Arthur Hayes

Whales buy Pendle after BitMEX co-founder sold it for a loss

Published

3 months agoon

By

admin

On-chain data shows a large amount of Pendle inflow into whale addresses a day after Arthur Hayes, co-founder of the BitMEX crypto exchange, sold the asset.

Lookonchain’s X post shows that Hayes sold 1.59 million Pendle (PENDLE) for $5.62 million last week. This brought a $1.29 million loss to the former CEO of BitMEX.

Data shows that Hayes deposited and sold the Pendle tokens on Binance, the largest cryptocurrency exchange by trading volume.

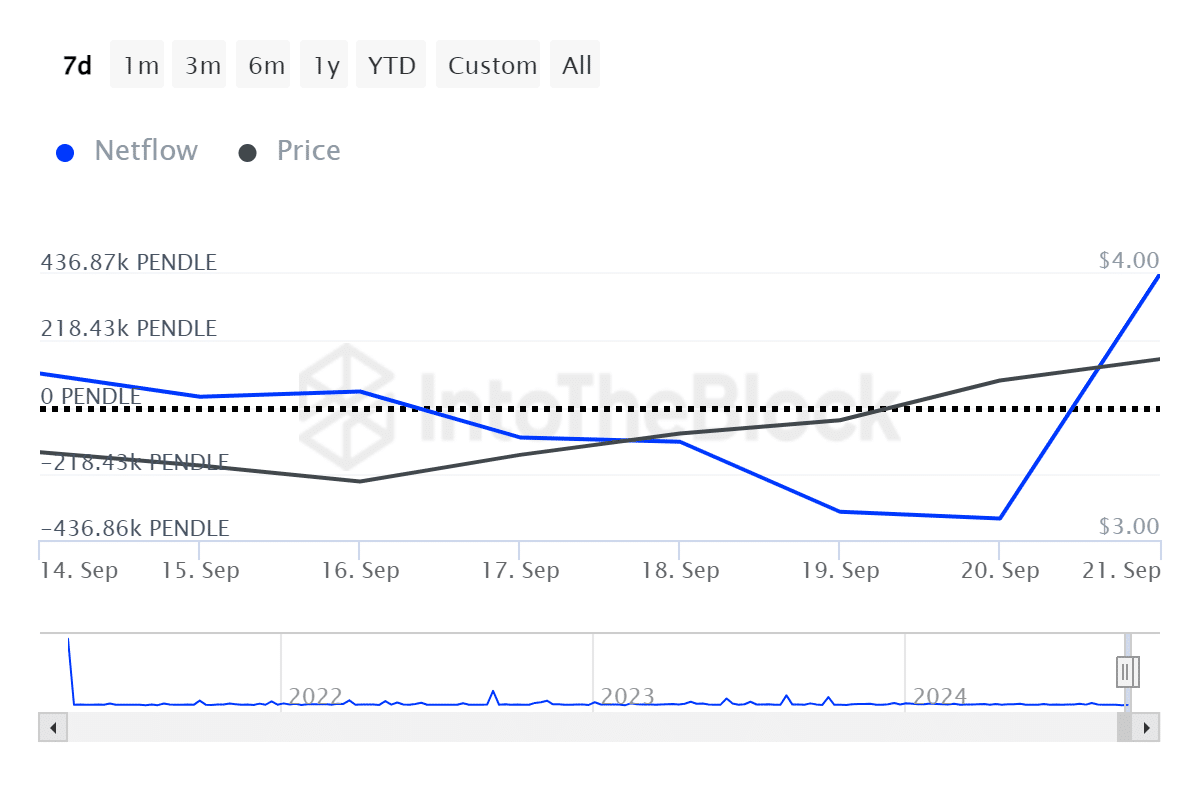

Since the selloff, Pendle witnessed increased on-chain movements from large holders. According to data provided by IntoTheBlock, the token’s whale net flows shifted from 366,310 PENDLE in outflows to 436,860 Pendle in inflows on Saturday, Sept. 21.

The indicator shows that large holders accumulating Pendle have dominated the whales selling the asset.

Meanwhile, the number of large transactions consisting of at least $100,000 worth of Pendle declined from 30 to 17 on the same day, per ITB data.

On the other hand, the volume of large transactions has steadily increased since Sept. 19. In simple terms, only a few of the largest PENDLE holders might have accumulated the token after Hayes sold most of his holdings.

Pendle gained 28% in the past 24 hours and is trading at $4.29 at the time of writing. The asset’s market cap is hovering around $690 million with a daily trading volume of $380 million.

Notably, whale-dominated movements could usually bring high price volatility to a cryptocurrency as many holders will try to aim for short-term profits.

Source link

You may like

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

24/7 Cryptocurrency News

ENA Price Surges Despite Arthur Hayes’ $8 Million Sale

Published

2 days agoon

December 21, 2024By

admin

Ethena (ENA) didn’t let the significant sell-off by Arthur Hayes deter its uptrend. Hayes, after publicly supporting Ethena Labs, unstaked 9 million ENA and sent 7 million ENA ($8.44 million) to Binance today.

He previously withdrew 16.79 million ENA from Binance in late November at $0.666 for an estimated $8.71 million profit (+78%). Hayes currently holds 9.96 million ENA valued at $11.7 million, with 7.94 million tokens staked.

Ethena (ENA) Continues to Outperform the Market Despite Arthur Hayes Sale

Ethena (ENA) continued its upward momentum despite significant selling activity by prominent crypto investor Arthur Hayes.

According to SpotOnChain, Hayes unstaked 9 million ENA tokens and deposited 7 million ENA (worth $8.44 million) to Binance earlier today, even after publicly expressing support for Ethena Labs. This follows his earlier withdrawal of 16.79 million ENA from Binance between November 26 and 28 at an average price of $0.666, totaling $11.19 million.

Arthur Hayes (@CryptoHayes) unstaked 9M $ENA and deposited 7M $ENA ($8.44M) to #Binance 45 minutes ago, despite showing support for @ethena_labs earlier today!

He previously withdrew 16.79M $ENA at ~$0.666 ($11.19M) from Binance between Nov 26 and 28, 2024 (tweet 👇).

He… https://t.co/XLxUd4NW1l pic.twitter.com/Ik8JBC25To

— Spot On Chain (@spotonchain) December 21, 2024

Currently, Arthur Hayes holds 9.96 million ENA, valued at $11.7 million, with 7.94 million tokens staked. His strategic trades have earned him an estimated profit of $8.71 million, representing a 78% return. Despite these developments, ENA’s price has shown resilience, continuing to rise in the face of selling pressure.

Ethena has been doing great in the last 24 hours, up 8.47%, while major cryptocurrencies such as Bitcoin and Ethereum continue to struggle after a sharp market downturn earlier this week.

Even though it had a strong rebound today, ENA previously experienced a massive 34.62% fall from $1.30 on December 16 to $0.85 by December 20. The token has recovered excellently and is now trading at $1.08. Having a market capitalization of about $3.17 billion, ENA is now the 43rd largest cryptocurrency, showing strength in a highly volatile market.

Ethena ($ENA) Poised for 85% Surge, Says Analyst

It seems Arthur Hayes didn’t listen recent prediction by crypto analyst and YouTuber Chill Trader. He shared a chart for ENA/USDT that indicated Ethena could surge by 85.34%. He highlighted a bullish Cup-and-Handle pattern, with key support at $0.94, which is currently being tested. If this level holds, the analyst predicts a price target of $2.15, supported by strong momentum from the 200-day Exponential Moving Average (EMA) at $0.63, well below current levels.

https://twitter.com/Chill_trader99/status/187000682226792866

For instance, a drop below $0.94 might push it further down to the lower support line of $0.86. Chill Trader added that volume is essential, while strong buying volume is required for a bounce off of support, and high selling volume would show a breakdown.

In addition to the bullish technical signals, recent strategic partnerships add to the case for a potential surge in Ethena’s price. The project has partnered with Donald Trump’s World Liberty Financial (WLFI) and investment giant BlackRock, signaling growing institutional interest.

Ethena’s partnership with WLFI brings the sUSDe stablecoin as collateral to its Aave-backed DeFi platform and is, therefore, getting a lot of attention in the circles of decentralized finance. On the other hand, BlackRock focuses on strategies in risk management for tough markets with returns from treasury investments.

On December 16, they introduced USDtb, a new stablecoin backed by BlackRock’s BUIDL Fund, which was developed in collaboration with tokenization platform Securitize.

The growing buzz surrounding Ethena’s partnerships and the potential influence of a Trump-backed administration has sparked increased interest in ENA, suggesting a promising outlook for the cryptocurrency in the near future.

Teuta Franjkovic

Teuta is a seasoned writer and editor with over 15 years of expertise in macroeconomics, technology, and the crypto and blockchain sectors.

She began her career in 2005 as a lifestyle writer for *Cosmopolitan* before transitioning to business and economic reporting for renowned outlets like *Forbes* and *Bloomberg*.

Inspired by thought leaders like Don and Alex Tapscott and Laura Shin, Teuta embraced blockchain’s potential, viewing cryptocurrency as one of humanity’s most transformative innovations.

Since 2014, she has specialized in fintech, focusing on crypto, blockchain, NFTs, and Web3. Known for her strong collaboration and communication skills, Teuta also holds dual MAs in Political Science and Law.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Ethena Price Shoots 20% Amid Heavy ENA Accumulation by Arthur Hayes

Published

4 weeks agoon

November 28, 2024By

admin

Bitmex co-founder Arthur Hayes is on an ENA accumulation spree driving more than 22% Ethena price gains in the last 24 hours. This comes as Hayes is reportedly moving all of his Aethir (ATH) holdings to Ethena (ENA) as part of portfolio reshuffling, after making heavy losses in ATH.

Ethena Price Skyrockets on Arthur Hayes Buying Spree

As of press time, ENA price is trading 22.50% up at $0.7502 with its market cap soaring all the way to $2.13 billion. In the last two days, Hayes made notable withdrawals of ENA from crypto exchange Binance, showing his intensified interest in the synthetic dollar protocol.

According to blockchain tracking platform Spot On Chain, Hayes recently withdrew an additional 10.36 million ENA tokens, valued at $7.49 million. This brings his two-day accumulation to a staggering 16.79 million.

The average purchase price of ENA by the BitMEX co-founder currently stands at $0.66. Thus, Ethena price appreciation thereafter has resulted in an unrealized profit of $1.14 million, or over 14% appreciation already.

On November 26, Arthur Hayes liquidated all of his Aethir (ATH) holdings after months of holding and making an estimated loss of $815,000. However, quickly spotting a good opportunity in ENA, Hayes has already recovered these losses in two days with some additional unbooked profit.

The BitMEX co-founder has been shilling Solana-based meme coins off lately with his latest bet being FlowerAI (FLOWER). He also made strong profits from his early bet on Goatseus Maximus in October last month.

ENA Bullish Momentum and Other Milestones

As per the Coinglass data, the ENA open interest has shot up by 23% to $374 million while the total ENA liquidations have shot up to $1.29 million, of which $335,000 are in long liquidations and $956,000 are in short liquidations. Moreover, the total value locked (TVL) on the Ethena blockchain has also surged to $4.09 billion.

The Ethena blockchain is gaining strong traction through its synthetic dollar USDe. It is backed by collateral in the form of Bitcoin (BTC) and Ethereum (ETH). Additionally, the USDe differs from traditional stablecoins by offering a native yield. Recently, the popular derivatives platform Deribit integrated USDe in the form of crypto margin collateral.

Moreover, Ethena Labs celebrated an important milestone of reaching a 4 billion supply for USDe while generating an annual percentage yield (APY) of a staggering 25% for its users. Back in September, the platform also unveiled its UStb stablecoin collateralized by financial giant BlackRock and Securitize.

All eyes are on the ENA bulls as they need to hold Ethena price above the strong support of $0.75. If they manage to pull this off, ENA could be heading for another 33% gains to $1. Some investors are also speculating that ENA will hit its all-time high of $1.5.

Bhushan Akolkar

Bhushan is a FinTech enthusiast with a keen understanding of financial markets. His interest in economics and finance has led him to focus on emerging Blockchain technology and cryptocurrency markets. He is committed to continuous learning and stays motivated by sharing the knowledge he acquires. In his free time, Bhushan enjoys reading thriller fiction novels and occasionally explores his culinary skills.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Arthur Hayes, Murad’s Prediction For Meme Coins, AI & DeFi Coins For 2025

Published

1 month agoon

November 9, 2024By

admin

In a recent podcast, crypto experts Murad Mahmudov and Arthur Hayes shared their insights on the evolving roles of meme coins, DeFi, and AI tokens. The experts highlight significant shifts and predict how these assets may function by 2025. Besides, they also discussed the ways in which the crypto space is evolving, with meme coins and DeFi tokens acting as distinct financial instruments with varying purposes and trajectories in the market.

Murad & Arthur Hayes On DeFi And Meme Coin

Murad Mahmudov, known for his analysis of crypto market cycles, expressed skepticism about the idea of a “DeFi Renaissance” spurred by potential future US policies under the Trump Presidency. In a recent podcast, Mahmudov argued that most DeFi protocols prioritize their own growth over distributing revenues to stakeholders. Arthur Hayes also echoed a similar sentiment, predicting a minor impact of Trump’s win on the crypto space in the longer run.

He stated, “A lot of people have been arguing that Trump Victory is going to kind of bring about DeFi Renaissance or whatever, but I remain skeptical.” He sees DeFi tokens as often being speculative, deriving a large portion of their value from community-driven narratives rather than intrinsic financial performance.

Talking about meme coins, Mahmudov sees the niche to be gradually becoming a sort of “purification mechanism” in the crypto space. He suggested that as the market matures, meme coins and DeFi tokens will diverge into two distinct categories: cash-flow coins, which are serious, revenue-oriented, and likely to appeal to institutional investors, and meme coins, which retain speculative and community-driven appeal.

“In the future, meme coins will continue to absorb community and speculative premiums,” he said. Besides, he added that this separation will help legitimize cash-flow coins in the eyes of more traditional financial analysts. Meanwhile, Murad has shortlisted top meme coins like DOGE, FLOKI, and SHIB to benefit the most in the coming days.

However, BitMEX co-founder Arthur Hayes has a different and more opportunistic perspective on meme coins. Rather than holding long-term, he views these assets as trading instruments with quick in-and-out opportunities. “Meme coins are fun to trade because you don’t need to understand cash flows or tech,” Hayes commented. For him, the appeal lies in viral appeal. This speculative approach, according to Hayes, allows him to capitalize on the short-term hype while minimizing long-term risk exposure.

AI Coins In Focus

The conversation also covered the rise of AI meme coins, such as GOAT, which Arthur Hayes views as noteworthy due to their pioneering status. While Murad sees AI-based meme coins as potentially fleeting, since rapid AI advancements could quickly make certain tokens obsolete, Hayes believes owning the original and widely recognized AI token could be valuable.

Hayes explained he would invest in the token as the market is talking about it. Besides, the GOAT crypto has also gained notable attention lately, as evidenced by the robust surge in its price. However, both experts raised caution for the long-term viability of tech-driven crypto tokens amid AI advancements.

Mahmudov argued that AI will accelerate code commoditization, making it harder for purely technological tokens to retain value. Instead, he believes that tokens grounded in “human faith, community, and belief” will endure, highlighting his preference for BTC and established meme coins over tech-reliant assets.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Solana beats Ethereum in a key metric 3 months in a row

SCENE’s 2024 Person of the Year: Iggy Azalea

BTC Risks Falling To $20K If This Happens

Most Layer 2 solutions are still struggling with scalability

Here’s why Stellar Price Could Go Parabolic Soon

Perp-Focused HyperLiquid Experiences Record $60M in USDC Net Outflows

Experts say these 3 altcoins will rally 3,000% soon, and XRP isn’t one of them

Robert Kiyosaki Hints At Economic Depression Ahead, What It Means For BTC?

BNB Steadies Above Support: Will Bullish Momentum Return?

Metaplanet makes largest Bitcoin bet, acquires nearly 620 BTC

Tron’s Justin Sun Offloads 50% ETH Holdings, Ethereum Price Crash Imminent?

Investors bet on this $0.0013 token destined to leave Cardano and Shiba Inu behind

End of Altcoin Season? Glassnode Co-Founders Warn Alts in Danger of Lagging Behind After Last Week’s Correction

Can Pi Network Price Triple Before 2024 Ends?

XRP’s $5, $10 goals are trending, but this altcoin with 7,400% potential takes the spotlight

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: