679541931727359450

Published

2 months agoon

By

admin

You may like

Trump in considerations for CFTC to regulate crypto

Will XRP Price Reach $2 By The End Of November?

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Bitcoin Script: Focus On The Building Blocks, Not The Wild Geese

Kraken to close NFT marketplace by February 2025

Kraken To Shut Down Its NFT Marketplace

CFTC

Trump in considerations for CFTC to regulate crypto

Published

43 mins agoon

November 26, 2024By

admin

The U.S. President-elect’s administration is considering the commodity trading authority to take over the crypto regulations.

The Commodity Futures Trading Commission (CFTC) is in Donald Trump’s eye to lead the emerging financial industry, cryptocurrency, after the exchange commission weighed on the past few years to rule.

According to Fox Business on Nov. 26, the effort to move the power to the CFTC has been seen as Trump and the Republican majority repeal the jobs from the Securities and Exchange Commission (SEC).

If the concept is approved by Congress, the commission will have a major role in regulating digital assets, as well as crypto-related products such as Bitcoin spot ETF and Ethereum spot ETF. It will also allow them to supervise the options market, which released some crypto products earlier this month.

The newly elected President also wanted to bring an innovative environment to the digital asset, which can create a better outlook for the industry since crypto is still considered as a new financial market.

SEC role will replaced by CFTC

The SEC, under Biden’s presidency, has received a lot of criticism from the crypto market due to the heavy enforcement of court and regulations. Last year, the commission was accusing crypto-related entities up to 46 times, which increased by 53% from the previous year. It is also the highest number of lawsuits since the commission supervised crypto in 2013, according to a report from Cornerstone Research.

Crypto exchanges, like Binance and Coinbase, are the major target for SEC lawsuits, including the Changpeng Zhao (CZ) cases for operating illegal exchanges and violating securities law. Coinbase is also facing the same lawsuit under SEC Chairman Gary Gensler, which indicates as unregistered exchange.

CFTC, on the other hand, will play a significant role in the growing industry with 50 million traders and a $3 trillion market size. The move also would allow the commission to regulate crypto exchanges, companies, and individuals in specific markets.

Source link

24/7 Cryptocurrency News

Will XRP Price Reach $2 By The End Of November?

Published

2 hours agoon

November 26, 2024By

admin

Crypto analysts Mikybull Crypto and CrediBULL Crypto have suggested that the XRP price could reach $2 by the end of November. However, CrediBULL Crypto warned about what could hinder XRP from reaching this target.

XRP Price To Reach $2 By The End Of November

In an X post, Mikybull Crypto stated that the XRP price was looking so good at its current level and predicted that the crypto could reach $2 this week. CrediBULL Crypto also suggested that XRP could rally to $2 before this month ends but warned that it could depend on the Bitcoin price movement.

In an X post, the crypto analyst said that Bitcoin and XRP were at a pivotal point in their current price levels. He remarked that if the latter is at a level where it could record an extended 5th wave for this rally and continue above $2 without any significant pullback, it should be bottoming within its current range.

CrediBULL Crypto added that if the Bitcoin price holds 94,000, there is a decent chance the XRP price will be above $1.10, and the extended 5th wave will happen. However, if Bitcoin breaks below $1.10, it will confirm the completion of the first major Wave 1 from $0.48 to $1.62.

With the Bitcoin price falling today, this XRP rally to $2 before the end of this month could be at risk based on CrediBULL Crypto’s analysis. It is worth mentioning that the crypto analyst raised the possibility of XRP still enjoying this rally if Bitcoin can hold this $94,000 level and chop around this range for a bit.

The Rally To $2 Could Pave The Way To Double Digits

In an X post, crypto analyst Egrag Crypto suggested that the XRP price rally to $2 could pave the way for the crypto to reach double digits. This came as he revealed that the Fib channel 0.236 aligns perfectly at $2.

The crypto analyst remarked that with the right news and catalysts, XRP will soon break past this critical level, and then the real FOMO will kick in at $2. Egrag Crypto stated that reaching the Fib 0.5 level alone will take the XRP price into double digits. He noted that historically, the crypto has even surpassed this Fib level to hit at least 0.702.

Boluwatife Adeyemi

Boluwatife Adeyemi is a well-experienced crypto news writer and editor who has covered topics that cut across DeFi, NFTs, smart contracts, and blockchain interoperability, among others. Boluwatife has a knack for simplifying the most technical concepts and making it easy for crypto newbies to understand. Away from writing, He is an avid basketball lover and a part-time degen.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Altcoins

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Published

4 hours agoon

November 26, 2024By

admin

A closely followed trader in the crypto space says there may be opportunities for select altcoins once Bitcoin (BTC) stabilizes.

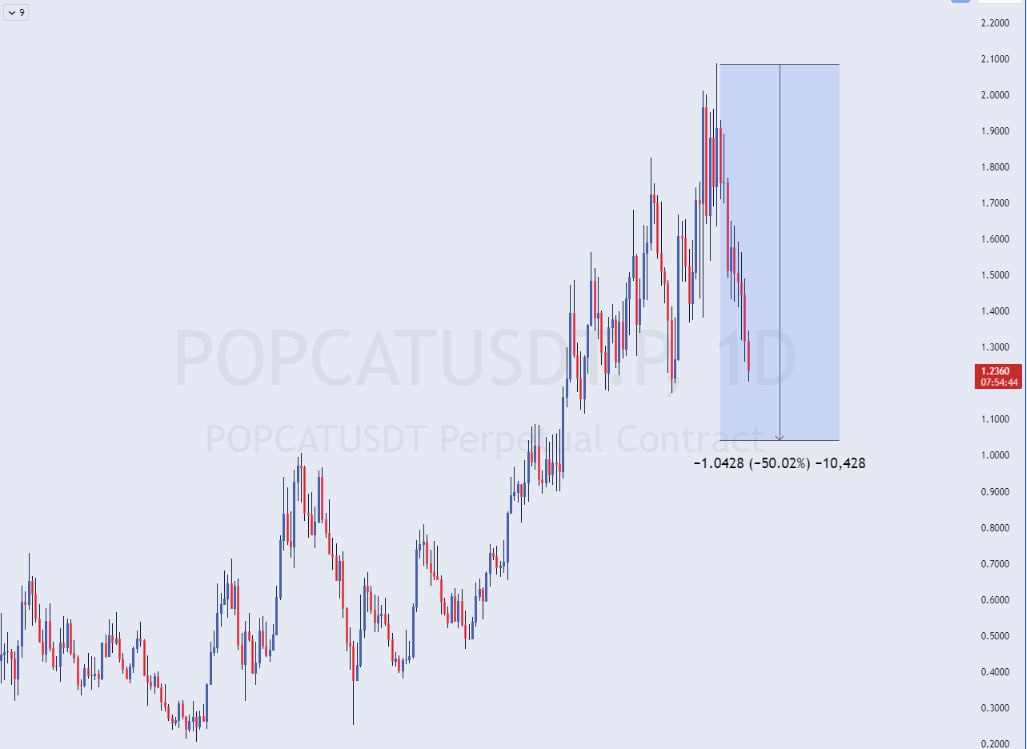

Pseudonymous analyst The Flow Horse tells his Telegram subscribers that the more liquid altcoins within the top 100 could present good entry points for bulls after their 50% dips.

The trader names cat-themed memecoin POPCAT as an example.

“Gentle reminder that alts probably can go a bit lower if Bitcoin does but after this type of mark up the 50% retracement level on liquid top 100 pairs is often a very good level to bid.

I would start creating filters and alerts for charts that are approaching their 50% retracement levels, Popcat is a good example.”

The Flow Horse also says that Celestia (TIA) and SEI are “good examples” of coins that are showing strength despite Bitcoin currently correcting and dragging much of the digital assets markets down with it.

The trader says it’s more than likely that BTC will consolidate under the $100,000 level, with some money flowing out of the risk curve into altcoins.

“Regardless of the near-term outcome, I think you can take one thing from BTC, no need to force anything here, BTC imo is more than likely going to take a little breather anyway before any real move above 100k.

Ideally, the market comes into agreement that we don’t have to worry about much lower prices, or that it doesn’t make sense to yet, and we can see some of the capital that does come out of Bitcoin go into alts.”

At time of writing, Bitcoin is trading at $94,201.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Mia Stendal/Vladimir Sazonov

Source link

Trump in considerations for CFTC to regulate crypto

Will XRP Price Reach $2 By The End Of November?

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Bitcoin Script: Focus On The Building Blocks, Not The Wild Geese

Kraken to close NFT marketplace by February 2025

Kraken To Shut Down Its NFT Marketplace

Pump.fun Accounted for 62% of Solana DEX Transactions in November, So Far

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Zodia Custody teams up with Securitize for institutional access to tokenized assets

Crypto Analyst Explains Why Dogecoin Price Will Hit $1

Bitcoin Long-Term Holders Have 163K More BTC to Sell, History Indicates: Van Straten

The transformative potential of Bitcoin in the job market

Ripple CLO Stuart Alderoty Challenges US SEC

Changpeng Zhao critiques meme coins, suggests projects should focus on utility

Expert Warns Of Upcoming 25% Drop, Timing And Trends Explained

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: