Markets

MicroStrategy, Coinbase Stock Dip as Bitcoin Price Momentum Cools

Published

2 months agoon

By

admin

Crypto stocks across the board took a dive at Monday’s open after Bitcoin failed to maintain its early weekend momentum, but some are starting to rebound as the day goes on.

At 9:45 am ET, Coinbase (COIN) fell 4% to $156.63. MicroStrategy (MSTR), the world’s largest corporate Bitcoin holder, dipped by 5% to about $133, while the Valkyrie Bitcoin Miners ETF (WGMI) fell by the same amount to a price of nearly $16.

By comparison, the S&P 500 traded flat, and the Nasdaq 100 traded 0.5% down at Monday’s open. Meanwhile, after surging above $60,500 on Saturday, Bitcoin has now fallen below the $58,000 mark as of this writing. It’s down nearly 4% over the last 24 hours.

Coinbase has ticked back up to almost $162, down less than 1% on the day, while WGMI rose above $17, putting its daily loss at nearly 2%. However, MicroStrategy has recovered only slightly as of this writing, down almost 4% on the day to a current price of $136.

Coinbase has underperformed Bitcoin year to date, rising just 3.5% as of Monday versus Bitcoin’s 31% rise. Similarly, despite its exceptional early-year performance, fading hype around CleanSpark (CLSK) over the past several months has driven WGMI into negative territory compared to January 1.

By contrast, MSTR is up 91%, outpacing Bitcoin’s gains during the crypto explosion in early March. MetaPlanet, a much smaller company based in Japan, is up a whopping 544% after adopting its own MicroStrategy-inspired Bitcoin strategy in April.

Both companies have doubled down on their BTC-centric strategies in recent weeks, with MetaPlanet announcing another $2 million BTC purchase last week, and MicroStrategy buying another $1.1 billion in BTC shortly after.

In a Sunday report, Canaccord Genuity placed its price target for MSTR at $173, up 30% from today’s price. “Our price target is derived by assuming 20% one-year appreciation to BTC versus current spot, a 15% increase in value to the software business, and our assumption that the current sum-of-the-parts premium remains intact.”

DeFi Technologies, a Canadian fintech company with multiple cryptocurrencies on its balance sheet, is also up 283% this year, and bucked the bearish trend on Monday with a 1.5% rise.

On Wednesday, the Federal Reserve is expected to announce its first interest rate cut in years, which could have complex implications for the crypto and stock market. As of writing, futures markets are split on whether the cut will be for 25 or 50 basis points, and are increasingly favoring the latter.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

$100

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Published

5 hours agoon

November 22, 2024By

admin

What an enormous day it has been today.

Gary Gensler officially announced that he is stepping down from his position as Chairman of the Securities and Exchange Commission (SEC), and minutes later, Reuters reported that Donald Trump’s “crypto council” is expected to “establish Trump’s promised bitcoin reserve.” A bitcoin reserve, that would see the United States purchase 200,000 bitcoin per year, for five years until it has bought 1,000,000 bitcoin.

Right after both of those, Bitcoin continued its upward momentum and broke $99,000, with $100,000 feeling like it can happen at any second now.

It is hard to contain my bullishness thinking about the United States purchasing 200,000 BTC per year. They essentially have to compete with everyone else in the world who is also accumulating bitcoin and attempting to front run them. There are only 21 million bitcoin and that is a LOT of demand.

To put this into context, so far this year the US spot bitcoin ETFs have accumulated a combined total of over 1 million BTC. At the time of launch the price was ~$44,000 and now bitcoin is practically at $100,000. And that’s all ETFs combined. Imagine what will happen when just one entity wants to buy a total of 1 million coins, having to compete with everyone else accumulating large amounts as well?

I mean MicroStrategy literally just completed another $3 BILLION raise to buy more bitcoin, and will continue raising until it purchases $42 billion more in bitcoin. The United States are most likely going to be purchasing their coins (if this legislation is officially signed into law) at very high prices. The demand is insane and only rising in the foreseeable future.

With two months left to go until Trump officially takes office, it remains to be seen if this bill becomes law, but at the moment things are looking really good. As Senator Cynthia Lummis stated, “This is our Louisiana Purchase moment!” and would be an absolutely historic moment for Bitcoin, Bitcoiners, and the future financial dominance of the United States of America.

This is the solution.

This is the answer.

This is our Louisiana Purchase moment!#Bitcoin2024 pic.twitter.com/RNEiLaB16U

— Senator Cynthia Lummis (@SenLummis) July 27, 2024

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Markets

The Chart That Shows Bitcoin’s Bull Run Won’t Stop at $100,000

Published

14 hours agoon

November 21, 2024By

admin

Peak Bitcoin, hardly.

https://x.com/pete_rizzo_/

As I wrote in Forbes in 2021, the world is waking up to a new reality in regards to Bitcoin – the unlikely truth that Bitcoin’s programming has cyclical effects on its economy.

This has led to at least 4 distinct market cycles where Bitcoin has been branded a bubble, skeptics have rung their hands, and each time, Bitcoin recovers more or less 4 years later to set new all-time highs above its previously “sky-high” valuation.

I personally watched Bitcoin go from $50 to $1,300 in 2013. Then, from $1,000 to $20,000 in 2017, and I watched it go from $20,000 to $70,000 in 2021.

So, I’m just here to relate that, from my past experience, this market cycle is just heating up.

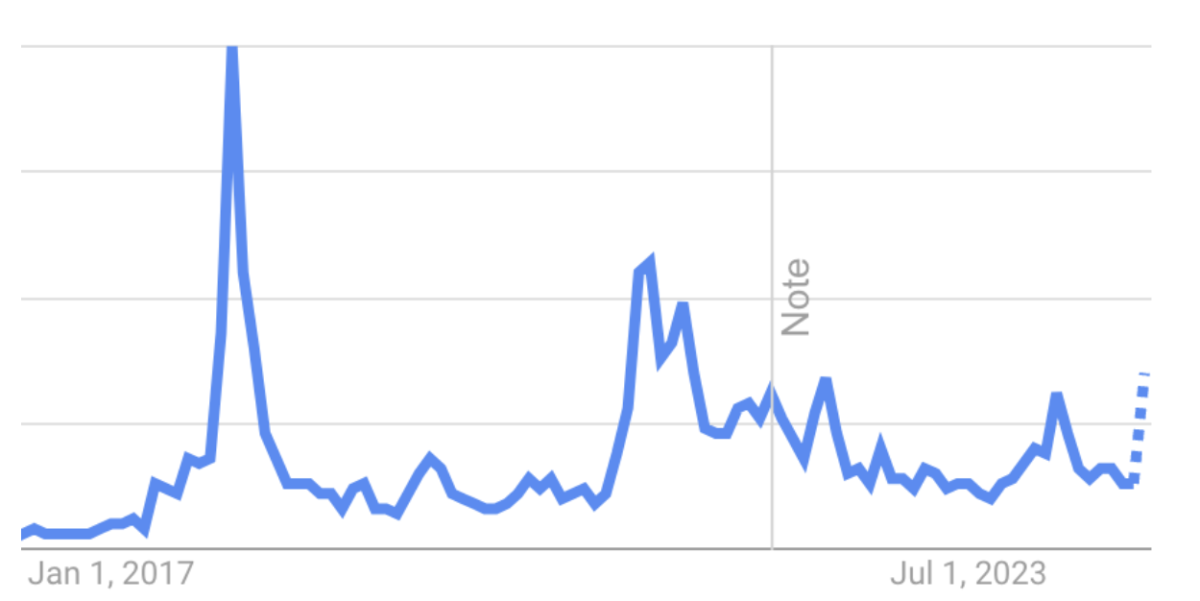

For those who have been in Bitcoin, there’s one tried-and-true and that’s Google Search. As long as I’ve been in Bitcoin, this has been the best indicator of the strength of the market.

Search is low, you’re probably in a bear market. Search heading back to all-time highs? This means new entrants are getting engaged, learning about Bitcoin, and becoming active buyers.

Remember, this is a habit change. Bitcoin HODLers are slowing shifting their assets to a wholly new economy. So, Google Trends search then, represents a snapshot of Bitcoin’s immigration. It shows how many new sovereign citizens are moving their money here.

And it’s something that all who are worried about whether bitcoin’s price topping out in 2024 should pay attention to.

Last year was the Bitcoin halving, and historically, the year following previous halvings has led to price appreciation. Maybe you’re tempted to think, “this time is different” – not me. I look at search and I see a chart that continues to accelerate into price discovery. Trust me when I say no one I know is selling bitcoin.

As shown above, buyer interest is accelerating, and these new buyers have to buy that Bitcoin from somewhere. Add nation states, US states, and a coming Trump administration set to ease the burden on the industry?

Well, I think the chart above says it all really.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Bitcoin

Bitcoin Nears $96K, Continuing Wild ‘Trump Trade’ Rally

Published

1 day agoon

November 21, 2024By

admin

BTC traded above $95,900 in early Asian hours, less than 6% from a landmark $100,000 figure that would push it above a $2 trillion market capitalization.

Source link

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

Polkadot investor predicts a 30,000% rally for this $0.04 token by 2025

Donald Trump Proposed Crypto Advisory Council To Set Up Strategic Bitcoin Reserve

Want Greater Bitcoin Adoption? Engage With Your Government.

Why the Media Loves the Worst of Crypto

HashCats prepares for Token Generation Event after completing mining season

Gary Gensler To Step Down As US SEC Chair In January

The Chart That Shows Bitcoin’s Bull Run Won’t Stop at $100,000

$2 Million PEPE Purchase Sees 105 Billion Tokens Snapped Up

XRP price expected to reach $7, Dogecoin $3, and PCHAIN $1 from $0.004

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential