crypto liquidations

$295m liquidated as Bitcoin, Ethereum downtrend continues

Published

3 months agoon

By

admin

Crypto investors suffered the biggest liquidation in over a week as Bitcoin and most altcoins continued their downtrend.

Bitcoin and altcoins liquidations rise

Data compiled by CoinGlass shows that total liquidations on Friday, Sep. 6, jumped to over $221 million, up from $72 million a day earlier. It was the biggest jump since Aug. 27 when liquidations soared to $281 million.

- Bitcoin (BTC), the biggest cryptocurrency, led the liquidations with over $114 million;

- Ethereum (ETH), $72 million worth and

- Solana (SOL), $14 million.

Bitcoin and other cryptocurrencies dropped as investors dumped risky assets and moved to safe havens. The tech-heavy Nasdaq 100 index dropped by over 500 points while the small-cap Russell 2000 index crashed by over 1.96%.

This decline happened after the U.S. published mixed jobs reports, signaling that the Federal Reserve will deliver a 0.25% cut instead of the expected 0.50%. The numbers showed that the unemployment rate fell slightly to 4.2% while wage growth bounced back.

Especially after the excitement of a month ago, when analysts and economists suddenly jacked up their probability of an economic recession, this morning’s (August) US jobs report comes as a relief… that is unless you were absolutely convinced that the Federal Reserve would cut…

— Mohamed A. El-Erian (@elerianm) September 6, 2024

There is a risk that Bitcoin and other altcoins may continue falling in the coming weeks. For one, a sense of fear is spreading in the market as the fear and greed index has fallen to the fear area of 30. In most periods, cryptocurrencies retreat when investors are fearful.

Bitcoin and Ethereum are also seeing weak institutional demand as their ETFs have continued their outflows. Data shows that Bitcoin ETFs have shed assets in the past eight consecutive days while Ether funds have shed over $568 million since inception.

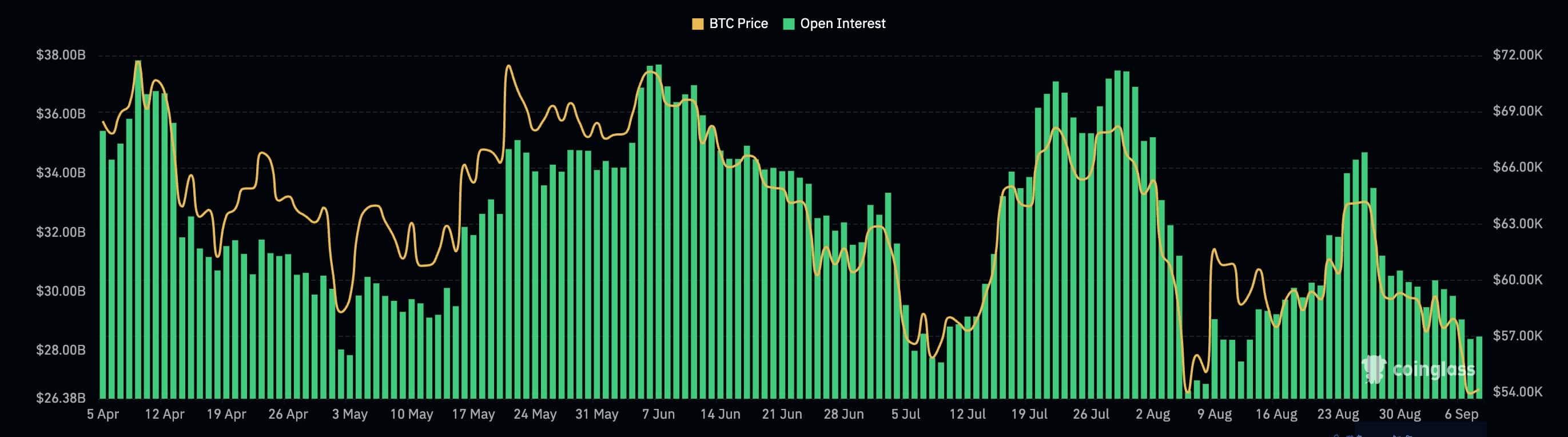

Additional data shows that the futures open interest continued falling and is hovering at its lowest point in over a month. Bitcoin’s open interest dropped to $28.4 billion, down from the year-to-date high of over $37 billion.

Bitcoin price has weak technicals

Bitcoin Death Cross?

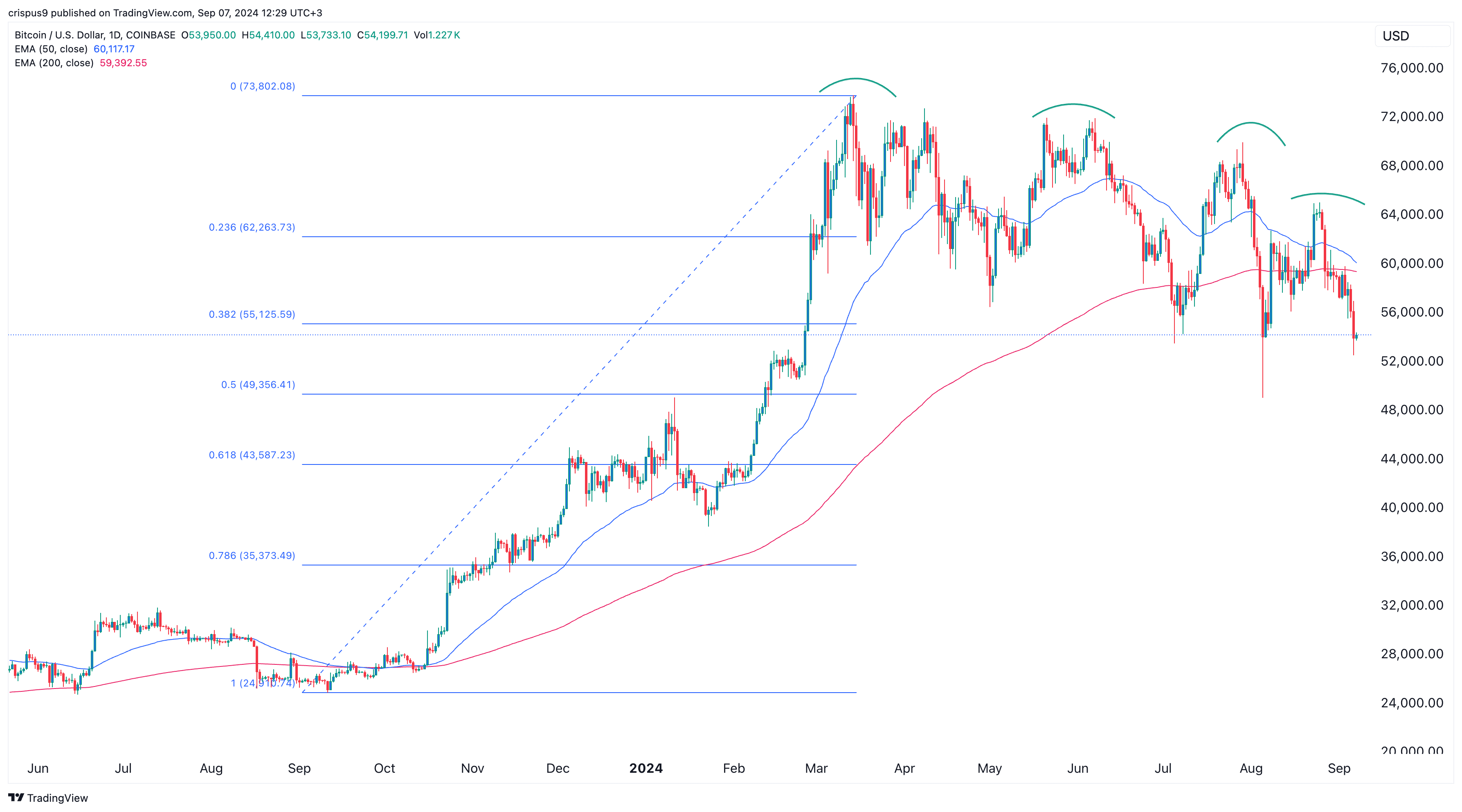

Technically, there is a risk that Bitcoin is about to form a death cross pattern as the spread between the 200-day and 50-day Exponential Moving Averages is narrowing.

The last time Bitcoin formed a death cross was in 2022. The event led to a 65% crash.

Bitcoin has also moved below the 38.2% Fibonacci Retracement point, meaning that it could drop to the 50% level of $49,000, its lowest level last month. A drop below that point will lead to more downside. Other altcoins tend to crash when BTC is not doing well.

Source link

You may like

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Bitcoin

Ethereum, Solana touch key levels as Bitcoin spikes

Published

4 months agoon

July 20, 2024By

admin

Bitcoin has jumped above $66,000, reaching its highest level since mid-June when prices hovered above $67,000.

The price of Bitcoin (BTC) is currently 4.7% up in the past 24 hours as buyers hover around $66,670. Meanwhile, Ethereum (ETH) has climbed above $3,500 and Solana (SOL) is trading above $170 – with gains of 3% and 8% respectively.

Other altcoins are also trading positive, with BNB (BNB) up 4.9%, Dogecoin (DOGE) 4.5% and Cardano (ADA), 3%.

Bitcoin rises amid global IT outage

The bounce in Bitcoin’s price came as chatter continued around the benchmark cryptocurrency’s potential inclusion as a strategic national reserve for the US.

Key to Bitcoin’s surge to intraday highs above $66,800 was the chaos accompanying a major IT outage on Friday, with airlines grounded and banks, media, and other global companies disrupted.

The outage followed a software update by cybersecurity giant CrowdStrike.

As the widespread cyber outages spotlighted Bitcoin’s strengths, the market seemed to take cues for a fresh rebound. The space also witnessed a huge surge in spot ETF volume.

Shorts feel pain as Bitcoin price surges

Meanwhile, the surge in prices had shorts obliterated. The past hour, as at 14:24 ET on Friday, has for instance seen over $6 million BTC shorts liquidated – compared to just $79,700 in long positions.

Data shows liquidations in the past four hours have seen bearish bitcoin bets worth over $12 million liquidated compared to around $1.6 million longs.

In the broader market, over $30 million shorts have been liquidated in the past four hours. This outpaces long liquidations by a wide margin as only $5.3 million in long positions have been rekt in this period.

On Thursday, analysts at Santiment had noted a surge in short positions in the bitcoin market, with BTC price hovering below $63k. Liquidations mounted as BTC price rose to above $66,800.

Source link

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential