Europe

OSCE hosts workshop aimed at crypto regulation in Eastern Europe

Published

1 month agoon

By

admin

The OSCE’s recent workshop brought together regulators from Ukraine, Moldova, and Armenia to address the urgent need for crypto regulations in the face of rising financial risks.

Eastern Europe is doubling down on regulatory measures for crypto exchanges as the Organization for Security and Co-operation in Europe hosts a workshop aimed at enhancing compliance and mitigating financial risks in the digital asset space.

In an Oct. 11 press release, the OSCE revealed that from Oct. 9 to Oct. 11, it convened a workshop in Vienna aimed at bolstering the regulatory framework for Virtual Asset Service Providers across Ukraine, Moldova, and Armenia.

The event, organized by the Office of the Co-ordinator of OSCE Economic and Environmental Activities, focused on enhancing participants’ ability to “mitigate money laundering and terrorism financing risks within the evolving digital asset ecosystem,” according to the press release. Led by OSCE financial regulation experts, the workshop featured a mix of discussions and interactive sessions designed to engage participants in practical compliance challenges.

“This workshop is a vital step in building the capacity of financial regulators to address the growing risks posed by virtual assets.”

Vera Strobachova-Budway, acting head of the economic governance unit at OCEEA

Key modules addressed pressing issues in VASP compliance, including anti-money laundering measures and counter-terrorism financing strategies. Participants also received “hands-on tools for supervising VASPs and analyzing suspicious activity,” equipping them with advanced skills in identifying and mitigating risks, per the press release.

OSCE elevates standards for crypto regulation

The workshop marks another step in the OSCE’s effort to formalize best practices in crypto regulation, fostering collaboration among regional regulators and financial experts. The initiative is part of a broader project aimed at regulating crypto businesses, supported by Germany, Italy, and the United States, among others.

Earlier in August, the OSCE also conducted a three-day training in Warsaw to enhance crypto investigation skills for Armenian and Georgian law enforcement. This specialized session on “countering blockchain obfuscation techniques” was part of ongoing efforts to combat illicit activities facilitated by cryptocurrencies.

Source link

You may like

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

CBDC

ECB official calls for urgency on digital euro amid global CBDC race

Published

2 days agoon

November 21, 2024By

admin

The European Central Bank is urging faster action on the digital euro as legislative delays risk hindering progress amid growing global competition.

The digital euro project is facing delays in the European Union, with the European Central Bank urging faster action to prevent Europe from falling behind global competitors.

Evelien Witlox, the ECB’s project manager for the digital euro, told Euronews in an interview that Europe should speed up with the development to avoid falling behind, as global competitors like the U.K. and China are also exploring central bank digital currencies.

Thus far, there is no pan-European digital payment solution as 13 of the 20 countries in the eurozone lack a national card scheme, relying instead on international players like Visa and Mastercard, the report notes. Witlox noted that the European market remains fragmented, with “the ones that come closest to covering the whole of Europe are non-European.”

To address this, the ECB launched a CBDC exploration project in October 2021. However, before the digital euro can move forward, the European Parliament and Council must finalize the legal framework—a process that has yet to be completed nearly 17 months after the European Commission’s proposal. This delay has raised concerns within the ECB, Witlox noted.

Although discussions on the digital euro have made progress, Witlox reiterated the need for urgency to keep “sufficient pace in this process so that we can ensure that the digital euro will be there when we really need it.” Although there is no set timeline for the digital euro’s launch, Witlox remains optimistic, stressing that Europe is still “at the forefront of the development [of a CBDC].”

Source link

crypto tax

UAE and Switzerland lead as premier locations with no crypto tax, research finds

Published

3 weeks agoon

November 1, 2024By

admin

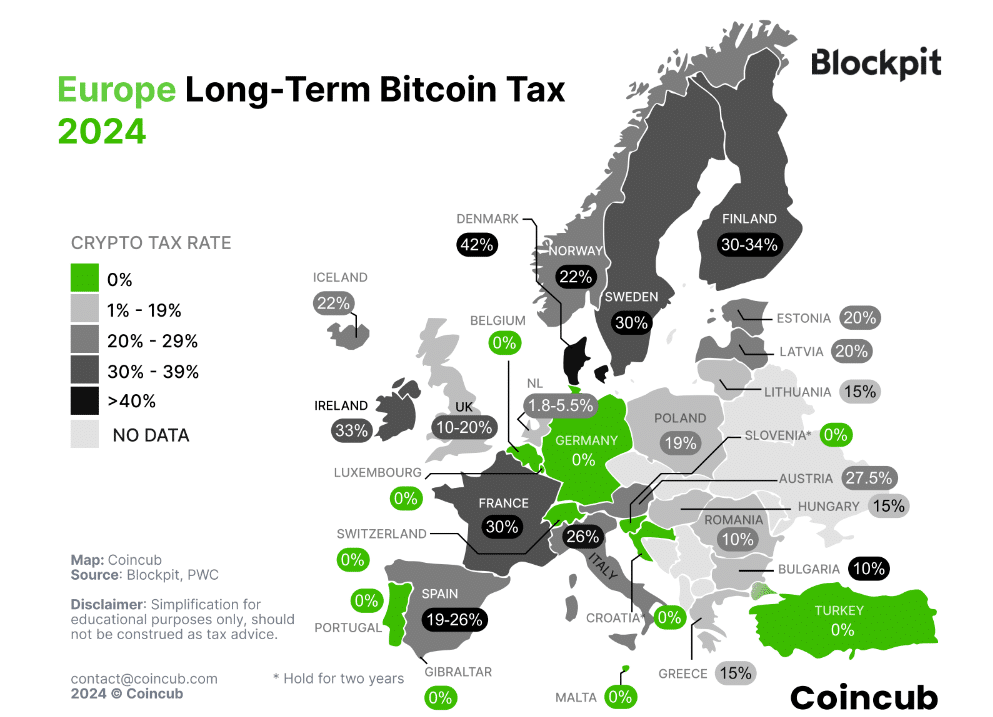

A recent research report by Coincub and Blockpit highlights how varying tax policies, from zero taxes in the UAE to high rates in the U.S., shape crypto investment strategies.

The crypto taxation landscape varies widely across the globe, as revealed by a research report from Blockpit and Coincub.

Data reveals that the UAE remains an attractive destination for crypto investors, with no personal income or capital gains tax on cryptocurrency gains for individuals. Similarly, Switzerland positions itself as a tax haven, offering zero personal income and capital gains tax on crypto gains.

In Europe, the situation is more mixed. While some nations provide favorable tax conditions for long-term holdings, others maintain elevated tax rates. For example, Denmark has one of the highest personal crypto tax rates globally, with up to 53% of long-term and short-term capital gains from crypto being taxed by the local watchdog.

The report notes that, on average, many European countries impose relatively high taxes on crypto gains, but the old continent “has the most tax breaks for long-term hodling your Bitcoin.”

Meanwhile, the United States has the highest total gains and average tax rates of 17.5% (long-term) and

23.5% (short-term), what could potentially bring in tax revenues approximately $1.87 billion, the analysts estimate. They warn that high taxation could “discourage investment,” pushing crypto activities underground, or force investors to relocate to more tax-friendly jurisdictions.

“Nations like Vietnam, Turkey, and Argentina might prioritize attracting crypto investment, fostering technological innovation, and providing alternatives to unstable local currencies over immediate tax collection.”

Blockpit

Analysts indicate that the global approach to crypto taxation is set to undergo significant changes starting in 2025, driven by international initiatives such as the Crypto-Asset Reporting Framework and the Tax Administration for the Reporting of Crypto-Asset Activities.

Developed by the Organization for Economic Co-operation and Development, CARF aims to enhance tax transparency and combat tax evasion by creating a global framework for reporting crypto transactions. In parallel, TARKA is designed to facilitate cooperation among tax authorities in the 48 participating countries, per the report.

Source link

Amazon

Boerse Stuttgart’s crypto provider taps Amazon to expand crypto offerings for institutions

Published

1 month agoon

October 14, 2024By

admin

Boerse Stuttgart Digital has partnered with Amazon Web Services to enhance its crypto infrastructure, enabling European financial institutions to scale their offerings.

Boerse Stuttgart Digital, a German crypto infrastructure hub powered by Boerse Stuttgart Group, has entered into a partnership with Amazon Web Services to enhance its offerings for European financial institutions as the demand for crypto services continues to rise.

In a Monday press release, Oct. 14, the Stuttgart-headquartered company said the collaboration aims to improve the scalability of its solutions, designed for traditional banks, brokers, and asset managers. The company says the collaboration was born in response to a new trend as retail customers and corporates across Europe are “increasingly seeking reliable avenues to venture into the crypto market.”

“Traditional financial institutions are facing a pivotal choice: to miss out on this structural trend or partner with established infrastructure providers which stand for trust, security, and reliability.”

Boerse Stuttgart Digital

Addressing the partnership, Boerse Stuttgart Group’s CEO Matthias Voelkel said that institutional investors are “eager to offer their clients access to cryptocurrencies and digital assets without compromising on trust, security and reliability.”

The development comes as Boerse Stuttgart Digital expands its client roster, particularly with DZ Bank, a key player in the German cooperative banking sector and one of the largest banking groups in Europe. In mid-September, Boerse Stuttgart Digital said that DZ Bank would empower 700 cooperative banks to offer their retail customers the ability to trade cryptocurrencies and store them in licensed fiduciary custody.

Source link

Legacy Media’s Transformation: Why Evolution Beats Extinction

Massive Ethereum Buying Spree – Taker Buy Volume hits $1.683B In One Hour

Ethereum lags behind Bitcoin but is expected to reach $14K, boosting RCOF to new high

Bitcoin Miner MARA Buys Another 5771 BTC As Price Nears $100k

Jason "Spaceboi" Lowery's Bitcoin "Thesis" Is Incoherent Gibberish

Bankrupt Crypto Exchange FTX Set To Begin Paying Creditors and Customers in Early 2025, Says CEO

Top crypto traders’ picks for explosive growth by 2025

3 Tokens Ready to 100x After XRP ETF Gets Approval

Gary Gensler’s Departure Is No Triumph For Bitcoin

Magic Eden Token Airdrop Date Set as Pre-Market Value Hits $562 Million

Blockchain Association urges Trump to prioritize crypto during first 100 days

Pi Network Coin Price Surges As Key Deadline Nears

How Viable Are BitVM Based Pegs?

UK Government to Draft a Regulatory Framework for Crypto, Stablecoins, Staking in Early 2025

Bitcoin Cash eyes 18% rally

182267361726451435

Top Crypto News Headlines of The Week

Why Did Trump Change His Mind on Bitcoin?

New U.S. president must bring clarity to crypto regulation, analyst says

Ethereum, Solana touch key levels as Bitcoin spikes

Will XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Bitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential

Ethereum Crash A Buying Opportunity? This Whale Thinks So

Shiba Inu Price Slips 4% as 3500% Burn Rate Surge Fails to Halt Correction

‘Hamster Kombat’ Airdrop Delayed as Pre-Market Trading for Telegram Game Expands

Washington financial watchdog warns of scam involving fake crypto ‘professors’

Citigroup Executive Steps Down To Explore Crypto

Mostbet Güvenilir Mi – Casino Bonus 2024

Bitcoin flashes indicator that often precedes higher prices: CryptoQuant

Trending

2 months ago

2 months ago182267361726451435

24/7 Cryptocurrency News3 months ago

24/7 Cryptocurrency News3 months agoTop Crypto News Headlines of The Week

Donald Trump4 months ago

Donald Trump4 months agoWhy Did Trump Change His Mind on Bitcoin?

News3 months ago

News3 months agoNew U.S. president must bring clarity to crypto regulation, analyst says

Bitcoin4 months ago

Bitcoin4 months agoEthereum, Solana touch key levels as Bitcoin spikes

Price analysis3 months ago

Price analysis3 months agoWill XRP Price Defend $0.5 Support If SEC Decides to Appeal?

Opinion4 months ago

Opinion4 months agoBitcoin Open-Source Development Takes The Stage In Nashville

Bitcoin4 months ago

Bitcoin4 months agoBitcoin 20% Surge In 3 Weeks Teases Record-Breaking Potential