24/7 Cryptocurrency News

AI Coins To Rally As Analyst Set $165 Price Target For NVDA Stock?

Published

3 months agoon

By

admin

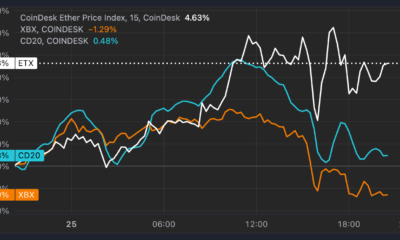

The AI coins have went through a topsy-turvy phase lately, amid a volatile scenario in the broader crypto market. In addition, the recent crash in the Nvidia stock has further dampened the market sentiment, causing a massive selloff in both the stock and crypto markets. However, a recent bullish outlook on NVDA stock price has fueled hopes over a potential rebound in the artificial intelligence-related tokens.

Analysts Remain Bullish On Nvidia Stock

The investors are keeping a close track of the AI coins, given the recent slump in the sector. Notably, the financial market has faced immense selling pressure this week, after reports emerged that US DOJ has issued a subpoena on Nvidia. The news caused a 10% drop in the NVDA stock price on Tuesday while weighing on the top AI tokens.

However, on Thursday, Nvidia refuted the claims of the DOJ’s subpoena, bolstering the market confidence. In addition, a spokesperson of the firm also said that the company would actively cooperate with the regulators if and whenever required, further boosting the investors’ confidence.

Amid this, Bank of America has reiterated its bullish stance on the company’s stock. The BofA analysts have maintained their buy rating for NVDA stock, reiterating a price target of $165, citing the “compelling growth” potential of the firm.

The analysts noted that despite the short-term challenges, the company’s stock remains attractive for investors. In addition, the recent dip in its price will further provide buying opportunity to the investors.

Meanwhile, the analysis also highlights the high demand for the company’s AI chips, which is likely to grow in the coming days. Simultaneously, the recent robust Nvidia earnings results have also fueled market sentiment, making its stock a favorite for many.

AI Coins To Rally?

The recent bullish outlook has fueled discussions over a potential recovery in the AI coins sector. Although the sector is still in the red, amid a broader market downturn today, these latest developments are likely to boost the market sentiment.

For context, AI-related crypto usually follows the movement of the big AI firms. In other words, any positive developments in technology, especially in the artificial intelligence sector, tend to boost the prices of these tokens.

As of writing, the top AI coins like NEAR, ICP, and FET, have traded in the red in the last 24-hour timeframe. However, over the past hour, NEAR price was up 0.68% to $3.78, while FET price rose 1.24% to $1.09. Simultaneously, ICP price noted a surge of 0.98% to $7.33.

At the same time, NVDA stock noted gains of 1.02% and exchanged hands at $107.2501, wiping off some of its recent losses. Notably, the stock closed at $106.21 on Wednesday.

Rupam Roy

Rupam, a seasoned professional with 3 years in the financial market, has honed his skills as a meticulous research analyst and insightful journalist. He finds joy in exploring the dynamic nuances of the financial landscape. Currently working as a sub-editor at Coingape, Rupam’s expertise goes beyond conventional boundaries. His contributions encompass breaking stories, delving into AI-related developments, providing real-time crypto market updates, and presenting insightful economic news. Rupam’s journey is marked by a passion for unraveling the intricacies of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Trump holds $7 million in crypto: Arkham Intelligence

John Deaton Calls Out Gary Gensler For Ties With Sam Bankman-Fried

Ethereum’s ETH Outperforms as Bitcoin (BTC) Price Recoils Off $100K Sell Wall

Safegcd’s Implementation Formally Verified

US detaining Bitcoin mining equipment at border: report

Robinhood Lists Dogwifhat, WIF Price To $5?

24/7 Cryptocurrency News

John Deaton Calls Out Gary Gensler For Ties With Sam Bankman-Fried

Published

1 hour agoon

November 25, 2024By

admin

Pro-XRP lawyer John Deaton has questioned the relationship between U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler and FTX founder Sam Bankman-Fried (SBF). Deaton’s comments came in response to the SEC’s announcement of record-breaking financial remedies in its fiscal year 2024 enforcement actions.

John Deaton Accuses SEC of Favoritism Toward Sam Bankman-Fried

In a recent post on X, John Deaton criticized Gary Gensler for holding private meetings with FTX’s Sam Bankman-Fried while denying similar access to U.S.-based crypto executives such as Coinbase CEO Brian Armstrong and Kraken’s Jesse Powell. These actions according to John Deaton demonstrated favoritism by the SEC.

Deaton also pointed to the $10m contribution by Bankman-Fried to politicians as another reason that may have enabled FTX to enter the regulatory talks. The lawyer criticized Gary Gensler, he posed that this financial connection must have been behind the courtesy given to the offshore crypto exchange.

The Pro-XRP lawyer’s criticism comes as SEC Chair Gary Gensler announced he will step down from his position on January 20, 2025. The announcement, made via an SEC press release and confirmed by Gensler in a post on X, coincides with the inauguration of Donald Trump as the 47th president of the United States

SEC Reports Record $8.2 Billion in Financial Remedies

Additionally, the SEC announced it had secured $8.2 billion in financial remedies during fiscal year 2024. This was highest amount recorded by the regulatory body in its history. Despite this achievement, the Commission reported a 26% decline in total enforcement actions compared to the previous fiscal year, filing 583 cases. Of these, 431 were classified as “stand-alone” actions, representing a 14% drop from fiscal year 2023.

Notably, $4.6 billion of the financial remedies stemmed from the SEC’s case against Terraform Labs and its founder, Do Kwon. The judgment accounted for over half of the year’s total recoveries.

Meanwhile, John Deaton has used the SEC’s recent actions to renew his calls for regulatory reform. The pro-XRP lawyer argued recently that the agency’s approach relies on outdated laws to regulate emerging technologies.

In addition, following Gensler’s expected resignation, Deaton has endorsed Brad Bondi as a potential replacement for Gensler. John Deaton cited the need for a clear and fair regulatory framework that fosters innovation in the blockchain.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Robinhood Lists Dogwifhat, WIF Price To $5?

Published

5 hours agoon

November 25, 2024By

admin

Robinhood has added Dogwifhat (WIF), a Solana-based meme coin, to its cryptocurrency trading options, generating considerable excitement among traders and investors. Known for its limited crypto offerings, Robinhood’s inclusion of WIF signals the growing acceptance of meme coins within mainstream trading platforms. Following the announcement, WIF price surged by over 13% within an hour, reaching a weekly high of $3.655 before consolidating.

Dogwifhat WIF Price Could Hit $5 as Robinhood Expands Crypto Offerings

Following a recent announcement, Dogwifhat (WIF) on Robinhood’s platform has sparked optimism regarding the meme coin’s future price trajectory. This marks a notable expansion in Robinhood’s crypto portfolio, which has historically included only a few carefully selected cryptocurrencies. WIF is the second meme coin added by Robinhood this month, following the listing of Pepe, another highly popular project.

The WIF price reached a peak of $3.655 after the announcement, reflecting increased trading activity and market interest. Experts suggest that if WIF breaks key resistance levels around $3.75, it could see further growth. If the bullish sentiment persists, market analysts project a potential rise to $5.

Data from CoinMarketCap indicates that Dogwifhat experienced a 50% rise in trading volume within 24 hours of the Robinhood announcement. This surge in activity reflects heightened interest among investors and traders. The coin’s open interest also climbed by 9%, signaling strong participation in futures and options markets.

Technical Indicators Support The Possibility of Further Growth

The Stochastic RSI on the chart indicates that the asset recently experienced overbought conditions near 80 and has since dropped to the 11-12 range, signaling oversold levels. This suggests a potential for a bullish reversal with current momentum.

The Bull and Bear Power (BBP) indicator also shows positive momentum at 0.2377, suggesting bulls maintain control despite recent corrections. The bullish histogram reflects strong buying interest.

Robinhood’s decision to list Dogwifhat highlights the evolving role of top meme coins in the cryptocurrency market. Meme tokens like WIF have historically attracted new investors during bullish market conditions. With growing cryptocurrency options, Robinhood’s endorsement of WIF indicates increasing confidence in the meme coin sector.

Dogwifhat’s market capitalization is now $3.3 billion, making it the fifth-largest meme coin by valuation. This follows a recent analysis that highlights WIF price potential to hit its all-time high (ATH) this week.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience, having contributed significantly to various media outlets on cryptocurrency trends and technologies. With over 4000 published articles across various media outlets, he aims to inform, educate and introduce more people to the Blockchain and DeFi world. Outside of his journalism career, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Super Pepe Coin Whale Sells 130B PEPE, Shifts Focus To EIGEN

Published

16 hours agoon

November 25, 2024By

admin

Amid a highly turbulent crypto market witnessed as the week kicks off, a super Pepe Coin whale shifted focus to EIGEN has sparked significant market discussions. Notably, on-chain data pointed out a massive 130 billion PEPE whale selloff, with the investor simultaneously diversifying his portfolio by buying over 200K of the Ethereum-based token.

This swap of positions, amid a slumping action witnessed by the meme coin and a gaining action seen by the EigenLayer ecosystem token, set off waves of speculations over the coins’ future tendencies.

Super Pepe Coin Whale Refocuses Investments, Buys EIGEN

According to whale data by Spot On Chain as of November 25, a super whale sold 74.07 billion in Pepe Coin worth $1.53 million for 448.1 ETH as the price dropped recently. The same whale was recorded offloading 130.2 billion of the meme coin, worth $2.71 million, for 891 ETH over the past three days. Although this massive selling caused market tension, it’s noteworthy that the super whale still holds 3.241 trillion Pepe Coin, with a 12.6x profit of $68.3 million.

However, the same whale also focused on buying EIGEN, swapping 181.3 ETH for 217,348 of the Ethereum-based token over the past two days. The whale currently holds 1.608 million of the EigenLayer token, worth $4.31 million, with an 11% profit. Overall, the trade swap sparked significant optimism over the EigenLayer ecosystem’s primary token, while market watchers monitor the leading meme coin closely.

PEPE & EIGEN Prices Show Mixed Actions

While the meme coin’s price slipped, aligning with the selloff by super Pepe Coin whale, the Ethereum-based coin rose, leveraging buying pressure. PEPE price was down 2% intraday and 5% weekly, trading at $0.00002026. Its 24-hour low and high were $0.00001918 and $0.00002086, respectively.

Whereas, EIGEN price soared nearly 7% intraday and 23% weekly, reaching $3.06. The coin’s 24-hour low and high were $2.56 and $3.07, respectively. While crypto market participants remain optimistic about the Ethereum-based token in light of the massive accumulation, the remaining massive PEPE holdings add a layer of intrigue to the leading meme coin’s price action ahead.

Intriguingly, a recent Pepe coin price analysis by CoinGape Media flagged that the meme coin eyes a $0.000025 target, with significant potential upside for further momentum. This optimistic projection comes against the backdrop of bullish technical formations on the frog-themed crypto’s price chart. Market watchers continue to eye both coins for future price action shifts as the broader market continues to showcase price fluxes.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Trump holds $7 million in crypto: Arkham Intelligence

John Deaton Calls Out Gary Gensler For Ties With Sam Bankman-Fried

Ethereum’s ETH Outperforms as Bitcoin (BTC) Price Recoils Off $100K Sell Wall

Safegcd’s Implementation Formally Verified

US detaining Bitcoin mining equipment at border: report

Robinhood Lists Dogwifhat, WIF Price To $5?

MicroStrategy Adds 55,500 More BTC To Its Portfolio For $5.4 Billion

Newmarket Capital Launches Battery Finance, Bitcoin-Collateralized Loan Strategy

Can the XRP price realistically jump to $10 in 2024?

Shiba Inu Price Eyes 76% Rally As 6.8m SHIB Tokens Burned

VanEck Doubles Down on Big Bitcoin Price Target, Says Key Indicators Continue To ‘Signal Green’

Multichain AI token poised to dethrone SOL, TON: 5,000% gains expected

Will Pi Network Price Reach $100 in This Bull Market?

Axie Infinity developer cuts 21% workforce: report

Chill Guy Meme Coin Pumps Another 50% as Creator Fights Back

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: