patience and will continue to provide updates,” wrote the protocol on X.

Service Announcement: The Sui network is currently experiencing an outage and not processing transactions. We’ve identified the issue and a fix will be deployed shortly. We appreciate your patience and will continue to provide updates.

— Sui (@SuiNetwork) November 21, 2024

Sui’s blockchain outage has seemingly impacted the SUI token price. According to data from crypto.news, the Sui token has gone down by nearly 2% in the past hour. It is currently trading hands at $3.41. In the past 24 hours, SUI has plummeted by 7.29%.

Even though, the token has gone up by nearly 75% in the past month.

SUI currently ranks in the 18th place in the lineup of cryptocurrencies, holding a market cap of $9.7 billion and a fully diluted valuation of $34 billion. The Sui token has a circulating supply of $2,8 billion tokens.

The South Korean crypto exchange, Upbit, announced it will be temporary suspending deposits and withdrawals for the Sui token due to its block generating outage.

The notice informs users that if they deposit or withdraw Sui tokens after the announcement was posted, then there is a chance that their funds cannot be recovered.

Several crypto industry figures took to X to comment on the recent Sui Network outage. Most of them teased Sui’s goal of becoming Solana’s biggest competitor. Ironically, the Solana blockchain also has a track record of outages in the past, with the latest one recorded in February this year.

“Sui [is] just repeating Solana history,” said one X user.

“Hasn’t Solana gone down multiple times?” asked another X user.

“SUI blockchain is down. And they claimed to be a Solana Killer,” wrote crypto YouTuber Ajay Kashyap on his X post.

Source link

Blockchain

SBI, UBS and Chainlink complete pilot for automated tokenized fund solution

Published

3 days agoon

November 18, 2024By

admin

SBI Digital Markets, UBS Asset Management, and Chainlink have successfully completed a pilot program showcasing the use of smart contracts to manage tokenized funds.

The companies announced this on Nov. 18, noting that the solution brings automated tokenized fund management to the market and leverages the Chainlink (LINK) infrastructure. With this solution, users can automate their tokenized fund management processes, unlocking blockchain capabilities for the world’s $132 trillion assets under management market.

urrently, the total real-world assets on-chain represent a market of around $13.2 billion.

Solution allows for efficient scaling of tokenized funds

According to a press release, the tokenized fund pilot demonstrated how fund managers can leverage smart contracts and Chainlink’s Cross-Chain Interoperability Protocol to efficiently scale their products on-chain and across distributors.

Central to this initiative is the Digital Transfer Agent smart contract model, a novel fund administration system that utilizes multiple Chainlink oracle networks. SBI’s custodian and fund distributor successfully deployed this model to enable multi-chain subscriptions and redemptions.

As the tokenized funds industry evolves to attract the world’s top players, the demand for on-chain administration is increasing. Notably, a recent report revealed that 93% of fund services providers do not offer full automation for their data inputs and workflow processes. This lack of automation creates key bottlenecks for traditional fund operators.

However, smart contracts, oracle networks, and tokenized funds provide the asset management industry with a pathway to full automation.

“This new way of launching fund structures and administering them via smart contracts empowers both fund managers and their service providers to deliver new on-chain financial products and lower operational costs to investors, both things they are actively looking for,” said Winston Quek, chief executive officer at SBI Digital Markets.

The solution, currently live on various blockchain testnets, will soon go to mainnet.

SBI Digital Markets, UBS Asset Management, and Chainlink announced the solution at the Singapore Fintech Festival, launching it as part of the Monetary Authority of Singapore’s ‘Project Guardian.’

This development follows a partnership between Swift, UBS Asset Management, and Chainlink aimed at bridging tokenized assets with legacy payment systems. UBS also recently unveiled a pilot for cross-border payments called “UBS Digital Cash”.

Source link

Bitcoin

Institutional Investors Go All In on Crypto as 57% Plan to Boost Allocations as Bull Run Heats Up, Sygnum Survey Reveals

Published

1 week agoon

November 14, 2024By

admin

“This report tells the story of progress and calculated risk, the use of a diverse set of strategies to leverage opportunities and most of all, the continued belief in the market’s long-term potential to reshape traditional financial markets” Lucas Schweiger, Sygnum Digital Asset Research Manager and report author, said in the press release shared with CoinDesk.

Source link

Donald Trump Proposed Crypto Advisory Council To Set Up Strategic Bitcoin Reserve

Want Greater Bitcoin Adoption? Engage With Your Government.

Why the Media Loves the Worst of Crypto

HashCats prepares for Token Generation Event after completing mining season

Gary Gensler To Step Down As US SEC Chair In January

The Chart That Shows Bitcoin’s Bull Run Won’t Stop at $100,000

$2 Million PEPE Purchase Sees 105 Billion Tokens Snapped Up

XRP price expected to reach $7, Dogecoin $3, and PCHAIN $1 from $0.004

Bitcoin Miner MARA Holdings Raises $1B To Buy More Bitcoin

Sui Network blockchain down for more than two hours

Analyst Says Six-Figure Bitcoin Price Incoming – But Warns One Factor Could Delay BTC Rally Till Next Year

How Will BTC React to $3B Buying Spree?

ECB official calls for urgency on digital euro amid global CBDC race

The Story Behind a Crypto Trader Turning $378K into $35.2M

Justin Sun Goes Bananas: Snags Controversial “Comedian” Artwork for $6.4 Million

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential