Celsius

Trial of Celsius founder Alex Mashinsky begins

Published

2 months agoon

By

admin

Lawyers representing Alex Mashinsky have argued that he “did not intend to defraud or harm anyone” — and the claims he made in weekly videos to Celsius customers were done in good faith.

What Celsius case is about?

Celsius Network was one of the biggest casualties of a brutal crypto winter in 2022, with the embattled lender suddenly freezing the withdrawals of 1.7 million customers.

The company had suffered from a huge black hole in its balance sheet — and abruptly tipped into bankruptcy, blaming “extreme market conditions.”

While founder Alex Mashinsky regularly insisted his platform was “better than a bank,” with yields that seemed too good to be true, prosecutors allege it was different behind the scenes.

The Securities and Exchange Commission’s claimed that false and misleading statements were made to investors, and there was widespread market manipulation of its native token CEL.

And while Celsius had insisted that it was a safe investment opportunity, regulators warned “significant risks” had been taken with investors’ funds.

Now, more than two years on from the doomed firm’s spectacular collapse, Mashinsky is going on trial in New York — and faces seven criminal charges.

They include wire fraud, securities fraud, and commodities fraud. If convicted, the fallen entrepreneur could face up to 115 years behind bars.

When the arrest took place back in July 2023, U.S. Attorney Damian Williams declared:

“If you rip off ordinary investors to line your own pockets, we will hold you accountable.”

The Department of Justice has shown it has a strong track record of untangling messy crypto collapses and gathering the evidence needed to secure convictions.

FTX went under in November 2022 — and less than a year later, Sam Bankman-Fried was found guilty of all seven counts against him and later jailed for 25 years.

His legal team have now launched an appeal, and argue that he was treated unfairly by the judge throughout his trial.

Ex-executive in Celsius, Roni Cohen-Pavon, pleaded guilty to four charges on Sep. 13. Cohen-Pavon, an Israeli citizen, is free on a $500,000 bond and may leave the U.S. to visit Israel. He agreed to cooperate with prosecutors.

Mashinsky’s strategy

Lawyers representing Mashinsky have argued that he “did not intend to defraud or harm anyone” — and the claims he made in weekly videos to Celsius customers were done in good faith.

They are calling for testimony from six former executives within the company — including its chief financial officer. His law firm Mukasey Young wrote in a filing last week:

“In short, it appears that Mr. Mashinsky has been charged for acts and events as to which he had no knowledge, formed no criminal intent, and at times, even instructed the opposite. Mr. Mashinsky should be granted the opportunity to question the individuals whose conduct has been laid at his feet.”

The lawyers went on to warn that “the stakes are high” given the potential sentence that Mashinsky faces — and given that this could potentially be a life term, the former businessman should have the opportunity to gather evidence in his defense.

A key challenge for Mashinsky lies in how five of the witnesses cannot be subpoenaed by a U.S. court because they live abroad:

“An inability to obtain the testimony of these witnesses would result in a failure of justice.”

Creditors repaid

In recent months, work has been underway to compensate the customers locked out of their savings when Celsius went under.

Creditors have been receiving up to 85 cents on the dollar — considerably more than those owed money by other firms that have tipped into bankruptcy.

This is partly related to how the crypto markets have rallied in recent months, but nonetheless, a large chunk of the recovered funds have gone to the lawyers overseeing the Chapter 11 proceedings.

Receiving payouts has been a bittersweet experience for many victims. Although it ends many months of uncertainty, many would have ended up missing out on crypto’s recent rally.

Now out of bankruptcy proceedings, Celsius has been reborn as Ionic Digital, a company that’s focused on Bitcoin mining. The lender’s creditors are among its shareholders.

Last month, it was announced that a “state-of-the-art” facility had gone live in Texas that boasts over 15,000 miners — the first of four buildings to be created.

Figures from Ionic also show that the business also mined 1,331 BTC in the six months from February to July.

Despite this financial resolution, many of those caught up in the Celsius debacle will be watching Alex Mashinsky’s trial closely — with some submitting victim impact statements to explain how they were affected by the bankruptcy.

Source link

You may like

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Survival of the healthiest: Creating a successful crypto

Cardano Hydra Unveils Gamified Test Campaign, ADA Price Reacts

The DeFi duo with potential to multiply a crypto portfolio

Bitcoin Rally Benefits From US Buyers

BTC Continues To Soar, Ripple’s XRP Bullish

Alex Mashinsky

Judge denies ex-Celsius CEO’s bid to dismiss fraud, manipulation charges

Published

2 weeks agoon

November 11, 2024By

admin

Lawyers representing Alex Mashinsky, the former CEO of the crypto platform Celsius facing a criminal indictment in the United States, have lost a motion to drop two charges related to commodities fraud and manipulating the price of the Celsius (CEL) token.

In a Nov. 8 filing in the US District Court for the Southern District of New York, Judge John Koeltl ruled that Mashinsky’s legal team’s arguments to have the charges dismissed were “either moot or without merit.” The judge denied the motion to dismiss the two charges, leaving seven counts on the indictment for the former Celsius CEO’s trial, scheduled to begin in January 2025.

Source: SDNY

The former Celsius CEO’s lawyers claimed that the securities and commodities fraud charges were inconsistent, as prosecutors alleged the platform’s Earn Program was treated as a security while the Bitcoin (BTC) deposited by investors were commodities. Mashinsky also claimed that he lacked “fair warning” that allegedly manipulating the price of CEL (CEL) was a criminal charge.

The motion to dismiss the two charges filed in January included a request for Judge Koeltl not to allow information on Celsius’ bankruptcy to be included in the criminal case. The judge declined to decide on the motion on Nov. 8, suggesting he would respond to motions in limine or at trial.

Questions about FTX for jurors

Following the Nov. 8 order, Mashinsky’s lawyers also requested they be allowed to ask prospective jurors questions about their knowledge of the defunct cryptocurrency exchange FTX. According to the legal team, there will “undoubtedly” be testimony about FTX at trial, and the exchange was “toxic in the cryptocurrency world.”

Related: Celsius token surges 300% a month after $2.5B payment to creditors

Authorities arrested and charged Mashinsky with seven felony counts in July 2023. He pleaded not guilty and has been free to travel with restrictions on a $40 million bond.

Former Celsius chief revenue officer Roni Cohen-Pavon, indicted alongside Mashinsky, also faces charges for “illicitly” manipulating the CEL price. Cohen-Pavon initially pleaded not guilty but later changed his plea to guilty. He is scheduled to be sentenced on Dec. 11.

Magazine: ‘Less flashy’ Mashinsky set for less jail time than SBF: Inner City Press, X Hall of Flame

Source link

24/7 Cryptocurrency News

Celsius Holds $5M On-chain Balance Amid $2.5B Bankruptcy Distribution

Published

3 months agoon

August 27, 2024By

admin

Crypto firm Celsius has distributed over $2.5 billion to creditors in its ongoing bankruptcy process. On-chain data shows the firm now holds $5 million amid the recent distributions. The company’s bankruptcy distribution plan which dragged on for months is now underway, per new filing.

Celsius On-chain Balance Drops to $5M

Celsius bankruptcy distribution plan has seen over $2.5 billion sent to eligible creditors. According to crypto analytics firm Arkham Intelligence, the company holds only $5 million in on-chain balances. Most users expressed delight concerning the distribution process to creditors calling on remaining investors to claim their payouts.

In a recent filing, Celsius bankruptcy administrator announced payment of $2.53 billion to 251,000 creditors covering about 93% of total values. However, this figure is only two-thirds of eligible creditors with another 121,000 creditors yet to claim their funds. Per the filing, the reason for the delay in these classes of creditors could be due to the small amounts of their holdings.

“Approximately 64,000 of these remaining creditors have a distribution of less than $100, and approximately 41,000 more have a distribution of between $100 and $1,000…Given the small amounts at issue for many of these creditors, they may not be incentivized to take the steps needed to successfully claim a distribution.”

These payments made by the bankrupt crypto lender were cash and liquid digital assets at Jan 16 prices. This year, the prices of crypto assets saw an uptick following the approval of spot Bitcoin ETFs by the United States Securities and Exchange Commission (SEC).

LATEST: CELSIUS HAS ONLY $5M REMAINING ON-CHAIN

According to a court filing, Celsius Network has now distributed over $2.5B, or 93% of eligible funds to over 250K individual creditors.

Celsius began distributing over $3B of assets to creditors in January of this year – and now… pic.twitter.com/ktZdkLG3gD

— Arkham (@ArkhamIntel) August 27, 2024

Firm’s Bankruptcy Saga

The company’s crisis rocked the crypto ecosystem in 2022 adding the industry’s woes alongside Terra Network and crypto exchange FTX. The crypto lender once had over 1.7 million users with over $25 billion in assets under management (AUM).

The company’s popularity was linked to the wider adoption of decentralized finance (DeFi) before its bankruptcy in July 2022. As a result, the bankruptcy case rolled out with the court approving the final distribution plan this year. Recently, Celsius tapped PayPal’s Hyperwallet services to enable distributions.

David Pokima

David is a finance news contributor with 4 years of experience in Blockchain Technology and Cryptocurrencies. He is interested in learning about emerging technologies and has an eye for breaking news. Staying updated with trends, David reported in several niches including regulation, partnerships, crypto assets, stocks, NFTs, etc. Away from the financial markets, David goes cycling and horse riding.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Bitcoin

Celsius demands billions of dollars from Tether: What’s going on

Published

3 months agoon

August 12, 2024By

admin

Bankrupt lending platform Celsius has filed a lawsuit against Tether seeking 39,542 BTC.

According to the lawsuit, the amount was collateral for a loan from the issuer of the Tether (USDT) stablecoin. Tether requested more collateral after the price of Bitcoin (BTC) dropped in early 2022.

Celsius granted Tether‘s request, but the collateral was again threatened. The lawsuit says that while the lending platform was raising funds during the period specified in the contract, the USDT issuer liquidated the entire collateral within hours.

According to the lawsuit, “amidst the chaos,” on June 13, 2022, then-former Celsius CEO Alex Mashinsky allegedly permitted Tether to liquidate the collateral in an orderly manner. However, the platform noted that the lender never received written consent:

Tether’s efforts, of course, are now subject to intervening federal bankruptcy law. Thus, these preferential and fraudulent transfers of Bitcoin should be avoided, and the Bitcoin or its value should be recovered for the benefit of Celsius’s estate.

The company said that instead of providing additional collateral, Celsius instructed Tether to liquidate its Bitcoin collateral to close a position of approximately $815 million.

In addition to 39,542 BTC, Celsius demanded 15,658 BTC and 2,228 BTC, which it allegedly provided as additional collateral, for a total of 57,428 BTC.

Tether’s response

Commenting on the situation with Celsius, Tether CEO Paolo Ardoino noted that the entire process, from over-collateralization to margin call and liquidation, was carried out properly, as instructed by Celsius management.

Notes:

1. This complaint shows a lack of basic understanding of the concepts of market slippage, block liquidation and risk management. Very poor arguments made. Also the liquidation was directed by Celsius management team and agreed each step in the way.

— Paolo Ardoino 🤖🍐 (@paoloardoino) August 10, 2024

According to him, in 2022, Tether provided USDT to some of its clients, including Celsius. Tether’s agreements with its customers are simple: Tether provides USDT to select customers who provide excess collateral in Bitcoin.

This complaint shows a lack of basic understanding of the concepts of market slippage, block liquidation and risk management. Very poor arguments made. Also the liquidation was directed by Celsius management team and agreed each step in the way.

He also reminded that Tether’s top priority remains the safety of USDT users. According to Ardoino, the company’s capital is $12 billion, so stablecoin holders will not be affected even in a worst-case scenario.

We, at Tether, have proven our resilience uncountable numbers of times in recent years. Bullying never scares us. We are very confident in being able to demonstrate the correctness of our actions in court.

What happened to the loan?

In 2020, Celsius entered into an agreement with Tether to borrow stablecoins USDT and EURT at low interest rates. At its peak, Celsius had over $2 billion in loans from Tether, secured by a significant amount of Bitcoin as collateral.

Amid the Bitcoin crash in mid-2022, the crypto lender’s collateral was at liquidation risk. According to the agreement, the company was required to provide additional collateral.

Celsius claims that Tether acted in bad faith by hastily liquidating a significant amount of cryptocurrency and breaching the terms of the agreement.

The document says this ultimately led to financial difficulties and bankruptcy for the company. Celsius’s lawsuit’s main goal is to return the Bitcoin assets, which the crypto lender claims were sold below market value and with numerous violations.

How did Celsius go bankrupt?

Celsius froze the withdrawal of client assets in June 2022. A month later, the company went bankrupt. According to several analysts, the crypto broker was experiencing liquidity problems. However, the company stated the opposite—allegedly, this measure was supposed to help “stabilize liquidity.”

Hi all! I’m Jason Stone, and from August 2020 until April 2021, I led the group of talented individuals who managed the 0xb1 address.

— 0xb1 (@0x_b1) July 7, 2022

At the end of January 2023, a forensic expert found that Celsius Network faced a shortage of stablecoins worth a billion U.S. dollars in May 2021. At the same time, the company did not notify clients or regulators about this until the bankruptcy itself but continued to advertise its services.

Celsius Network’s creditors revealed a reorganization plan for the company, which most account holders approved. In November 2023, the court approved Celsius’ restructuring plan. A few months later, the crypto lender announced that it had completed bankruptcy proceedings and intended to pay creditors $3 billion.

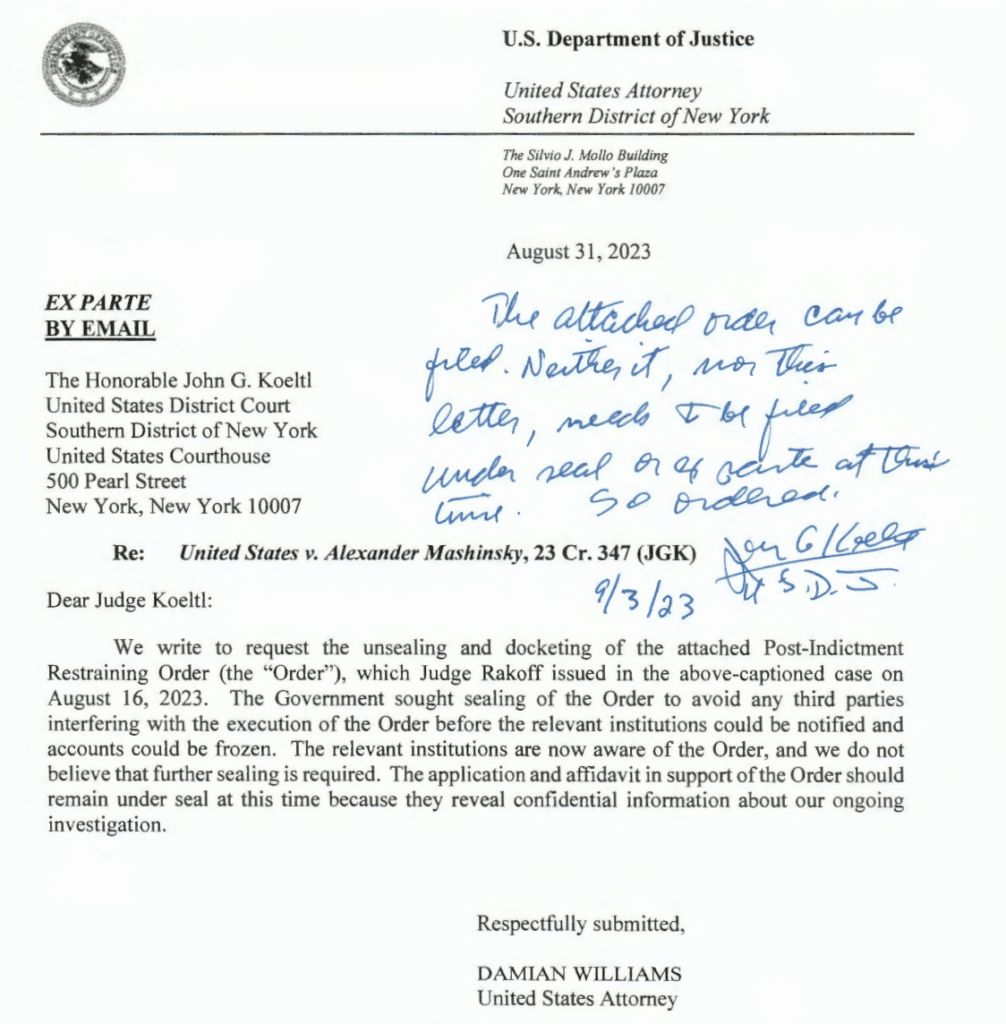

Celsius CEO blames prosecutors for collapse

In July 2023, Mashinsky was arrested after the Securities and Exchange Commission filed a lawsuit against the company. He is accused of fraud and market manipulation, and the company’s token is recognized as security. He was soon released on bail of $40 million. Prosecutors said they would need six to eight weeks to collect evidence, including Mashinsky’s videos on the Internet, in which he allegedly misled investors.

He pleaded not guilty, and his lawyers called the charges “baseless.” Moreover, Mashinsky himself previously accused the New York Attorney General’s Office of the collapse of his business.

In September 2023, Mashinsky’s bank accounts and real estate were frozen by a court decision as part of a criminal case against the company and its top management.

What’s next?

The lawsuit is no guarantee that Celsius will get what it wants. For now, the platform is likely to face another lawsuit after a two-year bankruptcy battle. Either way, the lawsuit further illuminates how Tether has sidestepped the financial difficulties other crypto firms have faced during the 2022 bear market.

Source link

Elon Musk Tweet of Joe Rogan Profile Sends DOGE Price Higher

Survival of the healthiest: Creating a successful crypto

Cardano Hydra Unveils Gamified Test Campaign, ADA Price Reacts

The DeFi duo with potential to multiply a crypto portfolio

Bitcoin Rally Benefits From US Buyers

BTC Continues To Soar, Ripple’s XRP Bullish

Ethereum whales accumulate RCO Finance after 2025 predictions hint at a 19,405% rally

US PCE, FOMC Minutes, & Crypto Expiry In Focus, Brace For Market Impact

Cardano Primed To Continue Surging As Whales and Institutions Accumulate ADA, Says Crypto Analyst

Senator Lummis wants to replenish Bitcoin reserves with gold

Will Toncoin Price Hit $10 After Recent 20% Rally?

AI Crypto Startup O.XYZ Faces Allegations of Misrepresentation and Internal Turmoil: Sources

Gensler to resign as SEC chair: What’s next under Trump?

Ripple Provided The Blueprint To Defeat Gary Gensler

Another U.S. SEC Democrat to Drop Out, Leaving Republicans Running Agency by February

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: