Bitcoin Magazine Pro

Bitcoin's Potential Rally Amid U.S. Dollar Weakness

Published

3 months agoon

By

admin

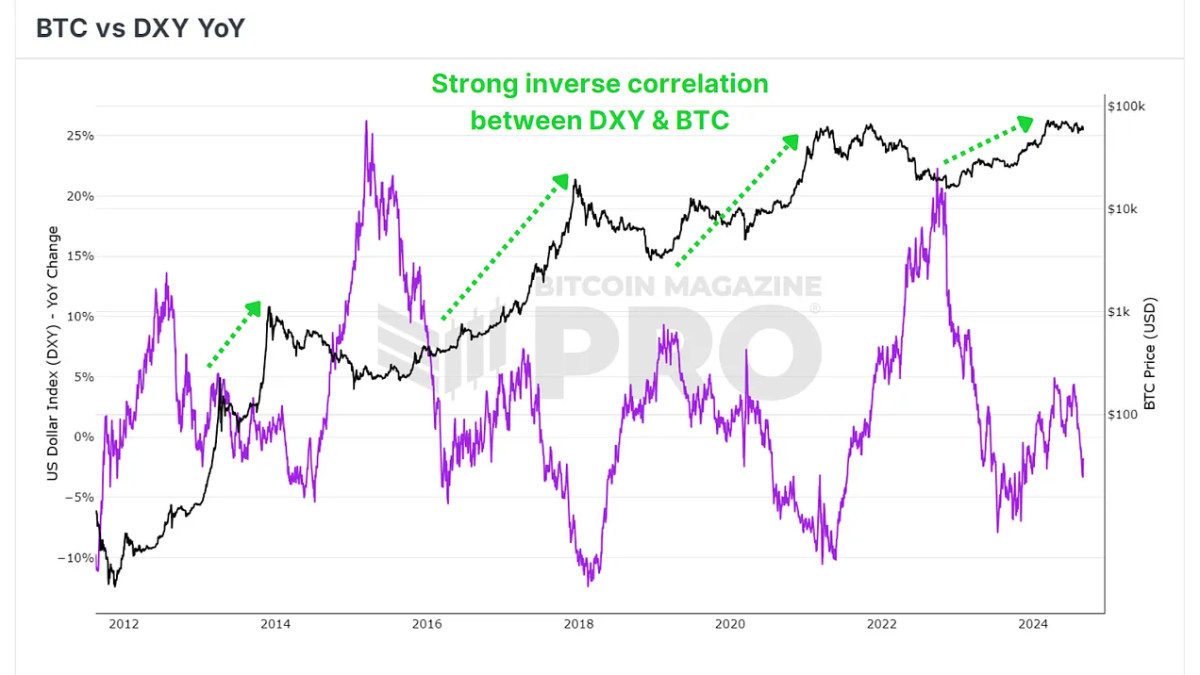

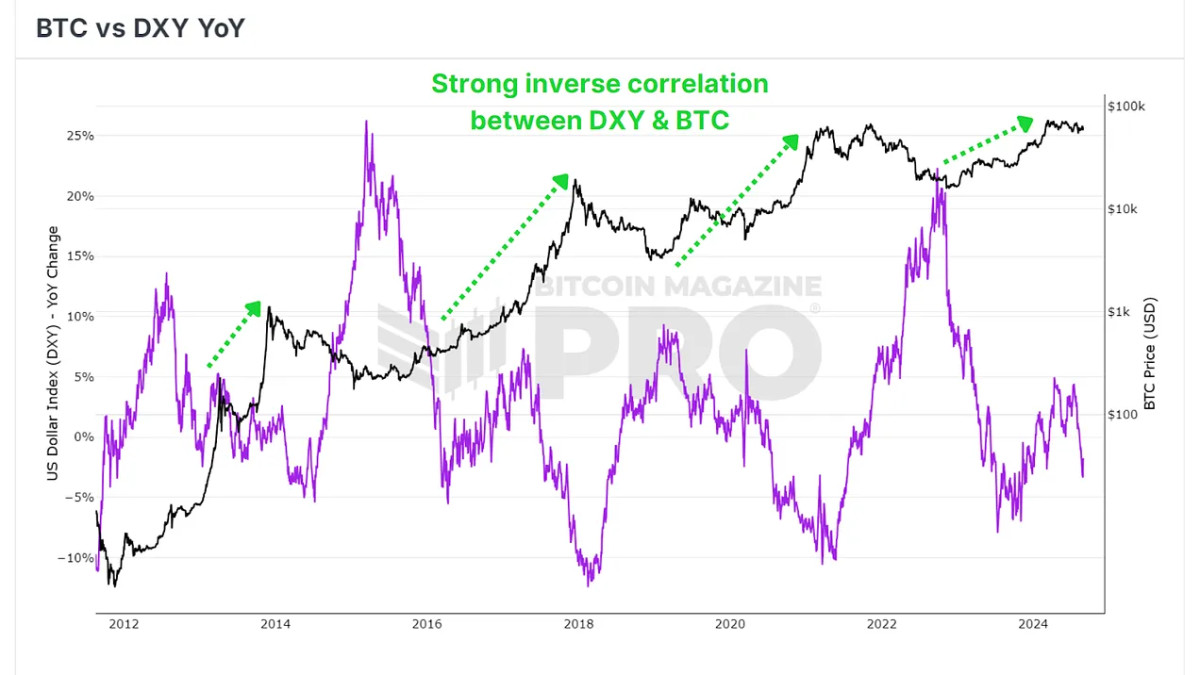

Bitcoin and the U.S. dollar have a long-standing inverse correlation, notably when observing the Dollar Strength Index (DXY). When the dollar weakens, Bitcoin often gains strength, and this dynamic might now be setting the stage for restarting the BTC bull cycle.

DXY

The Dollar Strength Index (DXY) measures the value of the U.S. dollar against a basket of other major global currencies. Historically, a declining DXY has often coincided with significant rallies in Bitcoin’s price. Conversely, when the DXY is on the rise, Bitcoin tends to enter a bearish phase.

We have recently seen a significant decline in the DXY, which could be signaling a shift toward a more risk-on environment in financial markets. Typically, such a shift is favorable for assets like Bitcoin. Despite this downturn in the DXY, Bitcoin’s price has remained relatively stagnant, raising questions about whether BTC might soon experience a catch-up rally.

Sentiment Shifting

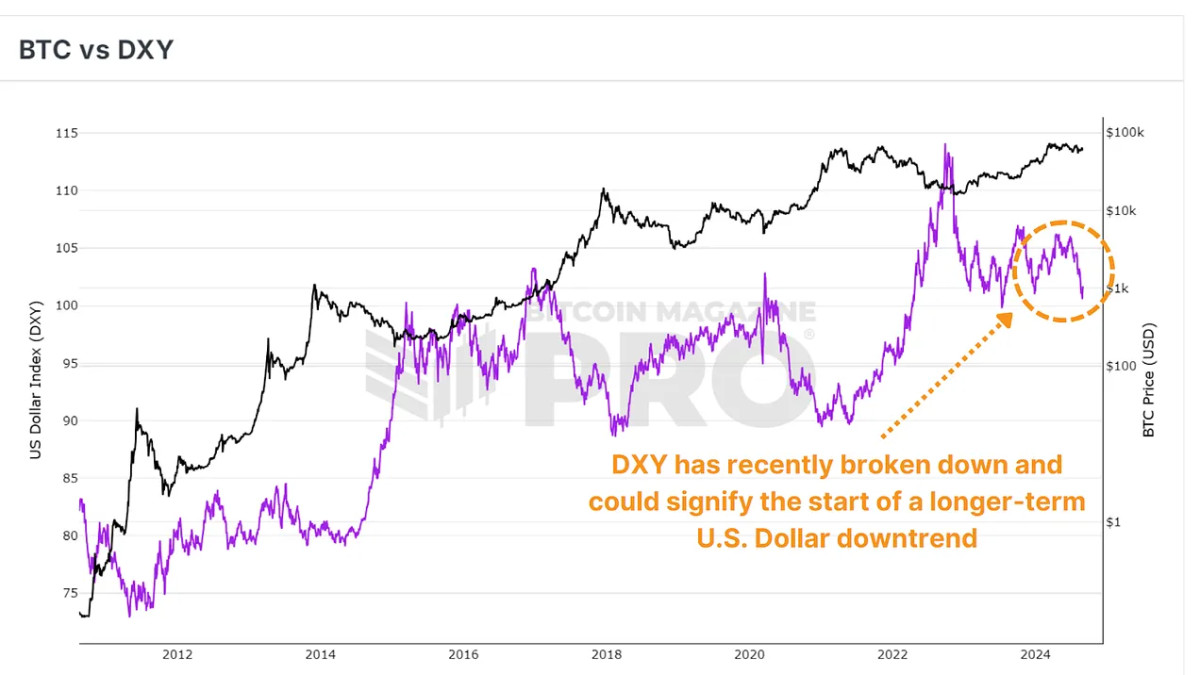

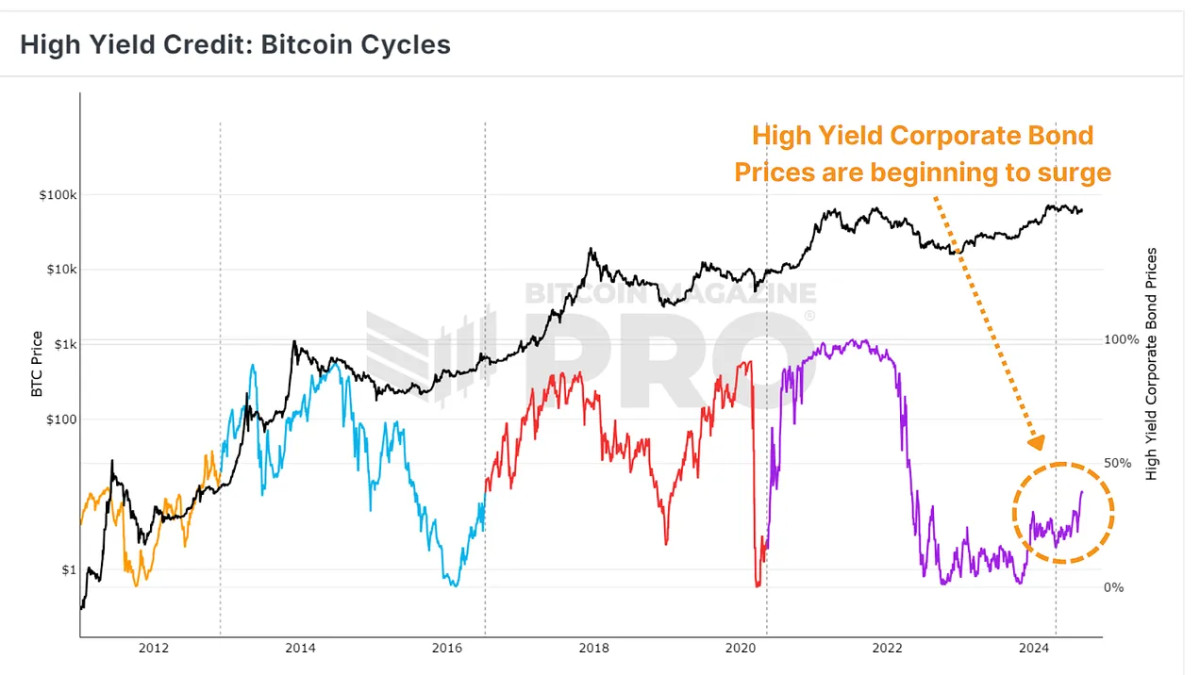

Coinciding with the decrease in demand for the U.S. dollar, the high-yield credit data suggests increasing demand for higher-yielding corporate bonds. This indicates that investors are more eager to obtain outsized returns, and historically this appetite has resulted in more significant capital inflows and higher prices as a result for Bitcoin.

Lagging Behind?

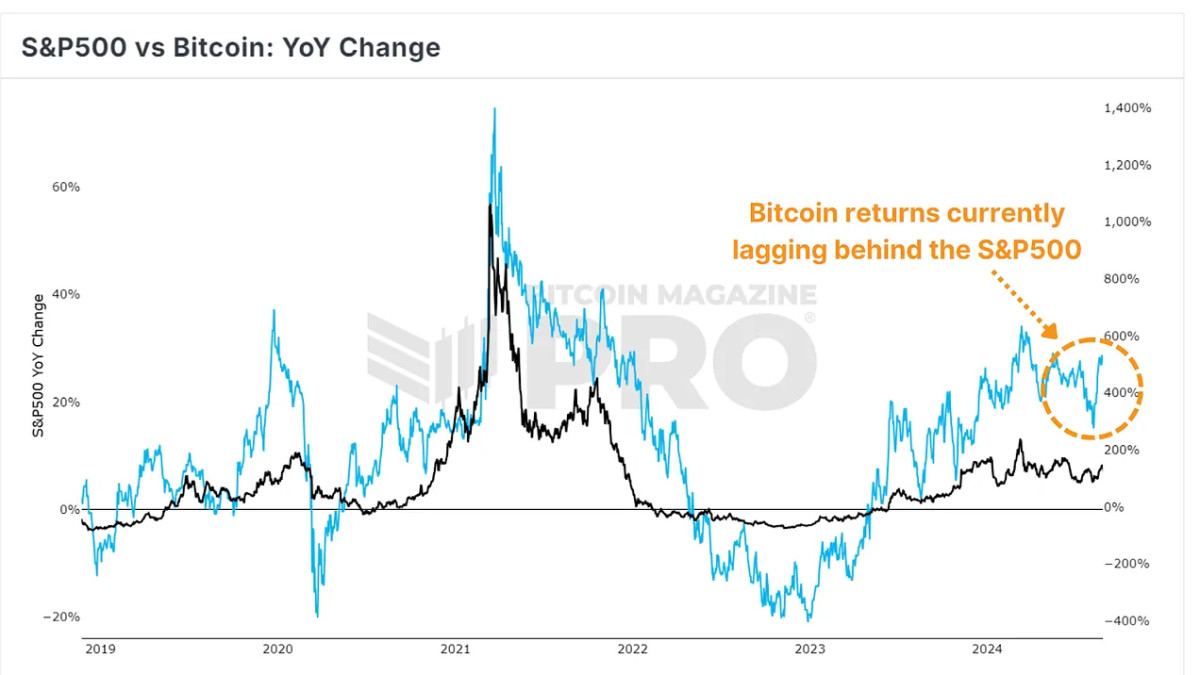

In comparison, the S&P 500 has seen substantial growth in recent weeks, while Bitcoin has remained relatively stagnant. However, the increasing correlation between Bitcoin and the S&P500 suggests that Bitcoin might soon follow the upward trend we’ve seen in traditional equities.

Conclusion

In summary, while Bitcoin has been slow to react to the recent decline in the DXY, the broader market conditions suggest a potential for a bullish phase in our current cycle. We’ve seen a shift in sentiment amongst traditional market investors and, subsequently, a period of outperformance for the S&P500.

Whether the market is overestimating the impact of the dollar’s decline remains to be seen, but the potential for a rally is there.

For a more in-depth look into this topic, check out a recent YouTube video here: The US Dollar Decline Will Be the BTC Bull Market Catalyst

Source link

You may like

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

Bitcoin Magazine Pro

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Published

11 hours agoon

November 22, 2024By

admin

The Bitcoin Pi Cycle Top Indicator has gained legendary status in the Bitcoin community for its uncanny accuracy in identifying market cycle peaks. Historically, it has timed every single Bitcoin cycle high with remarkable precision—often within just three days. Could it work its magic again this cycle? Let’s dive deeper into how it works and its significance in navigating Bitcoin’s market cycles.

What is the Pi Cycle Top Indicator?

The Pi Cycle Top Indicator is a tool designed to identify Bitcoin’s market cycle tops. Created by Philip Swift, Managing Director of Bitcoin Magazine Pro in April 2019, this indicator uses a combination of two moving averages to forecast cycle highs:

- 111-Day Moving Average (111DMA): Represents the shorter-term price trend.

- 350-Day Moving Average x 2 (350DMA x 2): A multiple of the 350DMA, which captures longer-term trends.

When the 111DMA rises sharply and crosses above the 350DMA x 2, it historically coincides with Bitcoin’s market cycle peak.

The Mathematics Behind the Name

Interestingly, the ratio of 350 to 111 equals approximately 3.153—remarkably close to Pi (3.142). This mathematical quirk gives the indicator its name and highlights the cyclical nature of Bitcoin’s price action over time.

Why Has It Been So Accurate?

The Pi Cycle Top Indicator has been effective in predicting the peaks of Bitcoin’s three most recent market cycles. Its ability to pinpoint the absolute tops reflects Bitcoin’s historically predictable cycles during its adoption growth phase. The indicator essentially captures the point where the market becomes overheated, as reflected by the steep rise of the 111DMA surpassing the 350DMA x 2.

How Can Investors Use This Indicator?

For investors, the Pi Cycle Top Indicator serves as a warning sign that the market may be approaching unsustainable levels. Historically, when the indicator flashes, it has been advantageous to sell Bitcoin near the top of the market cycle. This makes it a valuable tool for those seeking to maximize gains and minimize losses.

However, as Bitcoin matures and integrates further into the global financial system—bolstered by developments like Bitcoin ETFs and institutional adoption—the effectiveness of this indicator may diminish. It remains most relevant during Bitcoin’s early adoption phase.

A Glimpse Into the Future

The big question now is: will the Pi Cycle Top Indicator remain accurate in this cycle? With Bitcoin entering a new era of adoption and market dynamics, its cyclical patterns may evolve. Yet, this tool has proven its worth repeatedly over Bitcoin’s first 15 years, offering investors a reliable gauge of market tops.

Final Thoughts

The Pi Cycle Top Indicator is a testament to Bitcoin’s cyclical nature and the power of mathematical models in understanding its price behavior. While its past accuracy has been unparalleled, only time will tell if it can once again predict Bitcoin’s next market cycle peak. For now, it remains an indispensable tool for those navigating the thrilling highs and lows of Bitcoin.

Explore the full chart and stay informed.

Source link

Bitcoin Magazine Pro

Are Retail Investors Behind The Bitcoin Price Surge This Bull Run?

Published

6 days agoon

November 16, 2024By

admin

As Bitcoin once again finds itself in price discovery mode, market watchers and enthusiasts are curious: has retail FOMO set in yet, or is the retail surge we’ve seen in past bull cycles still on the horizon? Using data from active addresses, historical cycles, and various market indicators, we’ll examine where the Bitcoin market currently stands and what it might signal about the near future.

Rising Interest

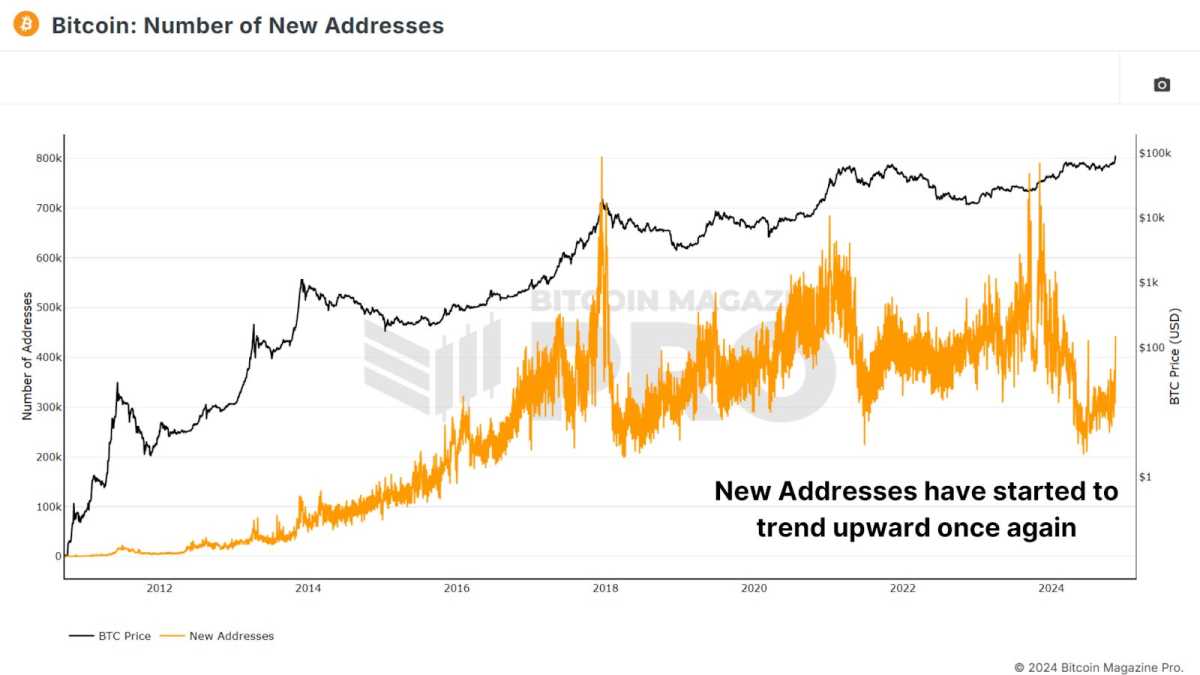

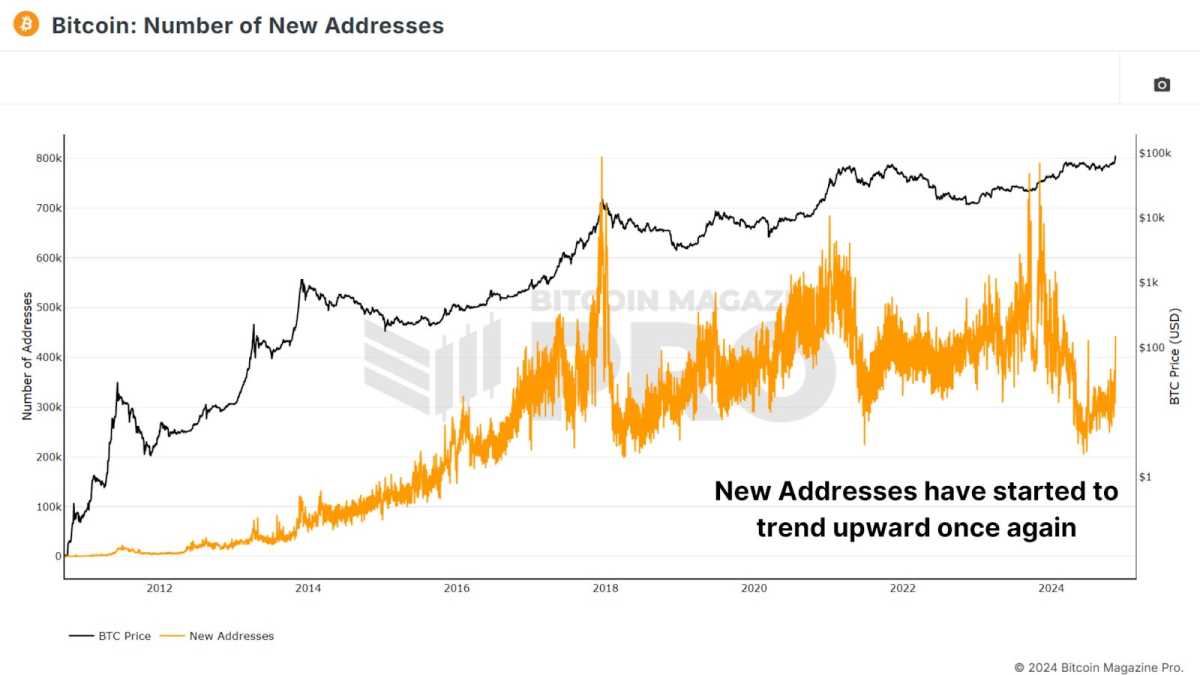

One of the most direct signs of retail interest is the number of new Bitcoin addresses created. Historically, sharp increases in new addresses have often marked the beginning of a bull run as new retail investors flood into the market. In recent months, however, the growth in new addresses hasn’t been as sharp as one might expect. Last year, we saw around 791,000 new addresses created in a single day—a sign of considerable retail interest. In comparison, we now hover significantly lower, although we have recently seen a modest uptick in new addresses.

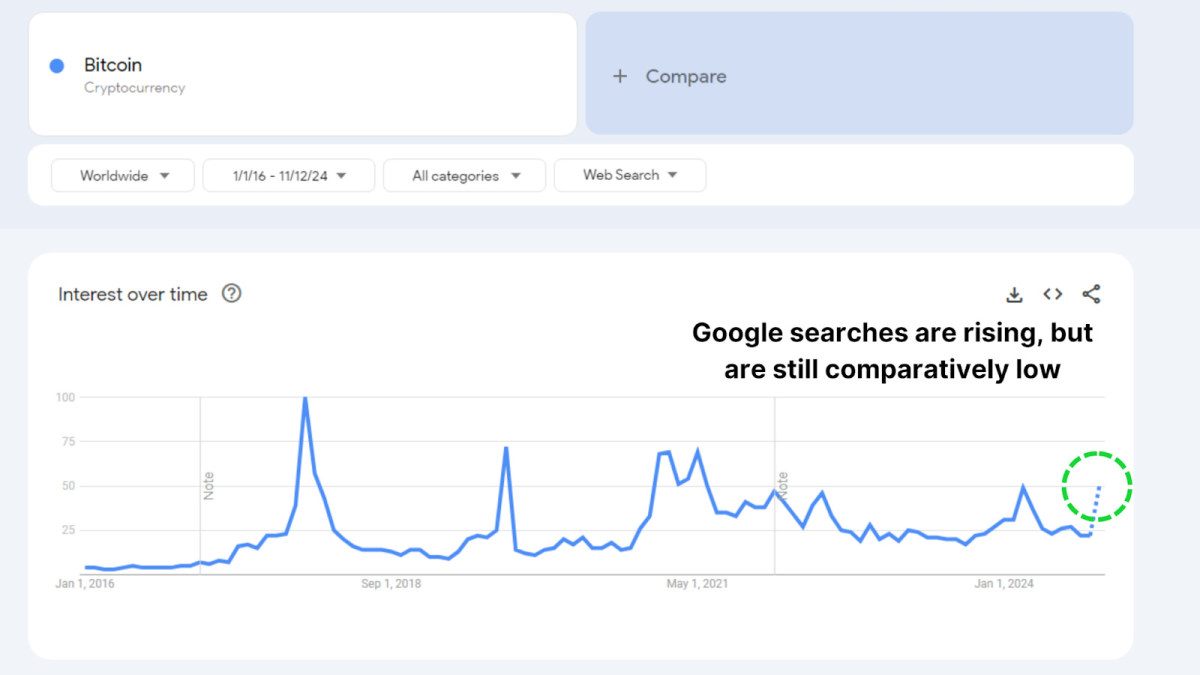

Google Trends also reflects this tempered interest. Although searches for “Bitcoin” have been increasing in the past month, they remain far below previous peaks in 2021 and 2017. It seems that retail investors are showing a renewed curiosity but not yet the fervent excitement typical of FOMO-driven markets.

Supply Shift

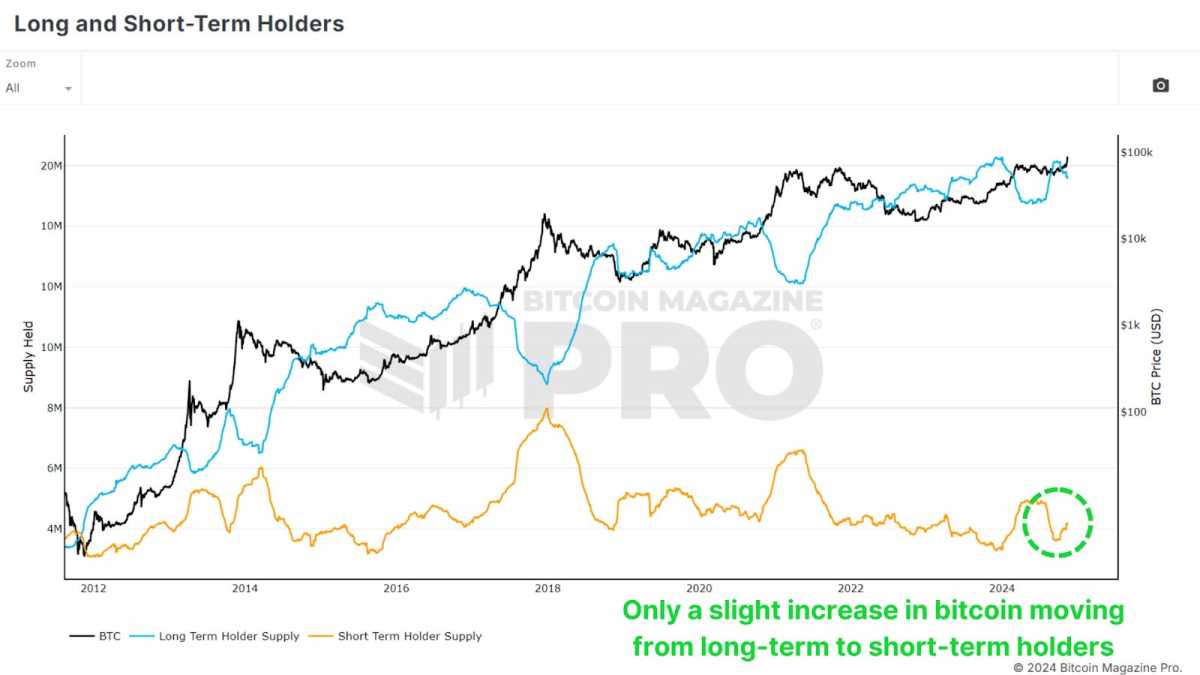

We are witnessing a slight transition of Bitcoin from long-term holders to newer, shorter-term holders. This shift in supply can hint at the potential start of a new market phase, where experienced holders begin taking profits and selling to newer market participants. However, the overall number of coins transferred remains relatively low, indicating that long-term holders aren’t yet parting with their Bitcoin in significant volumes.

Historically, during the last bull run in 2020-2021, we saw large outflows from long-term holders to newer investors, which fueled a subsequent price rally. Currently, the shift is only minor, and long-term holders seem largely unfazed by current price levels, opting to hold onto their Bitcoin despite market gains. This reluctance to sell suggests that holders are confident in further upside potential.

A Spot-Driven Rally

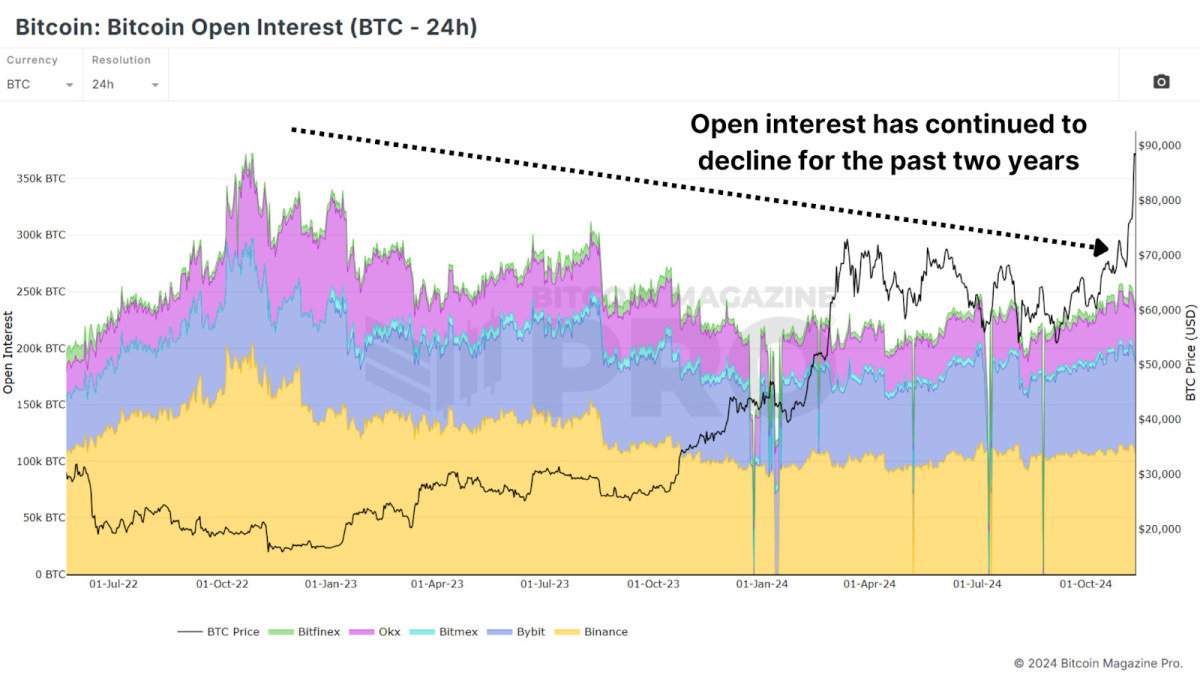

A key aspect of Bitcoin’s latest rally is its spot-driven nature, in contrast to previous bull runs heavily fueled by leveraged positions. Open interest in Bitcoin derivatives has seen only minor increases, which stands in sharp contrast to prior peaks. For instance, open interest was significant before the FTX crash in 2022. A spot-driven market, without excessive leverage, tends to be more stable and resilient, as fewer investors are at risk of forced liquidation.

Big Holders Accumulating

Interestingly, while retail addresses haven’t increased substantially, “whale” addresses holding at least 100 BTC have been rising. Over the past few weeks, wallets with large BTC holdings have added tens of thousands of coins, amounting to billions of dollars in value. This increase signals confidence among Bitcoin’s largest investors that the current price levels have more room to grow, even as Bitcoin reaches all-time highs.

In past bull cycles, we saw whales exit or decrease their positions near market peaks, a behavior we’re not seeing this time. This trend of accumulation by experienced holders is a strong bullish indicator, as it suggests faith in the market’s long-term potential.

Conclusion

While Bitcoin’s rally to all-time highs has brought renewed attention, we’re not yet seeing the telltale signs of widespread retail FOMO. The subdued retail interest suggests we may be only in the beginning phase of this rally. Long-term holders remain confident, whales are accumulating, and leverage remains modest, all indicators of a healthy, sustainable rally.

As we continue into this bull cycle, the market’s structure suggests that the potential for a larger retail-driven surge remains ahead. If this retail interest materializes, it could propel Bitcoin to new heights.

For a more in-depth look into this topic, check out a recent YouTube video here: Has Retail Bitcoin FOMO Begun?

Source link

Bitcoin Magazine Pro

The Truth About Bitcoin Price Models: Stock-to-Flow, Power Law, and Beyond

Published

1 week agoon

November 13, 2024By

admin

Predicting Bitcoin’s price has always been a hot topic for investors. Matt Crosby, lead market analyst at Bitcoin Magazine Pro, explores this topic in his recent video, “Truth About Bitcoin Stock To Flow, Power Law & Price Models“. Here, we break down Crosby’s key insights to help investors enhance their Bitcoin strategies.

Stock-to-Flow (S2F): A Useful Tool, Not a Crystal Ball

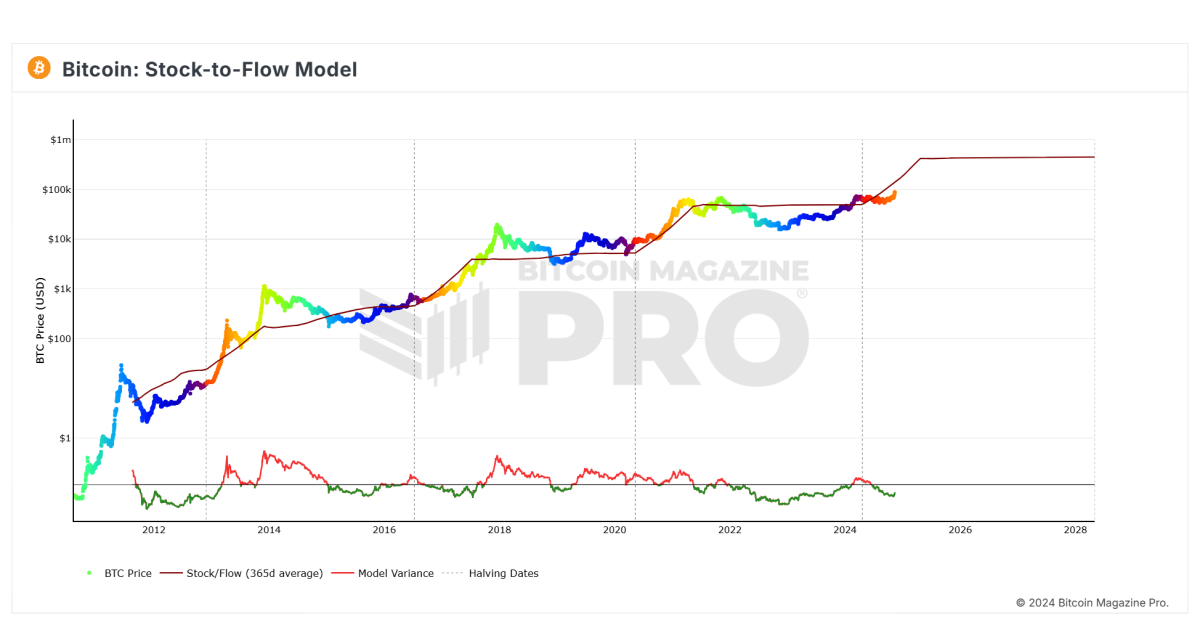

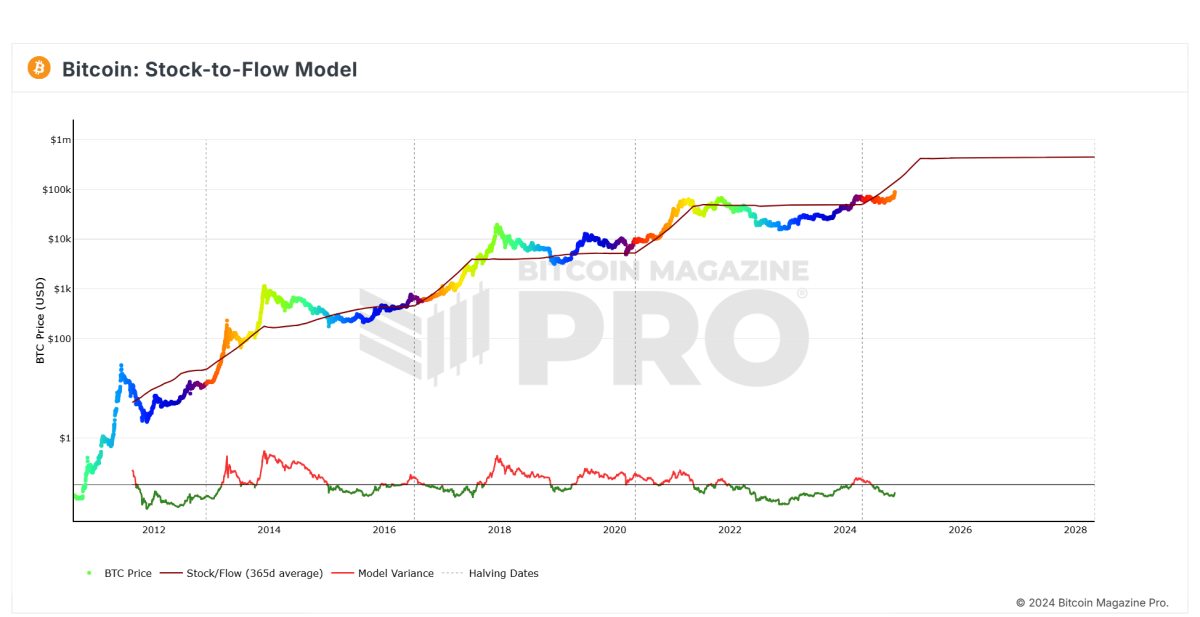

The Stock-to-Flow (S2F) model is one of the most popular ways to predict Bitcoin prices, and Crosby explains its benefits and drawbacks clearly.

Key Takeaways:

- What Is S2F? S2F assesses Bitcoin’s scarcity by comparing the “stock” (current supply) to the “flow” (newly mined coins), similar to how rare commodities like gold are evaluated.

- Updated Predictions: The Cross-Asset S2F model initially forecasted Bitcoin hitting $288,000 between 2020 and 2024. More recently, it suggested a possible valuation of $420,000 by April 2025.

- Limitations: S2F works until unexpected events—like global economic changes—disrupt Bitcoin’s usual patterns. Crosby aptly points out, “S2F works until it doesn’t.”

While S2F is a helpful guide, it’s essential for investors to consider broader market conditions and macroeconomic influences alongside it.

Bitcoin Power Law: The Long-Term View

Crosby also explores the Bitcoin Power Law, a model that uses a log-log chart to illustrate Bitcoin’s historical price patterns.

Why It Matters:

- Logarithmic Scaling: By using logarithmic scaling, the Power Law highlights Bitcoin’s long-term trend of reduced volatility and moderated growth.

- Limitations: This model offers insights for the long haul but is less helpful for short-term predictions or market surprises.

For investors aiming to diversify their portfolios and strategically time their investments, the Power Law provides context but should be used with other, more dynamic tools.

Real-Time Metrics: The Key to Adaptability

Crosby emphasizes the limits of static models like S2F and the Power Law, advocating for real-time, data-driven approaches instead.

Tools Investors Should Use:

- MVRV Z-Score: Measures market cap against realized cap, identifying when Bitcoin is overvalued or undervalued.

- SOPR (Spent Output Profit Ratio): Provides insights into market sentiment by tracking profit-taking behavior.

- On-Chain Metrics: Metrics like Bitcoin’s realized price and value-days-destroyed help detect market turning points.

These metrics give investors the tools to adapt their strategies to the market’s behavior in real-time rather than relying solely on predictions.

Why External Factors Matter

Crosby cautions against relying only on Bitcoin-specific data, emphasizing the importance of external factors:

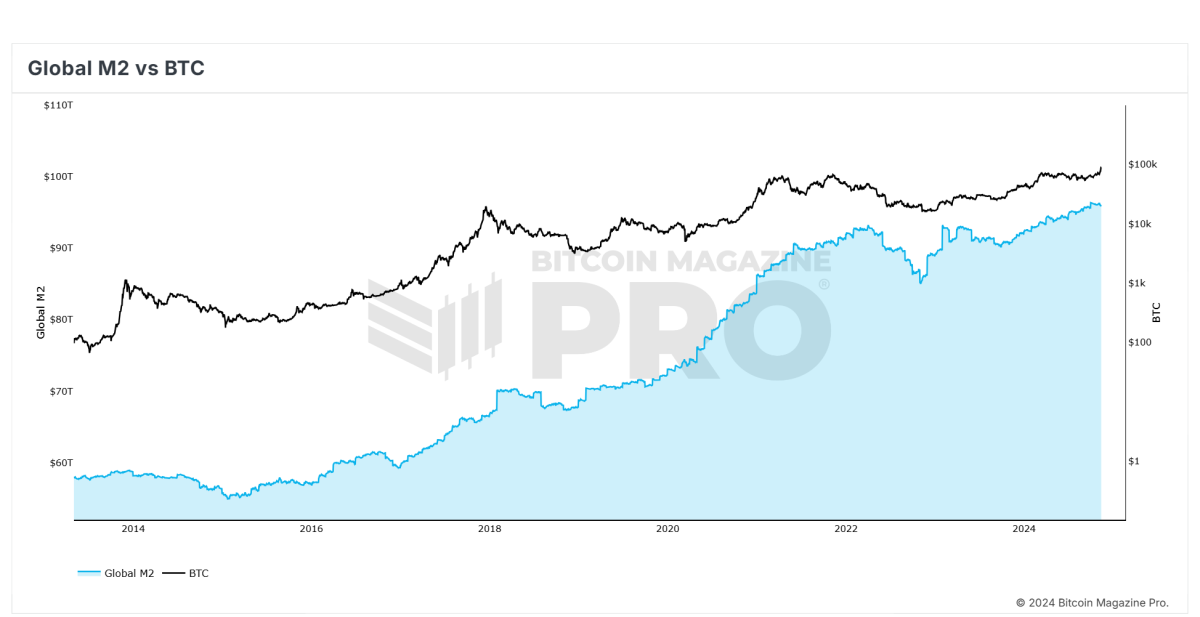

- Global Liquidity: Bitcoin’s price often moves with global liquidity cycles, making macroeconomic awareness crucial.

- Institutional Adoption: Actions by major players such as sovereign wealth funds, corporate treasuries, or institutional asset managers can greatly influence Bitcoin’s price.

- Regulatory Changes: Government decisions to regulate or adopt Bitcoin can significantly affect its valuation.

Incorporating both macroeconomic factors and Bitcoin-specific metrics is key for a well-rounded analysis.

Final Thoughts: Stay Pragmatic

Crosby concludes by reminding investors that no single model can predict Bitcoin’s price with certainty. Instead, these tools should be used to provide structure and insight into an unpredictable asset.

Practical Tips for Investors:

- Use Multiple Models: Cross-check predictions using different models to gain a clearer understanding of the market.

- Embrace Real-Time Data: Rely on metrics like MVRV Z-score and SOPR for timely, actionable insights.

- Adapt to Change: Be ready to adjust strategies based on both internal data and external influences.

Bitcoin Magazine Pro offers advanced analytics and real-time data to help investors navigate this fast-paced market. To dive deeper into Crosby’s insights, watch the full video here: Truth About Bitcoin Stock To Flow, Power Law & Price Models.

Source link

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential