Law and Order

OpenSea NFT Marketplace Hit With Class Action Suit Over Alleged Securities Sales

Published

2 months agoon

By

admin

The Moskowitz Law Firm filed another class-action lawsuit against a crypto firm Thursday, this time alleging that OpenSea’s customers were sold NFTs as unregistered securities.

The lawsuit brought in a Florida federal court claims that two residents of the Sunshine State sustained damages as a result purchasing NFTs on the platform, which served as a go-to place to purchase digital art and collectibles when the NFT market ran red-hot in 2021 and 2022.

“We have learned a great deal in our extensive crypto litigation,” Moskowitz Law Firm Managing Partner Adam Moskowitz told Decrypt in a statement. “With today’s ever-changing regulation, there should be a process to sell NFTs in a well-regulated environment.”

The Miami-based law firm is currently litigating against a wide range of crypto firms and their associates, including FTX and 11 celebrities who endorsed the collapsed crypto exchange. It has also sued basketball legend Shaquille O’Neal over his Solana-based NFT project Astrals, and soccer star Cristiano Ronaldo over his promotion of the crypto exchange Binance.

The latest lawsuit alleges that OpenSea engaged in a scheme “to mislead and deceive investors” while unjustly enriching itself by charging fees on NFT transactions. The Florida residents believed that NFTs traded on OpenSea were registered securities due to OpenSea’s representations, a copy of the case’s complaint shared with Decrypt states.

While the lawsuit does not list damages resulting from NFT purchases, it asserts that NFTs fall under the definition of a security as investment contracts. In various enforcement actions, the SEC itself has asserted similar claims, stating that NFT purchasers invested money in a common enterprise with the expectation of profit derived from the efforts of others.

Moskowitz’s lawsuit follows OpenSea’s disclosure of receiving a Wells notice in August, signaling that the Securities and Exchange Commission (SEC) is likely to sue the marketplace. On Twitter (aka X), OpenSea CEO Devin Finzer described the prospect of an enforcement action against OpenSea as a step into uncharted territory that puts artists at risk.

“The SEC [is] threatening to sue us because they believe NFTs on our platform are securities,” Finzer, a resident of Miami, said. “We should not regulate digital art in the same way we regulate collateralized debt obligations.”

As Finzer pointed out, NFTs can represent ownership in many things, including domain names, trading cards, and event tickets. Earlier this week, SEC Commissioners Hester Peirce and Mark Uyeda described the regulator’s approach to NFTs as “misguided and overreaching.”

Though the commissioners accused the SEC of an overzealous application of securities laws while targeting an NFT-gated restaurant chain, Moskowitz’s lawsuit argues that “the SEC’s stance on cryptocurrency has always been consistent.”

Last month, the law firm notched a partial win in its case against O’Neal, when a Florida judge ruled that the case could proceed on some accusations. In Thursday’s complaint, Moskowitz pointed to OpenSea as a platform where NFTs from O’Neal’s Astrals project were available.

OpenSea did not immediately respond to a request for comment from Decrypt.

Edited by Andrew Hayward

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

You may like

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Bitcoin Crashes Under $93,000: What’s Behind It?

Trump in considerations for CFTC to regulate crypto

Will XRP Price Reach $2 By The End Of November?

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Bitcoin Script: Focus On The Building Blocks, Not The Wild Geese

Law and Order

Trump Nominates Pro-Crypto Hedge Fund Manager Scott Bessent as Treasury Secretary

Published

4 days agoon

November 23, 2024By

admin

President-elect Donald Trump has nominated Scott Bessent, a prominent hedge fund manager known for his pro-cryptocurrency stance, to serve as the next Secretary of the Treasury, multiple news outlets reported late Friday.

Bessent, founder of Key Square Group, has been a significant economic adviser to Trump’s campaign and is expected to play a pivotal role in shaping the administration’s economic policies. Among other things, he’s an ardent supporter of Trump’s plan to create a strategic Bitcoin Reserve.

Born in 1962 in Conway, South Carolina, Scott Bessent graduated from Yale University in 1984. He began his career in finance at Brown Brothers Harriman and later joined Kynikos Associates. In 1991, Bessent became a partner at Soros Fund Management, where he played a key role in the firm’s notable wager against the British pound.

After leaving Soros Fund Management in 2000, Bessent founded a $1 billion hedge fund, which he managed until 2005. He also served as a senior investment advisor at Protégé Partners. In 2011, Bessent returned to Soros Fund Management as Chief Investment Officer, a position he held until 2015. That year, he established Key Square Group, a global macro investment firm.

Pro-Cryptocurrency Advocacy

Bessent has been an outspoken advocate for cryptocurrencies, viewing them as integral to the future of finance. He has expressed optimism about the role of digital assets in promoting financial freedom and innovation. His pro-crypto stance aligns with the administration’s interest in integrating digital currencies into the broader economic framework.

He’s supported both Democratic and Republican candidates. In 2000, he hosted a fundraiser for Vice President Al Gore’s presidential campaign. More recently, he has been a significant donor and adviser to President-elect Trump’s campaign, contributing over $2 million and providing economic policy guidance.

Bessent’s nomination is subject to Senate confirmation. If confirmed, he will be responsible for implementing the administration’s economic agenda, including tax reforms and policies related to digital currencies. His extensive experience in finance and investment is expected to influence the Treasury Department’s approach to emerging financial technologies.

Initial reaction on X was overwhelmingly positive from all corners, with some praising Bessent’s financial experience and acumen and others pointing out that Bessent is Trump’s first, openly gay Cabinet nominee.

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Law and Order

California Court Rules Lido DAO Members Can Be Held Liable Under Partnership Laws

Published

1 week agoon

November 19, 2024By

admin

A federal court judge ruled on Monday that Lido DAO, the governing body behind the popular liquid staking protocol, can be treated as a general partnership under state law.

The court rejected Lido’s claim that it isn’t a legal entity, classifying it as a general partnership and setting a precedent for how profit-driven DAOs are treated.

It was also ruled that identifiable participants were managing the DAO’s operations and, therefore, could not evade liability through its decentralized structure, according to court documents filed in the U.S. Northern District Court of California.

“[The lawsuit] presents several new and important questions about the ability of people in the crypto world to inoculate themselves from liability by creating novel legal arrangements to profit from exotic financial instruments,” Judge Vince Chhabria wrote in his ruling.

Paradigm Operations, Andreessen Horowitz, and Dragonfly Digital Management were implicated as general partners based on their alleged active involvement in Lido governance and operations.

However, Robot Ventures, another Lido investor, was dismissed due to insufficient allegations of active participation.

General Counsel and Head of Decentralization at a16z crypto, Miles Jennings, said Judge Chhabria’s decision had “dealt a huge blow to decentralized governance” in a statement posted to X on Monday.

“Under the ruling, any DAO participation (even posting in a forum) could be sufficient to hold DAO members liable for the actions of other members under general partnership laws,” he said.

What happened

According to court documents, plaintiff Andrew Samuels purchased LDO tokens on the secondary market in April and May 2023 through the Gemini exchange.

By December of that year, Samuels filed a class-action lawsuit after incurring losses from purchasing the platform’s native LDO tokens, alleging they were sold to him as unregistered securities, and held Lido DAO liable for the decline in their value.

On Monday, the court agreed with Samuels’ contention, finding Lido’s structure—where token holders govern decisions and earn from staking rewards—constitutes a general partnership under California law. It also found Lido DAO’s lack of direct token sales did not exempt it from liability.

“The courts have construed the statutory phrase ‘offers or sells’ broadly to cover someone who ‘solicits’ the purchase of securities. Samuels has adequately alleged that Lido indeed solicited the purchase of these tokens on crypto exchanges.”

Lido DAO functions as a general partnership, as it involves “the association of two or more persons to carry on as coowners a business for profit forms a partnership, whether or not the persons intend to form a partnership,” the court ruled, citing state law.

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Law and Order

Crypto Dad Giancarlo Denies SEC Job Rumors: ‘I’ve Already Cleaned Up Gensler Mess’

Published

2 weeks agoon

November 15, 2024By

admin

J. Christopher Giancarlo, affectionately known as “Crypto Dad,” dismissed speculation that he is being considered to replace Gary Gensler as head of the Securities and Exchange Commission (SEC).

On Thursday, the former Chair of the U.S. Commodity Futures Trading Commission (CFTC) took to X to deny reports he was seeking the agency’s top job.

“I’ve made clear that I’ve already cleaned up an earlier Gary Gensler[‘s] mess,” he said. “[I] Don’t want to have to do it again.”

He also pushed back against rumors he was seeking “some crypto role” within the U.S. Treasury Department, claiming they were “also wrong.”

The buzz around Giancarlo’s potential return to a regulatory role comes amidst speculation of a shake-up at the SEC following Donald Trump’s re-election, with Gary Gensler’s position as chairman hanging in the balance.

Giancarlo served as a commissioner at the CFTC from June 2014 to April 2019, stepping into the role shortly after Gensler’s departure as CFTC chair.

He earned the nickname “Crypto Dad” as he became a top figure in the crypto community by advocating for crypto innovation during his tenure.

After stepping down from his role, he co-founded the Digital Dollar Project in January 2020, which seeks to promote discussions on the future of “digital monetary innovations.”

Giancarlo has maintained that central bank digital currencies (CBDCs) are not the only path forward, noting that “crypto, CBDCs, stablecoins, and more” is the global future.

President-elect Donald Trump, whose return to the Whitehouse in January marks a significant comeback for the Republican party, has vowed to quash any future CBDC policy.

The crypto community is bracing for the possibility of Gensler’s departure, as Trump has also promised to replace the current SEC chair, whose term runs until 2026.

Giancarlo is not the only name being floated; other pro-crypto candidates include SEC Commissioners Hester Peirce and Mark Uyeda, former Binance.US CEO Brian Brooks, and others.

Gensler, a contentious figure in the crypto space, hinted at his possible departure during a speech at the 56th Annual Institute on Securities Regulation on Thursday.

At the end of the speech, he stated, “It’s been a great honor to serve with them, doing the people’s work, and ensuring that our capital markets remain the best in the world,” referring to his SEC colleagues.

The pressure on Gensler is at an all-time high this week as 18 states, along with the DeFi Education Fund, filed a lawsuit accusing the SEC of overreaching its authority on crypto regulations.

Filed Thursday, the suit alleges that under Gensler’s leadership, the SEC deliberately bypassed standard procedures and withheld new crypto rules to pursue a “regulatory land grab.”

Edited by Sebastian Sinclair

Daily Debrief Newsletter

Start every day with the top news stories right now, plus original features, a podcast, videos and more.

Source link

Maximizing Bitcoin Accumulation – Beyond the Benchmark

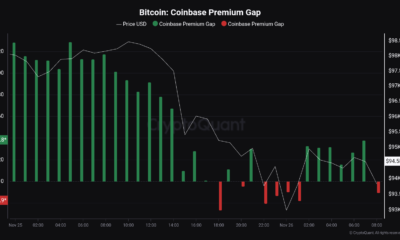

Bitcoin Crashes Under $93,000: What’s Behind It?

Trump in considerations for CFTC to regulate crypto

Will XRP Price Reach $2 By The End Of November?

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Bitcoin Script: Focus On The Building Blocks, Not The Wild Geese

Kraken to close NFT marketplace by February 2025

Kraken To Shut Down Its NFT Marketplace

Pump.fun Accounted for 62% of Solana DEX Transactions in November, So Far

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Zodia Custody teams up with Securitize for institutional access to tokenized assets

Crypto Analyst Explains Why Dogecoin Price Will Hit $1

Bitcoin Long-Term Holders Have 163K More BTC to Sell, History Indicates: Van Straten

The transformative potential of Bitcoin in the job market

Ripple CLO Stuart Alderoty Challenges US SEC

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential