Check Test Posting

Published

2 months agoon

By

adminЭто тестовое сообщение для проверки возможностей публикации.

The post Check Test Posting first appeared on BTC Wires.

Source link

You may like

Pump.fun Accounted for 62% of Solana DEX Transactions in November, So Far

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Zodia Custody teams up with Securitize for institutional access to tokenized assets

Crypto Analyst Explains Why Dogecoin Price Will Hit $1

Bitcoin Long-Term Holders Have 163K More BTC to Sell, History Indicates: Van Straten

The transformative potential of Bitcoin in the job market

DeFi

Pump.fun Accounted for 62% of Solana DEX Transactions in November, So Far

Published

37 mins agoon

November 26, 2024By

admin

Tokens created on Pump.fun have accounted for 62.3% of all decentralized exchange (DEX) transactions on Solana so far in November, according to Dune data. In terms of volume, the value of what’s changed hands, this is slightly less pronounced at 42.3%.

The data bolsters arguments that the protocol has become a cornerstone in the Solana ecosystem.

Pump.fun debuted in January this year, enabling anyone to launch a token. Originally it only cost a few bucks to do it, but the team eventually made it completely free. In turn, it has become one of the most culturally significant crypto projects, birthing some of the biggest meme coins of the year—the likes of PNUT, GOAT, and CHILLGUY.

However, the platform has also come under immense pressure following a slew of controversial, morally questionable, and illegal tokens appearing on the platform. This all began when an apparent mom shook her boobs on a livestream to pump her son’s meme coin. While this was weird, the platform took a disturbing turn when another meme coin dev set himself on fire for his token.

Following this, Pump.fun decided to add livestreaming as a native feature. Previously users had been streaming on third-party sites, such as Kick. At first it was painfully glitchy and degens ignored it. But last week, it became the meta again. With this, some took to the platform to perform goofy stunts for money—such as sitting on a toilet for days on end.

A number of disturbing livestreams have since appeared on the platform that disturbed viewers. Decrypt has seen screengrabs and videos of Pump.fun livestreams featuring threats to animal life, the actual beheading of a chicken, bestiality, and an apparent suicide—although the last instance is rumored to be fake.

This caused outrage across the industry, and calls for the platform to shut down the livestreaming feature started to echo.

Pseudonymous on-chain sleuth WazzCrypto predicted that the United States Department of Justice would shut down the site. And Preston Byrne, a crypto lawyer, claimed the project was likely breaking the law.

“Pumpdotfun does a lot very incorrectly from a social media law POV,” Byrne, Head of UK Legal at Arkham Intelligence and Managing Partner at Byrne & Storm, posted on Twitter. “No terms of service, no DMCA registration, and copyright policy, no privacy policy.”

He believes that this puts the future of Pump.fun in a precarious position legally, especially in the UK—where the company is based. As such, he agrees it’s the correct decision to shut down streaming until it has sorted its legal affairs, which Byrne told Decrypt should only take 10 hours of legal work.

If the worst case happens, and Pump.fun is banned, this could have a knock on effect on Solana as a network. As mentioned, Pump.fun has accounted for 62.3% of transactions so far in November but it’s been a similar case for some months now.

In September and October, Pump.fun accounted for 60% and in August it accounted for 57% of all Solana DEX transactions. This isn’t even including the amount of transactions that happen prior to a token migrating to decentralized exchanges once the token hits a market cap of $69,000. According to Dune, only 1.2% of the nearly 50,000 tokens launched over the past 24 hours have achieved this.

For this reason, some have started to fear the worst for Solana as it leans too heavily on the degenerate nature of Pump.fun. “An economy built on this will not make it,” Project Lead at Ethereum news protocol TrueMarkets, known as Millie, posted on Twitter.

Edited by Stacy Elliott.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Bitcoin adoption

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Published

43 mins agoon

November 26, 2024By

admin

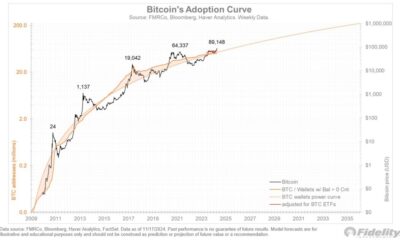

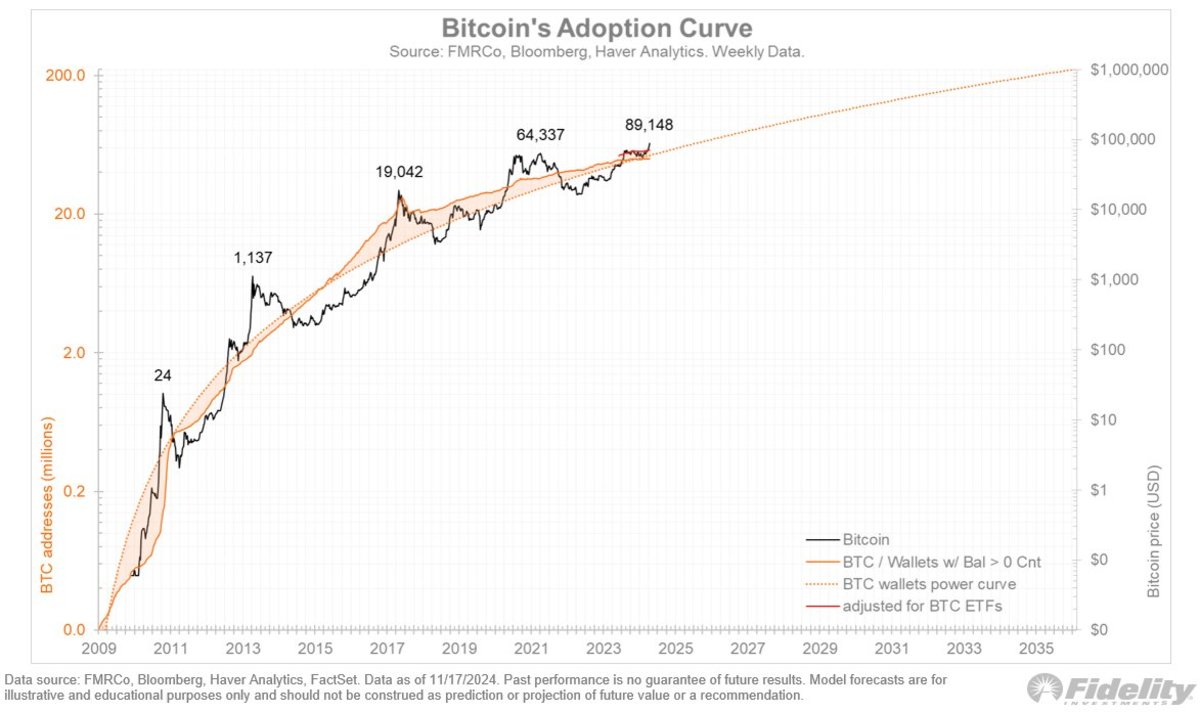

Fidelity Investments’ Director of Global Macro, Jurrien Timmer, continues to provide insightful frameworks for understanding Bitcoin’s valuation and growth. In a recent update, Timmer shared his take on Bitcoin’s adoption and value trajectories, illustrated by detailed charts that reflect both historical trends and hypothetical scenarios.

Timmer’s models aim to simplify Bitcoin’s complex growth dynamics, bridging the gap between network adoption and valuation. “While the supply is known, the demand is not,” he stated, emphasizing the critical role of adoption curves and macroeconomic variables such as real rates and monetary policy.

Adoption Curves: Slowing But Consistent Growth

Despite a slowdown in Bitcoin’s network growth, as measured by the number of wallets with a non-zero balance, Timmer noted that the trend still aligns with the steep power curve shown in his updated adoption chart. While the internet adoption curve has a gentler slope, Bitcoin’s adoption trajectory remains steeper, signifying its rapid but maturing growth.

Importantly, Timmer highlighted a key limitation in the measurement of wallet growth: the understated wallet/address count due to Bitcoin ETFs, which consolidate holdings into just a few wallets. “It’s very likely that the wallet/address count is understated,” he said, pointing out that ETFs obscure the broader distribution of Bitcoin adoption.

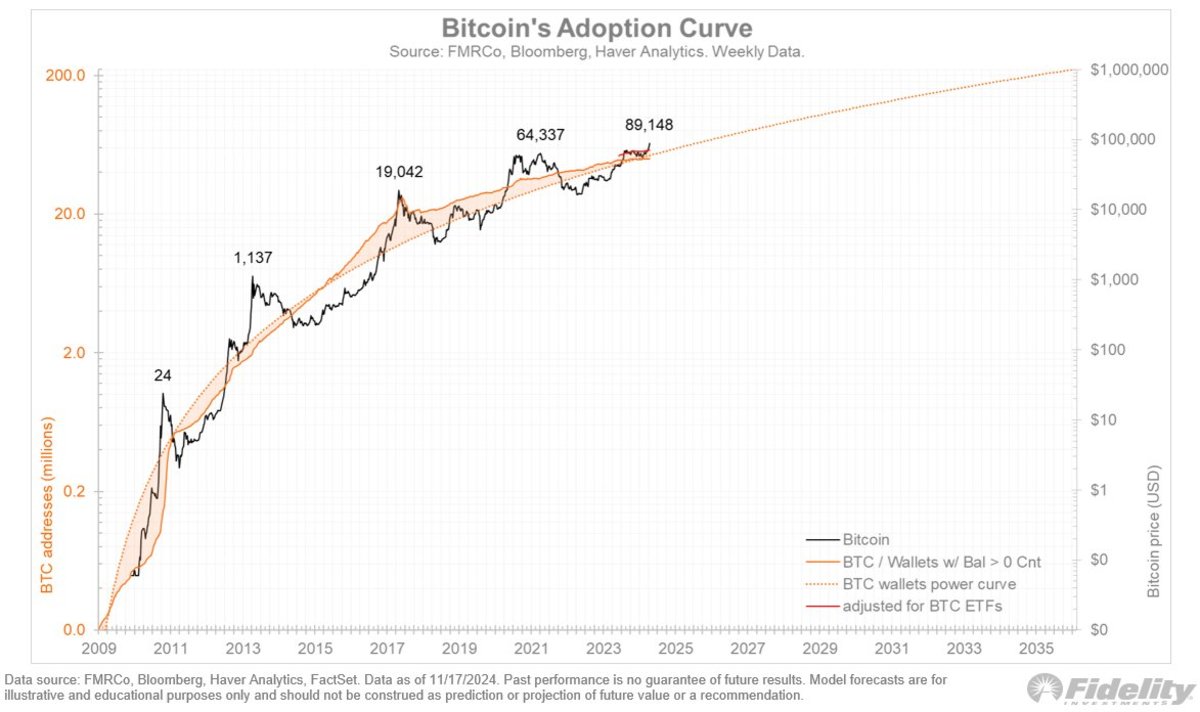

Monetary Policy Meets Adoption Dynamics

Building on his previous models, Timmer added a new layer to his valuation framework by incorporating money supply growth alongside real interest rates. The updated charts compare two hypothetical paths for Bitcoin’s valuation: one driven by adoption curves and real rates, and another that includes monetary inflation as a factor.

“Again, these are not predictions,” Timmer clarified, “but merely attempts at visualizing the use case on the basis of adoption, real rates, and monetary inflation.” This layered approach underscores how external macroeconomic forces, like monetary policy, could influence Bitcoin’s adoption and valuation.

Why This Matters

Timmer’s updated models reinforce Bitcoin’s position as a maturing financial asset. By combining historical S-curves, Metcalfe’s Law, and macroeconomic factors, he offers a comprehensive view of Bitcoin’s unique blend of network utility and monetary features. His work highlights the importance of adoption in driving Bitcoin’s value, while also demonstrating how real-world monetary conditions could shape its future.

For Bitcoin proponents and skeptics alike, Timmer’s insights serve as a valuable framework for understanding the asset’s dual nature as both a network and a form of money. The inclusion of monetary inflation in his models further underscores Bitcoin’s potential as a hedge against fiat currency debasement.

The Road Ahead

As Bitcoin continues to evolve, Timmer’s models provide a critical lens for tracking its development. Whether it’s the flattening of the adoption curve or the interplay between monetary policy and valuation, his analysis underscores the asset’s growing complexity—and its enduring relevance in the financial world.

For investors, analysts, and enthusiasts, these insights are a reminder of Bitcoin’s transformative potential, even as its growth curve matures.

Source link

asset tokenization

Zodia Custody teams up with Securitize for institutional access to tokenized assets

Published

2 hours agoon

November 26, 2024By

admin

Zodia Custody has partnered with Securitize, a leader in tokenizing real-world assets.

The collaboration aims to enhance support for institutional investors engaging with tokenized assets, including BlackRock’s USD Institutional Digital Liquidity Fund — BUIDL. Zodia Custody will use Securitize’s technology to expand its custody services for institutional clients holding tokenized assets, according to a company announcement.

Zodia’s custody solution includes secure cold storage, ensuring client assets are segregated and compliant with regulatory standards. This is especially important for institutional investors who prioritize the safety of their holdings in the evolving digital asset market.

Zodia Custody, based in London, is a digital asset custodian supported by major financial institutions, including Standard Chartered, Northern Trust, and SBI Holdings.

Tokenization accessibility

Tokenization involves converting physical assets like real estate, stocks, or funds into digital tokens stored on a blockchain. These tokens represent ownership and can be traded or managed more efficiently than traditional financial instruments.

This process is gaining traction due to its cost efficiency and increased accessibility for investors. For instance, BUIDL has already attracted $530 million in assets under management since its launch in March 2024.

The market for tokenized real-world assets is projected to surpass the $4.5 trillion cryptocurrency market capitalization by 2028. While USD stablecoins currently dominate tokenization use cases, new products linked to assets like debt and real estate are emerging.

Zodia CEO Julian Sawyer emphasized the partnership’s significance, stating: “BUIDL’s growth demonstrates the opportunities in tokenized assets and their transformative potential for both traditional finance and digital-native businesses.”

Source link

Pump.fun Accounted for 62% of Solana DEX Transactions in November, So Far

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Zodia Custody teams up with Securitize for institutional access to tokenized assets

Crypto Analyst Explains Why Dogecoin Price Will Hit $1

Bitcoin Long-Term Holders Have 163K More BTC to Sell, History Indicates: Van Straten

The transformative potential of Bitcoin in the job market

Ripple CLO Stuart Alderoty Challenges US SEC

Changpeng Zhao critiques meme coins, suggests projects should focus on utility

Expert Warns Of Upcoming 25% Drop, Timing And Trends Explained

Is Marathon Digital (MARA) a Better Bet Than MicroStrategy (MSTR) Stock Now?

Cardano eyes spot ETF entry as analyst foresees surge, Rollblock set to explode next

BTC Dips Below $95K, LDO Up 15%

Trader Warns of Potential XRP Correction, Says Dogecoin Trading at Most Likely Area To Expect Rejection

Meme Coins Die — Bloggers’ Advertising is Ineffective

Hashdex Files Second Amendment for Nasdaq Crypto Index US ETF Approval

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential