Bitcoin

Investor Dan Tapiero Says Bitcoin Primed To ‘Launch’ if BTC Breaks One Major Resistance Level

Published

2 months agoon

By

admin

Investor Dan Tapiero says that Bitcoin (BTC) is setting up for a breakout after printing a massive bullish technical pattern.

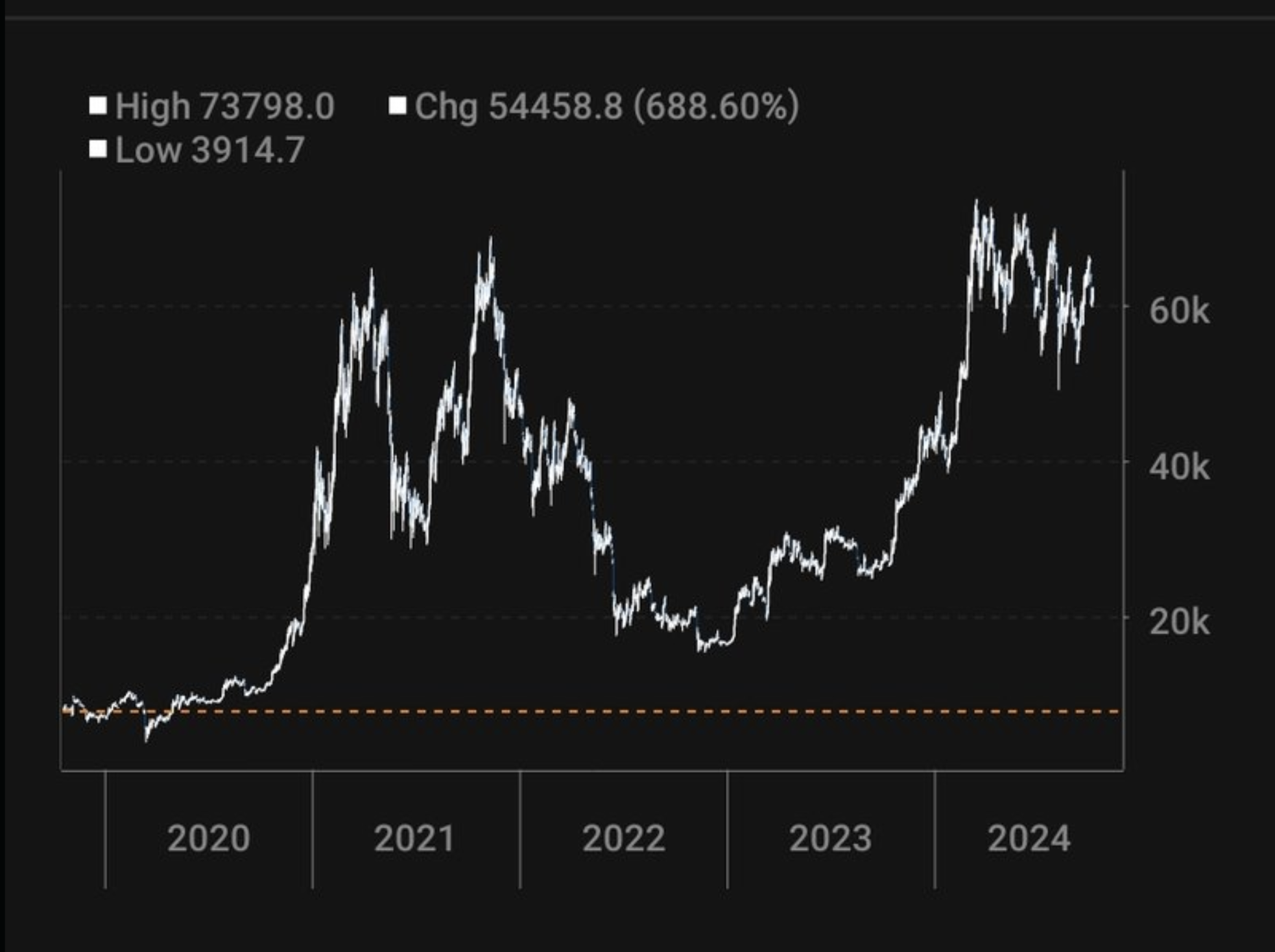

Tapiero says that Bitcoin is forming a large, years-long cup and handle structure that is setting BTC up for a breach of the March 2024 highs at $74,000.

A cup-and-handle formation is typically viewed as a bullish continuation pattern, suggesting that an asset is taking a breather after a steep rally before taking out a key resistance level.

But according to Tapiero, Bitcoin can still go through a period of sideways consolidation before witnessing a convincing breakout.

“If that ain’t a cup and handle, I don’t know what is.

Just a great day today across the board.

Stronger payrolls and liquidity-driven BTC and ETH still trading well.

Break of the March highs and we launch. Could still do a little chop chop but days like today confirm…

[Ethereum] has achieved network effect. Only BTC and ETH are in this category, but SOL is moving in this direction as well. This is not an emotional appeal. I’m just looking at usage, revenues, community build, years in existence etc.”

Tapiero expects crypto staking, which typically offers higher yields compared to traditional financial products, to be a key component for the next bull market.

“Powerful driver of this crypto up cycle will be yield (yes, again).

3% on staked ETH now better than 2% on euro two-year, 1.4% on China two-year.

US two-year at 3.7% but expect 2% next year.”

The investor adds that China has opened the liquidity floodgates to stimulate its economy. According to Tapiero, the move is a huge bullish catalyst for Bitcoin.

“Huge macro event.

Things so bad in China, the government flinches.

QE (quantitative easing) for China equity.

Rate cuts.

Big liquidity coming.

Low likely in for China assets.

Bazooka.

Bullish gold, BTC.”

At time of writing, Bitcoin is trading at $63,648, up 3% in the past day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

You may like

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Cash (BCH) added nearly 35% to its value in the past month and rallied 12% on Nov. 21. Bitcoin’s (BTC) observed a rally to $98,384 early on Nov. 21, with BCH and other top cryptocurrencies tagging along for the ride.

An analysis of on-chain and technical indicators and data from the derivatives market shows that BCH could extend gains and retest its mid-April 2024 peak of $569.10.

Bitcoin hits all-time high, fork from 2017 ignites hope for traders

Bitcoin hit a record high of $98,384 on Nov. 21, a key milestone as the cryptocurrency eyes a run to the $100,000 target. BTC was forked in 2017, creating a spin-off or alternative, Bitcoin Cash.

BCH hit a peak of $1,650 in May 2021. Since April 2024, BCH has been consolidating with no clear trend formation.

BCH price rallied nearly 30% since Nov. 15, on-chain indicators show that further rally is likely in the Bitcoin spin-off token.

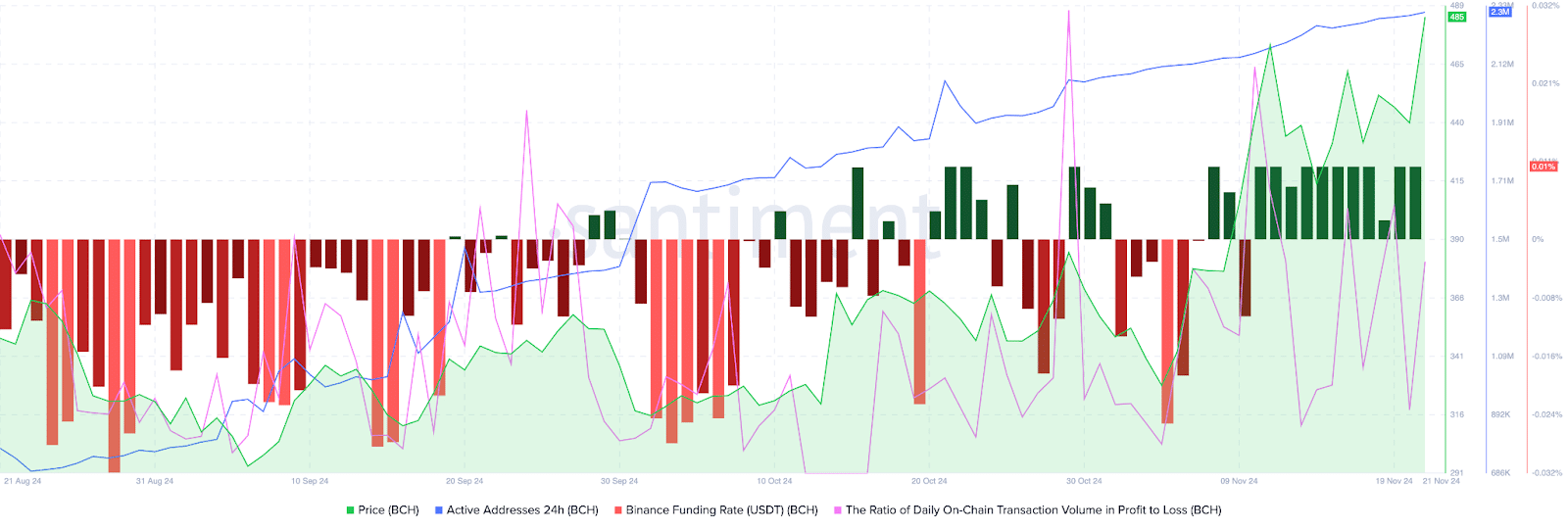

Bitcoin Cash’s active addresses have climbed consistently since August 2024. Santiment data shows an uptrend in active addresses, meaning BCH traders have sustained demand for the token, supporting a bullish thesis for the cryptocurrency.

The ratio of daily on-chain transaction volume in profit to loss exceeds 2, is 2.141 on Thursday. BCH traded on-chain noted twice as many profitable transactions on the day, as the ones where losses were incurred. This is another key metric that paints a bullish picture for the token forked from Bitcoin.

Binance funding rate is positive since Nov. 10. In the past eleven days, traders have been optimistic about gains in BCH price, according to Santiment data.

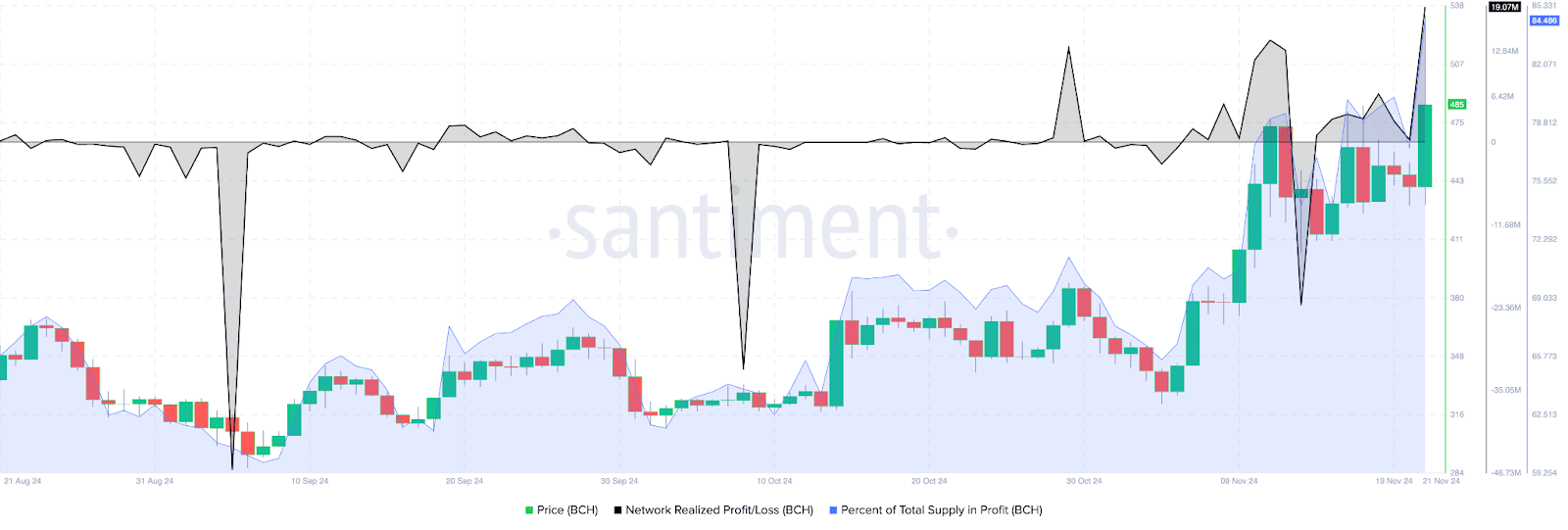

The network realized profit/loss metric identifies the net gain or loss of all traders who traded the token within a 24 hour period. NPL metric for Bitcoin Cash shows traders have been taking profits on their holdings, small positive spikes on the daily price chart represent NPL.

Investors need to keep their eyes peeled for significant movements in NPL, large positive spikes imply heavy profit-taking activities that could increase selling pressure across exchange platforms.

84.48% of Bitcoin Cash’s supply is currently profitable, as of Nov. 21. This metric helps traders consider the likelihood of high profit-taking or exits from existing BCH holders, to time an entry/ exit in spot market trades.

Derivatives traders are bullish on BCH

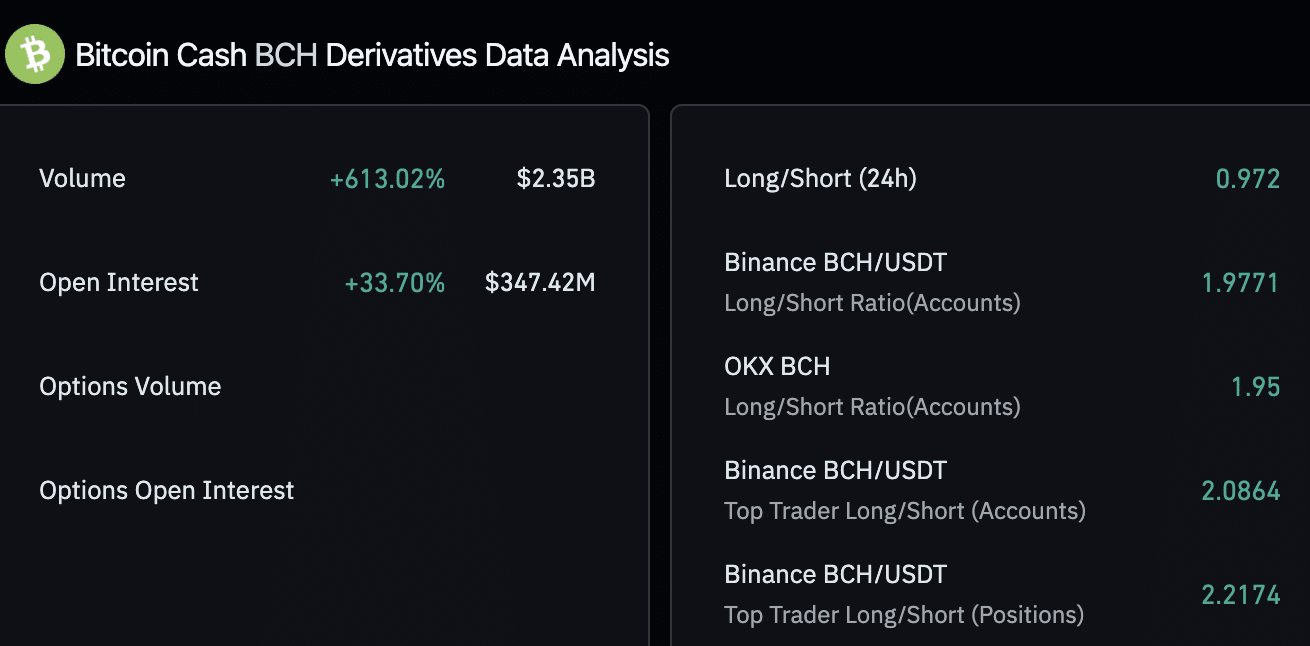

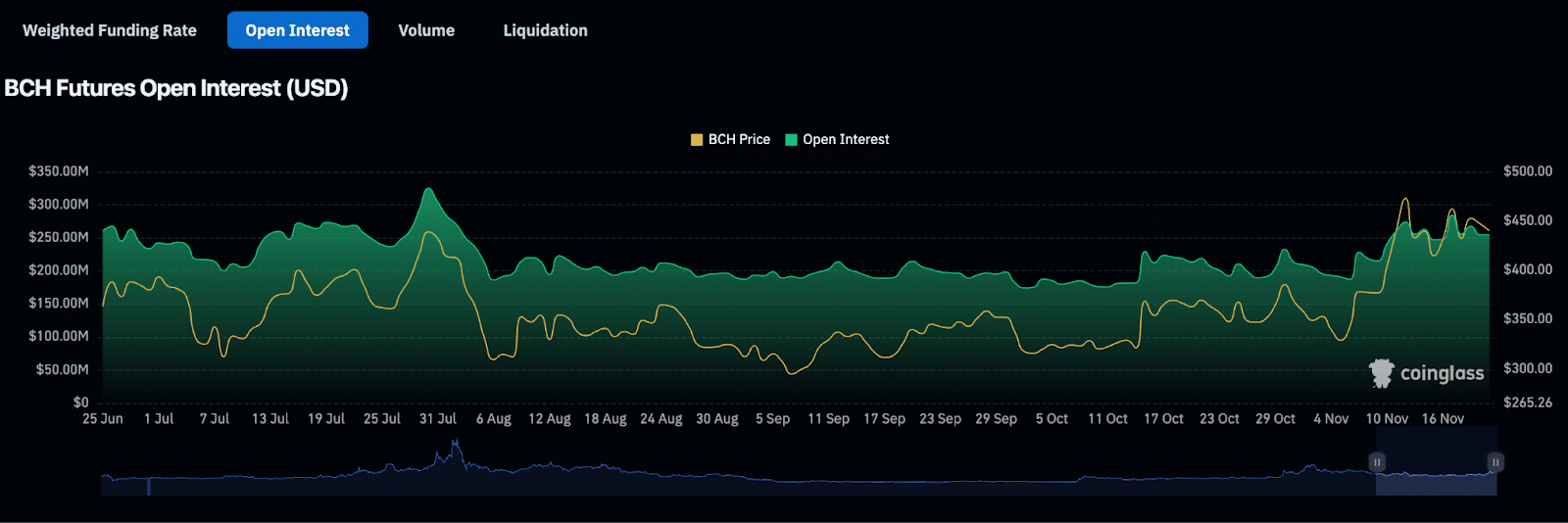

Derivatives market data from Coinglass shows a 33% increase in open interest in Bitcoin Cash. Open interest represents the total number of active contracts that haven’t been settled, representing demand for the BCH token among derivatives traders.

Derivatives trade volume climbed 613% in the same timeframe, to $2.35 billion. Across exchanges, Binance and OKX, the long/short ratio is above 1, closer to 2, meaning traders remain bullish on BCH and expect prices to rally.

BCH futures open interest chart shows a steady increase in the metric, alongside BCH price gain since November 5, 2024. Open interest climbed from $190.74 million to $254.87 million between November 5 and 21.

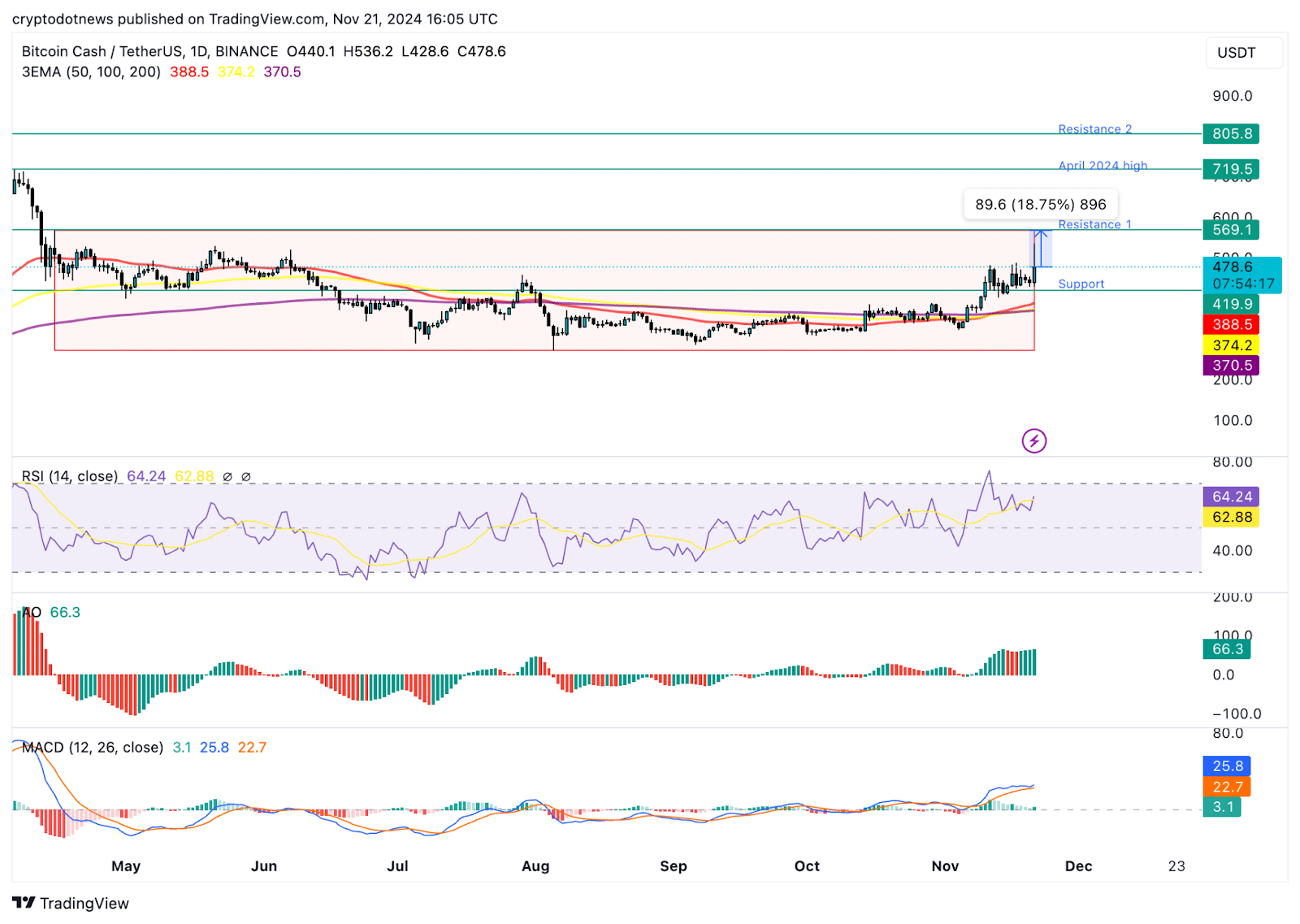

Technical indicators show BCH could gain 18%

The BCH/USDT daily price chart on Tradingview.com shows that the token remains within the consolidation. The token is stuck within a range from $272.70 to $568.20. BCH could attempt to break past the upper boundary of the range, a daily candlestick close above $568.20 could confirm the bullish breakout.

The April 2024 high of $719.50 is the next major resistance for BCH and the second key level is at $805.80, a key level from May 2021.

The relative strength index reads 64, well below the “overvalued” zone above 70. RSI supports a bullish thesis for BCH. Another key momentum indicator, moving average convergence divergence flashes green histogram bars above the neutral line. This means BCH price trend has an underlying positive momentum.

The awesome oscillator is in agreement with the findings of RSI and MACD, all three technical indicators point at likelihood of gains.

A failure to close above the upper boundary of the range could invalidate the bullish thesis. BCH could find support at the midpoint of the range at $419.90 and the 50-day exponential moving average at $388.50.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Source link

Bitcoin

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Published

7 hours agoon

November 22, 2024By

adminBitcoin has shattered expectations once again, surging past the critical $93,257 level in a display of unstoppable momentum. This breakout has ignited fresh waves of bullish optimism across the crypto market, as traders and investors anticipate greater gains. With market sentiment shifting and key indicators aligning, could this be the spark for Bitcoin’s next major rally?

As optimism steadily increases in the market, the goal is to take a closer look at BTC’s impressive breakout above the $93,257 mark, analyze the positive sentiment driving its climb, and assess the potential for continued upward strength in the market.

Bullish Indicators: What’s Fueling BTC’s Uptrend?

Currently, on the 4-hour chart, BTC is sustaining its position after successfully surpassing the $93,257 mark while trading above the 100-day Simple Moving Average (SMA). By maintaining its position above this level and the 100-day SMA, BTC demonstrates resilience and capability for more price growth, targeting new highs.

An analysis of the 4-hour Relative Strength Index (RSI) shows a significant surge, climbing to 70% from its previous low of 56%, indicating strong bullish pressure for BTC. While this increase signals growing positive market sentiment, it raises concerns about the rally’s sustainability since a price correction could occur if profit-taking ensues.

Bitcoin is showing strong positive movement after breaking past the $93,257 level, supported by a rise above the 100-day SMA, reflecting sustained bullish strength and potential for continued upward movement. The fact that BTC is consistently above the 100-day SMA suggests a solid trend and that the bulls are eager to push prices higher, possibly leading to an extended growth if pressure continues to build.

Finally, the RSI on the daily chart is currently at 81%, well above the key 50% threshold, signaling a strong uptrend for Bitcoin. With the RSI at this level, it suggests that the upside pressure is likely to continue, which means that Bitcoin’s price could keep rising in the near term, as there are no signs of a reversal or decline.

What The $93,257 Breakout Signals For Bitcoin

The $93,257 breakout opens the door to a more optimistic future outlook for Bitcoin. This key resistance level has been decisively breached, suggesting that BTC may continue its upbeat momentum, potentially targeting higher price levels such as the $100,000 mark and beyond.

However, careful monitoring is essential for any signs of resistance or market corrections that could hinder its ascent. Should such a scenario occur, Bitcoin’s price could begin to drop toward the $93,257 mark. A break below this level might trigger further declines, possibly testing additional support levels in the process.

Source link

Bitcoin

Bitcoin Approaches $100K; Retail Investors Stay Steady

Published

8 hours agoon

November 22, 2024By

admin

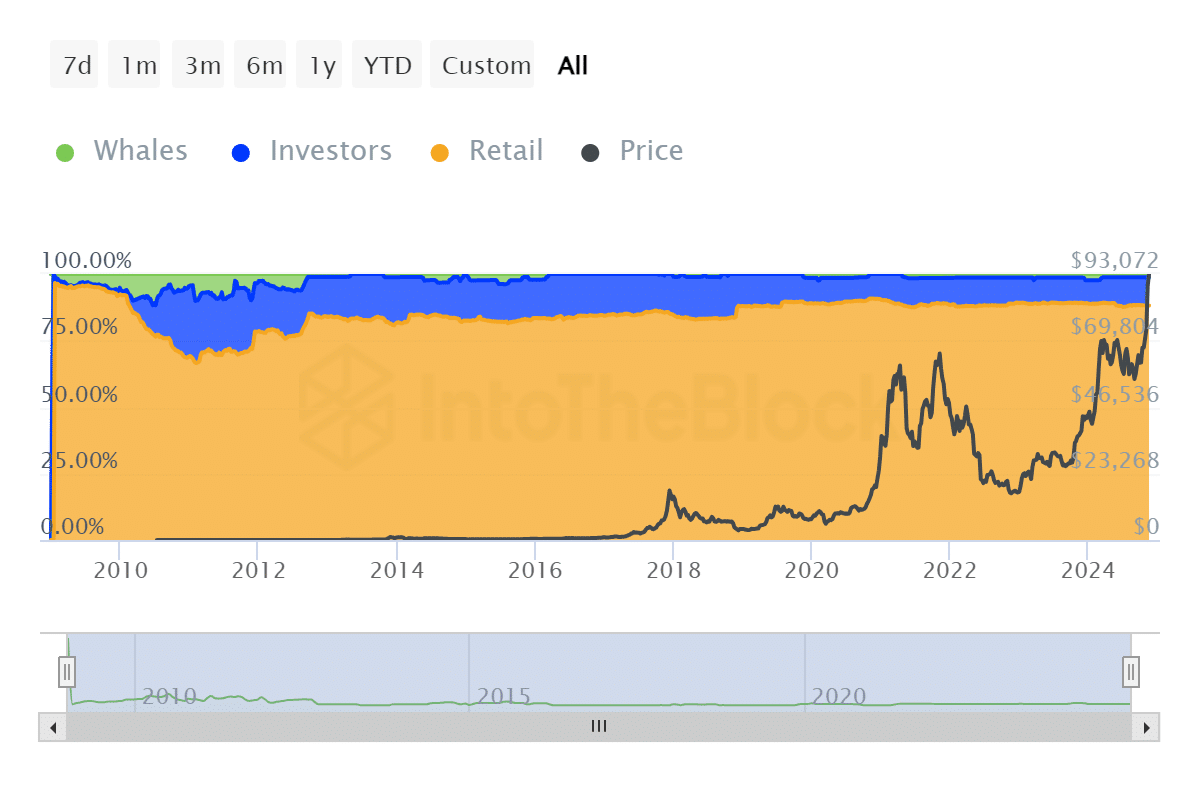

Bitcoin trades at $99,340.23, approaching the $100K mark as retail investors retain market dominance.

What is more interesting about this rally is the dominance of retail investors, who currently account for 88.07% of all Bitcoin (BTC) in circulation, according to The Block. Contrary to the recent claims that institutional investors are leaving retail investors behind in ownership of BTCs, the asset is still in the hands of retail investors, which underlines their stronghold in the market. This grassroots stronghold contrasts the much smaller shares held by whales at 1.26% and institutional investors at 10.68%.

Adding momentum to BTC, the historic debut of BlackRock’s BTC ETF options witnessed $1.9 billion in notional value traded on the first day. It is a landmark news because it signifies growing institutional interest in BTC, yet lowers entry barriers for everyday investors. But there’s still some way to go, says Jeff Park, Head of Alpha Strategies at Bitwise Invest, in his observations on X about the ETF’s potential to reshape access to BTC.

1/ Just as we expected, the market launched with a beautiful “volatility smile” quickly established by 945AM and for the rest of the day. In fact, the smile got even wider throughout the day, finishing with higher wings by EoD. pic.twitter.com/BHI09pORS4

— Jeff Park (@dgt10011) November 20, 2024

Bitcoin Breakdown:

How BTC ownership is distributed supports the overall trend of asset availability in the market. Companies such as Coinbase have substantial quantities of BTC, holding more than 2.25 million BTC. However, most of this is kept for their clients. Satoshi Nakamoto‘s wallet, which contains 96,8452 BTC, remains untouched as it played a role in creating the Genesis block.

Overall, funds and ETFs account for 1.09 million BTC, or about 5.2%, while governments such as the U.S. and China collectively hold around 2.5%.

Despite BTC witnessing price surges, the market is far from stable and often shows extreme volatility. For instance, on Nov. 21, the price of BTC dipped to $95,756.24, with trading volume reaching $98.40 billion. This volatility then reflects the vital role that retail investors play during price hikes, even as institutional investors become more active in the market.

Some argue that BTC is becoming more centralized, but the data does not back this claim. Financial products like ETFs are attractive to institutions, but they also make BTC more accessible to retail investors. BTC continues to align with Satoshi Nakamoto’s vision of a decentralized and democratized financial system. As BTC nears the $100,000 threshold, its open-and-shut conversation that BTC’s ownership remains essential.

Source link

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

Rare Shiba Inu Price Patterns Hint SHIB Could Double Soon

The Bitcoin Pi Cycle Top Indicator: How to Accurately Time Market Cycle Peaks

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Bitcoin Approaches $100K; Retail Investors Stay Steady

Solana Hits New ATH On Huge Whale Accumulation, More Gains Ahead?

Microsoft Should Buy $78 Billion Worth of Bitcoin

Ethereum Believers May Be Staring Down Opportunity As ETH Reaches Another Low Against Bitcoin: CryptoQuant CEO

UK government is ready for crypto regulations next year

“Crypto Dad” Chris Giancarlo Emerges Top For White House Crypto Czar Role

Bitcoin Nears $100,000 As Trump Council Expected To Implement BTC Reserve

Know Your Missiles: Russia’s Experimental Hypersonic Missile Is A New Kind of Killing Machine

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential