Bitcoin

SEC filing underway, Bitcoin rewards app Fold adopts FLD ticker

Published

2 months agoon

By

admin

Bitcoin financial services company Fold app has submitted an S-4 SEC filing to the US Securities and Exchange Commission in preparation to go public with its IPO.

The Fold app submitted its S-4 SEC filing on Oct. 7. An S-4 filing is a statement created with the SEC by a publicly traded company undergoing a merger or acquisition. In the case of Fold, it announced last July that it plans to go public by merging with FTAC Emerald Acquisition.

According to the document, if the merger is approved and recognized by stakeholders and regulators, then Fold will remain listed on the Nasdaq with FLD as the new ticker symbol. The registration statement lists the firm Emerald as the registrant and Fold as the co-registrant.

“Merger Sub will be merged with and into Fold, with Fold surviving the Merger as a wholly-owned subsidiary of Emerald,” said the statement.

In July 2024, Fold agreed to merge with the special purpose acquisition company FTAC Emerald Acquisition at a pre-money equity valuation of $365 million.

According to the press release, Fold currently holds more than 1,000 Bitcoin(BTC) in its balance sheets. The funds acquired from the merger were allocated for the purpose of bolstering Fold’s growth in regards to its operations and treasury

The fintech company was founded in 2019 Founded in 2019 by William Reeves, Matthew Luongo, and Corbin Pon, Fold raised $20.2 million from 28 investors, according to PitchBook. Fold allows users to earn bitcoin rewards through its debit card, similar to credit card cashback. The company currently has 574,000 accounts.

In 2020, Fold partnered with Visa to introduce a new card that enables users to receive 1 to 2 percent of payment made back in the form of Bitcoin. In 2023, the Visa-Fold rewards program expanded to accommodate card users living in Latin America, Europe, and Asia Pacific regions.

Source link

You may like

Newmarket Capital Launches Battery Finance, Bitcoin-Collateralized Loan Strategy

Can the XRP price realistically jump to $10 in 2024?

Shiba Inu Price Eyes 76% Rally As 6.8m SHIB Tokens Burned

VanEck Doubles Down on Big Bitcoin Price Target, Says Key Indicators Continue To ‘Signal Green’

Multichain AI token poised to dethrone SOL, TON: 5,000% gains expected

Will Pi Network Price Reach $100 in This Bull Market?

Battery Finance

Newmarket Capital Launches Battery Finance, Bitcoin-Collateralized Loan Strategy

Published

24 mins agoon

November 25, 2024By

admin

Newmarket Capital recently closed the first investment deal for its new Battery Finance loan strategy, which enables borrowers to incorporate bitcoin into long-term financing structures as collateral.

On November 7, 2024, Newmarket Capital, an institutional capital manager and Registered Investment Adviser completed a refinancing for the Bank Street Court apartment in Old City, Philadelphia, PA. The loan was collateralized by both the building and approximately 20 bitcoin.

Newmarket Capital CEO Andrew Hohns is excited about not only setting his company’s new strategy in motion but the symbolism in the deal.

“It’s a building that is located less than half a block away from the first bank of the United States,” Hohns told Bitcoin Magazine. “Philadelphia has had a lot of firsts and innovations over the years, and we’re proud to contribute another one to the list.”

How The Battery Finance Strategy Works

Battery Finance enables bitcoin to be used as 10% to 30% of the collateral for loans alongside traditional assets. To bring this new strategy to life, Newmarket Capital partnered with Ten 31 to establish Battery Finance, a majority-owned subsidiary of Newmarket Capital that utilizes bitcoin in financing structures.

Unlike other lending companies that let clients borrow against bitcoin with a risk of liquidation in the event that bitcoin’s price drops below a certain threshold, Newmarket Capital removes the risk and offers loan structures without a mark-to-market trigger.

“As lenders, we are constructive on the long-term value of bitcoin and comfortable recognizing bitcoin as collateral without mark-to-market risk,” said Hohns.

“We achieve this by incorporating bitcoin as a component of a broader collateral package alongside traditionally financeable assets. In this way, we have improved our downside through the introduction of bitcoin, an uncorrelated element — an asset that has had such a strong history of appreciation over time — in the collateral package.”

Deals that employ this strategy can be structured differently. In some cases, a borrower can use bitcoin they’re already holding as collateral for a loan, while, in other cases, Newmarket Capital and the borrower purchase bitcoin as part of the loan’s structure. The latter is how the loan for the Bank Street Court building was structured.

“It’s a $16.5 million building, and we offered the building owner a $12.5 million loan,” explained Hohns.

“The use of proceeds was to pay off the existing financing, which was $9 million, to provide them with approximately two million dollars of CapEx for certain improvements to the property they wanted to make,” he added.

“With the remaining $1.5 million dollars, we purchased just shy of twenty bitcoin as part of our combined collateral package.”

(At the time of writing, that bitcoin had already appreciated 30% in value since it was purchased for the loan.)

Unlike traditional loans which often lock borrowers in with prepayment penalties or a make-

whole, the Bank Street Court financing can be paid off at any time with no penalty. To allow for this outcome, the borrower and the lender align to share appreciation on the upside from the bitcoin over the life of the loan.

The longer the loan is outstanding, the greater the share of bitcoin appreciation that vests for the borrower, incentivizing borrowers to take a long term view on the bitcoin.

Although the loan can be repaid at any time and the building released, the earliest that the bitcoin can be wound down is four years, in line with bitcoin’s four year rhythm. The loan carries a single digit interest rate and has a maturity of 10 years.

Bringing Forward Bitcoin’s Value

Hohns, a Bitcoiner himself, understands that other Bitcoiners have a low time preference, that they prioritize future economic well-being over more immediate gratification. However, he acknowledges that there are limits to this approach, which is why Newmarket Capital created the Battery Finance strategy.

“The lowest time preference is not feasible for humans, because we have a finite life,” he said.

“There’s a point where we want to accomplish things with our lives. We want to grow our business or start a new business or just do the things that we all have passion for, like opening up a MakerSpace or a brewery or a bookstore — whatever the case might be. If you’re just HODLing the Bitcoin, you’re deferring those dreams,” he added.

“By offering this financing tool, we can essentially serve as a mechanism to transform those time preferences, to bring forward the appreciation of the bitcoin by offering a significant amount of financing to accomplish whatever the real world goals borrowers have.”

Target Borrowers

Battery Finance is currently focused on working with borrowers who are interested in acquiring or refinancing commercial properties.

“For the time being, we’re inviting interest around loans that are, generally speaking, $10 million to $30 million dollars, which include 10% to 30% percent bitcoin with 70% to 90% percent traditionally-financeable income-producing assets,” explained Hohns.

“This is a tool for both asset owners that want to redenominate some of the equity in their

existing portfolio into bitcoin and its also a tool for Bitcoiners who want to obtain stable long-term financing supported in part by their bitcoin to acquire assets in the real world. This way, they can generate income and accomplish their goals while remaining invested in bitcoin.”

In time, Battery Finance plans to service a broader range of customers.

“We see broad applicability for this lending structure, including, over time, to people that are at different phases of their Bitcoin savings journeys,” said Hohns. “I hope that these kinds of products will develop into solutions that enable people to do things like finance a house or automobile with their bitcoin.”

Source link

Bitcoin

VanEck Doubles Down on Big Bitcoin Price Target, Says Key Indicators Continue To ‘Signal Green’

Published

4 hours agoon

November 25, 2024By

admin

Asset management firm and exchange-traded fund (ETF) issuer VanEck is standing firm on its bullish price prediction for Bitcoin (BTC).

In a new report, VanEck says a number of key indicators the firm tracks continue to suggest that BTC is not yet in the late stages of a bull run.

“Now in uncharted territory with no technical price resistance, we believe the next phase of the bull market is just beginning. This pattern mirrors what happened four years ago, when Bitcoin’s price doubled between the 2020 election and year-end, followed by an additional ~137% gain in 2021.

With a transformative shift in government support for Bitcoin underway, investor interest is rising rapidly; we are receiving inbound calls at an accelerating pace as many investors find themselves under-allocated to the asset class. While we remain vigilant for signs of overheating, we reiterate our cycle price target of $180,000/ BTC as a number of key indicators we track continue to signal green for this rally.”

VanEck also looks at perpetual futures trading data, or “perps” which are derivative contracts that allow traders to easily leverage trade cryptocurrencies. The perp market is balanced by funding rates that force one side of the market to pay the other to keep positions open.

The firm says that BTC becomes overheated when the 30 Displaced Moving Average (DMA) perp funding rates exceed 10% for one to three months.

VanEck also expects the new US presidential administration slated to be led by Donald Trump to be more accommodative to the crypto industry, helping boost further rallies as 2025 comes into view.

“In our view, this election marks a bullish turning point, reversing years of offshoring jobs and capital caused by previous hawkish leadership. By fostering entrepreneurial dynamism, the US is poised to become a global leader in crypto innovation and employment, transforming crypto into a critical industry for domestic growth and a key export to emerging markets.”

At time of writing, Bitcoin is trading at $97,098.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any losses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Source link

Bitcoin has surged past the $99,800 mark, setting another all-time high as it inches closer to the psychological $100,000 milestone. Despite briefly testing the level, BTC has yet to break through, leaving investors and analysts eagerly anticipating the next move. With demand remaining robust, the stage appears set for Bitcoin to push past this key barrier in the coming days.

Related Reading

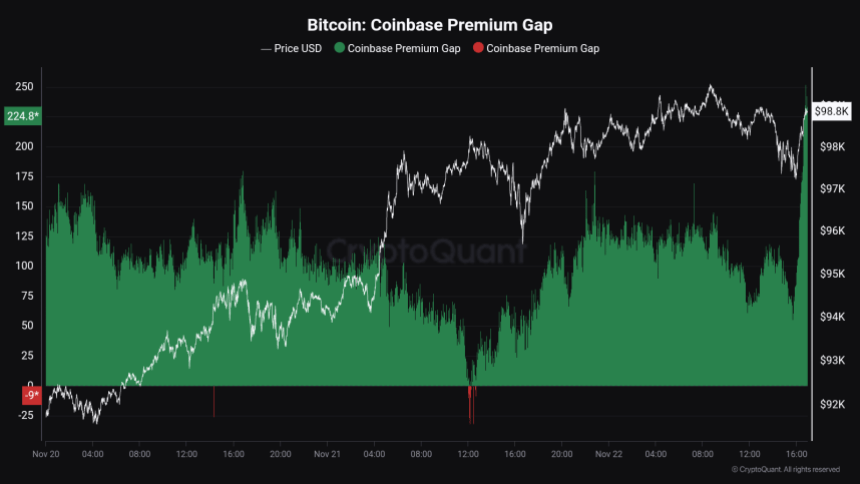

Recent data from CryptoQuant highlights a significant factor driving this rally: the Coinbase Premium Gap, which currently sits at $224. This metric, representing the price difference between Bitcoin on Coinbase and other global exchanges, signals strong buying activity from US Coinbase investors.

The relentless upward momentum has further solidified Bitcoin’s dominance in the crypto market, with many viewing the $100,000 level as a critical supply zone. While the price has yet to break through, the ongoing rally reflects a growing belief that Bitcoin’s parabolic bull phase is far from over. As the market approaches this pivotal moment, all eyes remain on BTC’s ability to sustain its momentum and claim new highs, setting the tone for the weeks ahead.

Bitcoin Price Action Remains Strong

Bitcoin has been in an “only up” phase since November 5, showing no signs of weakness as it consistently climbs to new heights. Even after failing to break above the $100,000 mark yesterday, price action remains incredibly strong. Bulls are firmly in control, and if Bitcoin holds above critical demand levels, the long-anticipated $100,000 milestone could be breached within hours.

CryptoQuant analyst Maartunn revealed that robust demand from US investors is a key driving force behind this rally. According to his data, the Coinbase Premium Gap—a metric that tracks the price difference between Bitcoin on Coinbase and other global exchanges—stands at $224.

This positive premium underscores US-based buying activity as a significant factor in the current bullish momentum. A high premium often suggests that investors on Coinbase are willing to pay a higher price than others, a strong indicator of heightened demand.

Related Reading

As the market watches closely, Bitcoin’s ability to maintain its upward trajectory hinges on staying above vital support levels. The psychological resistance at $100,000 remains formidable, but the unyielding appetite from US investors points to continued strength in the days ahead. With such solid fundamentals, many analysts believe Bitcoin is poised for another explosive rally once the $100,000 barrier is decisively cleared.

BTC Rally Is Only Starting

Bitcoin is trading at $98,800 after a failed breakout above the highly anticipated $100,000 mark. Despite this temporary setback, price action remains firmly bullish as BTC continues to hold above key demand levels, showing resilience and strength in the current market. The failure to retrace to lower prices indicates that bullish momentum is still intact, keeping investors optimistic about a potential breakthrough.

If BTC maintains its position above the critical $95,000 support level, the likelihood of a surge past the $100,000 psychological barrier increases significantly. Holding above this level would signal strong buyer interest and the potential for further upside, paving the way for Bitcoin to resume its upward trajectory in the near term.

Related Reading

However, if Bitcoin fails to hold above $95,000, a retrace to lower demand zones would confirm a short-term correction. Such a pullback could provide the necessary fuel for the next rally, as it would allow the market to consolidate before making another attempt at breaking the $100,000 mark.

For now, all eyes remain on Bitcoin’s ability to defend its key support levels as the market anticipates the next major move in this historic rally.

Featured image from Dall-E, chart from TradingView

Source link

Newmarket Capital Launches Battery Finance, Bitcoin-Collateralized Loan Strategy

Can the XRP price realistically jump to $10 in 2024?

Shiba Inu Price Eyes 76% Rally As 6.8m SHIB Tokens Burned

VanEck Doubles Down on Big Bitcoin Price Target, Says Key Indicators Continue To ‘Signal Green’

Multichain AI token poised to dethrone SOL, TON: 5,000% gains expected

Will Pi Network Price Reach $100 in This Bull Market?

Axie Infinity developer cuts 21% workforce: report

Chill Guy Meme Coin Pumps Another 50% as Creator Fights Back

Super Pepe Coin Whale Sells 130B PEPE, Shifts Focus To EIGEN

AI predicts one altcoin set to outperform XRP and Solana in 2025

BTC and Major Altcoins Pullback, SAND Soars 60%

Трамп обирає менеджера прокрипто-хедж-фонду Скотта Бессента на посаду міністра фінансів

Trump calls up crypto pals, Senator says sell gold for Bitcoin | Weekly Recap

Where to Invest in November End?

XRP Price Hits 3-Year High At $1.6

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential