Blockchain

RCO Finance starts a new revolution in crypto by merging blockchain and artificial intelligence to create wealth.

Published

3 months agoon

By

admin

RCO Finance (RCOF) is revolutionizing crypto trading by integrating artificial intelligence with blockchain technology. By merging these advanced tools, the Ethereum-based project seeks to create a new paradigm for wealth generation.

This innovative move places RCO Finance at the forefront of decentralized finance’s evolution. Let’s discover how RCOF will use these cutting-edge technologies to transform crypto trading.

RCO Finance Merges Blockchain And AI, New Era In Crypto Trading

The decentralized finance sector is on the cusp of a dramatic shift as RCO Finance emerges with an innovative style to enhance wealth generation. By bridging artificial intelligence into blockchain technology, RCO Finance has developed a modern method to trade crypto assets or other financial instruments profitably and passively.

The platform leverages Ethereum’s blockchain resources and an AI-powered robo-advisor to achieve this goal.

The robo-advisor is an automated investment manager designed to offer cost-effective management services to users. First, it administers a survey to collect information regarding each user’s financial goals, preferences, and risk tolerance. Then, it curates strategies tailored to the information provided to ensure their satisfaction.

Given its ability to analyze market data, it can provide trading insights that investors can use to make well-informed decisions. It can also conduct market research, spot opportunities, and execute trades in the interests of traders. In other cases, the robo-advisor will direct an investor or trader to buy or sell an asset to increase trading accuracy.

RCO Finance Uses Blockchain Technology To Ensure Transparency

While the robo-advisor is meant to enhance trading results, blockchain provides the bedrock for RCO Finance’s existence. This advanced technology facilitates seamless cross-border transactions registered in a secure and decentralized ledger to ensure transparency.

Whenever a trader accesses any of the 120,000 digital assets on the platform, the transactions are executed via RCO Finance’s smart contract and recorded on the blockchain.

Among the 12,500 digital asset classes available on RCO Finance are stocks, shares, derivatives, real-world assets, and exchange-traded funds. Although exchange-traded funds are typically for institutional investors with more liquidity, RCO Finance has made them accessible to regular crypto traders by breaking them into affordable units.

Crypto traders may swap their cryptocurrencies for any other assets listed on the platform, regardless of the class to which they belong.

RCO Finance is a KYC-free platform, reflecting its commitment to protecting users’ privacy and identities. Whether beginners or expert traders, the platform is suitable for either end of the spectrum due to its user-friendly interface. Users can store their assets on the platform, given that SolidProof has audited its smart contract.

RCO Finance’s Presale Approaches A New Presale Milestone

RCO Finance is closing in on a significant presale milestone. Nearing the $2 million mark, RCOF, its native token, is poised to break a new record in terms of revenue generated. This feat can be attributed to the growing adoption of RCOF among crypto enthusiasts looking to maximize gains.

RCOF is in Stage 2 of its presale, primed for a rally to $0.4, its final presale target. This projection suggests that the token is set for a 1,000% increase in its current price, which could multiply investors’ returns tenfold. Moreover, experts believe RCOF will moon after its exchange listing, given the level of visibility that will follow.

Besides the gains, RCOF investors will enjoy exclusive benefits such as a 50% discount on purchases made at its current presale stage. Later, quarterly dividends and tier-based rewards, calculated based on how many tokens a user holds, will be paid directly into holders’ wallets. RCOF holders will also get to vote in ecosystem governance elections.

Given that this opportunity is limited to a short period, the best time to seize it is now.

For more information about the RCO Finance Presale:

Join The RCO Finance Community

The post RCO Finance starts a new revolution in crypto by merging blockchain and artificial intelligence to create wealth. first appeared on BTC Wires.

Source link

You may like

Ethereum whales accumulate RCO Finance after 2025 predictions hint at a 19,405% rally

US PCE, FOMC Minutes, & Crypto Expiry In Focus, Brace For Market Impact

Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

Senator Lummis wants to replenish Bitcoin reserves with gold

Will Toncoin Price Hit $10 After Recent 20% Rally?

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Blockchain

Blockchain Association urges Trump to prioritize crypto during first 100 days

Published

2 days agoon

November 22, 2024By

admin

The Blockchain Association has called on president-elect Donald Trump and Congress to prioritize five key actions during the administration’s first 100 days to establish the U.S. as a global leader in cryptocurrency innovation.

In an open letter, the industry group outlined specific measures to address regulatory challenges and support the domestic digital asset economy.

The Blockchain Association is a U.S.-based crypto lobbying group advocating for a regulatory framework for cryptocurrencies. They emphasized lifting the bank account ban on crypto companies and appointing new leadership for the SEC, Treasury Department, and IRS.

They also proposed creating a cryptocurrency advisory committee to work with Congress and federal regulators.

Five priorities for Trump’s first 100 days

The letter highlighted five steps aimed at fostering a supportive environment for crypto businesses and users:

- Creating a Crypto Regulatory Framework

The Blockchain Association urged Congress to draft comprehensive legislation for cryptocurrency markets and stablecoins. This framework, it argued, would balance consumer protection with innovation. Stablecoins are digital currencies tied to traditional assets, such as the U.S. dollar, offering price stability for users. - Ending the Debanking of Crypto Companies

The group expressed concern over crypto businesses losing access to banking services. These companies rely on traditional banks to handle payroll, taxes, and vendor payments. Without banking access, their operations can be severely disrupted. - Reforming the SEC and Repealing SAB 121

The association called for a new SEC chair to replace what it described as a hostile regulatory approach under the current leadership. It also recommended reversing SAB 121, an accounting rule that imposes strict requirements on crypto-related businesses. - Appointing New Treasury and IRS Leadership

Tax policies for cryptocurrencies, such as the proposed Broker Rule, have been criticized for potentially stifling innovation and driving companies offshore. The letter urged the administration to appoint leaders who would support privacy and foster a fair tax environment for digital assets. - Establishing a Crypto Advisory Council

The letter proposed a council to facilitate collaboration between the industry, Congress, and federal regulators. Public-private partnerships, it said, could create rules that protect consumers while encouraging innovation.

Crypto collaboration

In their letter, the Blockchain Association emphasized its readiness to work with the administration and 100 member organizations to ensure the U.S. regains its position as a financial and technological innovation leader.

“We stand ready to work with you to ensure the United States can regain its position as the crypto capital of the world,” the Blockchain Association wrote in the letter.

This letter comes as Trump adopts a strong pro-crypto stance. Earlier in November, reports emerged that Trump plans to create a White House position solely focused on cryptocurrency and related policies.

This letter also comes a day after crypto-foe and SEC chair Gary Gensler announced his upcoming resignation.

Source link

Blockchain

Sui Network blockchain down for more than two hours

Published

3 days agoon

November 21, 2024By

admin

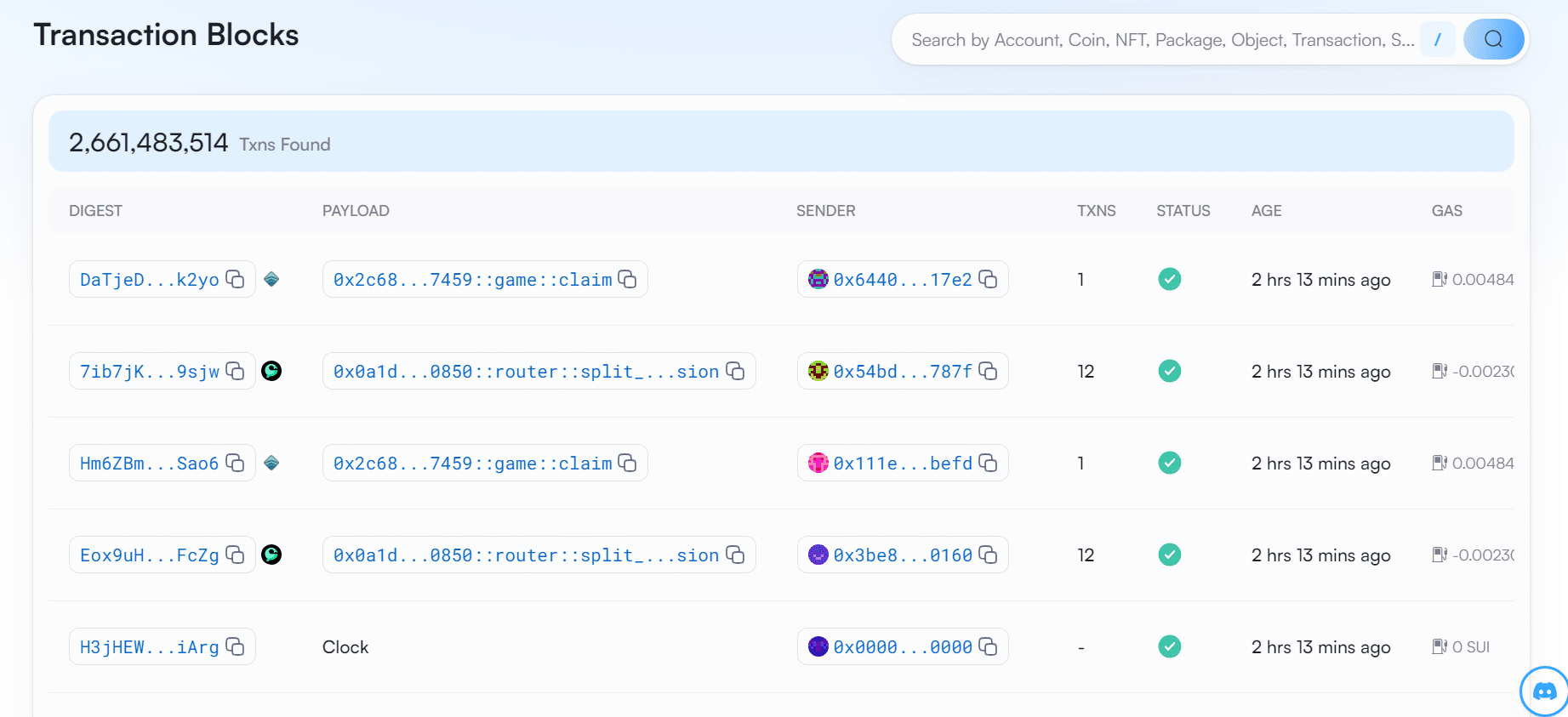

The Sui Network is suspected to be down for more than two hours. The protocol has not produced any new transaction blocks since Nov. 21 UTC 9:15.

Based on the latest data from Sui Network’s explorer site Sui Vision, the decentralized layer-1 blockchain has stopped producing blocks for more than two hours.

At the time of writing, the last transaction block took place on Nov. 21 at 9:15 am UTC. Since then, no new blocks have been produced on the blockchain.

The Sui Network confirmed the outage on its official X account, stating that the blockchain is currently unable to process transactions. However, it claims that the problem has been identified and will be back to normal soon.

“We’ve identified the issue and a fix will be deployed shortly. We appreciate your patience and will continue to provide updates,” wrote the protocol on X.

Service Announcement: The Sui network is currently experiencing an outage and not processing transactions. We’ve identified the issue and a fix will be deployed shortly. We appreciate your patience and will continue to provide updates.

— Sui (@SuiNetwork) November 21, 2024

Sui’s blockchain outage has seemingly impacted the SUI token price. According to data from crypto.news, the Sui token has gone down by nearly 2% in the past hour. It is currently trading hands at $3.41. In the past 24 hours, SUI has plummeted by 7.29%.

Even though, the token has gone up by nearly 75% in the past month.

SUI currently ranks in the 18th place in the lineup of cryptocurrencies, holding a market cap of $9.7 billion and a fully diluted valuation of $34 billion. The Sui token has a circulating supply of $2,8 billion tokens.

The South Korean crypto exchange, Upbit, announced it will be temporary suspending deposits and withdrawals for the Sui token due to its block generating outage.

The notice informs users that if they deposit or withdraw Sui tokens after the announcement was posted, then there is a chance that their funds cannot be recovered.

Several crypto industry figures took to X to comment on the recent Sui Network outage. Most of them teased Sui’s goal of becoming Solana’s biggest competitor. Ironically, the Solana blockchain also has a track record of outages in the past, with the latest one recorded in February this year.

“Sui [is] just repeating Solana history,” said one X user.

“Hasn’t Solana gone down multiple times?” asked another X user.

“SUI blockchain is down. And they claimed to be a Solana Killer,” wrote crypto YouTuber Ajay Kashyap on his X post.

Source link

Blockchain

SBI, UBS and Chainlink complete pilot for automated tokenized fund solution

Published

6 days agoon

November 18, 2024By

admin

SBI Digital Markets, UBS Asset Management, and Chainlink have successfully completed a pilot program showcasing the use of smart contracts to manage tokenized funds.

The companies announced this on Nov. 18, noting that the solution brings automated tokenized fund management to the market and leverages the Chainlink (LINK) infrastructure. With this solution, users can automate their tokenized fund management processes, unlocking blockchain capabilities for the world’s $132 trillion assets under management market.

urrently, the total real-world assets on-chain represent a market of around $13.2 billion.

Solution allows for efficient scaling of tokenized funds

According to a press release, the tokenized fund pilot demonstrated how fund managers can leverage smart contracts and Chainlink’s Cross-Chain Interoperability Protocol to efficiently scale their products on-chain and across distributors.

Central to this initiative is the Digital Transfer Agent smart contract model, a novel fund administration system that utilizes multiple Chainlink oracle networks. SBI’s custodian and fund distributor successfully deployed this model to enable multi-chain subscriptions and redemptions.

As the tokenized funds industry evolves to attract the world’s top players, the demand for on-chain administration is increasing. Notably, a recent report revealed that 93% of fund services providers do not offer full automation for their data inputs and workflow processes. This lack of automation creates key bottlenecks for traditional fund operators.

However, smart contracts, oracle networks, and tokenized funds provide the asset management industry with a pathway to full automation.

“This new way of launching fund structures and administering them via smart contracts empowers both fund managers and their service providers to deliver new on-chain financial products and lower operational costs to investors, both things they are actively looking for,” said Winston Quek, chief executive officer at SBI Digital Markets.

The solution, currently live on various blockchain testnets, will soon go to mainnet.

SBI Digital Markets, UBS Asset Management, and Chainlink announced the solution at the Singapore Fintech Festival, launching it as part of the Monetary Authority of Singapore’s ‘Project Guardian.’

This development follows a partnership between Swift, UBS Asset Management, and Chainlink aimed at bridging tokenized assets with legacy payment systems. UBS also recently unveiled a pilot for cross-border payments called “UBS Digital Cash”.

Source link

Ethereum whales accumulate RCO Finance after 2025 predictions hint at a 19,405% rally

US PCE, FOMC Minutes, & Crypto Expiry In Focus, Brace For Market Impact

Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

Senator Lummis wants to replenish Bitcoin reserves with gold

Will Toncoin Price Hit $10 After Recent 20% Rally?

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Gensler to resign as SEC chair: What’s next under Trump?

Ripple Provided The Blueprint To Defeat Gary Gensler

Another U.S. SEC Democrat to Drop Out, Leaving Republicans Running Agency by February

Catzilla vs Cardano vs TRX for year-end success

Will Polkadot Price Continue To Rally Following 100% Surge?

Dogecoin, Shiba Inu set the trend; this altcoin is ready to take the spotlight next

This Analyst Correctly Predicted The Bitcoin Price Jump To $99,000, But His Prediction Is Not Done

Analyst Who Accurately Predicted Solana Price Rally Shares Next Target

NFT sales drop 9.6% to $160.9m, Ethereum and Bitcoin network sales plunge

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential