BTC Investments

Metaplanet’s Bitcoin reserves nearing 750 BTC after bulk buy

Published

4 hours agoon

By

admin

Japanese investment firm Metaplanet has bought $6.7 million worth of Bitcoin, adding 108.99 BTC to their expanding cryptocurrency reserves.

On Oct. 11, Metaplanet invested ¥1 billion or equal to $6.7 million in Bitcoin(BTC) reserves. This brings the company’s holdings in cryptocurrency to 748.50 BTC, which is currently valued at $45.65 million.

This marks the Tokyo-based hotel operator turned investment firm’s third ¥1 billion investment into their Bitcoin holdings since the start of this month. Previously, the firm purchased 108.786 BTC on Oct. 7, which brought their total Bitcoin reserves to 639.50 BTC or $40.54 million based on the market prices at the time of purchase.

On Oct. 9, Metaplanet CEO Simon Gerovich posted a chart showcasing Metaplanet’s Bitcoin reserves compared to those owned by other companies across the globe, including Microstrategy, Tesla, and Marathon Digital.

“Expect us to take up more space soon alongside some Bitcoin titans!” Gerovich wrote on his X post.

On the chart, the company that holds the largest Bitcoin reserves is Microstrategy with 252,220 BTC since its last purchase on Sept. 20 of 7,420 BTC.

Metaplanet has been dubbed “Asia’s MicroStrategy” by market proponents after the firm followed in the footsteps of the U.S AI analytics firm.

Metaplanet announced that it will continue to diversify its Bitcoin holdings in May 2024, when Japan was plagued by high government debt levels, negative real interest rates, and a weaking national currency.

In order to keep up with this mission, Metaplanet has partnered with Singaporean digital asset trading firm QCP Capital and Japan’s SBI VC Trade.

The Japanese investment firm sold 223 contracts worth $62,000 put option to the Singaporean firm, earning Metaplanet a profit of 23.97 BTC in option premium. While Metaplanet’s partnership with SBI VC Trade offers the firm corporate custody services and financing options using Bitcoin as collateral.

Metaplanet is not the only Japanese firm taking steps to invest in cryptocurrency. According to a June survey by Nomura and Laser Digital, over 500 investment managers in Japan have expressed interest in digital asset investments.

The survey found that nearly 50% of respondents are also open to using stablecoins for settlements and daily transactions.

Source link

You may like

OSCE hosts workshop aimed at crypto regulation in Eastern Europe

US PPI Inflation Data Further Sparks Concern Over Bitcoin Dip Ahead

Binance Exec Tigran Gambaryan Denied Bail Despite ‘Meeting All the Requirements,’ Says Family

Tron’s Justin Sun Shares Vision For Liberland As Prime Minister

CZ’s first public appearance since release set for Dubai

Trump-Themed PoliFi Tokens Buck Bitcoin Downtrend as China Stimulus Hopes Return

Bitcoin

Japanese firm Metaplanet secures $6.8m loan to bolster Bitcoin holdings

Published

2 months agoon

August 8, 2024By

admin

Japanese investment firm Metaplanet has secured a 1 billion yen loan, the entire amount of which will be used to buy Bitcoin (BTC).

Details Metaplanet shared in an Aug. 8 post on X show that the lender is MMXX Ventures, which itself holds shares in Metaplanet. The loan term will run for six months starting Aug. 8 and will attract an interest rate of 0.1% per annum.

The Tokyo Exchange-listed company is expected to repay the collateral-free loan in one lump sum after the loan period elapses.

Were Metaplanet to buy Bitcoin (BTC) right now, the loan amount, which amounts to $6.8 million at current exchange rates, could get it about 119 BTC, with one BTC currently priced at $57,170.

Metaplanet’s announcement comes only days after the investment company said it intended to raise $70 million through a stock rights offerings, with more than 80% of that amount earmarked for buying Bitcoin.

The loan and stock rights offerings are part of Metaplanet’s plan to grow its crypto holding, which is reportedly at 246 BTC, worth just north of $14 million. The company is looking to hedge its long-term growth by leveraging Bitcoin’s potential long-term appreciation, with some analysts predicting the cryptocurrency’s price could go as high as $1 million in the next decade.

This move is quite similar to what MicroStrategy has been doing in the last few years. The U.S. company currently holds more than 79,000 BTC, which is valued at about $4.5 billion. MicroStrategy CEO Michael Saylor, on Aug. 7, revealed that he personally owns Bitcoin worth more than $1 billion, meaning he could hold as much as 20,000 BTC in his trove.

JUST IN: Michael Saylor says he personally owns more than $1 billion worth of #Bitcoin.

— Watcher.Guru (@WatcherGuru) August 7, 2024

Meanwhile, the price of Bitcoin has gone up slightly in the last 24 hours. At the time of writing, it showed a 0.7% improvement from the previous day, and had registered a 24 hour trading volume of $43.5 billion, making it the second-most traded digital asset after Tether (USDT).

Source link

OSCE hosts workshop aimed at crypto regulation in Eastern Europe

US PPI Inflation Data Further Sparks Concern Over Bitcoin Dip Ahead

Binance Exec Tigran Gambaryan Denied Bail Despite ‘Meeting All the Requirements,’ Says Family

Metaplanet’s Bitcoin reserves nearing 750 BTC after bulk buy

Tron’s Justin Sun Shares Vision For Liberland As Prime Minister

CZ’s first public appearance since release set for Dubai

Trump-Themed PoliFi Tokens Buck Bitcoin Downtrend as China Stimulus Hopes Return

BlackRock & Metaplanet Buy Bitcoin Dips As Crypto Market Turns Sour

The new DeFi-meme hybrid attracting DOGE & AAVE whales

Bitnomial Sues SEC Over XRP Futures, Cites CFTC As Primary Regulator

Ethereum Price Targets a Comeback: Will the Bounce Last?

Addressing wallet bhallenges and targeting 8,300% gains

Fidelity Steps Into Blockchain With New Money Market Fund

10th-Largest US Bank Paying $3,100,000,000 Fine in Historic Admission of Guilt After Criminals ‘Dump Piles of Cash’ on Banks’ Counters

ETH whale says watch out for this Solana competitor with 6,000% potential

182267361726451435

Top Crypto News Headlines of The Week

New U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Bitcoin Open-Source Development Takes The Stage In Nashville

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Ethereum, Solana touch key levels as Bitcoin spikes

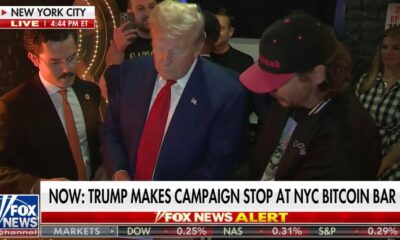

Why Did Trump Change His Mind on Bitcoin?

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

Citigroup Executive Steps Down To Explore Crypto

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Crypto Market Movers: 5 Altcoins Making Waves This Bull Run

Trending

4 weeks ago

4 weeks ago182267361726451435

24/7 Cryptocurrency News2 months ago

24/7 Cryptocurrency News2 months agoTop Crypto News Headlines of The Week

News1 month ago

News1 month agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin2 months ago

Bitcoin2 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Opinion3 months ago

Opinion3 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Altcoins2 months ago

Altcoins2 months agoEthereum Crash A Buying Opportunity? This Whale Thinks So

Bitcoin3 months ago

Bitcoin3 months agoEthereum, Solana touch key levels as Bitcoin spikes

Donald Trump3 months ago

Donald Trump3 months agoWhy Did Trump Change His Mind on Bitcoin?