Price analysis

Tech Expert Says Solana is Centralized, What’s Next For SOL Price?

Published

2 months agoon

By

admin

SOL price has been affected by the ongoing market decline and has potentially abandoned the anticipated bull pennant breakout. However, the pattern is still valid, and a little more consolidation between $130 and $161 should allow it to remain viable for a breakout. In the meantime, popular Wikileaks whistleblower Edward Snowden believes Solana is centralized, a tale he shared at the recently concluded Token2049.

Is Solana Being Centralized Bad for SOL Price?

Speaking at the Token2049 conference, Former NSA intelligence and government Edward Snowden said Solana was centralized and probably only good for meme coins and scams.

SNOWDEN: Solana is centralised

👊 😎 pic.twitter.com/MY6Di6sAPH

— Radar🚨 (@RadarHits) October 2, 2024

He noted that Solana is a case of a group of individuals taking advantage of a generational technological revolution for profit. While Solana provides convenience through its fast speeds and low transaction costs, Snowden pointed out that investing real value in the chain would be risky because of its centralized nature.

The issue of not being decentralized has always plagued the Solana blockchain. Generally speaking, centralization is generally not good for a cryptocurrency as it defeats the purpose of blockchain itself. Solana has been accused of inflating transaction numbers, which has had a positive impact on its SOL price.

Historically, Solana price has shown resilience despite criticisms. For instance, after the initial centralization claims emerged, the SOL price dipped but quickly bounced back as the market focus shifted to its undeniable ecosystem growth.

Moreover, the recently rejected Solana ETF filed by VanEck and 21 Shares contributed to improving Solana’s legitimacy as a top blockchain contender in the eyes of the public.

Solana Price Sets Eyes On $300 Despite Criticisms

Like in previous criticisms, Solana remains adamant to rise to new highs. The SOL price chart shows a bullish setup, which, if broken, could propel the price to over $500.

The Solana price is currently trading at $141.64, which sits around the 38.2% Fibonacci retracement level from its larger downtrend. This is a significant level, as it often acts as a pivot point for continuation or reversal.

The 50% Fibonacci retracement at $115 is holding as strong support, with the next major resistance above the 38.2% level at the 23.6% Fib retracement, close to $164.

The arrow on the chart points to potential higher price levels, suggesting bullish momentum is expected, possibly driving Solana toward $225 (first major resistance) and beyond $325.

Solana price prediction shows if the asset fails to sustain above the 0.5 Fibonacci retracement level, it may signal crypto market weakness, leading to lower prices. SOL may find support around $85 or $61 if the Solana price continues dropping.

Frequently Asked Questions (FAQs)

Edward Snowden described Solana as centralized and suggested it might only be suitable for meme coins and scams. He expressed concerns that a small group of individuals is capitalizing on the blockchain’s potential for profit, undermining the decentralized ethos of cryptocurrency.

Centralization contradicts the fundamental principles of blockchain technology, which promotes decentralization, security, and transparency. A centralized network can be more vulnerable to control by a few entities, raising concerns about manipulation and sustainability.

Investment decisions should be based on individual risk tolerance and market research. While some analysts see bullish potential for SOL, ongoing market volatility and concerns regarding centralization warrant careful consideration before investing.

Related Articles

Evans Karanja

Evans Karanja is a crypto analyst and journalist with a deep focus on blockchain technology, cryptocurrency, and the video gaming industry. His extensive experience includes collaborating with various startups to deliver insightful and high-quality analyses that resonate with their target audiences. As an avid crypto trader and investor, Evans is passionate about the transformative potential of blockchain across diverse sectors. Outside of his professional pursuits, he enjoys playing video games and exploring scenic waterfalls.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

You may like

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Price analysis

Will Solana Price Hit $500 In November?

Published

2 days agoon

November 20, 2024By

admin

Solana (SOL) price has surged by 42% since November, showcasing strong bullish momentum amid a recovering cryptocurrency market. The prominent Layer 1 blockchain is gaining investor confidence by breaking multiple resistance levels. This rally aligns with broader market improvements, fueling speculation of a potential breakout. Market enthusiasts now watch closely as Solana eyes a significant milestone, potentially reaching $500 this month.

Bitcoin’s remarkable rally past $90,000 has reignited optimism across the crypto market, driving gains in major altcoins like Solana. Over the past week, SOL surged over 10%, fueled by speculation around a potential Solana ETF debut in 2025.

Could Solana Price Hit the $500 Mark in November?

Following the success of Bitcoin and Ethereum ETFs earlier this year, experts predict Solana may be next to gain approval. The possibility of an SEC green light has drawn increased institutional and retail interest toward SOL. This growing demand continues to boost Solana’s price momentum, with analysts projecting it could reach the $500 mark.

As enthusiasm spreads across the crypto sector, the spotlight remains firmly on Solana’s potential future in the ETF landscape. At the time of writting, the SOL price is trading at $234, with a slight decrease of 2% in the past 24-hours. Solana price continues to climb, the top altcoins ATH of $260 with only a 10% surge needed.

The Solana price prediction trajectory remains firmly bullish, with market sentiment hinting at the potential for unprecedented highs in the near future. If current upward trends persist, the cryptocurrency could target the significant $300 mark in the coming months. With strong bullish sentiment, the price could surge by 110%, potentially reaching an impressive $500 milestone.

The Moving Average Convergence Divergence (MACD) shows bullish momentum. The MACD line remains above the signal line, supported by positive histogram bars, signaling continued buying interest.

Solana has hit a remarkable achievement, with its Total Value Locked (TVL) surpassing $8.421 billion. This highlights the blockchain’s growing traction in decentralized finance (DeFi).

The market capitalization of stablecoins on the Solana network has reached $4.522 billion. This reflects the increasing adoption of stablecoins for transactions and liquidity within its ecosystem.

Solana’s bullish momentum, fueled by market optimism, DeFi growth, and ETF speculation, positions it for significant gains. While $500 remains ambitious, sustained demand and favorable conditions could drive SOL toward this milestone.

Frequently Asked Questions (FAQs)

Solana’s price is rising due to market optimism, DeFi growth, and ETF speculation.

While ambitious, strong market momentum and demand make it possible.

Solana’s TVL surpassing $8.421 billion highlights its growing DeFi traction.

Coingape Staff

CoinGape comprises an experienced team of native content writers and editors working round the clock to cover news globally and present news as a fact rather than an opinion. CoinGape writers and reporters contributed to this article.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Pepe Coin price remains in a bear market after falling by 23.3% from its year-to-date high. Crypto experts expect that the popular meme coin will bounce back and blast past its all-time high in the near term.

Crypto Analysts See Pepe Coin Price Hitting New ATH

Most cryptocurrency analysts agree that it is just a matter of time before Pepe price jumps by 31% and hits its all-time high as the crypto bull run continues.

Bluntz, a popular crypto trader used Elliot Wave analysis on the four-hour chart to predict that the coin will soon make a bullish breakout. He believes that it has moved to the ABC pattern and a symmetrical triangle, which is nearing its confluence level. In most periods, this pattern leads to a strong bullish breakout.

This view was shared by other analysts like Dami-DeFi, who has over 76,000 followers, and Trader ELM.

Fundamentally, traders note that Pepe is one of the most popular meme coins in the industry and that it has a real chance to flip Shiba Inu. Data shows that Pepe regularly has higher volume metrics than Shiba Inu, a sign of demand among traders. It had a 24-hour volume of $5.4 billion compared to SHIB’s $1.9 billion.

Also, there are signs that whales are accumulating the coin. Data from Etherscan shows that a whale bought Pepe coins worth over $65 million on Wednesday.

Pepe Price Has Strong Technicals

The daily chart shows that the Pepe coin price blasted past the crucial resistance level at $0.00001721 on November 13. This was an important level since it was its highest level on March 27 and its previous all-time high.

Most notably, this was the upper side of the cup and handle pattern, a popular sign of a continuation.

The coin has now pulled back after hitting its all-time high of $0.00002595 as the recovery takes a breather and some investors take profits. It has remained above the 50-day and 200-day moving averages, which formed a golden cross pattern in September.

Pepe coin price seems to be forming a doji candlestick pattern, which is characterized by a tiny body and long upper and lower shadows. In most cases, this is one of the most accurate reversal candlestick patterns.

Therefore, there is a likelihood that the Pepe price will bounce back and possibly retest the all-time high of $0.000025. A break above that level will point to more gains to $0.000030.

On the flip side, a crash below the support at $0.000017 will invalidate the bullish view. It will raise the possibility of mean reversion as sellers target the 50-day moving average at $0.000012.

Frequently Asked Questions (FAQs)

Pepe Coin price could bounce back to a record high because of its strong fundamentals and technicals. It has formed a symmetrical triangle on the 4H chart and a cup and handle pattern on the daily.

The most likely scenario is where the Pepe coin rallies and reaches a record high of $0.000025 in the near term.

Some of the potential catalysts for the Pepe token are its strong technicals and the fact that whales are accumulating the token.

crispus

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Source link

Markets

Shiba Inu price prepares a big move as burn rate surges 940%

Published

3 days agoon

November 19, 2024By

admin

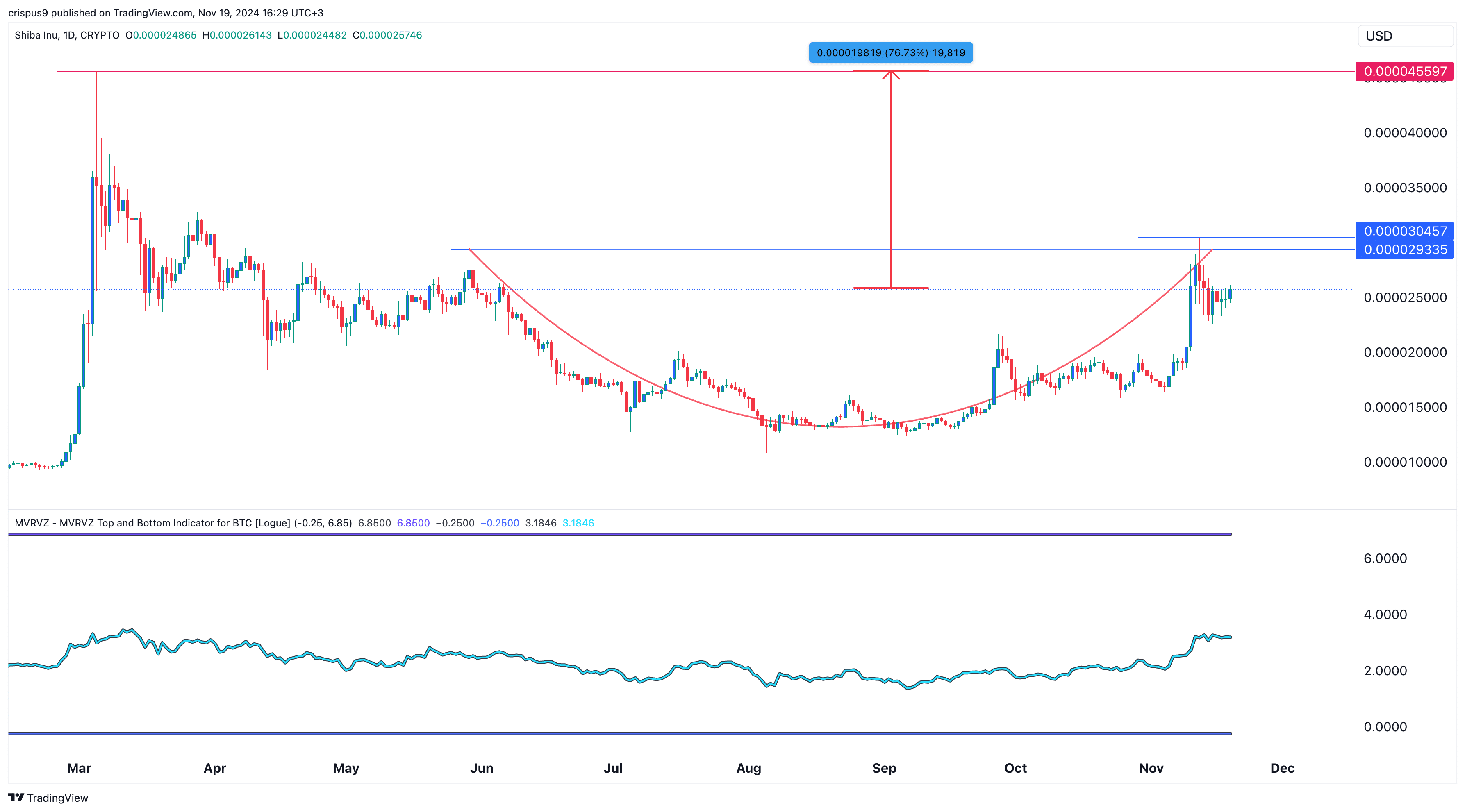

Shiba Inu price is preparing for a massive bullish breakout as its token burn accelerates, the crypto fear and greed index remains in the green zone, and a bullish pattern forms.

Shiba Inu (SHIB), second-biggest meme coin, was trading at $0.000026 on Tuesday, Nov. 19, slightly above last Friday’s low of $0.0000246. It has jumped by 142% from its lowest level in August.

SHIB’s rebound occurred as data from Shiburn showed that the number of Shiba Inu tokens burned on Tuesday surged by almost 940% to 3.69 million. This burn brought the total number of burnt SHIB tokens to over 410 trillion, while its circulating supply stood at 583.7 trillion tokens.

Shiba Inu’s token burn involves sending tokens to a wallet without a key, effectively removing them from circulation. These tokens come from its ecosystem networks like Shibarium and ShibaSwap, as well as voluntary contributions by community members.

Shiba Inu is also recovering as the crypto fear and greed index remains in the extreme greed zone at 83. Historically, altcoins tend to perform well when there is a heightened sense of greed in the crypto market.

This sentiment has also driven gains in other meme coins, bringing the total market cap of the meme coin sector to $128 billion. This valuation surpasses that of large companies such as Lockheed Martin, Palo Alto Networks, ADP, and Airbus.

Shiba Inu price has formed a bullish pattern

The outlook for Shiba Inu remains bullish, as the coin has formed a highly bullish pattern on the daily chart. It displays a cup and handle formation, characterized by a rounded bottom followed by a pullback or consolidation near the top.

The coin is in the process of forming the handle section. A break above the upper side of the cup at $0.00002933 could signal further gains, with the next target being the year-to-date high of $0.000045—76% higher than the current level.

Shiba Inu remains above the 50-day moving average, while the Market Value to Realized Value indicator has climbed above 3. However, a drop below the key support level at $0.000020 would invalidate the bullish outlook.

Source link

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

Polkadot investor predicts a 30,000% rally for this $0.04 token by 2025

Donald Trump Proposed Crypto Advisory Council To Set Up Strategic Bitcoin Reserve

Want Greater Bitcoin Adoption? Engage With Your Government.

Why the Media Loves the Worst of Crypto

HashCats prepares for Token Generation Event after completing mining season

Gary Gensler To Step Down As US SEC Chair In January

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

✓ Share: