eigen

Is It Time to Buy in EIGEN?

Published

3 months agoon

By

admin

EigenLayer (EIGEN) price, an Ethereum-based restaking protocol, marked its entrance into the cryptocurrency market on October 1. The token, which can now be traded and staked, was listed on several major exchanges, including Binance, Kraken, Coinbase, ByBit, and OKX. This listing follows the final distribution of tokens through airdrops by Puffer Finance.

Coinbase, a leading US crypto exchange by trade volume, added EIGEN to its platform yesterday. This move significantly boosts the token’s liquidity, which many holders initially received through airdrops earlier this year.

EigenLayer Price Fluctuatuats Amid Market Debut

The EigenLayer price was marked by unlocking at 5:00 AM UTC, and trading prices ranged from $3.50 to $4.50. As of now, the EIGEN price is trading at $3.74, reflecting a slight decrease of 4% amid broader crypto market downtrends.

EIGEN’s market introduction is part of EigenLayer’s strategy to enhance the utility of staked assets. The platform allows users to leverage their staked ETH or other Liquid Staking Tokens (LSTs) to support decentralized applications within the EigenLayer ecosystem. This approach aims to increase the assets’ utility and strengthen the overall security of the Ethereum ecosystem.

Since trading began, the EigenLayer price has entered the top 100 tokens by market capitalization. This rise indicates the growing interest and potential for expansion and engagement within the project. It is also poised to enhance governance and bolster EigenLayer’s role in the decentralized landscape.

Transaction data from SpotOnChain highlighted some significant activities involving large-scale holders. Justin Sun, the founder of TRON, moved a notable 5.24 million EIGEN tokens to the HTX exchange. Additionally, other substantial transfers included 496,013 EIGEN tokens sent to Binance by HashKey Capital and 253,947 EIGEN from another prominent wallet.

Despite some large holders choosing to sell, there are notable accumulations, too. For instance, two whales purchased 702,324 EIGEN tokens, valued at approximately $2.86 million, according to lookonchain data.

This dynamic trading environment underscores the high stakes and intense interest surrounding the EigenLayer price as it makes its mark in the crypto world. The project’s innovative use of staked assets within its ecosystem promises to redefine engagement and utility in the decentralized finance landscape.

According to data from DeFiLlama, EigenLayer’s Total Value Locked (TVL) has sustained a significant market presence with current holdings of over $11 billion. After surpassing the $1 billion mark in December 2023, EigenLayer’s TVL saw a rapid ascent, peaking at just over $20 billion in June.

Will EIGEN Rebound Amidst Market Fluctuations?

Since that high, the staking protocol has experienced notable outflows but maintains a robust figure of $12 billion. This figure indicates sustained investor trust and engagement despite market fluctuations. The platform’s market cap presently stands at approximately $674.61 million, with an upcoming unlock of 14.9% of holdings set for release in the next six days.

The EigenLayer price may test the crucial $3 support level if bearish trends persist. However, with sustained investor interest and upcoming token unlocks, there’s potential for a rebound that could see prices rise to as high as $5.

Frequently Asked Questions (FAQs)

EigenLayer is an Ethereum-based restaking protocol that allows users to leverage their staked ETH or other Liquid Staking

EigenLayer tokens can be traded on major cryptocurrency exchanges such as Binance, Kraken, Coinbase, ByBit, and OKX.

EigenLayer enhances the utility of staked assets by allowing them to be used to support various decentralized applications, increasing their overall usefulness and security within the Ethereum ecosystem.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Macro Guru Raoul Pal Predicts Crypto Market Will Rally ‘Pretty Strongly’ Into Year-End – Here’s His Outlook

Blockchain auditor Hacken launches AI-powered MiCA-compliance tool for crypto firms

Crypto in 2024: A Game-Changing Year for Investors

Philippines SEC releases new crypto regulatory framework draft

Another Publicly Traded Firm Just Adopted a Bitcoin Reserve Strategy

MicroStrategy Announces Special Shareholders Meeting to Buy More Bitcoin

24/7 Cryptocurrency News

Eigen Whale Bags $9M Tokens From Binance, EigenLayer To Rally?

Published

2 weeks agoon

December 9, 2024By

admin

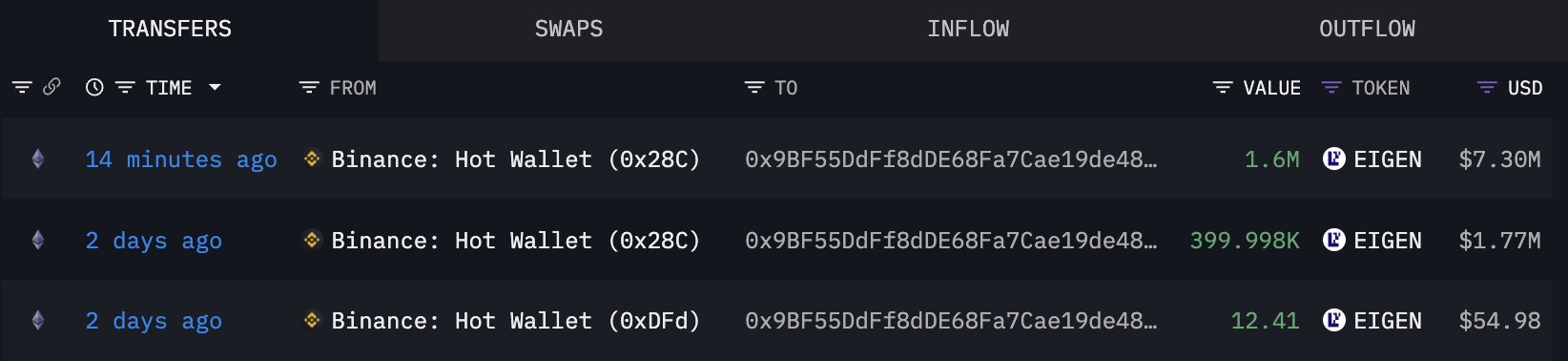

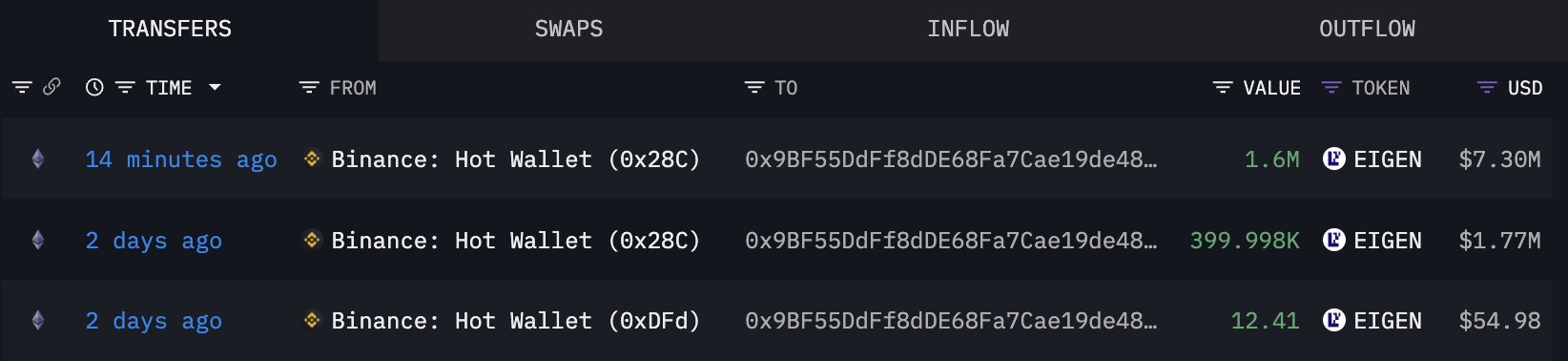

An Eigen whale has caught the eyes of the market participants with his move, accumulating 2 million EigenLayer recently. According to the latest data, the whale made the transfer, worth over $9 million, from one of the leading crypto exchanges, Binance. However, despite the recent buying, the Eigen price has dropped today, fueling further discussions in the crypto market.

Eigen Whale Bags $9M Tokens From Binance

In a recent X post, the leading on-chain analytics firm Lookonchain has highlighted the transaction. According to the report, Eigen Whale has transferred 2 million EigenLayer tokens, valued at around $9.06 million, from the top crypto exchange, Binance, over the last two days. Notably, the latest purchase of the whale was 1.6 million EIGEN from the exchange, worth around $7.25 million.

This massive buying indicates that the trader remains confident about the asset’s long-term potential. However, despite this hefty transfer, the EigenLayer price has noted a retreat today, sparking discussions in the broader crypto market.

Meanwhile, it appears that the recent move by Tron founder Justin Sun has caused panic among some traders. For context, Sun has recently dumped 322,119 EIGEN, worth around $1.44 million, to HTX, sparking market concerns. Besides, he also dumped other tokens like ETHFI, ETH, into the same exchange recently.

Will EIGEN Price Rally?

Eigen price today was down around 1% and exchanged hands at $4.44. However, its one-day trading volume jumped 35% to $280 million. Notably, the crypto has touched a 24-hour high of $4.97 and a low of $4.38, while hitting its all-time high of $5.06 on December 7. CoinGlass data showed that EigenLayer Futures Open Interest also noted a slump of 0.2% to $116.9 million, indicating that the investors are taking a pause after the massive rally.

Notably, the market appears to have remained optimistic on the asset. For context, Binance added Eigen to its loanable assets and VIP loans earlier this year, showcasing the exchange’s confidence in the coin.

Meanwhile, the whales are also appearing to be shifting their focus towards the crypto, which could support a further rally ahead. For context, a recent report showed that a Pepe Coin whale shifted its focus towards EIGEN last month, selling 130 billion PEPE.

Rupam Roy

Rupam is a seasoned professional with three years of experience in the financial market, where he has developed a reputation as a meticulous research analyst and insightful journalist. He thrives on exploring the dynamic nuances of the financial landscape. Currently serving as a sub-editor at Coingape, Rupam’s expertise extends beyond conventional boundaries. His role involves breaking stories, analyzing AI-related developments, providing real-time updates on the crypto market, and presenting insightful economic news.

Rupam’s career is characterized by a deep passion for unraveling the complexities of finance and delivering impactful stories that resonate with a diverse audience.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

Super Pepe Coin Whale Sells 130B PEPE, Shifts Focus To EIGEN

Published

4 weeks agoon

November 25, 2024By

admin

Amid a highly turbulent crypto market witnessed as the week kicks off, a super Pepe Coin whale shifted focus to EIGEN has sparked significant market discussions. Notably, on-chain data pointed out a massive 130 billion PEPE whale selloff, with the investor simultaneously diversifying his portfolio by buying over 200K of the Ethereum-based token.

This swap of positions, amid a slumping action witnessed by the meme coin and a gaining action seen by the EigenLayer ecosystem token, set off waves of speculations over the coins’ future tendencies.

Super Pepe Coin Whale Refocuses Investments, Buys EIGEN

According to whale data by Spot On Chain as of November 25, a super whale sold 74.07 billion in Pepe Coin worth $1.53 million for 448.1 ETH as the price dropped recently. The same whale was recorded offloading 130.2 billion of the meme coin, worth $2.71 million, for 891 ETH over the past three days. Although this massive selling caused market tension, it’s noteworthy that the super whale still holds 3.241 trillion Pepe Coin, with a 12.6x profit of $68.3 million.

However, the same whale also focused on buying EIGEN, swapping 181.3 ETH for 217,348 of the Ethereum-based token over the past two days. The whale currently holds 1.608 million of the EigenLayer token, worth $4.31 million, with an 11% profit. Overall, the trade swap sparked significant optimism over the EigenLayer ecosystem’s primary token, while market watchers monitor the leading meme coin closely.

PEPE & EIGEN Prices Show Mixed Actions

While the meme coin’s price slipped, aligning with the selloff by super Pepe Coin whale, the Ethereum-based coin rose, leveraging buying pressure. PEPE price was down 2% intraday and 5% weekly, trading at $0.00002026. Its 24-hour low and high were $0.00001918 and $0.00002086, respectively.

Whereas, EIGEN price soared nearly 7% intraday and 23% weekly, reaching $3.06. The coin’s 24-hour low and high were $2.56 and $3.07, respectively. While crypto market participants remain optimistic about the Ethereum-based token in light of the massive accumulation, the remaining massive PEPE holdings add a layer of intrigue to the leading meme coin’s price action ahead.

Intriguingly, a recent Pepe coin price analysis by CoinGape Media flagged that the meme coin eyes a $0.000025 target, with significant potential upside for further momentum. This optimistic projection comes against the backdrop of bullish technical formations on the frog-themed crypto’s price chart. Market watchers continue to eye both coins for future price action shifts as the broader market continues to showcase price fluxes.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

24/7 Cryptocurrency News

EIGEN Price Jumps 10% As EigenLayer Reveals Reason Behind $5.5M Token Sale

Published

3 months agoon

October 4, 2024By

admin

EigenLayer (EIGEN) price has jumped 9% in the last 24 hours, despite a struggle between bulls and bears for dominance. This price increase is taking place at the same time as investigations are ongoing into the allegedly unauthorised trading of $5.5m worth of EIGEN tokens, which may have violated the lock-up agreements for employees and early investors.

EigenLayer Probes Suspicious $5.5M Token Sale

EigenLayer is currently tracking a wallet that has transferred close to 1.67 million EIGEN tokens, worth approximately $5.5 million. The sale is alleged to have taken place through MetaMask, which could be in contravention of EigenLayer’s one year lockup arrangement. The lockup means that the current and former employees and early investors of EIGEN cannot transfer or stake any of their EIGEN tokens before September 2025.

The suspicious wallet, which was identified by Arkham Intelligence, was funded by EigenLayer’s multi-signature Gnosis Safe. This has given rise to questions on internal control and security measures in place within the organization. EigenLayer’s team is still investigating to find out if this incident was a sale by an employee or a former employee or even one of the early investors.

”We are currently looking into unapproved selling activity related to this wallet and will update the community with the details when possible,” the EigenLayer team tweeted on X (formerly Twitter).

Community Update: Incident Details

In its community update, EigenLayer explained that the suspicious sale was a consequence of a single incident of security compromise. Among them, one of the investor’s emails containing the instructions for the transfer of tokens to custody was hacked by an attacker.

The attacker was able to transfer 1,673,645 EIGEN tokens to another account, and sell them through a decentralized swap platform. The stolen money was then swapped for stablecoins and sent to centralized exchanges.

“We are in contact with these platforms and law enforcement. A portion of the funds have already been frozen,” EigenLayer stated. The update also emphasized that the broader ecosystem remains secure. “There is no known vulnerability in the protocol or token contracts, and this compromise was not related to any onchain functionality.”

Justin Sun’s Involvement and Token Sell-Off

The investigation is coming only a few days after the Tron founder Justin Sun has sold a significant amount of his EIGEN tokens. According to reports, Sun sold 5.37 million EIGEN tokens at an average of $4.03 per token, making approximately $21 million in profit from tokens received in airdrops via EigenLayer’s Ethereum ReStaking track.

Sun’s decision to sell most of his tokens just a day after the token unlocking on October 1st created more selling pressure, which caused concern about price fluctuations.

Following the sale of his EIGEN tokens, Sun deposited the revenue in USDT into the Aave v3 protocol, an Ethereum-based decentralized money market.

EIGEN Price Skyrockets Despite Investigation

Despite the unauthorized token sale and Justin Sun’s recent sell-off, EIGEN has rebounded, experiencing a 9% price increase over the past 24 hours. Investors are weighing the potential long-term value of EigenLayer’s protocol, which remains one of the most innovative solutions in Ethereum’s DeFi ecosystem.

Since its October 1 unlocking event, the token has seen increased volatility, initially dropping 23% from recent highs. However, on-chain data indicates that some investors are accumulating EIGEN tokens, betting on future growth. For example, one whale purchased over 31,000 EIGEN tokens after the sell-off, suggesting confidence in the protocol’s prospects despite recent setbacks.

EigenLayer has quickly become a major player in Ethereum’s DeFi landscape with its pioneering “restaking” model, allowing users to reuse staked ETH to secure decentralized applications. As of early October, the protocol’s total value locked (TVL) stands at $10.8 billion, ranking it among the top three DeFi platforms, alongside Lido and Aave.

Kelvin Munene Murithi

Kelvin is a distinguished writer with expertise in crypto and finance, holding a Bachelor’s degree in Actuarial Science. Known for his incisive analysis and insightful content, he possesses a strong command of English and excels in conducting thorough research and delivering timely cryptocurrency market updates.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Macro Guru Raoul Pal Predicts Crypto Market Will Rally ‘Pretty Strongly’ Into Year-End – Here’s His Outlook

Blockchain auditor Hacken launches AI-powered MiCA-compliance tool for crypto firms

Crypto in 2024: A Game-Changing Year for Investors

Philippines SEC releases new crypto regulatory framework draft

Another Publicly Traded Firm Just Adopted a Bitcoin Reserve Strategy

MicroStrategy Announces Special Shareholders Meeting to Buy More Bitcoin

These 2 Solana killers have potential turn $1000 into $100k in the next 10 week

BTC Touches $94K, VIRTUAL Soars 35%, ZEC Gains 20%

Trump Makes More Pro-Crypto Appointments

Solaxy presale raises $4.5M for Solana Layer 2 solution

Elon Musk xAI Secures $6B To Boost Generative AI Expansion: Details

Metaplanet Bitcoin Reserves Grow With Fresh $61 Million Purchase

Investors turn to Lightchain AI 3000x potential after PEPE drop

Moonpay In Talks To Acquire Coinbase Commerce Rival Helio

The Satoshi Papers Explores The Role Of The State In A Post-Bitcoin World: An Interview With Natalie Smolenski

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Washington financial watchdog warns of scam involving fake crypto ‘professors’

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

NoOnes Bitcoin Philosophy: Everyone Eats

Trending

3 months ago

3 months ago182267361726451435

Donald Trump5 months ago

Donald Trump5 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News4 months ago

24/7 Cryptocurrency News4 months agoTop Crypto News Headlines of The Week

News4 months ago

News4 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion5 months ago

Opinion5 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin5 months ago

Bitcoin5 months agoEthereum, Solana touch key levels as Bitcoin spikes

Bitcoin5 months ago

Bitcoin5 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: