Relative Strength Index

Here Are Potential Bullish Turnaround Points

Published

2 months agoon

By

admin

SUI is experiencing a notable pullback after its recent rally, with multiple key support levels coming into focus. As the price edges lower, these areas will play a pivotal role in determining whether the asset can regain its bullish momentum. A strong defense of these supports could signal the start of a fresh upward move, while a failure to hold may lead to deeper declines.

This article aims to assess SUI’s recent price pullback and explore critical support levels that could trigger a potential bullish reversal. By analyzing technical indicators and market conditions, it seeks to provide insights into possible recovery scenarios, highlighting the levels to watch for a sustained upward movement or further downside risk.

Recent Price Action: SUI’s Decline Explained

Recently, SUI’s price has taken a bearish turn on the 4-hour chart, following a rejection at the $2.1 resistance level. Despite this decline, the cryptocurrency remains above the 100-day Simple Moving Average (SMA), indicating that a recovery may be possible, provided buyers regain control and the market shifts back in favor of the bulls.

An analysis of the 4-hour Relative Strength Index (RSI) suggests that bulls could be preparing for a resurgence. Although the RSI has slipped to 55% from the overbought zone, it remains above the crucial 50% mark, indicating that bullish momentum persists. This positioning reflects a temporary slowdown, but as long as the RSI holds above this threshold, the market retains the potential for renewed upward movement.

Related Reading

Also, on the daily chart, SUI is exhibiting signs of negative pressure, trading above the 100-day SMA. While the price remains above the SMA, this current bearish movement could be short-lived, as there remains a possibility for a price recovery. The positioning above the SMA implies that buyers could step in to reverse the trend if they regain control, potentially leading to a rebound in price.

Finally, on the 1-day chart, a closer examination of the RSI formation indicates that SUI’s price may experience further declines, as the signal line has descended to 69% from the overbought territory. However, there is the possibility of a bullish comeback if the RSI can maintain its position above the 50% threshold.

Key Support Levels: Where Could SUI Buyers Step In?

SUI is approaching critical support levels that could attract buyers and trigger a recovery. The initial key level to monitor is the $1.4 support zone, which could serve as a critical point for renewed bullish interest.

Related Reading

Should buyers step in at this level, SUI might rebound toward the $2.1 resistance mark. A successful breakout above this resistance could pave the way for the formation of a new all-time high, signaling a strong resurgence.

However, if the $1.4 support level fails, the next critical area to watch is around the $1.1 mark, where a stronger base of support could form as the price continues to decline. Maintaining these levels is crucial since it will determine whether SUI can regain upward momentum or remain vulnerable to more bearish pressure.

Featured image from YouTube, chart from Tradingview.com

Source link

You may like

Will This Sell Signal Trigger ETH Crash?

No, Michael Saylor Doesn't Control Bitcoin

This Solana Rival Is Looking Great Amid Bitcoin Pullback, Says Top Crypto Analyst

Capybara is down by nearly 30% in 24-hour trading

Can Dogecoin Price Realistically Hit $4.20?

Remembering John McAfee's Bullish Bitcoin Price Bet as we near $100K Milestone

Bitcoin

Bitcoin Breakout At $93,257 Barrier Fuels Bullish Optimism

Published

5 days agoon

November 22, 2024By

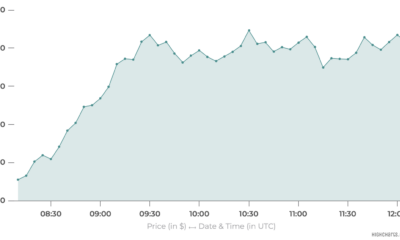

adminBitcoin has shattered expectations once again, surging past the critical $93,257 level in a display of unstoppable momentum. This breakout has ignited fresh waves of bullish optimism across the crypto market, as traders and investors anticipate greater gains. With market sentiment shifting and key indicators aligning, could this be the spark for Bitcoin’s next major rally?

As optimism steadily increases in the market, the goal is to take a closer look at BTC’s impressive breakout above the $93,257 mark, analyze the positive sentiment driving its climb, and assess the potential for continued upward strength in the market.

Bullish Indicators: What’s Fueling BTC’s Uptrend?

Currently, on the 4-hour chart, BTC is sustaining its position after successfully surpassing the $93,257 mark while trading above the 100-day Simple Moving Average (SMA). By maintaining its position above this level and the 100-day SMA, BTC demonstrates resilience and capability for more price growth, targeting new highs.

An analysis of the 4-hour Relative Strength Index (RSI) shows a significant surge, climbing to 70% from its previous low of 56%, indicating strong bullish pressure for BTC. While this increase signals growing positive market sentiment, it raises concerns about the rally’s sustainability since a price correction could occur if profit-taking ensues.

Bitcoin is showing strong positive movement after breaking past the $93,257 level, supported by a rise above the 100-day SMA, reflecting sustained bullish strength and potential for continued upward movement. The fact that BTC is consistently above the 100-day SMA suggests a solid trend and that the bulls are eager to push prices higher, possibly leading to an extended growth if pressure continues to build.

Finally, the RSI on the daily chart is currently at 81%, well above the key 50% threshold, signaling a strong uptrend for Bitcoin. With the RSI at this level, it suggests that the upside pressure is likely to continue, which means that Bitcoin’s price could keep rising in the near term, as there are no signs of a reversal or decline.

What The $93,257 Breakout Signals For Bitcoin

The $93,257 breakout opens the door to a more optimistic future outlook for Bitcoin. This key resistance level has been decisively breached, suggesting that BTC may continue its upbeat momentum, potentially targeting higher price levels such as the $100,000 mark and beyond.

However, careful monitoring is essential for any signs of resistance or market corrections that could hinder its ascent. Should such a scenario occur, Bitcoin’s price could begin to drop toward the $93,257 mark. A break below this level might trigger further declines, possibly testing additional support levels in the process.

Source link

Relative Strength Index

SUI Price Stability At $3.5 Signals Room For More Growth, $4 Mark Imminent?

Published

1 week agoon

November 19, 2024By

admin

Despite market fluctuations, SUI has demonstrated remarkable stability, holding steady above the critical $3.5 support level. This steady performance reflects underlying bullish momentum, as buyers continue to defend this key zone, boosting confidence in the asset’s upward potential. With strong support intact, SUI appears well-positioned to target higher resistance levels, sparking optimism for further gains.

This analysis aims to explore SUI’s ability to stay above the $3.5 level and assess its implications for future price movements. By examining key technical indicators and resistance zones, this piece seeks to provide insights into whether SUI can sustain its bullish strength or if market pressures could trigger a shift in its trajectory.

What SUI Stability Above $3.5 Means For Bulls

SUI is showcasing renewed bullish strength as it maintains a firm position above the critical $3.5 support level. This stability highlights growing buying interest and market confidence, paving the way for a possible move toward the $4 mark. Its ability to hold above this key level and the 4-hour Simple Moving Average (SMA) reinforces the asset’s upward momentum, and positions SUI for further gains if positive sentiment persists.

An analysis of the 4-hour Relative Strength Index (RSI) analysis shows a rebound from 51%, rising toward and above the 60% level, indicating a renewed optimistic outlook. If the RSI continues to rise above 60%, it would confirm the positive trend, boosting the potential for more price growth.

Additionally, SUI shows significant upward movement on the daily chart, marked by the formation of a bullish candlestick as it moves toward the $4 mark. Trading above the crucial 100-day SMA reinforces the positive trend, indicating sustained strength. As SUI continues to climb, it bolsters market confidence, setting the stage for growth. With upside pressure brewing, the next key target to watch out for is the $4 resistance level, which could determine whether the bullish move extends.

The daily chart’s RSI has increased to 80%, signaling strong positive sentiment with sustained buying pressure. While the asset remains in an overbought territory, it shows no signs of weakening. If the momentum continues, further price gains are possible, though one should be cautious, as prolonged overbought conditions could lead to a correction if buying pressure decreases.

Potential Scenarios: Upside Targets And Risks To Watch

SUI’s current stability above the $3.5 support level indicates potential for continued upside. Should buying pressure persist, the next key target lies at $4, where bullish interest could be triggered, leading to new price highs.

However, if resistance at $4 proves challenging to break through, consolidation or a minor decline may occur, possibly causing the price to retreat toward the $3.5 support level. A break below this level could result in additional losses, with the next key support target being around $2.8, followed by other support areas below.

Source link

Bitcoin

Bitcoin Surges Past $93,000 – Can A Breakthrough Unlock New Heights?

Published

2 weeks agoon

November 16, 2024By

admin

Bitcoin is on the move again, surging toward its previous high of $93,257 with renewed momentum that has triggered excitement among traders. After a period of consolidation, Bitcoin’s latest price action signals a potential breakout that could set the stage for even greater gains. As it inches closer to this critical resistance level, can the crypto giant break through and unlock new heights, or will the bears reclaim control? With the market’s eyes fixed on this pivotal moment, the next move could reshape BTC’s future.

This analysis aims to explore Bitcoin’s current surge toward the $93,257 resistance level and assess the likelihood of a breakout. By examining key technical indicators and market trends, it seeks to determine whether BTC can overcome this significant hurdle and reach new highs. Additionally, it will explore the possible impact of such a breakthrough on its price trajectory and the broader market sentiment.

Bitcoin’s Renewed Momentum Leading To $93,257

Bitcoin is currently maintaining a bullish stance, holding firmly above the 100-day SMA on the 4-hour chart, a strong indicator of continued upward momentum. The price now aims for its previous high of $93,257, having successfully avoided a drop below the $85,211 support. If this pressure continues, a break above $93,257 could create a path for new highs, while holding above the $85,211 support level signals strength in the ongoing rally.

An analysis of the 4-hour Relative Strength Index (RSI) shows a continued upside movement as the RSI climbs to 61% after dipping to 53%, signaling that the market is maintaining its bullish strength. Significantly, the sustained rise in the RSI suggests that the uptrend is gaining traction with the potential for more price increases as the buying pressure builds.

Related Reading

Additionally, the daily chart reveals that BTC is experiencing strong upbeat momentum, highlighted by the formation of bullish candlesticks. The asset’s position well above the key 100-day SMA further reinforces this positive trend. As BTC maintains its current trajectory, it bolsters market optimism, setting the stage for additional gains as it aims for the $93,257 target.

Lastly, the RSI on the daily chart is at 92%, indicating strong positive movement after recovering from a dip to 77% suggesting a shift in market sentiment with increased buying pressure. While the high RSI points to continued growth, prolonged overbought conditions may lead to a correction if buying activity begins to wane.

Key Resistance: Can Bitcoin Push Through?

Bitcoin is approaching a critical resistance level at $93,257, a price point that could determine the next phase of its bullish trajectory. If Bitcoin successfully surpasses $93,257, it could pave the way for new highs, indicating continued strength in the market.

Related Reading

However, if the resistance holds, Bitcoin could experience a pullback or consolidation, with the price retracing toward the $83,211 support level. A break below this support could indicate more declines, with the possibility of testing additional key support zones.

Featured image from iStock, chart from Tradingview.com

Source link

Will This Sell Signal Trigger ETH Crash?

No, Michael Saylor Doesn't Control Bitcoin

This Solana Rival Is Looking Great Amid Bitcoin Pullback, Says Top Crypto Analyst

Capybara is down by nearly 30% in 24-hour trading

Can Dogecoin Price Realistically Hit $4.20?

Remembering John McAfee's Bullish Bitcoin Price Bet as we near $100K Milestone

Cramer Doubles Down on Bitcoin, Pushes Back Against Criticism He Called the Top

Tornado Cash smart contracts cleared of OFAC sanctions in latest ruling

Bitcoin Price May Crash Below $88,000 On Global M2 Money Correlation

Use Bitcoin Easily And Privately With Cake Wallet

Ripple Drops Another $25M Into Crypto PAC to Sway 2026 Congressional Races

Suriname presidential candidate eyes on Bitcoin adoption

US Court Rules Tornado Cash Smart Contracts Not Property, Lifts Ban

Maximizing Bitcoin Accumulation – Beyond the Benchmark

Bitcoin Crashes Under $93,000: What’s Behind It?

182267361726451435

Why Did Trump Change His Mind on Bitcoin?

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Bitcoin Open-Source Development Takes The Stage In Nashville

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Price analysis4 months ago

Price analysis4 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential