Price analysis

Shiba Inu Price Eyes 38% Rally Amid Bullish Reversal Pattern

Published

2 months agoon

By

admin

SHIB, the second-largest meme cryptocurrency by market cap, experienced a 14% surge over the past five days, rising from $0.000013 to $0.00001478. This bullish rally was likely driven by the broader market recovery following the U.S. Federal Reserve’s 0.5% rate cut. The Shiba Inu price shows signs of a potential extended recovery, supported by this double-bottom reversal pattern.

Shiba Inu Price Targets 38% Surge as Bullish Reversal Takes Shape

The cryptocurrency market took a bullish turnaround in September following the Bitcoin price reversal from $52,500 to $63,456— a 20% increase. The renewal recovery sentiment shifted the prevailing correction in Shiba Inu price into a sideways trend above $0.0000123.

In the last 11 weeks, the SHIB price showcased three failed attempts to breach the bottom support line, indicating the active accumulation zone for buyers. The latest reversal uplifted the altcoin 19.82% to trade at $0.0000147 while the market cap surged to $8.7 billion.

An analysis of the daily chart shows the formation of a double-bottom reversing pattern, a chart setup often spotted at major market bottoms.

If the pattern holds true, the dog-themed memecoin is poised for a 9.3% surge before the critical breakout from the $0.000016 neckline. The potential breakout will intensify the bullish momentum and drive another 25% surge to target $0.00002.

According to the Santiment data, the supply of SHIB on exchanges steadily declined to reach 75.3 Trillion coins. This downward trend suggests a withdrawal of tokens from exchanges, which can indicate investors’ accumulation or a decrease in selling pressure.

On the contrary, the 30-day MVRV (market value-to-realized value) ratio has spiked to 7.66%, indicating that short-term buyers are in profit. Historically, the MVRV ratio value of 8-10% has coincided with Shiba Inu price prediction tops as these speculative traders often exit the market early for profit booking.

Therefore, if the overhead supply persists, the Shiba Inu price could revert to $0.000012 and prolong the consolidation trend.

For a detailed analysis, check out the top meme coins article.

Frequently Asked Questions (FAQs)

If SHIB breaks out from the $0.000016 neckline, it is poised for a 25% surge, potentially reaching $0.00002.

The $0.0000122 level serves as a crucial accumulation zone, where buyers have actively prevented the price from falling further, indicating strong support.

A decline in SHIB supply on exchanges, down to 75.3 trillion coins, suggests increased accumulation by investors and reduced selling pressure

Sahil Mahadik

Sahil is a dedicated full-time trader with over three years of experience in the financial markets. Armed with a strong grasp of technical analysis, he keeps a vigilant eye on the daily price movements of top assets and indices. Drawn by his fascination with financial instruments, Sahil enthusiastically embraced the emerging realm of cryptocurrency, where he continues to explore opportunities driven by his passion for trading

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Changpeng Zhao critiques meme coins, suggests projects should focus on utility

Expert Warns Of Upcoming 25% Drop, Timing And Trends Explained

Is Marathon Digital (MARA) a Better Bet Than MicroStrategy (MSTR) Stock Now?

Cardano eyes spot ETF entry as analyst foresees surge, Rollblock set to explode next

BTC Dips Below $95K, LDO Up 15%

Trader Warns of Potential XRP Correction, Says Dogecoin Trading at Most Likely Area To Expect Rejection

Markets

Can the XRP price realistically jump to $10 in 2024?

Published

19 hours agoon

November 25, 2024By

admin

The XRP price has staged a strong recovery this month, making it one of the best-performing top ten cryptocurrencies.

Ripple (XRP) peaked at $1.6305 last week, rising 324% from its lowest point this year and pushing its market cap to over $81 billion. This valuation surpasses major global firms like Deutsche Bank, Marriott International, and BP.

With XRP’s bullish trajectory, analysts have shared optimistic forecasts. Edo Farina, a long-term Ripple supporter, predicted in an X post that the coin could surge to $10 during this bull run.

He cited fundamental catalysts, including expectations that Donald Trump’s victory could resolve Ripple’s ongoing conflict with the Securities and Exchange Commission will be over next year.

Meanwhile, Ripple and Archax have partnered to launch a tokenized fund on the XRP Ledger, signaling renewed activity on the network

Additionally, Ripple is developing RLUSD, a stablecoin intended to compete with Tether (USDT) PayPal USD, and USD Coin (USDC).

There are also rumors of Ripple launching an Initial Public Offering (IPO) in the coming years. A January CNBC report suggested the company postponed its IPO plans due to SEC challenges, a situation that could shift next year.

Can the XRP price jump to $10?

The price of Ripple traded at $1.4381 on Nov. 25, requiring a 600% increase to reach $10. Such a move would exceed its recent performance but aligns with past trends, like its 1,800% jump from 2020 lows to its all-time high in 2021.

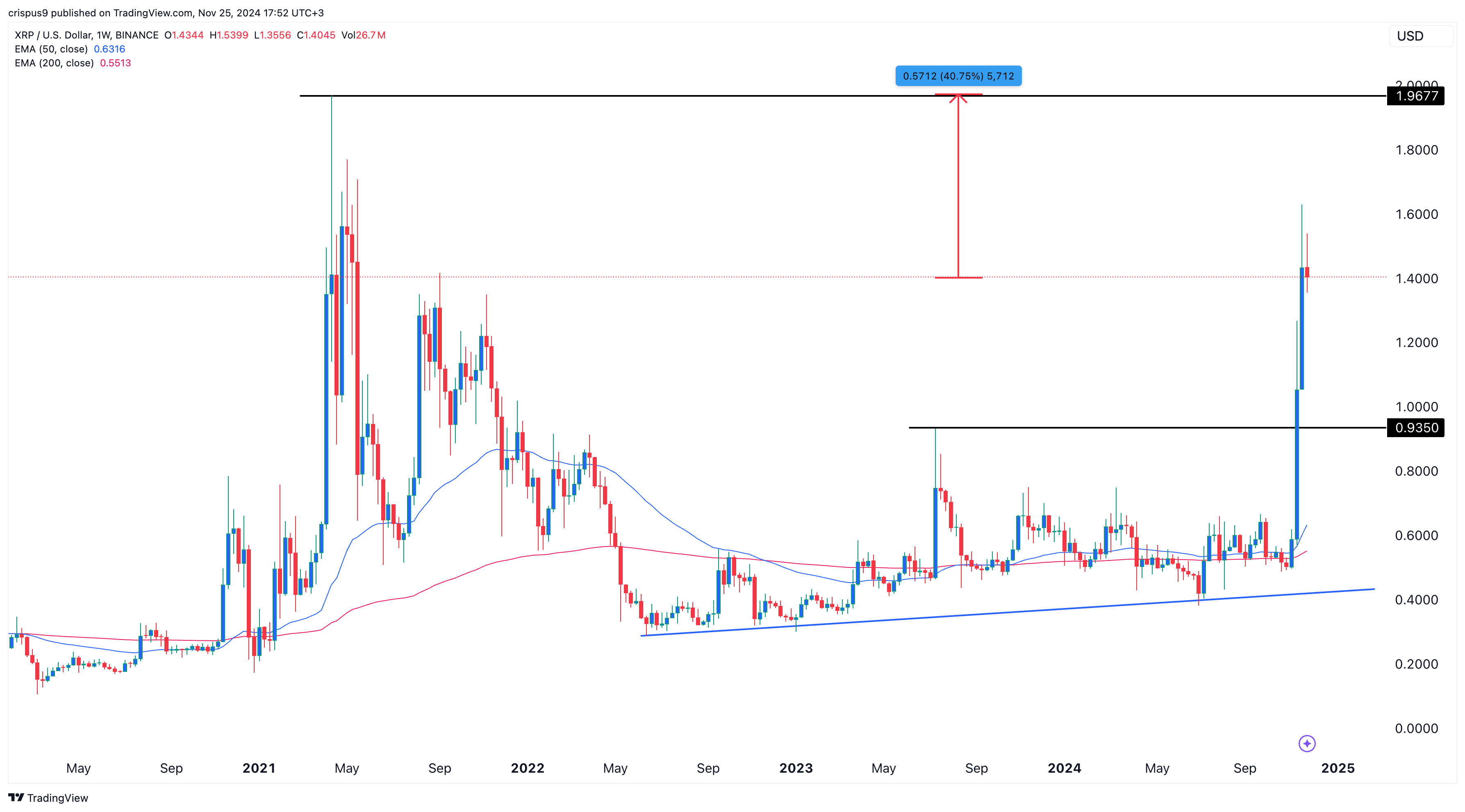

The weekly chart shows that Ripple broke the significant resistance level of $0.9350, the neckline of a slanted triple-bottom pattern. The coin has moved above the 50-week and 200-week Exponential Moving Averages, suggesting positive momentum. There are also indications of a bullish pennant pattern forming.

While XRP may continue climbing, potentially reaching its all-time high of $1.96 and further to $5, a leap to $10 in 2024 remains unlikely.

Source link

Price analysis

Shiba Inu Price Eyes 76% Rally As 6.8m SHIB Tokens Burned

Published

20 hours agoon

November 25, 2024By

admin

Shiba Inu price has underperformed other popular meme coins in the past few days. SHIB trades at $0.000026 on Monday, where it has been stuck since November 10, as investors anticipate more upside as the burn rate rebounds.

Shiba Inu Price Likely to Rally 76% As 6.8m SHIB Burnt

One potential catalyst for the SHIB price is that the number of coins in circulation continues to drop, helped by the robust token burn. Data by Shiburn shows that the amount of these burns rose by 40% in the past 24 hours to 4.85 million.

Therefore, the number of Shiba Inu tokens has continued to drop from the original 999 trillion to 410 trillion, a figure that will continue falling in the future. The token burn is when SHIB coins are moved to an inaccessible wallet either voluntarily or from ecosystem fees to be removed from the circulating supply forever.

These token burns help to create value for existing tokens by reducing the number of coins in circulation. It is often compared to when a company executes a share buyback, which in turn increases the earnings per share.

Some of the top players in this ecosystem are ShibaSwap and Shibarium. ShibaSwap is a decentralized DEX network where people swap tokens, while Shibarium is a layer-2 network that has completed over 500 million transactions. Data on its website shows that ShibaSwap’s volume has jumped to $75 million this month, the highest level since March.

SHIB Price Analysis: Shiba Inu Bulls Prepares For Uptrend

In an X post, Shib Knight, a popular crypto analyst predicted that the SHIB was preparing for its next leg and that it looked “sendy”.

The most bullish case for the Shiba Inu price rally is a cup-and-handle pattern on the daily chart. This techncial formation contains a rounded bottom that looks like a cup, which is often followed by a minor retracement that forms the handle. Hence, the namesake.

The target of $0.000045 for this setup is obtained by measuring the depth of the cup and adding it to the neckline, connecting the cup and handle’s swing highs.

The upper side of this pattern is at $0.000030, where it has struggled to move above since May. According to this pattern, the ongoing consolidation is part of the formation of a handle section. In most periods, this pattern is one of the most bullish patterns in the market.

Additionally, Shiba Inu price has formed a golden cross pattern as the 50-day and 200-day Exponential Moving Averages (EMA) have formed a bullish crossover. Therefore, the confirmation for the next leg up will come if the SHIB rises above the upper side of the cup at $0.000030. If this happens, SHIB could jump to $0.000045, its highest level this year, which is about 76% above the current level.

On the flip side, this Shiba Inu price prediction will become invalid if the coin drops below the key psychological point at $0.000023. A drop below that level will point to more downside, potentially to $0.0000158, its lowest point on October 25.

Frequently Asked Questions (FAQs)

It has strong technicals after forming a golden cross pattern and a cup and handle. A cross above the cup will point to more gains, potentially to the year-to-date high of $0.000045.

Odds are that the SHIB price will stage a strong rally soon. However, a drop below the support at $0.000022 will invalidate the bullish view and raise the odds of it falling to $0.00001.

Shiba Inu’s burn rate is continuing, while analysts expect the ongoing crypto bull run will continue in the near term.

crispus

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Pi Network

Will Pi Network Price Reach $100 in This Bull Market?

Published

23 hours agoon

November 25, 2024By

admin

Pi Network has erased some of the gains made last week as the recent rally in the crypto industry took a breather. Still, there are chances that the Pi coin will resume its rebound, and potentially hit $100 ahead of the mainnet launch.

Pi Network Price Prepares For the Mainnet Launch

The Pi Network IoU price will be on the spotlight after the recent successful PiFest event and the upcoming ending of the KYC verification of pioneers.

In a recent statement, Pi’s developers said that over 27,000 sellers registered in the Map of Pi during the recent PiFest event. Map of Pi is a dApp in its ecosystem that enables sellers accepting the Pi coin to register themselves.

These numbers mean that the coin is getting popular among sellers, a move that could make it a better cryptocurrency compared to Bitcoin in terms of shopping. It also means that the developers have achieved one of the three conditions that needs to happen ahead of the mainnet launch. This condition calls for the network to have an ecosystem that will give the Pi coin utility.

The other condition is that the developer needs to complete the KYC verification of all miners, a process that has accelerated in the past few months. The grace period of this process will complete on November 30.

Additionally, with cryptocurrencies being in a strong bull run, the third condition of a friendly environment has been met. Therefore, there is a likelihood that the Pi mainnet launch will happen as soon as in December.

Pi Coin Analysis: Will It Hit $100?

The Pi Coin IoU, which is not associated with the Pi project, jumped to $100 in October as anticipation of the mainnet launch. It then suffered a harsh reversal and bottomed at $44.95 on November 12. This decline was notable because its lower side was slightly above the 100-day moving average, which explains why the coin has bounced back.

Pi Network’s rebound also happened a few weeks after it formed a golden cross as the 200-day and 50-day moving averages crossed each other.

The current retreat happened after the coin rose to the extreme overshoot of the Murrey Math Lines. Therefore, with the rising expectation of an upcoming mainnet launch, there are chances that the Pi coin price will bounce back, and potentially retest the important resistance at $100. A break above that level will raise the odds of the coin rising to the year-to-date high of $122.05.

On the flip side, a drop below the top of the trading range at $56.25 will invalidate the bullish view, and raise the odds of it falling to $45, its lowest level this month.

Frequently Asked Questions (FAQs)

There are chances that the coin will bounce back ahead of the mainnet launch, which is expected to happen in December this year. If this happens, the coin may retest the key resistance at $100, its highest point last month.

No. Pi coin is not associated with the real project and is not an indicator of what will happen when the mainnet launch happens.

It is unlikely that the Pi Coin will do well after the mainnet launch as evidenced by the recent crashes of Hamster Kombat and Notcoin.

crispus

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Changpeng Zhao critiques meme coins, suggests projects should focus on utility

Expert Warns Of Upcoming 25% Drop, Timing And Trends Explained

Is Marathon Digital (MARA) a Better Bet Than MicroStrategy (MSTR) Stock Now?

Cardano eyes spot ETF entry as analyst foresees surge, Rollblock set to explode next

BTC Dips Below $95K, LDO Up 15%

Trader Warns of Potential XRP Correction, Says Dogecoin Trading at Most Likely Area To Expect Rejection

Meme Coins Die — Bloggers’ Advertising is Ineffective

Hashdex Files Second Amendment for Nasdaq Crypto Index US ETF Approval

Bitcoin Dips to $93,000 With $400 Million in Longs Rekt. Where to From Here?

You Can Now Invest In Bitcoin And Open-source Companies

Trump holds $7 million in crypto: Arkham Intelligence

John Deaton Calls Out Gary Gensler For Ties With Sam Bankman-Fried

Ethereum’s ETH Outperforms as Bitcoin (BTC) Price Recoils Off $100K Sell Wall

Safegcd’s Implementation Formally Verified

US detaining Bitcoin mining equipment at border: report

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: