AI

Bittensor tops crypto charts as AI tokens ride Nvidia wave

Published

2 months agoon

By

admin

Decentralized AI project Bittensor skyrocketed to the top of the weekly gainers’ list, riding the wave of Nvidia’s stock surge.

Bittensor (TAO) topped the charts this week as the biggest gainer among the top 100 cryptocurrencies with a solid 31% price jump. At the time of writing, TAO ranked 41st by market cap which stood at over $2.51 billion, with its price up 8.87% in the last 24 hours, trading at $313.59.

TAO’s recent climb can be credited to Nvidia Corp’s stock rallying 13.5%, closing at $119.08 on Sept. 13. This surge pushed Nvidia’s market cap to a whopping $2.92 trillion, according to MarketWatch.

With Nvidia stocks up 140.5% so far this year, the momentum has lifted TAO and other AI-focused cryptocurrencies along with it, pushing the AI-crypto market cap up by 0.8% in the last 24 hours. According to CoinGecko, the total market cap for AI tokens now stands at $23.9 billion.

AI tokens typically move in tandem with Nvidia’s stock. On Sept. 4, tokens like Artificial Superintelligence Alliance (FET) and Render (RNDR) fronted double-digit losses after a 9.5% dip in Nvidia’s stock. Back in February, these tokens rallied after Nvidia’s strong Q4 2023 earnings, and a similar buzz also built up ahead of its Q2 2024 report.

TAO primed for liftoff

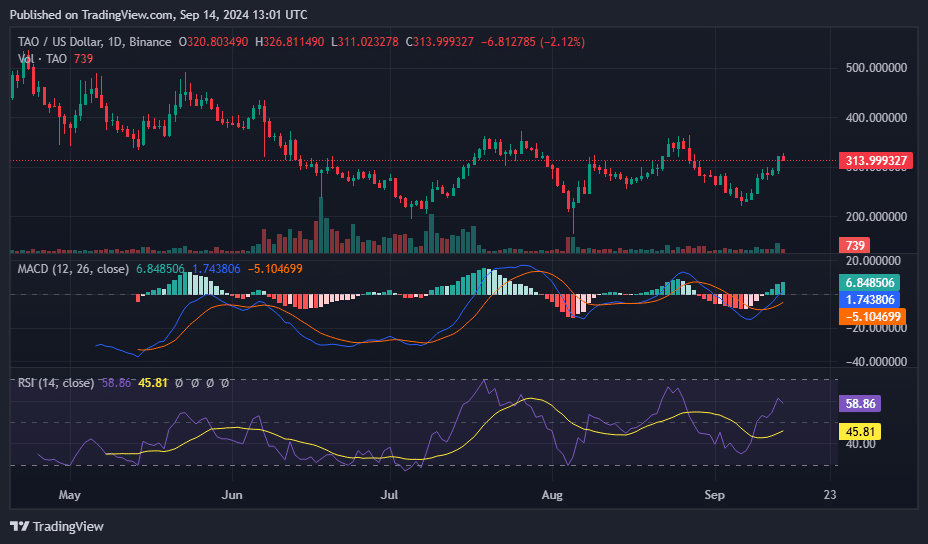

The 1D TAO/USD price chart from Sep. 14, signals a strong bullish trend, suggesting a potential for upward movement.

The Moving Average Convergence Divergence has crossed above its signal line, and displaying longer green bars on the histogram, both positive signs for upward momentum.

Moreover, the Relative Strength Index currently stands at 59, indicating the asset is in a healthy trading zone, still far away from overbought levels.

This provides room for potential growth without immediate concerns of a pullback due to overvaluation, painting a bullish outlook for the token’s short-term price trajectory, with further gains expected in the short term.

Market observers on X are echoing a similar bullish sentiment. According to analyst Marco Polo, TAO is currently ranging between $268 and $357. He expects a powerful upward move once TAO breaks above the $357 mark.

Meanwhile, analyst Ramon shares a similarly bullish outlook but identifies a slightly higher key resistance around the $400 mark.

Ramon predicts that TAO could reach the $3,000 to $5,000 range of this bull run, depending on liquidity moving out of Bitcoin and the strength of the overall AI narrative, which has been further fueled by recent developments like Apple’s announcement of its generative AI at the iPhone 16 event.

Source link

You may like

5 tokens to consider buying today

Terra Luna Classic Community Discord On Proposal Amid LUNC Price Rally

Trump Nominates Pro-Crypto Hedge Fund Manager Scott Bessent as Treasury Secretary

Dogecoin surges 10% as this new altcoin shakes the market, and preps for stage 2 presale

Ripple CEO Shares Bullish News With XRP Army As Trump Names Treasury Secretary

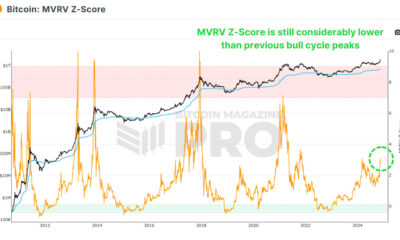

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

AI

Decentralized AI Project Morpheus Goes Live on Mainnet

Published

4 days agoon

November 19, 2024By

admin

Morpheus went live on a public testnet, or simulated experimental environment, in July. The project promises personal AIs, also known as “smart agents,” that can empower individuals much like personal computers and search engines did in decades past. Among other tasks, agents can “execute smart contracts, connecting to users’ Web3 wallets, DApps, and smart contracts,” the team said.

Source link

Adoption

AI startup Genius Group picks Bitcoin as main treasury asset

Published

2 weeks agoon

November 12, 2024By

admin

Bitcoin as an institutional reserve asset gained more traction as a Singapore-based AI company took a page from MicroStrategy’s book.

Per a press statement, publicly-traded artificial intelligence firm Genius Group will onboard Bitcoin (BTC) as its main treasury holding and immediately purchase $120 million worth of the world’s leading cryptocurrency.

Genius Group also said it would hold 90% of its current and future treasury value in Bitcoin, adding to its initial 1,380 token buy plan disclosed on Nov. 12. The startup’s GNS shares surged 50% during pre-market trading, according to Yahoo Finance. GNS prices shook off gains by publishing time, but the shares still traded higher than their previous close.

At least three institutional players have now adopted the BTC accumulation strategy pioneered by Michael Saylor’s software behemoth MicroStrategy. Firms like Tokyo’s Metaplanet, medical tech provider Semler Scientific, and now Genius announced BTC purchasing plans inspired by Saylor’s company.

All three companies hold over 1,000 BTC. The trio were leagues away from MicroStrategy’s 279,420 Bitcoin trove valued at over $24 billion due to recent highs.

We believe that with our Bitcoin-first strategy, we will be among the first NYSE American listed companies to fully embrace Microstrategy’s Bitcoin strategy for the benefit of our shareholders.

Thomas Power, Genius Group director

Stocking most of its treasury with BTC was also revealed shortly after Genius reshuffled its top decision-makers. Genius added multiple crypto-savvy board members as the firm paid more attention to web3 and blockchain technology.

Source link

24/7 Cryptocurrency News

Coinbase Unveils On-Chain AI Agents On Ethereum L2 Base

Published

4 weeks agoon

October 27, 2024By

admin

Coinbase announced a new set of fully on-chain AI agents users can create in under three minutes on its Ethereum L2 network Base.

Built with tools from Coinbase, OpenAI, and Replit, these agents can manage crypto wallets, connect with X (formerly Twitter), and perform other tasks.

This marks a significant step toward the convergence of AI and blockchain technology.

Coinbase’s Vision: A Future Where AI Agents Drive DeFi

Recently, Coinbase and its CEO Brian Armstrong showed a far-reaching vision for the new era of AI and blockchain integration. In this world, AI agents have the financial independence to spend and transact through cryptocurrency wallets.

For Armstrong, this is how DeFi becomes a game-changing place. Digital economies are reshaped through AI-driven systems autonomously without human interference.

Create an AI agent with a crypto wallet (and optional X account) in less than 3 minutes

Based Agent! https://t.co/QznYkoZTC0

— Brian Armstrong (@brian_armstrong) October 26, 2024

One major limitation that really holds back AI systems from widely usage today, is financial autonomy. Opening bank accounts or keeping credit cards for AI agents is not possible. They are not able to handle resources or purchase things on their own.

That really hinders their use of important services, like cloud computing in AWS, paid APIs, and subscription-based digital tools. The lack of independent transaction capabilities greatly restricts AI system’s real-world applications.

Cryptocurrency wallets for AI agents remove various barriers that would otherwise be in place. The crypto wallet allows AI agents to interact with open marketplaces, transacting with stablecoins on Base and Coinbase’s Layer 2 blockchain.

Financial independence means that they can pay bills, subscribe to things, or buy digital assets. This capability is a breakthrough that will grant AIs the ability to act as autonomous economic entities across industries.

Because of that, Armstrong recently offered the AI agent a new crypto wallet. He acknowledged that Truth Terminal already had a crypto wallet but insinuated that its human creator controls it.

AI Agents to Drive Crypto Innovation

The integration of crypto wallets with AI agents represents one of those points of inflection in integrating AI with blockchain. This is where the dream of an AI-to-AI economy is being trailed by platforms such as Coinbase. There, even financial transactions and asset management-participation in decentralized governance, is done autonomously between AI agents, independently of human intervention.

For crypto investors, this shift in dynamics translates into an opening of new opportunities. As financial freedom is slowly bestowed upon AI agents, their ability to operate freely, independently in decentralized ecosystems unravels new ways of growth, innovation, and investment. It also promises long-term value for infrastructural and consumer use cases.

Teuta

Teuta is a seasoned writer and editor with over 15 years of experience in macroeconomics, technology, and the cryptocurrency and blockchain industries. Starting her career in 2005 as a lifestyle writer for Cosmopolitan in Croatia, she expanded into covering business and economy for several esteemed publications like Forbes and Bloomberg. Influenced by figures like Don Tapscott and Bruce Dickinson, Teuta embraced the blockchain revolution, believing crypto to be one of humanity’s most crucial inventions. Her fintech involvement began in 2014, focusing on crypto, blockchain, NFTs, and Web3. Known for her excellent teamwork and communication skills, Teuta holds a double MA in Political Science and Law, enjoys punk rock, chablis, and has a passion for shoes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

5 tokens to consider buying today

Terra Luna Classic Community Discord On Proposal Amid LUNC Price Rally

Trump Nominates Pro-Crypto Hedge Fund Manager Scott Bessent as Treasury Secretary

Dogecoin surges 10% as this new altcoin shakes the market, and preps for stage 2 presale

Ripple CEO Shares Bullish News With XRP Army As Trump Names Treasury Secretary

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: