Bitcoin price

Vivek: Unsurprisingly, The Bitcoin Price Follows Global Liquidity

Published

2 months agoon

By

admin

What We’re Reading: Bitcoin: A Global Liquidity Barometer

I have been intrigued by the significant increase in global liquidity during 2024, driven by extensive money printing and debt expansion, and how it impacts Bitcoin’s price.

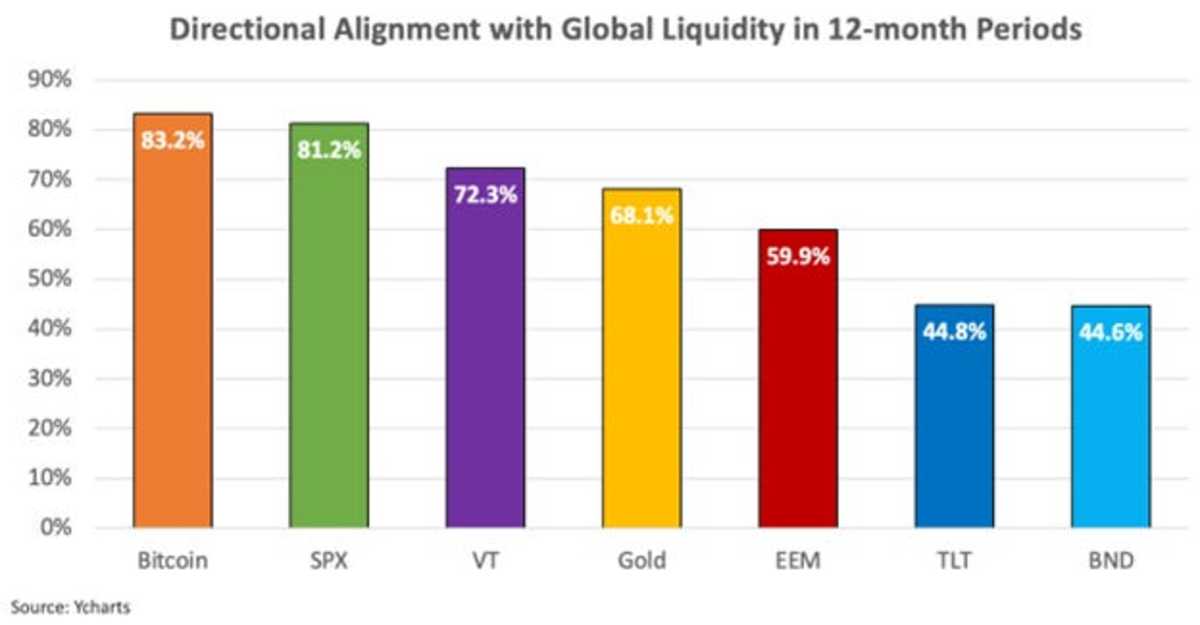

Bitcoin is an expression against the government’s monetary expansionist policies, so its price follows global liquidity, as seen here on this chart.

It was fascinating to read the recent report by Lyn Alden and Sam Callahan analyzing Bitcoin’s correlation to global liquidity. This further reconfirmed my view that more monetary expansion drives more people to Bitcoin, increasing prices.

Their rigorous analysis found that over 12-month periods, Bitcoin’s price moves in the same direction as global liquidity a remarkable 83% of the time. This is higher than any other major asset class, making Bitcoin a uniquely pure barometer for global liquidity trends.

The report quantified Bitcoin’s correlation with global M2 money supply, finding a very strong 0.94 overall correlation between May 2013 and July 2024. Bitcoin’s average 12-month rolling correlation was 0.51, while stocks and gold showed moderately high correlations as well in the 0.4 to 0.7 range.

Of course, Bitcoin’s correlation isn’t perfect. Shorter-term breakdowns can occur around crypto-specific events like exchange hacks or Ponzi schemes collapsing.

Supply-demand imbalances also cause temporary decoupling when Bitcoin reaches extreme overvaluation levels during market cycle peaks. Yet despite these breakdowns, the long-term relationship persists.

Right now, liquidity is soaring to unprecedented levels, suggesting Bitcoin could soon embark on a massive bull run if this relationship holds. While I believe no model perfectly captures Bitcoin’s complexity, recognizing its role as a monetary canary in the coal mine can lend valuable insight. If history rhymes, Bitcoin’s sirens are ringing loudly that a liquidity-driven boom will soon be underway.

Source link

You may like

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

24/7 Cryptocurrency News

How Will BTC React to $3B Buying Spree?

Published

22 hours agoon

November 21, 2024By

admin

Bitcoin (BTC) price today trades at $97,606.0 as of 10 AM. BTC price hit a daily high of $97,837.0 today after rallying 4.41% on November 21.

Why Is Bitcoin Price Up Today?

Bitcoin price today is up 4.41% today and currently auctions around $97,606.0. Since the breakout from the seven-month consolidation and the $75k hurdle, the crypto market outlook has turned bullish. While a few altcoins shoot higher, the alt season is yet to begin.

*bitcoin price updated as of 10 AM.

Price of BTC trades at $97,606.0, bringing the year-to-date gain from 56% on October 20 to 108% as of November 18. Although many altcoins have shot up over triple digits, Bitcoin is catching up. Ethereum price’s YTD performance is lackluster, stands at 39%, and is well below BTC.

Although Bitcoin is the largest cryptocurrency by market capitalization, Bitcoin’s popularity is due to its first-mover advantage and its being a secure, decentralized network. In addition, many narratives, like digital gold, inflation hedges, and uncorrelated assets, have kept BTC at the forefront of the crypto market since its inception in 2009.

Bitcoin Price Eyes Bullish End to 2024

Industry veterans’ speculation of a bull run post-US elections was right, and Bitcoin is likely to end November 2024 on a positive note. Many even expect a six-digit target for BTC by the end of November, and this is due to the historical returns. History shows that Bitcoin has always performed massively in the fourth quarter.

With that said, if Bitcoin price hits a new ATH in November or December, Bitcoin’s market capitalization, which stands at $1,931.5 billion could push toward the $2 trillion mark.

Bitcoin: The Largest Cryptocurrency

While Bitcoin’s market cap hovers around $1,931.5 billion, with Ethereum, the duo controls nearly 65% of the total cryptocurrency market capitalization, which is $2.40 trillion. Despite the seven-month consolidation, Bitcoin’s $1.3 trillion market cap remains strong, anticipating it reaching $2 trillion in 2025.

BTC’s 24-hour Trading Volume

Being the top crypto has its benefits; more people tend to flock toward the asset. Likewise, BTC’s 24-hour trading volume stands at $99.0 billion. Binance, one of the largest cryptocurrency exchanges, contributes a major portion of this volume. Binance’s share of BTC’s 24-hour trading volume comprises spot and perpetuals trading. While spot volume hovers around 11%, perpetual volume is 41%. Exchanges like OKX, Bitget, etc, follow Binance.

Bitcoin Blockchain Upgrades

With a market cap of $1.3 trillion, it is necessary for the network to remain secure, decentralized, and scalable. This is possible by upgrading the Bitcoin network regularly.

Here are some notable upgrades the Bitcoin network has received or planned to receive since its inception in 2009.

Bitcoin Network Upgrades Since 2009

Here are some key milestone upgrades to the Bitcoin network over the past decade.

2017-2019

2015-2016

2013-2014

2010-2012

2009-2010

Bitcoin Price Forecast For Next Month

| Date | Price | Change |

|---|---|---|

| November 21, 2024 | $94,679 | 0.29% |

| November 22, 2024 | $99,364 | 5.25% |

| November 23, 2024 | $100,935 | 6.91% |

| November 24, 2024 | $101,744 | 7.77% |

| November 25, 2024 | $102,639 | 8.72% |

Based on Coingape’s Bitcoin price prediction, investors can expect a double-digit rally that leads to a peak of $104,725 as of November 26, leading to a correction. In a month from now, the largest crypto by market cap could be exchanging hands at around $100k.

Bitcoin Price Forecast Between 2025 and 2029

| January | $100,873.53 | $99,727.36 | $100,300.45 | 61.3% |

| February | $100,812.06 | $99,696.19 | $100,254.13 | 61.3% |

| March | $100,750.58 | $99,665.02 | $100,207.81 | 61.2% |

| April | $100,689.11 | $99,633.85 | $100,161.49 | 61.1% |

| May | $100,627.64 | $99,602.68 | $100,115.17 | 61% |

| June | $100,566.17 | $99,571.52 | $100,068.85 | 61% |

| July | $100,504.69 | $99,540.35 | $100,022.52 | 60.9% |

| August | $100,443.22 | $99,509.18 | $99,976.20 | 60.8% |

| September | $100,381.75 | $99,478.01 | $99,929.88 | 60.7% |

| October | $100,320.28 | $99,446.84 | $99,883.56 | 60.7% |

| November | $100,258.80 | $99,415.67 | $99,837.24 | 60.6% |

| December | $100,197.33 | $99,384.50 | $99,790.92 | 60.5% |

| All Time | $100,535.43 | $99,555.93 | $100,045.68 | 60.9% |

| January | $103,010.64 | $102,667.46 | $105,097.01 | 69% |

| February | $105,823.94 | $105,950.42 | $110,403.10 | 77.6% |

| March | $108,637.25 | $109,233.38 | $115,709.19 | 86.1% |

| April | $111,450.55 | $112,516.33 | $121,015.28 | 94.6% |

| May | $114,263.86 | $115,799.29 | $126,321.37 | 103.2% |

| June | $117,077.17 | $119,082.25 | $131,627.46 | 111.7% |

| July | $119,890.47 | $122,365.21 | $136,933.55 | 120.2% |

| August | $122,703.78 | $125,648.17 | $142,239.64 | 128.8% |

| September | $125,517.08 | $128,931.13 | $147,545.73 | 137.3% |

| October | $128,330.39 | $132,214.08 | $152,851.82 | 145.9% |

| November | $131,143.69 | $135,497.04 | $158,157.91 | 154.4% |

| December | $133,957 | $138,780 | $163,464 | 162.9% |

| All Time | $118,483.82 | $120,723.73 | $134,280.51 | 116% |

| January | $139,801.17 | $144,684.75 | $169,276.92 | 172.3% |

| February | $145,645.33 | $150,589.50 | $175,089.83 | 181.6% |

| March | $151,489.50 | $156,494.25 | $180,902.75 | 191% |

| April | $157,333.67 | $162,399 | $186,715.67 | 200.3% |

| May | $163,177.83 | $168,303.75 | $192,528.58 | 209.7% |

| June | $169,022 | $174,208.50 | $198,341.50 | 219% |

| July | $174,866.17 | $180,113.25 | $204,154.42 | 228.4% |

| August | $180,710.33 | $186,018 | $209,967.33 | 237.7% |

| September | $186,554.50 | $191,922.75 | $215,780.25 | 247.1% |

| October | $192,398.67 | $197,827.50 | $221,593.17 | 256.4% |

| November | $198,242.83 | $203,732.25 | $227,406.08 | 265.8% |

| December | $204,087 | $209,637 | $233,219 | 275.1% |

| All Time | $171,944.08 | $177,160.88 | $201,247.96 | 223.7% |

| January | $212,511.67 | $218,298 | $243,655 | 291.9% |

| February | $220,936.33 | $226,959 | $254,091 | 308.7% |

| March | $229,361 | $235,620 | $264,527 | 325.5% |

| April | $237,785.67 | $244,281 | $274,963 | 342.3% |

| May | $246,210.33 | $252,942 | $285,399 | 359% |

| June | $254,635 | $261,603 | $295,835 | 375.8% |

| July | $263,059.67 | $270,264 | $306,271 | 392.6% |

| August | $271,484.33 | $278,925 | $316,707 | 409.4% |

| September | $279,909 | $287,586 | $327,143 | 426.2% |

| October | $288,333.67 | $296,247 | $337,579 | 443% |

| November | $296,758.33 | $304,908 | $348,015 | 459.8% |

| December | $305,183 | $313,569 | $358,451 | 476.5% |

| All Time | $258,847.33 | $265,933.50 | $301,053 | 384.2% |

| January | $317,150.58 | $326,144.33 | $372,391.92 | 499% |

| February | $329,118.17 | $338,719.67 | $386,332.83 | 521.4% |

| March | $341,085.75 | $351,295 | $400,273.75 | 543.8% |

| April | $353,053.33 | $363,870.33 | $414,214.67 | 566.2% |

| May | $365,020.92 | $376,445.67 | $428,155.58 | 588.7% |

| June | $376,988.50 | $389,021 | $442,096.50 | 611.1% |

| July | $388,956.08 | $401,596.33 | $456,037.42 | 633.5% |

| August | $400,923.67 | $414,171.67 | $469,978.33 | 655.9% |

| September | $412,891.25 | $426,747 | $483,919.25 | 678.4% |

| October | $424,858.83 | $439,322.33 | $497,860.17 | 700.8% |

| November | $436,826.42 | $451,897.67 | $511,801.08 | 723.2% |

| December | $448,794 | $464,473 | $525,742 | 745.6% |

| All Time | $382,972.29 | $395,308.67 | $449,066.96 | 622.3% |

By 2025, Bitcoin price could hit the six-digit territory, and expect a massive bull run to kickstart in the years leading up to 2029. Coingape’s Bitcoin price prediction notes that BTC could trade between $82,213.41 and $660,471.83 by 2029.

Bitcoin Price Outlook between 2030 and 2050

2030

2031

2032

2033

2040

2050

| January | $465,154.42 | $481,462.17 | $546,469.67 | 779% |

| February | $481,514.83 | $498,451.33 | $567,197.33 | 812.3% |

| March | $497,875.25 | $515,440.50 | $587,925 | 845.6% |

| April | $514,235.67 | $532,429.67 | $608,652.67 | 879% |

| May | $530,596.08 | $549,418.83 | $629,380.33 | 912.3% |

| June | $546,956.50 | $566,408 | $650,108 | 945.7% |

| July | $563,316.92 | $583,397.17 | $670,835.67 | 979% |

| August | $579,677.33 | $600,386.33 | $691,563.33 | 1012.3% |

| September | $596,037.75 | $617,375.50 | $712,291 | 1045.7% |

| October | $612,398.17 | $634,364.67 | $733,018.67 | 1079% |

| November | $628,758.58 | $651,353.83 | $753,746.33 | 1112.4% |

| December | $645,119 | $668,343 | $774,474 | 1145.7% |

| All Time | $555,136.71 | $574,902.58 | $660,471.83 | 962.3% |

| January | $667,167.08 | $691,240.58 | $802,526.58 | 1190.8% |

| February | $689,215.17 | $714,138.17 | $830,579.17 | 1235.9% |

| March | $711,263.25 | $737,035.75 | $858,631.75 | 1281.1% |

| April | $733,311.33 | $759,933.33 | $886,684.33 | 1326.2% |

| May | $755,359.42 | $782,830.92 | $914,736.92 | 1371.3% |

| June | $777,407.50 | $805,728.50 | $942,789.50 | 1416.4% |

| July | $799,455.58 | $828,626.08 | $970,842.08 | 1461.5% |

| August | $821,503.67 | $851,523.67 | $998,894.67 | 1506.7% |

| September | $843,551.75 | $874,421.25 | $1,026,947.25 | 1551.8% |

| October | $865,599.83 | $897,318.83 | $1,054,999.83 | 1596.9% |

| November | $887,647.92 | $920,216.42 | $1,083,052.42 | 1642% |

| December | $909,696 | $943,114 | $1,111,105 | 1687.1% |

| All Time | $788,431.54 | $817,177.29 | $956,815.79 | 1439% |

| January | $946,061.92 | $979,838.83 | $1,150,786.08 | 1751% |

| February | $982,427.83 | $1,016,563.67 | $1,190,467.17 | 1814.8% |

| March | $1,018,793.75 | $1,053,288.50 | $1,230,148.25 | 1878.6% |

| April | $1,055,159.67 | $1,090,013.33 | $1,269,829.33 | 1942.4% |

| May | $1,091,525.58 | $1,126,738.17 | $1,309,510.42 | 2006.3% |

| June | $1,127,891.50 | $1,163,463 | $1,349,191.50 | 2070.1% |

| July | $1,164,257.42 | $1,200,187.83 | $1,388,872.58 | 2133.9% |

| August | $1,200,623.33 | $1,236,912.67 | $1,428,553.67 | 2197.7% |

| September | $1,236,989.25 | $1,273,637.50 | $1,468,234.75 | 2261.6% |

| October | $1,273,355.17 | $1,310,362.33 | $1,507,915.83 | 2325.4% |

| November | $1,309,721.08 | $1,347,087.17 | $1,547,596.92 | 2389.2% |

| December | $1,346,087 | $1,383,812 | $1,587,278 | 2453% |

| All Time | $1,146,074.46 | $1,181,825.42 | $1,369,032.04 | 2102% |

| January | $1,387,378.67 | $1,426,572.58 | $1,647,465.92 | 2549.9% |

| February | $1,428,670.33 | $1,469,333.17 | $1,707,653.83 | 2646.7% |

| March | $1,469,962 | $1,512,093.75 | $1,767,841.75 | 2743.5% |

| April | $1,511,253.67 | $1,554,854.33 | $1,828,029.67 | 2840.3% |

| May | $1,552,545.33 | $1,597,614.92 | $1,888,217.58 | 2937.1% |

| June | $1,593,837 | $1,640,375.50 | $1,948,405.50 | 3033.9% |

| July | $1,635,128.67 | $1,683,136.08 | $2,008,593.42 | 3130.7% |

| August | $1,676,420.33 | $1,725,896.67 | $2,068,781.33 | 3227.5% |

| September | $1,717,712 | $1,768,657.25 | $2,128,969.25 | 3324.3% |

| October | $1,759,003.67 | $1,811,417.83 | $2,189,157.17 | 3421.1% |

| November | $1,800,295.33 | $1,854,178.42 | $2,249,345.08 | 3517.9% |

| December | $1,841,587 | $1,896,939 | $2,309,533 | 3614.7% |

| All Time | $1,614,482.83 | $1,661,755.79 | $1,978,499.46 | 3082.3% |

| January | $1,912,592.58 | $1,975,978.17 | $2,362,093.25 | 3699.3% |

| February | $1,983,598.17 | $2,055,017.33 | $2,414,653.50 | 3783.8% |

| March | $2,054,603.75 | $2,134,056.50 | $2,467,213.75 | 3868.4% |

| April | $2,125,609.33 | $2,213,095.67 | $2,519,774 | 3952.9% |

| May | $2,196,614.92 | $2,292,134.83 | $2,572,334.25 | 4037.4% |

| June | $2,267,620.50 | $2,371,174 | $2,624,894.50 | 4122% |

| July | $2,338,626.08 | $2,450,213.17 | $2,677,454.75 | 4206.5% |

| August | $2,409,631.67 | $2,529,252.33 | $2,730,015 | 4291.1% |

| September | $2,480,637.25 | $2,608,291.50 | $2,782,575.25 | 4375.6% |

| October | $2,551,642.83 | $2,687,330.67 | $2,835,135.50 | 4460.1% |

| November | $2,622,648.42 | $2,766,369.83 | $2,887,695.75 | 4544.7% |

| December | $2,693,654 | $2,845,409 | $2,940,256 | 4629.2% |

| All Time | $2,303,123.29 | $2,410,693.58 | $2,651,174.63 | 4164.3% |

| January | $2,753,723.75 | $2,916,544.25 | $3,019,295.17 | 4756.4% |

| February | $2,813,793.50 | $2,987,679.50 | $3,098,334.33 | 4883.5% |

| March | $2,873,863.25 | $3,058,814.75 | $3,177,373.50 | 5010.6% |

| April | $2,933,933 | $3,129,950 | $3,256,412.67 | 5137.7% |

| May | $2,994,002.75 | $3,201,085.25 | $3,335,451.83 | 5264.9% |

| June | $3,054,072.50 | $3,272,220.50 | $3,414,491 | 5392% |

| July | $3,114,142.25 | $3,343,355.75 | $3,493,530.17 | 5519.1% |

| August | $3,174,212 | $3,414,491 | $3,572,569.33 | 5646.3% |

| September | $3,234,281.75 | $3,485,626.25 | $3,651,608.50 | 5773.4% |

| October | $3,294,351.50 | $3,556,761.50 | $3,730,647.67 | 5900.5% |

| November | $3,354,421.25 | $3,627,896.75 | $3,809,686.83 | 6027.7% |

| December | $3,414,491 | $3,699,032 | $3,888,726 | 6154.8% |

| All Time | $3,084,107.38 | $3,307,788.13 | $3,454,010.58 | 5455.6% |

The bullish explosive trend noted up to 2029 will continue for BTC based on CoinGape predictions and potentially push the average price of BTC in 2050 between $2.9 million and $3.3 million. Investors should note that these long-term predictions can change and, hence, should be taken with a grain of salt.

How Will Bitcoin Price React to $3 Billion Buying Spree?

Michael Saylor, the CEO and founder of MicroStrategy, has increased the size of its convertible note from $1.75 billion to $2.6 billion. This suggests that the company will continue its BTC buying spree.

According to the announcement, the offering will close today, November 21, and is aimed at high-net-worth investors with a maturity of 2029. The blog also added,

“The notes will be sold in a private offering only to persons reasonably believed to be qualified institutional buyers.”

Investors need to note that the latest offerings has not finished yet, as MicroStrategy announces the new offering.

On a side note, here’s Michael Saylor’s tweet from two days ago.

MicroStrategy has acquired 51,780 BTC for ~$4.6 billion at ~$88,627 per #bitcoin and has achieved BTC Yield of 20.4% QTD and 41.8% YTD. As of 11/17/2024, we hodl 331,200 $BTC acquired for ~$16.5 billion at ~$49,874 per bitcoin. $MSTR https://t.co/SRRtRrB2jO

— Michael Saylor⚡️ (@saylor) November 18, 2024

Although this is fundamentally bullish for Bitcoin, the implication of this might not be felt in the short term. The lack of influence on BTC’s value can be attributed to over-the-counter (OTC) deals. Institutions or high-net-worth individuals use methods to conceal their buys in the short term and do not affect the market price of the underlying asset.

Regardless, the outlook is bullish, and the momentum is strong, so it wouldn’t be surprising if Bitcoin hits $100,000 before November ends.

Source link

Bitcoin

The Case For A Future Valuation Of $1 Million

Published

2 days agoon

November 20, 2024By

admin

Since November 5, the day President-elect Donald Trump secured another term in office, Bitcoin has experienced a remarkable uptrend, reaching a new all-time high of $93,300.

Since then, BTC has been trading within a narrow range between $89,000 and $92,000, positioning for a potential move toward the $100,000 milestone. This raises an intriguing question whether a price of $1 million per coin is feasible over the next decade.

A Long-Term Vision For Investors

Market expert VirtualBacon has conducted an in-depth analysis of these possibilities, delving into the numbers, trends, and catalysts that could propel Bitcoin to experience a surge of nearly 1,000% from its current price levels.

Within the current market cycle, the expert forecasts that Bitcoin could hit $200,000 in the next one to two years. However, he notes that while this milestone is significant, altcoins may offer higher returns at a greater risk, often crashing by 80% to 90% in bear markets.

In contrast to altcoins, which face increasing regulatory scrutiny, Bitcoin stands out as a safer long-term investment. VirtualBacon argues that Bitcoin’s potential is not just confined to the next few years but spans a decade or more.

Related Reading

To understand why Bitcoin’s price could reach $1 million, VirtualBacon asserts that investors need to consider its fundamental utility as a store of value. Bitcoin’s fixed supply of 21 million coins, its global accessibility, and its resistance to censorship and manipulation make it a compelling alternative to traditional financial assets.

The expert suggests that if Bitcoin is to become recognized as the digital gold of the 21st century, reaching a market capitalization that rivals gold’s estimated $13 trillion is not merely a theoretical possibility but “a logical outcome.”

Key drivers for this potential growth include increasing participation from asset managers, corporate treasuries, central banks, and wealthy individuals. Recent data indicates that Bitcoin ETFs have seen record inflows, with $1 billion invested last week, reflecting growing institutional confidence.

Additionally, discussions among corporations, such as Microsoft considering Bitcoin reserves, further enhance its strategic value. Wealthy individuals are also beginning to adopt Bitcoin as a standard portfolio allocation, with even a modest 1% investment becoming commonplace among billionaires.

What Does Bitcoin Need To Reach $1 Million?

For Bitcoin to reach the $1 million mark, two critical factors must be analyzed: global wealth growth and portfolio allocation. VirtualBacon notes that in 2022, total global wealth was estimated at $454 trillion, and projections suggest this could grow to $750 trillion by 2034.

Currently, gold holds approximately 3.9% of global wealth, while Bitcoin is at a mere 0.35%. If Bitcoin’s allocation in global portfolios rose to just 3%, still significantly below gold’s share, its market cap could soar to $20 trillion, pushing the price to $1 million per coin.

Historically, gold’s market cap saw significant growth following the launch of exchange-traded funds in 2004, with its portfolio allocation increasing from 1.67% to 4.74% over the next decade.

Related Reading

If Bitcoin follows a similar trajectory, its allocation could rise from 0.35% to 1.05% or more, translating to a market cap of approximately $7.92 trillion, equating to about $395,000 per Bitcoin. Therefore, reaching $1 million doesn’t require Bitcoin to surpass gold; it must capture about 57% of gold’s projected market cap by 2034.

With gold representing 4.7% of global portfolios compared to Bitcoin’s 0.35%, a modest increase in Bitcoin’s share of global wealth to 3%—just 60% of gold’s allocation—could “easily” result in a $20 trillion market cap and a $1 million price point.

At the time of writing, BTC is trading at $92,240, up 7% every week.

Featured image from DALL-E, chart from TradingView.com

Source link

$100k

Why $100,000 Bitcoin Is Right Around The Corner

Published

3 days agoon

November 19, 2024By

admin

If you have been following Bitcoin news today, like I have, you can not be more bullish on Bitcoin. Seriously, what a time to be alive!

Just today:

- MicroStrategy purchased another 51,780 BTC for $4.6 billion and announced its plans to raise $1.75 billion to buy more bitcoin

- Semler Scientific bought another 215 BTC for $17.7 million

- Genius Group launched its Bitcoin treasury by purchasing 110 BTC for $10 million

- MARA Holdings announced a $700 million raise to buy more BTC

- Metaplanet issued ¥1.75B debt offering to buy more BTC

- Global healthcare group Cosmos Health adopted BTC as a treasury reserve asset

Insane, right?

The corporate Bitcoin adoption is going absolutely parabolic. The race among public companies to stack the most satoshis has kicked into hyperdrive.

Some other news:

- Donald Trump is meeting with Coinbase CEO Brian Armstrong and is expected to discuss appointments

- Donald Trump’s media $DJT in talks to purchase crypto trading platform Bakkt

- Options trading on BlackRock’s spot Bitcoin ETF could be listed as soon as tomorrow

It’s only Monday, and my head is already spinning! With this tidal wave of positive adoption, I’d be downright shocked if we don’t blast through $100,000 per Bitcoin this week.

I expect a flood of more bullish news and serious FOMO buying pressure this week. Seriously, tighten your seatbelts, folks—with this momentum, Bitcoin hitting a hundred grand is coming sooner than you imagined!

This article is a Take. Opinions expressed are entirely the author’s and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

Source link

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

Polkadot investor predicts a 30,000% rally for this $0.04 token by 2025

Donald Trump Proposed Crypto Advisory Council To Set Up Strategic Bitcoin Reserve

Want Greater Bitcoin Adoption? Engage With Your Government.

Why the Media Loves the Worst of Crypto

HashCats prepares for Token Generation Event after completing mining season

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential