chainlink

Is $15 Next For Chainlink Price After Proof of Reserves Integration?

Published

2 months agoon

By

admin

Chainlink price is gaining traction and is slowly headed toward a potential breakout level. Besides the overall crypto market recovery, Chainlink has been working hard to secure integrations. The latest is one with 21.co which will go a long way to help the company ensure its assets. For Chainlink, each integration is paid for with LINK, creating demand for the token. But can the price reach $15 amid this rapid adoption?

What Next for Chainlink Price after 21.co Integration

On September 23, 21.co, the company behind 21Shares, integrated Chainlink’s Proof of Reserves (PoR) for its Wrapped Bitcoin (21BTC) on the Solana and Ethereum blockchains. For context, 21Shares has $2 billion asset under management (AuM), which means it is not a small company. The integration aims to provide a real-time verification of Bitcoin reserves backing 21BTC.

.@21co__ has integrated Chainlink Proof of Reserve (PoR) on @ethereum & @solana to enhance reserves transparency for 21BTC, its wrapped Bitcoin.

How PoR provides the Ethereum & Solana ecosystems with assurances that 21BTC is fully backed 1:1 by BTC👇https://t.co/kUqFTlofcJ pic.twitter.com/SD6UdG4ABV

— Chainlink (@chainlink) September 23, 2024

The Chainlink PoR brings reserve data on-chain, enabling protocols to build automated logic around the data backing the asset. This improves security by preventing malicious infinite mint attacks.

Link price has increased by 0.7% in the last 24 hours and is trading at $11.51.

LINK Price Analysis: Volume Confirms 22% Breakout Imminent

Chainlink price has recently broken above a trend line but shows signs of instability, with fluctuations around this line. The relevance of the trend line is being questioned due to these movements.

The inverse double-bottom formation on the chart is bullish, with a clearly defined neckline at around $12.35

Key Support and Resistance Levels

- $11: immediate support lies around $11 (neckline of the inverse head-and-shoulders pattern).

- $10: The next strong lower support zone is around.

- $15: Major resistance is at $15, where the price might face heavy selling pressure, aligning with the top of the projected breakout target.

If the Chainlink price breaks above $12.35, it could surge to $15, indicating a strong bullish trend that could potentially reach $19.50. However, it requires a sustained movement above $12.35.

Volume has been increasing slightly as the price approaches the neckline, which is an early indication that a breakout could be imminent if the buying pressure continues to rise.

Chainlink price prediction shows that if the asset movement fails to break above $12.35, it could lead to further declines to $9 and even $8. Additionally, Chainlink continues to top the chart among projects with the highest development activity. The integration of of 21.co is just another addition to the over 1,000 integration the Oracle service provider has offered on its platform. The LINK price could surge not just to $15, but 10–15X, and it would still remain undervalued, given the immense capability of the technology.

Frequently Asked Questions (FAQs)

The recent surge in Chainlink’s price is primarily driven by its integration with 21.co’s Proof of Reserve (PoR) system, which is expected to create more demand for the LINK token as it continues to secure integrations.

Chainlink’s Proof of Reserve (PoR) is a mechanism that provides real-time verification of reserves, such as Bitcoin, backing certain assets. It ensures transparency and security, preventing malicious attacks and ensuring that assets are properly backed.

Chainlink price could reach $15 and possibly beyond, depending on sustained market momentum and continued adoption of its technology. Some analysts suggest that due to its capabilities, LINK could even achieve a 10–15X increase in value over time.

Related Articles

Evans Karanja

Evans Karanja is a crypto analyst and journalist with a deep focus on blockchain technology, cryptocurrency, and the video gaming industry. His extensive experience includes collaborating with various startups to deliver insightful and high-quality analyses that resonate with their target audiences. As an avid crypto trader and investor, Evans is passionate about the transformative potential of blockchain across diverse sectors. Outside of his professional pursuits, he enjoys playing video games and exploring scenic waterfalls.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

chainlink

Chainlink (LINK), UBS Asset Management, Swift Complete Pilot to Bridge Tokenized Funds With TradFi Payment Rails

Published

2 weeks agoon

November 5, 2024By

admin

The project, completed as part of the Monetary Authority of Singapore’s (MAS) Project Guardian, showcased how Swift’s infrastructure can facilitate off-chain cash settlements for tokenized funds. It also demonstrates how tokenization and blockchain can work to improve, not replace, Swift, which connects over 11,500 financial institutions in more than 200 countries.

Source link

algo

Analyst Names Two Altcoins That Can Soar About 600% This Cycle, Updates Outlook on Dogecoin

Published

3 weeks agoon

November 4, 2024By

admin

A closely followed crypto analyst believes that two altcoins have the potential to skyrocket by as much as 5x before this cycle is over.

Pseudonymous analyst Altcoin Sherpa tells his 228,100 followers on the social media platform X that he’s extremely bullish on the altcoin market.

According to the analyst, even average altcoins will see massive price rallies if conditions turn bullish for crypto.

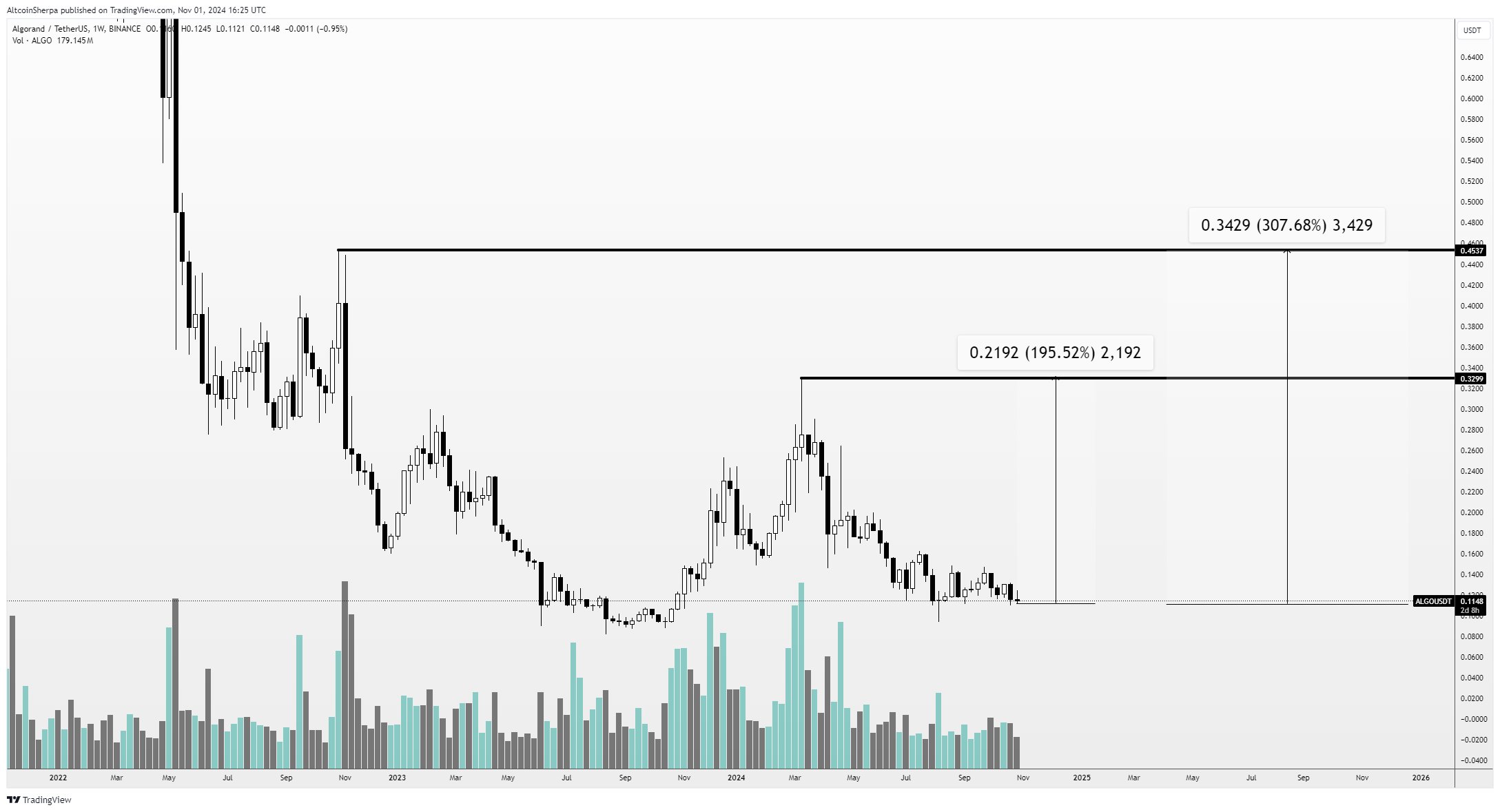

Specifically, the trader sees the decentralized oracle network Chainlink (LINK) and the layer-1 protocol Algorand (ALGO) printing gains between 400% and 600% before the current cycle comes to a close.

“Market average for sh*tcoins from here on out: probably about 3-5x for this cycle on the low end and 5-10x for prices on the high end.

Meaning: If you buy pretty much anything at this point in time, I expect it to go 3-5x.

Here are two examples with LINK [and] ALGO.”

Looking at the trader’s chart, he seems to predict that LINK will surge by over 350% to revisit all-time high levels. As for ALGO, Altcoin Sherpa shares a chart suggesting that an over 300% move will not even take the coin close to its all-time high of $3.56.

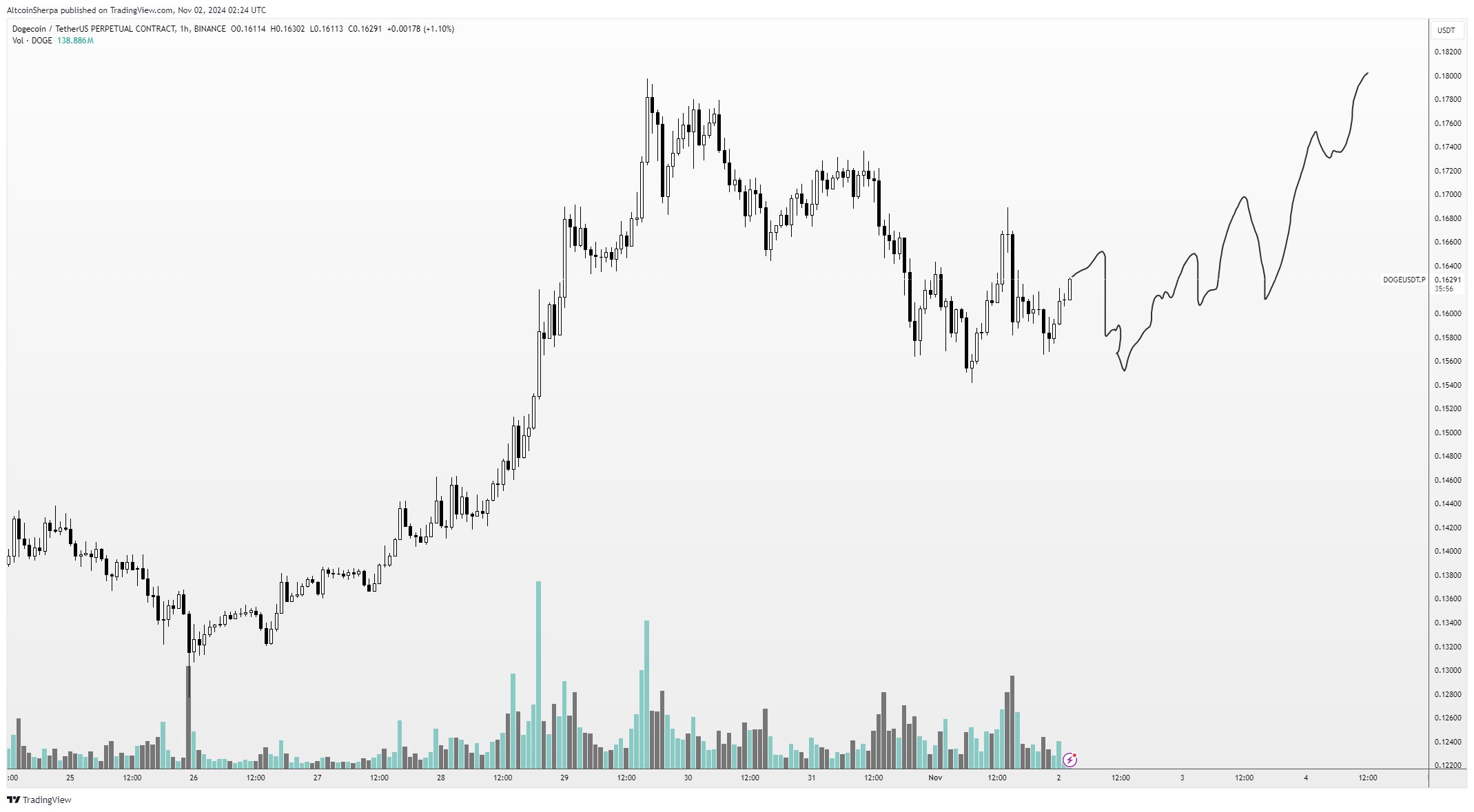

Turning to the top memecoin Dogecoin (DOGE), Altcoin Sherpa thinks the altcoin is taking a breather before sparking a new leg up.

“This is the bottom you want to see for DOGE in my opinion.

Lots of volatility and a range forming.”

At time of writing, DOGE is trading for $0.159.

Altcoin Sherpa also names other coins that he thinks will do well once the market enters full-bull territory.

“Mid-cap memes are taking a lot of mindshare and I still think stuff like BONK/PEPE/WIF probably outperforms a great percentage of utility coins. But if you’re looking for utility, I would prob go:

-New coins like EIGEN

-High float/older coins like FTM (+rebrand)

-new infra coming out like monad/berachain

-new coins that came out and down only (never pumped) aka REZ, ZK and those types

Lots of different ways to play the upcoming alt pump; be flexible and prepared.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Salamahin/HUT Design

Source link

Altcoins

Chainlink (LINK) Extends Run As Top ERC-20 Project in Terms of Development Activity: Santiment

Published

4 weeks agoon

October 27, 2024By

admin

The decentralized oracle network Chainlink (LINK) is once again the top-ranked ERC-20 project in terms of recent development activity, according to the crypto analytics platform Santiment.

Santiment notes on the social media platform X that Chainlink registered 649.03 notable GitHub events in the past 30 days, nearly double the number of the second-ranked project, Ethereum (ETH), which clocked 342.2.

The decentralized oracle project also topped the list in June, July and September.

The web3 project Status (SNT) ranked third in the past 30 days, registering 270.57 events. Status aims to offer users a secure messaging app, crypto wallet and web3 browser via an open-source, peer-to-peer protocol and end-to-end encryption.

An ERC-20 project is a standard that developers use to issue tokens on the Ethereum blockchain and virtual machine.

Santiment notes that it doesn’t count routine updates and utilizes a “better methodology” to collect data for GitHub events based on a “backtested process.”

The analytics firm has previously said that heavy development activity centered around a crypto project indicates developers believe in the protocol. Development activity also suggests that the project is less likely to be an exit scam.

LINK is trading at $11.11 at time of writing. The 18th-ranked crypto asset by market cap is down more than 6% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

Polkadot investor predicts a 30,000% rally for this $0.04 token by 2025

Donald Trump Proposed Crypto Advisory Council To Set Up Strategic Bitcoin Reserve

Want Greater Bitcoin Adoption? Engage With Your Government.

Why the Media Loves the Worst of Crypto

HashCats prepares for Token Generation Event after completing mining season

Gary Gensler To Step Down As US SEC Chair In January

The Chart That Shows Bitcoin’s Bull Run Won’t Stop at $100,000

$2 Million PEPE Purchase Sees 105 Billion Tokens Snapped Up

XRP price expected to reach $7, Dogecoin $3, and PCHAIN $1 from $0.004

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: