Bitwise

Bitwise Makes XRP ETF Plans Official With SEC Filing

Published

2 months agoon

By

admin

While the submission of an S-1 filing is the first step in introducing a fund, the document is basically meaningless if it isn’t followed by another filing, called the 19b-4, which is required to signal a requisite rule change at the stock exchange seeking to list the investment

Source link

You may like

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin

Bitcoin doesn’t need a dollar crash to hit $200k: Hougan

Published

3 weeks agoon

October 30, 2024By

admin

Bitcoin doesn’t require a U.S. dollar crash to become a six-figure asset class, Bitwise CIO Matt Hougan opined on X.

Bitcoin (BTC) has often been hailed as a hedge against the dollar’s declining purchasing power and as a potential beneficiary of a massive fiat implosion.

Some proponents have suggested that Bitcoin needs a dollar collapse to reach $200,000 per BTC and beyond. However, Hougan argued that this assumption is incorrect for two main reasons: growing demand for store-of-value assets and persistent government spending.

According to the Bitwise executive, these factors reinforce investor conviction when they invest in Bitcoin. Hougan further argued that store-of-value markets have gained momentum due to “governments abusing their currencies.”

1/ A financial advisor asked me a great question over dinner last week:

Does the U.S. dollar need to collapse for bitcoin to hit $200,000?

The answer is “no.” Here’s why…

— Matt Hougan (@Matt_Hougan) October 29, 2024

For instance, U.S. spending has accelerated in recent years, and the country’s debt has surpassed $35 trillion. Analysts estimate the national debt grows by about $1 trillion every 100 days at its current pace.

Additionally, Unlimited Funds CIO Bob Elliott cited data indicating that “developed world sovereign debt,” such as U.S. Treasuries, may no longer effectively serve as bailout mechanisms, potentially supporting a pro-Bitcoin outlook.

The selloff in US bonds has sparked a global dump of developed world sovereign debt.

Since US yields started rising after the Fed meeting in Sept, global bond yields are higher, while the dollar and gold are surging, reflecting an increasingly global debt contagion.

Thread.

— Bob Elliott (@BobEUnlimited) October 29, 2024

Hougan expects this pattern to continue, leading to more mature BTC markets, increased adoption, and higher prices for the leading cryptocurrency.

So, no, the dollar doesn’t need to collapse for bitcoin to hit $200k. All you need is Bitcoin to continue on its current path of maturing as an institutional asset. But it’s increasingly looking like both parts of the argument will come true. That’s why Bitcoin is surging toward all-time highs.

Matt Hougan, Bitwise CIO

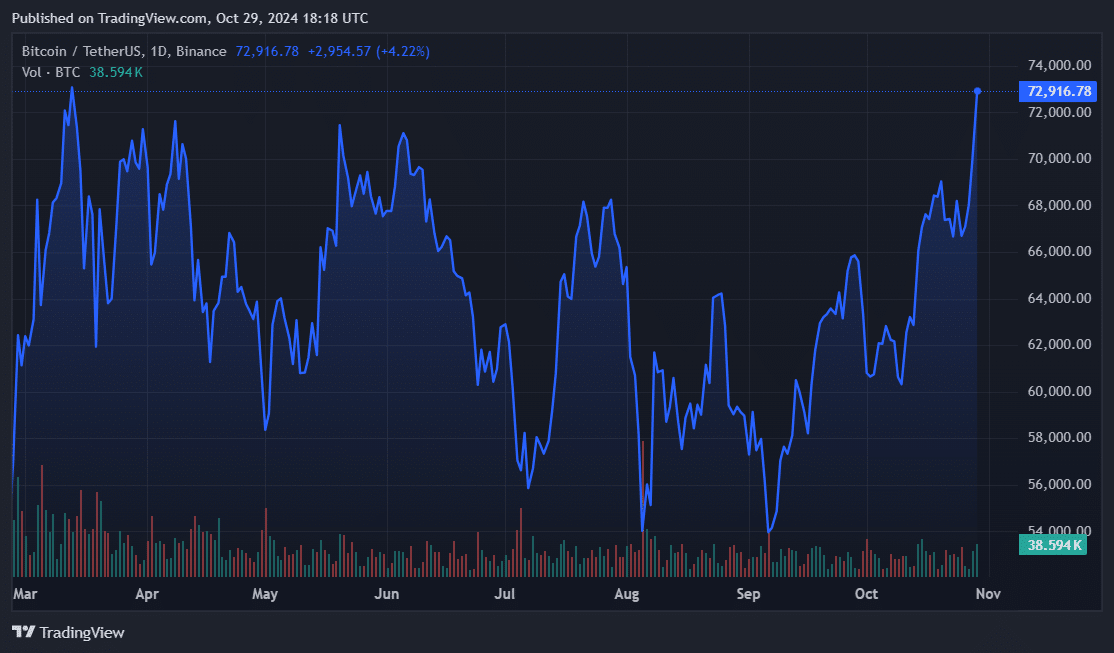

Hougan’s remarks came on Oct. 29, as BTC rallied closer to its all-time high set in March. BTC rose 5% in the last 24 hours, reaching $72,756. While technical indicators pointed to a potential Bitcoin breakout, historical patterns warn of volatility as U.S. citizens prepare to vote in the upcoming presidential election.

Source link

Bitcoin

Bitcoin Heading to Six Figures As BTC ETF Net Inflows Accelerate to $20,000,000,000: Bitwise CIO Matt Hougan

Published

1 month agoon

October 20, 2024By

admin

Bitwise chief investment officer Matt Hougan is unveiling the catalysts that he believes will push Bitcoin (BTC) to $100,000 and beyond.

Hougan says on the social media platform X that macroeconomic conditions and on-chain data appear to be suggesting that Bitcoin is poised to spark huge rallies.

According to the Bitwise executive, major central banks are adopting loose monetary policies as Bitcoin supply dwindles following this year’s halving event when BTC miner rewards were slashed in half.

“We’re heading to six-figure Bitcoin.

* ETF flows reaccelerating

* Election approaching

* Infinite deficits (bipartisan agreement!)

* Economic stimulus in China

* Global rate cuts (Fed, ECB)

* Halving supply shock starting to bite

* Whales accumulating.”

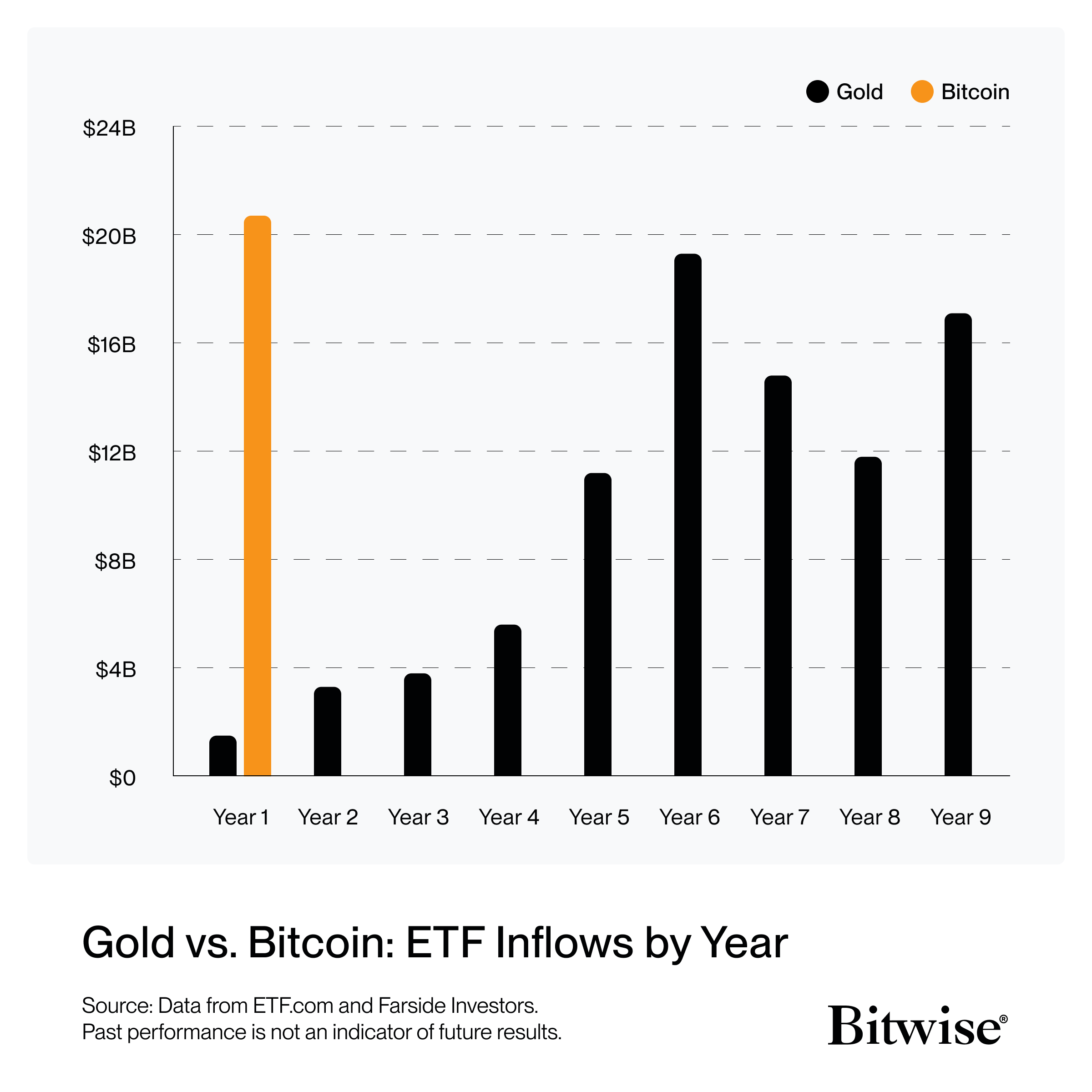

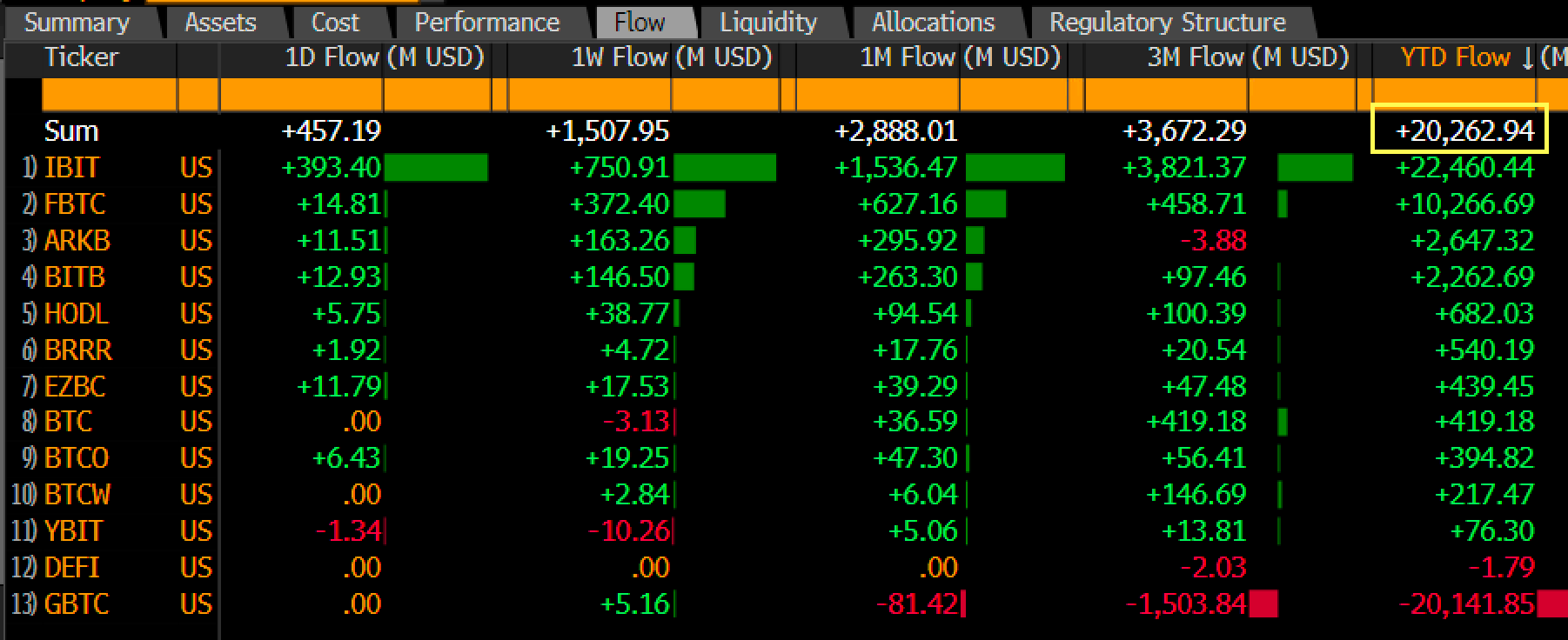

Hougan also highlights Bitwise’s data on Bitcoin exchange-traded funds (ETFs), showing that inflows have exceeded $20 billion just this year. The chart reveals that BTC ETFs have massively outperformed their gold counterparts in terms of inflows during the first year of existence.

“This.”

Bloomberg senior ETF analyst Erich Balchunas explains the significance of the massive inflows witnessed by Bitcoin ETFs this year. According to Balchunas, gold ETFs had to wait for half a decade before seeing a comparable capital allocation.

“Bitcoin ETFs have crossed $20 billion in total net flows (the most important number, and most difficult metric to grow in ETF world) for the first time after a huge week of $1.5 billion.

For context, it took gold ETFs about five years to reach the same number. Total assets are now $65 billion, also a high water mark.”

At time of writing, Bitcoin is trading for $68,172.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Source link

bitc

Bitwise Continues SEC Filing Spree With Bitwise Trendwise Bitcoin and Treasuries Rotation Strategy ETF (BITC)

Published

2 months agoon

October 4, 2024By

admin

$4.5 billion crypto asset manager Bitwise is filing for its second crypto exchange-traded fund (ETF) this week.

According to the U.S. Securities and Exchange Commission (SEC), Bitwise filed a Form N-1A for a new product called the Bitwise Trendwise Bitcoin and Treasuries Rotation Strategy ETF (BITC) earlier today.

A Form N-1A is a required registration form for management companies.

This is the second ETF filing that Bitwise has made with the SEC this week.

On Wednesday morning, Bitwise submitted an S-1 registration statement to the SEC for a spot XRP ETF tracking the price movements of XRP, according to a report.

Bitwise has already successfully launched ETFs in the United States for Bitcoin (BTC) and Ethereum (ETH).

According to today’s filing, BITC will be a novel type of ETF product aiming to capitalize on the potential upside of Bitcoin while also mitigating downside risks by rotating into U.S. Treasuries when Bitcoin’s volatile price consolidates.

Per a press release from Bitwise, the filing is part of a larger movement to convert three futures-based ETFs into trendwise strategy investment vehicles.

“The conversion is expected to take place on or around December 3, 2024. The funds will change their names and strategies as follows:

BITC: The Bitwise Bitcoin Strategy Optimum Roll ETF will convert to the Bitwise Trendwise Bitcoin and Treasuries Rotation Strategy ETF

AETH: The Bitwise Ethereum Strategy ETF will convert to the Bitwise Trendwise Ethereum and Treasuries Rotation Strategy ETF

BTOP: The Bitwise Bitcoin and Ether Equal Weight Strategy ETF will convert to the Bitwise Trendwise BTC/ETH and Treasuries Rotation Strategy ETF”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DreamStudio

Source link

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential