Opinion

Revolutionizing Bitcoin Mining: The Power of Three-Phase Systems

Published

3 months agoon

By

admin

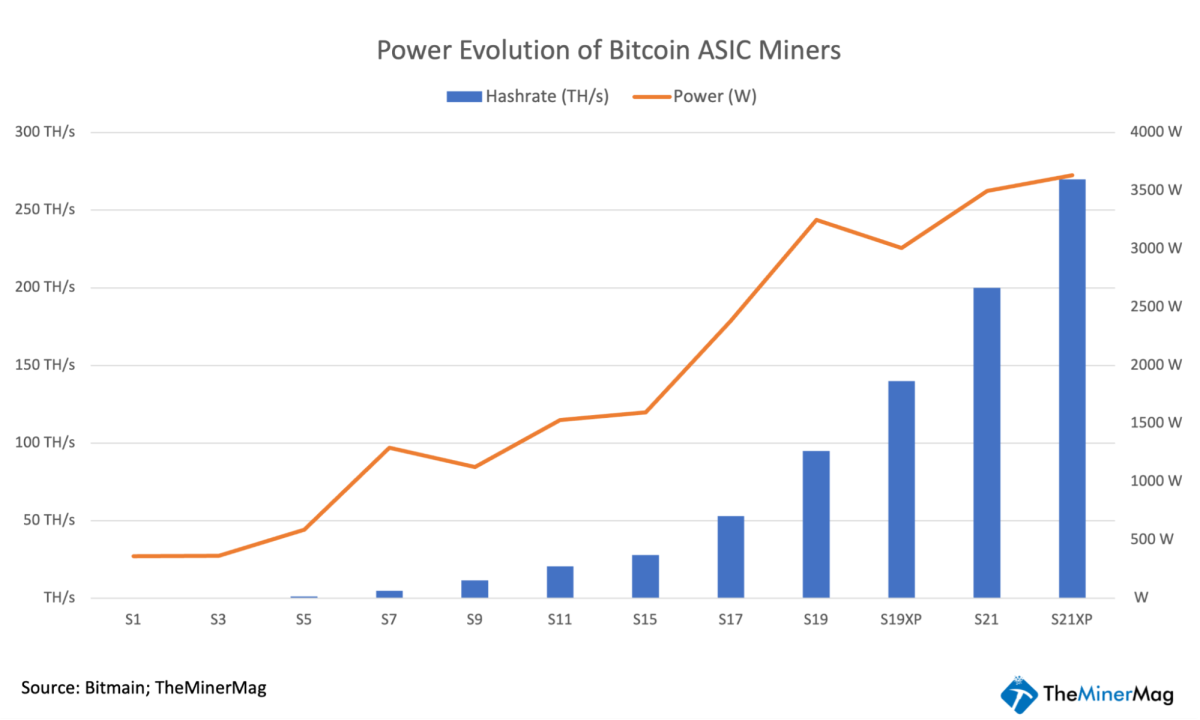

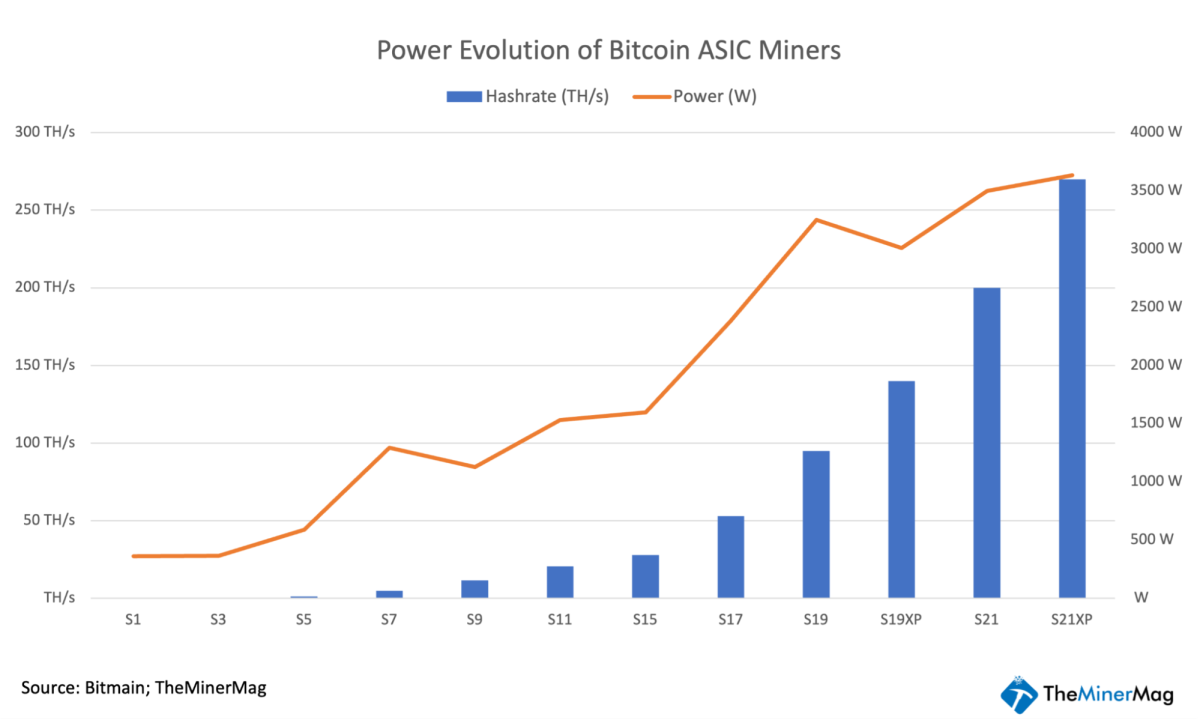

Bitcoin mining has seen exponential growth since the first ASIC miner was shipped in 2013, improving hardware efficiency from 1,200 J/TH to just 15 J/TH. While these advancements were driven by better chip technology, we’re now reaching the limits of silicon-based semiconductors. As further efficiency gains plateau, the focus must shift to optimizing other aspects of mining operations—particularly the power setup.

Three-phase power has emerged as a superior alternative to single-phase power in bitcoin mining. With more ASICs being designed for three-phase voltage input, future mining infrastructure should consider adopting a uniform 480v three-phase system, especially given its abundance and scalability across North America.

Understanding Single-Phase and Three-Phase Power

To comprehend the significance of three-phase power in bitcoin mining, it’s essential first to understand the basics of single-phase and three-phase power systems.

Single-phase power is the most common type of power supply used in residential settings. It consists of two wires: one live wire and one neutral wire. The voltage in a single-phase system oscillates sinusoidally, providing power that reaches a peak and then drops to zero twice during each cycle.

Imagine you are pushing a person on a swing. With each push, the swing moves forward and then comes back, reaching a peak height and then descending back to the lowest point before you push again.

Just like the swing, a single-phase power system has periods of maximum and zero power delivery. This can lead to inefficiencies, especially when consistent power is required, although this inefficiency is negligible in residential applications. However, it becomes significant in high-demand, industrial-scale operations like bitcoin mining.

Three-phase power, on the other hand, is commonly used in industrial and commercial settings. It consists of three live wires, providing a more constant and reliable power flow.

In the same swing analogy, imagine you have three people pushing the swing, but each person is pushing at different intervals. One person pushes the swing just as it starts to slow down from the first push, another pushes it a third of the way through the cycle, and the third person pushes it two-thirds of the way through. The result is a swing that moves much more smoothly and consistently because it’s being pushed continuously from different angles, maintaining a constant motion.

Similarly, a three-phase power system ensures a constant and balanced power flow, resulting in higher efficiency and reliability, particularly beneficial for high-demand applications like bitcoin mining.

The Evolution of Bitcoin Mining Power Requirements

Bitcoin mining has come a long way since its inception, with significant changes in power requirements over the years.

Before 2013, miners relied on CPUs and GPUs to mine bitcoins. The real game-changer came with the development of ASIC (Application-Specific Integrated Circuit) miners as the bitcoin network grew and competition increased. These devices are specifically designed for the purpose of mining bitcoins, offering unparalleled efficiency and performance. However, the increased power requirements of these machines necessitated advancements in power supply systems.

In 2016, a top-of-the-line miner was capable of computing 13 TH/s with a power consumption of approximately 1,300 watts (W). While considered highly inefficient by today’s standards, mining with this rig was profitable due to the low network competition at that time. However, to generate meaningful profits in today’s competitive landscape, institutional miners now rely on rigs that demand around 3,510 W.

The limitations of single-phase power systems has come to the fore as the power requirements of ASIC and the efficiency demands of high-performance mining operations grows. The transition to three-phase power became a logical step to support the growing energy needs of the industry.

480v Three-Phase in Bitcoin Mining

Efficiency First

480v three-phase power has long been the standard in industrial settings across North America, South America, and other regions. This widespread adoption is due to its numerous benefits in terms of efficiency, cost savings, and scalability. The consistency and reliability of 480v three-phase power make it ideal for operations that demand greater operational uptime and fleet efficiency, especially in a post-halving world.

One of the primary benefits of three-phase power is its ability to deliver higher power density, which reduces energy losses and ensures that mining equipment operates at optimal performance levels.

Additionally, implementing a three-phase power system can lead to significant savings in electrical infrastructure costs. Fewer transformers, smaller wiring, and reduced need for voltage stabilization equipment contribute to lower installation and maintenance expenses.

For example, a load requiring 17.3 kilowatts of power at 208v three-phase would need a current of 48 amps. However, if the same load is supplied by a 480v source, the current requirement drops to just 24 amps. This halving of the current not only reduces power loss but also minimizes the need for thicker, more expensive wiring.

Scalability

As mining operations expand, the ability to easily add more capacity without major overhauls to the power infrastructure is crucial. The high availability of systems and components designed for 480v three-phase power makes it easier for miners to scale their operations efficiently.

As the bitcoin mining industry evolves, there is a clear trend towards the development of more three-phase compliant ASICs. Designing mining facilities with a 480v three-phase configuration not only addresses current inefficiencies but also future-proofs the infrastructure. This allows miners to seamlessly integrate newer technologies that are likely to be designed with three-phase power compatibility in mind.

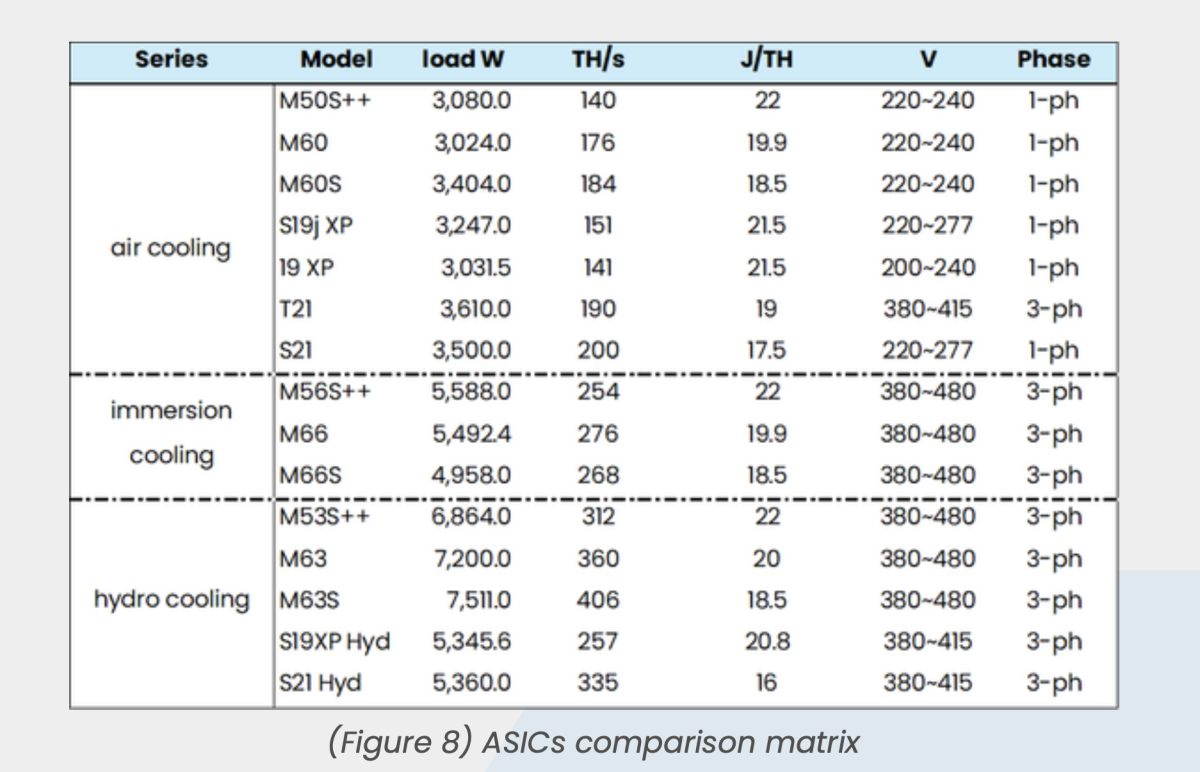

As shown in the table below, the immersion-cooling and hydro-cooling techniques are superior methods in scaling up bitcoin mining operations in terms of reaching higher hashrate output. But to support such a much higher computation capacity, the configuration of three-phase power becomes necessary for maintaining a similar level of power efficiency. In short, this will lead to a higher operational profit with the same profit margin percentage.

Implementing Three-Phase Power in Bitcoin Mining Operations

Transitioning to a three-phase power system requires careful planning and execution. Here are the key steps involved in implementing three-phase power in bitcoin mining operations.

Assessing Power Requirements

The first step in implementing a three-phase power system is to assess the power requirements of the mining operation. This involves calculating the total power consumption of all mining equipment and determining the appropriate capacity for the power system.

Upgrading Electrical Infrastructure

Upgrading the electrical infrastructure to support a three-phase power system may involve installing new transformers, wiring, and circuit breakers. It’s essential to work with qualified electrical engineers to ensure that the installation meets safety and regulatory standards.

Configuring ASIC Miners for Three-Phase Power

Many modern ASIC miners are designed to operate on three-phase power. However, older models may require modifications or the use of power conversion equipment. Configuring the miners to run on three-phase power is a critical step in maximizing efficiency.

Implementing Redundancy and Backup Systems

To ensure uninterrupted mining operations, it’s essential to implement redundancy and backup systems. This includes installing backup generators, uninterruptible power supplies, and redundant power circuits to protect against power outages and equipment failures.

Monitoring and Maintenance

Once the three-phase power system is operational, continuous monitoring and maintenance are crucial to ensure optimal performance. Regular inspections, load balancing, and proactive maintenance can help identify and address potential issues before they impact operations.

Conclusion

The future of bitcoin mining lies in the efficient utilization of power resources. As advancements in chip processing technologies reach their limits, focusing on power setup becomes increasingly critical. Three-phase power, particularly a 480v system, offers numerous advantages that can revolutionize bitcoin mining operations.

By providing higher power density, improved efficiency, reduced infrastructure costs, and scalability, three-phase power systems can support the growing demands of the mining industry. Implementing such a system requires careful planning and execution, but the benefits far outweigh the challenges.

As the bitcoin mining industry continues to evolve, embracing three-phase power can pave the way for more sustainable and profitable operations. With the right infrastructure in place, miners can harness the full potential of their equipment and stay ahead in the competitive world of bitcoin mining.

This is a guest post by Christian Lucas, Strategy at Bitdeer. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

Blockchain

Most Layer 2 solutions are still struggling with scalability

Published

3 hours agoon

December 23, 2024By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Since pivoting to a layer 2-centric approach, the Ethereum (ETH) ecosystem has relied heavily on L2 solutions to scale. However, these solutions are struggling to compete effectively, especially under pressure from alternatives like Solana (SOL). During the recent meme coin craze, Solana attracted much of the activity due to its advantages: low fees, high transaction speed, and user-friendliness.

To understand the challenges, it’s essential to examine why L2 solutions have not demonstrated the scalability and cost advantages that were widely anticipated.

Why meme projects favor Solana over Ethereum L2s

Meme projects have significantly contributed to the recent surge in market activity. These projects favor Solana for several reasons beyond user-friendliness:

- Low fees: Solana’s low transaction costs make it ideal for fee-sensitive applications like memecoins.

- High speed: Solana’s multithreaded architecture enables high throughput, ensuring seamless user experiences.

- Better developer experience: Solana’s tools and ecosystem are optimized for ease of use, attracting developers and projects.

Why is scalability important?

Scalability is fundamentally measured by the number of transactions a blockchain can process. A highly scalable blockchain can handle more TXs while offering lower fees, making it crucial for widespread adoption and maintaining a seamless user experience.

This is especially important for grassroots projects like meme coins, many of which are short-lived and highly fee-sensitive. Without scalability, these projects cannot thrive, and users will migrate to platforms that offer better efficiency and cost-effectiveness.

Why Ethereum L2s aren’t up to the challenge

Architectural limitations of Ethereum. Ethereum has long faced scalability issues, and L2 rollups are its primary solution to these problems. L2s operate as independent blockchains that process transactions off-chain while posting transaction results and proofs back to Ethereum’s mainnet. They inherit Ethereum’s security, making them a promising scaling approach.

However, Ethereum’s original design poses inherent challenges. Ethereum’s founder, Vitalik Buterin, has admitted that “Ethereum was never designed for scalability.” One of the key limitations is the lack of multithreading in the Ethereum Virtual Machine. The EVM, which processes transactions, is strictly single-threaded, meaning it can handle only one transaction at a time. In contrast, Solana’s multithreaded architecture allows it to process multiple transactions simultaneously, significantly increasing throughput.

L2s inheriting Ethereum’s limitations. Virtually all L2 solutions inherit Ethereum’s single-threaded EVM design, which results in low efficiency. For instance, Arbitrum: With a targeted gas limit of 7 million per second and each coin transfer costing 21,000 gas, Arbitrum can handle about 333 simple transactions per second. More complex smart contract calls consume even more gas, significantly reducing capacity. Optimism: With a gas limit of 5 million per block and a block time of 2 seconds, Optimism can handle only about 119 simple transfers per second. Gas-intensive operations further reduce this capacity.

Unstable fees. Another major issue with Ethereum and its L2 solutions is unstable fees during periods of high network activity. For applications relying on low and stable fees, this is a critical drawback. Projects like meme coins are especially fee-sensitive, making Ethereum-based L2s less attractive.

Lack of interoperability between L2s. The scalability argument for having multiple L2s only holds if contracts on different L2s can interact freely. However, rollups are essentially independent blockchains, and accessing data from one rollup to another is as challenging as cross-chain communication. This lack of interoperability significantly limits the potential of L2 scalability.

What can L2s do to further scale?

Embed features to enhance interoperability. Ethereum L1 needs to do more to support interoperability among L2s. For example, the recent ERC-7786: Cross-Chain Messaging Gateway is a step in the right direction. While it doesn’t fully resolve the interoperability issue, it simplifies communication between L2s and L1, laying the groundwork for further improvements.

Architectural updates: Diverge from the existing L1 design. To compete with multithreaded blockchains like Solana, L2s must break free from Ethereum’s single-threaded EVM design and adopt parallel execution. This may require a complete overhaul of the EVM, but the potential scalability gains make it a worthwhile endeavor.

Future milestones

Ethereum’s L2 solutions face significant challenges in delivering the scalability and cost-effectiveness that applications like meme coins demand. To stay competitive, the ecosystem must address fundamental architectural limitations, enhance interoperability, and embrace innovations in blockchain design. Only by doing so can Ethereum L2s achieve the scalability needed to support widespread adoption and fend off competition from emerging blockchains like Solana.

Laurent Zhang

Laurent Zhang is the president and founder of Arcology Network, a revolutionizing Ethereum layer-2 solution with the first-ever EVM-equivalent, multithreaded rollup—offering unparalleled performance and efficiency for developers building the next generation of decentralized applications. With an executive leadership and innovation background, Laurent holds a degree from Oxford Brookes University. Laurent’s professional journey includes over a decade of experience in science, research, engineering, and leadership roles. After graduating in 2005, he joined MKS Instruments as an Algorithm Engineer. From 2010 to 2012, he worked as a research engineer at the Alberta Machine Intelligence Institute, followed by a position as a research scientist at Baker Hughes from 2012 to 2014. He then served as vice president of engineering at Quikflo Health between 2016 and 2018. Since 2017, Laurent has been the president of Arcology Network, being a visionary of a future where blockchain technology reaches its full potential, offering unmatched scalability, efficiency, and innovation.

Source link

Recently, BlackRock released an educational video explaining Bitcoin, which I thought was great—it’s amazing to see Bitcoin being discussed on such a massive platform. But, of course, Bitcoin X (Twitter) had a meltdown over one specific line in the video: “There is no guarantee that Bitcoin’s 21 million supply cap will not be changed.”

HealthRnager from Natural News claimed, “Bitcoin has become far too centralized, and now the wrong people largely control its algorithms. They are TELLING you in advance what they plan to do.”

Now, let me be clear: this is total nonsense. The controversy is overhyped, and the idea that BlackRock would—or even could—change bitcoin’s supply is laughable. The statement in their video is technically true, but it’s just a legal disclaimer. It doesn’t mean BlackRock is plotting to inflate bitcoin’s supply. And even if they were, they don’t have the power to pull it off.

Bitcoin’s 21 million cap is fundamental—it’s not up for debate. The entire Bitcoin ecosystem—miners, developers, and nodes—operates on this core principle. Without it, Bitcoin wouldn’t be Bitcoin. And while BlackRock is a financial giant and holds over 500,000 Bitcoin for its ETF, its influence over Bitcoin is practically nonexistent.

Bitcoin is a proof-of-work (PoW) system, not a proof-of-stake (PoS) system. It doesn’t matter how much bitcoin BlackRock owns; economic nodes hold the real power.

Let’s play devil’s advocate for a second. Say BlackRock tries to propose a protocol change to increase bitcoin’s supply. What happens? The vast network of nodes would simply reject it. Bitcoin’s history proves this. Remember Roger Ver and the Bitcoin Cash fork? He had significant influence and holdings, yet his version of bitcoin became irrelevant because the majority of economic actors didn’t follow him.

If Bitcoin could be controlled by a single entity like BlackRock, it would’ve failed a long time ago. The U.S. government, with its endless money printer, could easily acquire 10% of the supply if that’s all it took to control Bitcoin. But that’s not how Bitcoin works. Its decentralized nature ensures no single entity—no matter how powerful—can dictate its terms.

So, stop worrying about BlackRock “changing” Bitcoin. Their influence has hard limits. Even if they tried to push developers to change the protocol, nodes would reject it. Bitcoin’s decentralization is its greatest strength, and no one—not BlackRock, not Michael Saylor—can change that.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Opinion

It’s Time to Admit It – There Are Only 2.1 Quadrillion Bitcoins

Published

2 days agoon

December 21, 2024By

admin

If the above statement offends you, you might not have read the Bitcoin source code.

https://x.com/pete_rizzo_/

Of course, I’m sure you’ve heard that there are 21 million bitcoin – and this is true, the Bitcoin protocol allows for only “21 million bitcoin” to be created, yet these larger denominations can be subdivided into 100 million sub-units each.

Call them whatever you want, there are only 2.1 quadrillion monetary units in the protocol.

This dollars and cents differential has long been the subject of debate – in the time of Satoshi, Bitcoin’s creator, the dual conventions, Bitcoin having both a bulk denomination, and a smaller unit, was not much of a concern. There were questions about whether the software would work at all, and bitcoin were so worthless, selling them in bulk was the only rational option.

Rehashing this debate is BIP 21Q, a proposal to the Bitcoin users authored by John Carvalho, founder of Synonym, creator of the Pubky social media platform, and a tenured contributor whose work dates back to the days of the influential Bitcoin-assets collective.

In short, the BIP proposes that network actors – the various wallets and exchanges – change how Bitcoin denominations are displayed, with the smallest unit of the protocol renamed “bitcoins,” as opposed to “satoshis,” as they have been commonly called.

Here are the specifics of the BIP:

Redefinition of the Unit:

- Internally, the smallest indivisible unit remains unchanged.

- Historically, 1 BTC = 100,000,000 base units. Under this proposal, “1 bitcoin” equals that smallest unit.

- What was previously referred to as “1 BTC” now corresponds to 100 million bitcoins under the new definition.

Terminology:

- The informal terms “satoshi” or “sat” are deprecated.

- All references, interfaces, and documentation SHOULD refer to the base integer unit simply as “bitcoin.”

Display and Formatting:

- Applications SHOULD present values as whole integers without decimals.

- Example:

- Old display: 0.00010000 BTC

- New display: 10000 BTC (or ₿10000)

Unsurprisingly, the debate around the BIP has been hostile. For one, it’s not a technical BIP, though this is not a requirement of the BIP process. Suffice to say, it’s perhaps the most general BIP that has been proposed under the BIP process to date, as it mainly deals with market conventions and user onboarding logic, not any changes to the software rules.

However, I have to say, I find the proposal compelling. Nik Hoffman, our News Editor, does not, preferring to stick to the market affirmative.

Yet, I think the proposal raises relevant questions: why should new users be forced to compute their Bitcoin balances using only decimals? Surely this has the adverse side effect of making commerce difficult – it’s simply antithetical to how people think and act today.

Also, in terms of savings, at an $100,000 BTC price, it isn’t exactly compelling to think you could be spending a whole year earning 1 BTC, though that may be.

Indeed, there have been various debates for all kinds of units – mBTC, uBTC – that play around with the dollars and cents convention, but Carvalho here is wisely skipping to the end, preferring just to rip the band-aid off. $1 would buy 1,000 bitcoins under his proposal.

What’s to like here, and I argued this during a Lugano debate on the topic in 2023, is that it keeps both the larger BTC denomination and the smaller unit, now bitcoins. They are both important, and serve different functions.

My argument then was that having a larger denomination like BTC (100 million bitcoins) is important. If there was no “BTC unit,” the press and financial media would be faced to reckon that “1 bitcoin” is still worth less than 1 cent.

How much mainstream coverage and interest do we think there would be? I’d bet not very much.

In this way, BIP 21Q is a best-of-both-worlds approach.

The financial world, press, and media can continue championing the meteoric rise in value of “BTC,” while everyday users can get rid of decimals and complex calculations, trading the only real Bitcoin unit guaranteed to exist in perpetuity.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

CryptoQuant Hails Binance Reserve Amid High Leverage Trading

Trump Picks Bo Hines to Lead Presidential Crypto Council

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential