Blockchain

Put developers at the center of web3

Published

1 month agoon

By

admin

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Web3 development has stalled. The concepts that have dominated the current crypto cycle—L2s, DeFi, RWAs, gaming, and prediction markets—originated in the previous cycle. We’re not growing, and we’re not innovating—we’re stuck.

The web3 dev community has done historic work, but that community is vanishingly small—approximately 22,000, less than 0.1% of the estimated 27 million developers worldwide. We can’t onboard “the next billion users” until we onboard the first million devs. To get them, we need to empower devs by treating them as not just builders but creatives, embracing AI dev tools, and fostering a culture of developer collaboration.

In his keynote address at the recent Token2049 extravaganza in Singapore, Ethereum (ETH) co-founder Vitalik Buterin outlined his vision for the future of blockchain: finish building the “durable digital structures” that comprise the network’s ecosystem, work toward making crypto faster, cheaper, and easier to use; and preserve the aspirational qualities of blockchain tech that differentiate it from the traditional financial system.

It’s an inspiring vision. But who’s going to do all this building and all this work? Where are all the ideas to realize this vision supposed to come from? As we often say in web3, “Devs, do something!”

The numbers keep falling

Yet, in 2023, the overall number of blockchain devs fell by more than 10%, driven by an exodus of “newcomer” devs (those with less than one year of experience in blockchain), whose numbers dropped over 50% year-over-year. Even with last year’s milestone rollout of Ordinals, Bitcoin (BTC) lost 19% of its devs, leaving only 1,000 BTC builders.

The number of web3 developers is decreasing; we need this number to increase. So, instead of saying, “Devs, do something!” we need to say, “Do something for devs!” To make web3 a more appealing home for developers, we need to let them cook. Here’s how.

Devs are creatives, so treat them that way. Devs are innovative and innovation is creative, so devs are creatives. Creativity is messy, non-linear, and doesn’t always happen on schedule. Let’s stop treating devs as if their role is to compile pre-existing blocks of code into pre-designed Lego towers, because it’s not. Let’s give devs the support they need to create, test, and build new ideas.

AI is a part of coding now, so embrace it. AI is not a dev replacer; it’s a dev enhancer. AI is a dev mech suit. AI is how Gen Z will learn and write code, massively accelerating the learning curve for newer devs. Junior devs will be able to focus on mastering concepts rather than trying to piece together incomplete documentation or wading through thousands of lines of code for that one missing semicolon.

And AI isn’t just for beginners. Experienced devs are already using AI-powered tools to reduce time to deployment and assist with increasingly important audits of increasingly complex smart contract protocols.

My company, Cookbook, offers ChefGPT, an AI chatbot that can help spark ideas, search smart contract libraries for templates, troubleshoot problems, and more. For devs, this means it’s faster and easier to plan, build, and deploy projects onchain. For developer relations reps, this means devs get answers faster in every language and time zone.

AI dev tooling has a key role to play in the future of web3. Let’s make these tools available to as many devs and students as possible.

The need for a community

Devs work best when they work together, so help them collaborate. We talk about community a lot in web3, but our web3 dev community is fractured and isolated. Web3 devs are a small community that should be closer. There are nearly ten times as many members in the BAYC Discord (still) than there are web3 devs. Web2 devs are far more collaborative than web3 devs.

That could be attributed to the still-emerging status of the web3 industry, where devs often are also owners, executives, investors, or otherwise have direct interests in the success of their protocol. Consequently, they may feel they have competing interests against others’ success. But that doesn’t fully explain the lack of collaboration among web3 devs.

Web3 is tribal. Bitcoin vs. Ethereum vs. Solana, and so on, has sometimes felt like a religious war unfolding on crypto Twitter. But the reality is that we are now, and have always been, moving toward a multi-chain universe where different blockchains serve different use cases with increasing degrees of interoperability. So, while fun is fun, the idea that we need to shred each other over different VM structures as human sacrifices to the Twitter algorithm is dumb. Vitalik is a Bitcoiner. Anatoly ♥️ ETH. Less bickering, more building.

That means less forking and reskinning of others’ projects. It also means more communication and cooperation with other devs. Messageboards and virtual meetings are OK, but much of the real relationship-building has to occur—gasp—in real life.

It’s a truism going back to Steve Jobs and Pixar—or even WWII-era Bell Labs—that random interactions between creative people tend to spark creative ideas. Web3 needs that energy. And we know that people are less inclined to drag each other online when they have to see each other in person. So, let’s meet up.

One simple way to facilitate these IRL interactions is to create more shared workspaces like the House of Web3 in San Francisco. We’re fortunate to have strong global crypto communities—in San Francisco, New York, Lisbon, Zug, Singapore, Buenos Aires, Lagos, Sydney—so let’s activate them. Let’s get in some rooms with some whiteboards and design the future together.

Web3 has made enormous progress in its mission to build a more open successor to Web2. To regain the momentum that we had before 2022, we need to do more for devs. Don’t just give devs work. Let devs cook.

Tyler Sehr

Tyler Sehr is a developer and builder specializing in web3 and blockchain development. He is currently the CEO and Founder of Cookbook.dev, a platform focused on simplifying smart contract development with a comprehensive library of tools for developers to easily build and deploy smart contracts. Sehr previously founded several DeFi and web3 projects, including StockSwap and FanFare. He also helped co-found Simple Breakthrough LLC, a web3 design and development agency that supports projects like QiDAO/Mai.Finance, BlockDuelers, and NFT Lootbox.

Source link

You may like

Trader Says Top-10 Altcoin To Vastly Outperform Bitcoin and Ethereum, Hit New Record High Quicker Than Expected

5 tokens to consider buying today

Terra Luna Classic Community Discord On Proposal Amid LUNC Price Rally

Trump Nominates Pro-Crypto Hedge Fund Manager Scott Bessent as Treasury Secretary

Dogecoin surges 10% as this new altcoin shakes the market, and preps for stage 2 presale

Ripple CEO Shares Bullish News With XRP Army As Trump Names Treasury Secretary

Blockchain

Blockchain Association urges Trump to prioritize crypto during first 100 days

Published

21 hours agoon

November 22, 2024By

admin

The Blockchain Association has called on president-elect Donald Trump and Congress to prioritize five key actions during the administration’s first 100 days to establish the U.S. as a global leader in cryptocurrency innovation.

In an open letter, the industry group outlined specific measures to address regulatory challenges and support the domestic digital asset economy.

The Blockchain Association is a U.S.-based crypto lobbying group advocating for a regulatory framework for cryptocurrencies. They emphasized lifting the bank account ban on crypto companies and appointing new leadership for the SEC, Treasury Department, and IRS.

They also proposed creating a cryptocurrency advisory committee to work with Congress and federal regulators.

Five priorities for Trump’s first 100 days

The letter highlighted five steps aimed at fostering a supportive environment for crypto businesses and users:

- Creating a Crypto Regulatory Framework

The Blockchain Association urged Congress to draft comprehensive legislation for cryptocurrency markets and stablecoins. This framework, it argued, would balance consumer protection with innovation. Stablecoins are digital currencies tied to traditional assets, such as the U.S. dollar, offering price stability for users. - Ending the Debanking of Crypto Companies

The group expressed concern over crypto businesses losing access to banking services. These companies rely on traditional banks to handle payroll, taxes, and vendor payments. Without banking access, their operations can be severely disrupted. - Reforming the SEC and Repealing SAB 121

The association called for a new SEC chair to replace what it described as a hostile regulatory approach under the current leadership. It also recommended reversing SAB 121, an accounting rule that imposes strict requirements on crypto-related businesses. - Appointing New Treasury and IRS Leadership

Tax policies for cryptocurrencies, such as the proposed Broker Rule, have been criticized for potentially stifling innovation and driving companies offshore. The letter urged the administration to appoint leaders who would support privacy and foster a fair tax environment for digital assets. - Establishing a Crypto Advisory Council

The letter proposed a council to facilitate collaboration between the industry, Congress, and federal regulators. Public-private partnerships, it said, could create rules that protect consumers while encouraging innovation.

Crypto collaboration

In their letter, the Blockchain Association emphasized its readiness to work with the administration and 100 member organizations to ensure the U.S. regains its position as a financial and technological innovation leader.

“We stand ready to work with you to ensure the United States can regain its position as the crypto capital of the world,” the Blockchain Association wrote in the letter.

This letter comes as Trump adopts a strong pro-crypto stance. Earlier in November, reports emerged that Trump plans to create a White House position solely focused on cryptocurrency and related policies.

This letter also comes a day after crypto-foe and SEC chair Gary Gensler announced his upcoming resignation.

Source link

Blockchain

Sui Network blockchain down for more than two hours

Published

2 days agoon

November 21, 2024By

admin

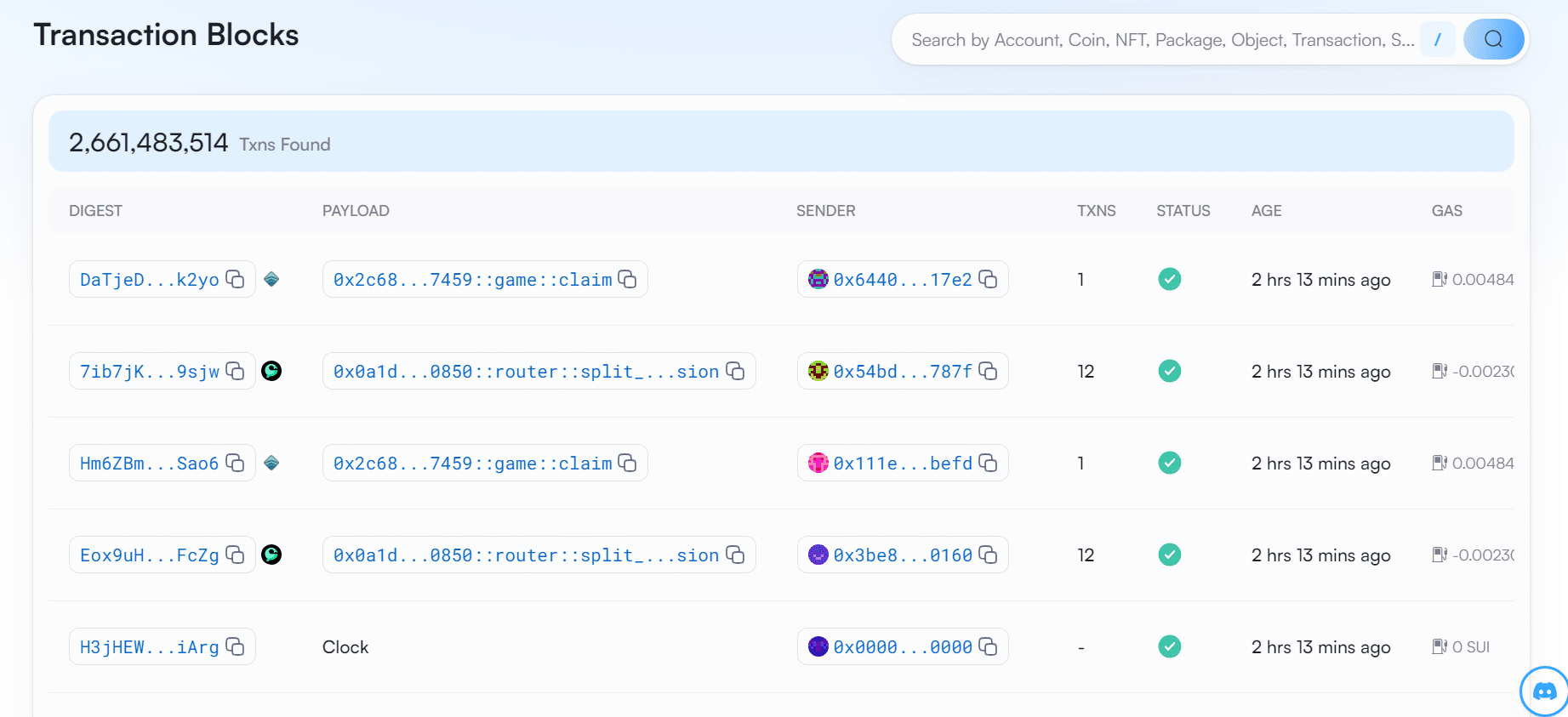

The Sui Network is suspected to be down for more than two hours. The protocol has not produced any new transaction blocks since Nov. 21 UTC 9:15.

Based on the latest data from Sui Network’s explorer site Sui Vision, the decentralized layer-1 blockchain has stopped producing blocks for more than two hours.

At the time of writing, the last transaction block took place on Nov. 21 at 9:15 am UTC. Since then, no new blocks have been produced on the blockchain.

The Sui Network confirmed the outage on its official X account, stating that the blockchain is currently unable to process transactions. However, it claims that the problem has been identified and will be back to normal soon.

“We’ve identified the issue and a fix will be deployed shortly. We appreciate your patience and will continue to provide updates,” wrote the protocol on X.

Service Announcement: The Sui network is currently experiencing an outage and not processing transactions. We’ve identified the issue and a fix will be deployed shortly. We appreciate your patience and will continue to provide updates.

— Sui (@SuiNetwork) November 21, 2024

Sui’s blockchain outage has seemingly impacted the SUI token price. According to data from crypto.news, the Sui token has gone down by nearly 2% in the past hour. It is currently trading hands at $3.41. In the past 24 hours, SUI has plummeted by 7.29%.

Even though, the token has gone up by nearly 75% in the past month.

SUI currently ranks in the 18th place in the lineup of cryptocurrencies, holding a market cap of $9.7 billion and a fully diluted valuation of $34 billion. The Sui token has a circulating supply of $2,8 billion tokens.

The South Korean crypto exchange, Upbit, announced it will be temporary suspending deposits and withdrawals for the Sui token due to its block generating outage.

The notice informs users that if they deposit or withdraw Sui tokens after the announcement was posted, then there is a chance that their funds cannot be recovered.

Several crypto industry figures took to X to comment on the recent Sui Network outage. Most of them teased Sui’s goal of becoming Solana’s biggest competitor. Ironically, the Solana blockchain also has a track record of outages in the past, with the latest one recorded in February this year.

“Sui [is] just repeating Solana history,” said one X user.

“Hasn’t Solana gone down multiple times?” asked another X user.

“SUI blockchain is down. And they claimed to be a Solana Killer,” wrote crypto YouTuber Ajay Kashyap on his X post.

Source link

Blockchain

SBI, UBS and Chainlink complete pilot for automated tokenized fund solution

Published

5 days agoon

November 18, 2024By

admin

SBI Digital Markets, UBS Asset Management, and Chainlink have successfully completed a pilot program showcasing the use of smart contracts to manage tokenized funds.

The companies announced this on Nov. 18, noting that the solution brings automated tokenized fund management to the market and leverages the Chainlink (LINK) infrastructure. With this solution, users can automate their tokenized fund management processes, unlocking blockchain capabilities for the world’s $132 trillion assets under management market.

urrently, the total real-world assets on-chain represent a market of around $13.2 billion.

Solution allows for efficient scaling of tokenized funds

According to a press release, the tokenized fund pilot demonstrated how fund managers can leverage smart contracts and Chainlink’s Cross-Chain Interoperability Protocol to efficiently scale their products on-chain and across distributors.

Central to this initiative is the Digital Transfer Agent smart contract model, a novel fund administration system that utilizes multiple Chainlink oracle networks. SBI’s custodian and fund distributor successfully deployed this model to enable multi-chain subscriptions and redemptions.

As the tokenized funds industry evolves to attract the world’s top players, the demand for on-chain administration is increasing. Notably, a recent report revealed that 93% of fund services providers do not offer full automation for their data inputs and workflow processes. This lack of automation creates key bottlenecks for traditional fund operators.

However, smart contracts, oracle networks, and tokenized funds provide the asset management industry with a pathway to full automation.

“This new way of launching fund structures and administering them via smart contracts empowers both fund managers and their service providers to deliver new on-chain financial products and lower operational costs to investors, both things they are actively looking for,” said Winston Quek, chief executive officer at SBI Digital Markets.

The solution, currently live on various blockchain testnets, will soon go to mainnet.

SBI Digital Markets, UBS Asset Management, and Chainlink announced the solution at the Singapore Fintech Festival, launching it as part of the Monetary Authority of Singapore’s ‘Project Guardian.’

This development follows a partnership between Swift, UBS Asset Management, and Chainlink aimed at bridging tokenized assets with legacy payment systems. UBS also recently unveiled a pilot for cross-border payments called “UBS Digital Cash”.

Source link

Trader Says Top-10 Altcoin To Vastly Outperform Bitcoin and Ethereum, Hit New Record High Quicker Than Expected

5 tokens to consider buying today

Terra Luna Classic Community Discord On Proposal Amid LUNC Price Rally

Trump Nominates Pro-Crypto Hedge Fund Manager Scott Bessent as Treasury Secretary

Dogecoin surges 10% as this new altcoin shakes the market, and preps for stage 2 presale

Ripple CEO Shares Bullish News With XRP Army As Trump Names Treasury Secretary

On-Chain Data Shows The Bitcoin Price Bull Run is Far From Over

Trump Picks Pro-Crypto Hedge Fund Manager Scott Bessent for Treasury Secretary

Crypto millionaires will be made by April 2025: 6 coins to hold

Cardano Price Hits $1 But Analyst Says This Is Just The Start

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential