Nigeria

REGULATING BITCOIN AND CRYPTO IN NIGERIA: CROSSROADS BETWEEN CAPITAL CONTROL AND FINANCIAL FREEDOM

Published

2 months agoon

By

admin

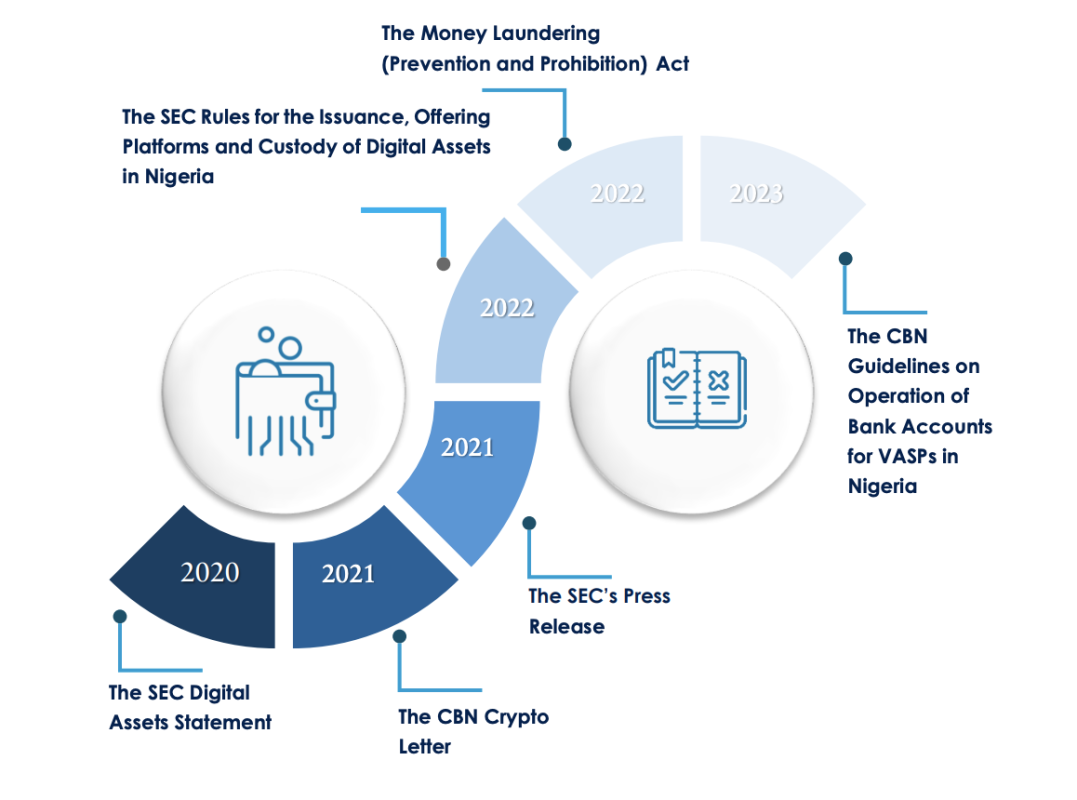

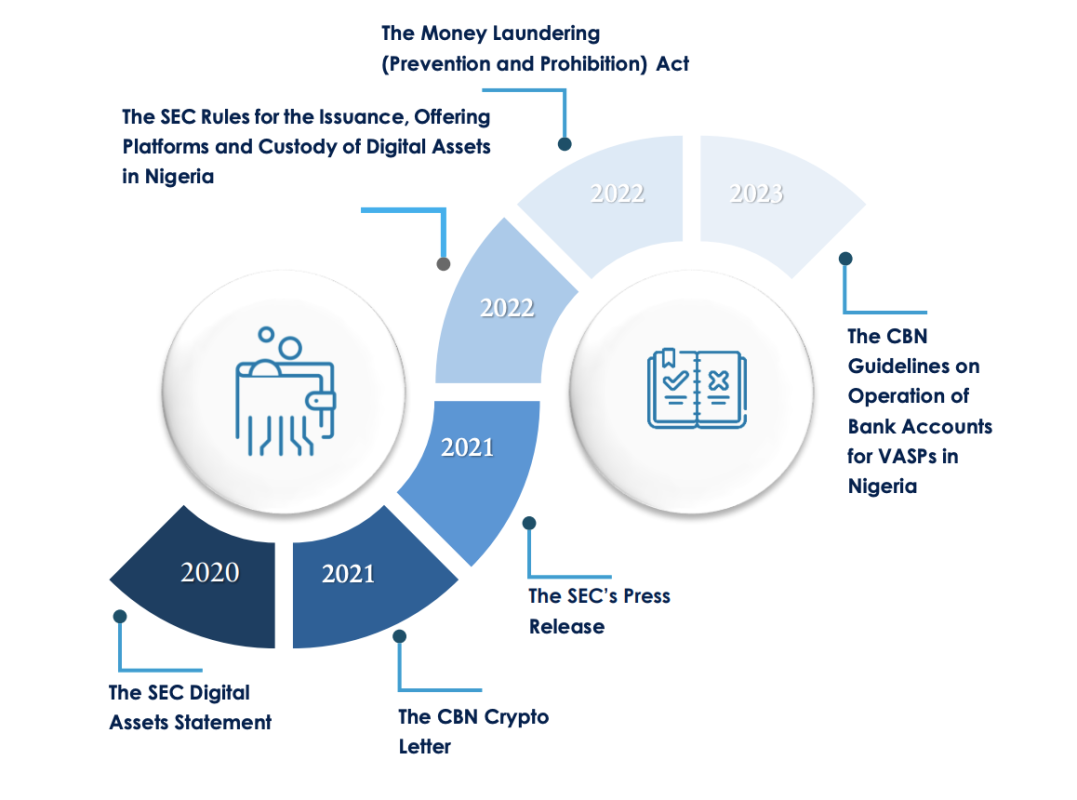

The ascent of Bitcoin and digital assets has sparked a classic battle, with governments acting as vigilant hawks, trying to control a technology that is as nimble and elusive as a gazelle darting across the savanna of decentralization. In Nigeria, this conflict is as tangled as dense jungle foliage, where regulators strive to enforce their rules on a system meant to evade conventional constraints, while individuals continue to pursue the elusive prize of financial freedom just out of grasp. The Central Bank of Nigeria (CBN) has oscillated between hardline approaches and cautious acceptance, exemplified by its 2021 directive banning banks from facilitating Bitcoin transactions. Yet, just a few years later, the same CBN approved the launch of a Naira-backed stablecoin, signaling a growing recognition of the inevitable role digital currencies will play in the future of finance. However, these regulations, rather than protecting Nigerians, have often undermined the rights of citizens to freely participate in the financial revolution that Bitcoin offers. This culminated in a recent court case brought by James Otudor, an ardent Bitcoin advocate, who has sued the Nigerian government, seeking to establish the fundamental right of citizens to trade and own Bitcoin and USDt. The case shines a spotlight on the larger issue of human rights being trampled upon in the name of regulatory oversight. It’s not just about financial innovation, it’s about ensuring that Nigerians are not excluded from the benefits of a global economy increasingly driven by decentralized technologies.

Across Africa, the regulatory landscape for Bitcoin and digital assets is shaped by two competing paradigms: collaboration and confrontation. Nigeria’s Securities and Exchange Commission (SEC) has taken some steps toward a collaborative model, as seen in the launch of its Regulatory Incubation Program aimed at fostering innovation while maintaining oversight. Yet, even within this supposedly progressive framework, the right of Nigerians to freely own and transact in Bitcoin remains under threat. Recent actions, such as the freezing of assets linked to the Bybit and KuCoin exchanges, illustrate how deeply entrenched government control remains. In other African nations, such as Ghana and Kenya, similar dynamics are playing out, with governments hesitating to fully embrace decentralized currencies, despite clear public demand. The Nigerian SEC’s approval of two cryptocurrency exchanges in 2024 represents a positive step, but this piecemeal approach fails to address the larger issue of financial sovereignty for Nigerians. South Africa has taken a slightly more balanced route, regulating Bitcoin and digital assets as financial assets while allowing for greater integration into the traditional financial ecosystem. Nevertheless, these approaches, while varied, all point to the same fundamental issue: the lack of a clear framework that respects the unique nature of Bitcoin and its potential to transform economies and empower citizens.

As Nigerian regulators grapple with how to manage this burgeoning industry, they must recognize that Bitcoin’s regulatory landscape cannot be lumped together with the entire digital assets ecosystem. Bitcoin operates on fundamentally different principles, with decentralization at its core, unlike many other digital assets that may still rely on centralized control or governance. Any attempt to impose blanket regulations on all digital assets, including Bitcoin, would be a catastrophic misstep, one that risks stifling innovation and depriving Nigerians of the opportunity to fully participate in the global economy. Regulators must, therefore, approach Bitcoin with a unique understanding of its intrinsic operational metrics. Its decentralized nature is not a flaw to be regulated out of existence but a feature that offers unprecedented opportunities for financial inclusion and economic freedom. Policymakers should learn from global examples, such as Europe’s MiCA framework, but adapt those lessons to the specific context of Bitcoin, ensuring that they do not impose unnecessarily restrictive regulations. The failure to distinguish Bitcoin from other digital assets in the regulatory process would result in inefficiency, stifle innovation, and risk pushing legitimate activities into the shadows. James Otudor’s court case stands as a pivotal moment, not just for Nigeria but for the entire continent, as it seeks to ensure that financial regulations are crafted with a respect for human rights and an understanding of the transformative power of decentralized finance.

The way forward for Nigeria is clear: regulators must craft policies that protect citizens while encouraging innovation, and they must do so with the understanding that Bitcoin is fundamentally different from other digital assets. The current regulatory push, if not carefully balanced, risks becoming a tool of oppression rather than empowerment. By engaging with the Bitcoin community and developing a nuanced approach to regulation, Nigeria can position itself as a leader in the global financial revolution. Anything less would be a disservice to the millions of Nigerians who have already embraced this new paradigm and a betrayal of the ideals of freedom and innovation that Bitcoin represents.

This is a guest post by Heritage Falodun. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

You may like

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

Bitcoin Policy

Want Greater Bitcoin Adoption? Engage With Your Government.

Published

14 hours agoon

November 21, 2024By

admin

It’s been a good week for Bitcoin and its status in the eyes of federal deposit insurance corporations. (Well, there’s a weird sentence I never thought I’d write.)

On Tuesday, the anti-crypto U.S. Federal Deposit Insurance Corporation (FDIC) Chairman, Martin Gruenberg, announced he’d be stepping down in January.

And yesterday, Heritage Falodun, CEO of DigiOats, Nigeria’s leading Bitcoin education and consultancy platform, educated members of the Nigeria Deposit Insurance Corporation (NDIC) about the benefits of bitcoin and other digital assets.

Falodun, an indefatigable Bitcoin proponent, spearheaded a seminar for the NDIC entitled “Cryptocurrency in the Evolving Financial Industry”.

This week, @DigiOats alongside with #MassCyberTech completed a groundbreaking seminar for @NDICNigeria 🇳🇬on “Cryptocurrency in the Evolving Financial Industry”. We explored #Bitcoin adoption, regulation, and sustainable finance marking a key moment for Nigeria’s financial future pic.twitter.com/hpWQOqZt8L

— DigiOats⚡️ (@DigiOats) November 21, 2024

In it, he highlighted the following points:

- Bitcoin can serve as a reserve asset for nation states, including Nigeria

- Using bitcoin (and other digital assets), banks can reduce settlement time

- Bitcoin can reduce capital controls, as its censorship resistant

Falodun and his team also provided an overview on the evolution of money and financial systems and also touched on the ways in which bitcoin and crypto are already integrated into traditional financial structures in efforts to convince the NDIC of Bitcoin and crypto’s importance.

“Nigeria must adopt balanced regulations that protect citizens and foster innovation,” Falodun told Bitcoin Magazine. “By embracing Bitcoin’s uniqueness and engaging the Bitcoin community, Nigeria can lead the global financial revolution.”

Falodun knows that without properly educating government officials, Bitcoin runs the risk of being misunderstood and, therefore, regulated improperly.

“I would like regulators to understand that Bitcoin’s decentralized nature is not a flaw to be regulated out of existence, but a feature that offers unprecedented opportunities for inclusion, economic freedom and optimization of financial rails,” he added.

I respect Falodun’s efforts.

Before you go calling me a statist or some other silly reductive term, I’d like to remind you that even well-known cypherpunks like Adam Back have said that part of the struggle around greater Bitcoin adoption (and encryption in general) will include engaging with governments (and courts).

Proponents of Bitcoin should acknowledge our current political reality and make the case for Bitcoin to those in power if they want to see it flourish — or if they want to at least stop governments from crafting poor policy around Bitcoin and/or attacking the industry.

Take a cue from Falodun and do your part to educate local government officials, members of state-level administrative agencies or even Federal-level bureaucrats about Bitcoin.

It’s one of the most important things you can do to keep your country from falling behind.

Source link

Binance

Joe Biden Thanks Nigerian President for Releasing Binance Executive Tigran Gambaryan From Prison

Published

3 weeks agoon

October 31, 2024By

admin

US President Joe Biden has expressed his appreciation to Nigerian President Bola Tinubu for securing the release of Binance’s compliance officer Tigran Gambaryan from prison.

Gambaryan, a former agent of the US Internal Revenue Service (IRS), was visiting Nigeria to address regulatory concerns about Binance when local authorities arrested and jailed him on charges of money laundering and operating an unlicensed financial institution.

Amid reports of Gambaryan’s deteriorating health and the Nigerian government’s refusal to give him adequate medical treatment, 18 US state attorneys general wrote a joint letter telling Biden that Nigeria’s blatant misuse of power should be met with the full weight of the US government’s influence given the financial and political support that America extends to the West African nation’s current regime.

Last week, Judge Emeka Nwite ordered that Gambaryan be released from Kuje prison where the executive was incarcerated following his arraignment in April.

R.U. Adaba, a lawyer who represents the prosecuting agency, said that Nigeria is dropping the charges due to diplomatic interventions and in consideration of the extent of Gambaryan’s involvement as an employee of Binance.

The White House says that during a recent call, Biden thanked Tinubu for the development in Gambaryan’s case.

“President Biden offered his condolences on the recent flooding that has impacted northeastern Nigeria and underscored his appreciation for President Tinubu’s leadership in securing the release on humanitarian grounds of American citizen and former U.S. law enforcement official Tigran Gambaryan last week.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

24/7 Cryptocurrency News

Will Nigerian Court Grant Bail To Detained Binance Executive?

Published

3 months agoon

September 4, 2024By

admin

Nigerian Court in Abuja is currently in the spotlight as it reviews the bail application of Tigran Gambaryan, a Binance Holdings Ltd. executive. Gambaryan, the head of financial crime compliance at Binance, has been detained in Nigeria for over six months.

The court proceedings on Wednesday extended for several hours, after which the judge announced that a decision on the bail would be made later next month.

Nigerian Court Delays Bail For Binance Executive To October 9

The Nigerian Court heard extensive arguments concerning the bail request of Tigran Gambaryan. During the session, the crypto exchange executive’s legal representation emphasized his deteriorating health condition, underscoring the urgent need for surgical intervention.

The legal team claimed his health could not be adequately addressed within the medical facilities available to him in detention. The defense further argued that these circumstances justify the granting of bail on medical grounds.

In contrast, the state prosecutor countered these claims by insisting that Gambaryan has received appropriate medical care, including services at a well-equipped hospital in Abuja.

Further, the prosecutor’s stance highlights the government’s position that Gambaryan’s health needs are being met. This challenges the necessity of bail on the grounds presented by the defense. The judge finally stated that a decision on the bail would be made on October 9.

Binance Legal Battle and International Concerns

The case has attracted significant international attention due to the circumstances surrounding the Binance executive arrest and detention. In February, the executive was detained along with a colleague during a visit to discuss compliance issues.

More so, the situation escalated following the colleague’s escape and subsequent charges against Gambaryan. Nigeria Economic and Financial Crimes Commission brought the charges, which include currency manipulation and money laundering.

This incident has strained relations and led to accusations from Binance. The exchange claims that Nigerian authorities demanded a clandestine payment to resolve the company’s legal troubles, a claim Nigeria denies.

In addition, just last week, Binance CEO Richard Teng denied Nigeria’s claim of $26 billion made in revenue in 2023 as reported by the courts. He also called for the humanitarian release of the detained executive.

Moreover, this dispute has drawn scrutiny from international observers and prompted intervention from US lawmakers, who have urged the US government to assist in resolving his detainment. The outcome remains uncertain as the Nigerian Court deliberates on the bail application.

Binance continues to face legal challenges even as its co-founder, Changpeng Zhao, expects release on September 29. The court sentenced him to four months for violations of anti-money laundering laws. Recently, a judge issued a minor order as ten attorneys representing Changpeng withdrew from the lawsuit.

Ronny Mugendi

Ronny Mugendi is a seasoned crypto journalist with four years of professional experience. He has worked extensively with various media outlets on cryptocurrency trends and technologies. When he’s not analyzing the latest crypto developments, Ronny enjoys the thrill of bike riding, exploring new trails and landscapes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

Polkadot investor predicts a 30,000% rally for this $0.04 token by 2025

Donald Trump Proposed Crypto Advisory Council To Set Up Strategic Bitcoin Reserve

Want Greater Bitcoin Adoption? Engage With Your Government.

Why the Media Loves the Worst of Crypto

HashCats prepares for Token Generation Event after completing mining season

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: