Opinion

The Paradox of the Bitcoin Maximalist

Published

2 months agoon

By

admin

However, dystopia is not an inevitable outcome. The onus to act, with purpose, still lies with crypto natives, and more specifically those who claim to be Bitcoin maximalists. While institutional dominion is a problem, the more immediate problem is the lack of acceptance that Bitcoin is a people’s currency. The sooner it is accepted that Bitcoin may be treated like any other asset, the sooner that full focus can be given to maximizing its value for everyone. If global crypto adoption is to truly manifest, minds must change and grassroots action must be taken.

Source link

You may like

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

Michael Saylor

Microsoft Should Buy $78 Billion Worth of Bitcoin

Published

49 mins agoon

November 22, 2024By

admin

As someone who has used Microsoft products my whole life, it pains me to see they are fumbling the bag on Bitcoin. The company’s $78 billion in cash reserves are losing value daily. Meanwhile, they stubbornly refuse to follow MicroStrategy’s proven winning strategy — convert those melting dollars to scarce Bitcoin!

Microsoft announced a couple of months ago that it would buy back shares up to $60 billion; it seems like this did nothing to increase the stock price. Imagine if they had bought Bitcoin instead. That money would have been much more powerful if allocated to Bitcoin. The company would likely have added hundreds of billions in market cap.

Just look at MicroStrategy. In just four years, they turned their $1 billion company into $100 billion by adopting Bitcoin as a treasury reserve asset. They are now the most compelling and successful story in corporate finance, with the best-performing stock in the last four years, beating every US company – even NVIDIA.

Yet Microsoft clings to an outdated financial strategy, destroying shareholder value. Microsoft should follow its technology instincts, not faulty financial logic. There is no long-term viability in holding cash.

I was listening to X Spaces yesterday, during which MicroStrategy’s CEO Michael Saylor revealed that he offered to explain Bitcoin’s benefits privately, but Microsoft’s CEO Satya Nadella rejected the meeting. Now, he is making a last-ditch appeal by presenting a 3-minute Bitcoin proposal to Microsoft’s board.

Earlier, the board already advised shareholders to reject assessing Bitcoin’s potential upside. Nonetheless, I am interested to see how this meeting will turn out. Saylor is a great educator, so you never know.

They should realise that no corporate treasury asset like Bitcoin can enhance enterprise value. Even a small $5 billion Bitcoin allocation could add tens of billions in market cap.

Look, Microsoft, the choice is clear – hoard melting dollars or embrace uncensorable digital gold. Your shareholders are begging you to buy Bitcoin. It’s time to listen before that $78 billion completely disappears. This is your fiduciary duty as Bitcoin continues mass adoption.

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

$100

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Published

5 hours agoon

November 22, 2024By

admin

What an enormous day it has been today.

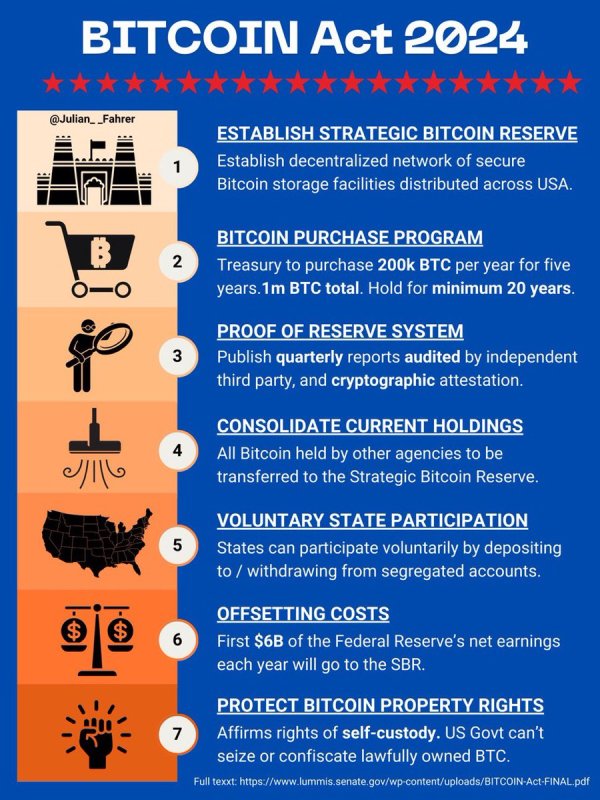

Gary Gensler officially announced that he is stepping down from his position as Chairman of the Securities and Exchange Commission (SEC), and minutes later, Reuters reported that Donald Trump’s “crypto council” is expected to “establish Trump’s promised bitcoin reserve.” A bitcoin reserve, that would see the United States purchase 200,000 bitcoin per year, for five years until it has bought 1,000,000 bitcoin.

Right after both of those, Bitcoin continued its upward momentum and broke $99,000, with $100,000 feeling like it can happen at any second now.

It is hard to contain my bullishness thinking about the United States purchasing 200,000 BTC per year. They essentially have to compete with everyone else in the world who is also accumulating bitcoin and attempting to front run them. There are only 21 million bitcoin and that is a LOT of demand.

To put this into context, so far this year the US spot bitcoin ETFs have accumulated a combined total of over 1 million BTC. At the time of launch the price was ~$44,000 and now bitcoin is practically at $100,000. And that’s all ETFs combined. Imagine what will happen when just one entity wants to buy a total of 1 million coins, having to compete with everyone else accumulating large amounts as well?

I mean MicroStrategy literally just completed another $3 BILLION raise to buy more bitcoin, and will continue raising until it purchases $42 billion more in bitcoin. The United States are most likely going to be purchasing their coins (if this legislation is officially signed into law) at very high prices. The demand is insane and only rising in the foreseeable future.

With two months left to go until Trump officially takes office, it remains to be seen if this bill becomes law, but at the moment things are looking really good. As Senator Cynthia Lummis stated, “This is our Louisiana Purchase moment!” and would be an absolutely historic moment for Bitcoin, Bitcoiners, and the future financial dominance of the United States of America.

This is the solution.

This is the answer.

This is our Louisiana Purchase moment!#Bitcoin2024 pic.twitter.com/RNEiLaB16U

— Senator Cynthia Lummis (@SenLummis) July 27, 2024

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

Bitcoin Policy

Want Greater Bitcoin Adoption? Engage With Your Government.

Published

9 hours agoon

November 21, 2024By

admin

It’s been a good week for Bitcoin and its status in the eyes of federal deposit insurance corporations. (Well, there’s a weird sentence I never thought I’d write.)

On Tuesday, the anti-crypto U.S. Federal Deposit Insurance Corporation (FDIC) Chairman, Martin Gruenberg, announced he’d be stepping down in January.

And yesterday, Heritage Falodun, CEO of DigiOats, Nigeria’s leading Bitcoin education and consultancy platform, educated members of the Nigeria Deposit Insurance Corporation (NDIC) about the benefits of bitcoin and other digital assets.

Falodun, an indefatigable Bitcoin proponent, spearheaded a seminar for the NDIC entitled “Cryptocurrency in the Evolving Financial Industry”.

This week, @DigiOats alongside with #MassCyberTech completed a groundbreaking seminar for @NDICNigeria 🇳🇬on “Cryptocurrency in the Evolving Financial Industry”. We explored #Bitcoin adoption, regulation, and sustainable finance marking a key moment for Nigeria’s financial future pic.twitter.com/hpWQOqZt8L

— DigiOats⚡️ (@DigiOats) November 21, 2024

In it, he highlighted the following points:

- Bitcoin can serve as a reserve asset for nation states, including Nigeria

- Using bitcoin (and other digital assets), banks can reduce settlement time

- Bitcoin can reduce capital controls, as its censorship resistant

Falodun and his team also provided an overview on the evolution of money and financial systems and also touched on the ways in which bitcoin and crypto are already integrated into traditional financial structures in efforts to convince the NDIC of Bitcoin and crypto’s importance.

“Nigeria must adopt balanced regulations that protect citizens and foster innovation,” Falodun told Bitcoin Magazine. “By embracing Bitcoin’s uniqueness and engaging the Bitcoin community, Nigeria can lead the global financial revolution.”

Falodun knows that without properly educating government officials, Bitcoin runs the risk of being misunderstood and, therefore, regulated improperly.

“I would like regulators to understand that Bitcoin’s decentralized nature is not a flaw to be regulated out of existence, but a feature that offers unprecedented opportunities for inclusion, economic freedom and optimization of financial rails,” he added.

I respect Falodun’s efforts.

Before you go calling me a statist or some other silly reductive term, I’d like to remind you that even well-known cypherpunks like Adam Back have said that part of the struggle around greater Bitcoin adoption (and encryption in general) will include engaging with governments (and courts).

Proponents of Bitcoin should acknowledge our current political reality and make the case for Bitcoin to those in power if they want to see it flourish — or if they want to at least stop governments from crafting poor policy around Bitcoin and/or attacking the industry.

Take a cue from Falodun and do your part to educate local government officials, members of state-level administrative agencies or even Federal-level bureaucrats about Bitcoin.

It’s one of the most important things you can do to keep your country from falling behind.

Source link

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

Polkadot investor predicts a 30,000% rally for this $0.04 token by 2025

Donald Trump Proposed Crypto Advisory Council To Set Up Strategic Bitcoin Reserve

Want Greater Bitcoin Adoption? Engage With Your Government.

Why the Media Loves the Worst of Crypto

HashCats prepares for Token Generation Event after completing mining season

Gary Gensler To Step Down As US SEC Chair In January

The Chart That Shows Bitcoin’s Bull Run Won’t Stop at $100,000

$2 Million PEPE Purchase Sees 105 Billion Tokens Snapped Up

XRP price expected to reach $7, Dogecoin $3, and PCHAIN $1 from $0.004

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential