24/7 Cryptocurrency News

Ripple Chairman Chris Larsen Transfers Another 20M XRP After Moving 50M

Published

2 months agoon

By

admin

In a transaction, Ripple Chairman Chris Larsen has transferred 20 million XRP from a previous shuffle of 50 million tokens.

Speculation puts the likely destination to be Binance, given the history of previous transactions made by the recipient address, though this is yet to be confirmed.

XRP Whales Make Waves With Larsen Massive Transfers

Earlier on Sept. 16, one of Larsen’s wallets transferred 50 million XRP in the first major transfer since its creation back in 2013. The transaction turned a new address on with 11 XRP and then transferred the 50 million tokens, part of which has transferred to another wallet recently.

Whales Stir As 40M XRP Get Moved Within An Hour In a series of transactions on Sept. 20, the address rao…gzS transferred in four batches 20 million XRP, each batch comprising 5 million tokens to an unknown wallet, rHo…Spm between 18:25 and 18:30 UTC.

With these movements, rao…gzS still maintains 30 million XRP from an initial supply of 50 million he earlier received. The destination wallet, rHo…Spm currently holds the 20 million XRP but its transaction history suggests it may well be dumped into the market anytime soon.

Recently, Vice President Kamala Harris scheduled crypto-related discussions to engage with cryptocurrency advocates. Among those endorsing her efforts are prominent American business figures, including Ripple’s Executive Chairman, Chris Larsen. Anthony Scaramucci also voiced support, noting that these steps mark progress in the right direction for the industry.

XRP Hack Fears Resurface Amidst Binance Transfers

It is also renowned for collecting big chunks of XRP from several addresses, holding them for a while, and then transferring them to Binance. Hence, many people are assuming that the recent 20 million XRP transferred from Chris Larsen could be directed to Binance.

Others have said that these movements could be related to the possible hack. Similar transfers from another wallet belonging to Larsen were, in February, confirmed to have taken place as a result of a hack, where 212 million XRP were stolen by the hackers.

Some new rumors have emerged about a fresh hack because some tokens have moved around different addresses recently. These rumors seem unlikely to be true because the first transaction happened almost five days ago and Larsen has said nothing about any exploit.

Meanwhile, tokenization of Real World Asset (RWA) is gathering pace as big players of the industry have begun shifting focus to the latest trend in the blockchain. SkyBridge Capital founder Anthony Scaramucci said during the Breakpoint 2024 conclave that tokenization would play a big role in transaction verification, and Solana would play an important role in the future of tokenized assets.

Teuta

Teuta is a seasoned writer and editor with over 15 years of experience in macroeconomics, technology, and the cryptocurrency and blockchain industries. Starting her career in 2005 as a lifestyle writer for Cosmopolitan in Croatia, she expanded into covering business and economy for several esteemed publications like Forbes and Bloomberg. Influenced by figures like Don Tapscott and Bruce Dickinson, Teuta embraced the blockchain revolution, believing crypto to be one of humanity’s most crucial inventions. Her fintech involvement began in 2014, focusing on crypto, blockchain, NFTs, and Web3. Known for her excellent teamwork and communication skills, Teuta holds a double MA in Political Science and Law, enjoys punk rock, chablis, and has a passion for shoes.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Pump.fun Accounted for 62% of Solana DEX Transactions in November, So Far

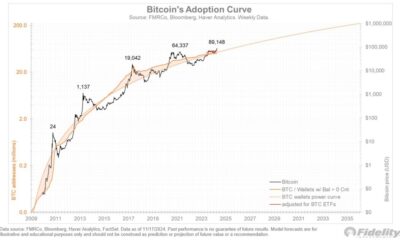

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Zodia Custody teams up with Securitize for institutional access to tokenized assets

Crypto Analyst Explains Why Dogecoin Price Will Hit $1

Bitcoin Long-Term Holders Have 163K More BTC to Sell, History Indicates: Van Straten

The transformative potential of Bitcoin in the job market

24/7 Cryptocurrency News

Ripple CLO Stuart Alderoty Challenges US SEC

Published

7 hours agoon

November 26, 2024By

admin

Ripple CLO Stuart Alderoty slammed the U.S. Securities and Exchange Commission (SEC) for bragging about enforcement actions and raising record fines. Stuart Alderoty has challenged the bragging rights of the US SEC, highlighting the flawed approach the government agency has taken in lawsuits.

Ripple CLO Slams US SEC For Boasting About Fines Collection

Ripple CLO Stuart Alderoty reacted to the U.S. Securities and Exchange Commission’s (SEC) post on X about collecting record fines in the history of the agency.

Alderoty lambasted the US SEC for bragging about record fines collection. He compared it with a professor boasting about their highest-ever class failure rate and the most cheating scandals.

Furthermore, he added that the SEC’s oversight has gone wrong, driven by perverse incentives. Notably, the agency has also failed to provide clarity to the crypto community about rules and regulations. “It’s not a measure of success,” he added.

“We announced that the SEC filed 583 total enforcement actions in fiscal year 2024 while obtaining orders for $8.2 billion in financial remedies, the highest amount in SEC history, said the US SEC.

The government agency also boasted about the success of the Division of Enforcement under SEC Chair Gary Gensler. It claims the enforcement division has helped promote the integrity of capital markets to benefit investors.

However, investors claimed the agency has harmed investors more and Gary Gensler is the least effective SEC Chairman in American history.

$4.5 Billion budget. $8.2 billion fines. $1 Trillion damage to capital markets. Solid taxpayer ROI.

— Gabor Gurbacs (@gaborgurbacs) November 26, 2024

Ripple Launches Tokenized Money Market Fund

Ripple has introduced its first tokenized money market fund in partnership with UK-based asset manager abrdn and crypto exchange Archax. The fund, available on the XRP Ledger (XRPL), aims to enhance financial accessibility and liquidity.

Meanwhile, XRP futures open interest surpassed $2.50 billion, signaling growing trader activity. Whale accumulation also continues, with over 250 million XRP purchased during recent price dips. This has fueled speculation of a rally toward $20 as XRP shows strong market demand.

Currently, XRP price trades at $1.33, down 10% in the last 24 hours. Its market cap stands at $75 billion, with $10 billion in trading volume.

Varinder Singh

Varinder has over 10 years of experience in the Fintech sector, with over 5 years dedicated to blockchain, crypto, and Web3 developments. Being a technology enthusiast and analytical thinker, he has shared his knowledge of disruptive technologies in over 5000+ news, articles, and papers. With CoinGape Media, Varinder believes in the huge potential of these innovative future technologies. He is currently leading the news team to cover latest updates and developments in the crypto industry.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Is Marathon Digital (MARA) a Better Bet Than MicroStrategy (MSTR) Stock Now?

Published

10 hours agoon

November 26, 2024By

admin

Bitcoin miner Marathon Digital (NASDAQ: MARA) buzz on Wall Street with 44% gains in the last week. Financial giant Cantor Fitzgerald raised the stock’s target price to $42, another 60% on expectations of outperforming MicroStrategy (MSTR) as well. MARA stock price surged to a six-month high on Monday amid the latest price target.

Why Is Marathon Digital (MARA) A Strong Bet

Cantor Fitzgerald has drawn attention to Marathon Digital Holdings (MARA) as a standout player in the Bitcoin ecosystem, reported Street Insider. The financial giant also emphasized its distinction from MicroStrategy (MSTR) due to its operational focus on Bitcoin mining. As of Monday’s closing, the MARA stock was trading at 26.42, with most of the gains coming over the past week.

MARA is currently the largest public-traded miner by the BTC hashrate, and produces nearly 25 Bitcoins every day. Unlike MSTR, which primarily invests in Bitcoin directly, MARA operates a mining business that generates Bitcoin at a discount to the spot price.

This approach, combined with its “HODL” strategy of retaining mined Bitcoin rather than selling, positions its operations as accretive on a Bitcoin-per-share basis, noted Cantor Fitzgerald.

The analysts at Cantor also said that MARA’s equity value currently trades at a ~152% premium over its Bitcoin holdings. On the other hand, MicroStrategy acquires Bitcoin at the spot market rate, but MARA has the leverage to mine Bitcoin at a ~40% discount to the spot price, which further strengthens its model.

Thus, Cantor Fitzgerald noted that as Marathon Digital reduces its reliance on third-party hosting firms, its cost of mining is likely to decline. This makes the business even more accretive in the long run. The Bitcoin miner purchased 5,771 BTC after raising $1 billion through a stock offering last week.

Our BTC Yield per Share remains robust at 35%. Excited to share @MARAHoldings has so far acquired 5,771 BTC using proceeds from 0% convertible debt at an avg price of $95,554 per BTC. This brings our total owned BTC to ~33,875 BTC, currently valued at $3.4B based on a spot BTC…

— Salman Khan (@theRealSalKhan) November 22, 2024

They further added that the Bitcoin miner’s operational efficiency, coupled with MARA’s strategic alignment, suggests the company could surpass MSTR in profitability metrics. As a result, Cantor Fitzgerald gave a target of $42 for the MARA stock.

What’s Next for MicroStrategy (MSTR)?

The world’s largest corporate Bitcoin holder Microstrategy (NASDAQ: MSTR) purchased additional 55,500 Bitcoins on Monday, for an investment value of a massive $5.4 billion. With this, it has taken its total Bitcoin holdings to 386,700 BTC.

However, amid the macro conditions and Donald Trump’s tariff raise, the MSTR stock closed 4.87% lower at $403 on Monday. Along with the US equity futures, the Bitcoin price crashed over 4% slipping under $94,000.

On the other hand, Bernstein analysts believe that there’s still steam left in the MSTR stock rally. As a result, they have given the MSTR stock price target of $600.

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

BTC Dips Below $95K, LDO Up 15%

Published

13 hours agoon

November 26, 2024By

admin

Following the recent bullish rally, cryptocurrency prices today are facing selling pressure, with market sentiment shifting towards cautiousness. Bitcoin (BTC) has dropped to the $93K level today. Altcoins show a mixed trend, with Ethereum (ETH) and XRP gaining 3% to 4%, while Solana (SOL) is down by 5%. Lido DAO (LDO) and Arbitrum (ARB) have emerged as the top gainers, with increases of 15% and 10% in the past 24 hours.

Meanwhile, the global crypto market cap has dropped by 2%, currently at $3.27 trillion. However, the overall trading volume has surged by 22%, reaching $241 billion. Let’s dive into the top cryptocurrencies by market cap and their price movements today, November 26.

Cryptocurrency Prices Today: BTC and SOL Drop, ETH and XRP See Gains

BTC price slipped to the $93K level today, while ETH and XRP rose by 3% to 5% in the past 24 hours. SOL declined by 5%, whereas LDO and ARB emerged as the day’s top gainers.

Bitcoin Price Today

BTC is currently trading at $94,666, marking a 3% decline in the last 24 hours. Its 24-hour low and high are $92,642 and $98,935, respectively. The market cap of Bitcoin stands at $1.87 trillion, with a trading volume of $84 billion in the same period. Its market dominance is 57.27%.

Additionally, Monday saw a daily outflow of $438 million from BTC ETFs, with BlackRock IBIT recording an inflow of $267 million, while Bitwise BTC experienced a major outflow of $280 million. Notably, Rumble, a video-sharing and cloud services platform, has announced plans to allocate up to $20 million from its corporate treasury to Bitcoin, reflecting growing corporate interest in the cryptocurrency.

Ethereum Price Today

Ethereum (ETH) is currently trading at $3,432, reflecting a 3% increase in the last 24 hours. Its 24-hour low and high are $3,349 and $3,545, respectively. Ethereum’s market cap stands at $414 billion, with a trading volume of $52 billion. With a market dominance of 12.7%, ETH remains the second-largest cryptocurrency by market cap.

According to sosovalue, ETH ETFs saw an inflow of $2.83 million, with Bitwise leading the way with an inflow of $8.75 million. Meanwhile, Grayscale recorded an outflow of $7.65 million.

Solana Price Today

Solana (SOL) is currently trading at $237, reflecting a 5% decrease in the last 24 hours. Its 24-hour low and high are $231 and $256, respectively. Solana’s market cap stands at $112 billion, with a 24-hour trading volume of $6.71 billion. With a market dominance of 3.47%, SOL ranks as the fourth-largest cryptocurrency by market cap.

Additionally, Solana’s memecoin launchpad Pump Fun has indefinitely suspended its live streaming feature. This decision follows backlash over the misuse of the live stream service, prompting the protocol to sunset this offering.

XRP Price Today

XRP is currently trading at $1.44, marking a 5% increase in the last 24 hours. Its 24-hour low and high are $1.385 and $1.53, respectively. With a market cap of $82 billion and a 24-hour trading volume of $11.4 billion, XRP has a market dominance of 2.54%, ranking as the sixth-largest cryptocurrency by market cap.

Moreover, the momentum for crypto ETFs continues to grow. Just yesterday, WisdomTree filed for an XRP ETF in Delaware, signaling increased institutional interest in cryptocurrency.

Meme Cryptocurrency Prices Today

The meme coin sector has experienced a downward trend over the past 24 hours. Dogecoin (DOGE) is down by 5%, currently trading at $0.40, while Shiba Inu (SHIB) has dropped 2%, trading at $0.00002504.

Additionally, other notable meme coins like PEPE, BONK, and FLOKI have dropped by 4% to 6%. This decline highlights the overall bearish momentum affecting the meme coin market.

Top Cryptocurrency Gainers Prices Today

Lido Dao

LDO price surged by 15% today, currently trading at $1.60. Its 24-hour low and high are $1.478 and $1.764, reflecting strong price movement.

Arbitrum

ARB price is trading at $0.89, showing a 10% increase in the last 24 hours. Its 24-hour low and high are $0.84 and $0.95, indicating notable price movement.

Top Cryptocurrency Losers Prices Today

The Sandbox

SAND price has dropped by 16% in the last 24 hours, currently trading at $0.66. Its 24-hour low and high are $0.65 and $0.82, reflecting significant volatility.

Decentraland

MANA price is currently trading at $0.62, showing a 15% decrease in the last 24 hours. Its 24-hour low and high are $0.61 and $0.73, indicating notable fluctuations.

Besides, the hourly time frame charts continued stirring investor speculations on cryptocurrency prices today, illustrating mixed actions. Crypto market enthusiasts continue to eye the market for further price action shifts.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Pump.fun Accounted for 62% of Solana DEX Transactions in November, So Far

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Zodia Custody teams up with Securitize for institutional access to tokenized assets

Crypto Analyst Explains Why Dogecoin Price Will Hit $1

Bitcoin Long-Term Holders Have 163K More BTC to Sell, History Indicates: Van Straten

The transformative potential of Bitcoin in the job market

Ripple CLO Stuart Alderoty Challenges US SEC

Changpeng Zhao critiques meme coins, suggests projects should focus on utility

Expert Warns Of Upcoming 25% Drop, Timing And Trends Explained

Is Marathon Digital (MARA) a Better Bet Than MicroStrategy (MSTR) Stock Now?

Cardano eyes spot ETF entry as analyst foresees surge, Rollblock set to explode next

BTC Dips Below $95K, LDO Up 15%

Trader Warns of Potential XRP Correction, Says Dogecoin Trading at Most Likely Area To Expect Rejection

Meme Coins Die — Bloggers’ Advertising is Ineffective

Hashdex Files Second Amendment for Nasdaq Crypto Index US ETF Approval

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: