Blockchain

TOKEN2049 Singapore main highlights

Published

2 months agoon

By

admin

TOKEN2049 has ended in Singapore. Here are three highlights from one of the most anticipated crypto conferences of the year.

One of the largest industry conferences, TOKEN2049, was held from Sept. 18 to 19 in Singapore. It brought together leading figures in the crypto space, who shared their thoughts on trends, developments and priorities for the industry.

What will the crypto industry be like in three years?

One of the highlights of the event was a panel entitled “The Next 3 Years in Crypto,” during which several leaders of major crypto projects discussed where the industry is heading in the near term. Stablecoin issuer Circle‘s CEO Jeremy Allaire, top crypto exchange OKX‘s founder and CEO Star Xu, and Ethereum co-founder Vitalik Buterin participated in the panel discussion and spoke about the digital asset sector’s future, sharing stories from their past experience as long-time participants and leaders in the space.

Self-custody is key

During the panel, OKX’s Xu noted the importance of self-custody technologies for storing cryptocurrency, given their relatively high level of security. However, he also pointed out that promoting self-custody in the crypto industry — meaning holding your crypto yourself instead of using a third-party, like an exchange — does not imply that there is no need to regulate the space.

Speaking about the future of digital assets, Xu noted that over the past ten years, the industry has seen many important technological developments. However, he believes that web3 applications and use cases should be developing even faster.

Less focus on NFTs

Buterin mentioned that one of the main advantages of digital assets is their international, borderless nature. He reiterated the notion that the industry has the potential to meet the needs of people globally who do not have access to the traditional financial system.

He also pointed out the need for practical use cases to drive the mass adoption of digital assets. Buterin called for less focus on expensive NFTs, arguing that they have no real benefits for the industry or for humanity.

The co-founder of Ethereum also said that he believes that improving security in the crypto industry should be a major focus, alongside trying to reduce transaction fees.

Vitalik comments on the accessibility of crypto and sings a crypto song

Buterin also touched on topics such as the accessibility of cryptocurrencies, their use as a means of payment, and security in the ecosystem as a whole.

He argued that it’s no longer valid to say that it’s too early for more widespread adoption of crypto. He compared the extremely limited awareness and adoption of Bitcoin (BTC) in 2013 with the situation just eight years later, in 2021, when a cup of coffee could be bought for Ethereum (ETH) in Argentina.

In between talking about the future of blockchain and cryptocurrencies, he also sang a song about crypto:

And then an improved version of Buterin’s song appeared on social media:

Arthur Hayes predicts market reaction to Fed rate cuts

Also on the first day of the event, the co-founder of derivatives exchange BitMEX, Arthur Hayes, gave a keynote speech with the title “Thoughts on Macroeconomics Current Events.”

Speaking the same day that the U.S. Federal Reserve was expected to announce very anticipated interest rate cuts — which indeed happened later that day — Hayes predicted that the cuts would cause the markets to drop in the short-term:

“I think that the Fed is making a colossal mistake cutting rates at a time when the U.S. government is printing and spending as much money as they ever have in peacetime.”

Hayes noted that the lower interest rates in the U.S. could trigger a market drop in part because of — again — fears around the unwinding of the yen carry trade. Lower interest rates from the Fed, coupled with recently rising rates from the Bank of Japan, lessen the gap between rates in the U.S. and Japan, making the yen carry trade less profitable.

The yen carry trade refers to when investors borrow yen at historically very low rates, convert it into currencies with higher-yield assets, like Treasury Bills in the U.S., and then invest in those assets. Last month, one of the driving factors behind global markets plummeting was the potential unwinding of the yen carry trade.

However, since the U.S. Fed announced a 0.5% cut in interest rates, Bitcoin has gained almost 7%.

The next TOKEN2049 event — which promises to feature 200+ speakers — is scheduled to take place this spring in Dubai.

Source link

You may like

Is Bitcoin Self-Custody Under Threat in Europe?

SynFutures announces F token airdrop

Ripple Lawsuit Lead Attorney Joins US SEC As Chief Litigation Counsel

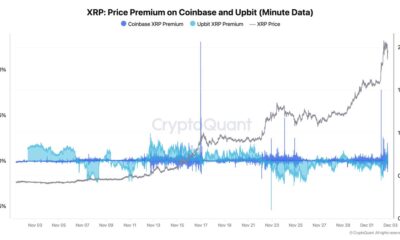

CryptoQuant CEO Warns Not To Short XRP Due To Insider Whales

The lack of soft forks is due to a lack of interest— not a lack of process

Now could be the best time to buy DOGE, XRP and new trending altcoin

Adoption

The transformative potential of Bitcoin in the job market

Published

1 week agoon

November 26, 2024By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Bitcoin (BTC) has already changed the world, and as it gains traction, its potential to reshape the job market is becoming increasingly apparent. Even though recently we saw layoffs by big companies like Consensys and Kraken, it must be due to the industry’s maturing nature where companies are not yet certain about hiring principals.

The real story is that Bitcoin and its associated technologies will drive long-term job growth and create new roles. Unlike traditional assets, Bitcoin is decentralized. So, it fosters innovation and creates jobs in software development, cybersecurity, and financial services.

Even despite the not well-regulated environment, it already attracts different professionals. By this, Bitcoin boosts local economies and increases tax revenues, so not only people benefit but governments as well.

A new frontier for jobs—but not without growing pains

To start with, Bitcoin was the first-ever cryptocurrency. It came as a novelty that wasn’t accepted right away. However, later on, as people were getting more into it, more companies started launching their crypto tokens. To do this, they, of course, needed people who had already gained certain knowledge about Bitcoin.

It’s been 16 years since its invention, and crypto is no longer an unexplored phenomenon. Little by little, it becomes an integral part of our lives—the future is digital, as they say. From blockchain development and data security to market analysis and customer support, the skill sets needed in the crypto industry are expanding.

However, the industry is not fully mature, so there are no set hiring standards yet. At first, companies rushed to hire employees, anticipating the massive growth they predicted. But this has sometimes led to overhiring as companies face difficulty estimating the precise number of employees needed.

So, this boom in hiring has recently faced setbacks. Major players in the crypto industry, such as Consensys, Kraken, and dYdX, have all laid off significant portions of their workforces in recent weeks. They let go of 20%, 15%, and 35% of their employees, respectively. However, it only shows that the crypto industry as a whole is still defining its optimal workforce size.

A closer look at the layoffs reveals a more nuanced reality. Crypto companies are rather re-strategizing—they are shifting to smaller company types. Why? Because they think that companies with fewer but highly specialized employees who use web3 tools and AI function more efficiently.

In this sense, Bitcoin and its associated technologies are not just creating traditional roles but are increasing the demand for a workforce with cross-functional and adaptable skill sets. Companies need more and more roles that can be dynamic and evolve along with the industry.

Also, the volatility of the crypto market means that hiring trends tend to rise and fall depending on the Bitcoin prices and overall market sentiment: During bullish periods, companies have higher profits and often expand their workforce. In contrast, bear markets, regulatory challenges, and internal restructurings can lead to workforce reductions. This is what we see with the recent layoffs.

The bigger picture: long-term growth despite setbacks

The picture of crypto industry employment trends is much wider than it might be seen at first sight. Despite the recent flow of layoffs, crypto-related jobs still seem attractive to the masses—demand for crypto-related roles continues to rise.

The supply also remains in a positive trend. The biggest increase in positions is tracked in blockchain development and product management. There is also a need for individuals skilled in, for example, decentralized finance, digital asset custody, or blockchain law. And it is very interesting, as such a tendency represents the diversity and growth of the job market around Bitcoin.

To provide the future workforce, the introduction of educational programs and certifications in crypto and blockchain prepare new generations for work in this new economy. Education around crypto has become more common, so job seekers have become better equipped with the skills necessary for roles in this sector. This, in turn, reduces the need for companies to hire large teams.

Adapting to the sector

Since the market hasn’t reached its full maturity, there will be a need for adaptability. Many of the roles in the crypto industry didn’t exist a decade ago, and even more new roles will continue to emerge. Some professionals might find themselves in positions that didn’t exist when they entered the job market.

Continuous education and upskilling are essential as never before. The Bitcoin job market requires a mix of technical expertise and regulatory understanding. Companies are definitely going to experiment with different business models and will have to navigate regulatory challenges. To do all these, they will need employees who can adjust quickly to changes and operate efficiently.

Arthur Azizov

Arthur Azizov is the CEO of B2BINPAY, an all-in-one crypto ecosystem for businesses. A thought leader and visionary with a global view, he launched his first business, a payment terminal company, in 2007, boasting over 15 years of practical entrepreneurial experience since then. Before B2BINPAY, he founded and scaled an international broker company, B2Broker Group, with over 450 employees and a $70M valuation.

Source link

Blockchain

Blockchain Association urges Trump to prioritize crypto during first 100 days

Published

2 weeks agoon

November 22, 2024By

admin

The Blockchain Association has called on president-elect Donald Trump and Congress to prioritize five key actions during the administration’s first 100 days to establish the U.S. as a global leader in cryptocurrency innovation.

In an open letter, the industry group outlined specific measures to address regulatory challenges and support the domestic digital asset economy.

The Blockchain Association is a U.S.-based crypto lobbying group advocating for a regulatory framework for cryptocurrencies. They emphasized lifting the bank account ban on crypto companies and appointing new leadership for the SEC, Treasury Department, and IRS.

They also proposed creating a cryptocurrency advisory committee to work with Congress and federal regulators.

Five priorities for Trump’s first 100 days

The letter highlighted five steps aimed at fostering a supportive environment for crypto businesses and users:

- Creating a Crypto Regulatory Framework

The Blockchain Association urged Congress to draft comprehensive legislation for cryptocurrency markets and stablecoins. This framework, it argued, would balance consumer protection with innovation. Stablecoins are digital currencies tied to traditional assets, such as the U.S. dollar, offering price stability for users. - Ending the Debanking of Crypto Companies

The group expressed concern over crypto businesses losing access to banking services. These companies rely on traditional banks to handle payroll, taxes, and vendor payments. Without banking access, their operations can be severely disrupted. - Reforming the SEC and Repealing SAB 121

The association called for a new SEC chair to replace what it described as a hostile regulatory approach under the current leadership. It also recommended reversing SAB 121, an accounting rule that imposes strict requirements on crypto-related businesses. - Appointing New Treasury and IRS Leadership

Tax policies for cryptocurrencies, such as the proposed Broker Rule, have been criticized for potentially stifling innovation and driving companies offshore. The letter urged the administration to appoint leaders who would support privacy and foster a fair tax environment for digital assets. - Establishing a Crypto Advisory Council

The letter proposed a council to facilitate collaboration between the industry, Congress, and federal regulators. Public-private partnerships, it said, could create rules that protect consumers while encouraging innovation.

Crypto collaboration

In their letter, the Blockchain Association emphasized its readiness to work with the administration and 100 member organizations to ensure the U.S. regains its position as a financial and technological innovation leader.

“We stand ready to work with you to ensure the United States can regain its position as the crypto capital of the world,” the Blockchain Association wrote in the letter.

This letter comes as Trump adopts a strong pro-crypto stance. Earlier in November, reports emerged that Trump plans to create a White House position solely focused on cryptocurrency and related policies.

This letter also comes a day after crypto-foe and SEC chair Gary Gensler announced his upcoming resignation.

Source link

Blockchain

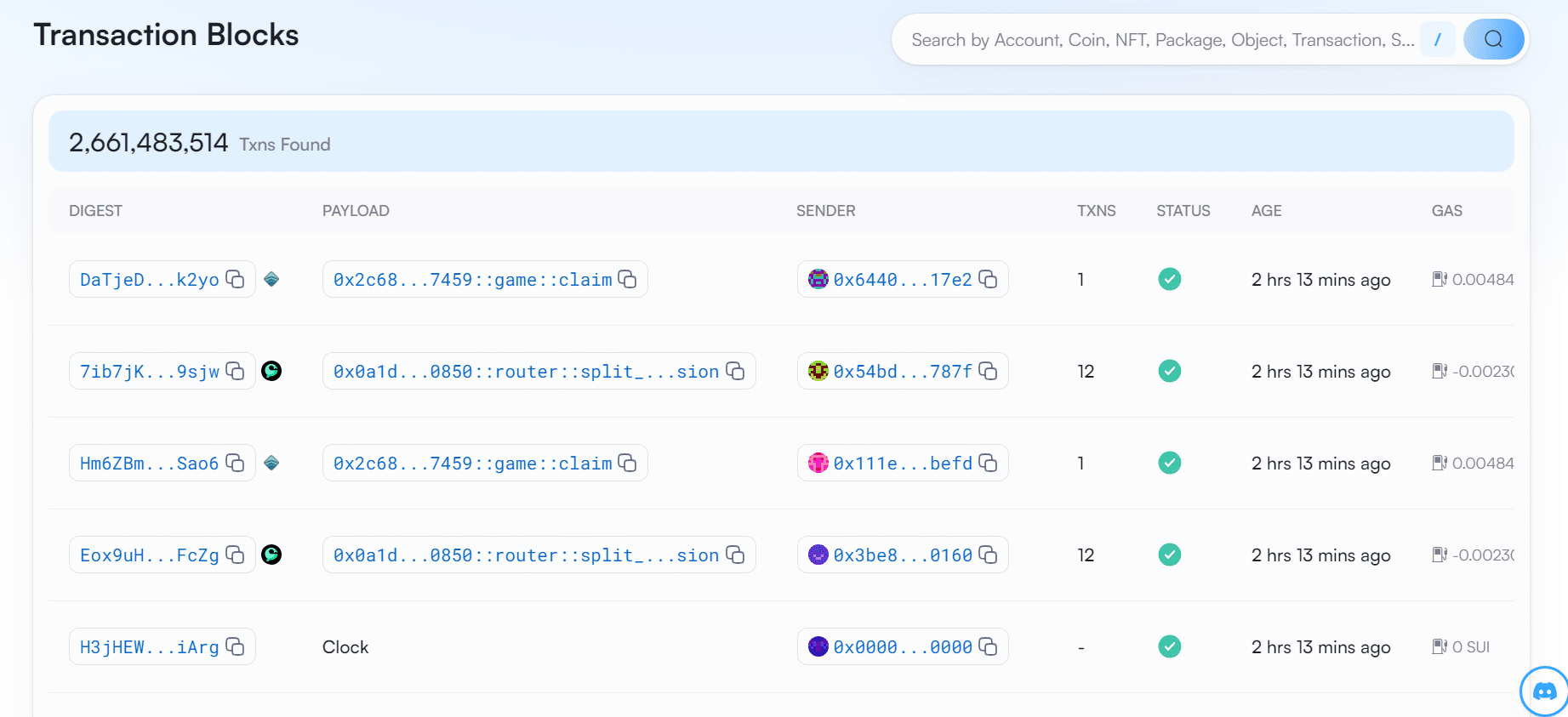

Sui Network blockchain down for more than two hours

Published

2 weeks agoon

November 21, 2024By

admin

The Sui Network is suspected to be down for more than two hours. The protocol has not produced any new transaction blocks since Nov. 21 UTC 9:15.

Based on the latest data from Sui Network’s explorer site Sui Vision, the decentralized layer-1 blockchain has stopped producing blocks for more than two hours.

At the time of writing, the last transaction block took place on Nov. 21 at 9:15 am UTC. Since then, no new blocks have been produced on the blockchain.

The Sui Network confirmed the outage on its official X account, stating that the blockchain is currently unable to process transactions. However, it claims that the problem has been identified and will be back to normal soon.

“We’ve identified the issue and a fix will be deployed shortly. We appreciate your patience and will continue to provide updates,” wrote the protocol on X.

Service Announcement: The Sui network is currently experiencing an outage and not processing transactions. We’ve identified the issue and a fix will be deployed shortly. We appreciate your patience and will continue to provide updates.

— Sui (@SuiNetwork) November 21, 2024

Sui’s blockchain outage has seemingly impacted the SUI token price. According to data from crypto.news, the Sui token has gone down by nearly 2% in the past hour. It is currently trading hands at $3.41. In the past 24 hours, SUI has plummeted by 7.29%.

Even though, the token has gone up by nearly 75% in the past month.

SUI currently ranks in the 18th place in the lineup of cryptocurrencies, holding a market cap of $9.7 billion and a fully diluted valuation of $34 billion. The Sui token has a circulating supply of $2,8 billion tokens.

The South Korean crypto exchange, Upbit, announced it will be temporary suspending deposits and withdrawals for the Sui token due to its block generating outage.

The notice informs users that if they deposit or withdraw Sui tokens after the announcement was posted, then there is a chance that their funds cannot be recovered.

Several crypto industry figures took to X to comment on the recent Sui Network outage. Most of them teased Sui’s goal of becoming Solana’s biggest competitor. Ironically, the Solana blockchain also has a track record of outages in the past, with the latest one recorded in February this year.

“Sui [is] just repeating Solana history,” said one X user.

“Hasn’t Solana gone down multiple times?” asked another X user.

“SUI blockchain is down. And they claimed to be a Solana Killer,” wrote crypto YouTuber Ajay Kashyap on his X post.

Source link

Trump’s Top SEC Chair Pick Paul Atkins Reluctant to Take Job: Source

Is Bitcoin Self-Custody Under Threat in Europe?

SynFutures announces F token airdrop

Ripple Lawsuit Lead Attorney Joins US SEC As Chief Litigation Counsel

CryptoQuant CEO Warns Not To Short XRP Due To Insider Whales

The lack of soft forks is due to a lack of interest— not a lack of process

Now could be the best time to buy DOGE, XRP and new trending altcoin

Altcoin Season To Face Challenges Ahead, CryptoQuant CEO Predicts

Crypto, Stocks and ‘Everything Bubble’ Still Has Room To Run, According to Analyst Jason Pizzino

This Cardano alternative expected to reach $1 in 2025, currently priced at $0.0259

Binance To Delist These Crypto In BTC Trading Pairs, What’s Next?

Polymarket Retains Loyal User Base a Month After Election, Data Shows

Coinbase CEO Brian Armstrong Sends Strong Message to Anti-Crypto Law Firms

Elon Musk’s $56 Billion Tesla Pay Deal Struck Down Again: Details

Bitcoin to Enter Final Bull Phase? Key Indicator Hints at Major Price Movement

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

3 months ago

3 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential