DEX

what’s the difference and which is better?

Published

2 months agoon

By

admin

Both Dogecoin and Shiba Inu have emerged as major players in the meme coin world. Their light-hearted branding has proven popular in the market, catapulting them to success.

While they may seem similar on the surface, these two coins have important differences that set them apart and provide distinct use cases and investment factors to consider.

Overview of Dogecoin and Shiba Inu

Launched in 2013, Dogecoin was the first ever so-called meme coin, a digital asset launched explicitly as a joke. The currency was created by software engineers Billy Marcus and Jackson Palmer partly as a way to poke fun at Bitcoin and its growing popularity. What the developers were not to know, of course, is that their own currency would go on to be worth tens of billions of dollars.

What began as a meme featuring the Shiba Inu dog breed quickly grew into a hugely popular cryptocurrency bolstered by a dedicated community as well as press and notoriety from public figures like Elon Musk.

DOGE managed to identify a real-world use case and became a popular way for cryptocurrency users to issue tips and carry out small transactions that would be cost-prohibitive with currencies like Bitcoin due to the higher fees involved, especially in years gone by.

In 2020, the Shiba Inu cryptocurrency emerged as a potential “Dogecoin killer.” Built on the Ethereum blockchain as an ERC-20 token, Shiba Inu aimed to capitalize on the meme coin trend while offering more utility than Dogecoin. Due to being issued on Ethereum, Shiba Inu can integrate with decentralized finance and offers access to DeFi services not supported by Dogecoin.

Let’s explore these differences more in the below section.

What’s the difference between Dogecoin and Shiba Inu?

One of the biggest differences between Dogecoin and Shiba Inu is the technology behind them. Dogecoin operates on its own blockchain and uses a Proof-of-Work (PoW) system, similar to Bitcoin. The Dogecoin blockchain is capable of fast and low-cost transactions, ideal for tipping and microtransactions, but limited in terms of interoperability with other blockchains or crypto services.

(SHIB) Shiba Inu, on the other hand, is not as robust in terms of rapid transactions at a low cost but arguably offers more utility.

As an ERC-20 token, SHIB can interact with essentially any Ethereum-based applications and smart contracts in the world. However, this also means that Shiba Inu is subject to Ethereum’s sometimes high gas fees and slow transaction times, depending on network congestion.

Finally, a major difference lies in their supply strategies.

Dogecoin has an inflationary supply model, where 5 billion new DOGE coins (DOGE) are introduced each year. Many crypto users found themselves exasperated at the popular “Doge to $1” campaign that became popular in 2021 among novice entrants to the space, as the price point would have required DOGE to reach a market cap of around $130 billion.

Meanwhile, Shiba Inu has a fixed supply, with an enormous initial number of 1 quadrillion tokens. The supply is often touted as a reason that individual SHIB coins are described as ‘cheap’ or affordable. Again, however, this belies a lack of understanding of tokenomics, as what investors should be considering is the market cap rather than the price of a single coin when measuring value.

About half of the SHIB supply was burned or removed from circulation, but the remaining supply still impacts its value potential.

Of course, to do a true Shiba Inu vs. Dogecoin comparison, we must consider the price history of these two coins.

Dogecoin vs Shiba Inu: market performance and volatility

Both coins have experienced dramatic price swings, often driven by social media and public figures. Let’s weigh up Shiba Inu vs Dogecoin comparison.

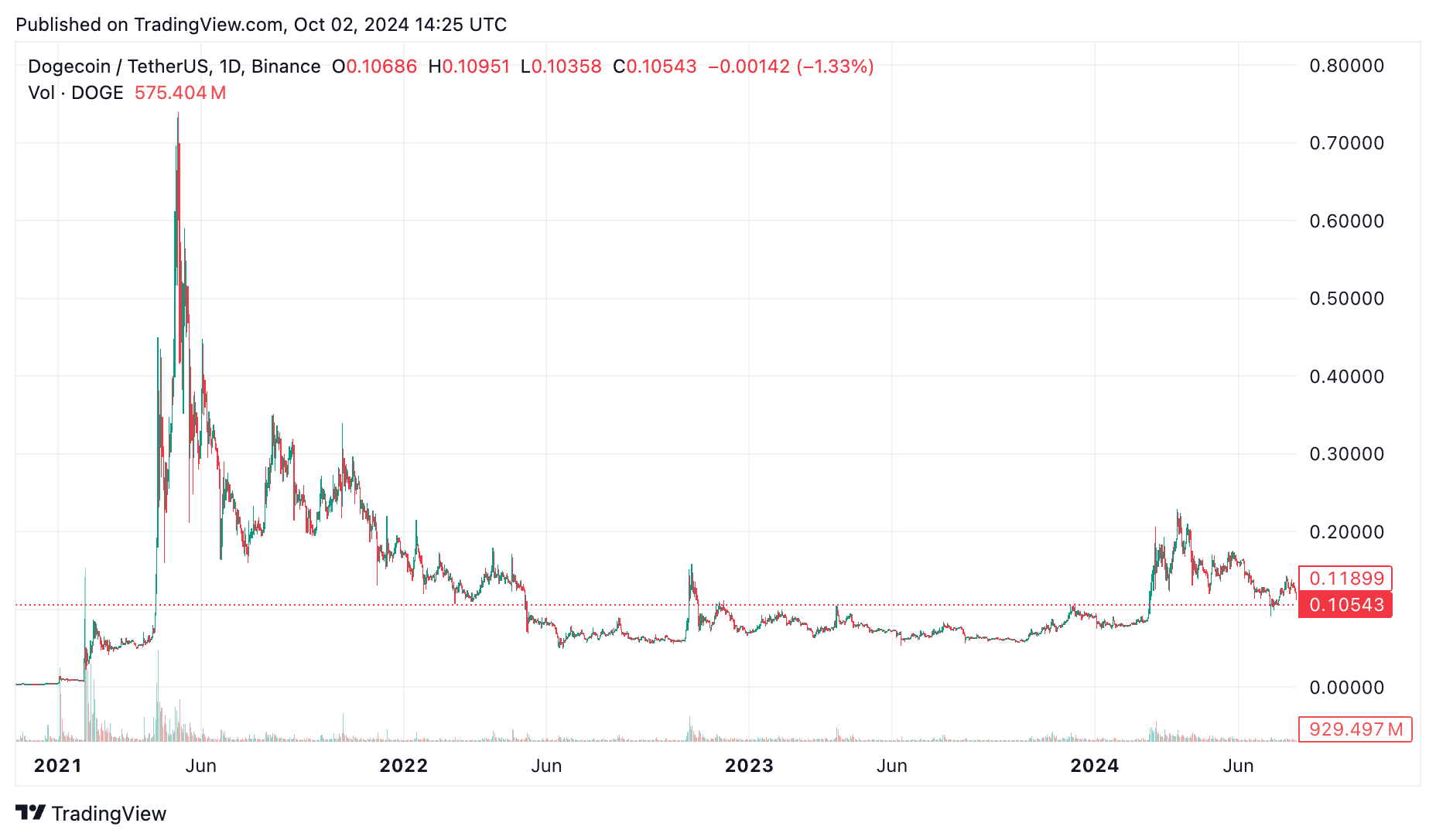

Dogecoin, thanks to endorsements from individuals like Elon Musk, saw its price peak in 2021 at $0.7376.

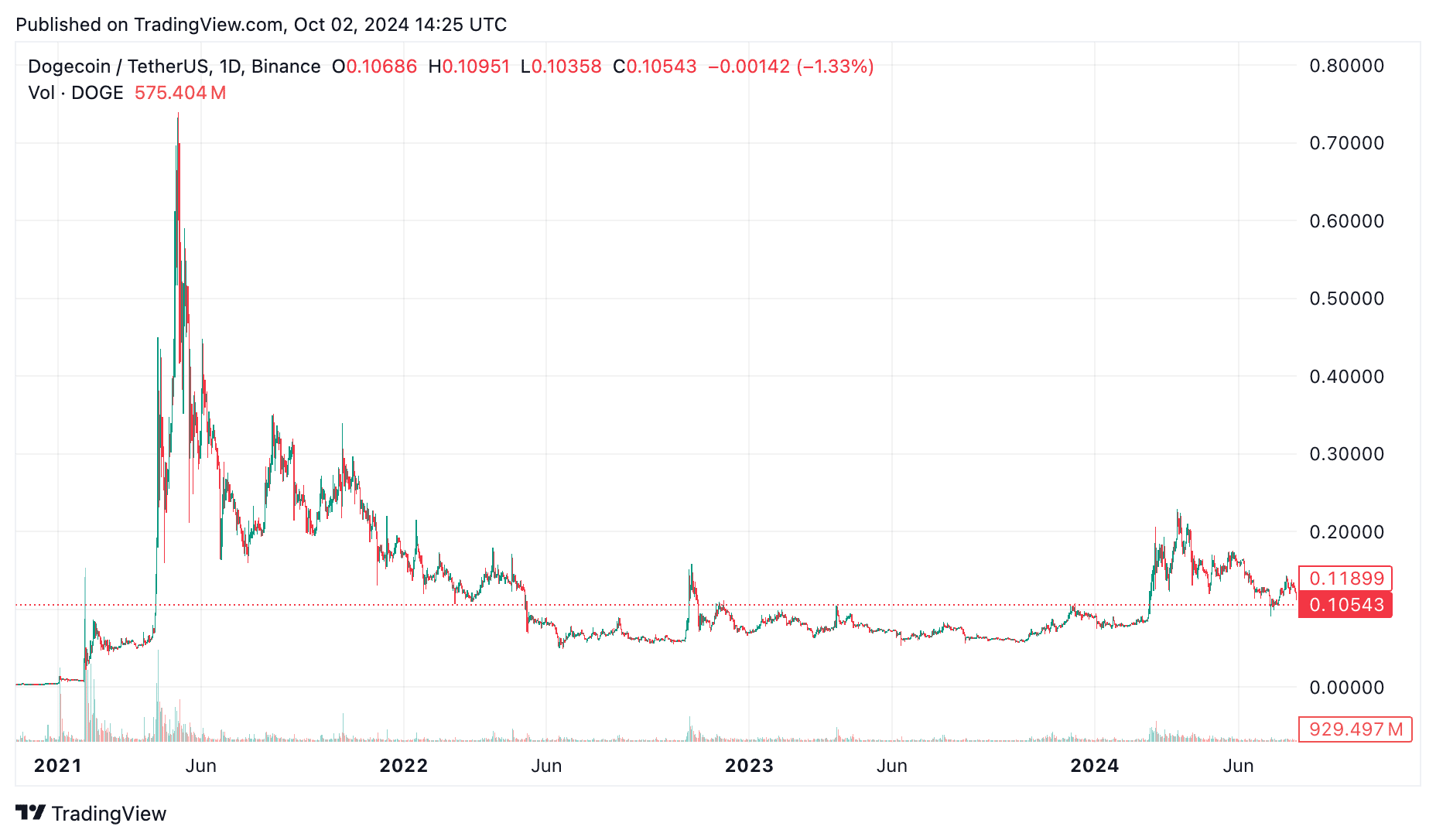

Shiba Inu peaked later in the same year at $0.00008845, fueled by the hype of its growing community.

In terms of market capitalization, Dogecoin consistently ranks higher and now stands at $15.6 billion compared to $9.6 billion for Shiba Inu. The coins are currently ranked at #8 and #13 in the overall market cap rankings respectively.

This reflects Dogecoin’s broader adoption as a simple and accessible cryptocurrency, while Shiba Inu’s complex DeFi potential offers more speculative value. However, SHIB is catching up, with a 118% growth in price over the last 12 months compared to a 69% growth this past year for DOGE.

Shiba Inu vs Dogecoin price prediction

Let’s take a look at the potential price forecast for Doge vs. Shiba.

Shiba Inu price prediction

Shiba Inu’s future largely depends on the success of projects like Shibarium, a layer-2 solution designed to reduce Ethereum’s high gas fees and increase scalability. If Shibarium succeeds, it could drive further adoption and increase SHIB’s value. However, its vast token supply may continue to weigh down the price.

As mentioned earlier, it’s interesting to note that Shiba Inu has had a strong year, but it’s quite a ways off its yearly high seen in May, with many pockets of resistance to break through before it approaches that price range.

Dogecoin price prediction

For Dogecoin, price predictions are often influenced by media hype, particularly driven by high-profile endorsements. Without significant technological advancements or new real-world use cases, its price may fluctuate based on speculative trading.

For a meme coin that was never intended to be taken seriously, it has certainly shocked the world with its strong community and price action. However, it’s difficult to accurately predict any sort of price action for this currency due to the somewhat whimsical nature of its upwards and downwards price momentum in the past and inflationary supply tokenomics.

Unlike Shiba Inu, Dogecoin is not particularly linked to success in the DeFi sector, and its success or failure is really anyone’s guess.

Which is better: Dogecoin or Shiba Inu?

So, Dogecoin vs. Shiba Inu: which is better?

When it comes to deciding which is better: Doge vs Shiba, the answer largely depends on your goals as an investor. The difference between Dogecoin and Shiba Inu is largely the transaction speed vs. functionality of the transaction, but in the end, both of these assets are meme coins.

Dogecoin offers a simple, fast, and low-cost cryptocurrency with an active community, making it a good choice for those looking for everyday utility or a fun investment.

It’s important to note that Dogecoin is by no means the only fast and low-cost cryptocurrency, nor is it the fastest or cheapest of the many options now available on the market, most of which have more features and integrations than Dogecoin. With no real utility in the modern crypto space beyond the potential for speculative gains, this is a particularly high-risk investment, even for a cryptocurrency.

Meanwhile, Shiba Inu provides more opportunities within the DeFi space due to its integration with Ethereum, offering higher potential rewards but also greater risk due to its volatility and dependence on Ethereum’s infrastructure.

Again, Shiba Inu is far from the most feature-laden or well-built DeFi currency on the market, and it has no edge or advantage over other ERC-20 tokens, and would be considered to have a disadvantage in the eyes of many investors.

At the end of the day, what these coins offer is simply a dedicated community that gets together to have fun and share memes rather than a serious investment opportunity. However, that’s not to say that seasoned investors cannot learn technical analysis to attempt to trade the charts for these meme coins.

Source link

You may like

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

cryptocurrency

Uniswap launches permissionless bridging across nine networks

Published

4 weeks agoon

October 23, 2024By

admin

Decentralized exchange Uniswap has launched in-app, permissionless cross-chain bridging for its users, with service available across nine blockchain networks.

On Oct. 23, the Uniswap (UNI) team announced that its permissionless cross-chain bridge was now live, bringing the DEX protocol closer to enabling cross-chain swaps. The cross-chain intents protocol, Across Protocol, powers this in-app Uniswap bridging feature, according to the announcement.

Only native assets

With the launch, Uniswap users can now undertake cross-chain transactions across nine networks. These include Ethereum (ETH), Arbitrum (ARB) Polygon (POL) and ZKSync (ZK). Other networks with initial support are Base, Zora, Blast, OP Mainnet and World Chain.

The feature only supports native assets, such as ETH on the Ethereum network or ARB on the Arbitrum network. Bridging will also be available for stablecoins. In terms of functionality, users will perform cross-chain transactions directly via their Uniswap interface and Uniswap Wallet.

According to data from Dune, multi-chain access currently has a cumulative count of over six million Uniswap users. However, cross-chain bridge swaps remain low. The Uniswap Labs team aims to significantly increase this number.

Uniswap recently unveiled UniChain, a new layer-2 chain targeting DeFi and cross-chain liquidity. Announced on Oct. 10, UniChain aims to help the crypto market address DeFi’s challenges. Key to this vision are decentralization, near-instant transactions, and multi-chain swapping.

Source link

DEX

Ecosystem growth fuels Ethena rally, analysts eye 65% upside

Published

1 month agoon

October 19, 2024By

admin

Ethena has broken out of a rare bullish pattern on the one-day charts and could see gains of over 65% from the current price.

Over the last seven days, Ethena (ENA) — best known for the USDe stablecoin — rose 24.4%. The crypto asset’s market cap surpassed the $1 billion mark on Oct. 14. It is now up 200% from its lowest point in September, and sits at $1.14 billion. Its daily trading volume hovers over $318 million.

According to analysts, Ethena has broken out of multiple patterns on the 1-day chart, which points to further upside.

Anonymous trader CryptoBull_360 noted that ENA has broken out from an inverse head and shoulders pattern, a rare pattern that signals a major bullish reversal that could further fuel the ENA rally. Moreover, It also rose above the upper side of a broadening wedge pattern that connects the highest swings since April 10.

The analyst sets a bullish target for ENA at $0.68. That’s up 65% from its current levels, provided that Bitcoin (BTC) continues to see positive momentum.

Other commentators echoed similar bullish sentiments with MisterSpread ENA to hit $0.52 in the short term as long as it holds above the support level at $0.42.

ENA’s price rally also coincided with a jump in futures open interest. According to CoinGlass, open interest in the futures market hit a high of $227 million, up from last week’s low of $137 million.

Previously, whales have also turned their attention towards the token and were seen accumulating the crypto throughout the past week as reported by crypto.news.

Smart DEX traders, known for consistently executing profitable swaps on decentralized exchanges, grabbed over 2.25 million ENA tokens over the past week, valued at $932.5K, demonstrating their confidence in the token’s potential growth.

Among other catalysts, is Ethena’s recent proposal to integrate its liquidity and hedging system into Hyperliquid, a decentralized exchange for perpetual trading.

The proposal, currently under review by the Ethena Risk Committee, suggests moving a portion of Ethena’s hedging flow on-chain to Hyperliquid, enhancing transparency and reducing counterparty risks.

Additionally, the proposal includes adding USDe stablecoin to Hyperliquid’s Layer 1 platform upon the launch of the EVM mainnet, further expanding its DeFi integrations.

At press time, ENA was exchanging hands at $0.403 per data from crypto.news.

Source link

CEX

Crypto-native platforms need on-ramps to grow and leap forward

Published

2 months agoon

September 28, 2024By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Crypto was once a self-contained industry. The average user only heard about it at the Bitcoin (BTC) price peaks and was reluctant to invest in this new asset class. Those passionate about crypto found their way through with limited options to convert their digital coins into fiat and back.

But those days are gone. As crypto products grow in popularity, many platforms, previously entirely confined to web3, are integrating fiat bridges to open their doors to new users.

Disruption that doesn’t benefit users

Imagine a common type of web3 product that wants to disrupt its niche and make its service go mainstream. It describes its solution and how blockchain revolutionizes the traditional way of doing things. Then, it says: connect your web3 wallet and make sure you have enough Ethereum (ETH) to pay gas fees. If you don’t have any, set up an account on a centralized exchange and buy some.

This path is ridiculously long and bumpy for a regular non-crypto user. Centralized exchanges are still the most common way to convert fiat money into crypto, but their cumbersome interface often leaves newcomers feeling dizzy. Even for experienced users, CEXes as a gateway are not always convenient—withdrawing funds to an external platform involves multiple confirmations and extra fees. All of this creates a great deal of friction, complicating the user’s journey into web3.

Why would a DEX need a fiat gateway?

One could argue that web3 projects aiming to go mainstream and blockchain-native platforms mostly focused on the crypto audience are different—in the sense that crypto protocols don’t really need fiat. For example, decentralized exchanges that let enthusiasts swap various L1 and L2 tokens earned in airdrops, bounty campaigns, and other activities confined to the blockchain realm.

Is that really the case? In practice, that’s not quite so. For instance, Uniswap introduced its fiat-to-crypto bridge back in December 2022 and has since partnered with various providers to expand opportunities for its users. This is a good example of how a DeFi project realized that it couldn’t reach the next level without opening a channel for inflows from the traditional economy. The move also strengthened the project’s value proposition, giving people more opportunities to safely trade in a decentralized environment.

Memecoins are another example. As the memecoin frenzy unfolded in 2024, this asset class became well-known to a wider audience, catching the attention of traditional investors. While many of them turned to centralized exchanges due to a lack of other options, the Shiba Inu (SHIB) memecoin integrated a fiat on-ramp, offering users the ability to purchase the token directly into their wallet. Investors gained an easy way to buy the asset, and the project increased the value and utility of its token.

The efforts of top crypto platforms to integrate on- and off-ramps highlight the user demand. However, they also indicate that the infrastructure for fiat-to-crypto bridges is now ready. Today, setting up an on-ramp can take just a few days using pre-built software that supports dozens of countries, payment methods, and national currencies. Good gateways are fully licensed in many regions, freeing their clients from compliance issues.

Some argue that crypto-native platforms don’t really need fiat bridges because not many people have used them so far. But what if that was the case simply because there were far too few bridges available?

We constantly think of how to make crypto more accessible. But it often doesn’t require us to reinvent the wheel—it’s about removing the friction faced by those who want to use their fiat in the crypto world. There was a time when fiat and blockchain realms barely intersected. However, as they continue to converge, only tighter integration between traditional and digital currencies will facilitate faster adoption of crypto.

Konstantins Vasilenko

Konstantins Vasilenko is a co-founder of Paybis, a pioneering fintech startup in the Baltic States, which has become a leader in the digital and cryptocurrency exchange business. Konstantin is a seasoned IT expert with over 20 years of experience spanning enterprise IT project management, CRM systems, blockchain technology, digital payments, and cryptocurrencies. Prior to Paybis, Konstantin honed his skills at Accenture. His career reflects a strong commitment to innovation and digital transformation, driving the bridge between traditional finance and the crypto economy.

Source link

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

Polkadot investor predicts a 30,000% rally for this $0.04 token by 2025

Donald Trump Proposed Crypto Advisory Council To Set Up Strategic Bitcoin Reserve

Want Greater Bitcoin Adoption? Engage With Your Government.

Why the Media Loves the Worst of Crypto

HashCats prepares for Token Generation Event after completing mining season

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential