679541931727359450

Published

2 months agoon

By

admin

You may like

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Bitcoin Crashes Under $93,000: What’s Behind It?

Trump in considerations for CFTC to regulate crypto

Will XRP Price Reach $2 By The End Of November?

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Bitcoin Script: Focus On The Building Blocks, Not The Wild Geese

Guides

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Published

39 mins agoon

November 27, 2024By

admin

Bitcoin has consistently outperformed all major asset classes over the past decade, solidifying its role as the benchmark for digital asset investors. For those committed to Bitcoin’s long-term vision, the ultimate financial goal often shifts from acquiring more dollars to maximizing their Bitcoin holdings.

Bitcoin is the Hurdle Rate

Bitcoin is to digital assets what treasury bonds are to the legacy financial system—a foundational benchmark. While no investment is without risk, Bitcoin held in self-custody eliminates counterparty risk, dilution risk, and other systemic risks common in traditional finance.

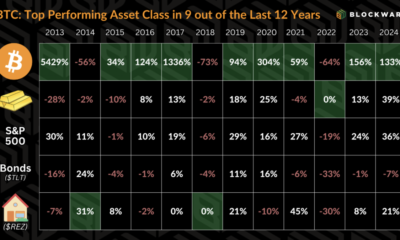

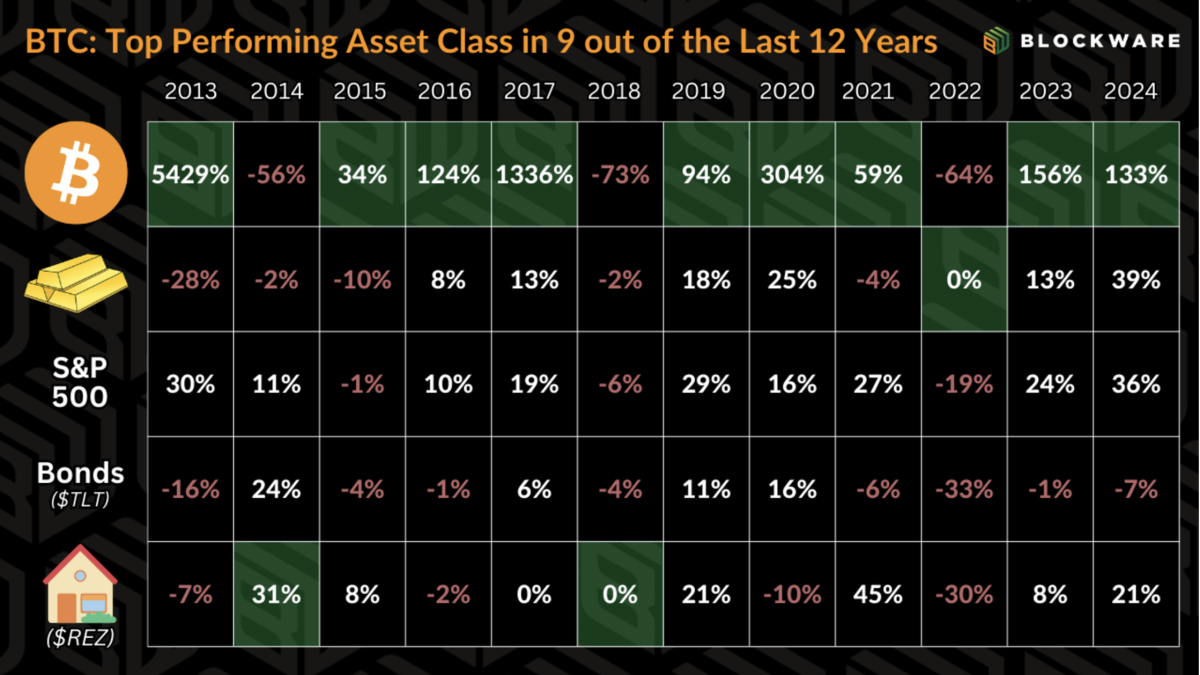

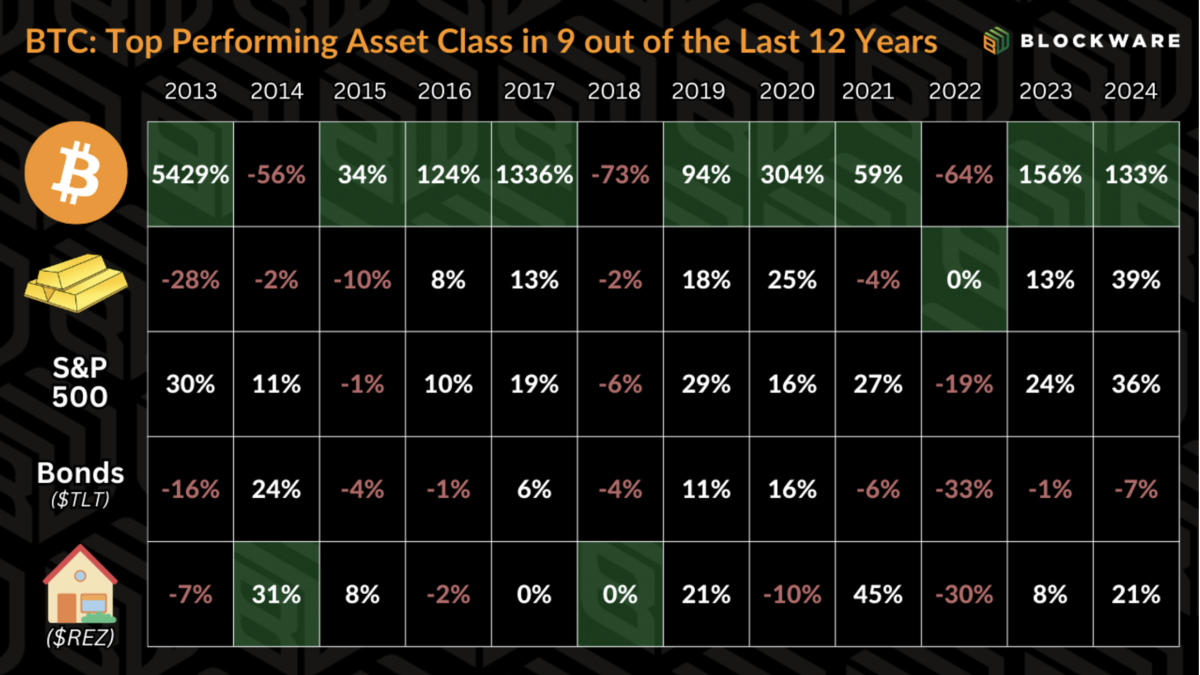

With BTC outperforming every other asset class in 9 of the past 12 years (by orders of magnitude), it’s no surprise that it has usurped treasury bonds as the “risk free rate” in the minds of many investors – especially those knowledgeable about monetary history and thus the appeal of Bitcoin’s verifiable scarcity.

Another way to phrase this would be that the financial objective of digital asset investors is to acquire more BTC rather than acquire more dollars. All investments or spending are viewed through the lens of BTC being the opportunity cost.

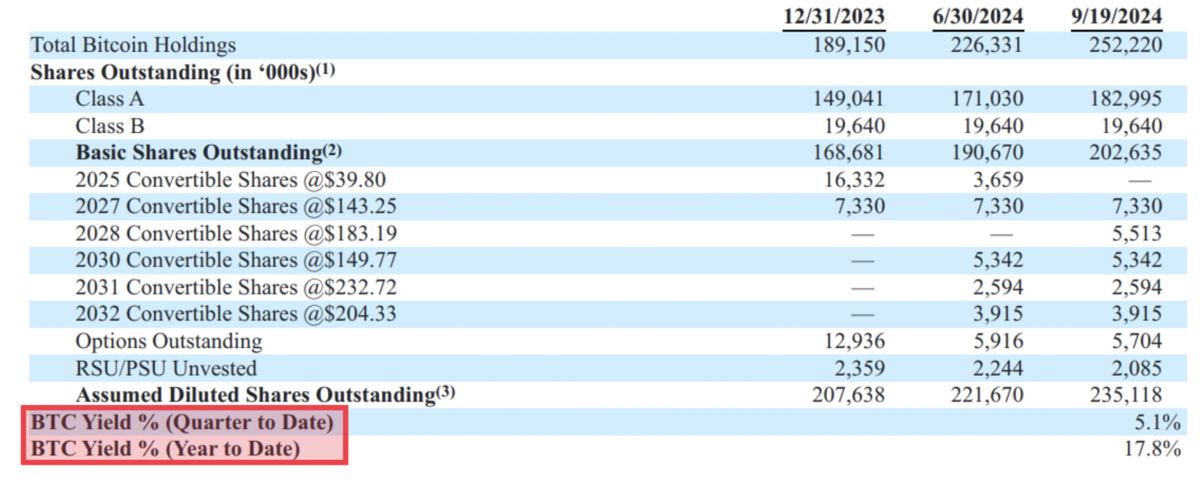

MicroStrategy has demonstrated what this looks like in the corporate world with their new KPI: BTC Yield. To quote from their September 20th, 8-K form: “The Company uses BTC Yield as a KPI to help assess the performance of its strategy of acquiring bitcoin in a manner the Company believes is accretive to shareholders.” MicroStrategy has taken full advantage of the tools available to them as a multi-billion dollar public company: access to low interest rate debt and the ability to issue new shares. This KPI shows that they are acquiring more BTC per outstanding share despite the fact that they are engaging in the traditionally dilutive activity of new share issuance.

Mission accomplished: they are acquiring more bitcoin.

But MicroStrategy has an advantage that the average fund manager or retail investor does not: they are a publicly traded company with the ability to tap into capital markets at little to no relative cost. Individual holders are unable to issue shares into the public market in order to raise capital and acquire BTC. Nor can we issue convertible notes and borrow dollars at a near zero % interest rate.

So that begs the question: how can we accumulate more bitcoin? How can we have a positive ‘BTC Yield’?

Bitcoin Mining

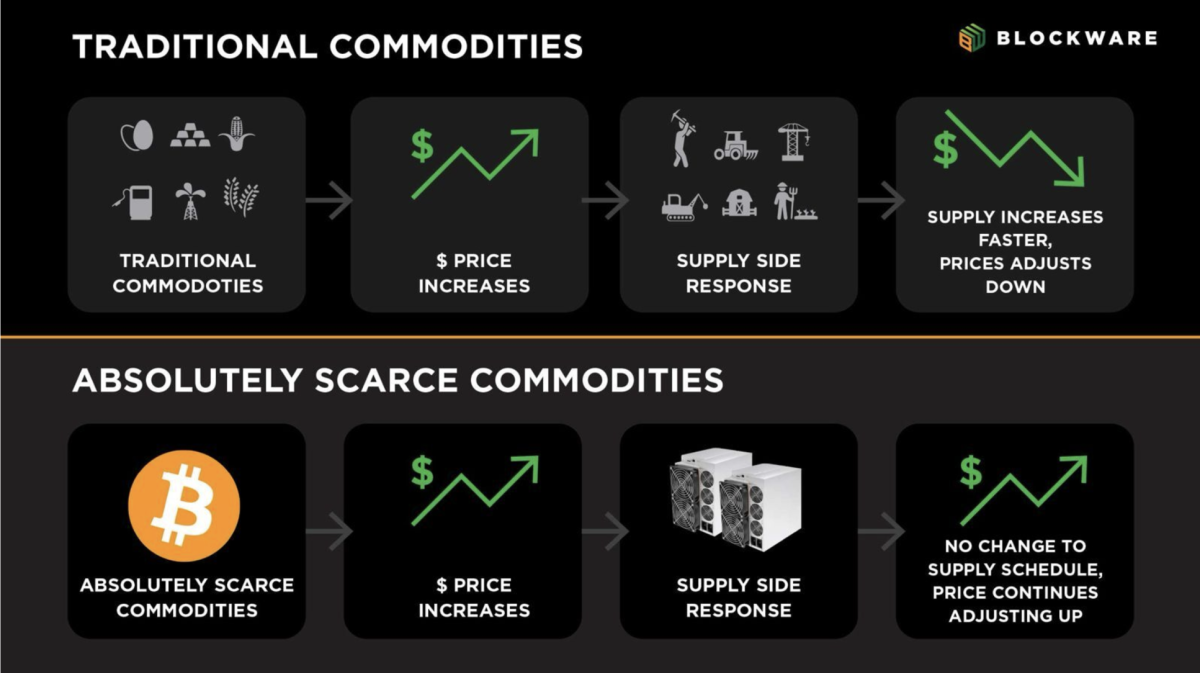

Bitcoin miners acquire BTC by contributing computational power to the Bitcoin network, and receiving a greater amount of BTC than what it costs in electricity to operate their machine(s). Now this is easier said than done. The Bitcoin protocol enforces a predetermined supply schedule using “difficulty adjustments” – meaning that more computational power dedicated towards Bitcoin mining results in the finite block rewards getting split up into smaller pieces.

The most effective Bitcoin miners are those that maximize their computational power while minimizing their operational costs. This is accomplished by acquiring the latest, most-efficient Bitcoin mining hardware, and operating with the lowest possible electricity rate.

Under current market conditions (as of 11/21/2024), 1 bitcoin has a price of ~$98,000. However, an Antminer S21 Pro mining with an electricity rate of $0.078/kWh is able to produce 1 BTC for ~$40,000 in electricity. This is an operating margin of nearly 145%. A business is typically considered to have “healthy profit margins” if they are in the 5-10% range – mining beats this easily. This is in spite of the fact that as of the April 2024 Bitcoin halving, they earn half as much BTC per unit of compute.

Price Growth Outpacing Difficulty Growth

The price of a financial asset – specifically bitcoin – is set at the margin. This means that the asset’s price is determined by the most recent transactions between buyers and sellers. In other words, the price reflects what the last buyer is willing to pay and what the last seller is willing to accept.

This, in part, is what enables BTC’s notoriously volatile price action. A lack of sellers at price X means buyers must bid the price higher than X in order to find the next marginal seller. Inversely, a lack of buyers at price X means a seller must lower their ask to find the next marginal buyer. BTC can quickly move up or down based on a lack of sellers or buyers in a specific range.

Consequently, the velocity at which the Bitcoin price can move is much higher than that of network mining difficulty. Substantial growth in network mining difficulty is not achieved by marginal bid/ask spreads, it is achieved by the culmination of ASIC manufacturing, energy production, and mining infrastructure development. There is not shortcutting the time and human capital necessary to increase the total computational power on the Bitcoin network.

This dynamic is what creates opportunities for Bitcoin miners to accumulate vast amounts of bitcoin.

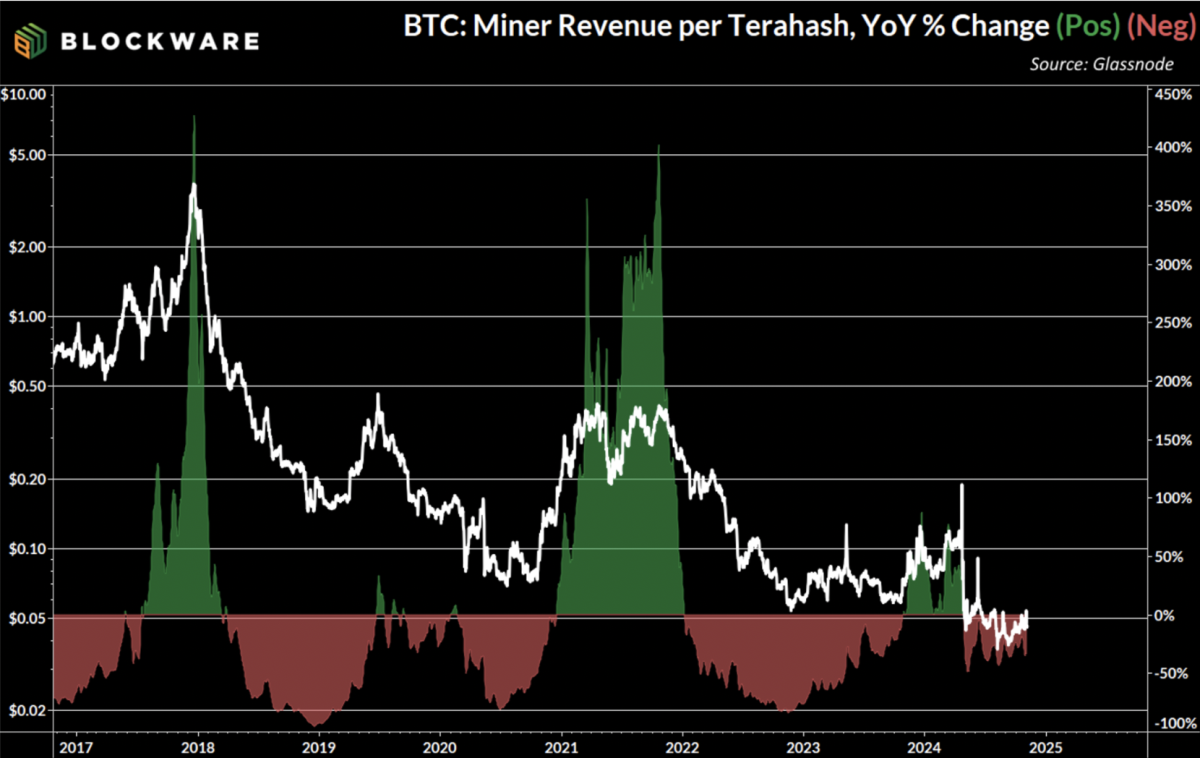

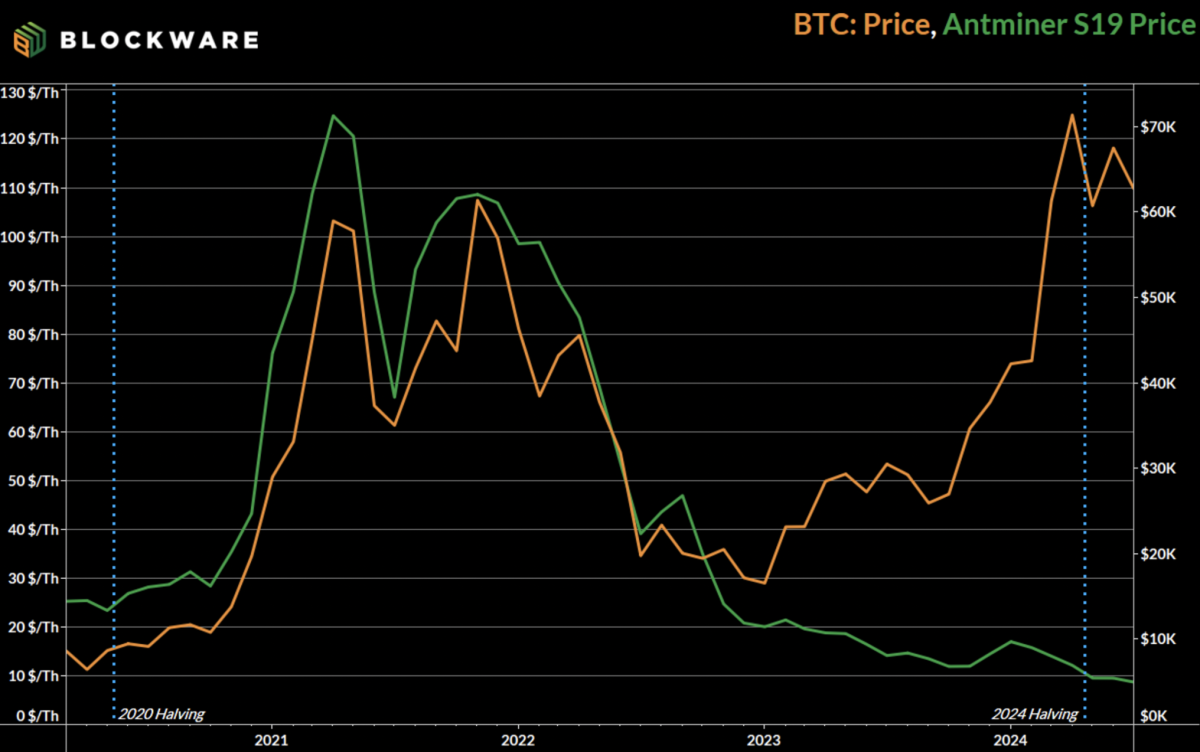

The chart here illustrates the explosive growth of Bitcoin mining profitability that takes place during bull markets. “Hashprice” measures the amount of revenue that Bitcoin miners earn per unit of compute on a daily basis. On a year-over-year basis, hashprice has increased by more than 300% at the height of each bitcoin mining cycle. This means that miners have had their profit margins more than triple in a 12-month span.

Over the long-run this metric trends down as more entities begin mining bitcoin, miners upgrade to more powerful & efficient machines, and the block subsidy is cut in half every four years. However, during bull markets, the combination of the forces that are a positive catalyst for mining difficulty (and thus net-negative for mining profitability) pale in comparison to the rapid growth in the price of bitcoin.

Price Volatility in Bitcoin Mining Hardware

In addition to wider profit margins during bull markets, Bitcoin miners have the simultaneous benefit of the fact that ASIC prices tend to move in tandem with the Bitcoin price. During the 2020 – 2024 cycle, the Antminer S19 (most efficient ASIC at the time) began trading at ~$24/T. By November 2021 – when the BTC price was peaking – they began trading for north of $120/T.

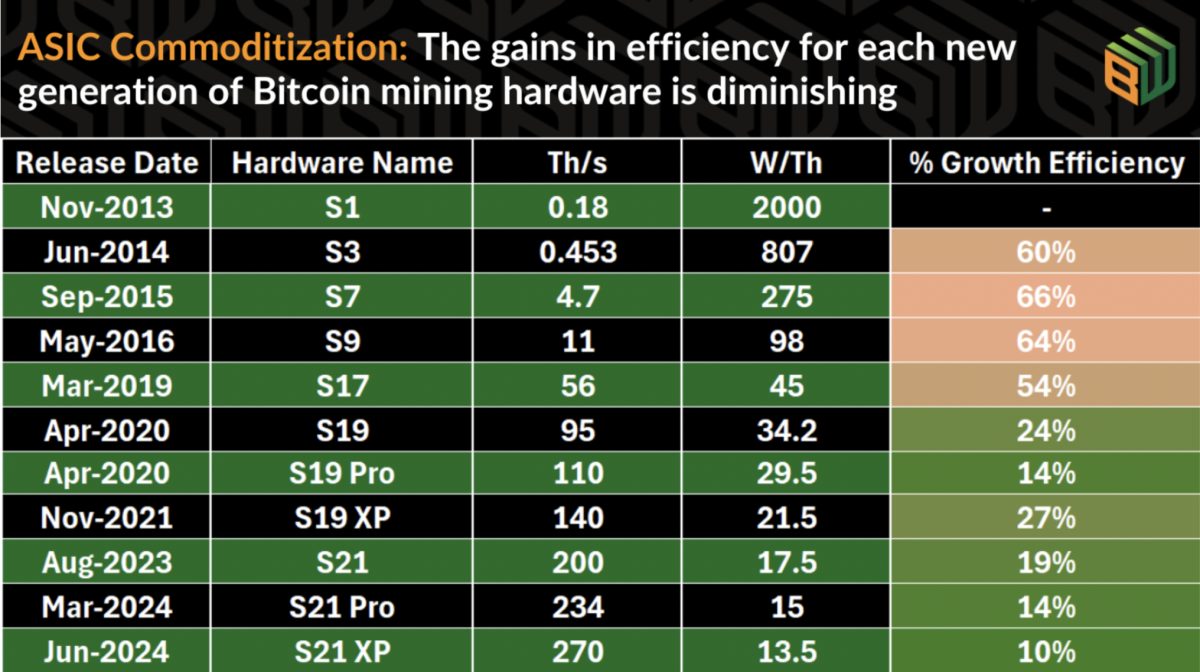

Bitcoin mining hardware retaining resale value is becoming increasingly the case with each new generation of hardware. In the early days of Bitcoin mining, technological advancements were swift and forceful – to the point that new ASICs would make older models obsolete overnight. However, the marginal gains of new ASICs have diminished to the point that older models are able to remain competitive for multiple years after release.

Since the S19 was launched in 2020 and retains a non-zero market price today, it is reasonable to expect that the S21 line of machines will be able to retain value for even longer. This gives miners a significant leg-up when it comes to accumulating bitcoin, because the upfront cost of purchasing machines is no longer “sunk”. Their machines have a price, one that is correlated to bitcoin, and there is a resource available to get liquidity.

Blockware Marketplace

Blockware developed this platform to enable any investor – institutional or retail – the opportunity to gain direct exposure to Bitcoin mining. Users of the marketplace are able to purchase Bitcoin mining rigs that are hosted at one of Blockware’s tier 1 data centers and have access to industrial power prices. These machines are online already, eliminating lengthy lead times that have historically caused some miners to miss out on those key months in the cycle in which price is outpacing network difficulty.

Moreover, this platform is built by Bitcoiners, for Bitcoiners. Which means that machines are purchased using Bitcoin as the medium of exchange, and mining rewards are never held by Blockware – they are sent directly to the users own wallet.

Lastly, this provides miners with the aforementioned opportunity, but not obligation, to sell their machines at any time and price. This enables miners to capitalize on volatility in ASIC prices, recoup the cost of their machines, and accumulate more BTC faster than they would with a traditional “pure play” approach.

This innovation removes the obstacles that have historically made hosted mining difficult, enabling miners to concentrate on the mission: accumulating more Bitcoin.

For institutional investors looking for bulk pricing on mining hardware, contact the Blockware team directly.

Source link

Bitcoin

Bitcoin Crashes Under $93,000: What’s Behind It?

Published

41 mins agoon

November 27, 2024By

admin

Bitcoin has observed a plunge under the $93,000 level during the past day. Here’s what the trend in an indicator suggests about what could be behind this downturn.

Bitcoin Coinbase Premium Gap Has Gone Cold

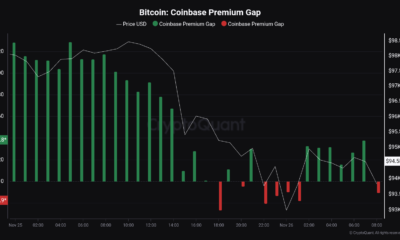

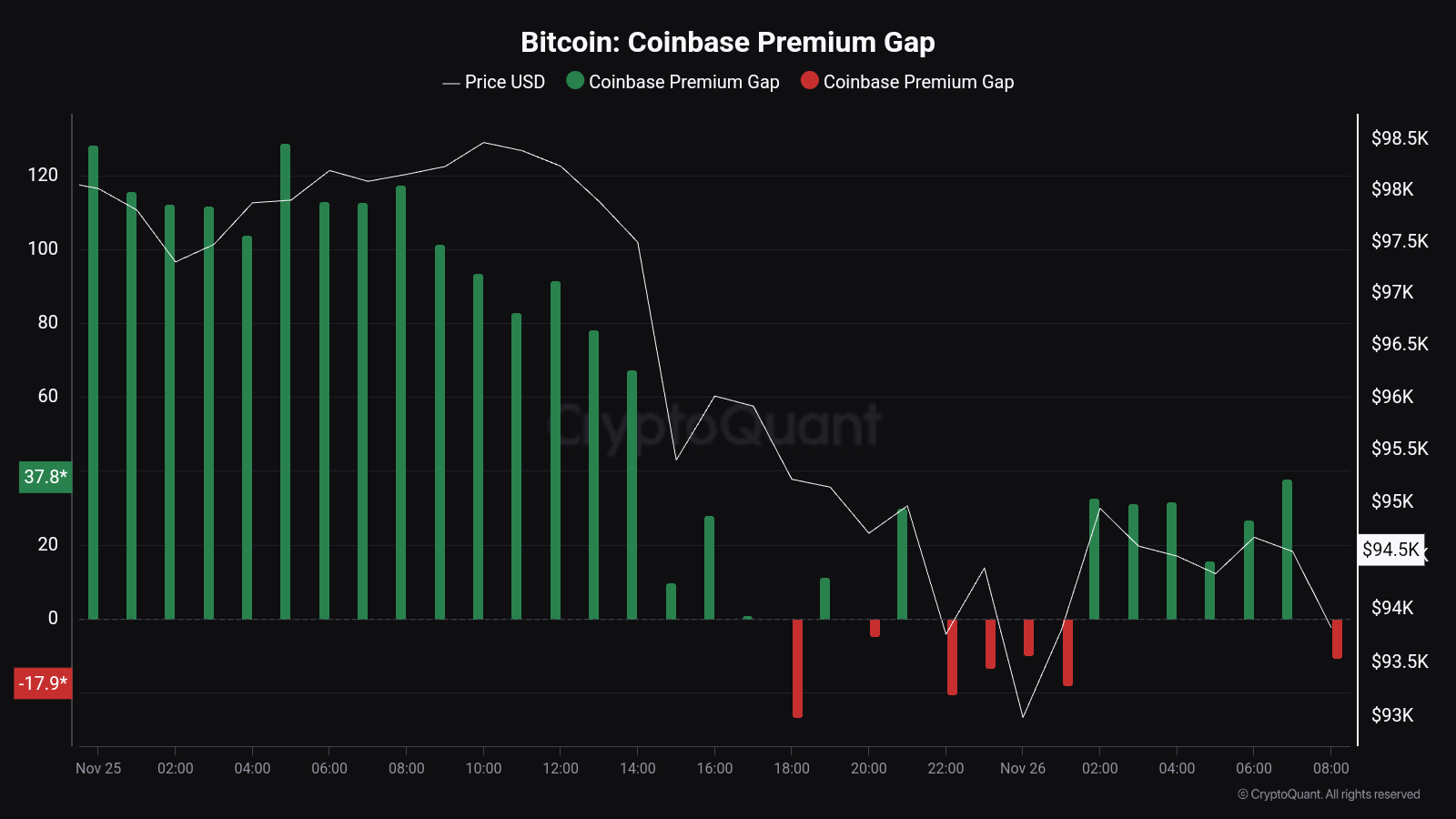

As pointed out by CryptoQuant community analyst Maartunn in a new post on X, the Coinbase Premium Gap has returned to neutral levels recently. The “Coinbase Premium Gap” here refers to an indicator that keeps track of the difference between the Bitcoin price listed on Coinbase (USD pair) and that on Binance (USDT pair).

This metric essentially tells us about how the buying or selling behaviours differ between the user bases of the two cryptocurrency exchanges. Coinbase’s main traffic is made up of American investors, especially large institutional entities, while Binance serves investors around the world.

When the Coinbase Premium Gap has a positive value, it means the US-based whales are participating in a higher amount of buying or a lower amount of selling than the Binance users, which is why the asset is more expensive on Coinbase. Similarly, it being negative implies a net higher buying pressure on Binance.

Now, here is a chart that shows the trend in the Bitcoin Coinbase Premium Gap over the past couple of days:

As displayed in the above graph, the Bitcoin Coinbase Premium Gap had been at notable positive levels earlier, but during the past day, its value has declined to the neutral zero mark.

According to Maartunn, the source of the positive premium was Microstrategy’s latest buying spree. Indeed, the cooldown in the indicator matches up with the timing of the completion of the $5.4 billion purchase by Michael Saylor’s firm. The significant accumulation from the company had helped the cryptocurrency maintain its recent highs, but with the buying pressure depleted, Bitcoin has retraced to price levels under $93,000.

BTC and the Coinbase Premium Gap have held a close relationship throughout 2024, so the metric could be to keep an eye on in the near future, as where it goes next may once again foreshadow the asset’s next destination. Naturally, a decline into the negative region could spell further bearish action for its price.

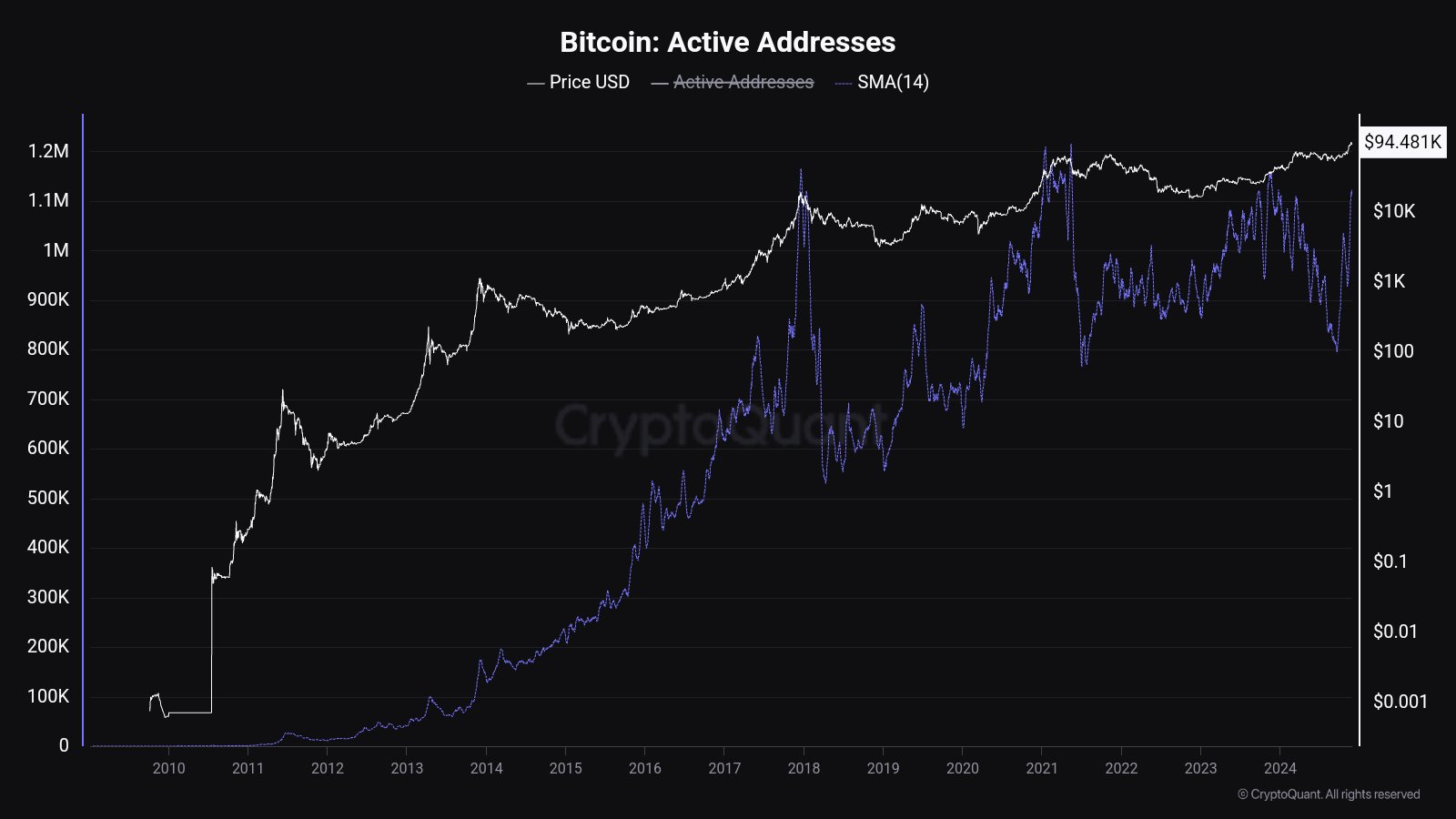

In some other news, the Bitcoin Active Addresses indicator has observed a sharp jump recently, as Maartunn has shared in another X post. This metric keeps track of the daily number of addresses that are participating in some kind of transaction activity on the network.

Below is the chart shared by the CryptoQuant analyst for the 14-day simple moving average (SMA) of the Active Addresses:

With this latest surge, the 14-day SMA of the Bitcoin Active Addresses has reached its highest point in eleven months. This suggests that a lot of activity has recently occurred on the network. Given that the asset has gone down in the past day, though, the most recent user interest has certainly not come for buying.

BTC Price

At the time of writing, Bitcoin is floating around $92,400, down almost 6% over the last 24 hours.

Source link

CFTC

Trump in considerations for CFTC to regulate crypto

Published

2 hours agoon

November 26, 2024By

admin

The U.S. President-elect’s administration is considering the commodity trading authority to take over the crypto regulations.

The Commodity Futures Trading Commission (CFTC) is in Donald Trump’s eye to lead the emerging financial industry, cryptocurrency, after the exchange commission weighed on the past few years to rule.

According to Fox Business on Nov. 26, the effort to move the power to the CFTC has been seen as Trump and the Republican majority repeal the jobs from the Securities and Exchange Commission (SEC).

If the concept is approved by Congress, the commission will have a major role in regulating digital assets, as well as crypto-related products such as Bitcoin spot ETF and Ethereum spot ETF. It will also allow them to supervise the options market, which released some crypto products earlier this month.

The newly elected President also wanted to bring an innovative environment to the digital asset, which can create a better outlook for the industry since crypto is still considered as a new financial market.

SEC role will replaced by CFTC

The SEC, under Biden’s presidency, has received a lot of criticism from the crypto market due to the heavy enforcement of court and regulations. Last year, the commission was accusing crypto-related entities up to 46 times, which increased by 53% from the previous year. It is also the highest number of lawsuits since the commission supervised crypto in 2013, according to a report from Cornerstone Research.

Crypto exchanges, like Binance and Coinbase, are the major target for SEC lawsuits, including the Changpeng Zhao (CZ) cases for operating illegal exchanges and violating securities law. Coinbase is also facing the same lawsuit under SEC Chairman Gary Gensler, which indicates as unregistered exchange.

CFTC, on the other hand, will play a significant role in the growing industry with 50 million traders and a $3 trillion market size. The move also would allow the commission to regulate crypto exchanges, companies, and individuals in specific markets.

Source link

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Bitcoin Crashes Under $93,000: What’s Behind It?

Trump in considerations for CFTC to regulate crypto

Will XRP Price Reach $2 By The End Of November?

Here Are Three Promising Altcoins for the Next Crypto Market Bounce, According to Top Trader

Bitcoin Script: Focus On The Building Blocks, Not The Wild Geese

Kraken to close NFT marketplace by February 2025

Kraken To Shut Down Its NFT Marketplace

Pump.fun Accounted for 62% of Solana DEX Transactions in November, So Far

Fidelity Investments Director Shares Bitcoin’s Adoption and Valuation Models

Zodia Custody teams up with Securitize for institutional access to tokenized assets

Crypto Analyst Explains Why Dogecoin Price Will Hit $1

Bitcoin Long-Term Holders Have 163K More BTC to Sell, History Indicates: Van Straten

The transformative potential of Bitcoin in the job market

Ripple CLO Stuart Alderoty Challenges US SEC

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential